Shopify Payments is a built-in payment processing service that Shopify users can opt to use to access features such as invoicing, card-on-file payment processing, omnichannel sales, chargeback management, and payment tracking.

Best for retail and ecommerce businesses using Shopify, Shopify Payments earned an overall score of 4.17 out of 5 in our evaluation of the best merchant services providers. However, since it’s exclusive to Shopify merchants, we did not include it in our top recommendations.

Shopify Payments Review Overview

Pros

- Easy signup

- Fully integrated with Shopify platform

- Shop Pay one-click checkout

- Waived Shopify commission per transaction

Cons

- Chargeback protection for a fee

- Not available for other ecommerce platforms (Shopify account required)

- Complaints of account holds and reserves

Deciding Factors

Support Business Types | Flexible Low-risk retail, nonprofit, ecommerce, professional services, and B2Bs |

Standout Features |

|

Monthly Software Fees | Competitive; robust and scalable plans

|

Setup and Installation Fees | $0 |

Contract Length | Month-to-month |

Point-of-Sale Options | Exclusive to Shopify |

Payment Processing Fees | Very competitive for small businesses

|

Customer Support | Excellent 24/7 live chat, email, and phone |

Is Shopify Payments Right for You?

As a front-end payment service, Shopify Payments is among the most affordable merchant services providers for small businesses, with no long-term contracts and simple, discounted, flat-rate transaction fees. However, because Shopify Payments is only available to Shopify sellers, it did not make the cut in our evaluation of the best merchant services for small businesses.

Shopify is the standard for omnichannel and ecommerce point-of-sale (POS) solutions. It is no surprise that Shopify Payments is the best payment processor for small ecommerce retail businesses selling on Shopify.

When to Use Shopify Payments:

- For retail businesses using Shopify: Every Shopify account comes with a free Shopify Payments service that allows you to accept all popular credit card and digital wallet payments.

- For existing ecommerce businesses looking to accept in-person payments: Shopify Lite offers multichannel sales tools and mobile POS hardware for online businesses that don’t need a website. It also comes with a Shopify Admin feature to manage your products, customers, and payments.

- For ecommerce businesses wanting to use Stripe’s online payment features: Stripe is one of the most secure and popular payment processors for growing ecommerce businesses, though it requires technical expertise (read our Stripe review to learn more). Shopify allows you to process payments through Stripe with Shopify’s easy-to-use platform. Because it’s fully integrated, no extra steps are required to start accepting payments.

Overall, Shopify is our top-recommended ecommerce platform and multichannel POS system. Read our Shopify ecommerce review and Shopify POS review.

When to Use an Alternative:

- If operating a high-risk business: Shopify Payments is not available for businesses that are considered high-risk or prohibited by the Payment Network and Stripe’s Financial Services Provider—adult content, lottery and gambling, drug paraphernalia, multi-level marketing products, CBD products, and financial services like credit repair and debt reduction. Check out our recommended high-risk merchant account providers instead.

- New businesses looking for a free merchant account: While Shopify Payments is built into every Shopify merchant account at no extra charge, you will need to have a Shopify account that would cost you at least $39 a month. If you prefer not to pay a monthly fee, consider our top free merchant account providers.

- Businesses not compatible with Shopify: Shopify Payments is only available to Shopify merchants. If you need strong offline payment processing features, or you are a nonretail or a hybrid retailer dealing with food and beverage, consider another payment processor that works without Shopify. Check out our leading mobile POS providers and payment gateways.

Shopify Payments Alternatives

Best For | Monthly Fee From | |

|---|---|---|

| Businesses that need a complete online payment solution | $25 |

| Individuals who require a reliable solution for occasional payments | $0 |

| Businesses that need integrations and versatility | $0 |

| MATCH (Member Alert to Control High-risk Merchants) listed businesses | $10 |

Shopify Payments User Reviews

There are no available user reviews exclusively for Shopify Payments, but you’ll find several comments about its payment processing service included in Shopify reviews for both the ecommerce platform and POS front. You can find this in our reviews of the Shopify ecommerce platform and Shopify POS.

Most notable user feedback about Shopify Payments is as follows:

| Users Like | Users Don’t Like |

|---|---|

| Accepts PayPal payments | Payment issues/fund holds |

| International payment methods | Multicurrency is limited to certain countries |

| Comprehensive knowledge base | Additional fee for not using Shopify Payments |

Shopify Payments offers simple flat-rate transaction fees, comes with no additional monthly or setup fees, and is built into Shopify merchant accounts. While there’s no monthly fee for using Shopify Payments, you still need to choose and pay for a monthly Shopify subscription (ecommerce platform for online sales and POS for in-person selling).

You can opt to use a different payment service with Shopify software, but the best thing about using Shopify Payments is that you no longer have to pay Shopify its commission fee for every transaction.

The system lost points for chargeback fees, lack of volume discounts, and lack of free hardware options.

Shopify Plan | Monthly Subscription Fee | Online Transactions (Domestic) | In-person Transactions | Shopify Add-on Fee |

|---|---|---|---|---|

$5 | 2.9% + 30 cents | N/A | N/A | |

Basic | $39 | 2.9% + 30 cents | 2.6% +10 cents | 2.0% |

Shopify | $105 | 2.7% + 30 cents | 2.5% + 10 cents | 1.0% |

Advanced | $399 | 2.5% + 30 cents | 2.4% + 10 cents | 0.6% |

All Shopify plans, except Shopify Starter, offer full ecommerce features. Shopify Starter is for merchants that only need a simple online store, shareable payment links, and in-person payment tools.

Aside from Shopify’s monthly software fees, other Shopify Payments fees may include:

- Chargeback Fee: Shopify charges a $15 fee for each chargeback. If you win the chargeback, Shopify will refund the fee.

- Alternative Payment Gateway Fee: Shopify charges an additional transaction fee on top of the credit card processing fees if you use a different payment provider other than Shopify Payments. The fee depends on the monthly plan you choose.

- Point-of-Sale (POS) Tools: Full ecommerce Shopify plans come with Shopify POS Lite features. If you want to upgrade to POS Pro for advanced features, you’ll be charged $89 per month per location.

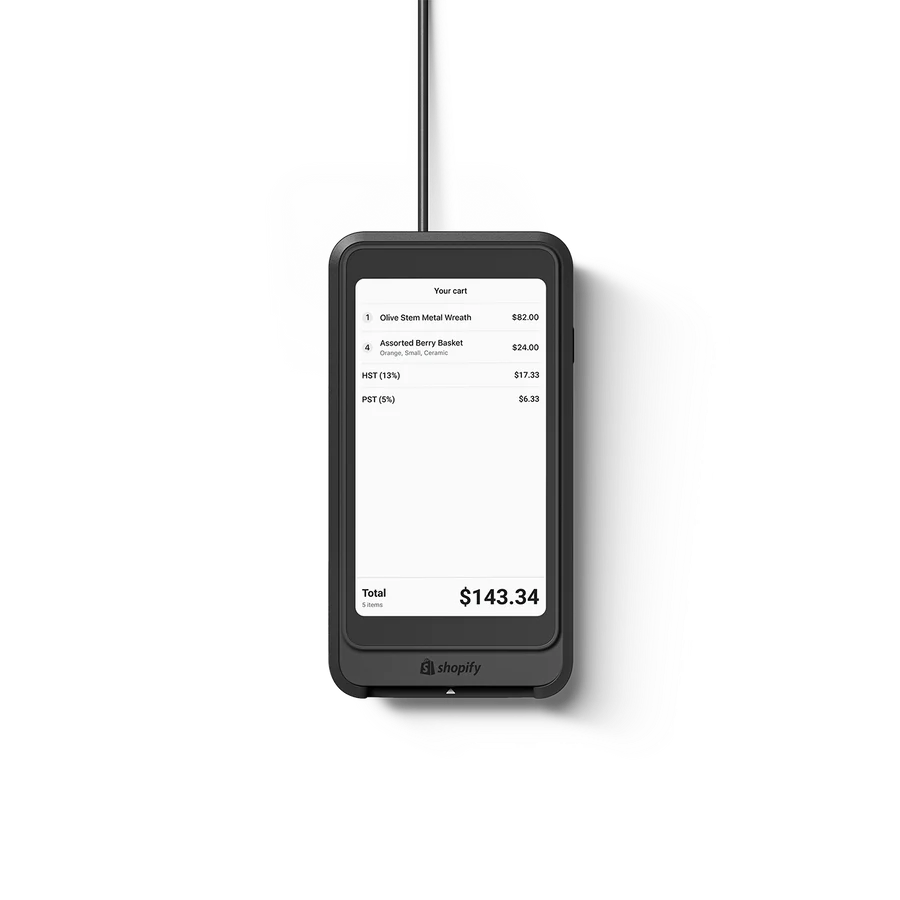

Shopify Payments comes with the ability to process in-person payments through a mobile device. Card readers are sold directly from Shopify and include free shipping, 30-day returns, 24/7 customer support, and a one-year warranty.

Merchants may also process in-person payments with just a compatible iPhone. Shopify’s Tap to Pay on iPhone allows businesses to accept contactless payments without purchasing any extra hardware.

Tap and Chip Readers | Shopify POS Go | Shopify POS Terminal |

|---|---|---|

|  |  |

$49 | $299 | $349 |

Best for: Mobile sales | Best for: Mobile and curbside sales | Best for: In-store checkouts |

Shopify Stands | Barcode Scanners | Receipt Printers |

|  |  |

$149-$185 | $199-$329 | $259-$369 |

Best for: Brick-and-mortar stores | Best for: Retailers with large inventory or sales volume | Best for: Brick-and-mortar stores |

Shopify Payments accepts various in-person and online payment methods, including ACH and B2B payment processing. You can also create payment links, send invoices, and manually create and input payment details. A mobile POS is also available. Somewhat high transaction fees prevented Shopify Payments from earning a perfect score.

You can use Shopify Payments for in-person selling by using Shopify POS hardware (discussed above). In-person card processing fees are pretty standard (2.4% to 2.7%), and if you wish to upgrade to a POS Pro plan, it will cost $89 per location. If you want to use Shopify POS for pop-up sales, a temporary market, or on a seasonal basis, you can rent POS hardware through Shopify’s partnership with Fello.

Invoicing is available for Shopify users who accept over-the-phone purchases and sell products wholesale or by subscription. You can create draft orders for your customers when you receive a notice of intent to purchase your products over the phone, in person, via email, or remotely from anywhere.

These draft orders are then sent to customers in an invoice where customers can click a link to complete their purchase. Shopify Payments lets you customize your invoice by adding itemized product descriptions, discounts, taxes, shipping specifications, and payment terms. It also allows you to create a customer profile while creating the invoice.

Shopify Payments provides you with the versatile ecommerce checkout features users get with a Shopify account. Apart from having the tools to create your very own ecommerce store complete with a website, it also gives you the ability to design checkout options for any type of online platform. This includes email carts, “Buy Now” buttons, quick response (QR) codes, and shareable links.

Additionally, Shopify also offers PayPal Express Checkout as one of its default payment alternatives. For the tech-savvy, a JavaScript Buy SDK (software development kit) helps you create a highly customized, branded online store and checkout on any website, online marketplace, or social media platform.

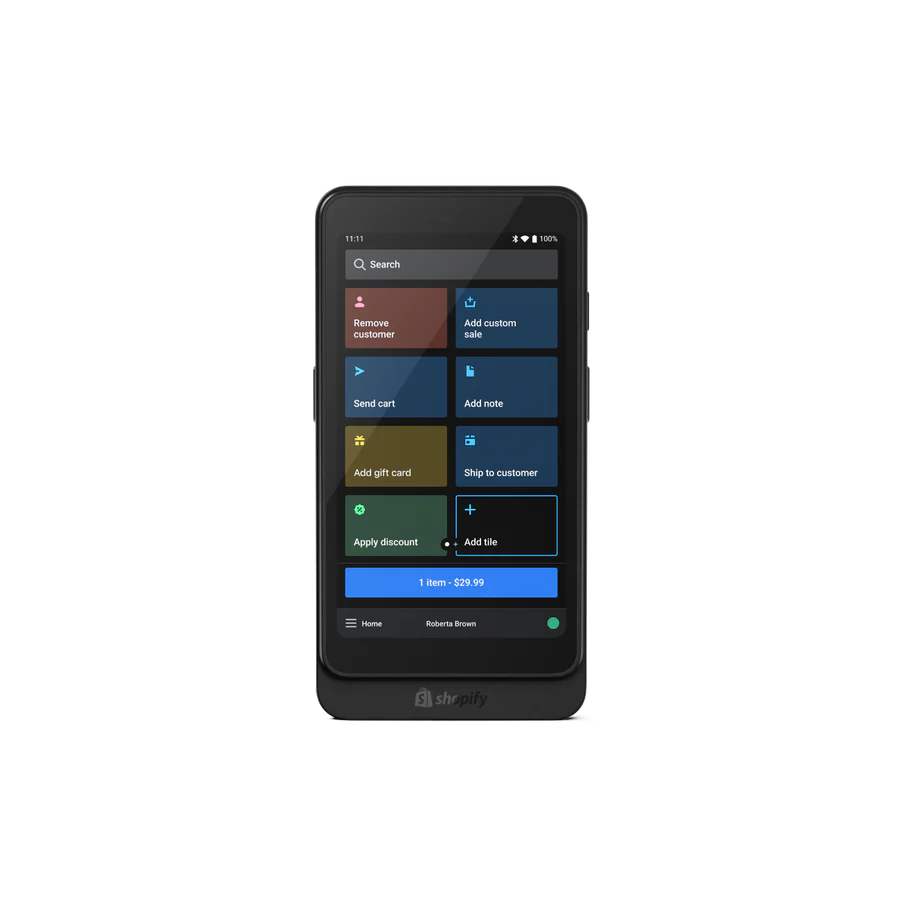

Shopify POS Go is Shopify’s mobile POS solution designed for mobile sales and curbside pickups, with your POS and card reader housed in one sleek mobile device.

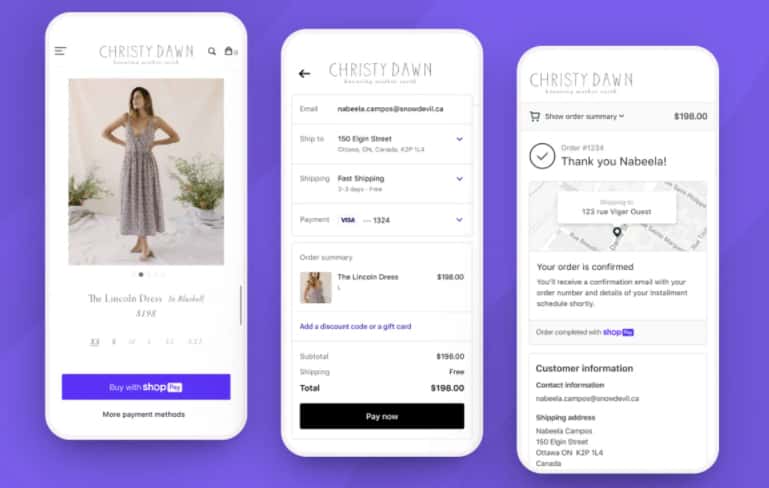

Shop Pay is Shopify’s accelerated checkout feature that allows your customers to sign up and securely store their payment information for future transactions. It also lets you offer customers buy-now, pay-later options on their purchases. Shop Pay is available for every Shopify merchant account and helps you set up an easy-to-use interface for your customers. It also provides end-to-end encryption of all your accepted payments through Shopify’s PCI-compliant servers.

Shop Pay is also available to Shopify merchants selling on social media, and even on Google (Source: Shopify)

What’s New With Shopify in 2024

Shopify constantly makes updates and improvements to its services. As of this writing, here are some notable ones:

- One-page checkout: Shopify Checkout got a new look, reducing checkout pages from three to one.

- Shopify Magic: Shopify introduced a lot of AI capabilities such as editing product images, writing product descriptions, sending emails to customers, turning live chats into checkouts, and crafting FAQs for your website.

- Earn rewards on your Shopify balance: Idle cash sitting in your Shopify balance is now rewarded in the form of an annual percentage yield of 3.86%.

- Full release of the Shopify Subscriptions app: The new Shopify Subscriptions app makes it easy for both the merchant and the customer to manage subscriptions.

- Capture payment per fulfillment: Shopify now collects payment only when items are fulfilled, not all at once at checkout.

Read about more of Shopify’s new features.

Shopify Payments stands out from its competitors for including a free POS option (POS Lite), 24/7 customer support, and excellent fraud and risk management features. A few points were docked from Shopify Payments’ score for deposit speed and paid hardware options.

Deposit Speed

Shopify Payments sends your funds to your bank account the next business day as long as you have more than $1 available to be paid. However, you can also configure your settings to have the proceeds of your sales deposited at intervals of your choice. You also get a report of your payout schedule from your Shopify dashboard.

Integrations

As an ecommerce solution, Shopify provides a wide range of integrations, so you can expect the same level of versatility with its payment processing service. While Shopify Payments only works within the Shopify ecosystem, it can be configured easily to integrate with several checkout solutions such as cart modification, cross-selling and upselling, and pick-up and delivery apps.

Mobile App

Shop is Shopify’s customer mobile app solution that allows shoppers to purchase your products from a mobile application. It offers local filters to identify local businesses currently offering certain sales features, such as shipping, pick-up, return policies, accelerated checkout using Shop Pay, package tracking, and personalized customer recommendations. It is available for both iOS and Android mobile devices.

The Shop app is easy to use and set up, from syncing product information to managing payment options with Shopify Payments. (Source: Shopify)

Multicurrency Transactions

With Shopify Payments, businesses that sell globally have the ability to sell in multiple currencies and receive payments in their local currency. This means that customers can view your products at local prices based on their location. You can also manage the currencies available for your customers from the time they view your product until they reach checkout.

Note: This feature is only available for higher Shopify plan users.

Fraud & Risk Management

Fraud Protect is Shopify Payments’ fraud and risk management feature, which you can assign per transaction for a specific fee. This provides your small business with guaranteed protection against fraudulent sales, covers you from any incidental fees arising from chargebacks, and manages the chargeback process on your behalf.

For larger businesses, this service includes an additional function that streamlines your order fulfillment process by monitoring each sale and providing you with notifications on every protected transaction from your Shopify dashboard.

In our evaluation, Shopify Payments’ overall score is more or less equal to our top picks for best merchant services for small businesses. If it were not exclusive to Shopify users, it would have landed a spot in our buyer’s guide.

Shopify Payments incurs no monthly fees—except for the subscription plan for an ecommerce platform—and is set up automatically with your Shopify account. Because there are no long-term contracts, you can also elect to discontinue your use of Shopify Payments manually.

It is the ideal payment processing option for Shopify sellers wanting to save on transaction fees, cheaper credit card processing rates, and bigger shipping discounts. However, Shopify Payments’ biggest challenge is its limitations in terms of the countries it can operate in, the industries it supports, and the platforms it is used on. Its exclusivity limits its users to only the features it offers, with no option to shop around for better deals.

Still, we recommend Shopify Payments for Shopify merchants. They can save more than the fees they incur going with other providers in the long run.

Customer Support

You can find an extensive guide on how to use Shopify Payments in Shopify’s help center. It also includes several video tutorials and tips for setting up and using the feature. As for customer support, Shopify Payments’ customer service is available 24/7 via phone, email, and chat. You can find fast solutions for your Shopify Payment concerns within its active seller community forum.

Shopify Payments Setup & Application

Signing up for a Shopify account automatically provides you with a Shopify Payments service, so there is no separate set of steps required to start accepting payments. You only need to submit your business documentation once, which will be used to approve you for opening a Shopify online store and payment processing.

You can start accepting payments once you have signed up successfully for a Shopify account and launched your online store. However, expect that your funds will be placed on hold until you pass the verification process, which takes up to three business days.

Shopify will require the following information to be approved for a Shopify Payments service:

- Proof of identity

- Proof of home address

- Proof of business (may include financial statements, business invoices, and reseller authorization or distributor information)

- Website information

When filling in the merchant application form:

- Under business details: Choose the business type and provide your business number (BN), employer identification number (EIN), or taxpayer identification number (TIN)

- For the address details: Make sure that you provide the same address listed on your business documents

Contract & Terms of Service

To understand Shopify Payments’ terms and conditions, we need to look at both the Shopify Payments Terms of Service (TOS) and the Stripe Connected Account Agreement, which stands as a separate agreement between Stripe and the merchant.

Shopify Terms of Service

- The Shopify Terms of Service clarifies that using Shopify Payments binds you automatically to an agreement with Stripe’s Connected service. This means that Shopify will have no control or obligation should Stripe cancel your payment service other than to notify you and offer you a different payment gateway (which will include add-on per-transaction fees).

- Stripe collects the fees on Shopify’s behalf, and either Shopify or Stripe may restrict you from accepting certain types of card brands without prior notice.

- While Stripe provides you with advanced fraud management features, Shopify will still require you to submit documentation proof of your compliance with Payment Card Industry Data Security Standard (PCI-DSS) and/or Payment Application DSS (PA-DSS) upon request.

- Shopify may set up a reserve of your funds―with terms they see fit―to cover chargeback and refunds. The TOS also indicates that you allow Shopify to charge you a fee for mediating or investigating chargeback disputes.

Stripe Connected Account Agreement

You may choose to discontinue the use of Stripe as your payment processor and, by default, terminate your use of Shopify Payments. It is crucial that you raise any questions you may have regarding these terms with a Shopify Payments representative before using this service.

Methodology: How We Evaluated Shopify Payments

We test each merchant account service provider ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

Shopify Payments Frequently Asked Questions (FAQs)

Click through the answers to common questions about Shopify Payments:

On Shopify, payments are processed through Shopify Payments or third-party payment gateways. Merchants using Shopify Payments can accept various payment methods such as debit and credit cards, PayPal, Meta Pay, Amazon Pay, and Apple Pay.

Shopify Payments is free to use but card processing fees still apply for each transaction. The transaction fees that apply will vary depending on your Shopify plan.

Shopify Payments is considered safe as it complies with industry-leading security standards and provides features like PCI DSS compliance, encryption, and fraud protection measures to safeguard transactions.

Bottom Line

If you are a Shopify user, having Shopify Payments as a payment processing service makes the most sense. It combines the advanced security and payment processing features of Stripe, with Shopify’s multichannel and multicurrency ecommerce solutions at no extra cost. You get discounted flat-rate transaction fees, and while there are monthly fees for maintaining a Shopify account, the subscription plan options can match the scale of any growing online business. Try Shopify Payments today by signing up for a free 3-day trial and $1 per month for three months.