Holiday pay is not required, but to remain competitive, U.S. businesses voluntarily pay employees for an average of 7.6 holidays per year—typically New Year’s, Memorial Day, July 4th, Labor Day, Thanksgiving, and Christmas. When employees are required to work on a holiday, businesses often provide additional compensation or a floating day off instead.

Holiday Pay Policy Template

One thing to note is that paid holidays, like paid vacations or paid time off (PTO), aren’t required by law (but, at present, a handful of states do require paid sick leave). Paid holidays are merely a benefit that helps you hire, retain, and motivate your staff. Ultimately, your holiday pay policy and which days you provide as paid holidays is your decision.

Here are two sample holiday pay policies you can download:

The first policy template is most common for offices and professional environments in which the business (like a bank or consulting firm) is closed on the holiday and pays workers for those days off. It provides a list of the holidays that are paid (you can modify this). The second template is for businesses that require employees to work on holidays, as is common in retail, home services, hospitality, and restaurants. It provides sample text to support both paid and unpaid holiday policies.

- Template 1: Holiday Pay Policy for Businesses That Close on Holidays

- Template 2: Holiday Pay Policy for Businesses That Are Open on Holidays

To use these templates, click the link and then make a copy to save, or cut and paste the text from these sample holiday pay policies directly into your employee handbook, adding each year’s holiday calendar dates before sharing the policy with your staff. Your small business employees will be delighted to know that you’ll pay for the time taken off on holidays.

Here are five tips to help establish a holiday pay program for your team:

Five Tips for Managing Your Holiday Pay Policy

As a business owner, the phrase “the holidays” might bring up less than cheery thoughts. We’ve got a five-step process you can use to deal with the holidays at your business and to administer a holiday pay policy.

1. Create, Document & Share Your Holiday Policy

You can use our holiday pay policy templates examples above, modifying the policy to your business work schedule and company requirements. Then, share it with your employees. We recommend you do this at least four weeks before the next holiday so they have time to plan.

Consider which holidays you’ll offer as paid. For information on what’s commonly offered by small businesses, jump ahead to the sections below on most commonly paid holidays. Then, decide whether some employees will need to work those holidays. (It’s often based on seniority, e.g., your long-term employees get a paid day off, while newer employees have to work and perhaps take a floating holiday instead).

You’ll also need to determine how to adjust the policy for part-timers, such as by prorating their holiday pay. In order to manage your holiday pay policy (once you determine which holidays to pay for), we recommend adding your policy to your employee handbook.

Holiday Pay Policy Considerations by Worker Type

Some companies provide different policies for different workers. For example, your retail employees who work in your stores may be required to work holidays so that your business can stay open on those days. Meanwhile, your office staff may not need to work on those days. And some companies, like plumbing and gas stations, provide 24/7 service, requiring workers to work on holidays.

Further, if you have a lot of employees with school-aged children, you may notice that most schools observe all of the holidays we list above and many more. Therefore, you might want to consider flexible arrangements on those days even if you don’t want to give them as paid holidays.

Workers who may benefit from various holiday policies include:

- Full-time office employees: These are the most common employees to be offered six to nine paid holidays, as you close your office in observance of those holiday dates.

- Full-time field or service employees: These employees may be offered paid holidays to allow them to spend time with family, although some may need flex holidays instead.

- Retail and restaurant employees: Depending on work schedules, consider giving full-time employees the day off while having part-time employees fill in or take flex time.

- Part-time employees: Part-time employees often receive a prorated amount of holiday pay; some businesses don’t offer holiday pay to part-timers.

- Freelance employees: Most small businesses don’t pay freelance workers for holiday pay, but it’s a perk you can offer, especially if your freelancer works full-time.

2. Track Time-off Requests & Holiday Pay

Next, you’ll need some way to keep track of who’s scheduled to work on a holiday, what holidays you pay for, and who is to be paid on which dates. Make sure you’re properly tracking vacation time, holidays, and paid time off as well. One in three companies doesn’t and may be subject to large fines from the Department of Labor (DOL) or state agencies.

In fact, we recommend using software to manage your holiday pay policy while staying in compliance with federal and state labor laws. HR software can not only track paid holidays, but also store your holiday pay policy document and the list of paid holidays online electronically, giving employees a mobile app to view this information themselves. That prevents employees from asking the same questions over and over, e.g., “When is our next holiday?” and “Will I have to work that day?”

Below are four examples of different kinds of small business software tools you can use to manage your holiday policies, holiday work schedules, and holiday pay if you choose to offer it.

Scheduling Software

For scheduling hourly staff to work over the holidays, consider using employee scheduling software like When I Work, which costs just a few dollars per employee, per month. It can schedule your team, track holidays, and store your holiday policy online.

In fact, When I Work offers some cool extras, like the ability to post an open shift that interested employees can choose to work, and shift swapping—giving your employees more control of their own work schedule over the holidays. When I Work is free for businesses with up to 75 workers in one location, and it tracks time worked too, making payroll processing easier.

Timekeeping Software

If you need time and attendance tracked for hourly staff (and overtime purposes) and also want to offer and manage paid time off, consider using a time and attendance app Homebase. It lets you preprogram paid holidays into the work schedule and passes employee time-worked data to your payroll software. You can also use it to manage paid time off (PTO) and other policies online as well as communicate with your team through an app.

Payroll Software

Payroll software typically lets you identify paid holidays in advance and automatically provides the correct holiday pay to both full- and part-time staff based on your holiday pay policy. Affordable small business payroll software like SurePayroll automatically calculates employee pay based on hourly rates and salaries, shift differentials, and overtime. It also pays and files your payroll taxes for you without you having to lift a finger. Try it free for 30 days.

HRIS Software

Human resource information system (HRIS) software (also called HR software) makes it easy to track holiday pay, personal leave, and more—all online and with many automated features. It’s often an upgrade from basic payroll software. For example, Zenefits’ HR and payroll platform include timekeeping, policy document storage, an employee handbook, and an employee self-service portal, all in one package.

When you’re ready to offer benefits or a 401(k), HRIS software can do that too. This kind of software runs $6 to $12 a month and up, per employee. Plus, it often charges a monthly service fee of about $40 per month.

3. Remind Employees About Holiday Schedules in Advance

It’s not a bad idea to send out a reminder one to two weeks prior to a paid holiday (or unpaid). Otherwise, your employees might assume that they have the day off, especially if they’re new to the workforce. Request that employees let you know if they need time off or have issues working their scheduled shifts during the holiday season.

Early reminders prepare your salaried staff to plan upcoming work activities. For hourly team members, it may alert them that their schedule may change. In any case, it gives your employees a heads-up so they can clarify any holiday schedule or pay concerns beforehand. Nothing’s worse than having to tell your restaurant worker that they don’t have the Friday after Thanksgiving off when they’ve already planned to visit their parents out of state.

4. Consider Hiring Temporary Employees or Don’t Open

If you run a restaurant and no one wants to work on Christmas Day, should you close or try to find temporary staff? Think of the costs and benefits of having the doors shuttered for the holiday versus staying open. Temps might be costly, but so might losing your team members if they start looking for other jobs that provide holidays off.

Look at the big picture, including last year’s data on what staying open on key holidays did for you revenue-wise. If you broke even or lost revenue that day, investing in a day off for employees may be a better way to go, whether you provide that time off as paid or not.

5. Remind Yourself That It’s the Holidays

Take a deep breath; the holidays in the U.S. are few and far between, and you can be prepared for the crazy Thanksgiving, Christmas, and New Year’s holiday flurry if you plan properly. Remind yourself that holidays are important to people. They want (and need) to spend time with family and friends. In fact, employees from other backgrounds may be fine working on Christmas but prefer Yom Kippur or Ramadan off instead.

Holidays provide a chance to build your company culture by honoring something important. And who wants to have to replace a steady, well-trained employee over the holidays in this tight labor market?

Here are some of the most common holidays across all U.S. businesses:

Most Commonly Paid U.S. Holidays

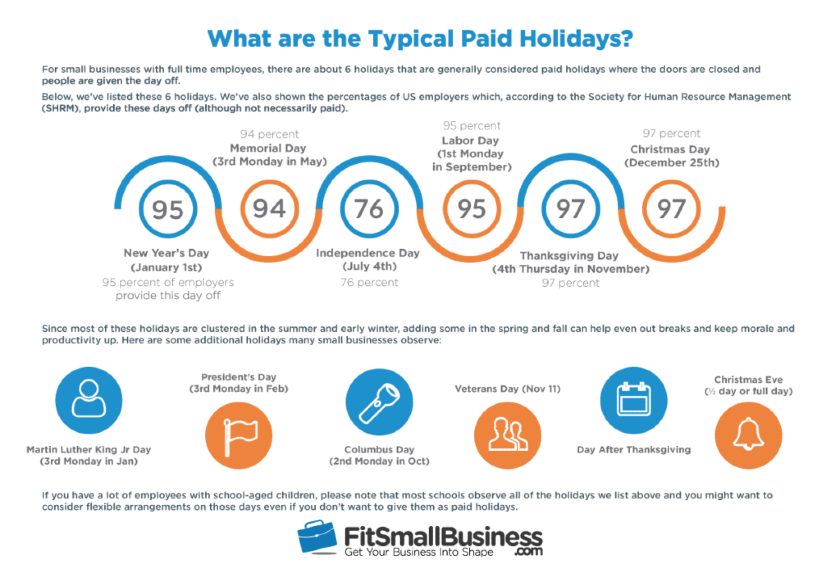

Data from the Society for Human Resource Management (SHRM) shows how many U.S. employers provide holidays for the six most common public holidays, which may not always be paid days off.

The six most common days are:

- New Year’s Day (January 1): 95%

- Memorial Day (third Monday in May): 94%

- Independence Day (July 4): 76%

- Labor Day (first Monday in September): 95%

- Thanksgiving Day (fourth Thursday in November): 97%

- Christmas Day (December 25): 97%

Many companies, even startups, allow employees to take off at least the major holidays.

Many employers add either the day after Thanksgiving or Christmas Eve, making these seven or eight holidays the ones most commonly provided to employees or compensated using holiday pay.

Because most of these holidays are clustered in the summer and early winter, adding paid holidays in the spring and fall can help even out seasonal breaks and keep your employee morale and productivity up. Here are some additional holidays that many small businesses observe:

- Martin Luther King Jr. Day (third Monday in January)

- Presidents Day (third Monday in February)

- Columbus Day (second Monday in October)

- Veterans Day (November 11)

For more about paid time off (PTO) as a whole and how to provide it, use our PTO guide, which covers vacation, sick leave, holidays, bereavement, and more. In addition, some companies provide a different set of paid holidays to salaried workers versus hourly workers or to part-timers who don’t work a full-time or regular schedule.

It’s also not a bad idea to be aware of PTO laws. Here’s a quick summary:

Federal, State, PTO & Holiday Pay Laws

You do not need to provide any paid or unpaid holidays for your employees, either per state or federal law. You also do not need to provide vacation time (although you may need to provide paid sick leave if your business is located in certain cities or states, such as California or Oregon).

Even if not required, providing paid holidays and vacation time can be an important component of recruiting and retaining great employees. In addition, providing paid time off can increase morale and improve productivity. That helps you hire top talent and prevents them from leaving your business in order to get more time with their family.

We recommend When I Work as free scheduling software to small businesses that can help you manage your holiday work schedules. When I Work allows you to build the schedule and then ask employees to sign up for shifts. It also allows shift swapping, which makes it easy for managers and employees to ensure shifts are covered.

Cost to Implement a Holiday Pay Policy

There are three primary costs that go into setting up and implementing a holiday pay policy. The first is the cost of developing, storing, and providing training on the holiday pay policy itself. The second is the cost to administer it. But the most costly aspect of holiday pay is that you are paying workers their standard wages on days they don’t actually work.

- Policy set up: It may take you a few hours per year to document, update, and share information on your holiday pay policy. Use our policy template to get started.

- Policy administration: You may need software to keep track of your employee schedules and paid holidays. This can run from free to a few dollars per employee, per month and up.

- Wages: To determine the cost of your holiday pay policy, multiply the number of workers you have by the number of holidays you pay, and then by the average worker earnings per day.

For example, let’s say your average employee works an eight-hour day making $15 per hour. That’s $120 per day ($15 x 8 hours per day). If you have 10 workers and give them seven paid holidays a year, it will cost you $8,400 in payroll costs (holiday pay wages).

Example: 10 workers x 7 days x $120 per day = $8,400

Rather than thinking of holiday pay in terms of costs, however, consider it an investment in your business. In fact, you’ll likely reduce your recruiting and hiring costs by thousands of dollars a year as you’ll be able to attract and retain workers who want paid holidays. Next to health benefits, paid time off is the most valued work perk that employees desire.

If you want to offer additional perks besides holiday pay, check out SurePayroll. This small business software automates your payroll, lets you offer pay-as-you-go workers’ compensation insurance, and even affordable 401(k) and health insurance plans for your employees—all with flexible pricing to fit your needs.

Pros & Cons of Providing Holiday Pay

HR professionals will tell you that offering holiday pay to workers is going to save you money in the long run by reducing your turnover. Nonetheless, if you talk to business owners, you’ll find there are pros and cons worth mentioning.

Pros of Offering Holiday Pay

Here are the pros and primary benefits to your business of providing holiday pay to employees:

- Improved employee morale: Your employees won’t have to choose between spending time with their family or getting paid. They’ll get both.

- Reduced turnover: Your employees won’t be tempted to change employers to one that pays for holidays. It’s a competitive advantage you’ll have over other employers.

- Reduced absenteeism: Your employees are less likely to call in “sick” on a holiday, or to take a sick day before or after the holiday since they’ll be paid to take the holiday.

Cons of Offering Holiday Pay

The downsides of paying employees for holidays are less compelling and include:

- Costly: You have to determine, in advance, your payroll costs of providing paid holidays similar to any other PTO benefit you provide, like vacation pay.

- Schedule conflicts: You may need employees to work on holidays, and thus will need to offer a floating holiday or another means to make it fair to those employees, such as providing them a bonus for working on a holiday.

- Post-holiday absenteeism: Some employees take advantage of paid holidays and call in sick the day before or after in order to give themselves an extended vacation.

- Can’t differentiate: If you offer paid holidays to some, you must offer it to all workers in similar jobs and categories. You can’t discriminate against any legally protected classes, such as only offering paid holidays based on religion or marital status.

How Holiday Pay Works

Paying employees for a holiday works exactly the same as paying the employee as if they worked that day. Whatever number of hours they would have worked on that day (such as an eight-hour workday) is paid for that holiday date during that pay period. Of course, it’s easier if you set holiday dates up in advance within your payroll software, so that you don’t have to manually input the number of hours and pay rate for each employee each holiday.

Your payroll software will typically have a category to track holiday pay as a separate paid time-off category. And your HR software can also be used to reinforce rules such as paying part-time employees an average number of hours or checking to see that the employee worked the day prior to a holiday if your holiday pay policy requires that.

Alternatives to Holiday Pay

Smaller companies that don’t feel they can afford to pay employees for all paid holidays might consider options, such as floating holidays, paid time off, or flexible scheduling. Another alternative is to provide the day off, but don’t pay for that day off—that gives your employees the time off they need, even if they don’t get paid while they’re taking that time away from work.

Floating Holiday

In lieu of standard paid holidays, you may wish to allow employees to take off days that are meaningful to them. For example, you may have non-Christian employees who don’t celebrate Christmas and would prefer to celebrate their own religious or family holidays instead. Here’s how to set up a floating holiday policy.

Paid Time Off

Many companies provide paid time off for vacation and family events. Like floating holidays, this gives employees the option to schedule multiple days at one time, perhaps allowing them to travel to see family for the holidays. Here’s how to set up a standard PTO policy.

Unlimited Paid Time Off

Some startups are experimenting with unlimited PTO as a way to attract and retain employees. They don’t, in fact, keep track of specific days that employees take off—instead, they provide employees with work expectations and a salary. There are some best practices on offering unlimited PTO, and, due to labor laws, this option only works for exempt employees.

Flexible Schedule

You may want to let employees flex their schedules around holidays based on who wants to work and who doesn’t. Or, perhaps employees can share shifts so that each person can spend at least a few hours that day with their family if they are required to work on a holiday. For example, one retail worker could take just the morning shift, while another picks up the afternoon shift.

Unpaid Holiday

Since paid holidays aren’t required by any federal, state, or local law, some employers don’t offer them. For example, if they close their business on those days, employees have the day off, unpaid. And some service businesses allow workers to sign up for those holidays they need to take off unpaid so that the work schedule (such as on-call) remains covered.

Paid Holidays That Are Worked

Some service providers and retail or food service establishments that must remain open on holidays incent their employees for taking those holiday shifts with differential pay. It could be a $100 holiday bonus for working that holiday, or it could be double time, meaning the employee receives twice their normal pay for all hours worked on that holiday.

Frequently Asked Questions (FAQs) About Holiday Pay

Here we include the most frequently asked questions about holiday pay.

Is holiday pay mandated by any legislation?

No. Some states mandate sick pay, and other states require short-term disability benefits to be provided. However, no federal, state or local laws require an employer to provide paid holidays (or even to allow employees to take those holiday days off, unpaid).

However, if you’re in a union environment that specifies paid holidays, or your business states in its employee handbook, offer letter, or any policy that specific holidays are to be paid, then you must abide by that.

What is the holiday pay rate?

Typically, employers who provide holiday pay for days not worked pay the workers the same rate they would have received if the employees had worked that day. For workers who work on a holiday, you may want to consider paying a premium, such as a bonus or time and a half. (Keep in mind that no holiday pay rates or offerings are mandated by law. It’s always an optional benefit an employer can choose to provide or not—unless a union contract states otherwise.)

Can unused holiday pay be carried over to the next year?

It’s uncommon for holiday pay to be carried over from one year to the next. If an employee can’t use their holiday pay (because they work that day, for instance), you can either pay them holiday pay on top of their pay for that day (double time) or you can offer them a floating holiday instead, with the condition that they use it within a given time frame, such as that month or prior to year-end.

What if an employee is sick or on leave during the holiday?

Some businesses only pay holiday pay for those employees who work their scheduled business days prior to and after the holiday. That prevents employees from turning a holiday into a vacation and prevents you from having no-shows after a long holiday weekend.

Employees on paid leave are generally paid the holiday as if they were working, while those on unpaid leave are not. In addition, some employees schedule their PTO around a holiday. In that case, for instance, they should still be paid the holiday as a holiday and the days before and after the holiday as PTO.

However, before you add restrictions to your holiday pay policy, check the sick leave laws in your state to ensure you don’t violate any local leave laws.

Should businesses with hourly employees pay out holiday pay?

Businesses with hourly employees don’t always provide paid holidays or paid vacations—but this doesn’t mean that you shouldn’t. If your retail store or cafe offers paid holidays or vacation, you can attract top talent for open positions and reduce the turnover of existing staff.

Don’t believe that providing a day off or a paid day off might benefit your business? It’s been proven to increase employee engagement. You might also decide to host a holiday party instead.

Should businesses pay out vacation time?

In addition to paid holidays, it’s worth mentioning that having two weeks (10 business days, or 80 hours) of paid vacation time is standard in most salaried roles. That standard is also worth considering for hourly workers if you want to attract and retain a higher level of talent.

What should my holiday policy look like if my business doesn’t close on holidays?

If you own a restaurant, cafe, or small theater business, there are any number of reasons why you might not close on a “usual” holiday and remain open for business. If this is the case, you will want to instead establish a holiday pay policy around the following:

- Which holidays your business is open and what the hours and shifts will be on those days

- Whether you will pay a bonus or pay double time for people who work those days

Then, you will want to establish a holiday pay policy and holiday work policy. Be sure your employees receive a copy.

Bottom Line

A holiday pay policy may feel stressful to a cash-strapped small business owner. But, consider the benefits of it for your employees and employer brand. Having a few paid holidays, or paying people extra to work on a traditional holiday, can help keep your employees happy. That reduces your overall employment costs and helps retain those employees who keep your doors open.