Preforeclosure houses typically occur when a homeowner falls behind on mortgage payments, which results in loan default. During preforeclosure, the homeowner can either sell the property or pay the outstanding balance on the loan. This allows an investor to buy a preforeclosure property below market value. To learn how to buy a preforeclosure home, follow our step-by-step guide—from deciding if it’s the right investment strategy to finding listings to closing on the property.

Finding and buying a preforeclosure property is more complicated than a traditional real estate purchase because listings are not always readily available to the public. Here are the steps on how to buy a preforeclosure home:

1. Understand the Preforeclosure Process

Preforeclosure is the first phase of the foreclosure process, which enables a mortgage lender to reclaim ownership of the mortgaged property to recuperate the debt associated with the defaulted mortgage. During preforeclosure, the lender sends a Notice of Default to the borrower, informing them that legal action is being taken toward foreclosure. However, the owner still has a chance to ward off a foreclosure by getting enough money to pay the bank or sell the property to pay off the loan.

2. Decide if Buying a Preforeclosure Property Is Right for You

Preforeclosure homeowners frequently face financial difficulties, and some would prefer to sell the home rather than have a foreclosure appear on their credit report. Preforeclosure homes are commonly available at a reduced rate to market value for investors.

Preforeclosure property investments are best suited for the following investors:

- Fix-and-flippers: They use a hard money loan to buy preforeclosures that need extensive repairs, then flip the property for a profit to pay off the loan.

- Long-term investors: They purchase homes that are about to go into foreclosure, make the necessary repairs, stabilize the property, and then finish the renovations to make the property eligible for a long-term loan.

Pros & Cons of Buying a Preforeclosure Property

The traditional home purchase process is different from buying a preforeclosure. Buying a preforeclosure has advantages, such as less competition since the home might not even be on the market. However, as you learn how to buy a preforeclosure home, you’ll see some drawbacks, like working with uncooperative homeowners and a more extended closing period. Here are the main advantages and disadvantages:

| PROS | CONS |

|---|---|

| Less buyer competition since some preforeclosure homes are often not on the market yet | Preforeclosure homes sometimes require deferred maintenance or significant repairs |

| You can buy preforeclosure houses below market value | Preforeclosure properties are difficult to find or search |

| It has lower settlement costs, and you can often finance the property | Homeowners are sometimes emotional, which makes the dealing process challenging |

| You can buy a preforeclosure home in higher-cost areas for less | Slow process, and it has a lot of paperwork for the buyers |

3. Research Neighborhoods

After learning what preforeclosed homes are, the third step on how to buy a house in preforeclosure is to ensure you’re looking for preforeclosure homes in the right neighborhoods. Investing in the right community allows you to capitalize on the appreciation and maximize your investment profits. It can make the difference between achieving expected returns and achieving exceptional returns.

Analyze online maps to determine whether the area is urban, suburban, or rural, as well as the accessibility of public transportation and major routes. Search online for available rentals to see market rents if you intend to rent the property. Consider the overall market conditions, affordability, public transportation or parking availability, and the school system when looking for a neighborhood. Furthermore, renters and buyers prefer locations that have the following characteristics:

- Accessibility to major establishments like supermarkets, parks, shopping, restaurants, and businesses

- Walkability

- Highly rated schools

- Sidewalks, streetlamps, and roads are in good repair

- Buildings and homes in good condition

- How long do properties sit on the market before being sold

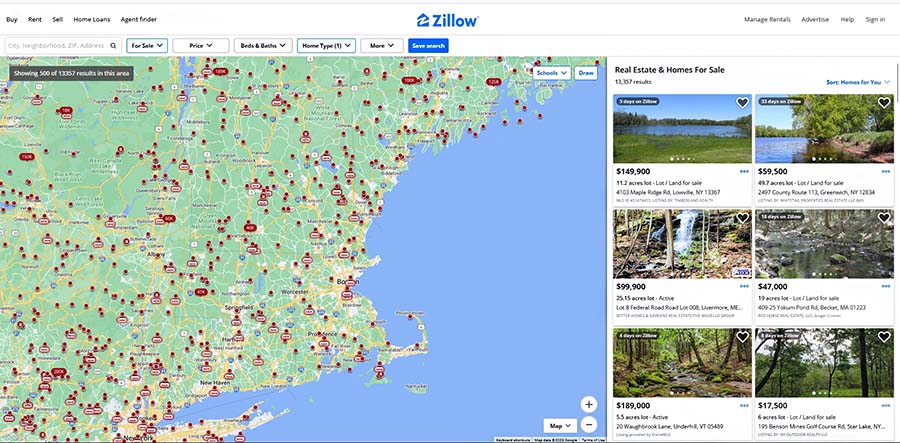

Zillow land search (Source: Zillow)

An easy way to find the right neighborhood to buy a preforeclosure house is to use real estate websites like Zillow. You can use its “preforeclosure” listing type filter and choose the location you want to search for, price range, lot size, home type, and current status. When you view listings, you can see the number of days on the market, purchase history, taxes, and property type.

4. Find Preforeclosure Listing Leads & Narrow Down Property Options

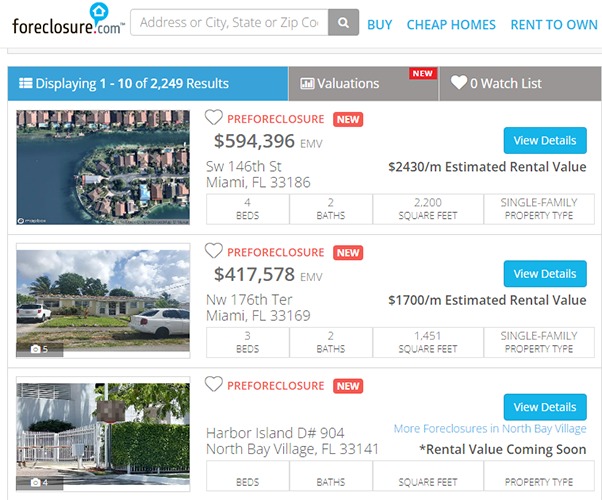

Knowing how to buy a preforeclosure home becomes more complicated when locating those that are for sale—often the most challenging part of the purchase process. Unlike typical property listings, preforeclosure listings do not appear in abundance on popular listing websites. However, there are several methods to find preforeclosure homes with or without the assistance of a real estate agent, one of which is by using online directories.

Find foreclosure and preforeclosure listings using online directories, which have extensive information on properties in your neighborhood. Use filters to sift through potential listings and easily find pertinent information.

Preforeclosure property search (Source: Foreclosure.com)

Online directories are the best option for investors to find real estate investing properties and preforeclosure listings because you can access them instantly from any device. However, verifying multiple sources is crucial because some directories occasionally contain inaccurate or outdated information.

Here are a few online directories to help you find preforeclosure listings:

Online Directories | ||||

|---|---|---|---|---|

Best For | Investors who want unlimited access to preforeclosure and foreclosure listings | Investors looking to prospect for non-agent represented listings like preforeclosure leads | Investors seeking a nationwide database by state to see the properties that are available in their area | Investors who want to cultivate high transaction probability deals by combining lead research with built-in customer relationship manager (CRM) |

Key Features |

|

|

|

|

Monthly Starting Price | $39.95 | $49.99 | $39.80 | $119 per user |

Learn More |

After narrowing your search to a few preforeclosure properties, conduct a comparative market analysis (CMA) and a rental market analysis (RMA) to examine comparable homes in the area. These reports will give investors an objective look at property data so they can decide which property purchase is right for them.

Download our free templates and learn how to make a rental market analysis (RMA) report by reading this articles:

Other ways to find preforeclosure properties include the following:

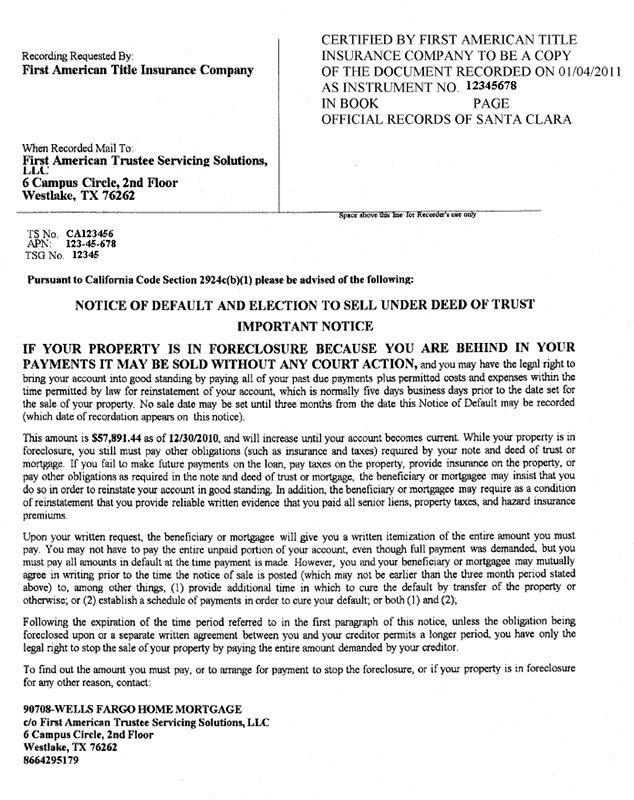

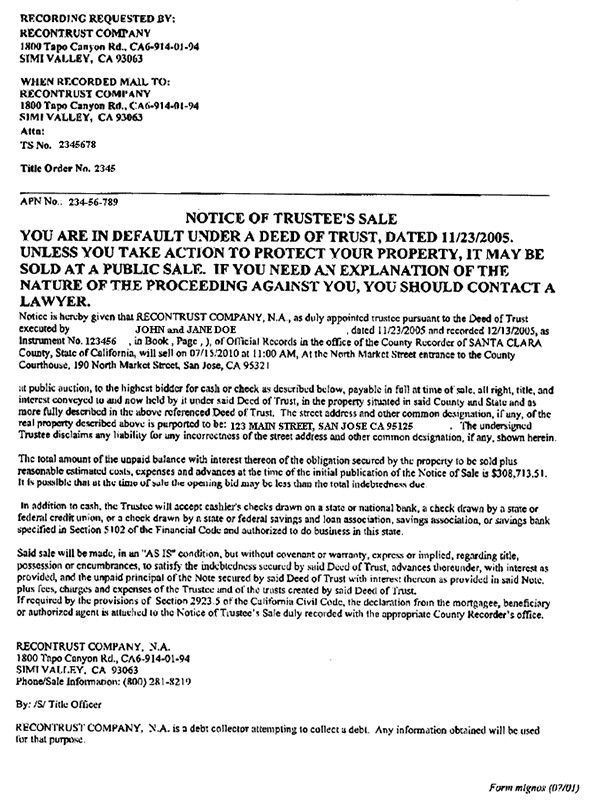

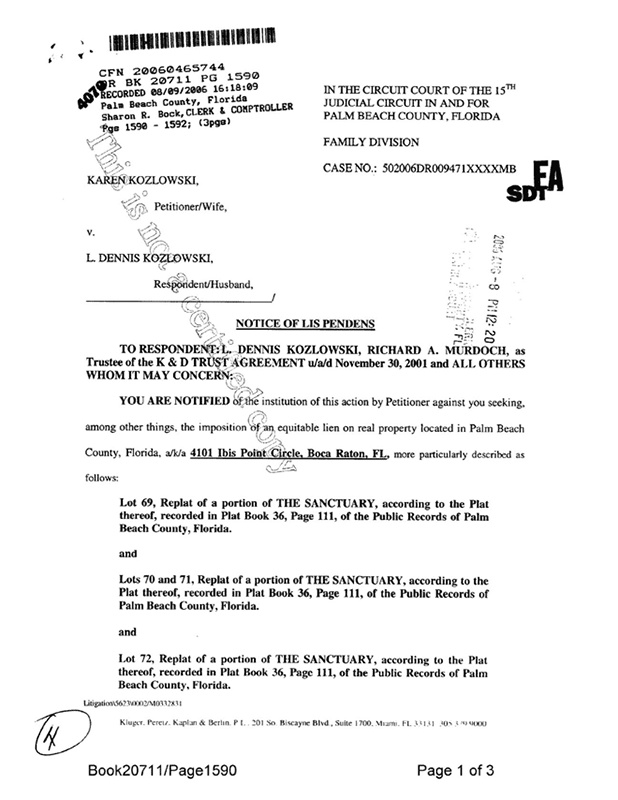

Access preforeclosure listings for free by visiting your county recorder’s office. Look for Notice of Default, Notice of Trustee Sale, and Lis Pendens in the public records section. These are public notices sent to the property owner during the foreclosure process.

Public records contain the following information:

- Property owner’s name

- Property’s address

- Foreclosing bank

- Amount owed on the home

Searching public records to locate accurate preforeclosure listings takes time and only gives you a little information. For instance, some of these documents don’t contain comprehensive property descriptions, home photos, or information on liens owed on the house. This method may be helpful for any investor or real estate agent with the time, energy, and expertise to communicate with property owners and get more information.

Real estate attorneys represent clients during their real estate transactions, including those whose properties are in preforeclosure. On the other hand, real estate wholesalers are entrepreneurs who acquire properties from homeowners and connect them with a buyer or investor. The wholesaler does not purchase the property. Instead, the owner’s temporary contract gives the wholesaler the authority to sell the property on their behalf, and the wholesaler keeps the difference.

Therefore, you should make valuable connections with specialized professionals who are consistently in contact with preforeclosure leads, like real estate attorneys and wholesalers, to get firsthand information. Attending in-person events or establishing connections through personal and professional friendships are the best ways to connect with real estate attorneys and wholesalers. Additionally, you can easily connect with them online or through social media.

When looking for active preforeclosure listings and comprehensive property information, your local Multiple Listing Service (MLS) is one of the significant data sources. The MLS is a local database of properties for sale that is only accessible to real estate professionals. For security and operating costs, each MLS is used and managed by real estate agents and brokers and is specific to your state.

Investors can work with accredited real estate agents and have access to the MLS. Your real estate agent will look through the MLS for preforeclosure listings. Furthermore, real estate agents could assist you in the process, such as negotiating with homeowners or lenders, navigating paperwork, and providing market insights. They will research and provide comprehensive property photos and information such as annual property taxes, square footage, and the price at which the home was last sold.

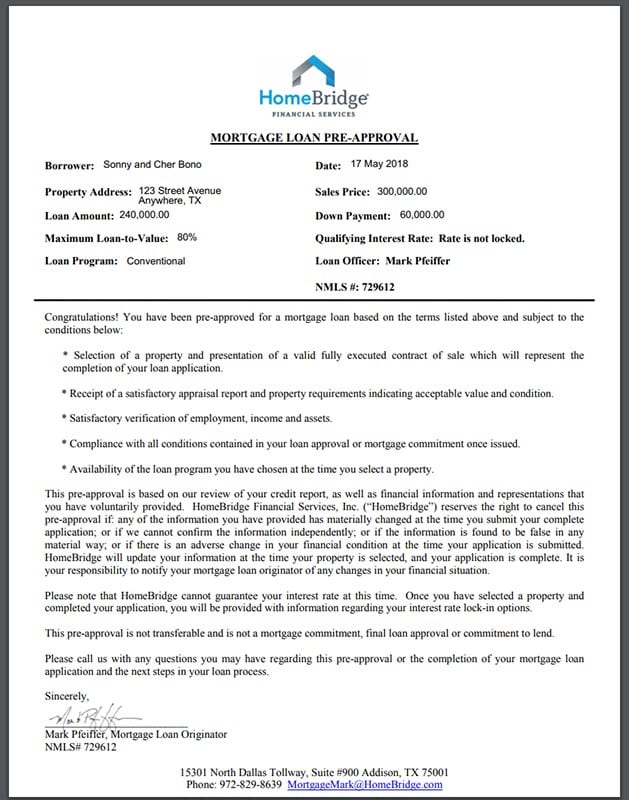

5. Get a Loan & Pre-approval Letter

Before making an offer on a preforeclosure property, find a lender and obtain a pre-approval letter. This letter shows you what your maximum borrowing amount is, reassuring the seller that you are serious and would be able to secure financing to buy the property. However, pre-approval does not guarantee you a loan. It means the lender determines how much you can borrow after a preliminary assessment of your creditworthiness for a loan.

Sample mortgage loan pre-approval letter (Source: HomeBridge)

The kind and state of the property influence your choice of lender. If you can pay for the property and any necessary renovations in cash, you’ll be in a better position for a quick close. But if you can’t pay in all cash, you will need to obtain a hard-money loan because you will most likely not be approved to purchase a preforeclosure with a conventional loan.

However, traditional lenders typically demand that the properties be in good repair or only need minor improvements. Apartment buildings with more than five units usually require a loan from a lender that provides commercial financing.

Visit our articles Investment Property Financing & Requirements and 5 Best Investment Property Loan Providers to decide the best loan options for your purchase.

6. Make an Offer & Negotiate

You can make an offer on a preforeclosure property once pre-approved for a loan—kicking off the negotiation process. When making an offer, it is critical to understand how much the house is worth, how much is still owed, and how much you may need to spend on repairs.

Don’t forget to include contingencies in your offer, allowing you to back out of the deal if terms are not met. A contingency in real estate is a clause in a purchase agreement that specifies an action or requirement that must be fulfilled for the contract to become legally binding. Before the contract becomes legally binding, the buyer and seller must agree on the terms of each contingency and sign it.

Here are some of the common contingencies in real estate:

- Title contingency: This provision gives the buyer the right to obtain a title search and raise any objections to the status of the property’s title, which the seller must clear before the buyer can close on the transfer of title.

- Appraisal contingency: This clause protects the buyer by requiring the property to appraise for at least the indicated sales price or the contract will be invalidated. This is due to banks’ aversion to lending money to borrowers for a home that costs more than it is worth. It may also state that the seller can lower the price to the appraised value.

- Inspection contingency: This clause specifies when the buyer has to have the property they intend to buy professionally inspected. The home inspection ensures no significant problems, such as a leaking roof, a faulty electrical system, or structural flaws.

- Sale of a prior home contingency: This clause protects homebuyers who need the cash proceeds from selling their existing home to buy a new one. The homebuyer can pull out the real estate contract if they need to sell their current home by the contract’s deadline but cannot find a buyer.

- Home insurance contingency: This provision requires the buyer to apply for and obtain homeowners insurance on the property. Either party may terminate the contract if they cannot get the necessary insurance. The seller or the mortgage lender frequently requests this.

- Mortgage contingency: This clause specifies a time frame for the buyer to obtain financing to purchase the home. If the buyer does not secure a loan by that deadline, they can withdraw from the deal without penalty, and the seller can relist their home and choose a different buyer.

When making an offer, working with a real estate professional is advantageous as they are familiar with purchase contracts and contingency deadlines.

7. Execute Paperwork & Close on the Property

The previous homeowner’s title will be transferred to you during this stage. Once the lender’s underwriting has approved the buyer and property, you will receive a commitment letter. The closing attorney or title company will set a closing date. The time from accepting an offer to closing varies depending on the property but can typically range from 30 to 60 days. This time frame is usually shorter if you are paying for the properties with cash.

You will be accountable for paying all closing expenses, such as transfer taxes, title insurance, lender fees, and property taxes, at the time of settlement. Closing costs can range from around 3% to 6% of the loan amount. If you take out a $300,000 mortgage, closing costs will vary from approximately $9,000 to $18,000. The title company will transfer money between you, your lender, and the seller. You will receive the keys, and the preforeclosure property will be yours once the fees are paid and the paperwork is signed.

However, if you intend to close in the name of your limited liability company (LLC) rather than your own, make sure the lender allows you to do so before applying for loans. Putting all your investment properties in an LLC adds protection. But if you own properties in multiple states, you should have an LLC in each state because laws and taxes vary per state.

Read our How to Start a Real Estate Holding Company or Real Estate LLC article to learn more about maximizing your LLC company in real estate investing.

8. Complete Post-closing Action Steps

Immediately after an investor closes on a property, several action steps must be taken to ensure the property is secure and you have maintained ownership. While a few of these steps may seem like they can wait until later, it is best to start them immediately.

- Since you can’t be sure who has the keys, you must change the locks

- Transfer or have the utilities turned back on in your name

- If the property requires repairs, begin immediately

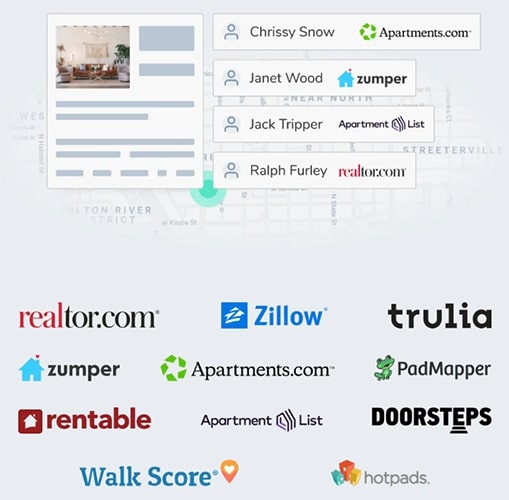

- Advertise the property for sale or rent, depending on your investment plan

Avail automatic syndication to listing sites nationwide

(Source: Avail)

Property management software, such as Avail, can help if you intend to rent the property. Avail provides robust property management services to independent landlords managing one unit or a portfolio of properties to simplify rent collection and listing rental properties. Syndicated listings, credit and criminal screening, state-specific leases, online rent payments, and maintenance tracking are all included.

Bottom Line

Preforeclosure homes are a great investment opportunity for long-term investors and home flippers. While locating preforeclosure properties can be tedious, investors can significantly benefit from the lower cost of these investment properties. Follow the seven steps above to easily navigate through the purchase process of a preforeclosure home.

Frequently Asked Questions (FAQs)

Before deciding, you should be informed of the risks involved in buying a preforeclosure home. These risks could result in you paying more than you anticipated for the property, and only some opportunities will be as good a deal as they seem. These are a few of the significant risks:

- Slow process: The bank may not be in a rush to sell the property, and it may take some time for them to approve you or your offer.

- Competition: Because these homes are frequently purchased for less than their market worth, there may be serious competition to obtain one.

- Structural issues: Many of these properties are known to have been wrecked by prior tenants as they left, or they may have suffered damage after sitting vacant for a long time. These are additional expenses that you must bear.

- Unexpected costs: You might have to pay off liens or back taxes associated with the property. These may result in significant unanticipated costs that raise the price of the home.

According to ATTOM February 2023 U.S. Foreclosure Market Report, there were 30,528 U.S. homes with foreclosure filings, including default notices, scheduled auctions, or bank repossessions. This is an increase of 18% from a year ago and a decrease of 3% from the previous month. In February 2023, there was one filing for foreclosure nationwide for every 4,574 dwelling units.

The states with the highest number of foreclosure filings were New Jersey (one in every 2,271 housing units), Maryland (one in every 2,390), Illinois (one in every 2,443), Nevada (one in every 2,854 housing units), and Indiana (one in every 2,956 housing units).

A foreclosure auction is the lender’s initial attempt to find someone to buy a home that the previous owner failed to pay for. Before the auction, you will likely have access to the home’s information but not a tour. You only need to bid as much as you’re willing to spend on the house once the auction begins, whether live or online. The details for how these foreclosure auctions work depend on where you live, so check with the city or county government’s website for more information about auctions in your area.