Payroll professionals, be they specialists or managers, handle payroll processing and ensure accurate and timely payment to employees. They collaborate with the accounting and HR teams to process tax remittances and deductions correctly.

Get a Quality Candidate On The First Day. Start your 4-day free trial today with ZipRecruiter® |

|

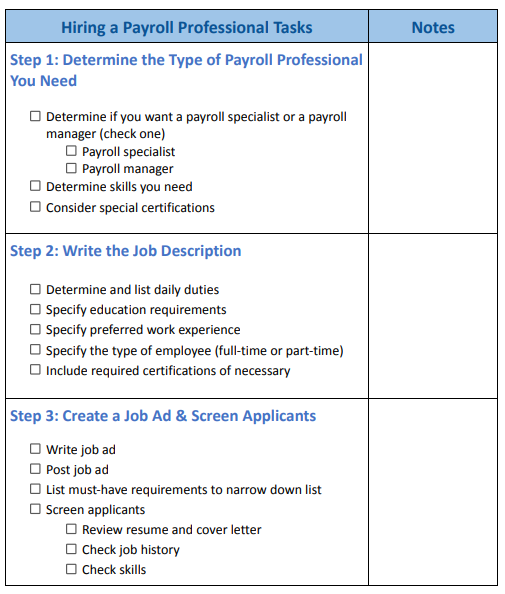

To help you find the right fit for your company, we’ve outlined six simple steps—and included them in a free downloadable checklist—to guide you through the process of hiring a payroll professional.

Step 1: Determine the Type of Payroll Professional You Need

Not all payroll professionals are the same—some oversee all aspects of payroll, while others focus more on paying employees. Typically, your first payroll hire will be a payroll specialist, and then you might add a payroll manager down the road.

Payroll Specialist vs Payroll Manager

Payroll professionals often have different job titles, but they generally fall into two categories: payroll specialists and payroll managers.

A payroll specialist focuses on calculating and processing payroll accurately—including hours, taxes, and benefits deductions—and ensuring timely payment to employees.

On the other hand, a payroll manager oversees payroll operations, ensuring compliance with HR and employment laws and implementing efficient processes.

While payroll managers can handle all aspects of payroll, they are typically a secondary hire after a specialist due to higher starting salaries. Small businesses with simpler payroll needs may find it more cost-effective to hire a specialist rather than a manager.

Payroll Specialist | Payroll Manager | |

|---|---|---|

When to hire | First payroll hire; best for small businesses with straightforward payroll needs | Subsequent payroll hire; best for growing businesses with a more robust payroll process |

Average Salary Based on Indeed | Average pay of $23.70 per hour or $38,703 per year | Average pay of $45.02 per hour or $83,951 per year |

Basic Duties |

|

|

Skills to Look For

When hiring employees, it’s crucial to focus on specific skills. Attention to detail is the key skill for a payroll specialist, as errors in payroll can impact employee morale and retention and potentially lead to legal issues. For a payroll manager, strong people and process management skills are essential.

You should also look for a payroll employee with the following skills:

- Advanced payroll knowledge

- Understanding of payroll garnishments and deductions

- Basic understanding of payroll laws

- Critical thinking

- Basic knowledge of payroll accounting

- Excellent communication and customer service

- Data entry

- Human resources information system (HRIS) experience

- Intermediary or advanced Excel knowledge

- Ability to collaborate with a team

- Ability to review time sheets and calculate overtime

Consider seeking candidates with special certifications, such as those offered by the PayrollOrg (PAYO), formerly the American Payroll Association (APA). The Fundamental Payroll Certification (FPC) is suitable for entry- or mid-level positions, while the Certified Payroll Professional (CPP) certification is more comprehensive and typically preferred for payroll managers with prior experience. If you hire an employee without these certifications, you can still provide training opportunities after hiring.

Check out our guide on how to get the best payroll training for more ideas on how to train your payroll employee(s).

Step 2: Write the Job Description

When writing a job description for a payroll specialist or manager, focus on the skills mentioned above to ensure your company’s needs are met. Clearly outline the specific duties involved in the role.

Additionally, make sure to classify the type of employee correctly as full time or part time, considering the appropriate working hours. This step will help with HR matters and ensure compliance with overtime payment for nonexempt employees.

Your job description should also sell your company. You’re going to use this as the basis for your public job advertisement, so answer some questions applicants may have:

- Why would someone want to work for your company?

- What benefits do you offer?

- What makes your business unique?

Proactively answering these questions gives potential candidates a better idea of your company culture and whether they’d be a good match.

Need help creating a job description? Check out our guide on how to write a job description and download our template to have an easier time.

Step 3: Create a Job Ad & Screen Applicants

Once you’ve written your job description, you need to post the job ad. Besides posting the opening on your company website, there are many sites where you can post a job for free to broaden your network. Be sure to check out our top recommended free job posting sites and use our tips on how to advertise a job to find qualified applicants for your open role.

Compliance Tip: If your business is hiring a payroll professional in certain states, you may need to put your target salary range in your public job posting. Check your state laws to see if you need to comply. Verify whether asking about a candidate’s past salary is allowed in your state as well.

When posting your job, expect a quick influx of applicants, especially for entry-level payroll specialist positions. The more junior the role, the higher the candidate volume.

To streamline the process, create a must-have list of requirements to compare and filter candidates efficiently. Take the time to review applications thoroughly and narrow down the selection to around a dozen qualified candidates for interviews, avoiding excessive time spent on unqualified candidates.

Step 4: Conduct Interviews

Interviewing plays a crucial role in finding a competent payroll professional who understands payroll regulations and can handle complex situations. Consider scheduling formal interviews by calling candidates, allowing for a brief phone interview to assess communication skills and interest.

To ensure fairness and effective evaluation, utilize a structured interview process where each candidate is asked the same set of questions, enabling you to compare and evaluate their responses accurately.

Here are some sample questions to ask during your payroll professional interviews:

- What HRIS or payroll software have you previously used?

- What is your typical payroll process?

- How do you collaborate with HR to ensure benefits deductions are correct?

- What payroll laws do you specifically watch out for during payroll runs?

- How would you improve payroll operations?

- What’s the most complex payroll situation you’ve faced, and how did you handle it?

- When you’ve made a payroll mistake, how did you discover the issue, and how did you fix it?

- How do you handle an angry employee who received the wrong pay?

Using targeted questions during the interview process allows you to assess an applicant’s proficiency in handling complex payroll situations and evaluate their compatibility with your company culture. Given the close collaboration and impact on all employees in small businesses, it is crucial to ensure the candidate can thrive in a collaborative and respectful environment.

Step 5: Call References & Run a Background Check

Upon completing the interviews, carefully review and compare your notes to narrow down the candidate list, aiming for one standout candidate or no more than three finalists.

Request at least three supervisory references from each candidate to conduct reference checks, prioritizing conversations with previous managers to gain valuable insights into their job performance and manageability. For entry-level positions, inquire about internships or relevant college courses, and consider reaching out to professors for additional input.

Here are some reference check questions you can ask:

- Did this person make routine payroll mistakes? What about one-off mistakes?

- Could you depend on this employee to have payroll done on time, every time?

- Was the employee punctual and dependable?

- Tell me about the biggest challenge with managing this person.

- Why did they leave your company and would you work with them again?

Read more on other reference check questions you can use during your screening.

Because payroll specialists and managers have access to confidential and financial information, it is essential to conduct a thorough background check on the final candidate. Obtain the candidate’s approval and consider partnering with a background check company that can provide a template form for the candidate to complete. You can check our top background check companies to find one that suits you.

Compliance Tip: Check your state laws. Some states require that companies run background checks after a job offer has been accepted.

Step 6: Make an Offer & Onboard

Upon completing the aforementioned steps, contact the selected candidate to offer them the position, assessing their enthusiasm and addressing any remaining details, such as salary and start date. Once all terms are agreed upon, proceed to write an employment offer letter to finalize the hiring process.

Your letter should include:

- Job title

- Salary and pay frequency

- Start date

- Reporting structure

Along with the offer letter, include the full job description to ensure the candidate acknowledges their responsibilities, allowing for easier accountability if expectations are not met. Provide the candidate with ample time to review, sign, and return the offer letter.

Once you receive the signed offer letter, you can proceed with the onboarding process.

When Should Small Businesses Hire a Payroll Professional?

As your small business expands, hiring administrative staff becomes essential, particularly for managing crucial aspects like payroll. The decision to hire a payroll professional depends on your specific needs, such as managing employees across multiple states.

Assess your payroll requirements, considering the benefits and costs associated with hiring a payroll specialist or manager. You can also use payroll software to help you with your payroll needs. Explore some options in our guides to the best payroll software reviews or best payroll services for small businesses. Additionally, remember that you can hire a payroll professional on a part-time basis, even for smaller businesses, to alleviate the workload, ensure accuracy, and maintain compliance.

How to Hire a Payroll Specialist Frequently Asked Questions (FAQs)

The duties of a payroll specialist typically include processing and managing employee payroll, calculating wages, ensuring accurate tax withholding, and maintaining payroll records.

Skills needed for a payroll specialist include proficiency in payroll software and systems, strong attention to detail, knowledge of payroll regulations and tax laws, and excellent organizational and communication skills.

The average salary for a payroll specialist can vary depending on factors such as experience, location, and company size, but in the United States, the average salary ranges from around $39,000 to $84,000 per year.

Bottom Line

Knowing how to hire a payroll specialist or manager is crucial to keeping your employees happy and your company compliant and making sure all taxes and deductions are accurate. To continue growing your organization, you need a payroll professional who can handle these duties for you. Following a structured process like the one we’ve provided will ensure you hire the right one for your small business.