New Jersey (NJ) charges state income taxes on all wages. You need to withhold taxes and unemployment insurance quarterly for each employee. In addition, the minimum wage is creeping toward $15 per hour. Read on to learn how to do payroll in New Jersey, as well as the specific regulations you’ll need to know to stay compliant.

Key Takeaways

- Minimum Wage: $14.13/hr.

- Set to hit $15.13/hr. by 2024

- New Jersey has a state-specific W-4—the NJ W-4 tax form

- Pennsylvania residents may need to fill out the NJ-165

- NJ has a progressive tax rate, from 1.40% to 10.75%

- Workers’ compensation insurance is required for every New Jersey employer

- Workers living in Pennsylvania may qualify for tax credits

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Step-by-Step Instructions for Doing Payroll in New Jersey

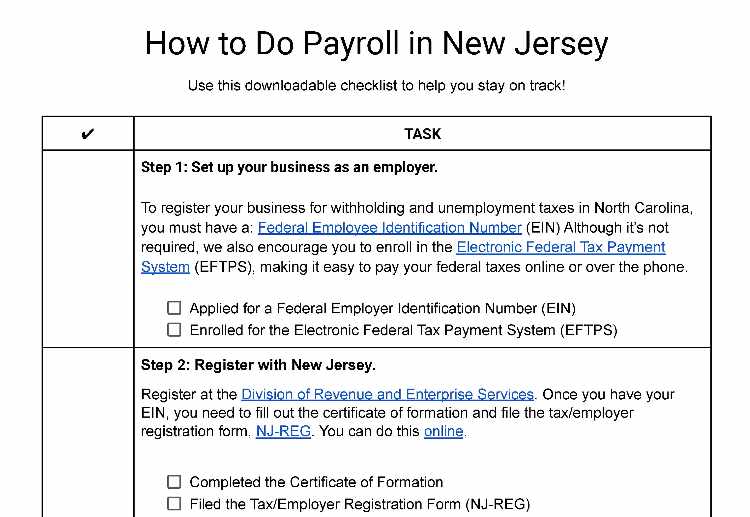

Step 1: Set up your business as an employer. Get your company’s Federal Employer Identification Number (EIN). If your company is new, you may need to apply for a FEIN. This is a simple process that can be completed online via the Electronic Federal Tax Payment System (EFTPS). If you work for a company that already has one, keep the FEIN handy—it is required to pay federal taxes.

Step 2: Register with New Jersey. Register at the Division of Revenue and Enterprise Services. Once you have your EIN, you need to fill out the certificate of formation and file the tax/employer registration form, NJ-REG. You can do this online.

Step 3: Set up your payroll. Create a set schedule of paydays that are at least twice a month (except for executives and supervisors, who can be monthly), and take into account overtime rules as listed below. You can do payroll by hand (although we don’t recommend it), set up an Excel payroll template, or sign up for a payroll software.

Step 4: Collect employee payroll forms. These forms are best filled out during employee onboarding. Employee forms include W-4, I-9, and direct deposit information. For New Jersey, employees fill out the NJ W-4. Pennsylvania residents under your employ may need to fill out the NJ-165 to pay taxes in their state only.

Step 5: Review time sheets. This step is one you’ll repeat as you do payroll each period. Keeping track of employees’ hours is essential for ensuring accurate payroll. Whether you use paper time sheets or time and attendance software, review time sheets for accuracy and discuss any errors or issues with employees right away. Having employees sign their time sheets is a good idea, whether they do so electronically or by pen on paper.

Step 6: Calculate payroll and pay employees. You can use software, a calculator, or even Excel to calculate payroll.

Step 7: File payroll taxes with the federal and New Jersey state government. Follow the IRS instructions for federal taxes, including unemployment.

To file New Jersey taxes and unemployment insurance, you’ll file online here. You need your state tax ID number and PIN.

- New Jersey Income Taxes: New Jersey state taxes are due April 30, July 30, Oct. 30, and Jan. 30. Fill out and file the NJ-W3 and submit it with the IRS W-2 and Form 1099.

- State Unemployment Insurance (SUTA): Employers must file the Forms NJ-927 and WR-30 by the following dates:

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 30 |

Jul, Aug, Sep | Sept. 30 | Oct. 30 |

Oct, Nov, Dec | Dec. 31 | Jan. 30 |

If the due date for a report or tax payment falls Saturday or Sunday, reports and payments are considered on time if they are received on or before the following business day.

Step 8. Document and store your payroll records. New Jersey requires you to keep records on employees for at least six years. Information should include contact information, hours worked and pay, itemized deductions, and the birthdate of the employee if under 18. Learn more in our article on retaining payroll records.

Step 9. Do year-end payroll tax reports. Send the federal Forms W-2 (for employees) and 1099 (for contractors). You also need to submit the NJ-W3-G for year-end reporting of gross taxable income.

Download our free checklist to help you stay on track while you’re working through these steps:

New Jersey Payroll Laws, Taxes & Regulations

No matter what state you are in, you must follow federal law for income taxes, Social Security, Medicare, and federal unemployment insurance (Federal Unemployment Tax Act).

New Jersey Taxes

New Jersey requires you to withhold income and unemployment insurance taxes for all resident and nonresident employees working in the state. It has a reciprocity agreement with Pennsylvania, however.

State Income Taxes

New Jersey requires you to pay income tax withholdings from all state residents unless you’re withholding another jurisdiction’s income tax at a rate equal to or greater than New Jersey’s. You also need to withhold state income taxes for nonresident employees.

New Jersey uses a progressive income tax rate—so, the more your employees make, the more they pay in taxes. The income rates range from 1.40% to 10.75%. You can find the withholding tables on the state website.

You need to file withholdings quarterly. Year-end filings must be done electronically.

Reciprocity Agreements

New Jersey has reciprocity laws with Pennsylvania. You’ll need to have any employee who is a Pennsylvania resident fill out Form NJ-165. Once filed, you won’t need to withhold New Jersey taxes.

Unemployment Insurance

New Jersey charges state unemployment taxes (SUTA). If you start a business, employ one or more individuals, and pay wages of over $1,000 in a calendar year, you may be subject to state unemployment tax. There are exceptions for those employing domestic workers or agricultural workers, and some nonprofit organizations.

The SUTA is based on a taxable wage base of $41,100. SUTA rates run from 0.6% to 7.0% for experienced employers. Rates are calculated and assigned on a fiscal year (July 1 to June 30) basis. Your experience rate is your reserve balance (contributions paid minus benefits charged) divided by your average annual payroll.

New employers are assigned a rate for the first three calendar years, after which, they pay according to their experience rate. In 2023, the rate is 2.9%.

In addition, you pay a state disability insurance rate, workforce development/supplemental workforce funds, and family leave insurance. These are usually as little as 0.0005%.

Did You Know? When you pay SUTA, you may qualify for up to a 5.4% discount on your FUTA. This can greatly reduce what you owe the IRS—from 6% to 0.6%. In addition, if you pay your terminated employees’ benefits, you may qualify for a discount on your UI taxes.

Workers’ Compensation Insurance

All New Jersey employers not covered by federal programs need to have workers’ compensation insurance or qualify for self-insurance. To self-insure, you need to get approval from the Commissioner of the Department of Banking and Insurance.

Approval for self-insurance is based upon the financial ability of the employer to meet its obligations under the law and the permanence of the business. Learn more on the workers’ compensation website.

Minimum Wage Laws in New Jersey

Like many states, New Jersey is slowly moving toward a $15 an hour minimum pay rate. Rates vary depending on the type of job.

If you have fewer than six employees, your rate may be lower. Tip-earning employees are expected to make up part of the wage in tips, but there is a minimum you must pay regardless. Farm employees doing piece-rate work must still be paid minimum wage.

By Date | Most employers | Seasonal and small employers (<6 employees) | Agricultural Employers | Cash wage for tip earners |

|---|---|---|---|---|

2023 | $14.13 | $12.93 | $12.01 | $5.26 |

2024 | $15.13 | $13.93 | $12.81 | No Change |

Note that the above amounts reflect the minimum amounts. Based on the Consumer Price Index, these amounts may be higher.

Exemptions include:

- Full-time students employed by the university they are attending (must earn 85% of minimum wage)

- Outside salespeople

- Part-time employees caring for children in the employer’s home

- Minors under 18 (with exceptions like farming, service industries, light manufacturing, and vocational school graduates)

Employees of summer camps, conferences, and retreats operated by nonprofit or religious organizations are exempt from minimum wage and overtime rates from June through September.

New Jersey Overtime Regulations

Overtime starts for hours in excess of 40 in a workweek and is 1.5 times the employee’s regular wage. There are exemptions for executive, administrative, and professional employees, farmworkers or those caring for livestock, and limousine drivers.

Different Ways to Pay Employees

Although there are several ways to pay employees, New Jersey lets you pay by cash or check. You need the employee’s consent to pay by direct deposit. Keep in mind, however, that more than 7 million people in the US don’t have a bank account, which means direct deposit does not work for them.

Pay Stub Laws

You must provide your employees with a statement of deductions for each pay period. If you have 10 or more employees, you must also include gross pay, net pay, hours worked, and rate of pay. You also must let them know in advance of changes in pay rates.

Your payroll program may already place this information on the pay stub. However, if you need to create your own pay stubs, check out our free pay stub templates. They are formatted and ready for print right away.

Minimum Pay Frequency

Employees in New Jersey must be paid at least twice a month, except for executives and supervisors, who may be paid monthly. You can set what days you pay, as long as they are regular and determined in advance.

If a payday falls on a non-workday, then you need to make payments on the preceding workday. You must pay employees within 10 days of the end of the work period.

Paycheck Deduction Rules

New Jersey allows for deductions only in specific circumstances and when authorized by contract or collective bargaining agreement:

- Employee welfare

- Insurance

- Hospitalization

- Pension or retirement funds

- Profit-sharing plans

- Company-oriented thrift plans

- Employee savings accounts

- Employer loans

- Purchase of company products or safety equipment

- Charitable contributions

- Labor union dues or fees

- Rental or cleaning of work uniforms

- Health club memberships

- Child care

Final Paycheck Laws

If an employee is fired or leaves, you need to pay them the final paycheck by the next regular payday. The only exception is when there is a labor dispute involving payroll employees, in which case you have an additional 10 days.

If employees are on an incentive system, you can pay a reasonable approximation of their wages due until you can make an exact determination. You need to pay through the regular channels or, if requested by the employee, mail them a final paycheck.

Accrued Paid Time Off

New Jersey has no specific laws concerning paid time off or vacation leave, but they do require paid sick leave (which we cover below). Employers can give employees paid time off or a combination of paid vacation/paid sick leave. The trend is moving back to combination vacation/sick leave.

Whichever way you do it, be sure you specify in your employee handbook any rules concerning non-sick leave paid time off, including use-or-lose policies and the ability to sell back leave.

Severance

In general, New Jersey does not have severance pay laws for firing or laying off individual employees. However, there are rules for mass layoffs.

If you have over 100 employees, where those employees work over 20 hours per week, then you must give advance notice of layoffs. When you are terminating the employment of over 50 employees (excluding part-time workers), then you must give 90 days’ advance notice.

You must also provide severance pay equal to one week of pay for each full year of employment for each worker. This rule does not apply to a worker quitting, retiring, or being fired for cause, such as misconduct.

New Jersey HR Laws That Affect Payroll

New Jersey’s HR laws are not especially complex, particularly compared to the neighboring state New York. However, it does have strict fines and penalties for noncompliance.

New Jersey New Hire Reporting

You need to report new hires through the New Jersey Child Support Employer Services Portal. Alternatively, you can download the PDF form and mail it to the agency at the address on the form. This must be done within 20 days of hire or rehire, per federal law.

Paid Sick Leave

New Jersey requires all employers to provide all employees with 40 hours of paid sick leave per year. You must maintain a 12-month benefit year that is not dependent on the employee’s anniversary date. Unused days must be carried over or paid out at the end of the benefit year.

New Jersey Family Leave Act

The New Jersey Family Leave Act allows up to 12 weeks’ family leave in a 24-month period without the threat of job loss. This act does not apply to the employee’s health, but rather to the care of family members. This can include:

- A leave of absence within a year of a child’s birth, adoption, or foster care to bond with the child

- Caring for a sick family member with a serious health condition

This rule applies to employers with at least 30 employees, and to employees who have worked for the employer for at least a year and at least 1,000 hours in the past 12 months. Employees need to give at least 15 days’ notice for intermittent leave, 30 days’ notice for consecutive leave for a child, “reasonable notice” for an ill family member, and as much notice as possible for emergencies.

You may also have to provide additional unpaid sick leave in accordance with the federal Family and Medical Leave Act.

Lunch & Other Break Time Requirements

New Jersey does not have any state-specific laws regarding meals or other breaks. You should default to federal law, which essentially says you need to pay for short breaks, but not bona fide meal breaks where the employee is not doing any work. Meal breaks are usually 30 minutes or longer, though they can be shorter depending on circumstances.

Minors under 18 get a mandatory 30-minute lunch break if they’ve worked more than five hours continuously.

Hiring Minors

New Jersey law concerning hiring minors is complex, with different work hours, requirements, and prohibitions depending on the age and type of work. It has separate rules for children in theatrical occupations, newspaper carriers, and street trades. There are also different rules for restaurants and bowling alleys during summer or school vacation, such as different hour restrictions. You can find the complete law on the New Jersey Department of Labor website, or check out the PDF summary.

In general, minors under 18 must have an employment certificate, and employers must keep a record of this. The chart below gives only the most general prohibitions. There are different rules for workers in factories, theater, or newspaper carriers. Refer to the PDF for details.

Age | Restricted hours when school is in session | Total hours allowed when school is in session | Total hours allowed on vacation days |

|---|---|---|---|

14-15 | 7 p.m.–7 a.m. | 3 hours/day, 18/week | 8 hours/day, 6 days/week, 40 hours/week |

16-17 | 11 p.m.–6 a.m. | 8 hours/day, 6 days/week, 40 hours/week | 8 hours/day, 6 days/week, 40 hours/week |

Minors under 16 are prohibited from working in or around power-driven machinery, which includes power lawn motors but does not include the cash machine conveyor belt found in stores. Minors cannot work certain chemical-type jobs such as mixing paint, handling acids or dyes, or work involving benzene exposure.

Payroll Forms

Most of New Jersey’s payroll tax forms need to be filed online, although it still offers other filing methods and you can find the forms in fillable PDFs online.

New Jersey State W4 Form

New Jersey’s withholding exemption form is the NJ W-4. Employees should fill this out when they first take on a job and whenever they have a change in their exemptions.

Other New Jersey State Payroll and Tax Forms

- MW400, Employer Obligation to Maintain and Report Records: You must give this to all employees upon hiring. This form describes your obligation as an employer to maintain and report records regarding wages, benefits, taxes, and other contributions.

- NJ-W-3M: These are income tax reconciliation forms, best submitted electronically.

- NJ-927 and WR-30: Used to report unemployment insurance withholdings, these are filed electronically. There are alternate instructions on the state website.

Find other payroll forms on the state website.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

New Jersey Payroll Tax Resources/Sources

- New Jersey Income Tax Withholding Instructions: Explains how to calculate and file taxes, executions, and special rules

- New Jersey Division of Taxation: Holds information on all types of taxes, including corporate taxes, and has the link for filing

- New Jersey Wage and Hour Compliance: Contains information and flyers about wage and hour rules

- New Jersey Family Leave Act Information Sheet: Provides rundown on NJFLA for employers or employees

- New Jersey Child Labor Form: Includes basic regulations by occupation and age, broken down for employers or employees.

- New Jersey Employer’s Handbook: Everything you need to know about unemployment, disability, and workforce development programs

Bottom Line

New Jersey charges state income taxes on all wages, from $1 to millions. It also requires state unemployment and workers’ compensation insurance if you have even one employee. The HR and payroll rules are straightforward, however, with no break or PTO regulations, but there is required sick pay and family leave. The rules for minors are more varied than those of other states. It pays to make sure you are following the rules correctly to ensure payroll compliance.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.