Payroll reports are documents based on your payroll data, showing specific information about your business relating to tax liabilities, pay rates, and other financial data. You can create a payroll report for nearly anything you want—assuming you have the data in place—for both internal usage as well as required IRS filings.

We’ll discuss the most important payroll reports, how to create them, and how your business will benefit from running them regularly.

Key Takeaways:

- The most essential payroll reports to run include payroll register, payroll tax & wage summaries, worker’s comp wages, and retirement plan contributions reports

- Not every payroll report needs to be run during each payroll period

- Key reports like payroll register and wage and tax summary should be run each pay period, as these give insight into business expenses

- Employee retirement contributions reports are essential if you offer retirement benefits—and some data in the report is required by law

- Manual payroll can be error-prone and time-consuming—using payroll software will make report generation easier and reduce errors for small businesses

Essential Payroll Reports

Creating payroll reports should be part of your regular small business payroll process. These will give you the information you need to file a form with federal or state agencies, and are also helpful for analyzing your payroll costs and process.

Payroll Register Report

A payroll register is a document your payroll team should regularly keep, as it provides details on each employee’s net pay, deductions, tax withholdings, and gross pay for each pay period. To create the payroll register report, you need to have these details readily available. If you keep manual payroll records, you’ll need to compile this data into a spreadsheet to view in an easy-to-read format. If you use payroll software, this is a standard report that can be run with a few clicks.

This report gives you the information needed to fill out a Form W-2 each year and is also great for conducting an internal payroll audit. It is also useful for your finance team or external accountant or bookkeeper to reconcile your books and assign payroll costs accordingly.

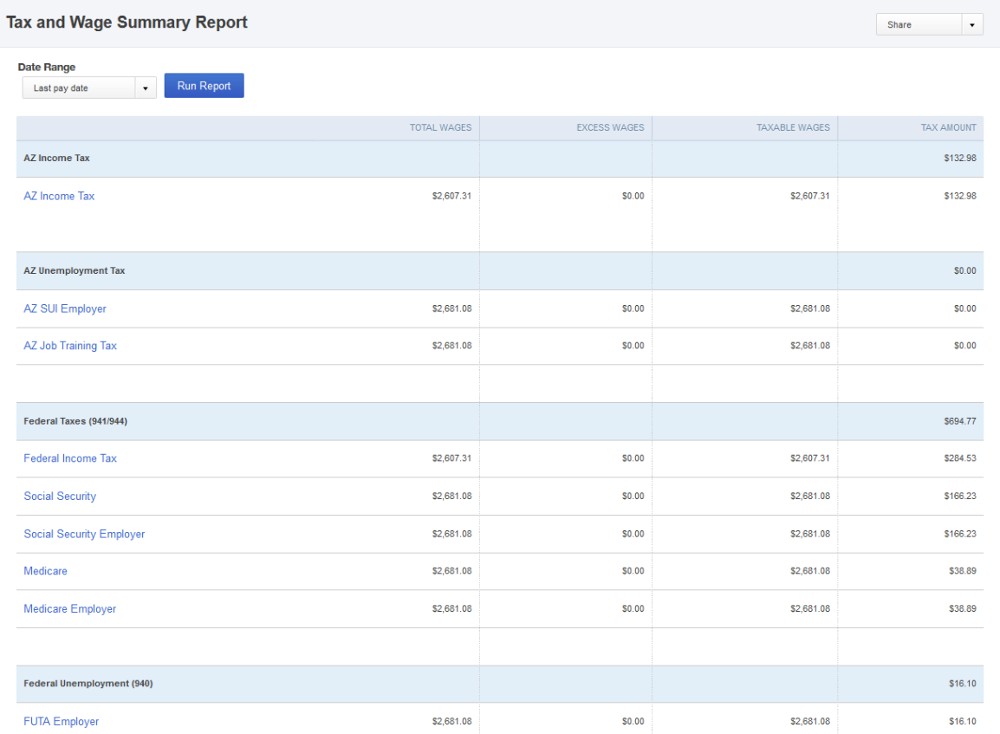

Payroll Tax & Wage Summary

A payroll tax and wage summary report shows each employee’s taxable wages and the amount of tax paid per employee. This report differs from a payroll register report, which provides more detailed information on deductions and withholdings. A payroll tax and wage summary report comes in handy when filing your state and local taxes.

(Source: Intuit)

Creating this report is simple if you use payroll software. If you manually keep payroll records, you’ll need to gather the information for each employee and put it into a spreadsheet showing each employee’s wages and taxes paid for the period you’re reviewing.

Many states and cities require you to file taxes based on information contained in this report. Make sure you know how often you need to file taxes with your state and local agencies so you run the payroll tax and wage summary report on time.

Workers’ Compensation Wages Report

A workers’ compensation wages report is a detailed record of wages paid to employees that are subject to workers’ compensation insurance. This report is necessary for the accurate calculation of workers’ compensation premiums.

If you use payroll software, running this report is simple. However, if you manually track payroll, you’ll need to gather your employees’ wage data and enter it into a spreadsheet to track wages earned during a pay period, including tips, bonuses, and overtime. Ideally, you should run this report with each payroll run so you know how much your workers’ compensation premiums are for that period.

This report is necessary for the accurate calculation of your workers’ compensation insurance premiums, and may even be required by state law. Maintaining this report can also protect your business in the event of a workers’ compensation claim by providing documented proof of the wages an employee earned at the time of their injury.

Retirement Plan Contributions Report

A retirement plan contributions report is an exhaustive record of contributions made to employees’ retirement plans, both from the employee and the employer. It’s required for the precise calculation of these contributions and to ensure your business meets its legal obligations.

A robust payroll system will help you track all the relevant data. If you do payroll manually, you’ll need to compile wage data and contributions made, both pre-tax and post-tax, for every employee, plus your company’s contributions, if you make any. This report shows you details about each employee’s contributions for a specific period, the type of retirement plan they’re contributing to, and the total contributions made. You’ll also see the contributions from your company.

If your company offers retirement plans, this report is vital. If you don’t have retirement plan offerings, consider doing so, as these are part of a comprehensive employee benefits package that can entice high-quality employees to sign-on and stick with your company.

Voluntary Payroll Reports

Not every payroll report is required for you to gather information for a federal or state agency. Sometimes, payroll reports are just good business practices, helping you see your company’s costs and ensuring you make smart business decisions with accurate information.

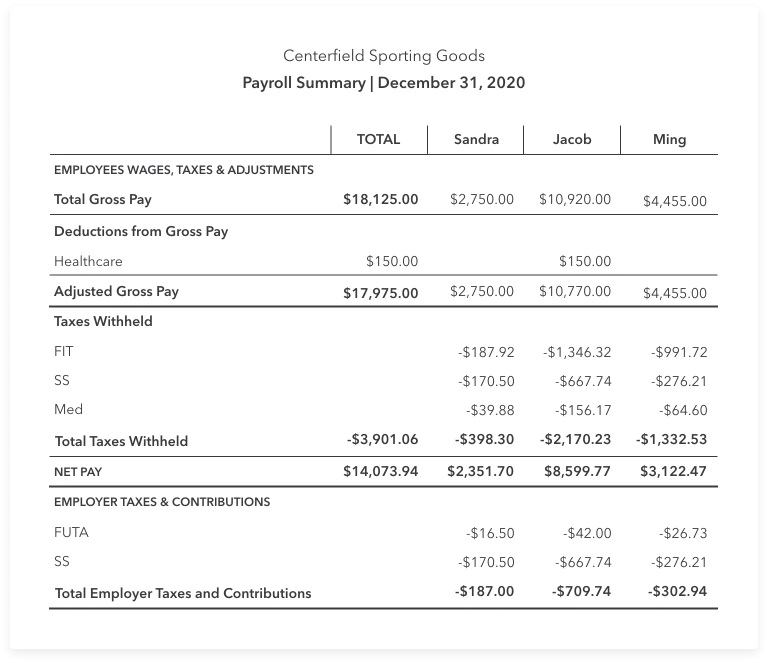

Payroll Summary

A payroll summary is a general report that shows you a high-level overview of your company’s payroll activity. Running this report regularly is one way to stay compliant with the Fair Labor Standards Act (FLSA), which requires employers to keep payroll records for at least three years.

This report also comes in handy if you intend to apply for a business loan. Banks and lenders will require a payroll summary report to get a better picture of your employee-related overhead.

(Source: Intuit)

Creating a payroll summary report manually will take some time. You’ll need to gather all the data below by looking through all of your employee’s records and putting the information in a single spreadsheet so you can view it all together. If you use payroll software, this is a standard report that you can access easily.

Payroll summary reports usually include:

- Employee name, hire date, and end date, if applicable

- Gross pay

- Adjusted gross pay

- Net pay

- Employer taxes and contributions

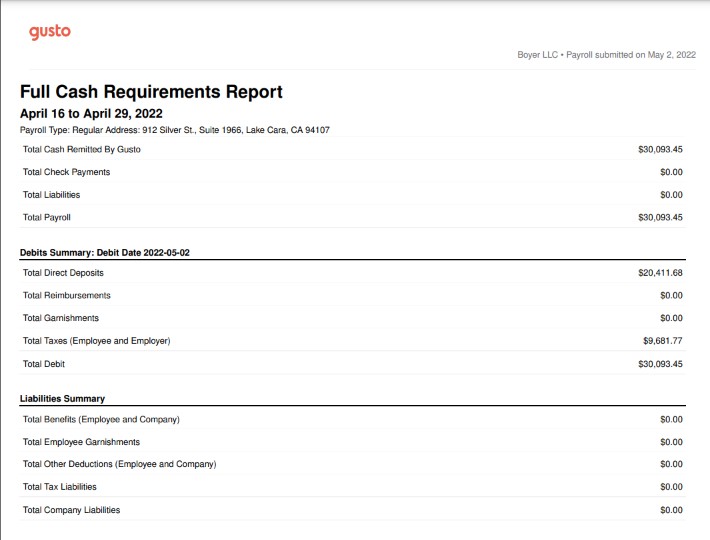

Cash Requirements Report

A cash requirements payroll report tells you how much money you need on hand—including total cash requirements—to cover payroll for the upcoming period. This report breaks down your total payroll costs for:

- Employee wages

- Taxes

- Benefits withholdings

- Any other deductions

(Source: Gusto)

Because a cash requirements report is useful for your business to know how much cash you need to cover payroll, make this part of your payroll process. If you’re doing payroll manually, create this report while you’re doing payroll so you can easily transfer data.

Meanwhile, using payroll software will make generating this report much easier, and is something you can do immediately after you finish processing payroll. Some programs even provide this automatically when you’re done running payroll.

Benefits & Deductions Report

A benefits and deductions report shows you a breakdown of the benefits and deductions for each employee during each pay period. It includes the employee’s name, your company’s costs to supply benefits, any employee-paid portion of benefits, and any other non-tax deductions.

If you’re creating this report manually, this is another one to do while you’re doing payroll. Since you’re already listing this information for payroll, you can duplicate it in a spreadsheet so you can track your total cost to employ. Payroll software should include this as a standard report, making it easy for you to run as you see fit.

This report is important because it gives you insight into what it costs your company to provide benefits to your employees. While you shouldn’t make staffing decisions based on this report alone, this report shows you the total cost to your company to employ someone. Small businesses often find the details contained in a benefits and deductions report enlightening, and it should be run at least annually.

Employee Time Report

Employee time reports are used to see how many hours each employee worked during a pay period. If you use time tracking or project management software, you may also be able to see what projects your employees spent their time on, allowing for even deeper cost analysis.

Many small businesses use an employee time report to manually enter payroll if they’re not using a fully integrated payroll system. Here are time sheet templates you can download and modify for use by your employees to track their hours worked. Your HR team can then use those time sheets to create an employee time report in preparation for payroll. If you use payroll software and enter employee hours or your software has time tracking built in, running this report is as simple as a few clicks.

An employee time report is also useful to determine if your workers are productive with their time. If projects aren’t being completed on time, for example, but someone is logging nearly 40 hours each week, you might need to have a conversation with them about their time management. In general, it’s a good idea to run an employee time report quarterly, but it can also be run whenever you suspect an issue.

Time Off Expense Report

It’s important that you know how much each benefit is costing your company. A time off expense report shows you what it costs to offer your employees paid time off (PTO). This is different from a time report, which just focuses on the number of hours worked.

Time off expense reports are great to use alongside other reports to give you a full picture of your company’s costs and should be used at least semi-annually.

To create a time off expense report manually, you’ll need to list out each employee’s name, their hourly rate, and total amount of time off they took during the time period you’re reviewing. This will give you data on how much it costs your company to give employees time off. If you use payroll software that tracks employee hours, you can run this report through the program dashboard.

How to Create a Payroll Report

To understand the financial aspects of your business operations, it’s essential to know what a payroll report is and how it can provide valuable insights. But you first have to run the payroll report with your company’s data.

Whether you’re using a spreadsheet to keep your payroll data or payroll software to manage your payroll, creating a report will require three straightforward steps.

1. Determine the Information Required

If you’re using payroll software, you’ll be able to select different standard reports or make custom selections about what information you want to include. You can leave out employees’ names and other identifying information, for example, if you’re doing an overall analysis. Eliminating information is key to keeping the report clean and digestible.

However, if you’re using a spreadsheet to create payroll reports, you’ll need to manually transfer the data. This process is ripe for errors and could result in inaccurate information, so take extra care to ensure you don’t make business decisions with bad data.

2. Choose the Time Range

When running a payroll report for an IRS or state filing, you’ll need to run it for the time period requested. If you’re filing your quarterly taxes, for example, you’ll need to run a report for just the quarter you’re filing.

Meanwhile, for internal usage, the time period is entirely up to you. For example, if you’re trying to figure out how much you’re spending on company-sponsored benefits, choose a time period that is long enough to show you accurate data. Using a time range that’s only a month long may not give you an accurate picture, especially if you’ve recently hired more employees or changed your benefits offering.

You don’t have to run every payroll report every time you run payroll. Running a payroll report to complete W-2 forms, for example, only needs to be done once per year. Other reports, like a cash requirements report, should be run every time and become part of your regular payroll process.

3. Analyze the Results

Upon completion of the payroll report, review the information. If you’re running a report to file your quarterly taxes, make sure the data looks accurate and double-check the time period. You don’t need to redo the report manually, but you’ll be able to tell if something looks off. It’s also a good idea to compare reports. For quarterly tax reports, compare it to the last quarter—and, if it’s substantially different, there might be an error.

If you’re running a report for analyzing your payroll expenses, review the information to gain insights about where your payroll spending is going. Running an end-of-year benefits report, for example, can show you how much your company spends on providing employee benefits, which can guide your decisions for the upcoming year.

Payroll Report Best Practices & Tips

When discussing what a payroll report is, it’s important to highlight that it’s not just a record. It’s a crucial instrument for managing and understanding your business’s financial health. Here are some tips to help you make this part of your regular payroll process.

- Be consistent. Ensure you generate your payroll reports consistently and in alignment with your pay schedule. Not every report needs to be run every time, but your payroll process should include instructions on which reports should be run and at what intervals.

- Keep accurate records. Accuracy is crucial in payroll reporting. Ensure all data entered into your payroll system is correct and up to date. This includes employees’ personal details, hours worked, wages, tax deductions, and retirement contributions. Inaccurate records can lead to legal issues and financial penalties.

- Use a reliable payroll system. We’ve said it before but it bears repeating: we do not recommend manual payroll. It’s simply too easy to make costly mistakes. A reliable payroll system can automate many aspects of payroll reporting, saving you time and reducing the risk of errors. These can also generate various reports with a single click. Check out our roundup of the best payroll software to find one that suits your business’s needs.

- Regularly review your reports. Don’t just generate payroll reports and then ignore them. Regularly reviewing your reports will help you spot trends, identify potential errors, and make informed decisions about your business. For example, if you notice a significant increase in overtime payments, it might indicate your employees are overworked and you need to hire more staff.

- Seek professional advice. If you’re unsure about anything related to payroll reporting, seek professional advice. An accountant or payroll consultant can help you understand your obligations, set up an efficient payroll system, and ensure that your reports are accurate and compliant.

Read our top tips for managing your payroll to ensure your process is efficient and error-free.

Benefits of Payroll Reports

While few payroll reports are required, running different reports provides you with specific insights about the operations and trajectory of your business and makes it easier to stay compliant with federal and tax requirements. For example, with the information you’ll pull from your payroll software or from Excel spreadsheets, you can file a quarterly payroll report (for most employers, this is Form 941) more efficiently.

Another benefit of using payroll reports is to know where your company’s money is going. Are you overspending on benefits? Are your payroll costs exceeding your profits? Even if the information you see isn’t great, it’s much better to know and take action than be completely in the dark about your business expenses.

Running payroll reports also shows you the performance of your company over time. If your staff size has remained constant but your profits have increased, that’s a good sign that your employees are more productive and your company is effectively managing your overhead. Without reports like these to paint a picture of where your company has been, you won’t be able to get your company to the next level.

Payroll Report Frequently Asked Questions (FAQs)

The frequency of generating payroll reports depends on your pay schedule, business needs, and the type of report. It’s standard practice to generate certain payroll reports each pay period, like the payroll register and payroll tax and wage summary. Other reports may only need to be run as needed or as required by the IRS or your state tax agency.

Should you discover errors in any payroll report, correct it immediately. Errors can lead to legal issues, financial penalties, and unhappy employees. If the error relates to employee wages or deductions, ensure you communicate the issue and any corrections made to the affected employee immediately.

We recommend keeping your payroll reports as part of your regular payroll records, which should be kept for at least three years. Some states require you to keep these records longer so make sure you’re checking with your local and state laws to ensure compliance.

Bottom Line

Running regular payroll reports not only gives you deep insights into your company’s operations, but it can also help you streamline federal and state filings. You can create these reports manually but using payroll software is the best way to ensure accuracy with payroll reporting, helping you effectively manage your business.