Leasing or renting a retail space requires careful planning, as the space you choose will not only be one of your most significant operating costs but will determine your location, product quantity, storage, and store layout. To effectively rent a retail space, you need to set a budget, look for a few quality options, and know how to negotiate your lease to find a cost-efficient place that meets your needs.

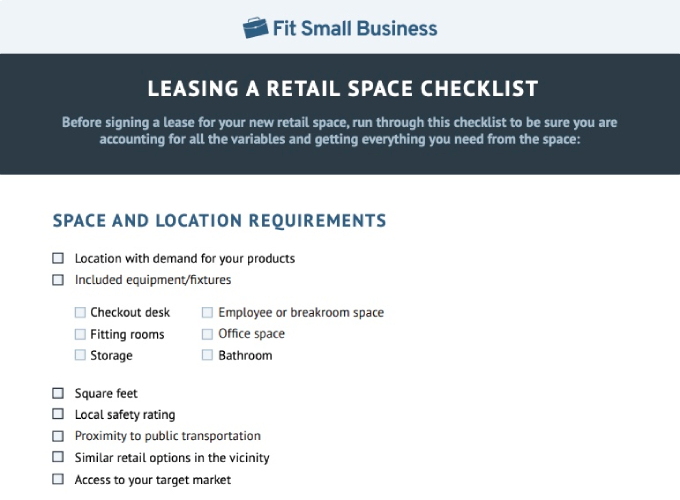

Doing all this can be difficult, so use the six steps below to streamline your process. We’ve also created a renter’s checklist you can use to ensure you’re getting everything you need from your space.

Step 1: Determine Your Budget

It’s helpful to start by knowing what you can afford. Determining your budget will narrow your choices and prevent you from falling into a financial hole.

Setting a budget can help you find a space that will work for you. (Source: Adobe Stock)

The maximum amount a business should allocate to their lease payment differs depending on the industry. Typically, however, retailers should expect to allocate between 5% and 10% of monthly gross sales to their lease payment.

Set a conservative budget because you’ll likely need extra cash to run your business daily and pay for unexpected expenses.

Below are sample figures from property management company Hartman to give you an idea of how much different retail stores typically spend on rent.

Industry | Percentage of sales allocated for rent |

|---|---|

Clothing and apparel | 7.66% |

General merchandise stores | 3.86% |

Furniture and furnishing stores | 5.98% |

Food and drink establishments | 5.81% |

Electronics and appliance stores | 2.09% |

Books, hobby, music, sporting goods stores | 3.30% |

Health and personal care stores | 3.37% |

To calculate what percentage of your business profits will go to your lease payment, simply divide the annual rent cost by your gross annual income.

Here is a quick sample calculation:

Annual Rent: $150,000

Gross Annual Income: $2 million

Equation: $150,000/$2 million = 8%

This means for every dollar your business earns, 8 cents goes to rent.

Rent is on the rise. According to the Federal Reserve Bank of Dallas, rent inflation is expected to increase from 5.8% in June 2022 to 8.4% in May 2023. Learn more in our article on real estate statistics.

Although this list will vary from city to city, here are some of the main factors that influence retail leasing costs:

- Location: High-traffic and high-visibility locations often increase the lease costs as they place your store in a prime place for high foot traffic.

- Demand: If you’re eyeing a convenient location for shoppers—such as a spot with a variety of additional shops around, ample parking space, and other amenities—prepare to pay high lease costs.

- Condition of the space: If a retail space is essentially move-in ready, you’re going to pay a lot more than you would for a similarly sized space that needs improvements or remodeling.

- Equipment: You may need setups and equipment for plumbing, gas, electric, or climate control like walk-in freezers. Depending on what the space is already outfitted with, any existing or included equipment could impact your monthly lease payment.

- Length of term: In general, the longer the lease term, the more bargaining power you have. However, you can still negotiate on short-term leases or for temporary retail arrangements like a pop-up shop or store-in-a-store.

- Lease incentives: If the lease comes with incentives such as regular improvements, then this will add to the cost. To lower lease costs, see if you can negotiate this and handle the upgrades yourself.

- Competition for the space: In many high-growth cities, commercial space is at a premium. You’re not the only potential tenant the landlord is considering, and someone else might make a higher offer to win the retail space you’re eyeing.

Apart from the lease base rate, there are other one-offs and recurring items you should consider in your budget.

- Property taxes: This cost makes up a large percentage of the expenses when leasing space and varies per state and county.

- Common area maintenance: This cost varies depending on the property’s maintenance needs. Factor in services like security, landscaping, and cleaning, as well as shared space maintenance.

- Utilities: Estimate costs for electricity, water, heat, sewer, internet, and other utilities you’ll need. For reference, in 2021, retailers spent an average 11.18 cents per kilowatt-hour. Some estimates say businesses in commercial buildings pay an average $2.10 per square foot for utilities.

- Construction: Many retail lease spaces are bare, empty, and in need of some construction and design work. Make sure to allocate a construction and interior design budget to make your shop visually appealing and reflective of your business personality. If you are making significant changes, the building may need a new certificate of occupancy.

- Supplies and equipment: While some spaces come with display racks and a checkout counter, many don’t. You’ll need to invest in furniture and equipment upfront—these expenses will quickly add up.

- Insurance: The cost of commercial property insurance varies, but it ultimately depends on the size of the space. Most retailers pay under $45 per month for general liability insurance.

Interested in learning more about insurance for commercial properties? Check out our guide to rental property insurance, which covers providers, cost, and coverage.

If you work with a real estate agent, remember to factor in their fee (also known as broker’s fee). Commercial real estate agents who lease retail space generally charge from 7% to 10% of the total lease costs. So, for example, if you sign a three-year lease at $50,000 a year ($150,000 total), and your agent charges 10%, the broker’s fee would be $15,000, due upon the lease signing.

Fees may also be on a per-square-foot basis. Typically, it works that for each year of your contract, your agent will charge $1 per square foot. For instance, let’s say you lease a 5,000-square-foot building with a three-year lease term, your broker fee would be around $15,000 (5,000 sq. ft. x $3).

Step 2: Decide How Much Space You Need

Knowing how much space you need is an important part of choosing a retail space. (Source: Pinterest)

When it comes to choosing a commercial retail space, one of your biggest considerations is going to be size. You certainly don’t want to pay for space you won’t need, but you also want to have enough space to be comfortable and accommodate growth. The best thing you can do is come up with a general calculation of how much space you need, which will narrow your property search significantly.

Outgrown your first retail space? Check out our article on opening a second retail space and expanding your business.

Here’s a basic formula for estimating the size of your sales floor based on sales goals:

Gross Sales Volume ÷ Sales per Square Foot = Size of Selling Space

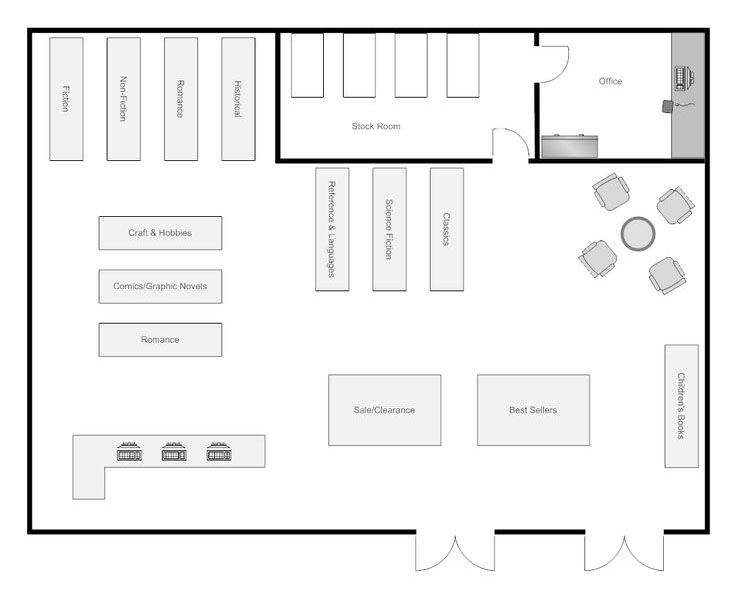

In addition to your sales floor, you should also be sure to include space for the additional areas of your store, like:

- Stockroom

- Offices

- Bathrooms

- Dressing rooms

- Backstock/storage space

- Checkout counter

- Employee space/break room

Check out our article on planning your retail store layout for additional information on how to set up your space.

Step 3: Find a Few Quality Retail Space Options

Finding multiple properties that you could lease is a great way to make a measured decision and gives you the option to leverage your choices during negotiations. (Source: Coin Laundry)

Now that you have your budget and space requirements, it is time to locate a few rental options. You don’t want to limit yourself to one right from the beginning. Instead, find four or five choices that could work and compare them to one another to determine the best fit. Multiple options will also give you more leverage when you negotiate costs later.

Here are the best ways to locate property:

When it comes to knowing the real estate market and connecting you with the best spaces, a commercial real estate agent is going to be your best bet. While you can opt to work on your own, an agent will make your life so much easier—navigating legalities, finding spaces, and getting everything for closing. The only drawback of working with a professional agent is the commission fee, but in our opinion, the fee is worth it for the service a real estate agent provides.

In terms of finding a commercial agent, you can look to a couple of resources:

- Other commercial tenants: If you know where you want to open your store, ask other business owners in the area for referrals for the agent that they worked with to find and lease their space.

- LoopNet: While primarily a listing website, LoopNet also has a feature to help you find commercial agents. You can search by location, property type, type of agent, and language to help you find a great match.

- CoStar Professionals: CoStar is a great resource for learning about commercial real estate and searching the commercial market. You can also sign up for a free subscription to CoStar to get access to CoStar professionals, which will connect you with a network of commercial agents.

- Google search: By simply typing in “commercial real estate agents + city,” Google will gather commercial agency websites and local agencies you can contact.

Once you have found an agent, you should also look for certain criteria to ensure they are a good fit:

- Expertise in your specific industry: Especially in larger cities, commercial agents will typically specialize in specific kinds of spaces—office, tenant, retail, etc. Be sure that you are working with an agent that works in your specific industry. Agents with expertise in specific areas will often have special certifications. Learn more in our article about real estate certifications.

- Establishment in your area: You will want to look for agents that work in your specific city or even neighborhood. This expertise means you will have a competitive edge while searching and negotiating contract terms.

- Reviews and referrals: Look for reviews on your agent and try to get a referral, if possible. This will help you to understand if they are communicative and how well they work with their clients.

- Record of success: Be sure to choose a commercial agent who has successfully completed multiple sales. This shows that they know how to be competitive and can lead you through the leasing process.

Interview potential candidates: The best way to ensure that you will have a good working relationship with your agent and get all the information you need about their career and expertise is to meet with agents and talk to them in person beforehand.

One of your best resources for finding quality properties is Google. Just head over to your search page and type in keywords about the type of space you’re looking for. For example, if I type “600 square foot retail space Denver,” I am met with a list of properties that meet my search criteria from several different sites.

Several sites are also dedicated to commercial real estate listings, including LoopNet and Craigslist. These sites usually include featured listings, lease prices, types of businesses allowed to operate in the space, property addresses, and agent contact information. You can also filter your searches by advanced search criteria, including price, square footage, ZIP code, and specific features.

You can check out our guide on the best commercial real estate databases for more resources for finding commercial spaces.

Step 4. Evaluate Each Potential Location

Weigh your options to figure out which property is going to be the best option for your business. (Source: Adobe Stock)

Once you have found a few good options in terms of space, it’s time to narrow them down based on location. In general, your best retail spaces are going to be:

- A safe area: If customers do not feel safe, they are not going to want to shop in your store. Check out MyLocalCrime, input your ZIP code, and see how your potential location measures up to surrounding areas.

- Where your customers are: Setting up your store where your key demographic or target market lives or works will attract customers. You can use data from the US Census Bureau to look up general demographics for an area or city.

To get insights into a local demographic, you can use Claritas—a free online resource where you can input your ZIP code to find and segment the clientele in your specific area.

- Near your competitors: Although it may seem counterintuitive, locating near your competition guarantees that you will have customers that are interested in your product. This can be especially invaluable for new businesses that do not have an established customer base.

- Near other compatible businesses: Retail spaces such as restaurants, bookstores, and coffee shops go well together. Apparel stores work great near makeup and shoe stores, and pharmacies and medical offices work well together. This type of collaboration is a great fit for pop-up spaces.

- Accessible and visible: Your retail location needs to be visible and accessible for customers, so an ideal location is close to local transit or major roads and/or in a high foot traffic area. This will help boost your visibility and ability to get people through your doors.

Did you know?

97% of consumers have backed out of a purchase because it was inconvenient to them. Situating your store in a place where your customers are already shopping will make your business a convenient place to shop, boosting sales conversion.

There are several professional services that you can hire to perform location analyses. Marketing and retail experts will evaluate existing or potential locations with different factors to shed light on how the location will perform and to find its strengths and weaknesses around which you can market and plan. We recommend WIGeoGIS for professional location analysis services.

Step 5: Evaluate Your Lease

Evaluate your lease and negotiate where you can to get the best deal. (Source: Adobe Stock)

Now that you have a space picked out, it is time to review the lease. This can be a complicated process, especially considering all the legal terminology and lease-speak. This is where working with a commercial real estate agent is helpful. They can help you to determine what should and should not be part of the lease, making sure you make the best decision for your business. Not only that, but they will represent you to the landlord and conduct all lease negotiations.

Did you know?

2022 saw more store openings than closings, and the retail market recorded nearly 100 million square feet of positive net absorption. Experts largely attribute that to a new approach to leases. After the pandemic, retailers are demanding shorter, more flexible lease terms, resisting the traditional 10-year term in favor of a term closer to one to five years.

Step 6: Negotiate & Sign Your Lease

Negotiate your lease to get the best terms possible and to save money. (Source: Adobe Stock)

Once you have read through your lease, you can go back to the leasing agent and try to negotiate for a better price or terms. The following are some of the most common terms you will negotiate in a commercial lease:

You can try to bring this down, especially if you’re looking at renting the space long-term. However, if you’re looking to stay for fewer than three years, you should focus your negotiating efforts on other areas.

Landlords will generally try to work into the lease an annual rent increase based on the consumer price index or some other measure. These are also called escalations, and tenants should reach an understanding before entering into any lease.

Utilities also take a chunk out of your profits, so try to see if this is something the landlord can include in the base rate. While they might not agree to include all, try to negotiate some items such as water and sewage.

The length of your lease will vary from state to state, but typical retail lease agreements are five to 10 years in duration. In the post-COVID era, however, many retailers are entering into shorter leases of one to five years.

Do note that a shorter lease duration typically increases the lease base rate unless you have arranged a unique situation, like a pop-up shop or temporary space.

Unfortunate events happen, so try to see if you can include a clause that will allow you to get out of the lease prematurely under unexpected circumstances. Think about damages within the space vicinity, loss of sales and bankruptcy, or environmental contamination.

Many commercial leases ask tenants to pay up to three months’ rent upfront. Try to negotiate this for one or two months to conserve cash flow.

Did you know?

When asked what types of properties investors believed to be the most risk-adjusted through 2023, nearly 30% cited neighborhood retail spaces. Both landlords and investors are looking for retailers to take their spaces. Leverage this when negotiating your lease terms.

While insurance is not a negotiable lease item, you should be aware that landlords will typically mandate that tenants get proper insurance on the property commensurate to the type of activities that will be happening on the property. The insurance terms will vary between states, but you should factor in the monthly insurance costs and note what type of insurance you need.

Once you have gone through all the negotiations and agreed to your lease terms, you will want to get everything in writing and have your agent review the contract to be sure the terms are properly reflected in the final text.

The selling agent is responsible for writing the contract, so you need to be sure that your interests are properly reflected prior to signing.

It is now your time to sign on the dotted line. Once signed, your broker (or you) will send the contract back to the seller. The seller will perform a final review of the contract and then sign it. Once everything is signed, you will want to obtain a copy of the contract for your records, and you can begin occupying your new retail space.

How to Rent a Retail Space Frequently Asked Questions (FAQs)

Click through the questions below to get answers to some of your most frequently asked renting questions.

The most common type of lease that you will see in retail space is a percentage lease, especially in malls. In a percentage lease, you pay a base rent plus a portion of the total sales you make in the space.

Before entering into a lease, you should be sure to ask about

- The type of lease

- The rental terms, including when rent is due and how long the late period is

- What additional fees you can expect

- Whether your rate is locked or subject to change

- What insurance coverage you have

- What changes you are allowed to make to the space

- What amenities are included (maintenance, cleaning, utilities)

- How utilities are paid

- What parking is included

A retail lease is a lease of a retail space where you sell goods and services to the public. A commercial lease, on the other hand, is a lease of a commercial property where people work, but no retail selling occurs. Think office space, warehouses, or industrial facilities.

Bottom Line

The best thing to do when looking for retail space for lease is to give yourself some time to weigh and consider the options to avoid making hasty decisions. After all, your retail space is the truest representation of your business. While it takes a lot of planning, we hope that this step-by-step guide gave you a good idea on how to get started and, ultimately, close a great and cost-efficient deal with a professional agent.