Helcim is a Canadian credit card processing and merchant services company catering to all kinds of small and growing businesses. It offers a suite of free payment processing tools and integration with various business systems. Fees start at interchange plus 0.15% + 6 cents with built-in volume discounts. These features earned Helcim 4.38 out of 5 in our evaluation of best merchant services.

However, Helcim lost points for its lack of faster funding options and fees imposed on chargebacks, hardware, and Amex transactions. Third-party review sites give Helcim an average score of 4.2 out of 5.

Helcim Overview

Pros

- Interchange-plus (cost-plus) pricing and low account fees

- No long-term contracts

- Free invoicing and ecommerce tools

- Free point-of-sale (POS) and online store software

Cons

- Limited back-office integrations

- Charges extra for Amex transactions

- Can be expensive for businesses processing under $50,000/month

- Only for businesses in US and Canada

Deciding Factors

Supported Business Types | Flexible Retail, restaurant, professional services, nonprofit, subscription, automotive, healthcare, and more—Helcim can accommodate many business types. |

|---|---|

Standout Features |

|

Monthly Software Fees | Very Competitive $0 |

Setup and Installation Fees | $0 |

Contract Length | Pay-as-you-go |

Point of Sale Options | Built-in free POS software, Vend |

Payment Processing Fees | Very competitive

|

Customer Support |

|

Is Helcim Right for You?

Helcim offers a fairly extensive set of tools for businesses of all sizes, spanning a wide range of industries, for a very competitive price. Its automated volume discount and interchange-plus pricing model comes with no monthly fee—a rare find for a dedicated merchant account. Most providers that offer free merchant accounts are payment facilitators or payment service providers (PSPs) like Square and Stripe.

When to Use Helcim

- Growing businesses that can benefit from volume discounts

- Merchants with established credit history to go through Helcim’s approval process

- Businesses looking for automatic surcharging options

- Businesses selling locally and in Canada

When to Use an Alternative

- Businesses with mostly international customers/clients

- Small startups looking for a fast and easy merchant account setup

Some smaller businesses may not find Helcim a good fit. For one, Helcim requires an application process where mostly merchants with established credit history often get approval. This is why PSPs that do not require an approval process like Square and PayPal are popular among small merchants and startups.

A closer look at Helcim’s pricing structure also shows that to start earning volume discounts, merchants should be processing at least $50,000 a year or around $4,200 per month. So while the costs are highly competitive, smaller businesses may find simple flat-rate fees easier to manage.

However, if you’re starting small and growing big—or hitting any stage of growth for that matter—Helcim’s automatic volume discounts provide the most convenient way to save on credit card transaction fees as you scale your business. You don’t need to worry about volume limits or apply for lower rates each time you hit a sales milestone. This, combined with zero monthly fees and free tools, gives Helcim a clear edge over most competitors.

Helcim Alternatives

Best for | Monthly Fee From | |

|---|---|---|

| Businesses processing $10,000+ monthly | $79 |

| High-volume sales ($20,000+ monthly) | $99 |

| Small businesses, especially those with low sales | $0 |

Our Comparisons of Helcim vs Other Software

Helcim User Reviews

| Users Like | Users Dislike |

|---|---|

| Reliable and easy-to-use platform | Bugs/issues with application |

| Transparent fees | Card reader connection issues |

| Professional customer service | Account migration and implementation issues |

Helcim users mostly comment on the helpful customer support. However, it’s hard not to notice the general complaint across multiple third-party review sites about Helcim’s technical issues. There are persistent complaints about bugs with the system and technical issues during setup and implementation.

- Trustpilot[1]: Helcim kept steady at 4.3 out of 5 stars from around 400 reviews (previously 300 around August 2023).

- G2[2]: Helcim is rated 4.2 out of 5 stars by 15 users (no change since our last update).

- Capterra[3]: Helcim’s user rating continues to decrease, now at 4.1 out of 5 from around 25 reviewers (previously 4.2 out of 5 in our August 2023 review).

Helcim offers an ideal pricing structure with its free merchant account and payment processing tools (which is quite rare). The credit card reader is somewhat expensive, but its interchange-plus pricing fees, low return fees, and reversible chargeback fees made Helcim a standout.

Helcim Payment Processing

Helcim’s interchange-plus pricing rates are broken into five tiers and adjusted based on a three-month rolling processing average of your card processing volume. Higher-volume businesses will automatically get lower rates. This is ideal for scaling businesses, as you don’t have to regularly renegotiate with your payment processor to ensure you’re getting the best rates for your current growth stage.

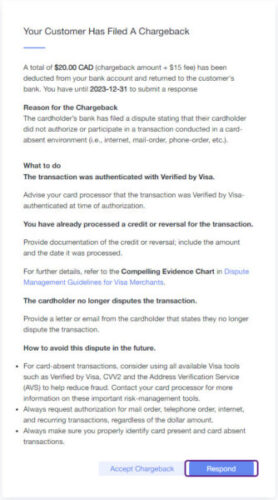

There are no fees for setup, PCI and non-compliance, cancellation, bank deposit, or customer support. Chargeback fees are $15, and Helcim will reimburse you if you win the dispute. Deposits are made in one to two days.

Monthly Sales Volume | Card-Present Rate Interchange Plus | Keyed and Online Rate Interchange Plus |

|---|---|---|

$0-$50,000 | 0.4% + 8 cents | 0.50% + 25 cents |

$50,001-$100,000 | 0.35% + 7 cents | 0.45% + 20 cents |

$100,001-$500,000 | 0.25% + 7 cents | 0.35% + 20 cents |

$500,001-$1,000,000 | 0.20% + 6 cents | 0.25% + 15 cents |

$1,000,001+ | 0.15% + 6 cents | 0.15% + 15 cents |

According to Helcim, the average processing fee for card-present transactions is 1.93% + 8 cents, while the average processing fee for card-not-present transactions is 2.49% + 25 cents.

Other fees include:

- Domestic ACH/Wire Transfers: 0.5% + 25 cents, capped at $6/transaction, $5 return fee

- American Express surcharge fees*: 0.10% + 10 cents per transaction

*Helcim’s acquiring bank charges extra for accessing the Amex network, and these charges are added to Helcim’s transaction rates.

Helcim Hardware

Helcim users who signed up after June 2020 will be using Helcim’s new card reader instead of getting integrated Ingenico and Poynt smart terminals. The Helcim card reader costs $99 per unit (previously $109) and allows merchants to accept swipe, chip, tap, and keyed-in card payments. It holistically integrates with your Helcim account to centralize all your data.

The Helcim card reader connects to your smartphone, tablet, or computer, along with Helcim’s payments app, to create a fully functional POS system. This is helpful because you can bring your own devices. It also comes with a dock that connects to a countertop POS for storefront use.

Helcim also recently launched its own smart standalone payments terminal with built-in point-of-sale, inventory, and customer management tools. Priced at $329, the Helcim smart terminal also features a touchscreen function, thermal receipt printer, and PIN payment option.

Helcim Card Reader | Helcim Smart Terminal |

|---|---|

| |

$99 | $329 or $68x5months |

|

|

New Features

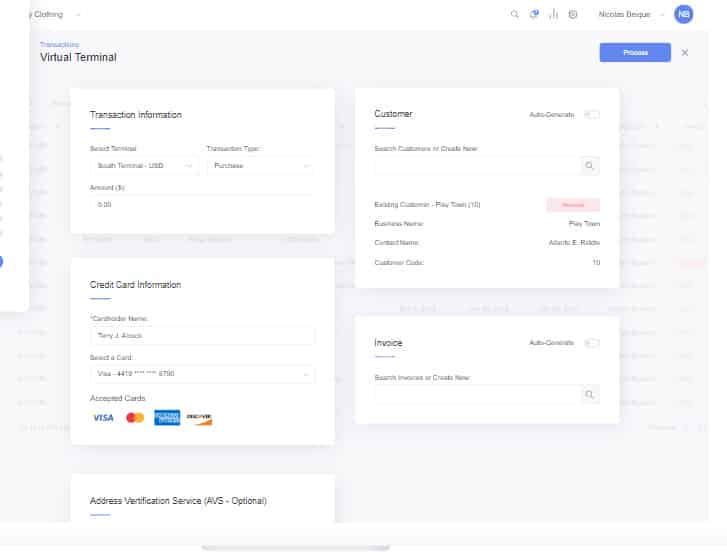

- Virtual Terminal Update: Helcim’s Virtual Terminal now comes with a payment summary section to provide a quick review of transaction and payment details, along with a merchant feedback tool where users can instantly send requests for additional features or any issues encountered while processing transactions.

- In-person Fee Saver Program: Until recently, Helcim’s Fee Saver program only supported online/invoiced transactions. Helcim now also offers this feature to in-person transactions for merchants using the smart terminal. However, this is not available in some states (Connecticut, Colorado, Maine, Massachusetts, Oklahoma, and Quebec).

Helcim earned a perfect score for payment processing features in our evaluation, primarily because all of the functionalities are available for free. It also has level 2 processing integrated into the virtual terminal, making Helcim an ideal solution for B2C and B2B merchants.

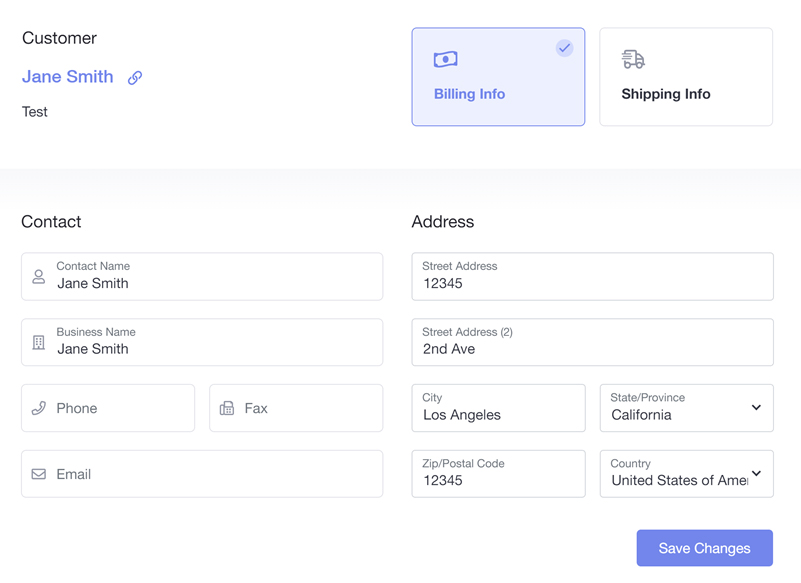

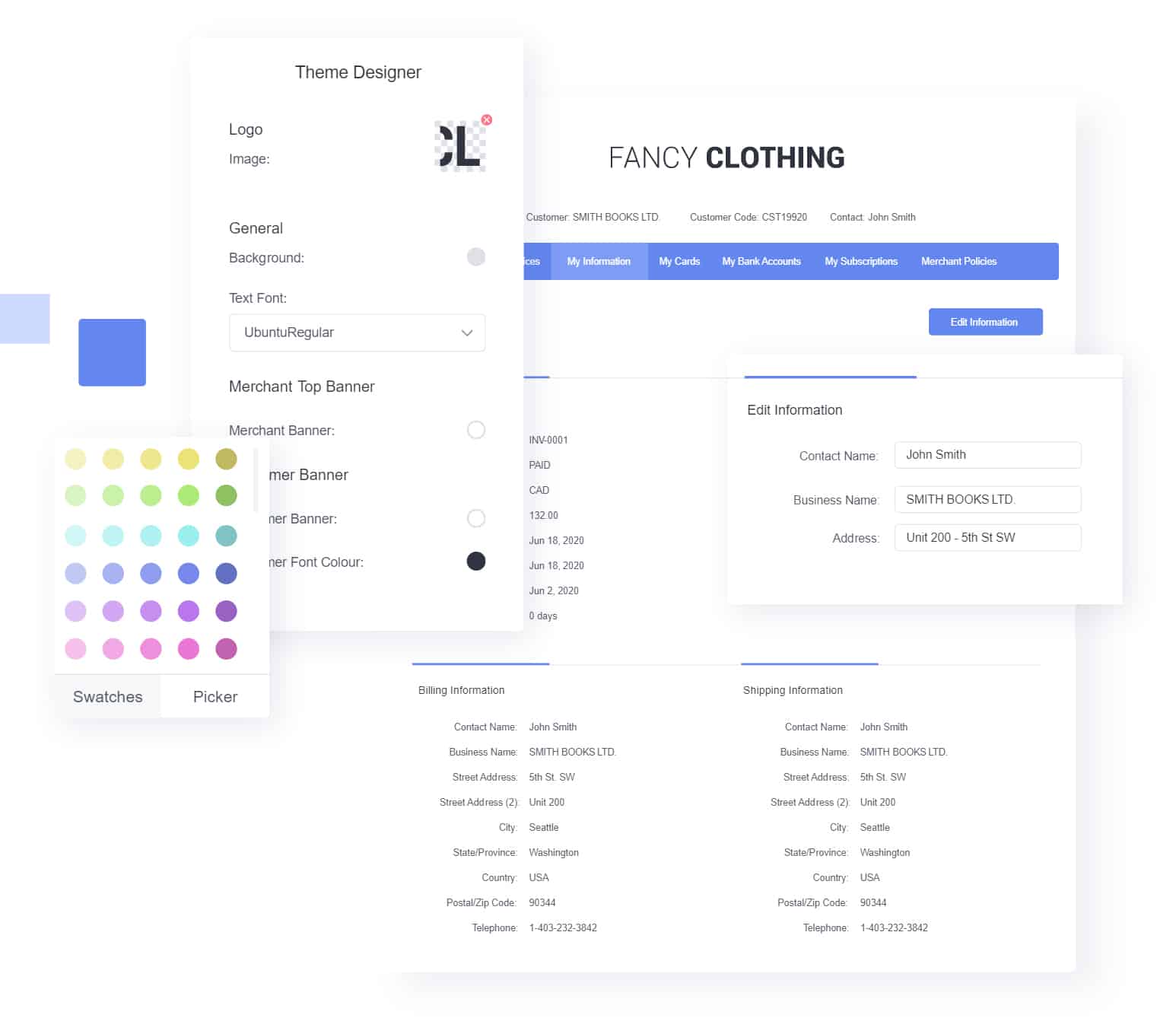

Helcim invoicing provides tools for creating and managing online payments. It is fully integrated with your merchant account, making it easy to send out and keep track of outstanding invoices. It also gives a wide range of customization options, including designing templates, providing multiple payment options for your customers, and setting up alerts. An invoice theme designer lets you customize the content of your template and add branding.

Helcim’s invoicing features are comparable to top payment processors like Stripe but are more affordable (Stripe charges 0.4%–0.5% per paid invoice, while there’s no extra charge for Helcim). It lets you create estimates and quotes and can automatically reconcile your accounts receivables. You can also add a payment button for customers to make payments immediately.

Online invoicing allows a wide range of customization to track, manage, and reconcile invoiced transactions. (Source: Helcim)

If you run a subscription retail business, Helcim’s recurring billing payments feature will allow you to set up unlimited subscription plans and customize your pricing with add-ons and free trials. You can then add or edit an existing recurring invoice and track those changes from your merchant platform.

Like Stripe, Helcim also offers a customer portal feature where subscribers can log in to sign up and manage their subscriptions. You can also provide customers with a customized quote from your website or send it via email with a Subscribe button that takes them to the portal. This feature is included in Helcim’s merchant account subscription at no extra cost.

For comparison, Stripe will charge you 0.5%–0.8% per paid invoice for its subscription billing and payment services. Stax’s billing and subscription software is available with an additional monthly fee.

Create a customized hosted customer portal and allow users to manage their own subscription settings at no extra cost. (Source: Helcim)

Helcim Bank Payments or ACH payments allow you to collect payments directly from your customer’s bank account. Helcim will let you accept ACH payments through online and recurring invoicing, subscription management, payment requests, and virtual terminals. You can accept ACH payments for up to $25,000 per transaction, which will then be deposited into your bank within four business days.

With an ACH payment method, you can add, delete, or update customer banking information on their profile. (Source: Helcim)

If you haven’t received your card reader yet, you can accept payments over the phone by logging on to the virtual terminal platform from any computer, tablet, or smartphone, without sacrificing security.

You can manually key in your customer’s card information or (for frequent customers) search for their profile in your system. Virtual terminals can be set up for accepting one-time and recurring payments. For businesses selling globally, you can configure your virtual terminal to accept multiple currencies.

Helcim virtual terminal allows you to securely accept payments from any computer or mobile device.

(Source: Helcim)

Helcim offers both Level 2 and Level 3 credit card data processing for B2B merchants. Access to Level 2 is available for all Helcim merchant account holders, while Level 3 is reserved for their merchants accepting Corporate, Purchasing, and Government credit cards. Helcim’s virtual terminal automates most of the data entry steps for completing these types of transactions. They also provide training and detailed instructions for their subscribers.

Helcim is our current leader in B2B payment processing solutions.

Since Our Last Update:

Helcim no longer offers multi-currency payment processing for US merchants. Meanwhile, only merchants out of Canada with a USD account can accept payments in both currencies.

Helcim Fee Saver offers an automated zero-cost payment processing solution; it can automatically detect which type of free credit card processing program is best suited according to the business’ location and card brand being used. So aside from posting the proper signages, merchants do not need to worry about compliance—Helcim automatically adjusts the pricing, reducing potential errors.

Every Helcim merchant account holder who processes both credit card and ACH transactions is qualified to use Helcim Fee Saver. Merchants can enable and disable this feature with a simple toggle switch available when creating an invoice and setting up payment links.

Recently, Helcim made Helcim Fee Saver available for in-person transactions. Unlike the online version, merchants no longer need to offer ACH to qualify. Merchants using the Helcim Smart Terminal can access this feature and toggle to use per transaction. Note, however, that this feature is not available in certain states: Connecticut, Colorado, Maine, Massachusetts, Oklahoma, and Quebec.

Helcim provides a wide range of payment methods and an impressive array of free, native tools for small businesses that go beyond what you would find with most payment processors.

Ecommerce

Helcim provides a built-in website builder to set up your own online store. It’s fully hosted by Helcim and very customizable, with templates and a drag-and-drop interface—you can design your website in minutes. You can upload your existing product catalog, add a blog, and integrate Helcim’s payment processing tools for faster access to your funds.

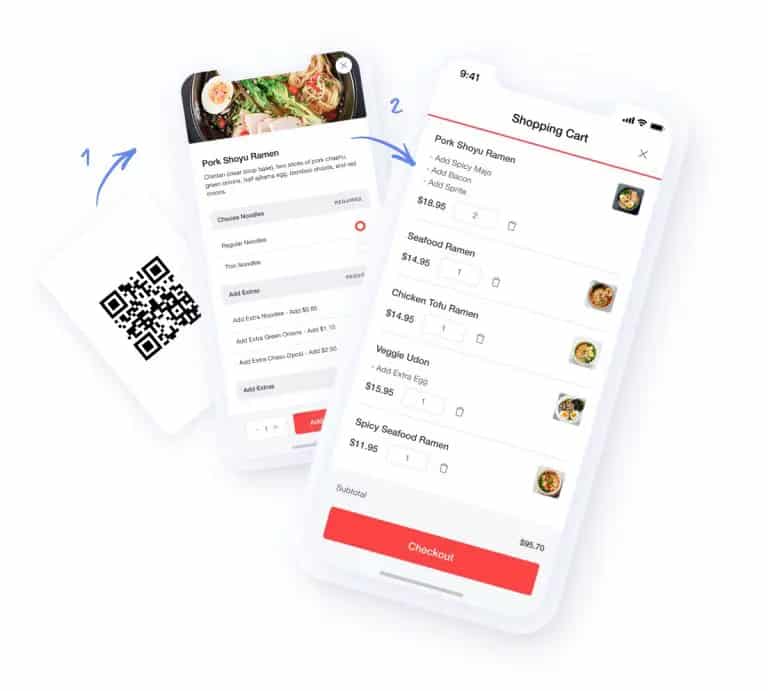

On top of a website builder, Helcim also offers a fully hosted online food ordering app for restaurant businesses.

Not many payment processors and merchant account service providers include built-in ecommerce tools with options for Facebook and Instagram integration—and at no extra cost. You may find ones with multiple ecommerce integration options, such as Payment Depot and Stripe, but chances are, some would require separate fees.

Square is our only other recommended payment processor with free online sales tools. Learn how Helcim stacks up against Square.

Helcim includes a built-in online food ordering app that allows you to take delivery requests and accept card and contactless payments. (Source: Helcim)

Hosted Payment Pages

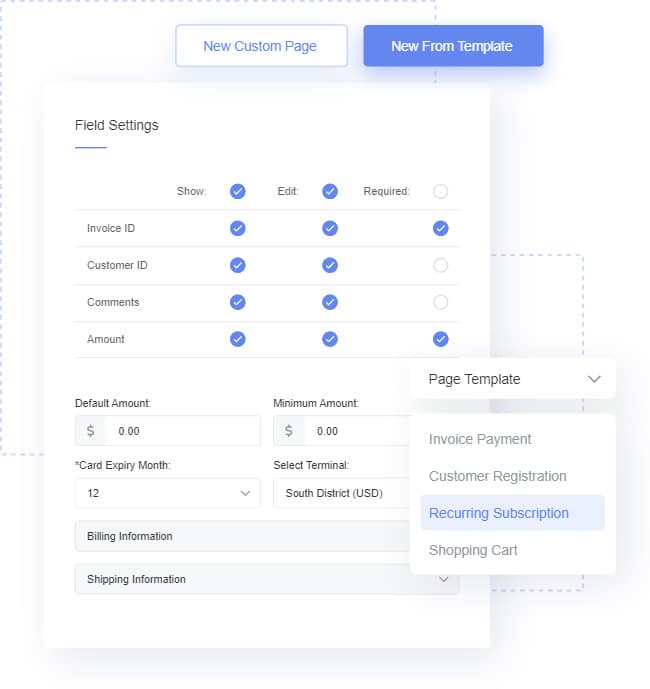

Helcim’s hosted payment pages are highly customizable without being too complicated to set up. It provides a payment page wizard tool that lets you build from templates with simple customization options and add more functionality for a better checkout experience, such as shipping and additional payment options—no coding skills necessary.

You can also embed your custom checkout page with a Buy Now button on existing websites or even as QR codes you can share via email or social media.

Leading providers like Square and Stripe also provide these features free of charge, but Helcim manages to combine the easy setup of Square with Stripe’s robust features. Like Stripe, Helcim’s payment pages can be customized to adapt languages, currencies, and local taxes but do not require complex coding skills to complete.

However, like Stripe, Helcim is better suited for businesses with large-volume sales and not small merchants. Square is our highly recommended alternative for small businesses looking for free ecommerce features.

The payment page wizard and custom data fields make Helcim’s payment pages versatile and easy to manage. (Source: Helcim)

Mobile Payment App

Helcim’s mobile payment app can be downloaded to a desktop or Android or iOS mobile device and accessed from the Helcim card reader. It’s easy to download and install, with guides available on the Helcim website and within the app itself. However, it’s not compatible with Chromebook or Windows 7 operating software.

The Helcim payment app is available in desktop, tablet, and smartphone versions. (Source: Helcim)

POS System

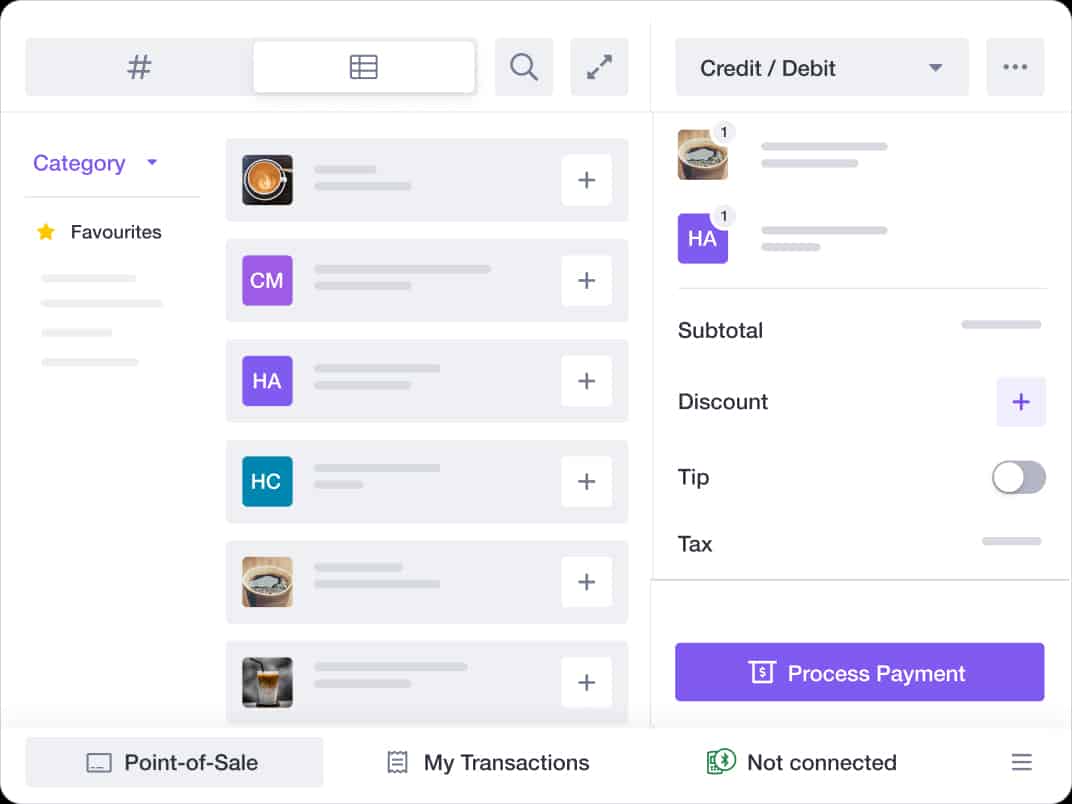

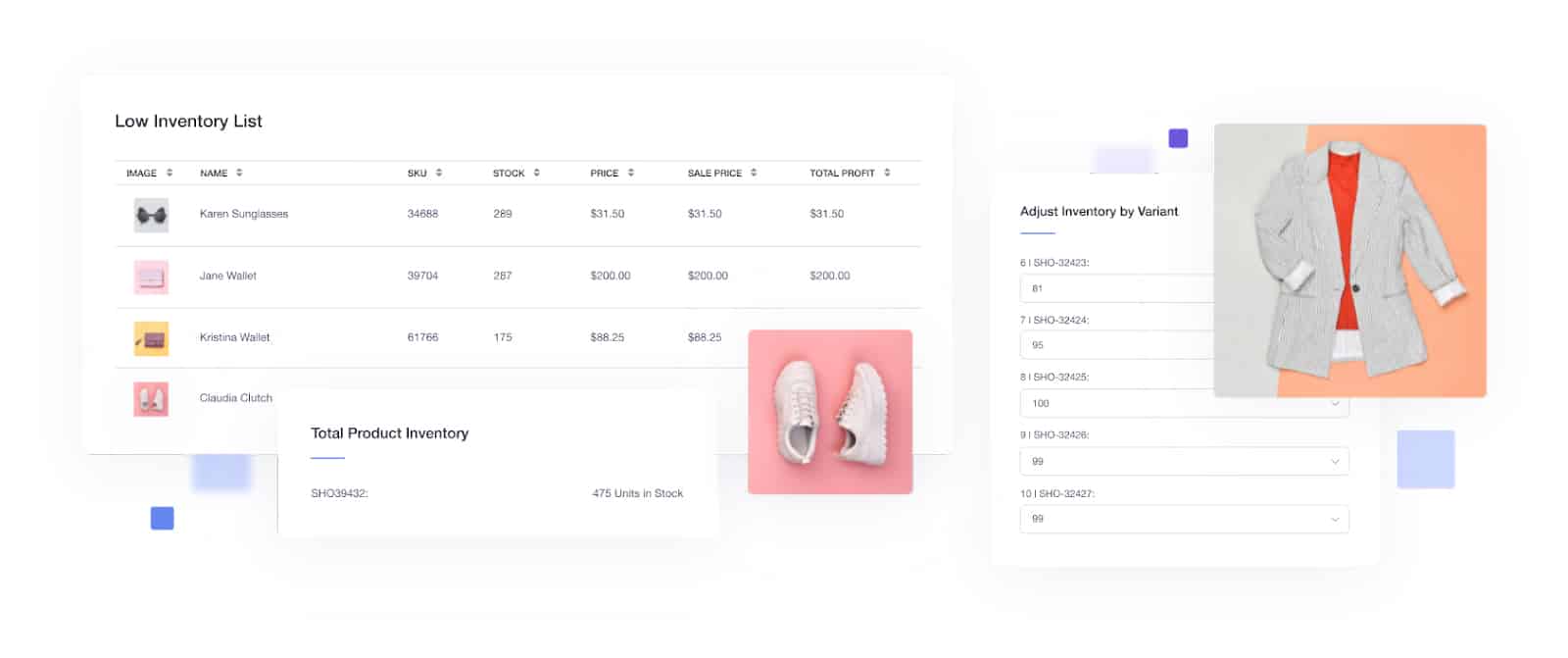

Helcim includes fully integrated free POS software that you can run on any countertop, tablet, or smartphone. You can connect Helcim’s card reader to start accepting payments. This software includes features that let you upload, track, and manage inventory, store customer information with its customer relationship management tools, and manage employees.

When integrated with Helcim’s ecommerce and online ordering system, which includes social media selling and shipping tools, it creates a complete multichannel sales platform with no extra cost.

Not a lot of merchant service providers include built-in free POS software. Square stands out but caters to small businesses, whereas Helcim is best for larger sales volumes. More importantly, the POS system also includes an inventory management feature that can handle large volumes of inventory and automatically sync your data on all platforms.

Helcim’s integrated POS system is free and can sync large-volume inventory data for seamless online and in-person sales. (Source: Helcim)

Some of Helcim POS software features are:

- Bulk inventory uploading

- Product images

- Product categories

- Custom orders (“Quick Products)

- Kitting

- Link purchase to customer profiles

- Omnichannel transactions

- Custom user interface

- Shipping management

- Custom tipping

- Custom taxes

- Line item notes

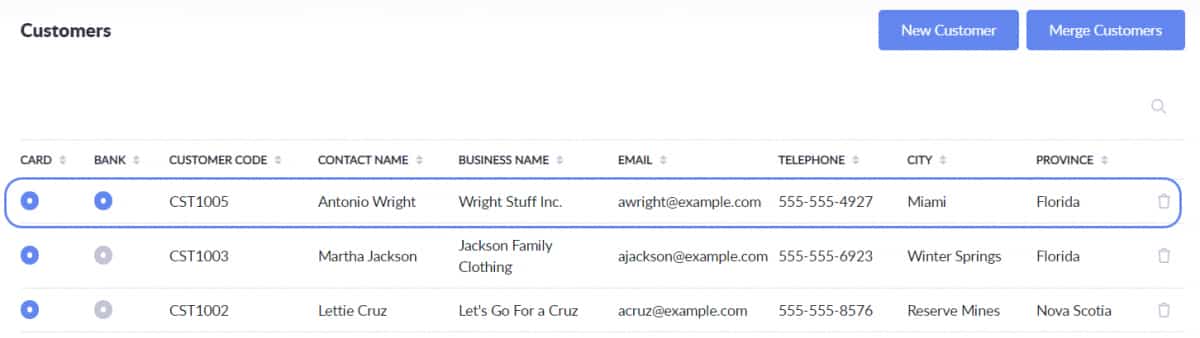

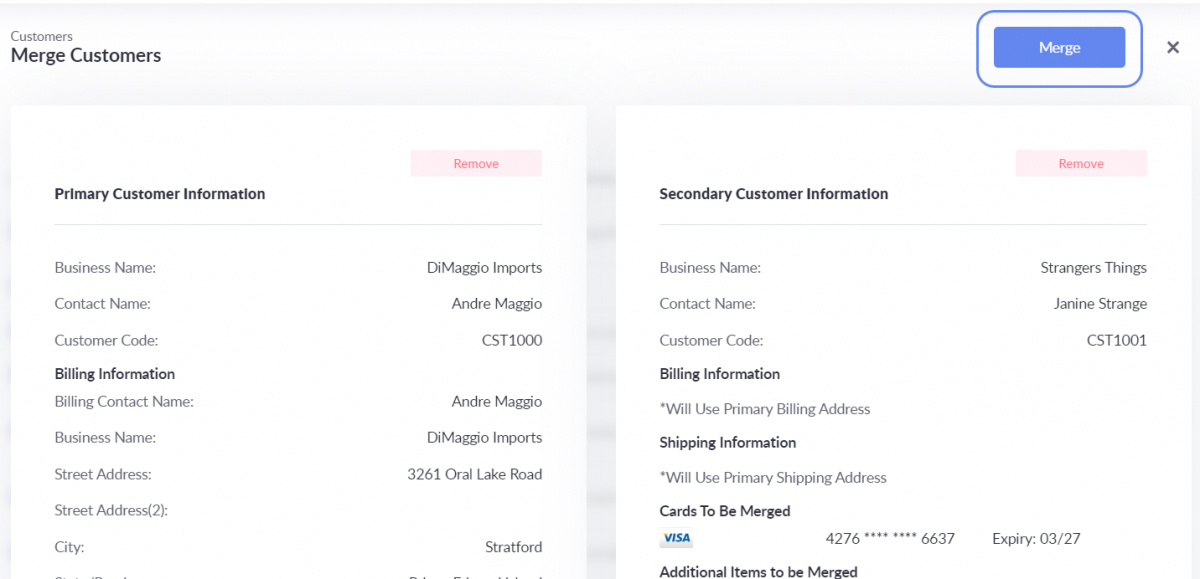

Customer Management

Helcim’s online customer management features provide tools for enhancing customer experience. It keeps you in touch with customers when they make a payment or sign up for a subscription. You can build customer profiles for faster payments, customized campaigns, and purchasing habits analysis for building loyalty programs. You can also bulk upload customer lists for faster setup.

Most payment processors include a built-in customer management feature, but not all include a hosted customer portal, which large businesses need to manage their client list effectively. Like Stripe, Helcim’s customer portal tracks customer profiles and purchase history, but Stripe requires the use of its Billing system, which imposes extra cost per transaction.

Add, delete, update, or merge customer records easily on Helcim’s customer management tool. (Source: Helcim)

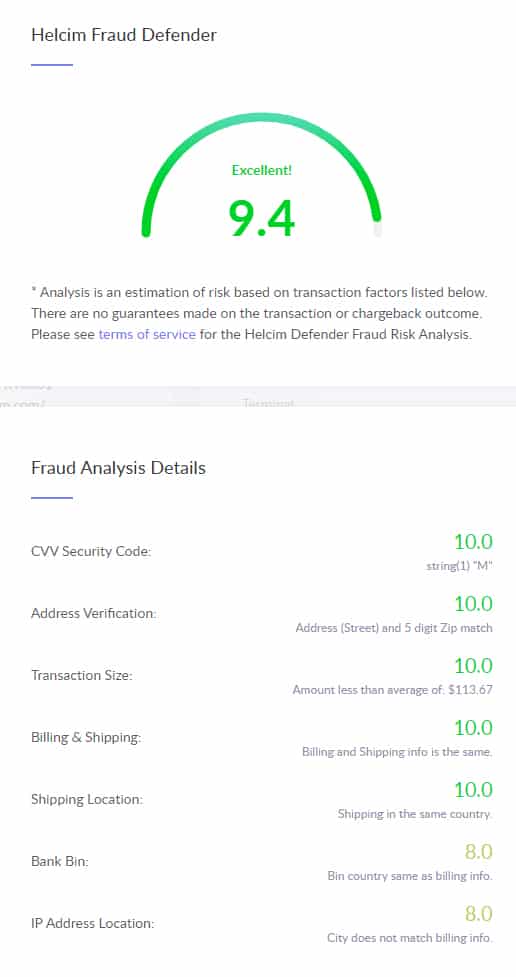

Security & Fraud Protection

Fraud protection is important for merchant service providers, especially those that cater to large businesses with global customers. Helcim has ecommerce automatic protection settings that void transactions based on your acceptable address verification and risk assessment settings.

The Fraud Defender program estimates transaction risk and scores it using several criteria such as IP address, shipping and billing location, and card security code, among others. A tokenized and encrypted card vault lets you store your customer’s credit card and bank information and use it to securely complete transactions.

Helcim’s fraud protection tools are comparable to Stripe, mainly because they cater to a similar clientele. However, Stripe’s security measures are highly customizable because they provide many developer-friendly features.

That said, Helcim also supports JavaScript-based payment security functionality alongside the Helcim API, which allows you to embed payment pages on your website securely. It comes with a code-generator tool, so creating the lines of code will be easier; data is stored on Helcim’s servers, so you don’t have to worry about PCI compliance.

Helcim’s Fraud Defender lets you automatically approve or decline transactions based on the calculated risk factors above. (Source: Helcim)

Integrations

One of Helcim’s earlier downsides has been limited integration, but it has since developed a number of built-in add-on features, such as its POS system, customer management, and ecommerce tools (though they could still use more). You can also still access platforms like Magento, Rezgo, WooCommerce, WHMCS, Ecwid for ecommerce, and Vend for POS.

QuickBooks is also available for preparing financial records and automating your payroll process. It integrates seamlessly with Helcim’s POS system, which includes an employee management feature. That said, Helcim can still benefit from more back-office business integration options in the future.

As a merchant service provider, Helcim’s range of payment method options is at par with the best in the market. It also offers great value for money with its interchange rates, volume discount, zero monthly fees, and pay-as-you-go pricing. Most users also agree that Helcim’s platform is easy to use and reliable. The quality of customer support is also impressive.

On the other hand, Helcim can still do well with more POS and back-office integration options. User reviews are few (less than a handful added since our last update), and the ratings for the service offer mixed evaluations. While it has responsive and professional customer service, it’s hard to ignore common complaints around technical setup and implementation issues.

Setup & Application

Helcim conducts a strict application process that’s better suited for established businesses. Startups and microbusinesses will find alternative payment processors like Square and PayPal with no approval process a more ideal option.

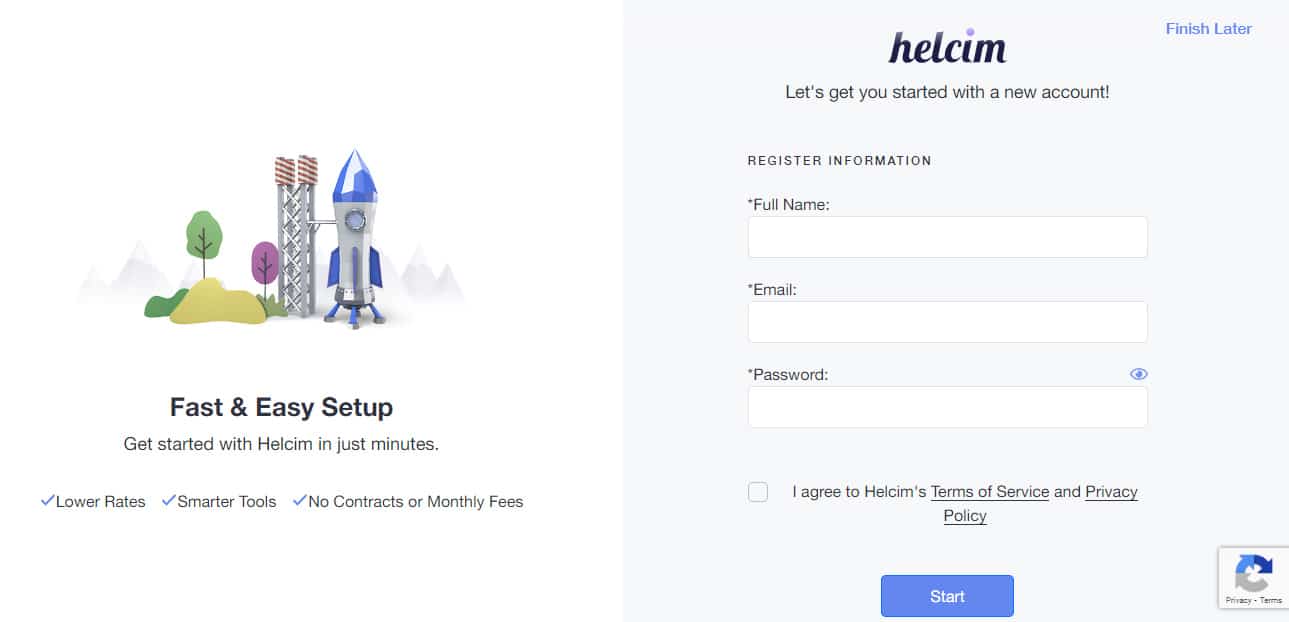

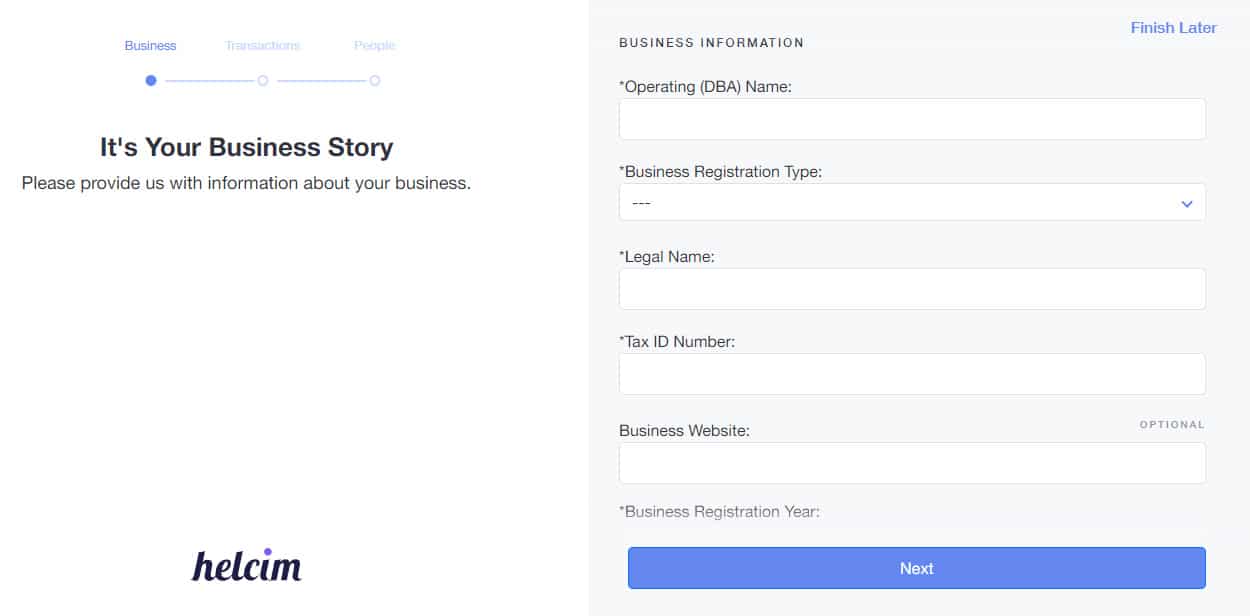

Signing up for a Helcim merchant account starts by visiting the website and completing the sign-up form. Note that the system will require you to set a strong password to proceed with your application. You will then be required to provide your business information and payment processing information.

If you have all of your information ready, application will only take a few minutes to complete. However, unlike with other popular payment processors such as Square and Stripe, you won’t be able to access the dashboard unless you complete the signup process.

Underwriting and approval time will depend on your sales volume and Helcim’s risk assessment in providing you with a merchant account.

Process Test Payments for Free:

Merchants who signed up after February 1, 2023, can now process test payments for up to $5 for free on Helcim’s live platform.

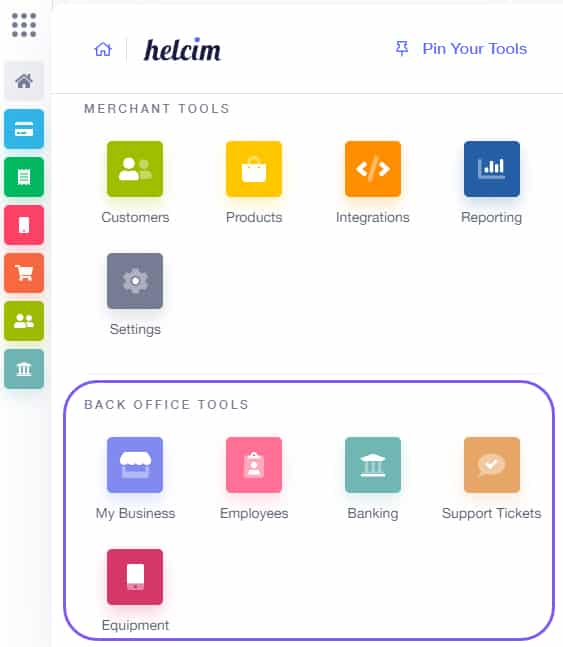

Customizable Dashboard

Helcim’s merchant account dashboard allows you to customize your profile settings with a few simple clicks. It also lets you customize the look and feel of your dashboard by having the option to pin the tools that you use the most on the screen.

Pin your most-used Helcim merchant management tools on your dashboard with a few clicks of a button. (Source: Helcim)

Developer APIs

Developer-friendly APIs go beyond payments. They also let you integrate the Helcim features in your account with your choice of POS system or develop a fully customizable and flexible platform with Helcim’s payment gateway to improve security and boost authentication tools. You can also add more payment options and even design customized report-generation functions to support your business.

Dispute Resolution Management

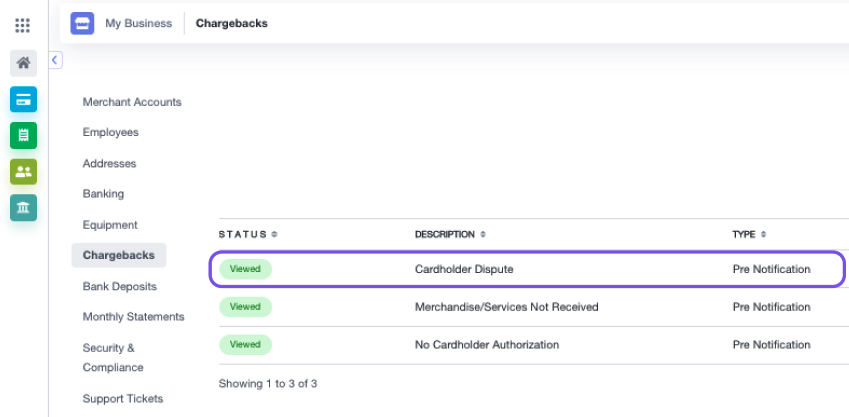

Improved chargeback management is also included in Helcim’s upgraded system. You can find a dispute resolution management system under the My Business tab in your Helcim account. This will show you any chargeback raised against your transactions, such as the amount, description, type, chargeback date, response due date, and the status of the dispute.

Customer Support

If you hit a snag, Helcim’s support center is stocked with a comprehensive library of troubleshooting content. If you need more hands-on help, you can reach out to a Helcim customer service representative via phone and email.

Monday to Friday: 7 a.m. to 5 p.m., MT

Saturdays: 9 a.m. to 5 p.m., MT

Toll-Free #: +1 (877) 643-5246

help@helcim.com

Methodology – How We Evaluated Helcim

We test each merchant account service provider ourselves to ensure an extensive review of the product. We start by comparing pricing methods, giving preference to those that offer zero monthly fees, pay-as-you-go terms, and low transaction fees. We then evaluate its range of payment processing features, scalability, and ease of use.

We use these criteria to examine the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

Helcim performed well in this criteria, only losing points for chargeback fees and hardware pricing.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Helcim earned perfect marks for this section.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

Helcim somewhat struggled in this criteria, earning only partial points for deposit speed and hardware purchasing options.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

Helcim fared well in this category, only missing points for popularity and integrations.

Frequently Asked Questions (FAQs)

Click through the sections below for the most common questions we get about Helcim.

We recommend Helcim for established businesses with monthly sales volume of at least $25,000. This ensures that merchants can maximize the discounted rates and free payment processing tools that Helcim has to offer.

You can use Helcim to accept payments online or remotely by setting up a free ecommerce store, processing payments over the phone with a virtual terminal, or sending payment links to your customers. You can also accept payments in person with Helcim’s mobile credit card reader.

Apart from offering interchange-plus transaction rates, Helcim provides its users with automatic, volume-based discounted pricing. This means your monthly transaction rates are based on your sales volume, so you immediately get the discounted rates. Other merchant service providers will require you to submit a request to evaluate your sales volume before approving lower transaction fees.

Card payments usually take one to two business days, while ACH payments take three to four business days for the funds to be available in your bank account.

Bottom Line

Overall, Helcim is an outstanding value-for-money merchant services provider for fast-growing and established businesses. You get the widest range of payment processing services (mostly) for free without any monthly fees. It has also made significant upgrades with access to ecommerce tools and free POS, although some may find Helcim’s card reader expensive.

Complaints over platform bugs, account setup, and migration issues are concerning. However, Helcim does have a very responsive and professional customer service with whom you can work closely to make sure these problems are immediately solved. Visit Helcim’s website to sign up for your free merchant account.

User review references:

1 Trustpilot

2G2

3Capterra