There are several things to keep an eye out for when learning how to do payroll in Massachusetts, as there is a lot of legislation regarding employee rights. Some major differences include more stringent final pay laws, Massachusetts Blue Laws (restrictions on business openings on Sundays and holidays), a state Paid Family Medical Leave (PFML) program, and a higher minimum wage.

Key Takeaways:

- Massachusetts Minimum Wage: $15.00 per hour and $6.75 per hour for tipped employees

- State W-4 Form: Form M-4

- Terminated employees must be paid on their last day

- Massachusetts is a flat income tax state (5%)

Running Payroll in Massachusetts: Step-by-Step Instructions

For the federal government, you will need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

In Massachusetts, you will need to register online with the Department of Revenue. To register, you will need the following information:

- EIN (this number may be the same as your Social Security number if you are a sole proprietor)

- Your legal name

- The mailing address of your business

- The start date of your business

If you need assistance registering, the Massachusetts Department of Revenue has a video to help new employers.

You’ll need to decide how often you’re planning to pay employees, if you need to track work hours, which payroll forms you need to collect and when, how you’ll perform payroll calculations, and so forth. You can opt to do payroll yourself, utilize Excel payroll templates, or sign up for a payroll service (check our best payroll services guide for some options).

The best time to collect payroll forms is during your new hire orientation. Federal payroll forms will include forms W-4, I-9, and direct deposit information. Massachusetts also requires you to submit a Form M-4.

You’ll need to collect time sheets for all hourly employees and nonexempt salaried workers. To do this, you have three options to use:

- A paper time sheet

- Free or low-cost time and attendance software

- A payroll service that has a time and attendance system

You will need to calculate payroll tax payments, employee paycheck amounts, paid time off balances, etc. You can choose to pay employees in a number of different ways (i.e., cash, check, direct deposit, pay cards). Federal taxes should be remitted through the EFTPS.

The IRS has forms and instructions on filing federal taxes, including unemployment. In addition, you can order tax forms from the IRS. Regarding Massachusetts state taxes, you must also report withholding tax based on the following schedule.

Massachusetts Payroll Tax Filing Deadlines

Estimated Annual Withholding Tax | Filing Frequency | Deadline |

|---|---|---|

Less than $100 | Annually | By Jan. 31 of the next year |

More than $100 but less than $1,201 | Quarterly | By April 30, July 31, Oct. 31, and Jan. 31 |

More than $1,201 but less than $25,000 | Annually | Before the 15th day of the next month, with the exceptions of March, June, Sept., and Dec.—for these months, filing is due on the last day of the next month |

You can report your taxes online through the MassTaxConnect website.

Additionally, you must register with the Department of Unemployment Assistance (DUA) to submit wage and employment reports and pay unemployment insurance contributions.

Massachusetts requires employers to keep payroll records for at least three years. These records must contain the employee’s name, address, job title, amount paid each payroll, and daily and weekly hours worked. It is important to retain records for all employees, including those who are no longer with your company. If you need help with which records to keep, see our article on retaining payroll records.

The federal forms that are mandated are W-2s (for employees) and 1099s (for contractors). These forms should be given to employees and contractors by January 31 of the following year. State W-2s are also required for Massachusetts, and these forms are due by January 31.

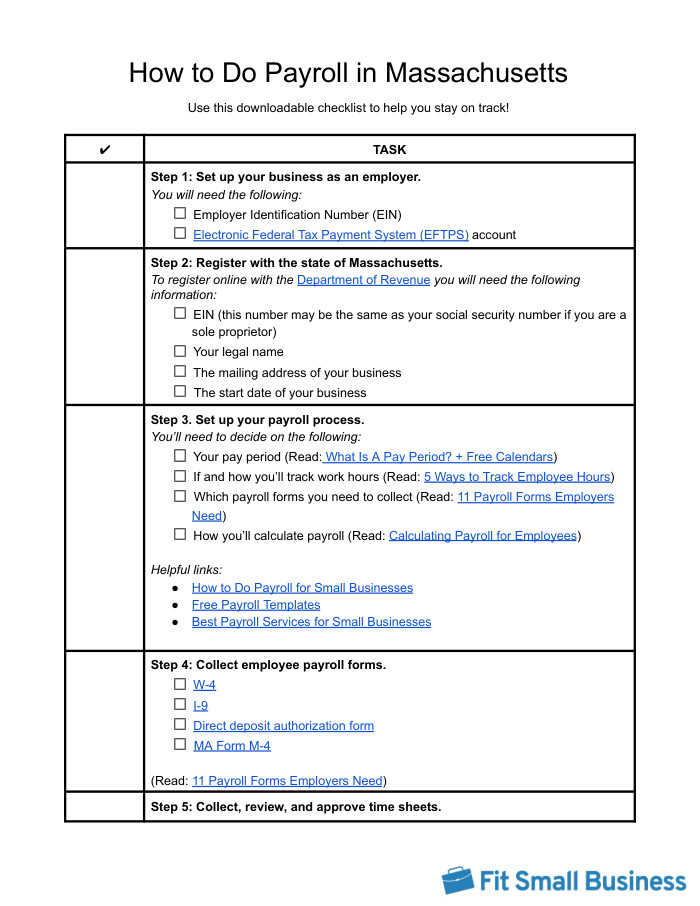

Download our free checklist to help you stay on track while you’re working through these steps:

Learn more about doing payroll yourself in our guide on how to do payroll—it even has a free checklist you can download to make sure you don’t miss any steps.

Massachusetts Payroll Taxes, Laws & Regulations

While there are several items relating to payroll taxes, laws, and regulations in Massachusetts that differ from federal regulations, you will be required to remit Social Security and Medicare (known as Federal Insurance Contributions Act, or FICA, taxes) regardless of what state you do payroll in. FICA is 7.65% of the employee’s paycheck—6.2% for Social Security and 1.45% for Medicare. Also, you must withhold the same amount (7.65%) from the employee’s take-home pay. Both amounts are paid to the IRS.

Massachusetts also has state income taxes and requirements relating to unemployment insurance, workers’ compensation, minimum pay frequency, and final pay laws.

State Taxes

You do have to account for state taxes in Massachusetts, but they are relatively simple since it is a flat-income tax state. All employees are taxed at 5% regardless of income earned, except for those earning over $1,053,750. Those high earners are subject to an additional 4% income tax. There is no local income tax in Massachusetts.

State Unemployment Insurance (SUTA)

The unemployment tax rate for non-construction industry employers in Massachusetts is 1.87% for the first three years of the employers’ existence, based on an employee’s first $15,000 in wages. The rate for construction industry employers is 3.76%.

After the fourth year, your rate is calculated based on the state’s reserve ratio method, which includes your company’s account balance and the current annual rate schedule. Your rate can be anywhere between 0.56% and 6.77% for positively rated employers.

When you pay SUTA, you may qualify for up to a 5.4% discount on your federal unemployment insurance taxes (FUTA). The FUTA rate is 6.0% on the first $7,000 that is paid to each employee in that year.

Workers’ Compensation Insurance

You are required by Massachusetts law to provide workers’ compensation insurance for your employees, even if you’re the only employee. The only exception is for domestic workers who work less than 16 hours a week. This insurance covers medical expenses and some lost wages for employees who are injured on the job.

The cost of workers’ compensation insurance is around 73 cents for each $100 payroll you processed. For example, a company that processes $250,000 of payroll can expect to pay around $1,825 in insurance.

Minimum Wage & Tips

Most jobs will require you to pay at least minimum wage with few exceptions, such as tipped employees, students, and some agricultural workers. For more information, review our list of federal minimum wage exemptions.

Massachusetts’ minimum wage is one of the highest in the country, at $15.00 per hour for non-tipped employees. Tipped employees’ minimum wage rate is $6.75 per hour, but only if the following conditions apply:

- They receive $15.00 per hour with tips included

- They are aware of the law

- All tips are provided to the employee or to a qualified tipped pool

For more information, please visit Massachusetts’ government website on the minimum wage program.

Overtime

Massachusetts generally follows federal guidelines on overtime—you must pay employees 1.5 times their regular hourly rate for all hours over 40 worked in a workweek. There are exceptions for certain classes of occupations. Some of these occupations can include “office” employees who earn more than $80/week, agriculture/aquaculture workers, and hospitality workers. Check our guide to calculating overtime—we provide a calculator for quick and easy computations.

All exceptions can be found on the Massachusetts Legislature’s website. Massachusetts does not require you to pay overtime if an employee works over eight hours in a day—only if they work over 40 hours in a week.

Different Ways to Pay Employees

In Massachusetts, you are able to pay employees via standard payment options. The law specifically states payment by check or cash, and the government’s website includes direct deposit. No matter which option you choose, the employee should be able to receive their funds without an additional fee.

Please see our guide on how to pay employees for more in-depth information.

Pay Stub Laws

You must provide your employees with a pay stub free of charge that contains the following information:

- Company’s name

- Employee’s name

- Pay date that is expressed by month, day, and year

- Hours worked during the pay period

- Hourly rate

- Pay deductions (i.e., benefit costs)

- Pay increases (i.e., shift pay)

You can provide pay stubs online as long as employees have the option to receive a printed copy of the pay stub at no cost to them. If you want to create your own pay stubs, use one of our free pay stub templates to help you get started.

Minimum Pay Frequency

In Massachusetts, you must pay employees in six to seven days after your pay period ends. Whether it is six or seven days depends on how many days they work within a calendar week from Sunday to Saturday.

Days worked | Deadline |

|---|---|

5-6 Days | No later than 6 days after the pay period ends |

1-4 or 7 Days | No later than 7 days after the pay period ends |

Pay Period: July 25 to August 7

Pay Deadline: August 14

Pay Period: July 25 to August 7

Pay Deadline: August 13

For these reasons, you should pay employees weekly or biweekly in Massachusetts.

Paycheck Deduction Rules

In Massachusetts, you cannot deduct pay from an employee’s check unless it is authorized by state and federal law (i.e., income taxes, Social Security, and Medicare). Deductions that are for the benefit of the employee (i.e., union dues, 401(k) deductions, and medical benefit premiums) can be deducted if the employee consents to it.

Other expenses that are directly related to an employee’s job, such as uniforms, supplies, and materials, cannot be deducted even if the employee is in agreement.

Final Paycheck Laws

If an employee submits a voluntary resignation in Massachusetts, you must pay them on whatever comes first: the next paycheck or by the Saturday after the employee leaves.

If an employee is involuntarily terminated in Massachusetts, you must pay the employee on their last day of work.

Massachusetts HR Laws That Affect Payroll

Massachusetts is a complex state when it comes to legislation that affects processing payroll. Many of its laws are focused on providing additional resources for workers, like restrictions on hours and enhanced Paid Family Medical Leave.

Breaks, Lunches & Time Off Requirements

Massachusetts’ time off requirements are more employee-friendly than federal guidelines when considering meal breaks and sick leave. An overview is listed below.

Breaks & Lunches

In Massachusetts, you are required to offer a 30-minute meal break for every six hours worked in a day. It is the company’s discretion on whether the break is paid and whether employees are mandated to take it. Employees must also be allowed to be free from their work and can leave the workplace. In addition, if the employee agrees to work through his or her break, then the break must be paid.

Sick Leave

Workers must accrue an hour of job-protected sick leave for every 30 hours of work, up to a maximum of 40 per calendar year. If you have fewer than 11 employees, sick leave can be unpaid; otherwise, it must be paid. Unused sick time does not need to be paid out when the employee leaves.

Vacation Leave & Paid Time Off (PTO)

Massachusetts does not require employers to offer vacation leave or paid time off (combined vacation and sick leave). If you do offer PTO, it must be at least as generous as the mandated sick leave requirements of up to 40 sick hours per year. Massachusetts considers PTO wages so, upon separation, you must include any earned and unused PTO in the employee’s final paycheck.

Also, you must provide a copy of the vacation or PTO policy to each employee, and the employee must acknowledge in writing that they understand the policy. You must abide by the policy in place until you communicate to employees that the policy is being changed.

Small Necessities Leave

Employees can take up to 24 hours every year for their child’s school activities and medical and/or dental appointments, as well as an elderly relative’s healthcare or well-care appointments. These hours can be unpaid.

Family & Medical Leave

Massachusetts offers its own state-sponsored leave program in addition to the federal Family and Medical Leave Act (FMLA). More details on FMLA can be found in the Department of Labor’s guide to FMLA.

The state’s program allows an employee to take up to 20 weeks of paid medical leave, up to 12 weeks of paid family leave, and up to 26 weeks of a combination of family and medical leave in a year. An employee can take paid medical leave to take care of themselves, and family leave to take care of a family member. Employees should try to give the company at least 30 days’ notice when planning on taking leave, but it is not a requirement. The maximum weekly benefit for 2024 is $1,149.90.

Prior to 2024, employees were not allowed to top off their paid family leave benefits with other vacation leave provided by their employer. That’s no longer the case. An employee can supplement the weekly capped paid family leave benefits with their PTO, up to an amount equal to the employee’s average weekly wage. The average weekly wage is calculated as the average amount earned per week in the two quarters in which the employee earned the most.

It’s also important to note that employers have no say in whether an employee tops off their paid family leave. This decision is solely up to the employee.

Massachusetts’ paid family leave program is funded by a Massachusetts tax applied to both employees and employers. The tax is based on a percentage of wages that is reported to the Department of Unemployment Assistance for employees and is based on a percentage of payments that will be reported to the IRS for eligible contractors.

Please Note: Your contractors are eligible if they make up more than half of your workforce and they meet the following criteria:

- The contractor’s performance is not based on your direction or guidance

- The contractor’s work is not based on the company’s normal activities

- The contractor is performing related work in an independently established job field

Some examples of these contractors are auditors and accountants.

Medical & Family Leave Contributions

For Businesses With 25 or More Employees:

- If you have 25 or more employees/independent contractors, the combined tax is 0.88%.

- As an employer, you must pay at least 60% of the medical leave contribution.

- You are not required to pay any of the family leave contributions; that portion of tax may be completely paid by the worker via a paycheck deduction. You are allowed to cover more than the minimum share.

For Businesses With 25 or Fewer Employees:

- If you have fewer than 25 employees/independent contractors, the combined tax is 0.46%.

- As a smaller employer, you are exempt from the medical leave contribution.

- You are not required to pay any of the family leave contributions; that portion of tax may also be completely paid by the worker via a paycheck deduction. However, you are allowed to cover more than the minimum share for the family leave contribution.

Massachusetts Blue Laws

Massachusetts Blue Laws is a group of rules that oversee which businesses can operate on Sundays and on certain legal holidays. To get more specific information, please visit the following section on the Massachusetts government website: Massachusetts Blue Laws. A general overview will be provided below.

Retail businesses: Typically speaking, retailers are able to open on Sundays and holidays without approval with the exception of retailers that serve alcohol. For those retailers, you will need to contact the Alcoholic Beverage Control Commission.

Nonretail businesses: Most businesses that are not retail establishments cannot operate on Sundays. For a list of exemptions, please visit the section regarding work Sunday on the Massachusetts Legislative Website. If you have any additional questions, please contact either the Department of Labor Standards Minimum Wage Program and/or the Attorney General’s Fair Labor Division by calling (617) 626-6952 or (617) 727-3465, respectively.

If you are exempted from the Blue Laws, a permit to work on Sundays can be granted by your local police chief in your work location. Permits can only be issued for necessary work that cannot be done any other day without causing major suffering or inconvenience.

State New Hire Reporting

Massachusetts requires you to report any new hires within 14 days of the employee’s hire date. You can report new hires online, by mail at P.O. Box 55141, Boston, MA 02205-5141, or by fax at (617) 376-3262. If your business has 25 or more employees, you must report new hires online.

Note: If you have employees or contractors in other states, you can also register them with the State of Massachusetts, which will forward them to the respective agencies in the state in which your employee or contractor works.

Payroll Forms

Listed below are the state-specific and federal forms you will need for Massachusetts.

State Payroll Forms

- M-4 Form: To assist employers in calculating state taxes to withhold from employee pays

- New Hire Reporting Form: Reports new employees and independent contractors to the Massachusetts Department of Revenue

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculates unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

For more details on federal forms, check out our guide on federal payroll forms you may need.

State Payroll Tax Resources/Sources

- State of Massachusetts Business Website: Government website that provides you with registration, other business forms, and the latest news and information

- Guide: Starting A New Business in Massachusetts: Step-by-step guide on registering your business

- MassTaxConnect: An online application operated by the Massachusetts Department of Revenue to pay and submit tax information

Massachusetts Payroll Frequently Asked Questions (FAQs)

Every small business operating in Massachusetts must comply with both state and federal payroll requirements. This includes withholding income taxes from employees’ wages, paying into Social Security and Medicare, and contributing to the state’s unemployment insurance program.

There are several ways to streamline your payroll tax process. Consider using a payroll software solution that can automate tax calculations, withholdings, and filings. You may also want to consider hiring a payroll service or a certified public accountant (CPA) who specializes in small business taxes.

Staying compliant requires staying up-to-date with changing payroll laws and regulations. Regular audits, using reliable payroll software, and seeking advice from a payroll professional can help. Non-compliance can result in penalties such as fines, interest on unpaid amounts, and in severe cases, imprisonment.

Bottom Line

Massachusetts payroll is different from other states due to the number of worker protections that it provides. These examples include its Blue Laws, paid family leave program, mandated workers’ compensation, frequency of payrolls, and final pay laws. Combined with its state income taxes, Massachusetts has many items that you will need to be aware of.

Be sure to follow the latest news, deadlines, and mandates by federal, state, and local governments, as there may be fines for non-compliance. To ensure that you are compliant on the federal side, please visit our article on payroll compliance.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.