A payment gateway and a payment processor are two elements needed to safely and securely process payments. The payment gateway collects, verifies, encrypts, and transmits the information to the payment processor, while the processor facilitates the actual transaction by working with the card network and relevant banks.

Learning the difference between a payment gateway and a payment processor can help merchants decide on the right payment processing set-up for their business.

What a Payment Gateway Does | What a Payment Processor Does |

|---|---|

Works in the front-end | Works in the back-end |

Collects the payment information | Facilitates the transfer of information between the gateway, payment network, customer’s bank, and merchant’s bank |

Verifies the payment information | May offer other services, such as fraud protection, chargeback management, data reporting, and analysis |

Encrypts the payment information | Facilitates the transfer of funds from the customer’s bank to the merchant’s bank |

Transmits the payment information to the payment processor |

Most payment service providers offer both payment gateway and processor services, so for most merchants, they only have one provider for both functions. Looking at these functions separately can help give a deeper understanding of how they work together.

What Is a Payment Gateway?

When a customer needs to make a payment, the payment gateway is the service or technology that collects the necessary information from the virtual terminal or from the checkout page. For in-person transactions, this function is handled by the card reader or POS system.

During the payment process, the payment gateway has the following functions:

- Collect the payment information

- Verifies the payment information

- Encrypts the payment information

- Transmits the payment information to the payment processor

It is the payment gateway’s job to make sure that the sensitive information is handled securely and it needs to adhere to the Payment Card Industry Data Security Standard (PCI DSS).

Learn more about PCI compliance for small businesses.

Types of Payment Gateways

The different types of payment gateways are defined by how information is collected, encrypted, and processed.

What Is a Payment Processor?

A payment processor is a service provider that handles the processing of card payments by facilitating communication between the customer’s bank, the merchant’s bank, and the card network.

During the payment process, the payment processor handles the actual transaction after receiving the payment information from the gateway. It handles the following functions:

- Receives the payment information from the payment gateway

- Validates the transaction by checking for available funds or credit through this process:

- Processor transmits information to the relevant card network

- Card network sends a request to the customer’s bank

- Customer’s bank approves or declines the transaction

- Card network informs the processor of approval or rejection

- Forwards the result of the transaction to the merchant

- If approved, the processor transmits the information to the merchant’s bank

In most cases, payment service providers function both as a gateway and a processor.

How Payment Gateways and Payment Processors Work Together

To further illustrate the role of payment gateways and payment processors in payment processing, let’s look at it from a non-digital perspective.

Imagine a financial system where banks accept written instructions from their account holders for any transactions. The written instructions need to include some secret codes or passwords for the bank to make sure that the instructions came from the account holder. Suppose a customer wants to buy an item from a retail store; here is how the transaction will go:

If we translate the process in the illustration above to how current digital payment processing works, the payment messenger is the payment gateway and the processing office is the payment processor.

It is easy to get the two confused, especially since most payment service providers function as both the payment gateway and the payment processor—they collect the payment information from the customer and go straight to the card networks for approval.

Learn more in our guide on how payment processing works.

How to Choose Which One to Use

Technically, you need both gateway and processor functions to accept card payments—and in most instances, only one provider takes on both functions. The difference is in how the gateway performs its function.

In-Person Payments

When processing card payments in person, the point-of-sale (POS) system or card reader you use for accepting card payments functions as your payment gateway. You will need to sign up with a processor that provides in-person payment capabilities. Check that the card readers and POS devices offered are easy to use and adhere to PCI DSS standards. See our list of the best credit card readers.

Online Store

If you want to accept card payments online through a website or online store, you will need to build your website from scratch or sign up with an ecommerce platform. In this scenario, the page where the card details are entered has the gateway functionality.

Some ecommerce platforms, like Shopify and Square Online, have their own gateways or processors—Shopify Payments and Square Payments, respectively. If you plan to use the built-in processor of your ecommerce platform, then you don’t need to sign up with a separate gateway or processor.

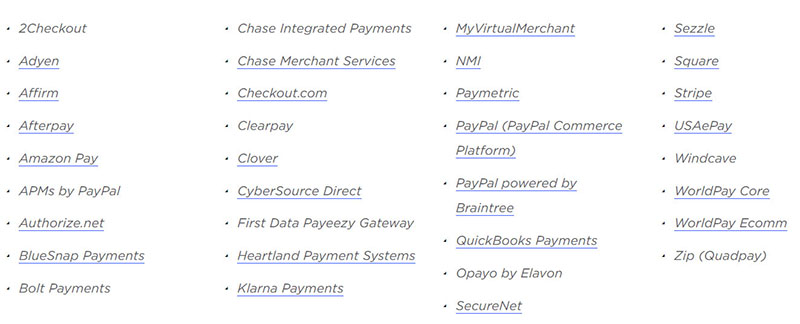

However, these two popular ecommerce platforms can also integrate with a limited number of third-party payment processors. If you already have a merchant account, check if you can use your merchant account provider as the payment processor for your website.

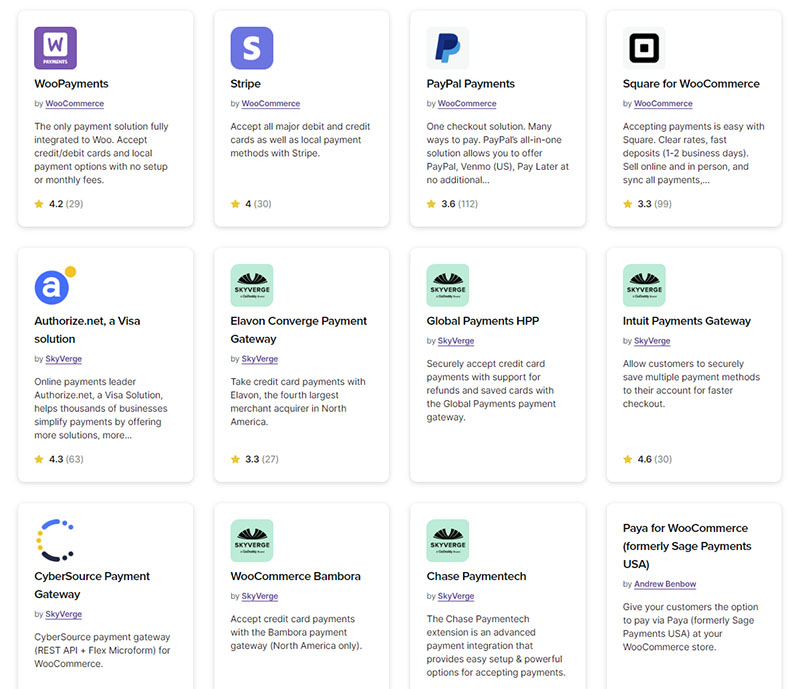

There are also ecommerce platforms that do not have their own payment providers, like BigCommerce and WooCommerce, but allow you to integrate with a wider variety of gateways and processors.

If you’re looking for an ecommerce platform to build your online store, check out our list of the best ecommerce platforms for small businesses.

If you plan to build your own website from scratch, you will need to include both a payment gateway and a payment processor in your website development. Since you are in full control of the design of your website, you may choose to get a separate payment gateway and payment processor.

Most businesses prefer to use a merchant account provider instead of just a separate gateway or processor. Most merchant services providers offer a range of services, including gateway and payment processing services, that allow your business to accept payments in different ways.

Frequently Asked Questions (FAQs)

Click through the sections below to learn more about the most common questions we get about payment gateway vs payment processor.

A payment gateway is responsible for collecting and encrypting payment information, while a payment processor facilitates the actual transaction by transmitting this information to the relevant financial institutions and card networks.

Payment gateways focus on securing data, while payment processors validate transactions and ensure the transfer of funds. These work in tandem to enable online payments, each serving a distinct role in the payment process.

Stripe serves as both a payment gateway and a payment processor. It offers a comprehensive payment solution that enables businesses to collect, secure, and transmit payment information (gateway function) and also handles the transaction’s processing, including communication with banks and card networks (processor function). Stripe’s dual role makes it a popular choice for businesses seeking an all-in-one payment service.

Amazon Pay primarily operates as a payment gateway. It allows customers to make payments on merchant websites using their Amazon account information, securely collecting and transmitting the payment data to complete the transaction. However, the actual processing of payments and the interaction with financial institutions are typically handled by the payment processor integrated with the merchant’s platform, rather than by Amazon Pay itself.

Square, like Stripe, functions as both a payment gateway and a payment processor. It is an all-in-one solution that allows merchants to accept card payments on various channels without the need for any other payment service provider, making it a convenient option for businesses looking for an integrated payment service that simplifies payment processing.

Bottom Line

Payment gateways secure customer data and collect payment information, while payment processors facilitate the actual transfer of funds and transaction validation. Businesses must choose their payment setup based on factors like control, customization, and platform compatibility. Versatile providers like Stripe and Square fulfill dual roles, simplifying the payment process. Understanding how payment gateways and processors work together will help businesses streamline payments, ensuring a seamless, secure, and successful online transaction experience.