Authorize.net is a Visa-owned company that offers one of the oldest and most trusted ecommerce payment solutions. It is a payment gateway that can facilitate virtual terminal, recurring, and virtual point-of-sale (POS) payments. Authorize.net is popular among merchants primarily for its compatibility with most payment processors and a wide variety of software.

We compared Authorize.net against other online payment processors and found it as the best payment gateway on our list. It scored 4.03 out of 5 and stood out for its versatility, but can improve with a more competitive pricing structure.

Authorize.net Overview

Pros

- Easy to set up and use

- Extremely reliable

- Discounted rates available for nonprofits

- Free mobile app

Cons

- Has a monthly fee

- Imposes a chargeback fee

- Fees on top of your merchant account

- Ecommerce is only available via integration

Deciding Factors

Supported Business Types | Flexible Retail, nonprofit, ecommerce, professional services, B2Bs |

|---|---|

Standout Features |

|

Monthly Software Fees | Fair $25/month regardless if you have a merchant account or not |

Setup and Installation Fees | $0 |

Contract Length | Pay-as-you-go |

Point of Sale Options | Integrates with more than 145 systems, from accounting software to POS hardware |

Payment Processing Fees | Very competitive

|

Customer Support |

|

Is Authorize.net Right for You?

Aside from offering flexible payment solutions and a wide selection of software integrations, Authorize.net is a Payment Card Industry (PCI)-compliant payment gateway with top-notch security and anti-fraud features to protect your business and customers.

When to Use Authorize.net

- If you want fast setup and approval with a merchant account

- If you need a secure online payment gateway

- If you are looking for a payment gateway with a wide range of integrations

- If your business regularly accepts international payments

When to Use an Alternative

- Businesses on a tight budget

- Brick-and-mortar businesses

- Businesses needing strong mobile credit card processing features

- Occasional sellers

Authorize.net’s strength is in its online payment processing such as accepting credit cards online, but other options may be more suitable for in-person and mobile payment processing. Storefronts and brick-and-mortar businesses might find a retail credit card processor or restaurant credit card processor more suitable.

In addition, Authorize.net charges a monthly gateway fee, so if you’re looking to keep associated costs low, choose a free merchant account. Smaller businesses with occasional sales may find better value in an all-in-one processing solution such as Square.

Authorize.net Alternatives

Best For | Monthly Fee From | |

|---|---|---|

| All-in-one online and POS solution | $0 |

| Online businesses looking for customization | $0 |

| Occasional sellers | $0 |

Learn how PayPal stacks up against Authorize.net in this detailed comparison.

Authorize.net User Reviews

| Users Like | Users Dislike |

|---|---|

| Fair pricing | Clunky design |

| Multiple integration options | Limited search options |

| Customizable security settings | Limited report generation features |

| Easy to set up | Customer support is hard to reach |

On the majority of Authorize.net reviews, customers like the platform. They appreciate that it provides peace of mind with its security features and is easy to integrate with other solutions. On the flip side, some users note a dated interface and complex dashboard.

- G21: 4.2 out of 5 from around 200 real-life user reviews

- Capterra2: 4.5 out of 5 from around 190 real-life user reviews

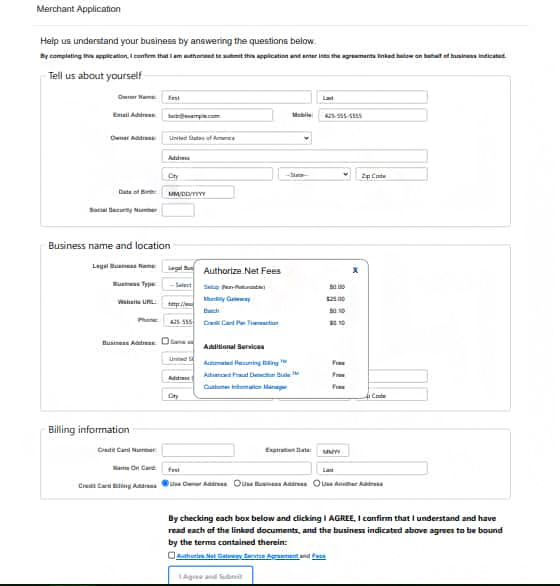

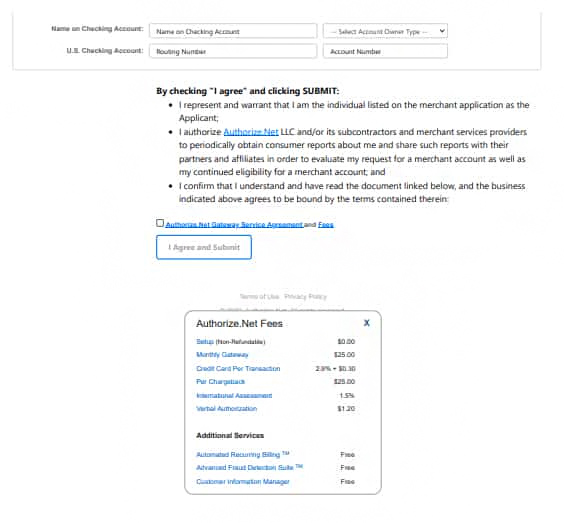

By default, all merchants need a merchant account to start accepting payments. With Authorize.net, you can choose between signing up for an all-in-one service (where Authorize.net sets you up with a partner service provider) or simply adding Authorize.net’s payment gateway solution to your existing merchant account.

Regardless of your choice, Authorize.net will charge you a monthly fee—but processing fees are much lower if you only need its payment gateway. However, note that all these Authorize.net fees are on top of the fees that your merchant account charges you; this cost Authorize.net points from our evaluation.

Authorize.net Payment Processing

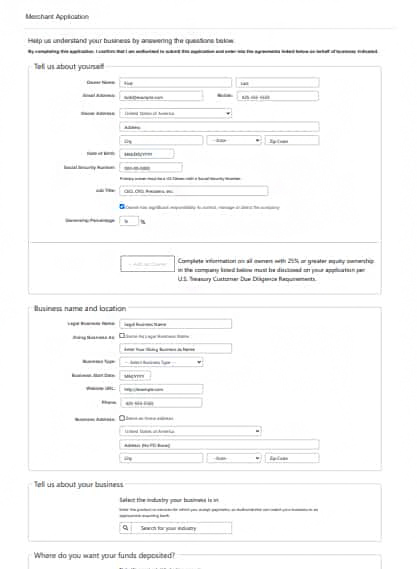

There has been no change in terms of processing fees for Authorize.net since our last update, however, note that this provider now requires a separate application process if you intend to accept e-check payments.

All-In-One Account | Payment Gateway Only | |

|---|---|---|

Monthly Fee | $25 | $25 |

Transaction Fee | 2.9% + 30 cents | 10 cents per transaction + 10-cent daily batch fee |

Merchant Account w/ Authorize.net Partner | Included | N/A |

Payment Gateway | Included | Included |

Setup Fee | $0 | $0 |

International Payment Processing | 1.5% per transaction | Depends on your merchant account/payment processor |

0.75% per transaction | 0.75% per transaction (requires separate approval processing) | |

Chargeback Fee | $25 per chargeback | Depends on your merchant account/payment processor |

Verbal Authorization | $1.20 per transaction | Depends on your merchant account/payment processor |

Recurring Billing Service | Included | Included |

Fraud Detection Service | Included | Included |

Customer Management Service | Included | Included |

Note that there is a minimum monthly transaction of $10 if you sign up for the e-check payment service, the following additional fees are included:

- e-Check chargeback fee: $25

- e-Check return fee: $3

Discounted rates are available to nonprofit organizations. And if you accept automatic recurring payments, Authorize.net offers an optional card updating service at 25 cents per update.

Please note that while not advertised, Authorize.net may charge other fees, such as for returned and late payments. Fees for your requested additional services will be found on the Additional Service documentation page accessed at the time of enrollment. Authorize.net will determine your exact fee schedule during the application and approval process.

Authorize.net Hardware

Authorize.net doesn’t have its own hardware but it does offer a free mobile POS app that supports a couple of mobile card readers for in-person transactions. However, at the moment only one card reader is available for purchase on the website.

Leasing via Authorize.net’s portal advantage program is also available (although not recommended). For card-not-present payments, you can use your existing hardware or purchase a new system to set up your Authorize.net payments.

|

|

$189 or $11.10/mo lease via Portal Advantage |

Authorize.net supports numerous payment solutions already included in its monthly fee. It offers online payment processing, including international payments. However, its ACH and e-check processing come with additional costs.

Although Authorize.net does not provide an online website builder like Square, its popularity and open API allow easy integration with any payment platform and system.

Digital Invoicing & Automatic Recurring Billing

Those accepting payments through invoices—such as wholesalers and subscription-based businesses—will find Authorize.net’s digital invoicing and recurring billing features an advantage. Not only does it come free with a payment gateway subscription, but these features do not require any integration. So, you can start sending invoices for one-time and recurring payments as soon as you have customized your settings.

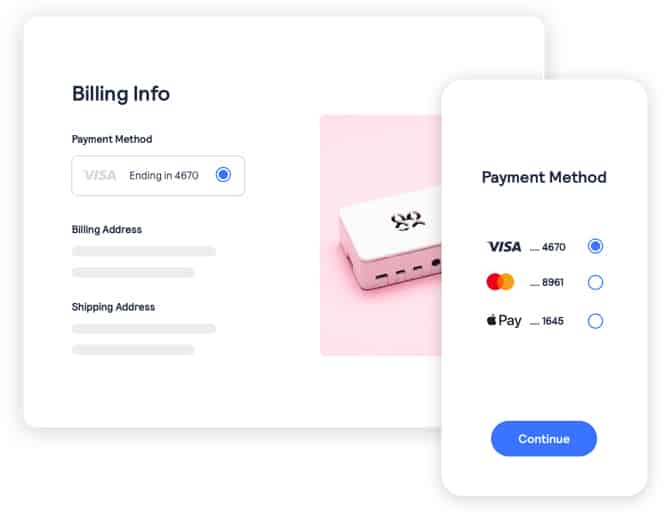

Customizing your digital invoice is easy, allowing you to include discounts and accept partial payments via card or e-check payments. For subscriptions and repeat customers, Authorize.net’s recurring payments tools will enable you to save billing and payment information for a faster, automatic payment option. The responsive invoice design makes it easy for customers to read and make payments on any device.

Repeat customers can save their billing information and preferred payment methods with Authorize.net’s recurring payment tools. (Source: Authorize.net)

Ecommerce Payments

You can use Authorize.net to quickly and easily embed a “buy now” button on your existing website. Nonprofits can use the “donate now” embed option. These hosted payment forms are PCI-compliant and compatible with simple and advanced customization requirements.

Simple Checkout is an easy-to-use HTML code generator you can find on your merchant interface. After customizing the settings for your payment button, copy and paste the HTML code on your website and immediately start accepting payments.

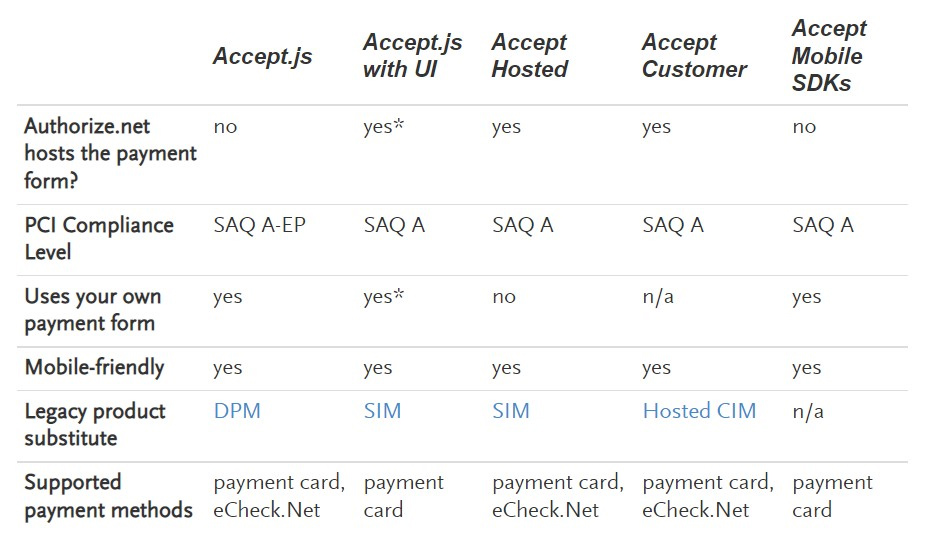

For a more customized payment page, Authorize.net has a set of tools called Accept Suite, designed for developers looking to create a more streamlined checkout experience. It allows you to design a customized payment form from scratch and either host it on your own website or embed it as an Authorize.net hosted form while still maintaining PCI DSS compliance.

Authorize.net Accept Feature Matrix (Source: Authorize.net)

In-person Payments

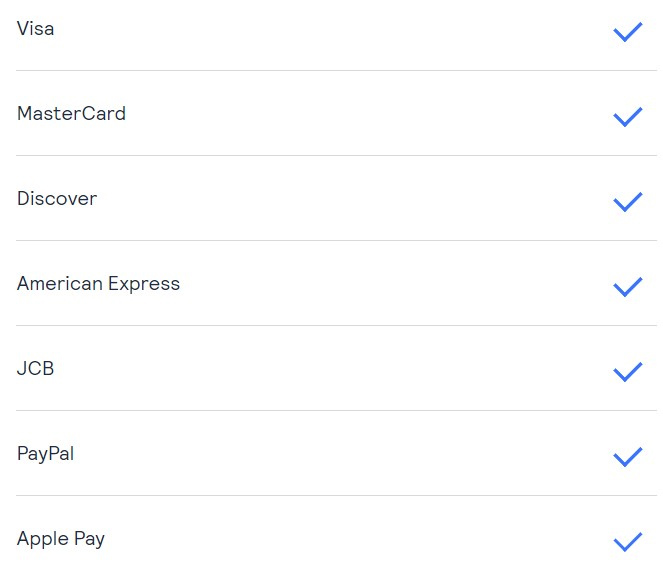

Although limited, Authorize.net does support in-person payments. It has an mPOS software (which allows you to connect a card reader to your mobile device) and a vPOS (which lets you process in-person payments on a desktop). Both are free to download and allow you to accept swiped and EMV payments. However, the biggest downside is that not all card readers and payment methods are available to Authorize.net payment processor partners.

Authorize.net accepts different payment types (Source: Authorize.net)

ACH & e-Check Payments

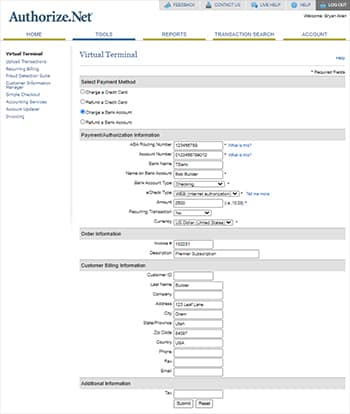

Authorize.net also lets you accept e-check payments through its virtual terminal at 0.75% per transaction. It is included with your daily batch processing but will take up to three business days for funds to reach your bank. Most businesses use this service over paper checks because it is processed faster and works well if you regularly accept subscription or invoice-based payments.

e-Checks can be processed on Authorize.net’s virtual terminal and can take up to three business days for funds to be deposited into your bank account (Source: Authorize.net)

Cross-border Payments

Authorize.net can process international payments for merchants based in the US, Canada, and Australia. It costs 1.5% per transaction for those who signed up for an all-in-one account. Authorize.net will sign you up with a partner merchant account services provider, such as Chase, TSYS, or Vantive, that supports cross-border transactions.

B2B Payments

Authorize.net comes with built-in level 2 data processing capabilities. You can customize the virtual terminal settings to include data required for level 2 payments. For more customization, you can use Authorize.net’s API and developer tools to set up your B2B payments processing.

Authorize.net is simple, easy to use, and allows multiple integrations. This flexibility, coupled with its PCI compliance and fraud protection, makes Authorize.net a good choice for those looking for the best payment gateway.

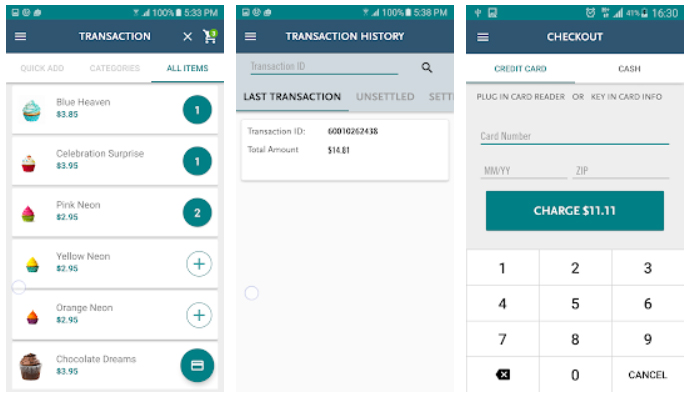

Mobile POS App

Reviews for the mPOS app, one way you can accept EMV and swiped payments, are less than encouraging, earning 3.3 out of 5 stars from about 160 reviews on Google Play3 and 2.5 out of 5 stars from around 250 reviews from the App Store4. Users unanimously raise concerns over features not working properly and card readers getting disconnected.

The mobile POS app lets you create an SKU catalog, accept payments with tips, perform voids and refunds, manage transactions, and customize taxes, shipping information, and digital receipts. (Source: Authorize.net)

Customer Information Management

Authorize.net will save cards on file, billing information, and shipping locations for each customer to make it easier for returning customers to complete future purchases. Each profile can hold up to 10 payments and 100 shipping details and can be used within your merchant interface or on your website through an API. And because Authorize.net stores your customer information within its secure servers, you will always be PCI-compliant.

However, while there’s a mention of integrating this feature on your website, there is no reference to creating a customer portal, which would allow your customers to sign up and manage their own profile. That said, APIs are available, so contact Authorize.net’s technical support to ask for options.

Virtual Terminal

If your business regularly accepts payments over the phone or email, Authorize.net’s virtual terminal is the platform to use for manual payments. It allows merchants to accept card and ACH/e-check payments by pulling up outstanding invoices and billing, then manually entering the payment information on your merchant platform.

The virtual terminal can also be configured to process level 2 data or B2B transactions by simply going to the settings and choosing the additional fields to include in the virtual terminal form. Authorize.net APIs and integrations are also available to create a more customized virtual terminal platform.

Integrations

Most payment processors offer Authorize.net alongside their built-in payment gateways as an alternative or an add-on. Authorize.net is partnered with about 160 software development platforms and 145 systems ranging from accounting software to POS hardware. Additionally, its open API makes it flexible enough to work with third-party and custom-built technologies.

Advanced Fraud Protection

Authorize.net’s Advanced Fraud Detection Suite (AFDS) helps identify, manage, and prevent suspicious and potentially fraudulent transactions, which can be costly. It lets you customize fraud detection with 13 rules-based filters and tools, such as country limitations and payment velocity settings to suit your business model.

You can also set up per-transaction notifications to alert you of suspicious activity as soon as it happens. What’s best about this feature is that, unlike popular payment gateways, it is included with Authorize.net’s monthly subscription.

We gave Authorize.net perfect scores for its overall value, ease of use, and integrations. However, it did not earn top marks for user reviews. Its mPOS app reviews on Google Play Store and App Store emphasized users’ dissatisfaction with its app features, which is one aspect it can improve.

Nevertheless, Authorize.net has almost everything a small business needs when it comes to online payment processing. Whether you already have a merchant account or have yet to get one, Authorize.net offers a stable and reliable service that is easy to integrate with numerous payment solutions for a flat monthly fee and 24-hour no-fee payout.

Authorize.net Setup & Application

As Authorize.net is a pure payment gateway service, you will need your own merchant account. If you don’t have one, you can sign up for an all-in-one service, which includes a merchant account with an Authorize.net partner, or choose to contact a reseller like Worldpay, TSYS, and Wells Fargo for a merchant account with an Authorize.net integration.

Most applications qualify for validation through Authorize.net’s automated underwriting system; however, other businesses may be flagged for considerable risk, in which case, approval can take as long as two business days.

Authorize.net will offer assistance in migrating data over from another platform, and there are no associated setup fees. Merchants don’t have to sign up for a long-term contract either—an added benefit.

Note that there are significant differences in the application forms of the payment gateway-only and all-in-one options, including the schedule of standard and additional fees.

Customer Support

Customer support is available via phone 24/7, except on major holidays. Merchants can also submit an online support case or use Authorize.net’s live chat. There’s even an online support center with an FAQ section, where merchants can troubleshoot issues themselves.

Simple Merchant Interface

Because it’s a specific platform with a narrow focus, the interface isn’t too cumbersome or overwhelming. People find it easy to get acclimated with the tool. Authorize.net was made to fit into a lot of existing platforms and processes, so it has a ton of integration options that make it easy to add to your existing merchant account and business software. It has integrations for ecommerce platforms, POS systems, accounting, and tools for pretty much every aspect of your business.

How We Evaluated Authorize.net

We test each online payment processor ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best online payment services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

20% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

Authorize.net received a relatively low score in this category, mainly because of its vague chargeback fee and required monthly fees.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Authorize.net got average scores in this criteria because of its lack of ecommerce tools and the additional fees for ACH and e-check payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

Its developer tools, deposit speed, fraud prevention, and 24/7 customer support landed Authorize.net higher scores in this category. It would garner higher scores if it improves its mobile app and offers Buy Now, Pay Later options.

25% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point of sale, and ecommerce solutions.

We gave Authorize.net perfect scores for the different sub-criteria in this category except for user reviews.

Frequently Asked Questions (FAQs)

Browse our list of frequently asked questions in our review of Authorize.net:

Bottom Line

Ultimately, Authorize.net is a great payment processing tool for merchants needing secure, reliable online transactions. It has flexible pricing and plans and many integrations, so you can set up your tech stack according to your business needs.