Creating and sticking to a retail budget is imperative to the success of your business—it will help you predict sales, optimize purchasing, understand costs, and prevent overspending. Here, we will go over how to budget a retail business in six steps, which includes gathering and analyzing data, creating sales and cost budgets and a profit and loss statement, and establishing a cash flow forecast. We also created a free retail store budget template that you can download in Step 1.

Step 1: Gather Data for Accurate Forecasting

When considering how to budget a retail business, the first step is gathering data so you can accurately understand how your business has performed in the past. This will help you make informed predictions about how it will perform in the future. In other words, to begin your retail budget, you will perform a sales forecast using past store data to anticipate your upcoming revenue stream and set a realistic retail budget.

Download our free template where you can start recording your data.

To perform your sales forecast and predict future revenue, you will collect data on:

- Past sales: You need to know how much your store(s) made in previous years to detect trends and make predictions about what your sales revenue could look like this year. If you have multiple locations or channels, then you want to keep the sales data separate so that you can view the individual performance of each location or channel and allocate budgets accordingly.

- Gross margin: Your gross margin refers to the total sales revenue minus all the costs associated with your inventory. Your margins data will help you understand how much of your revenue is left after you remove all associated costs, such as labor, carrying costs, and cost of goods sold (COGS).

- Marketing calendar: To get an accurate picture of your sales, you need to look at your marketing calendar so you know when you hosted sales and events that might have created a boost.

- Anomalous events: So you don’t overestimate or underestimate your budget, be sure to note any anomalous events that impacted your sales. For example, a winter storm may have caused you to close your doors for a week, leading to lower-than-normal sales for the month.

- Fixed costs: In addition to gathering sales data, you will also need to have a grasp of all of your fixed costs. Often called overhead costs, your fixed costs are all your business expenses that are not impacted by your sales—like rent and utilities. These are the costs that you will owe regardless of your store’s performance and will not change month over month.

- Variable costs: On the flip side of your fixed costs, you also should gather information on your variable costs. These are costs that are impacted by your sales—like your COGS, payroll, and shipping costs. Understanding these expenses and how they fluctuate will help you to anticipate how your expenses will change as your sales increase or decrease.

- Foot traffic: Understanding when customers are in your store will help you plan for staffing needs, identify the best times for events, and hone in on your inventory management needs.

Want to learn more about the expenses you should track? Check out What Are Expenses in Accounting? Variable & Fixed Explained.

Like-for-Like (LFL) Comparison

In addition to taking a look at all the data above to make your sales forecast, you might also want to do an LFL comparison. With LFL comparisons, you compare two stores with similar characteristics and omit any major outlying factors that could distort their numbers.

By isolating and evaluating specific variables you can see how they impact performance and understand why a certain store is succeeding or why another is faltering.

For example, I worked at a boutique with four locations, and we wanted to see how the different locations impacted sales so we could distribute inventory accordingly. To do this, we first removed all variables between the stores, other than location—like if one store had an event and the others didn’t or if one store carried a different product than the others. This made the stores essentially the same, other than their respective locations.

From there, we looked at store performance and were able to determine that our downtown store did the most sales, so it needed to carry the highest inventory volume.

Along with the metrics mentioned above, making LFL comparisons can help you set your sales calendar, staffing plan, and marketing campaign, and provide insights into what budgeting plan will be most fruitful for your business.

Step 2: Analyze Data & Look for Opportunities

Once you have gathered your data, use it to look for opportunities to improve profitability. Review where you were successful last year and learn from what you did well. Conversely, evaluate the times when sales were slow or promotions fell flat and try to understand where you went wrong. You might also look for areas where you overspent or could have invested more.

For example, say you saw a ton of traffic around the holidays, and your sales numbers were great from October through December. With this trend in mind, you might invest in a loyalty program in October to capitalize on foot traffic and run a sale in November to counterbalance your spending. Or, you might increase your holiday inventory so there are more products to capitalize on the boost in traffic.

Leverage your sales data to better understand the reasons for your business’s successes and failures so you can create an informed demand forecast, marketing strategy, and overall budget.

Create a Marketing Calendar

A retail marketing calendar is an annual calendar that includes all the major events, holidays, and seasons that businesses plan to market around for the year.

Retailers use marketing calendars to plan for key marketing initiatives and create timelines to capitalize on seasonal revenue opportunities. Using your past sales data, you can make a better-informed marketing calendar that is based on lessons learned from past marketing successes and failures.

Check out our 2023 Marketing Calendar for a complete guide on how to get started, as well as free calendar templates.

For example, say you found that in July, your store had very little traffic on the Fourth of July weekend when you were running a promotion—but had a surge of traffic the next weekend. With that in mind, you decide to move your July sale to the weekend after July 4 to capitalize on traffic.

Creating a marketing calendar also helps in setting a marketing budget. Don’t worry, though—we will look at how much you should be spending on marketing when we get down to Step 4.

Step 3: Write a Sales Budget to Predict Revenue

A sales budget refers to your annual estimated sales broken down by month and day, and it is used to predict your overall sales revenue for the year. Your sales budget is arguably the most crucial part of creating your overall budget as it determines projected profits and, by extension, your spending limits.

Factor in things like promotion days and the day of the week when creating your sales budget so you don’t set your numbers too high or low and skew your budget.

You can take many strategies when creating your sales budget, whether that be increasing your margins, sticking to a budget, or maximizing your promotions. Ultimately, your approach to setting sales goals should take into account all the data you collected in step one, as well as the plans you made in step two.

In addition to the data you gathered, there are two major things you should consider:

Your growth estimate refers to the estimated percent you predict your sales revenue will grow or shrink compared to the previous year. In retail, you typically use the growth estimate to create your sales estimates and set your overall budget.

For example, say, you anticipate your sales revenue for 2022 to be 10% higher than 2021 because of the rise in in-store sales and your new buy now, pay later (BNPL) services. You would then be able to set sales goals for each month or even for each day based on your 2021 numbers, just 10% higher for your anticipated growth.

As you are making your growth estimates, consider global, regional, and local events that might disrupt the retail market and move you away from the typical 3.5%–5% annual benchmark. And remember, it is still a very volatile market, so stick to safe predictions and avoid overspending to save yourself any headaches.

When you set your sales goals, you also determine your profit margins—the amount by which your sales revenue exceeds your expenses. This will tell you how much money you have in profit after you remove all expenses from your sales revenue.

Know the margin you need to meet to make your business profitable. Then, adjust your budgeting plan as needed to meet that margin. The general profit margin range you should shoot for depends on the type of goods you sell and the kind of retail you do. You can use the graph below for some industry-specific margin averages.

When budgeting, controlling your margins comes down to how much you plan to invest into your business, your overhead costs, the number of sales and promotions that you run, and your pricing strategy. Remember that the more sales you run and the more you spend on your business, the more you will cut into your margin.

Use the profit margin calculator below to see just how much your profit margin is and whether or not you are hitting your goals.

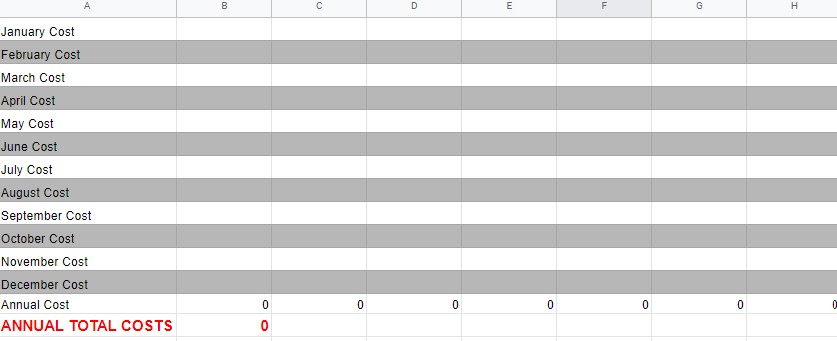

Step 4: Make a Cost Budget to Predict Costs

A cost budget is a plan that itemizes how much you expect to spend on your business for the year. As a retailer, your inventory will be a significant expense, but there are also other key areas of your business to which you will have to allocate funds, including marketing and labor.

How much you can spend on your business is ultimately determined by how much revenue you expect to make that year. Use your sales budget and gross revenue predictions to decide how much you can spend in total.

Now, let’s look at those areas and list the specific items you should account for in creating a cost budget for your retail business. You can also use our cost budget template for free.

If you are a new business, then you can look at our article on startup costs to get a rundown of what you can expect to spend to get your business up and running.

Just getting started? Check out our guide on how to start a retail business.

Retail Budgeting Benchmarks

As you start budgeting and distributing funds to certain expense categories, it is helpful to know the allocation benchmarks for the retail industry. In general, the cost distribution you should aim to meet is:

Store Facilities, Rent, and Utilities: 10%–12%

Labor: 10%–15%

Marketing: 3%–5%

Admin Expenses & Technology: 4%–5%

Inventory: Depends on your industry and COGS

Step 5: Create Your Projected P&L Statement to Provide a Full Picture

A P&L statement, also known as a profit and loss or an income statement, is an account statement that shows all of a company’s revenues and expenses for a certain period. In other words, it is a combination of both the sales and costs budgets that, when combined, shows you how much total revenue you can expect, given your projected profits and losses.

In retail, you typically break your P&L sheets up by quarters—with Q1 being January through March, Q2 with April to June, Q3 being July to September, and Q4 with October through December. The exact dates fluctuate annually, so check the exact fiscal quarter dates when creating your P&Ls.

When creating your projected P&L sheet, these are the line items that you should include:

- Revenue: This is how much you anticipate selling based on your sales budget.

- COGS: This is how much you anticipate spending on your inventory based on your margin budget and projected buying plan.

- Operating Expenses: This includes your labor, administrative, facilities, and any other expenses incurred by your business.

- Depreciation: This accounts for any market decreases in the value of your profits.

- Common Expenses: This refers to any expenses shared among multiple stores (for example, a customer loyalty program subscription that multiple locations utilize) and should be divided evenly among the stores on their P&L sheets.

- Net Profit: This is how much you have left after subtracting all costs from your total revenue.

Step 6: Design a Cash Flow Plan to Stay on Track

The final step in creating a budget for your retail business is to create a cash flow forecast. Cash flows show you how much money you have at any given time based on outgoing, incoming, and on-hand cash and provide an overview of how well you are sticking to your budget.

Your cash flow will have four parts:

- Outgoing Cash: How much you have spent

- Net Cash: Your current revenue minus your outgoing revenue

- Month Ending Cash: How much cash you have on hand plus your net cash

- Total Annual Cash: A running total of how much cash you have month over month

Common Retail Budget Mistakes

When you are learning how to budget a retail business, there are lots of common mistakes that you might run into. Use our list of retail budget mistakes to become aware of some of the most common pitfalls of retail budgeting, so you have a better chance of avoiding them.

- Overestimating sales: There are a lot of ways you can overestimate your projected sales revenue. Avoid this by doing thorough research and taking into account internal and external factors that might impact your profits. Additionally, it is always better to have more money than you thought, so we recommend underestimating to give yourself some margin for error.

- Forgetting economic factors: As you are gathering data and making your sales budget, it is important to consider how economic circumstances have changed over the year. If the economy has improved and consumer spending is up, you might be able to budget for higher sales. Conversely, if the economy has taken a downturn, you can expect lower revenue.

- Not giving yourself enough wiggle room: As you make your budget, you do not want your costs and anticipated spending to be too close to your revenue goals. Leaving yourself ample margins will give you the flexibility to run into unpredicted problems or opportunities without cutting into your profits or going into debt.

- Understaffing to save money: While it is tempting to cut corners in order to save on costs, the last place you want to do this is in the labor department. As you know, the United States is facing a labor shortage; people are changing jobs at unprecedented rates, and finding people to replace them is nearly impossible. The best way to avoid being short-staffed is actually to have an excess of employees and to allocate extra funds to onboarding and training.

Learn about the best ways to retain your staff without our guide to employee retention and learn more about the labor landscape with our piece on employee retention stats for 2023. Our guide to hiring for retail offers advice on striking the right balance of extra part-time staff.

- Inaccurate inventory management: Not understanding your inventory, how it performs, restock times, and your successes and failures is a result of mismanagement and can lead to major inaccuracies as you are creating your budget. Investing in inventory management software is the best way to track your inventory, but you can also do it by hand—just be sure you have a thorough system in place.

- Not accounting for shrinkage: Another retail metric that is easy to forget but has a big impact is shrinkage or retail loss. You should be sure to consider shrink as you draw up your budget.

- Extraneous expenses: Extraneous expenses are things like buying a team lunch, fixing a leak, or refunding a customer—any small expenses that are outside of normal, day-to-day costs. You will generally either want to build in margins for these types of things or allocate 1%–2% of your budget to this area. Also be mindful of how much you are spending on office, cleaning, and general supplies.

- Not making your goals granular enough: As we talked about in the sales budget section of this article, the best way to stay on track of your sales goals is to make one for each day. It can be difficult to follow your progress toward weekly or monthly sales goals without these daily increments and you will have a harder time knowing when you are off track.

How to Budget a Retail Business FAQs

Click through the questions below to get answers to some of your most common retail budgeting questions.

When considering how to budget a small retail business, you will want to start by doing research so that you can anticipate your revenue. With profit goals in mind, you should then calculate your anticipated costs and create a plan for how you are going to meet your revenue goals to cover those costs.

A retail store budget is a monetary plan that includes your revenue goals and cost predictions as well as a plan as to how you are going to meet your revenue goals.

A merchandising budget plan is an outline of all your merchandising initiatives, their anticipated costs, and revenue goals to cover those costs.

A retail budget will ensure that you have a strong picture of your business, allowing you to set reasonable revenue goals and spending allocations, so you can meet your profit goals and avoid overspending.

Bottom Line

Creating a budget for your retail business will set your business on the right track for profitability. By devising a realistic plan that accounts for all of your expenses, you can ensure that you will not overspend, overbuy inventory, or frustrate your employees.

With all of these budgets at your disposal, you can easily track and compare weekly, monthly, and quarterly targets and see how well you are progressing toward your goals. Remember, however, that they are also living documents. As things happen—economic downturn (or upturn), rising costs, inflation—you will have to adjust and revisit your budget. Let your budgets be fluid and have the ability to change as your circumstances do, too.