Learning how to buy multiple rental properties doesn’t have to be stressful. The process is the same as investing in a single rental property, from researching the best location to planning how to manage your property effectively. However, buying multiple rental properties requires stabilizing and seasoning your current properties, in-depth knowledge of different property types, knowledge of analyzing local markets, and financial calculations of potential income and expenses. Let’s take a close look at our six steps.

1. Stabilize & Season Your Current Rental Property

Before learning how to finance multiple rental properties, you must stabilize your current property by collecting market rents, filling vacancies, lowering tenant turnover, and minimizing capital improvements. Most lenders choose a fully stabilized rental property when applying for a home equity loan or line of credit. Before they lend on another rental property, some lenders require a six- to 12-month seasoning period on your first loan.

The seasoning period is when a property has been owned or has had an active mortgage. While each lender has a different “seasoning period,” most progressive, investor-friendly organizations have a three- to six-month seasoning period as the standard. A 12-month seasoning period is more common for more conservative institutions working with owner-occupied loans. If a property has not been adequately seasoned, banks and lenders frequently won’t permit investors to refinance it.

Significance of Seasoning for Investors With Multiple Properties

The Buy, Rehab, Rent, Refinance, Repeat (BRRRR) strategy of real estate investing focuses on buying properties that require work. Investors then rehab them to raise property value significantly, rent them out to get cash flow, perform a cash-out refinance, and use the proceeds to start the process with a different property all over again. The length of a lender’s seasoning period significantly affects how quickly the “Repeat” can occur.

BRRRR strategy for real estate investing (Source: Medium)

Because most competitive lenders have a three- to six-month seasoning period, BRRRR investors are frequently limited to recycling their cash twice a year. Comparatively, lenders with a three-month or no seasoning period can recycle the same stack of money four or more times a year. Although interest rates on no-seasoning loans may be a little higher, the increased speed and volume that investors can achieve more than compensates for this cost.

2. Consider a Mix of Property Types

When investing in multiple rental properties, it’s critical to consider the types of properties you want to own, fix and flip, and/or manage, as well as the amount of positive cash flow you want to generate as a property. This is to understand which property type will bring a steady cash flow, substantial appreciation, tax advantages, and competitive risk-adjusted returns.

Different types of properties (Source: BrikkApp)

Different types of properties to consider:

- Single-family residential

- Apartment complex

- Duplex, triplex, or fourplex multifamily buildings

- Preforeclosure homes

- Vacation rental property

- Turnkey properties

- Commercial properties

- Land

You can buy one type of property or build a mixed portfolio when deciding which type of property to purchase. However, consider how many properties you want to own and when you want to buy them to maximize the money you can make in real estate. Ideally, you should not purchase more than three to four properties yearly.

3. Find New Rental Property Locations

Once you’ve decided on the types of properties and the number of properties you want to own and manage, you can start looking for rental property listings on Realtor.com, Zillow, and Trulia. Your real estate agent can also set up a subscription to send notifications directly to your inbox based on your property criteria.

4. Evaluate the Financial Projections of Your Rental Properties

If you’re considering buying and financing multiple rental properties, analyze the rental market and do not buy an investment property impulsively. It is essential to evaluate financial projections as it will help you and your business adapt to uncertainty-based predicted demand for rental properties.

Rental Property Cash Flow Projections

Cash flow projections help you create a time-bound roadmap, avoid wasteful spending, and determine whether your plan is profitable. When considering how to buy multiple rental properties, it’s safer to have a positive cash flow rather than equity or appreciation, as these fluctuate.

Your projection aims to develop a profitable business, so if expenses consistently exceed revenue, you’ll need to review and evaluate how to increase income or cut costs. You may also need to increase expenditures by advertising vacancies or renovating, repairing, and upgrading, which will command higher rents and greater profitability.

Critical Metrics for Evaluating Rental Properties

There is no one-size-fits-all formula for calculating whether a rental property is a good investment, so you’ll want to use a variety of metrics. Investors often use three key metrics to evaluate a rental property: capitalization (cap) rate, cash-on-cash return, and return on investment (ROI).

Here are the three key metrics in evaluating rental properties:

- Cap rate: It is the expected rate of return on real estate. It uses net operating income and doesn’t include mortgage debt.

- Cash-on-cash return: This is the annual rate of return in relation to the amount of financing paid during the same year.

- Return on investment (ROI): Profit made on the investment is a percentage of the cost of the investment.

Using metrics to determine the performance of an investment property can help you avoid costly mistakes and stay on track with the goals you set in your cash flow projections.

To calculate your rental property’s potential gross annual rental income and vacancy rate, check out our Gross Rent Multiplier (GRM) Calculator and Vacancy Rate Definition, Formula & Average articles.

5. Decide How to Finance Multiple Properties & Prepare Paperwork

Financing is a significant consideration when learning how to buy multiple rental properties. Financing multiple rental properties can be challenging, so getting creative is often necessary if you plan to own more than four investment properties. There are many types of investment property loans you can use to help you build your rental portfolio. The best financing for your acquisition depends on your financial situation and the financing needed. Refer to the different financing types below for more information.

Financing Type | Best For | What It Is |

|---|---|---|

Fast, short-term financing | Short-term (typically up to 12 months), interest-only mortgages used by investors to purchase properties. These loans have higher rates of up to 12% but can be funded in 15 days. | |

At least 40% equity in a primary residence | A revolving line of credit collateralized by real estate. The maximum limit for an LOC is based on the property's equity amount and typically will not exceed 75% of the property's value. | |

Conventional Financing | Credit scores above 660, 20%-30% down payment, fixed interest rate | Loans that conform to guidelines set by Fannie Mae and Freddie Mac and are backed by the federal government. For investment property, lenders require a 25% down payment. |

Less stringent credit or fewer property requirements | Used by investors who don't qualify for traditional financing due to owning too many rental properties or having low credit scores. | |

Creative, short-term financing | Gives buyers easier terms than a traditional mortgage while giving sellers monthly income. Sellers offering owner financing may want to hold the primary lien against a property or charge a higher interest rate. | |

Retirement Account | Borrowing against retirement funds for a down payment or purchase | If you're self-employed, you can use a self-directed solo 401(k) to buy investment property; through your employer, you can use an individual retirement account (IRA). However, there may be some restrictions and potential penalties. |

Reinvesting rental property profits into additional properties | Allows investors to reinvest profits from selling a non-owner-occupied investment property into up to three other investment properties and avoid paying capital gains and depreciation recapture. | |

Buying multiple properties and later refinancing or selling them | A single loan that covers multiple investment properties. Although a blanket loan can have a 30-year loan term, it is more common to find a short-term loan of up to five years that is amortized for 30 years. | |

Cash-out Refinance | Investment properties with 40%-50% equity | Cash-out loans are a type of long-term financing with fixed monthly payments that are used to replace short-term interim funding. |

The paperwork and documentation you must submit when purchasing multiple rental properties will vary by lender and loan type. However, in most cases, you need to submit documents similar to obtaining a loan on a primary residence. Regardless of loan type, you should be prepared to provide the following—in addition to any lender-required forms and applications—upon your lender’s request:

- Personal and business tax returns: At least the two most recent years

- Pay stubs: At least the three most recent pay periods

- Bank statements: At least the three most recent statements

- Explanation of prior experience: While some lenders are open to first-time investors, most will require that you have prior real estate investment experience.

Benefits & Challenges of Financing Multiple Rental Properties

Purchasing numerous rental properties can be profitable, generating a consistent monthly cash flow stream. However, financing many rental properties might be more complicated than funding a single one. That is why it is essential to understand how to buy multiple investment properties and their advantages and disadvantages. Take a look at the table below for its benefits and challenges.

| BENEFITS | CHALLENGES |

|---|---|

| Can generate a steady monthly stream of income | Higher down payment requirements and interest rates |

| Tax benefits include deducting operating expenses, mortgage interest, and owner expenses; investors can also pursue depreciation to reduce taxable net income | A higher cash reserve is required |

| Provides more cash to reinvest for a down payment for additional property or on a mortgage to increase equity | A credit score of at least 720 is required |

Financing several rental properties might seem stressful, and there are undoubtedly more hurdles to get through than with a single mortgage. However, with so many options available, investors with good financial histories will surely find a way that works for them.

6. Create a Plan on How to Manage Multiple Properties

As you discover how to buy multiple rental properties, decide whether to self-manage the properties or hire a property manager or a property management company. If you hire a management company, you’ll likely pay between 4% and 10% of the gross rental income in property management fees. But if you manage multiple properties by yourself, it’s wise to set up a separate limited liability company (LLC) and sign up for online rent payment services and property management software.

Whether you or someone else manages your rentals, you will handle the finances, maintenance, and tenants. Management companies or property management software can help manage tenant-related issues, tenant screening, property maintenance, banking and finances, escrow deposits, and paying bills, and provide additional liability protection.

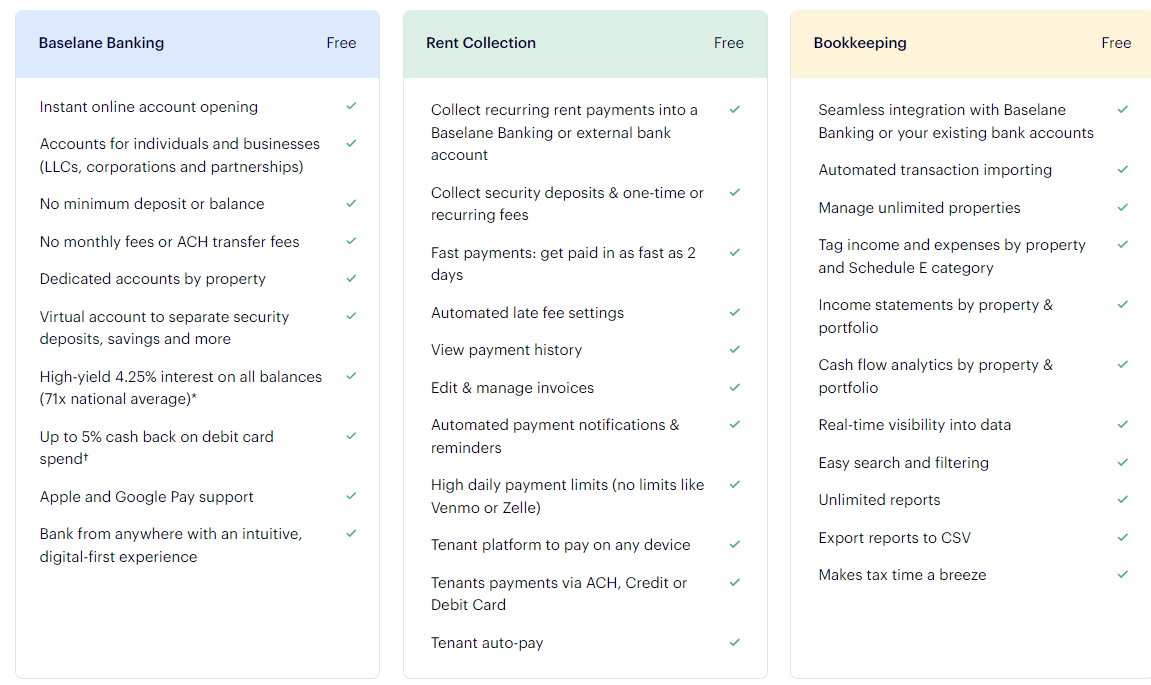

A look at Baselane’s features (Source: Baselane)

Rent collection can be a difficult task for independent landlords. As a result, using online rent collection software, such as Baselane, simplifies tenant rent payments, making it easier for landlords to collect money and manage their rental properties. Baselane’s online rent collection services are an excellent resource for busy landlords, offering various tools—from automated late fees to fast payments—to fit multiple landlord management styles and tenant needs.

Frequently Asked Questions (FAQs)

The things you should consider when investing in multiple rental properties are the following:

- Time and energy: Understanding the distinct dynamics of each real estate market takes a significant amount of time, energy, and effort. A full-time investor should avoid overextending by rapidly purchasing too many rental properties.

- Ownership structure: The higher the number of properties and tenants, the greater the liability risks. While landlord insurance plans can protect a landlord from liability and financial losses, holding each rental property in a separate LLC can lessen personal risk and keep assets separate.

- Financing options: There are numerous ways to finance multiple rental properties, including cash-out refinancing and portfolio loans from local banks and private lenders. Blanket mortgages can also be used to finance multiple rental properties simultaneously with a single loan.

The 2% rule in real estate states that a rental property is a good investment if the monthly rental income is equal to or more than 2% of the investment property price. For instance, to meet the 2% rule, the rental income for a $300,000 rental property must be at least $6,000. Also, a $100,000 investment property must generate at least $2,000 in rental income.

You can find rental properties on various online websites, including Zillow, Realtor.com, and HomePath.com. These websites list FSBO, real estate agent listings, and foreclosure homes. Roofstock Marketplace is also one of the best ways to buy multiple properties, as remote real estate investors use it to buy and sell single-family rentals, multifamily buildings, and large portfolios of rental property. Aside from these, MLS can locate active and expired listings that could make suitable rental property investments.

Bottom Line

When buying and financing multiple rental properties, do not proceed without carefully assessing the house’s condition and potential return on investment (ROI). The steps and tips outlined above should serve as a guide the next time you consider investing in multiple rental properties. The key is to be thorough and strategic in every stage of the buying process to achieve your desired result and become successful in investing in multiple rental properties.