Payanywhere is a payment services provider with strong solutions for in-person and mobile transactions. It comes with features such as invoicing, inventory and employee management, and free same-day funding. Payanywhere also allows merchants to process split checks, open tabs, and tips used in restaurant payments.

In our review of the best merchant services, Payanywhere earned a respectable 3.72 out of 5. Though it did not make our list of top providers, its processing rates are favorable for low order values with no monthly cost, but the inactivity fee prevents it from being ideal for occasional sellers. We generally recommend Payanywhere for small, primarily mobile businesses.

Pros

- Low fees on small transactions

- Free same-day and next-day funding

- Custom plans for low-volume merchants

Cons

- Charges an inactivity fee

- ACH processing only for custom plans

- Lacks ecommerce integration

- Platform is reportedly unstable and has frequent updates that interfere with performance

Supported Business Types | Primarily mobile businesses |

Standout Features |

|

Monthly Software Fees | $0 |

Setup & Installation Fees | $0 |

Contract Length | Varies; Month-to-month and long-term contracts |

Point-of-Sale (POS) Options |

|

Payment Processing Fees | Competitive

|

Customer Support |

|

Best for | Small ticket sales | Small businesses just starting out | Occasional in-person sales |

Monthly fee | Starts at $0/month | Starts at $0/month | Starts at $0/month |

Card-present transaction fee | 2.75% | 2.6% + 10 cents | 2.29% + 9 cents |

Keyed transaction fee | 3.25% plus 15 cents | 3.5% + 15 cents | 3.49% + 9 cents |

Ecommerce transaction fee | 3.25% plus 15 cents | 2.9% + 30 cents | 3.49% + 9 cents |

Looking for the lowest rates? The payment processing rates you will pay can vary based on your business’s size, type, and average order value (AOV). To find the most affordable option and compare multiple processing rates, read our guide to the cheapest credit card processing.

When to Use Payanywhere

- Startup businesses: Payanywhere offers a pay-as-you-go payment processing service

- Small mobile restaurants: Payanywhere made our list of best credit card payment apps for its simple restaurant payment tools.

When to Use an Alternative

- Occasional businesses: Consider free merchant accounts with no inactivity fee.

- Businesses with high average order value: Check out one of these other cheap credit card processors.

Payanywhere Overview

Payanywhere is an all-around payment processor that allows businesses to accept credit card payments both online and in-person. What’s unique about this provider is that it offers custom fees regardless of business size, which were previously reserved for businesses that process more than $30,000/month. It also offers free same-day funding, where other payment processors often charge at least 1% per payout.

Payanywhere no longer made our list of top Square competitors in the recent update because it removed the free mobile credit card reader while still charging an inactivity fee, but it remains a good mobile payment alternative for merchants. This provider continues to offer one of the best credit card payment apps, especially for those looking for simple restaurant-specific payment tools.

However, Payanywhere does not offer ACH or e-check payments (though they may be available with custom plans). And while it can process online transactions, it does not support international payments, which you’ll find in better payment gateways with more online payment processing tools.

Payanywhere also charges a monthly account inactivity fee if you don’t use the platform within 12 months, while those who prefer custom rates may be subject to long-term contracts.

Payanywhere starts with a free account but also offers custom plans. However, this comes with a long-term contract and possible cancellation fees. It also charges for inactivity and chargebacks and no longer offers a free 2-in-1 credit card reader that used to be very popular among small merchants.

Payment Processing

Payanywhere offers pay-as-you-go and custom pricing options. There’s also an inactivity fee of $3.99/month after 12 months of not using your account, so you’ll want to look at other options if you only sell occasionally.

Note that while the website does not provide any indication that it can process ACH or e-check payments, it may be available with a custom plan.

Pay-as-you-go | Custom | |

|---|---|---|

Contract length | Month-to-month | Possible long-term |

In-person transaction fee | 2.69% | Custom |

Keyed-in | 3.49% + 19 cents | Custom |

Invoice | 3.49% + 19 cents | Custom |

Recurring Payment | 3.49% + 19 cents | Custom |

Inactivity fee | $3.99/month after 12 months | N/A |

Chargeback fee | Not disclosed | Varies |

Other fees include:

- Monthly POS fees:

- Mobile POS: $0

- POS used on POS hardware: $9.95/month

Under Payanywhere’s terms of service, merchants that exceed $100,000 in annual sales volume will be converted from an aggregate to a dedicated merchant account. This may involve a change in transaction rates, contract length, and other incidental fees.

Hardware

Payanywhere supports mobile credit card readers for users only needing to accept on-the-go payments. It also carries smart terminals and smart POS systems that you can purchase or rent by paying a licensing fee. You will also need to pay for the POS software attached to each device, which costs $0–$39.95/month.

Payanywhere Hardware | |

|---|---|

| $49.95 Accepts traditional magstripe credit cards, EMV chip cards, and NFC contactless payments like Apple Pay and Samsung Pay. |

| Custom License Fee or purchase for $349.95 (plus $9.95/mo/device software fee) Features include: 5" touch screen with Android software, front and back cameras for barcode scanning, 4G and Wi-Fi connectivity, and preloaded Payanywhere app. |

| Custom License Fee or purchase for $249.95 (plus $9.95/mo/device software fee) Features include: 4" touch screen with Android software, built-in receipt printer, and preloaded Payanywhere app. |

| Custom License Fee or purchase for $449.95 (plus $49.95 one-time setup fee and $19.95/mo/device software fee) Features include: 4" touch screen with Android software, built-in receipt printer, and preloaded Payanywhere app. |

| Custom License Fee or purchase for $549.95 (plus $49.95 one-time setup fee and $19.95/mo/device software fee) Features include: 8" touch screen with Android software, customer-facing display, front and back cameras for barcode scanning, built-in receipt printer, charging dock, and accessory hub for countertop setup, 4G and Wi-Fi connectivity, and preloaded with Payanywhere app. |

| Custom License Fee or purchase for $949.95 (plus $99.95 one-time setup fee and $39.95/mo/device software fee) Features include: 12.5" HD touch screen with Android software, 4.3" customer-facing display, front and back cameras for barcode scanning, built-in receipt printer, Ethernet and accessory ports for countertop setup, 4G and Wi-Fi connectivity, and preloaded with Payanywhere app. |

Contract & Terms of Service (TOS)

By default, Payanywhere is a payment services provider that provides an aggregate merchant account to small merchants. However, merchants that exceed $100,000 in annual credit card sales volume will be upgraded to a dedicated merchant account. Like its custom plan, this arrangement may involve lower transaction fees and longer contract terms.

Payanywhere has also updated its terms of service since our last update. It no longer mentions anything about early termination fees, long-term contracts, or specific costs in cases of chargeback.

Setup & Application

To sign up for a Payanywhere merchant account, fill out the online form on its website, then wait for a tracking number to be assigned to you and get prompted to set up your login details. You can start filling out your information once logged in to your account. Note that by default, all merchants will be given a pay-as-you-go plan unless you request otherwise (you will need to contact Payanywhere sales representatives).

The next steps would be to select your payment hardware, complete your business profile, and provide your banking details. Once you are done, review and agree to the terms of service. You will receive an email notification to confirm your application within 24 hours.

Payanywhere supports all types of credit card payment methods, including recurring payments. However, there is no mention of processing ACH or e-check transactions (you may need to request or contact North American Bancard directly), and its online payment functions are limited to invoicing and virtual terminal transactions.

Payment Types

Payanywhere can process Visa, Mastercard, American Express, Discover, AliPay, and contactless payments like Apple Pay and Samsung Pay. Customers can also split tabs, pay via invoice, or sign up for recurring payments. Invoicing and recurring payment processing are also available, with options to customize. It also provides you with tools to allow customers to enroll in automatic payments.

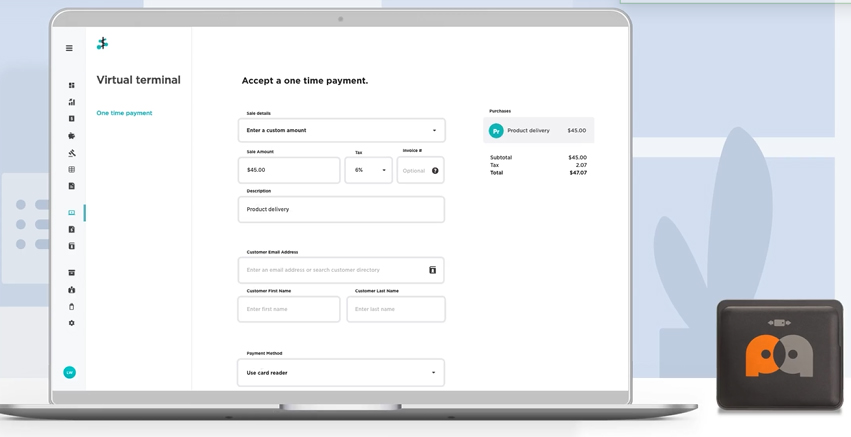

Virtual Terminal

Accept payments on your computer with its virtual terminal and cloud-based dashboard. It provides you with the ability to process payments through manual key-in of your customer’s card details, or you can connect a mobile card reader via Bluetooth for swipe- or chip-based transactions. You can also send digital receipts via email or SMS and save and track customer information in the virtual terminal

Payanywhere’s virtual terminal lets you process payments through keyed-in or card reader-based transactions. (Source: Payanywhere)

Mobile Payments

Payanywhere is ideal for mobile and in-person transactions, offering a full suite of hardware to administer these payments. It’s better suited for frequent sellers with a low AOV—and merchants that don’t need lots of bells and whistles when it comes to features. Payanywhere is a straightforward, simple system to learn. Though that makes it easy to use, it also limits functionality.

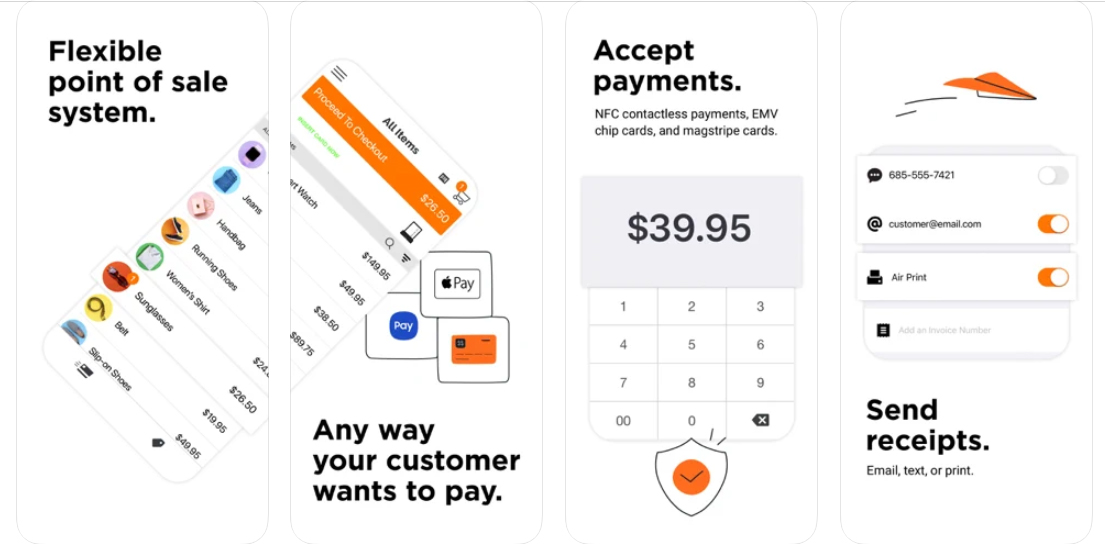

POS App

With the Payanywhere mobile app, you can process payments from a compatible smartphone or tablet. It includes inventory and employee management features and allows you to email, text, or print receipts to a connected printer. The app works offline so that you can swipe credit cards without an internet connection. Payanywhere recommends its POS app for both small retail and restaurant businesses.

Payanywhere lets you accept payments, manage inventory, and pull reports from any mobile device. (Source: Payanywhere app on iTunes)

Invoicing & Recurring Payments

Payanywhere supports invoicing and recurring payment functionalities. You can create and send one-time or recurring invoices, which customers can then pay online. You can also customize the payment amount, payment schedule, frequency, due date, and reminders, and even choose between sending via email or text.

The system can also set up a custom-branded payment portal where your customers can be redirected to, not just for making payments, but also to view their transaction history, download receipts, and update their payment methods if needed.

Free same-day funding and 24/7 customer support contributed to Payanywhere’s above-average scores for this criteria. However, POS and business management tools are somewhat limited, and it no longer supports the 2-in-1 credit card reader, which used to be available free with every Payanywhere account.

Point-of-Sale (POS) Tools

Payanywhere comes with a POS software available with available features based on the type of hardware the merchant is using. The mobile POS app is used in conjunction with the mobile credit card reader. Standard Payanywhere POS features include inventory, employee, and tickets and tabs management.

Small restaurants using Payanywhere are provided with the ability to create tickets and tabs for food and drink orders. Tickets can be named, contain notes, and assigned an identifier to locate the customer inside the restaurant. Meanwhile, tabs can be created by running a customer’s card for items being purchased, adding a ticket name, and assigning a customer identifier.

It’s important to note that Payanywhere is not a full-fledged restaurant software. For a more complete feature, read our list of best restaurant POS systems.

Payanywhere provides a cloud-based library for merchants to manage their inventory. It comes with tools for bulk uploading, modifiers, price variants, line item or group discounts, and more. Real-time inventory synchronization on all your connected POS devices makes it easy to track sales by a variety of categories and set low-stock alerts.

Payanywhere’s POS software also comes with free employee management tools, which most alternatives charge for an additional fee. It even comes with advanced features, such as custom roles and permissions, performance tracking, and report generation.

Payout Time

Payanywhere defaults to next-day funding with a 10 p.m. cutoff time (Saturday and Sunday deposits will appear on Mondays). Businesses like restaurants or bars that have hours past 10 p.m. can elect a “same-day” funding option that has a 10:30 a.m. cutoff time, so your transactions from overnight will deposit later that day. Though calling it “same-day” funding is a bit of a stretch, it is a fast turnaround time and comes with no added fees.

Same-day Funding

Same-day funding is free. All you need to do is go to the funding options on your Payanywhere app or Payments Hub to customize your settings. You are also provided with tools to manage and track your deposits.

Analytics Reporting

Like most payment processors, Payanywhere gives you real-time insight into payment-related data. View trends and historical sales for volume, payment type, customers, employees, and inventory, which are all synced across devices. You can also monitor and manage chargebacks, upload documentation, and respond to disputes when needed.

Integrations

There are also limited integration options as compared with other payment processors. That said, you can connect Payanywhere with QuickBooks, Homebase, GRUBBRR, GiveHub, and others.

Customer Support

Payanywhere support reps are reachable via email, phone, or live chat. Some users report it takes a while for live chat techs to respond, but the option is there if that’s your preference. Merchants can also turn to the extensive library of support content to troubleshoot issues themselves. There are articles and videos to walk you through different obstacles.

Payanywhere earned a decent score in this criteria for its pricing, ease of use, and unique features. There are also various factors that make Payanywhere stand out, and although are not always an obvious advantage, are a unique selling point, nonetheless.

First, it’s not every day you find payment processors that offer custom rates for low-volume merchants. And while a handful of providers convert aggregate to traditional, dedicated merchant accounts after a certain processing volume, Payanywhere’s terms are uniquely low at $100,000 a year (around $8,000 per month).

Second, as a payment processor, Payanywhere is easy to use. The mobile POS app is pretty straightforward and is clean and easy to navigate even on a small screen. The sign-up process is not so bad, but top payment processor alternatives like Square and PayPal will not require you to wait for 24 hours to start accepting payments.

Lastly, in terms of pricing, we liked how Payanywhere does not charge a fixed amount (cents) per transaction. This means that at 2.69% per transaction, merchants do not get imposed an additional fee regardless of how many transactions they process. And when compared to Square’s 2.6% + 10 cents, merchants selling items with low average order value will pay cheaper fees with Payanywhere even with the extra 0.09%.

Number of In-person $10 transactions | What you will pay with Payanywhere | What you will pay with Square |

|---|---|---|

1 x $10 | $0.269 | $0.36 |

2 x $10 | $0.538 | $0.72 |

Read our complete evaluation of Payanywhere vs Square.

There will be small merchants who would be interested in these very specific features. And with Payanywhere’s free same-day funding, decent POS software, Clover-like hardware setup, restaurant payment methods, and 24/7 customer support, some will even find this provider better suited for their business needs than the more popular alternatives.

What Users Say in Payanywhere Reviews

While Payanywhere has fewer reviews than other platforms, users are pleased with the payment processor, highlighting the simple yet effective software and integrations with popular POS systems like Square. In Google Play, Payanywhere has a 3.7 out of 5 rating based on over 4,400 reviews. In the App Store, it scores a 4 out of 5 based on around 1,000 reviews.

- Capterra: No new reviews since our last update. Fewer than 10 users scored Payanywhere 3.9 out of 5 stars. Most like how it’s easy to use and comes with affordable fees, though some have mentioned bugs with the software.

The most notable sentiment of Payanywhere users were:

| Users Like | Users Don’t Like |

|---|---|

| Affordable/free monthly | Login setup issues |

| Easy to use, particularly in sales tracking | Unsuccessful transactions |

| App upgrades w/more features | POS app issues after software update |

Methodology—How We Evaluated Payanywhere

We test each merchant account service provider ourselves to ensure an extensive review of the products. We compare pricing methods, identifying providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. We then further evaluate according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use―including account stability―popularity, and reputation among business owners and sites, such as the Better Business Bureau (BBB). Finally, we considered how well each system works with other popular small business software, such as accounting, POS, and ecommerce solutions.

Payanywhere Review Frequently Asked Questions (FAQs)

Payanywhere is primarily a payment facilitator which means it provides an aggregate merchant account for similar businesses. However, it can set up small merchants with a dedicated merchant account for businesses that process more than $100,000 in credit card sales per year.

Payanywhere is free to use, it does not require any monthly fee and merchants only need to pay the cost of accepting payments every month. However, there’s a $3.99 inactivity fee for those who do not use their account for 13 months. Custom plans are also available.

Yes, Payanywhere is exceptionally ideal for small businesses with frequent, low-ticket sales. Its fees are comparable to Square. In fact, Payanywhere is often considered when looking at Square alternatives.

Bottom Line

If you are looking for a simple mobile payment processor, Payanywhere is a good option for businesses handling frequent, mobile in-person transactions. Processing rates are affordable for low order values, making it ideal for frequent sellers of inexpensive goods. With its pay-as-you-go subscription plan, fast application process, and easy setup, it’s also a great payment processing alternative to Square.