The filing of Form 1120S is required annually for every S corporation (S-corp). The return includes a combination of financial data and questions about the nature and operations of the business. We’ll cover how to enter the financial information and do an in-depth dive into the questions required on Schedule B.

Thank you for downloading!

Tax software can make completing your Form 1065 much easier and will allow you to file it electronically. TaxAct is our top choice for filing business returns.

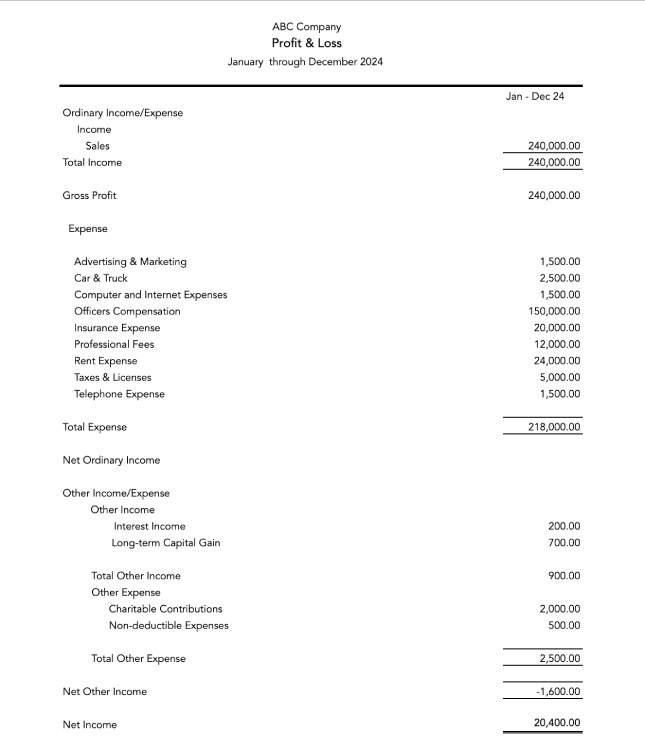

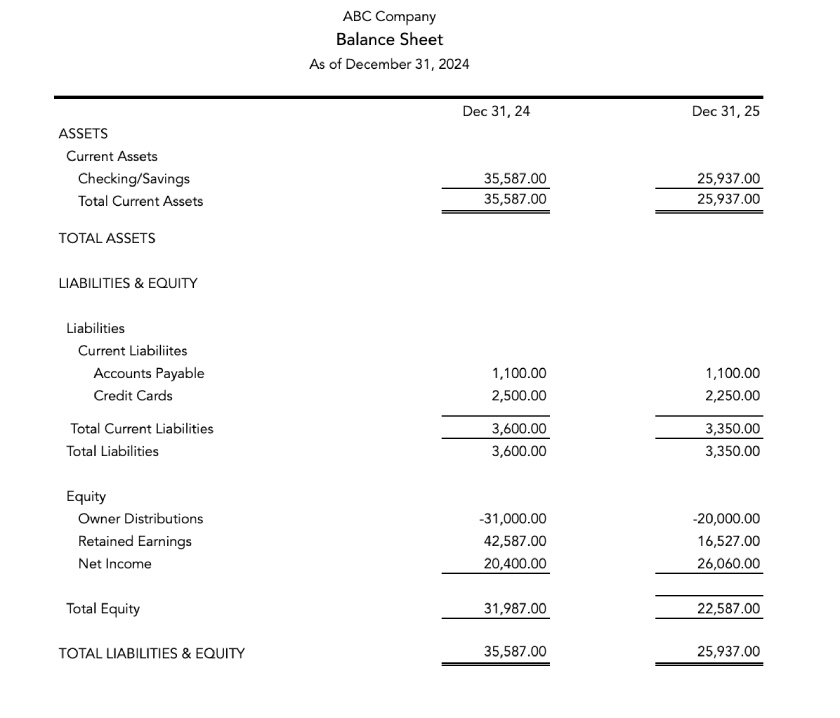

We have created a sample profit and loss (P&L) statement and balance sheet, shown below. We’ll fill out our Form 1120S with these numbers. Read along to make sure you understand each section.

Sample P&L Statement

Sample Balance Sheet

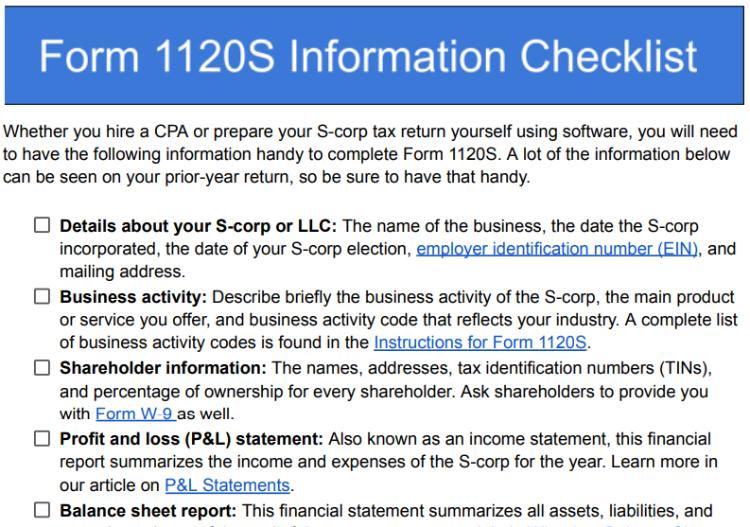

Step 1: Gather the Necessary Information for Form 1120S

Whether you hire a tax professional to prepare your taxes or use tax software, you’ll need information and documentation to complete 1120S. The eight things you need to complete Form 1120S are:

- Details about your S-corp or limited liability company (LLC): This includes the name of the business, the date the S-corp incorporated, the date of your S-corp election, your mailing address, and your employer identification number (EIN); our guide on how to get an EIN can help you. Here are some of the details that you’ll need for your S-corp:

- Tax year: State whether you’re filing on a calendar year or fiscal year. This must match your prior-year return unless you ask the IRS permission to change it. Most S-corps are required to use the calendar year.

- Business activity: Briefly describe the business activity of the S-corp, the main product or service you offer, and the business activity code that reflects your industry. A complete list of business activity codes is found in the IRS’s instructions for Form 1120S.

- Shareholder information: This includes the names, addresses, tax identification numbers (TINs), and percentage of ownership for every shareholder. Ask shareholders to provide you with IRS Form W-9 as well.

- Accounting method: The two most widely used accounting methods are cash and accrual. Most S-corps use the cash basis method of accounting. To learn more about the accounting methods, check out our guide on the cash vs accrual method. You’re required to use the same accounting method as in the prior year—unless you obtain permission from the IRS to change.

- P&L statement: Also known as an income statement, this financial report summarizes the income and expenses of the S-corp for the year.

- Balance sheet report: This financial statement summarizes all assets, liabilities, and owner’s equity as of the end of the tax year.

- Fixed asset purchases report: Print out a report showing the details of every purchase of equipment, machinery, buildings, vehicles, and other fixed assets. This detail is required to determine the S-corp’s depreciation deductions for the year. You’ll need to know the date of purchase, the date the equipment was first used for business purposes, the purchase price, any installation costs or substantial improvements, and the type of equipment or asset. This list should agree with the entries to the fixed asset accounts on your balance sheet.

- Payroll expense report: Print out a report showing compensation paid to each employee of the S-corp for the tax year. Highlight which employees are officers of the S-corp. Compensation for officers is reported on a separate line item from salaries and wages paid to other employees.

- Capital accounts: Make a detailed list of all transactions related to the capital accounts of the shareholders, such as capital contributions, distributions, dividends, and buyouts.

- Loans: Make a detailed list of all transactions involving loans from or loans to shareholders, such as loans advanced, loan repayments, interest paid, or interest received. While not necessary for the preparation of Form 1120S, all shareholder loans should be documented with a promissory note including a stated interest rate.

- Forms 1099: Did your S-corp need to file any Forms 1099, such as for independent contractors? Form 1120S asks this question, so it’s best if you double-check. Our guide on Form 1099 reporting can help you figure out if you’re required to issue any 1099s.

You can run P&L and balance sheet reports quickly and easily in accounting software like QuickBooks. Check out our QuickBooks Online review for its features if you don’t yet use it, but if you do and want assistance with statements, see our tutorials:

- How to Run a Profit and Loss (P&L) Report or Income Statement in QuickBooks Online

- How to Create a Balance Sheet in QuickBooks Online

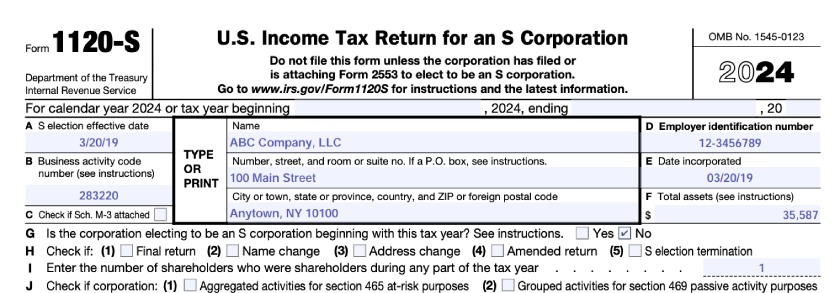

Step 2: Fill Out Form 1120S General Information Section

The first few line items of 1120S are very straightforward. Enter the name, mailing address, EIN, incorporation date, S-corp election date, and business activity code for your company.

IRS Form 1120S general information

Some tips for filling out the topmost section on this first page of Form 1120S include:

- Fiscal year: If the S-corp has adopted a fiscal year, indicate the dates for the beginning and end of the fiscal year in the line above the name. This must match your prior-year return unless you have IRS permission to change.

- S-corp election date: If this is your initial return, and you’re filing the S-corp election (Form 2553) with 1120S, you may need to write or type special words in the blank space in the top margin. See the IRS’s instructions for Form 2553 for details.

- Business activity code: This is a six-digit code representing your industry. Business activity codes are found in the IRS’s Form 1120S instructions.

- Item C: Small and midsized businesses (SMBs) with total assets less than $50 million at the end of the tax year don’t need to file Schedule M-3 and thus don’t need to check the box on Item C.

- Item F: Enter your total assets from your balance sheet.

- Item H checkboxes: Check any boxes that apply. If the S-corp dissolved and this is the last year the S-corp is filing a return, check the Final return box. If the S-corp is filing another return to revise or correct a previously filed return, check the Amended Return box.

Step 3: Fill Out Form 1120S Income & Deductions Section

On the first page of Form 1120S, the S-corp reports its operating income and deductions for the year. Nonoperating items, such as interest income, capital gains and losses, and charitable contributions, are reported on Schedule K instead of page 1 of the 1120S.

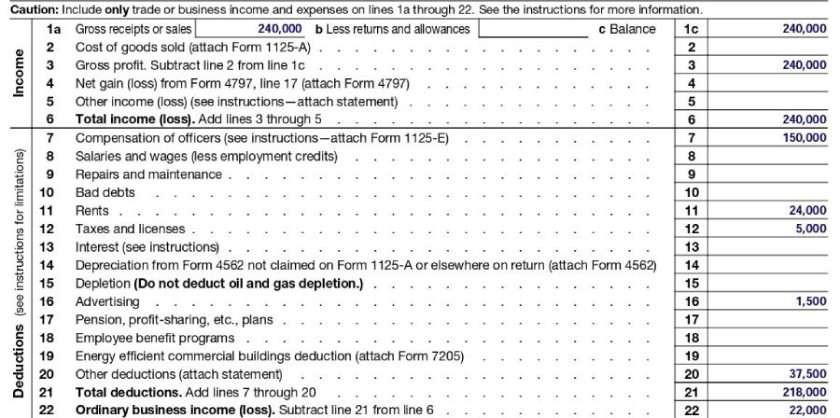

Refer to the S-corp’s sample P&L statement above when filling out Lines 1a through 21. Some line items require supplementary forms or statements to provide additional detail, such as Line 19 for Other Deductions.

IRS Form 1120S Page 1 Income & Deductions

Tips for preparing the income and deductions section of Form 1120S include the following:

- Income: Show ordinary business income on Line 1a and gains or losses from the sale of business assets on Line 4. If you report an amount on Line 4, attach Form 4797. Rental income, interest, and investment income are reported on Schedule K on page 4 instead of page 1.

- Cost of goods sold: If your business sells products, you may need to report cost of goods sold using Form 1125-A.

- Compensation of officers, salaries, and wages: You’ll need to separate how much was paid to officers of the S-corp (Line 7) and how much was paid to all other employees (Line 8). The S-corp may need to detail officers’ compensation on IRS Form 1125-E if the S-corp’s total receipts for the year were at least $500,000.

- Taxes and licenses: Line 12 includes state income taxes, state franchise taxes, business property taxes, county and city taxes, payroll taxes, city business licenses, and business registration fees.

- Interest expenses: If you answer yes to question 10 on Schedule B (discussed later) your interest deduction may be limited and you must file IRS Form 8990 to determine your deductible interest. Read our article on the deductibility of business interest for additional guidance.

- Depreciation: Use IRS Form 4562 to work out how much the S-corp’s depreciation deduction should be on Line 14. You’ll need to refer to the S-corp’s fixed asset purchases report to calculate depreciation. Any section 179 expense from Form 4562 should be reported on Schedule K instead of page 1 of the 1120S. Simplify your depreciation analysis by using our MACRS depreciation calculator.

- Plans like pension and profit-sharing: Show on Line 17 contributions to 401(k) plans, SEP-IRAs, and similar group retirement savings plans.

- Employee benefit programs: Line 18 indicates the S-corp’s deduction costs for health insurance benefits, group term life insurance benefits, and meals and lodging provided for the convenience of the employer. Refer to the IRS’s instructions for Form 1120S for the special rules on how to handle health insurance benefits for shareholder-employees.

- Other deductions: Detail on a separate statement any deductions that don’t fit into any of the categories shown on Line 2 or Lines 7 through 18. Examples of other deductions include travel, telephone service, or postage.

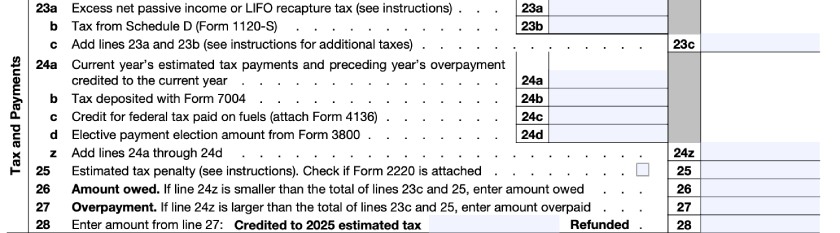

Step 4: Fill Out Form 1120S Tax & Payments Section

The purpose of this section is to calculate the federal taxes that apply if the corporation was previously a C corporation (C-corp) or engaged in a tax-free reorganization with a C-corp. In this section, you’ll list the estimated taxes paid during the year and the overpayments applied from the previous year.

You can leave this section blank if your S-corp has never previously filed a tax return as a C-corp. We highly recommend that you seek the help of a tax professional to calculate these potential taxes if you’ve converted a C-corp to an S-corp.

Tax and payments section of IRS Form 1120S

S-corps might have a federal tax liability on Lines 22a through 27 of Form 1120S due to:

- Excess net passive investment income tax: This tax applies when an S-corp has undistributed Earnings and Profits from years in which the S-corp filed as a C-corp, and the S-corp’s net passive income is more than 25% of its gross receipts for the year.

- Built-in gains tax: This tax might apply if, at any time in the past, the S-corp received assets from a C-corp in a tax-free exchange while the fair market value of the assets exceeded the book value.

S-Corporations may be subject to a variety of taxes. Read our article on S-corporation taxes to determine additional areas of tax exposure.

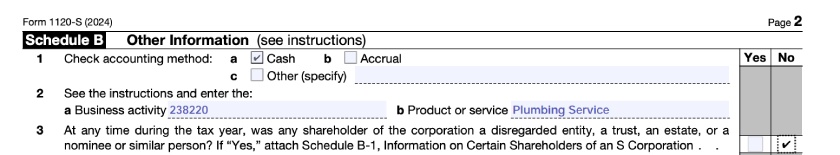

Step 5: Complete Schedule B Questions

Form 1120S, Schedule B starts on page 2 and presents 16 questions. Answering these questions correctly is important and probably the most confusing part of the Form 1120S. Since some of these questions will determine the parts of Form 1120S required to be completed, it makes sense to answer them before we go any further with the financial information.

Most small S-corps will answer these questions “No,” but I’ll try to help you understand if some of them might apply to you. If you have any questions, then you should consult a tax pro before filing your return.

- Line 1: Check the box indicating whether you use cash or accrual as your overall method of accounting. The vast majority of S-corps use the cash method. This must be the same as your overall method in the prior year unless you request permission to change your method by Filing Form 3115 with the IRS.

- Line 2: Line 2 asks for your business activity code and the product or service your S-corp provides. This should usually agree to the prior year’s return, but it can differ if there have been changes during the year. You can find a list of business activity codes in the Form 1120 instructions on page 52.

- Line 3: You can answer “No” to line 3 if all of the S-corp owners are individuals or qualified S-corp subsidiaries. If any other entity is an owner in your S-corp, then you should visit the instructions to Schedule B-1 to determine if you’ll need to answer “Yes” and attach the schedule.

Form 1120S, Schedule B, Questions 1-3

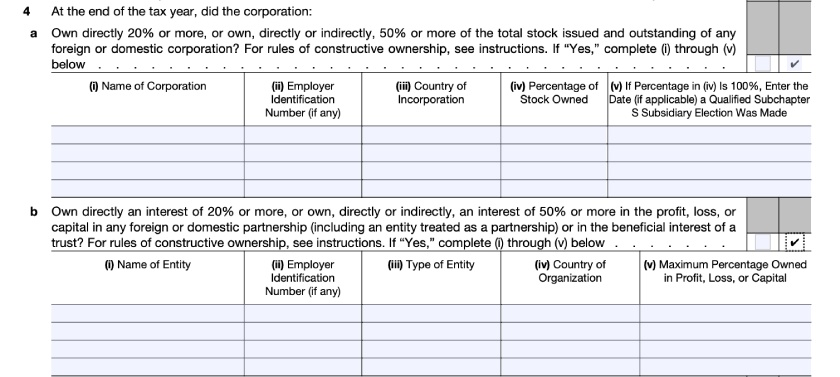

Question 4 deals with whether the S-corp owns any other corporations or partnerships. You’ll need to list corporations (in part a) and partnerships (in part b) if:

- The S-corp directly owns 20% or more of a corporation or partnership

- The S-corp plus all related parties owns 50% or more of a corporation or partnership

Related parties for figuring the 50% ownership test in the second bullet include the owners of the S-corp and their families (e.g., spouses, siblings, ancestors, and descendants).

Form 1120S, Schedule B, Question 4

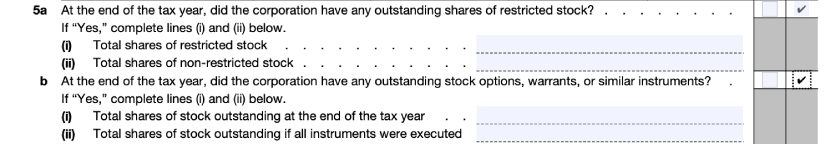

Most S-corps will answer “No” to both 5a and 5b. You’ll need to answer “Yes” and provide additional details if you’ve issued restricted stocks, stock options, or stock warrants, and those items are still outstanding. Again, this is pretty rare for S-corps.

Form 1120S, Schedule B, Question 5.

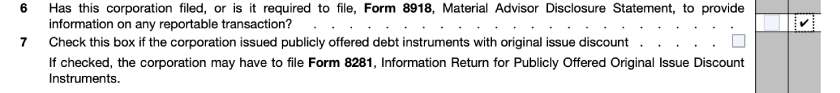

- Line 6: You’ll need to file Form 8918 if the S-corp advised other taxpayers to engage in reportable transactions, which are generally tax avoidance transactions. In other words, S-corps that are peddling tax shelter schemes will need to answer “Yes” and file Form 8918. This is extremely rare.

- Line 7: This line might apply to some larger S-corps. If you publicly issued debt with an original issue discount (OID) you need to check this box and file Form 8281. This line would never apply to more common forms of S-corp debt like loans from banks and shareholders.

Form 1120S, Schedule B, Questions 6 and 7

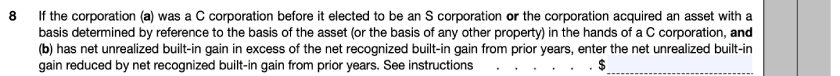

Line 8 determines if there is a potential liability under the built-in gains tax. There are two scenarios where the built-in gains tax might apply to you:

- The S-corp used to be a C-corp and at the time of the conversion its assets’ fair market value exceeded their book value.

- The S-corp received property from a C-corp in a nontaxable exchange where the asset was transferred onto the S-corp’s books at the same book value shown by the C-corp.

Form 1120S, Schedule B, Question 8

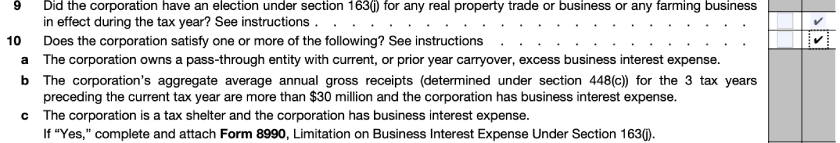

Both lines 9 and 10 deal with the limitation on the deductibility of business interest expense.

- Line 9: Certain businesses that deal in real property and certain farming businesses have the option to elect out of the interest limitations. If you haven’t made this election prior to the end of 2023, then answer “No”. If you’re interested in making the election for future years, you should seek out a tax pro for assistance.

- Line 10: There are three categories of businesses that are subject to the limitation on the deductibility of business interest. They are:

- Businesses that own flow-through entities with a business interest limitation in the current year or carried over from a prior year

- Businesses with average annual gross receipts from 2019 to 2022 over $29 million

- Businesses that are a tax shelter

Most S-corps do not fall into any of the three categories and can answer “No” to line 10. The instructions to Form 8990 are a good source if you’d like more information on the business interest limitations.

Form 1120S, Schedule B, Questions 9 and 10

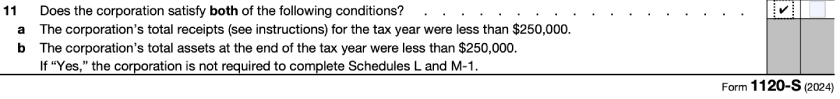

Very small S-corps with both total receipts and total assets less than $250,000 are not required to complete Schedules L and M-1 of Form 1120S. If you meet both of these requirements, answer “Yes,” and those two schedules are optional for you.

Form 1120S, Schedule B, Question 11

Our sample company, ABC Company, meets both these requirements, so we’ve marked “Yes.” However, we’ll still complete Schedules L and M-1 to provide an example.

- Line 12: If the S-corp had any debt forgiven or reduced during the year, answer “Yes” to line 12. Cancelation of debt is generally taxable and should be included on the return.

- Line 13: Qualified subchapter S subsidiaries are S-corps owned by the S-corp filing the return. If an S subsidiary election was terminated or revoked during the year, answer “Yes/” Most S-corps will never own another S-corp and can answer “No.”

Form 1120S, Schedule B, Questions 12 & 13

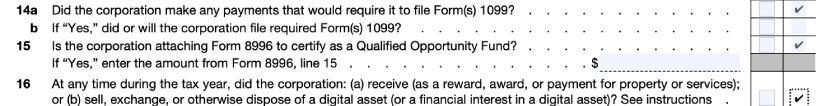

- Line 14a: Mark “Yes, “ if you were required to file Form 1099 for 2023. The most common reason to file Form 1099 is if you paid contractors over $600 during the year.

- Line 14b: If you answered yes to part A, then also mark “Yes” to part B indicating you filed the required forms. Leave part B blank if you answered no to part A.

- Line 15: Answer yes to line 15 if the S-corp is seeking to be certified as a Qualified Opportunity Fund, which is rare for an S-corp.

- Line 16: If the S-corp dealt in cryptocurrency during the year, answer yes, and be sure to report all the crypto activity in your income and expense. For example, answer yes if you accepted payment in crypto, paid bills with crypto, or bought and sold crypto.

Form 1120S, Schedule B, Questions 14 through 16

Step 6: Fill Out Form 1120S Schedule K

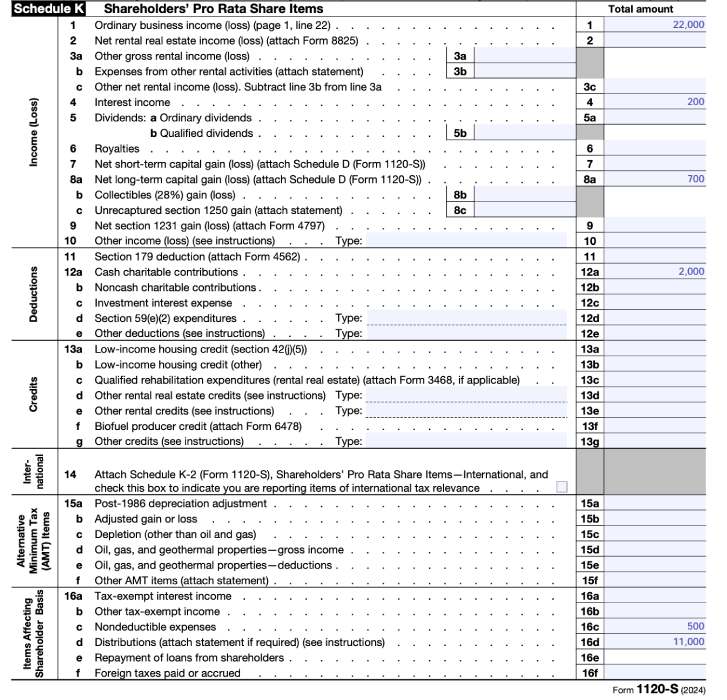

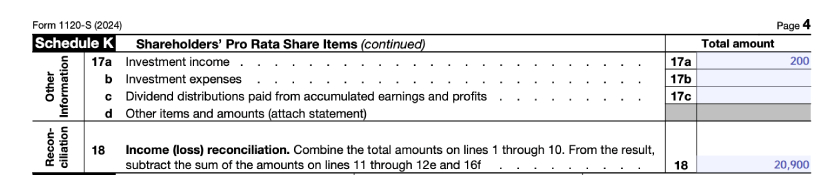

Schedule K is a summary of the S-corp’s operating income (from page 1), investment income, deductions, and credits for the year.

Form 1120S, Schedule K, Lines 1-16 (1 of 2)

Form 1120S, Schedule K (2 of 2)

Schedule K is split into four sections:

1. Income (Loss): Lines 1 through 10 report business income from page 1 on the first line, and then detail any nonbusiness income and loss not included on page 1. It’s very important that all items of income and loss be reported on either page 1 or Schedule K (lines 1 through 10), but not both.

Some common items reported on Lines 1 through 10 are:

- Business income: The business income or loss from Line 21 of page 1 must be entered on Line 1 of Schedule K

- Rental real estate income: If your company earns money by renting real estate to a third party, that activity must be reported on Form 8825 and the net income reported on line 2 of Schedule K. Rental income and expenses shouldn’t be included on page 1 of Form 1120S.

- Investment income: Interest, dividend, and royalties income must be reported on lines 4 through 6

- Capital gains/loss: Capital gains and losses must be reported on lines 8a through 8c

2. Deductions: Lines 11 and 12 report nonbusiness deductions such as charitable contributions and Section 179 expense. It’s important that all deductions on your P&L report be reported on either page 1 or Schedule K, lines 11 and 12—but not both.

3. Other information: Lines 13 through 17 are informational lines that might be needed to calculate the shareholder’s tax liability but don’t go directly into the calculation of net income on Form 1120S. Common items reported include nondeductible expenses on line 16c and distributions to shareholders on line 16d.

4. Reconciliation: Line 18 is a summary of all taxable income and deductions on Form 1120S and is calculated by adding lines 1 through 10 and then subtracting lines 11 and 12. Also enter this amount on Line 8 of Schedule M-1, which is discussed next.

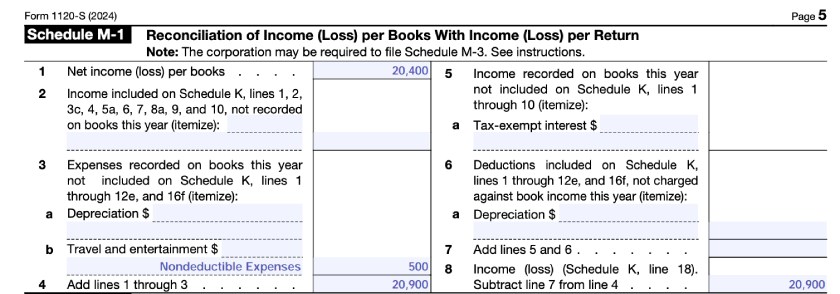

Step 7: Fill Out Form 1120S Schedule M-1

Schedule M-1 reports any differences between the S-corp’s P&L reported on Line 18 of Schedule K and its net income from the P&L statement. Corporations with less than $250,000 in both gross receipts and assets aren’t required to complete Schedule M-1. However, we encourage you to complete the M-1, as it confirms all the income and deduction information has been entered on your return.

Schedule M-1 for IRS Form 1120S

Common differences between book accounting and tax returns reported on Schedule M-1 include:

- Depreciation: The amount you deduct for depreciation on your P&L statement might be different from the amount of depreciation you claim on your tax return. You might use straight-line depreciation for your books but a modified accelerated cost recovery system (MACRS) or the section 179 deduction on the S-corp tax return.

- Nondeductible expenses: These are any expenses deducted from your P&L statement that aren’t tax-deductible.

- Tax-exempt interest: This is interest from municipal bonds included in your P&L statement that’s exempt from federal income tax.

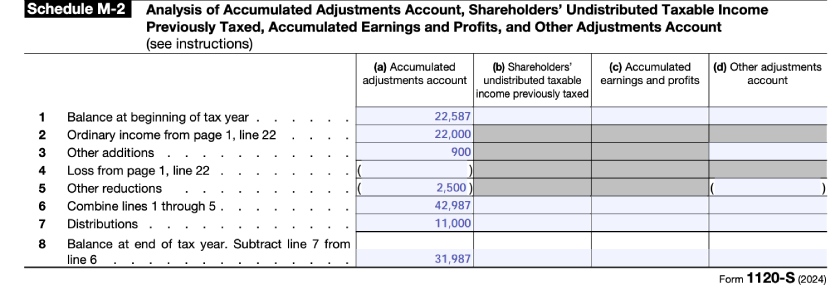

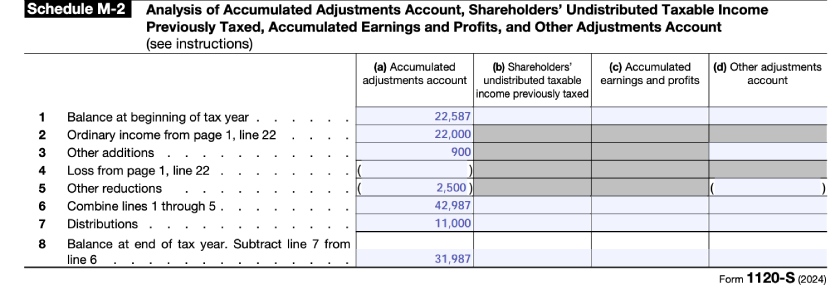

Step 8: Fill Out Form 1120S Schedule M-2

The purpose of Schedule M-2 is to show changes in the S-corp’s accumulated adjustments account (AAA) during the tax year, which is essentially your retained earnings in the company. The beginning balances on line 1 must match the ending balances from the prior-year return.

Book-to-tax differences may cause differences between retained earnings and your AAA account. There may also be additional differences if there are years when the business operated as a C-corporation and transactions were recorded on a book basis instead of tax.

Schedule M-2 for IRS Form 1120S

Tips for preparing IRS 1120S Schedule M-2 include:

- Income increases AAA: All items of income increase AAA other than tax-exempt income.

- Expenses decrease AAA: Expenses including non-deductible expenses decrease AAA. If you have tax-exempt income excluded above, then the expenses to generate that tax-exempt income do not reduce AAA.

- Distributions to shareholders: Both in-kind property distributions and cash distributions decrease AAA.

- Negative balance: AAA can have a negative balance, which can happen if an S-corp has been operating at a deficit.

- Accumulated earnings and profits: The amount in column C refers to earnings and profits if the S-corp used to be a C-corp.

- When in doubt: The Form 1120S instructions outline specific rules to follow when calculating AAA.

Step 9: Fill Out Form 1120S Schedule L

The purpose of Schedule L of Form 1120S is to provide the IRS with details of the assets, liabilities, and equity of the S-corp. The information for Schedule L comes from the S-corp’s balance sheet report.

You’ll need one balance sheet for the current year (end of tax year columns) and another balance sheet for the prior year (beginning of tax year columns). You don’t have to fill out Schedule L if you answered “yes” to questions 11A and 11B in Schedule B.

Schedule L Balance Sheet for IRS Form 1120S

Tips for preparing Schedule L include:

- Assets equal Liabilities and Shareholders’ Equity: Line 15 must equal line 27 for both the beginning and end of the tax year.

- Schedule L should agree to Schedule M-2: Schedule L, line 24 at the beginning of the year must agree to line 1 of Schedule M-2. Schedule L, line 24 at the end of the year must agree to line 8 of Schedule M-2.

- Balance Sheet Same as Books: Schedule L should agree with the S-corp’s balance sheet for financial accounting purposes.

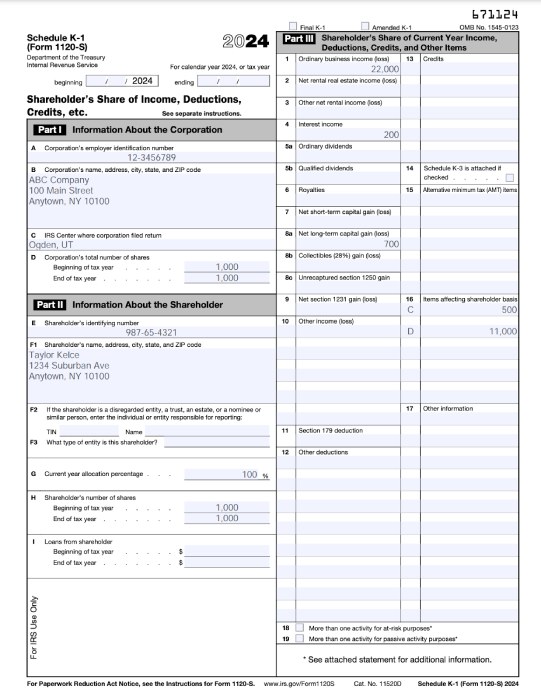

Step 10: Fill Out Form 1120S Schedule K-1 for Each Shareholder

Amounts from Schedule K are allocated to each shareholder based on the percentage of ownership. Prepare one IRS Schedule K-1 form for each shareholder. The amount reported on each shareholder’s K-1 is the amount from Schedule K multiplied by the shareholder’s percentage of stock ownership for the year:

Schedule K-1 (IRS Form 1120S)

- Once Schedule K is completed, Schedule K-1 is simple. The line numbers on the K correspond to the line numbers on the Schedule K-1. Therefore, the amount to report on the line for Schedule K-1 is the amount for that line on Schedule K times the shareholder’s ownership percentage. In our example, there’s only one shareholder. When there are multiple shareholders, the totals across all K-1s for each line should equal the Schedule K total for that line.

Here are some other tips for Schedule K-1:

- Furnish Schedule K-1 by due date: The S-corp needs to give a Schedule K-1 to each shareholder by the filing deadline (March 15th or September 15th with an extension).

- Amounts flow from Schedule K-1 to Form 1040: Shareholders take the amounts shown on their Schedule K-1 and report them on their personal tax return.

- Pass-through nature: This allocation process is how S-corp income, deductions, and credits pass through to the shareholders’ personal tax returns.

Recommended Tools for S-Corp Tax Preparation

Simplifying the tax prep process for an S corporation starts with keeping good books and records. If you need help keeping your records in order, consider selecting from our picks of the 8 Best Small Business Accounting Software options. Using accounting software will help you to have organized data for tax return prep. Even with good records, S corporation filing can be complicated.

If the process seems too unwieldy, you may want to hire someone to prepare the filing. You can use our suggestions for the 5 Best Online Tax Preparation Services for Small Businesses as a guide. And even though it’s not recommended, in a pinch, you can download Form 1120S from the IRS and fill it out by hand.

Frequently Asked Questions (FAQs)

Yes, even if there was no business activity to report, an S-corp must always file its first tax return with the IRS.

Yes, for S-corp returns due in 2024, the penalty for failure to file by the due date is $235 per month, per shareholder. So, if you have two shareholders, the penalty is $470 per month. The penalty is assessed on a maximum of 12 months.

If you can’t file your 1120S by March 15, you should file IRS Form 7004 by that date. By filing Form 7004, the IRS will give you an extra six months to file Form 1120S.

Bottom Line

You should now have a pretty good idea of how to file Form 1120S and where that information is found in the S-corp’s financial reports. Work through the 1120S tax return carefully and keep copies of your work. If you have questions, ask for help from a qualified tax expert.