The best credit card payment apps offer the latest in payment technology and are affordable, easy to use, and convenient.

8 Best Credit Card Payment Apps for 2024

This article is part of a larger series on Payments.

Not every business needs a complex point-of-sale (POS) system. Credit card processing apps can be downloaded for free to your smartphone or tablet and let you take credit card payments on the go.

After careful consideration, we give you eight of the best credit card payment apps for 2024.

- Square: Best all-in-one, free credit card payment app

- PayPal: Best for occasional sellers, PayPal users, and those selling to tourists

- Shopify: Best for ecommerce merchants

- Chase Payment Solutions: Best for free same-day funding

- SumUp: Best for solopreneurs with low-volume and low-ticket sales

- Payanywhere: Best for restaurants, bars, and food trucks

- Nomod: Best mobile payment app with flexible rates and no additional hardware

- SimplyPayMe: Best for service professionals without credit card readers

Best Credit Card Payment Apps Compared

App Payment Methods | Card Reader Payment Methods | Monthly Account Fee | In-person/ Contactless Fee | Our Score (Out of 5) | |

|---|---|---|---|---|---|

| Digital wallets Payment links QR codes | Swipe, tap, and dip | $0–$60 | 2.6% + 10 cents | 4.59 |

| Digital wallets Payment links QR codes Tap-to-pay | Tap and dip | $0–$40 | 2.29% + 9 cents | 4.31 |

| Digital wallets Payment links QR codes Tap-to-pay | Tap and dip | $5–$399 (Ecommerce plan) | 2.4%–2.7% cents | 4.05 |

| Digital wallets Payment links QR codes | Swipe, tap, and dip | $0–$15 | 2.6% + 10 cents | 4.03 |

| Digital wallets Payment links QR codes Tap-to-pay | Swipe, tap, and dip | $0--$199 (POS Plan) | 2.75% or 2.9% + 15 cents (invoice) | 4.00 |

| Digital wallets Payment links QR codes | Swipe, tap, and dip | $0 | 2.69% | 3.92 |

| Digital wallets Payment links QR codes Tap-to-pay | N/A | $0 | 2.9% + 30 cents or interchange plus 0.50% + 30 cents | 3.78 |

| Digital wallets Payment links QR codes Tap-to-pay Scan-to-pay | N/A | $1.99–$9.99 | 2.9% + 30 cents | 3.78 |

Square: Best Overall Credit Card Payment Application

Pros

- Free card reader and POS

- Lots of integrations

- Waives up to $250/mo chargeback fees

Cons

- Locked into Square payments

- Higher transaction fees

- Limited support hours

Mobile Payment App

- Google Play: 4.8 out of 5, around 217,000 reviews

- Apple App Store: 4.8 out of 5, around 405,000 reviews

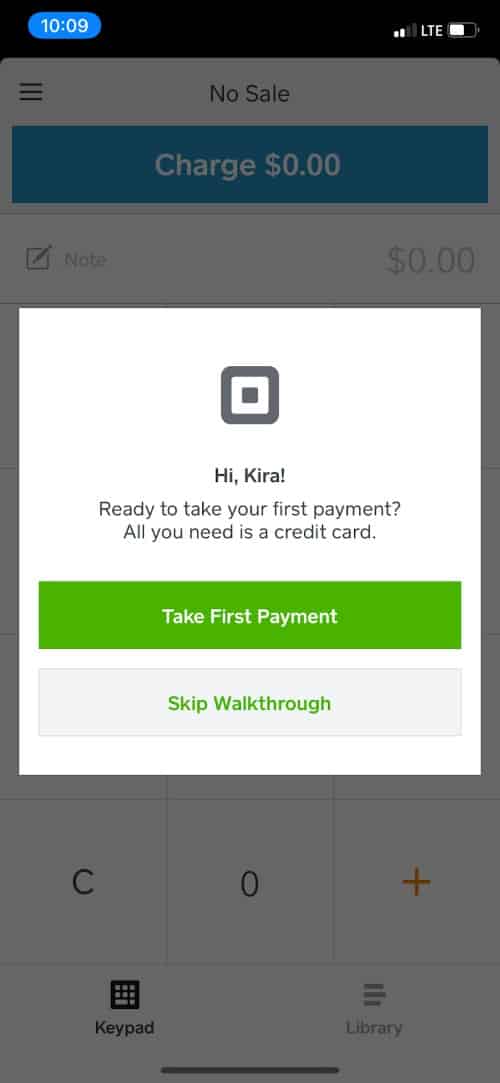

Square offers a free POS and credit card payment app that works seamlessly on iOS and Android mobile devices. It consistently makes our list of top mobile credit card processors. Square’s POS software includes inventory management, ecommerce, and checkout features, not to mention add-ons and integrations that allow the system to grow, making it a great choice for small businesses and startups.

In addition to an all-purpose credit card payment app, Square also has free POS apps for retail, restaurant, and appointment-based businesses. Learn more about point-of-sale (POS) systems.

Payment Processing

- In-person: 2.6% + 10 cents per transaction

- Keyed-in: 3.5% + 15 cents per transaction

- Online: 2.9% + 30 cents per transaction

- Buy-now-pay-later: 6% + 30 cents with AfterPay

- Volume discounts: Custom pricing for businesses processing over $250,000 in credit card sales.

- Mobile card reader:

- Magstripe reader (for swiped payments): $10 (first is free)

- Contactless reader: $49

Square’s fees are somewhat higher than many apps for credit card payments on our list. For example, SumUp’s 2.75% for in-person transactions may seem higher, but Square’s additional 10 cents per transaction can add up, especially if you have low-dollar-value transactions.

POS

- Basic POS: $0 per month

- Square Plus & Premium (Appointments): $29–$69 per month

- Square Plus (Advanced Retail and Restaurant): $89 per month

- Team Plus: $35 per month

- Invoices Plus: $20 per month

- Payroll: $35 per month plus $6 per employee

- Marketing: Starts at $15 per month

- Loyalty Program: Starts at $45 per month

PayPal Zettle and SumUp are similarly free but without the “expansion packs.” Meanwhile, Payanywhere also has a free plan, plus custom pricing plans with monthly fees and lower transaction rates.

Fully Functioning Register App for Ringing Payments

Square has a fully functioning register that works on smartphones, tablets, and POS devices and includes inventory tracking, taxes, and discounts. It also has an integrated online store. Offline mode lets you keep selling even when the internet is down.

Highly Rated Mobile App

Square ranks number one on our lists of best free credit card readers for iPhones and Android, and also leads our list of best mobile credit card readers. In the Apple App Store, it has a 4.8 rating out of 5 based on more than 405,000 reviews. For Android, it has 4.8 stars and more than 217,000 reviews.

Versatile, Flexible System

While Square’s free POS and reasonable transaction rates make it great for those selling at the occasional farmers market or conference, it can also grow with the ambitious entrepreneur. You can add other features, from loyalty to payroll, through Square, or add third-party applications like QuickBooks, BigCommerce, and more.

Chargeback Protection

Square is unique among the credit card processors on our list because it waives up to $250 a month in chargeback fees. This should be sufficient for a small business or solopreneur. Most credit card app providers charge per unsuccessful transaction, although SumUp charges per dispute to pay the bank fees.

Looking for something different? Some merchant service providers and payment processors like Square come with complete mobile payment solutions. Find out how we ranked the best mobile credit card processors or choose from among our recommended options for iPhones and Android users.

PayPal: Best for Occasional Sellers, PayPal Users & Those Selling to Tourists

Pros

- Low transaction rates

- International payment processing

- Trusted by consumers

Cons

- No offline mode

- Reputation for account freezes

- No free card reader

Mobile Payment App

- Google Play: 4.2 out of 5, about 90,000 reviews

- Apple App Store: 4.2 out of 5, around 26,000 reviews

PayPal is recognized as one of the most popular credit card payment apps in the industry. Not only does its payment app help merchants manage all credit cards in one place, but it can also directly accept payments via QR codes and tap to pay. PayPal is also popular for its easy-to-use payment links, invoicing, crypto payments management tools, and exclusive PayPal user checkout options.

Seasonal sellers that cater to tourists can also use PayPal’s international payment features. For casual in-person sales, PayPal Zettle also works well for small businesses. The POS is simpler than Square, easy to use, and free. Its discounted 3-in-1 card readers and cheaper in-person rates the processing rates are also cheaper. Learn how PayPal stacks up against Square.

- Monthly fee: $0–$40

- Card-present fee: 2.29% + 9 cents (via PayPal Zettle)

- Keyed-in fee: 3.49% + 9 cents

- QR code payments: 2.29% + 9 cents

- Chargeback fee: $20

- Mobile Card reader: $79, first discounted $29

PayPal’s in-person transaction fees are the cheapest on our list of apps for credit card processing. However, its rates vary for online sales, virtual terminal sales, donations, and country. Learn more about PayPal pros and cons.

Zettle’s entire POS system is free with the use of PayPal’s payment processing. There are no premium plans like Square.

Beginning Sept. 30, 2023, PayPal has discontinued its support for PayPal Here—PayPal’s original in-person payment processing service.

PayPal Zettle

Zettle replaced PayPal Here for merchants accepting payments in person. The mobile app is free but requires pairing with the Zettle card reader to start accepting credit card payments. You can also manually enter your customer’s payment details on the app, but the fees are higher.

Accept Cryptocurrency Payments

In the tradition of leading the innovation of the payment processing industry, PayPal is among the first of the major payment processors to support cryptocurrency. Each PayPal account (personal and business) comes with its very own digital crypto wallet. This is integrated with PayPal’s Zettle payment app, so your customers can opt to pay with cryptocurrency. Learn more about accepting cryptocurrency payments.

Social Selling

Like others on our list, PayPal lets you include links for social selling, and you can create payment buttons and payment links directly from the mobile app. PayPal, however, has the best reputation and name recognition among consumers. Adding a PayPal option to your sales increases your chance of making a sale. It also offers direct integration to popular peer-to-peer payment app Venmo. Learn how to create a Venmo account for your business.

Shopify POS: Best Ecommerce Payment App for Multichannel Sales

Pros

- Extensive inventory tools

- Ecommerce-focused

- Can rent POS hardware

Cons

- Works better on iOS than Android

- Charges extra for third-party processors

- Requires a paid Shopify account

Mobile Payment App

- Google Play: 3.0 out of 5, around 2,100 reviews

- Apple App Store: 4.5 out of 5, about 7,300 reviews

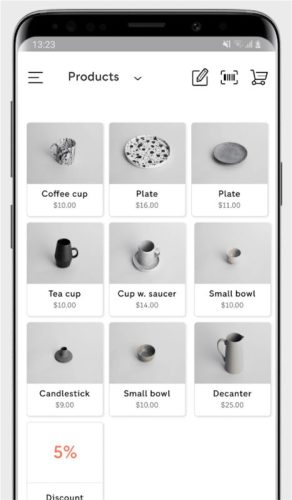

If you already sell online or have plans to, consider using Shopify. We love its checkout features and multichannel sales tools. It is one of the leading ecommerce solutions today and made our list of the best POS systems for multichannel retailers.

The app comes free with every ecommerce account and can be used on iPhone and Android devices. However, you can rent full POS systems for special occasions, something none of the others on our list do.

Shopify updated its ecommerce plans last January. Pricing now ranges from $5–$399 per month, from $29–$299. It also recently launched its new Shopify POS Go mobile card reader with an all-in-one touch-screen POS and card reader that rivals Square Terminal. Price starts at $399, with installment plans available. Read more about Shopify’s latest fees in our guide.

To use Shopify’s credit card processing, you need to purchase a software plan. The $5 a month Starter plan enables you to sell only on social sites and messaging. Shopify’s mobile card reader can be purchased at $49.

Your transaction fees depend on the plan you purchase—the more expensive plans have lower rates. You can use your own payment processor, but Shopify adds a fee to do this, which could negate the advantage. Only Shopify offers discounts on shipping. This chart explains the pricing:

Shopify Plan | Monthly Subscription Fee | Online Transactions (Domestic) | In-person Transactions | Waived Shopify Transaction Fee** |

|---|---|---|---|---|

Starter* | $5 | 2.9% + 30 cents | N/A | N/A |

Basic | $39 | 2.9% + 30 cents | 2.7% | 2.0% |

Shopify | $105 | 2.6% + 30 cents | 2.5% | 1.0% |

Advanced | $399 | 2.4% + 30 cents | 2.4% | 0.5% |

Multichannel Sales, Including Social Media & Online Marketplaces

Shopify makes it easy to integrate with channels like eBay, Facebook, and other social or online venues. The credit card app itself allows you to create payment buttons and links to send via email or add to a social media post. Several of the apps on our list, like PayPal, can do the same, but Square allows full integration like Shopify.

Shipping Discounts

The Shopify payment app also gives you access to logistics management (shipping and delivery). If you process mail orders, sell on eBay, or ship a lot of your products, then Shopify is worth considering for the shipping discounts alone. No other credit card processor on our list offers this, and depending on your volume, you may pay for the software in your savings.

Fraud Protection

Shopify’s machine learning tools analyze transactions for suspicious charges and bring them to your attention. It’s one of the best fraud prevention tools for POS. It does charge for chargebacks, however. If that’s a concern, look at Square, which waives up to $250 in monthly chargeback fees.

Rent POS Hardware

Credit card payment apps are best for businesses looking for a hardware-free solution. However, Shopify allows you to rent a system by the day. This is a great tool for those times when you may need to up your game, such as for a big convention with high-traffic sales.

Chase Payment Solutions: Best for Free & Fast Deposits

Pros

- Free merchant account

- Same-day funding with a Chase bank account

- Advanced report analytics

Cons

- Negative app reviews

- Chase bank account requires minimum maintaining balance or $15/month

- Reports of account closures without notice

Mobile Payment App

- Google Play: 3.5 out of 5, about 4,200 reviews

- Apple App Store: 2.5 out of 5, about 260 reviews

Chase is one of the biggest banks in the world, but one of the rare few that directly works with small businesses. Merchants with or without a Chase bank account can sign up with Chase Payment Solutions, but you will need one if you want access to free same-day funding.

Chase Mobile Checkout (for non-Chase bank account holders) and Chase Quick Accept (for merchants with a Chase bank account) both support a range of swipe, chip, and contactless credit card payment methods. There’s also a separate Chase mobile POS app with built-in payment processing tools.

- Monthly account fee:

- Merchant services: $0

- Chase business bank account: $0–$15 ($2,000 monthly maintaining balance)

- Transaction fees:

- In-person transaction fee: 2.6% plus 10 cents

- Online transaction fee: 2.9% plus 25 cents

- Keyed-in transaction fee: 3.5% + 10 cents

- Chargeback fee: $25–$100 per transaction depending on dispute volume

- Same-day funding: Free (for Chase business bank account holders), otherwise free next-day funding

- Mobile card reader: $49.95

Note that there is no monthly fee for owning a Chase business bank account provided that it maintains a minimum $2,000 balance. Custom rates are also available for larger transactions.

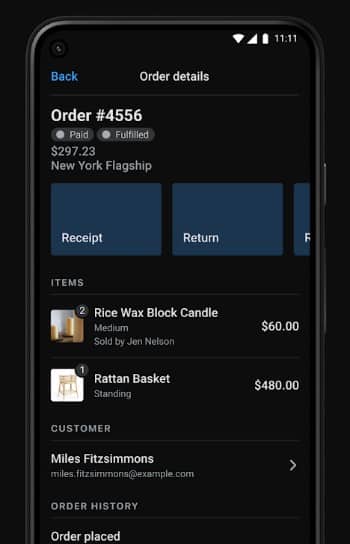

Mobile Checkout

Chase Mobile Checkout is available for merchants without a Chase bank account. It comes with an image-based product catalog and a range of credit card payment methods supported by Chase 3-in-1 mobile credit card reader (sold separately for $49.95). Free next-day funding is available for deposited funds.

Chase QuickAccept

Chase QuickAccept is similar to Chase Mobile Checkout except that it offers same-day funding and is only available for merchants with a Chase bank account. It also works with the same 3-in-1 card reader that you can get for free with QuickAccept.

Mobile POS

Chase has its own mobile POS solution for merchants who need a more robust inventory management capability. You can create catalogs with categories, assign different units of measurement (including time units for service-based businesses), and add custom taxes and discounts.

While Chase does not have industry-specific POS tools that Payanywhere has, it does provide more reliable payment processing features that can scale with your business.

Free Same-day Funding

Free same-day funding is available for merchants with a Chase bank account. Merchants without a Chase bank account have access to next-day deposits at no extra cost.

Customer Insights

Every Chase merchant account comes with a business intelligence platform that provides analytics for key metrics such as daily sales and trends. On top of that, it also provides robust customer data profiles and peer benchmarking based on Chase’s rich merchant-acquiring and card-issuing data.

SumUp: Best Credit Card App for Solopreneurs & Low-volume/Low-ticket Merchants

Pros

- Most affordable 3-in-1 mobile card reader

- Zero monthly fees

- Offline payment processing

Cons

- Apps have low user scores

- Separate paid subscription for POS

- Limited support

Mobile Payment App

- Google Play: 3.2 out of 5, almost 82,000 reviews

- Apple App Store: 3.6 out of 5, about 300 reviews

SumUp is a reliable, straightforward credit card processor that takes swipe, chip, and contactless payments. You will need the mobile payment app that comes with it to process transactions. The app itself comes with an inventory management function that’s easy to set up, or you can simply process charges manually with notes. Zero monthly fees, an affordable 3-in-1 card reader, and zero per-transaction markup make it competitive for low-volume and low-ticket sales.

In addition to card processing with a basic POS system, you can send links, create QR codes, set up an online store for free (Shopify charges for this), and even create digital gift cards.

- Monthly costs: $0–$199

- In-person transaction: 2.75%

- Online transaction: 3.25% + 15 cents

- Virtual terminal processing: 3.25% + 15 cents

- Gift card processing: 3.25% + 15 cents

- Invoice processing: 2.9% + 15 cents

- Chargeback fee: $0

- Mobile card reader: $39

SumUp’s 2.75% card-present fee is a little more expensive than those on our list, but the flat percentage, as opposed to percentage-plus-cents, makes it a better deal for low-ticket sales. In this way, it’s like Shopify and Payanywhere, though they have lower rates.

Cheaper for Low-ticket Sales

Like Payanywhere, SumUp offers good rates for low-ticket sales. Compared to Square, your transactions are cheaper with SumUp if the total is less than about $67. And, compared to Zettle’s current rates, SumUp is cheaper for transactions under $20.

Mobile App Features

The accompanying mobile app doesn’t include a lot of bells and whistles that take memory on your device and time to learn. But it’s equipped with tools to manage inventory with categories and variants, program in taxes, and create customized receipts. It also has a virtual terminal and can generate sales reports.

Basic In-app Invoicing

SumUp also offers a free invoicing tool with customizable invoices, embedded payment links, and automatic reconciliation between payments and open invoices. You can create and monitor invoices right from the app, including re-sending overdue invoices.

POS

SumUp offers its own POS system; however, unlike Square, this is a separate add-on service that will cost you $199 per month with a one-time $400 installation fee. Payment processing fees are slightly lower than when using the mobile card readers. It’s 2.6% + 10 cents for in-person and 3.5% + 15 cents for online and keyed-in transactions.

Payanywhere: Best Credit Card Payments App for Restaurants, Bars & Food Trucks

Pros

- Low fees on small transactions

- Free restaurant-specific tools

- Quick payouts

Cons

- Complaints about hidden fees

- Charges an inactivity fee

- No longer offers free hardware

Mobile Payment App

- Google Play: 3.5 out of 5, about 4,500 reviews

- Apple App Store: 3.9 out of 5, about 750 reviews

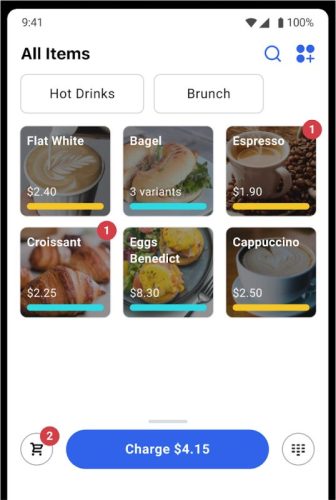

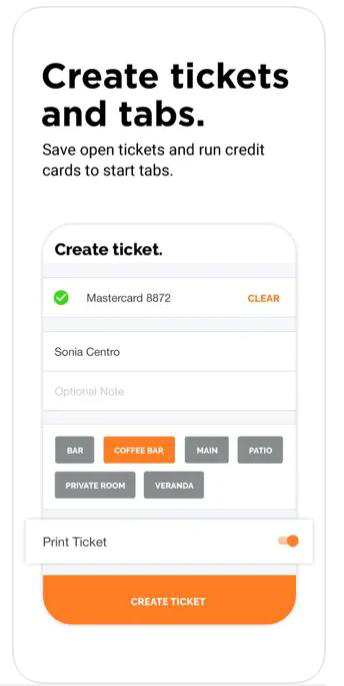

Payanywhere is a mobile-first solution with free built-in payments processing and POS app designed for restaurants, bars, and food trucks that rivals Square in features. It also offers a range of card readers and smart terminals (also built for mobility), with competitive processing fees, especially for small-ticket items. Like Square, Payanywhere works offline and can manage different payment options like open tickets, tipping, split payments, and even signature capture.

Overall, Payanywhere has a robust and easy-to-use credit card payment app with a mobile POS system. It offers a free same-day payout, something other processors on our list don’t do.

On the free plan, transaction fees run 2.69% for card-present sales and 3.49% + 19 cents per transaction for keyed-in sales. These are competitive, especially for low-ticket sales with card-present payment.

- Monthly fee: $0

- Card-present fee: 2.69%

- Keyed-in fee: 3.49% + 19 cents

- Mobile card reader: $59.95 (3-in-1)

- Inactivity fee: $3.99/mo after 12 months of inactivity

Payanywhere also has a free option and custom pricing plans that you need to contact Sales about. The pay-as-you-go option is free but has a higher swipe rate. It also has a $3.99 monthly inactivity fee that starts after 12 months of inactivity. If you process more than $10,000 per month, you may be put on a custom plan with a contract.

Cheaper for Low-ticket Sales

Payanywhere charges 2.69% for card-present transactions, with no extra cents. (Square, for example, adds 10 cents per transaction.) If your transactions are generally around or below $110, Payanywhere is cheaper than Square. Compared to Zettle’s current rates, Payanywhere is cheaper for transactions under $22.50.

Restaurant Features

Payanywhere offers open tabs, split payments, and tip functions that make it a good choice for restaurants—and a good alternative to Square for Restaurants. It also integrates with self-ordering kiosks like GRUBBRR. If your tickets are smaller, like in food trucks, you may save money with Payanywhere. Offline mode means your restaurant doesn’t shut down if the internet does and can take your food stand anywhere.

Employee Management

Unlike most of the apps for credit card payments on our list, Payanywhere includes employee management tools through Homebase at no extra charge. This includes hiring tools, time clocks, scheduling, and tracking employee sales. It’s a great asset for a small business or a restaurant that deals with high staff turnover.

Next-day Payout

Payanywhere has next-day funding with a 10 p.m. cutoff time. However, if you have later hours, you can get a “same-day” funding option with a 10:30 a.m. cutoff time, so your transactions from overnight will be deposited later that day. (Saturday and Sunday deposits will appear on Mondays.) This is the fastest turnaround of the systems on our list and, even better, comes with no added fees. Compare this to Square, which charges an additional 1.5% of the transaction for same-day funding.

Nomod: Best for Flexible Rates & No Additional Hardware

Pros

- Scans credit cards with the phone camera

- Flexible transaction rates and zero monthly fees

- Integrates with Stripe Connect

Cons

- Earliest payout is 2–3 business days, first payout takes 5 business days

- Basic product catalog management

- Very little user reviews

Mobile Payment App

- Google Play: 3.4 out of 5, about 150 reviews

- Apple App Store: 4.0 out of 5, about 25 reviews

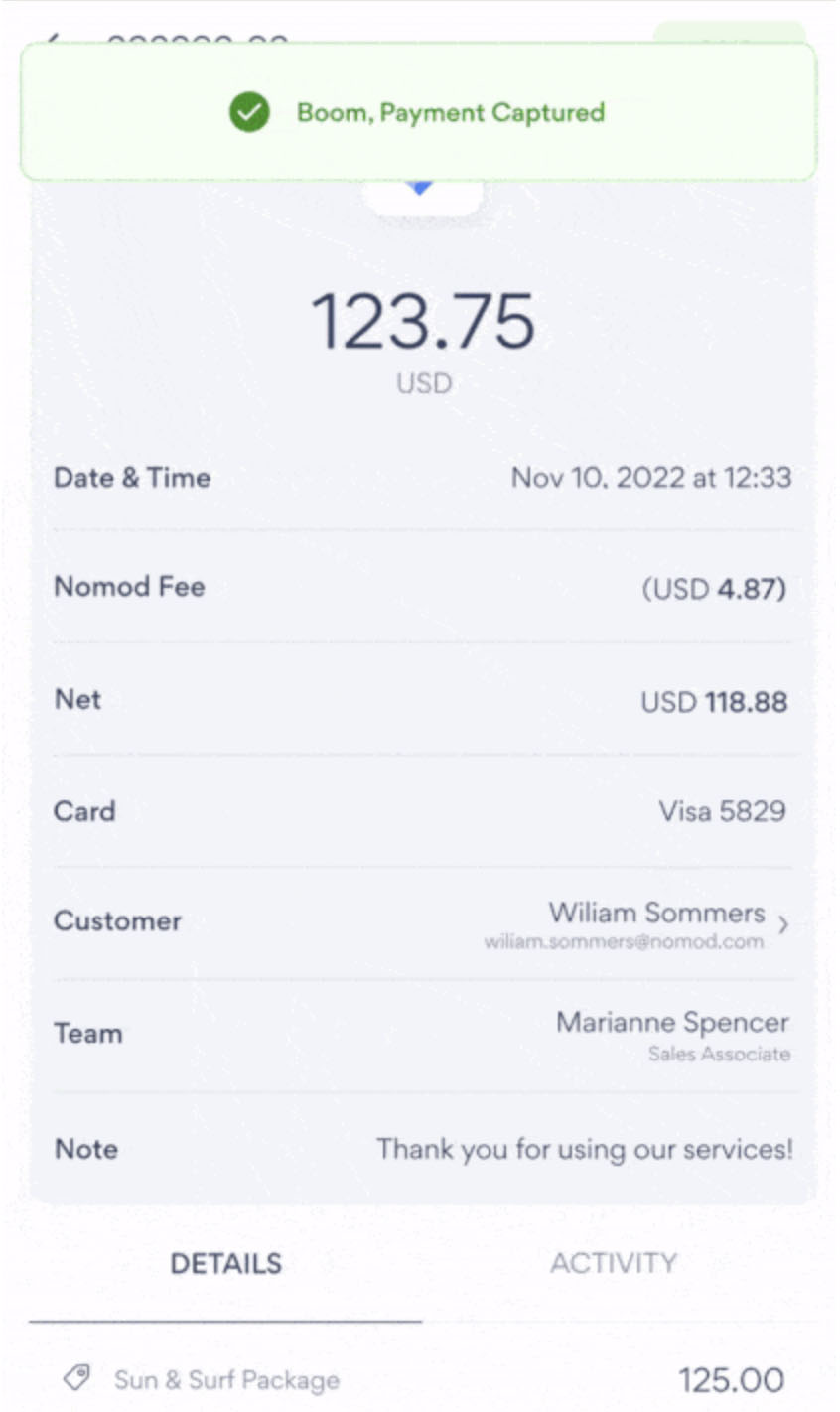

While relatively new, Nomod is a promising free credit card app with no monthly fees and subscription plans that adjust the pricing structure to help maximize savings. It offers a flat rate for core subscriptions, interchange-plus pricing for growing businesses, and custom rates for merchants processing over $100,000 in monthly sales.

But what’s most unique about Nomod is that it does not need a credit card reader to accept credit card payments. The app itself has the ability to process EMV chip payments and use your smartphone’s camera to scan your customer’s credit card information. There are very limited reviews, however, which affected Nomod’s app features and popularity scores in our evaluation.

It’s not often you find merchant services providers with apps to accept credit card payments that also offer flexible pricing structures like Nomod. This feature gives small merchants working with a budget more flexibility and options to maximize their savings.

- Monthly fee: $0

- Processing rates: For both card-present and card-not-present transactions

- Flat rate: 2.9% + 30 cents (Core plan)

- Interchange plus: 0.50% + 30 cents (Plus plan)

- Custom rates: For businesses processing more than $100,000 in monthly sales

- Mobile card reader: Not required

- Chargeback fee: $20 for use (varies by country)

Credit Card Scanner

WIth Nomod’s credit card payment app, merchants can use the camera on their smartphones or tablets to scan the customer’s physical credit card. Customers can then approve the transaction by manually entering their CVC on the mobile payment app for a secure in-person payment method.

Multicurrency

Nomod comes with a dynamic currency feature that allows merchants to accept payments in the customer’s local currency and receive funds in the merchant’s base currency. It supports 135 different currencies, so you can accept payment almost anywhere in the world with your smartphone.

Team Management

For growing businesses, Nomad lets you invite team members, assign a role, and manage permissions on the mobile app. Each team member will then get an invite to download the payment app and start accepting payments from their own mobile device.

Invoicing

Nomod also comes with an invoicing functionality that allows merchants to create, send, and manage invoices from the mobile app. Customers can make payments using digital payment methods such as Apple Pay and Google Pay from their own smartphone or on a computer.

SimplyPayMe: Best for Service Professionals Without Credit Card Readers

Pros

- Does not require a card reader

- Built-in POS and job scheduling software

- Offline payments processing

Cons

- Slow payouts (3–7 business days)

- Somewhat unclear transaction fees (for US merchants)

- Some features not available to US merchants

Mobile Payment App

- Google Play: 3.7 out of 5, about 120 reviews

- Apple App Store: 4.4 out of 5, about 150 reviews

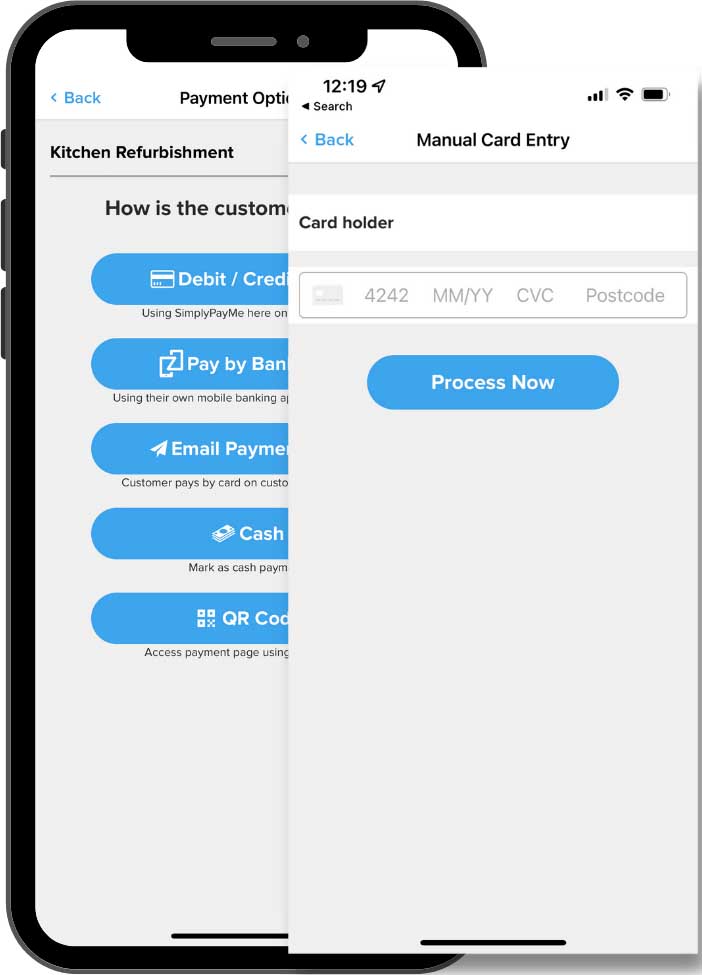

Like Nomod, SimplyPayMe is another payment service provider offering hardware-free payments processing to merchants through the latest advancement in mobile payments technology. It is the second of only two providers in our list that’s equipped with card scanning tools.

SimplyPayMe also comes with a POS, a very strong suite of invoicing features, plus a job scheduling software ideal for mobile service-based businesses such as landscaping, home-cleaning, HVAC, and more.

SimplyPayMe does not require a mobile card reader to accept payments—everything is contactless through its card scanner. However, it’s a bit of a struggle to identify its exact rates and subscription plan for US businesses (SimplyPayMe is a UK-based company) so it’s best to give SimplyPayMe a call to clarify.

- Monthly Fees (US): Terms and Conditions indicate that US-based merchants are automatically subscribed to its Invoicing Plus Plan (the pricing page shows entirely different plans).

- Basic: $1.99

- Starter: $4.99

- Growth: $9.99

- Payment processing:

- In-person: 2.9% + 30 cents

- Online (for payment links): Not specified

- Mobile card reader: Not required

- Chargeback fee: Not disclosed

Note that while it does away with the need to invest on additional hardware, SimplyPayMe’s in-person rates are similar to online rates for most of the providers in our list like Square, PayPal, and Chase, so there are no significant transaction fee savings involved.

Hardware-free Payments

SimplyPayMe uses card scanner technology built into its mobile payment app so merchants can accept payments without a physical mobile card reader. Customers can confirm the transaction by entering their three-digit CVC for in-person payments. Remote customers can pay through payment links and digital invoices.

Built-in POS Software

Like Square, the SimplyPayMe mobile app includes a point-of-sale software that allows merchants to manage their products or services, invoices, customer list, and sales on their smartphones. It also comes with job scheduling software for managing and tracking job statuses and employee performance.

Invoicing

Every SimplyPayMe plan comes with an invoicing feature that allows businesses to manage transactions from start to finish right on their smartphones. The software allows you to create, copy existing, send, and remotely get approved quotes with an “accept quote” button. It can also generate status reports, send detailed invoices with payment links, and send digital receipts.

Team Management

Most popular credit card apps for small businesses carry a full-featured invoicing software, but team management is often an add-on. SimplyPayMe makes both available on its mobile app without extra fees, which makes it, in part, stand out among its competitors.

How to Choose the Best Credit Card Payment App

To choose the best app for credit card payments, consider the following:

- Versatility: Payment app that’s compatible with iOS and Android devices

- Payment convenience: Able to accept payments straight from the mobile device

- With a card reader via swipe or tap and dip (through EMV chip)

- Without a card reader via digital wallets such as Apple Pay, QR codes, tap-to-pay, manual entry, and credit card scanning

- Scalability: Can grow with your business with add-ons and POS hardware

- Flexible pricing: Monthly fees for merchant accounts are affordable (or free) and transaction rates (including the pricing method) can match budgets of small business and startups. Learn more about merchant accounts.

- Reliability: Works offline, with minimal downtime, and great user reviews.

Not sure where to start? If you are a first-time business owner or just simply looking for a better merchant/ payments services provider alternative, check out our list of best merchant services and cheapest credit card processing companies for small business.

How I Evaluated Credit Card Payment Apps

Testing each credit card payment app is at the core of providing the best recommendations for small businesses. I took that expertise and combined it with reviews from real-world businesses to find the easiest to use, then looked at other important factors for small businesses: price, versatility, and primary functions.

Square is my best app for taking credit card payments because of its ease of use and free POS. It’s also on our lists of best mobile POS apps and top-recommended payment processors in general. It’s a highly flexible program that works for the hobbyist or the full-time retailer with a store and ecommerce website.

Click through the tabs below for our full evaluation criteria:

25% of Overall Score

The best credit card payment applications have low transaction fees with no monthly subscriptions, either for use or for a POS system. They can be used both with or without a card reader. Nomod had the highest score here, followed by Square and PayPal.

25% of Overall Score

This criterion considered a payment app’s overall simplicity and range of payment features. We also evaluated real-life iOS and Android user reviews of each payment app. Square earned a perfect score.

25% of Overall Score

We considered each payment processor’s overall merchant services features—how fast you get paid, the chargeback policy and fees, ease of merchant account application and setup, and available business management tools. Payanywhere earned the highest marks followed by Square.

25% of Overall Score

Frequently Asked Questions (FAQs)

These are some questions I often encounter about credit card payment apps for small businesses.

We find Square to be the best credit card payment app for small businesses. Not only is it affordable and easy to set up and use, but Square also offers the most reliable payment app and credit card readers in the market.

Mobile credit card processing is done by downloading a credit card processing app on your mobile device. This often comes with a mobile credit card reader that links with your smartphone and allows you to process credit cards with the usual swipe, tap, or dip method.

Credit card payment apps are free to download and use. The only fees you will pay are cost of transactions and monthly fee for your merchant account (if any).

What makes one payment app stand out from the rest are the additional products that come with it. From there you can choose the provider that supports the payment methods you need for your business. You will also want competitive processing fees, fast payout times, and account stability from your payment processor that provides the payment app.

Credit card processing apps are popular for their convenience in offering cashless transactions. It allows merchants to accept credit card payments on the go, whether around the store, out for deliveries, or client visits. Credit card payment apps are also often automatically synced to POS systems so it updates sales, inventory, and cost data in real time.

Bottom Line

Whether you have a brick-and-mortar business with an online store or an artist who sells their creations at the local flea market, credit card processing apps for small business can make taking payments easy while helping you keep track of your sales. Some, like SumUp, offer simple POS systems for the smartphone, while others are more complex, like Square, which has extra programs for employee management, reservations, and even payroll.

Square is our choice for the best credit card payment app because while it can handle a multitude of business functions beyond credit card processing, it is also simple enough for the hobbyist or solopreneur. The system is free, and you’re only charged for processing transactions, so sign up for Square today.