Established in February 2024 as a replacement for the now-discontinued QuickBooks Self-Employed, QuickBooks Solopreneur, which costs $20 monthly, is a user-friendly accounting software designed specifically for one-person businesses. Whether you need assistance with categorizing expenses, generating invoices, estimating taxes, or gaining financial clarity, QuickBooks Solopreneur can be the key to streamlining your finances and achieving business growth.

Our QuickBooks Solopreneur review goes over pricing, features, and use cases to help you decide if it fits the bill. We also cover a quick comparison between QuickBooks Solopreneur and Self-Employed.

The Fit Small Business editorial policy is rooted in our company’s core mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audiences have. This ensures that the content is rooted in knowledge and accuracy.

We also employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

Pros

- Features a user-friendly interface

- Has income and expense categorization

- Helps to estimate quarterly taxes and generate tax schedules for Schedule C filers

- Comes with a built-in mileage tracker

Cons

- Lacks a direct phone support line

- Is unable to customize the chart of accounts

- Is unideal for businesses with employees or multiple partners

- Has no double-entry accounting features

Pricing | $20 per month |

|---|---|

Free Trial | 30 days |

Discount | 50% off for the first three months |

Standout Features |

|

Customer Support | Live chat, chatbot, online resources, and community forum |

- Freelancers and independent contractors: If you work with various clients and juggle multiple invoices, QuickBooks Solopreneur simplifies sending professional invoices, tracking payments, and categorizing income for tax purposes.

- Business owners new to bookkeeping: With its intuitive interface and automated features, QuickBooks Solopreneur is a great tool for business owners without prior accounting experience. It can help them establish good financial habits and get comfortable tracking their business income and expenses.

- Solo businesses with straightforward finances: For businesses with limited inventory and no employees (like consultants, coaches, or tutors), QuickBooks Solopreneur offers a clear view of income, expenses, and profitability without overwhelming features.

- Solopreneurs on the go: The QuickBooks mobile app allows you to manage finances, create and send invoices, and snap a picture of a receipt for expense tracking. You can also track mileage via the mobile app.

QuickBooks Solopreneur Alternatives & Comparison

QuickBooks Solopreneur Reviews From Users

As of this writing, no user has left a QuickBooks Solopreneur review on third-party review platforms—likely because the tool is still green. If you check back later in the year, we may have user insights to share.

QuickBooks Solopreneur vs QuickBooks Self-Employed Comparison

QuickBooks Self-Employed has been discontinued and replaced by QuickBooks Solopreneur. Intuit has essentially rebranded QuickBooks Self-Employed and adjusted some of its functionality. While the differences between the two may be mainly subtle, there are a few key distinctions:

Feature | QuickBooks Solopreneur | QuickBooks Self-Employed |

|---|---|---|

Invoicing | ✓ | ✓ |

Accept Cards & ACH | ✓ | ✓ |

Customer List & Management | ✓ | ✓ |

Overview Tab With Money-related Insights | ✓ | ✓ |

Profit & Loss and Business Reporting | ✓ | ✓ |

Cash Flow History & Trends | ✓ | ✓ |

Mileage Tracking | ✓ | ✓ |

Auto-sales Tax With Sales Tax Report | ✓ | ✕ |

In-person Payments, Such as Quick Response (QR) Code and Payment Link | ✓ | ✕ |

Partial Payments | ✓ | ✕ |

Accept PayPal, Venmo, and Apple Pay | ✓ | ✕ |

Automatic Reminders | ✓ | ✕ |

Estimates | ✓ | ✕ |

Mobile Remote Deposit Capture (RDC) | ✓ | ✕ |

Embedded Tax Filing | ✓ | ✕ |

Access to QuickBooks Money | ✓ | ✕ |

Record & Track Expenses or Bills | ✕ | |

Assign Tags | ✕ | ✓ |

Attach Receipt | ✕ | ✓ |

Export to TurboTax | ✕ | ✓ |

QuickBooks Solopreneur Pricing

QuickBooks Solopreneur’s pricing is $20 per month—or $120 for the first year if you commit to an annual contract. You can try QuickBooks Solopreneur for free for 30 days or purchase immediately and get 50% off for the first three months.

QuickBooks Solopreneur Features

QuickBooks Solopreneur caters to solopreneurs by offering a streamlined set of features focused on simplifying finances and saving them time. These features are designed to work together to give solopreneurs a clear view of their finances, automate tedious tasks, and streamline essential financial processes. The software is user-friendly and allows solopreneurs to focus on running their businesses.

QuickBooks Solopreneur offers automatic expense categorization, which eliminates the need to categorize each transaction manually. Over time, as you review and adjust categories, QuickBooks Solopreneur will get better at suggesting accurate categories for future transactions.

However, automatic expense categorization isn’t foolproof. It’s crucial to review your categorized transactions regularly to ensure accuracy, especially early on as QuickBooks Solopreneur learns your spending habits.

Here’s a closer look at how it works:

- Bank and credit card integration: Connect your business bank accounts and credit cards to QuickBooks Solopreneur

- Transaction downloads: When you connect your accounts, QuickBooks Solopreneur downloads your transactions automatically

- Machine learning and rule-based categorization: It analyzes your previously categorized transactions and other transactions from similar QuickBooks Solopreneur users to make intelligent categorization suggestions. It also uses preset rules based on the merchant name, transaction description, and category patterns to assign categories automatically.

- Human review and override: While QuickBooks Solopreneur strives for accuracy, you can always review and change the suggested categories to ensure everything is categorized correctly.

While many of the expense categorization features are similar between QuickBooks Solopreneur and QuickBooks Self-Employed, one feature that QuickBooks Solopreneur lacks is the ability to assign tags.

The goal creation and tracking feature lets you track progress and make adjustments with recommendations and guidance to reach your goals. When creating a new goal, you have the option to specify whether you want to grow your income or obtain more customers. These are action items that solopreneurs have mentioned are most important to their business. Currently, goal setting and tracking are only available via web versions of QuickBooks Solopreneur and not in the mobile app.

Goal setting and tracking in QuickBooks Solopreneur

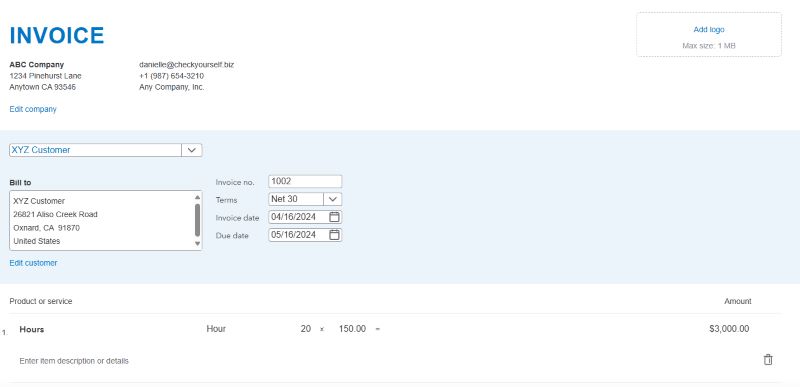

QuickBooks Solopreneur offers a well-rounded invoicing suite for solopreneurs, focusing on ease of use, efficient client communication, and faster payments. However, while it integrates with popular payment gateways, there might be additional fees associated with processing online payments—so for more complex invoicing needs, such as subscriptions or recurring billing, you might need to explore more advanced accounting software, such as QuickBooks Online or Xero.

Here’s a breakdown of QuickBooks Solopreneur’s invoicing functionalities:

- Creating and customizing invoices

- Design professional-looking invoices with your logo and customize them with relevant details for each client

- Convert estimates into invoices, which saves you time if you already have project details established

- Sending and tracking invoices

- Send invoices electronically through QuickBooks Solopreneur

- Track the status of your invoices, so you know if they’ve been opened or viewed by your clients

- Send automated or manual payment reminders to nudge clients if invoices are past due

- Payment options and integration

- Integrate with popular payment gateways—this allows clients to pay online through your invoices and can significantly speed up your collections process

- Progress invoicing

- Create progress invoices to bill clients for completed portions of the work (for projects with staged deliverables)

- Mobile accessibility

- Create, send, and track invoices from your mobile device using the QuickBooks mobile app, offering flexibility on the go

Sample invoice in QuickBooks Solopreneur

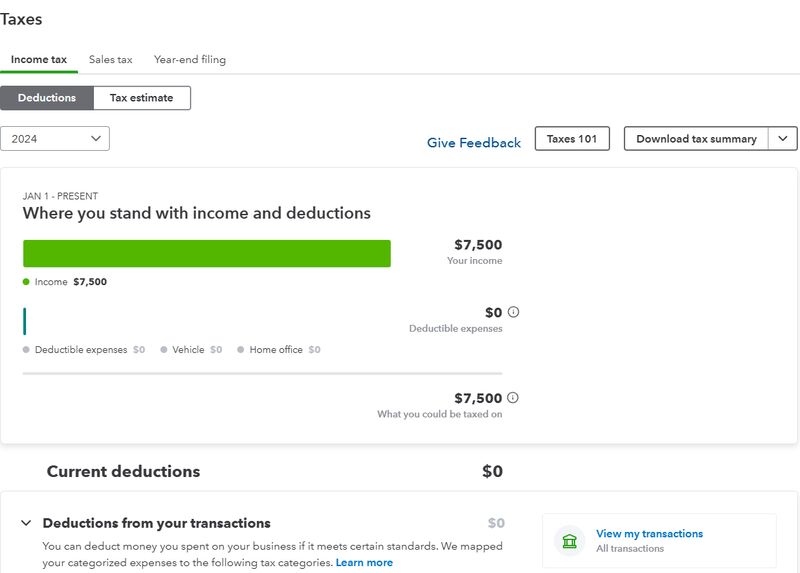

While QuickBooks Solopreneur doesn’t directly file your taxes, it simplifies tax management for solopreneurs, especially those who file a Schedule C with their tax returns, such as sole proprietors and single-member limited liability companies (LLCs).

Here are some of its tax-focused features:

- Mileage tracking: Automatically track your business miles by using your phone’s GPS and categorize trips with a swipe, maximizing mileage deductions.

- Income and expense tracking: QuickBooks Solopreneur helps to categorize your business income and expenses automatically, making tax prep much easier.

- Maximized tax deductions: By separating business and personal expenses, QuickBooks Solopreneur helps ensure you don’t miss out on claiming legitimate tax deductions.

- Report generation: Generate reports to gain a clear view of your business finances and tax situation.

- Sales tax: Allows for auto-sales tax with a sales tax report and an automated sales tax envelope.

It’s important to note that it is designed for Schedule C filers. Other businesses like partnerships and corporations generally are required to use double-entry accounting systems that can produce both a balance sheet and profit and loss (P&L) statement. So if you’re not a Schedule C filer, you might need a different solution like QuickBooks, Xero, or Zoho Books. Also, while QuickBooks Self-Employed offered a direct export to TurboTax, this is unavailable with QuickBooks Solopreneur.

Managing taxes with QuickBooks Solopreneur

QuickBooks Solopreneur offers access to the QuickBooks mobile app for both iOS and Android. It acts as a companion to the web-based software, allowing you to manage your finances on the go. If you’re currently a QuickBooks Self-Employed user, you’ll still have access to the QuickBooks Self-Employed app, but it isn’t offered to new users since it has been discontinued. Here’s a summary of the QuickBooks mobile app’s key features:

- Income and expense tracking: Record income and expenses quickly and categorize them for easy organization

- Mileage tracking: Leverage your phone’s GPS to track business miles and categorize trips automatically

- Invoice management: Create, send, and track invoices directly from your phone. You can also view invoice status and send payment reminders

- Reporting access: Access key financial reports like your Profit & Loss to monitor your business performance

One feature that QuickBooks Self-Employed offered but that is no longer available with QuickBooks Solopreneur is the ability to capture or match receipts.

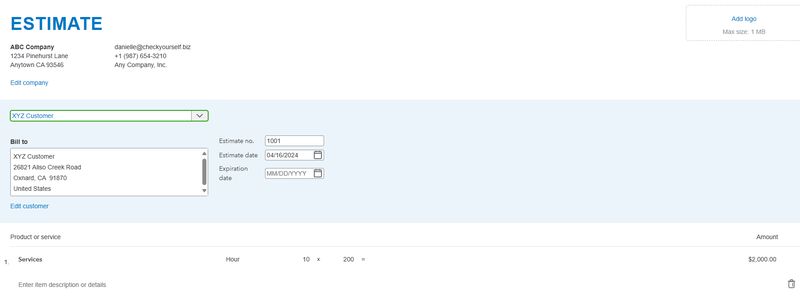

Not previously offered with QuickBooks Self-Employed, you can now create and manage estimates with QuickBooks Solopreneur. This helps you to present project costs to potential clients and convert them into paying customers. Once finalized, you can electronically send the estimate directly to your client via email within QuickBooks Solopreneur. You can monitor whether your client has opened or viewed the estimate and set an expiration date to encourage a timely response.

With a few clicks, you can convert approved estimates into invoices when the project begins, streamlining the billing process. For larger projects with milestones, you can also create progress invoices to bill clients for completed stages of the work.

Estimates present project costs in a clear and professional manner, making a good first impression on potential clients. They also clearly define project scopes and costs upfront, which can help avoid misunderstandings and ensure client approval before commencing work.

Sample estimate in QuickBooks Solopreneur

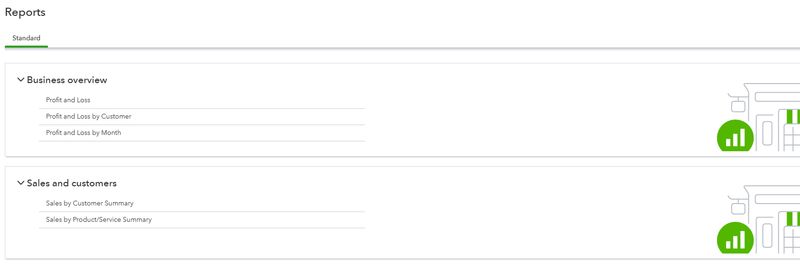

QuickBooks Solopreneur offers reports that focus on financial health and tax filing needs. It allows for some level of report customization, such as filtering dates, income/expense categories, and adjusting how the information is presented for better analysis. Overall, QuickBooks Solopreneur prioritizes user-friendliness and offers core reports to manage your business finances and prepare for tax filing as a Schedule C filer.

Here’s a sample of the available report types:

- Profit & Loss: This report summarizes your business income and expenses over a chosen period. It helps you to better understand your profitability.

- Sales Summaries: These reports include a sales by customer summary and a sales by product/service summary.

QuickBooks Solopreneur’s available reports

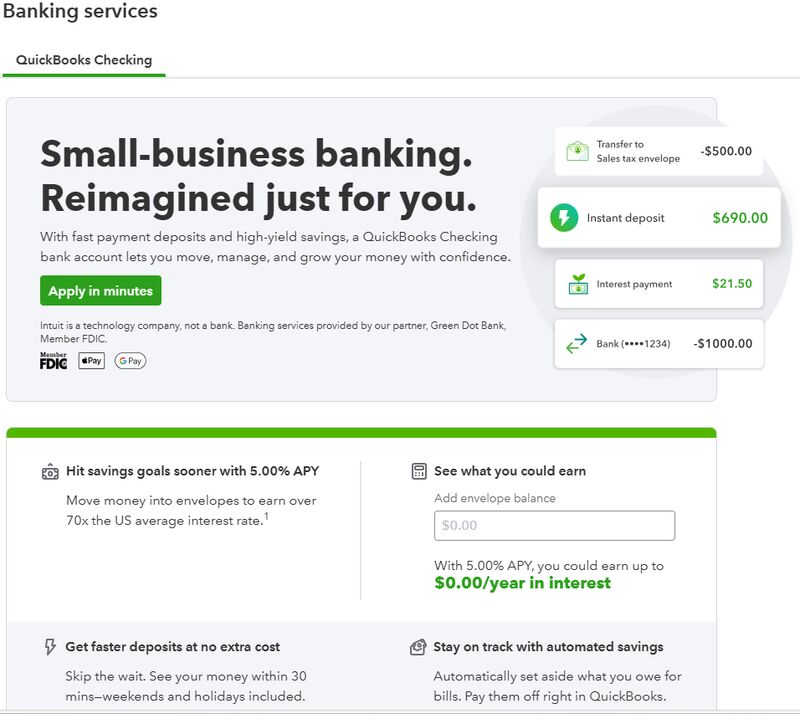

QuickBooks Solopreneur offers a combination of accounting software and a business bank account (QuickBooks Checking) designed specifically for solopreneurs. Having a dedicated business account helps to separate your business and personal finances, simplifying bookkeeping and making it easier to file your taxes. QuickBooks Checking offers features like free mobile deposits, high-yield savings options, and no minimum balance requirements.

You can connect your QuickBooks Checking account to the software, which allows for automatic transaction downloads and categorization, saving you time and effort. When your transactions are automatically downloaded, reconciling your bank statement becomes a quicker and easier process. Also, if you already have a business bank account you like, you can still use QuickBooks Solopreneur software without needing the checking account.

QuickBooks Checking

QuickBooks Solopreneur Customer Service & Ease of Use

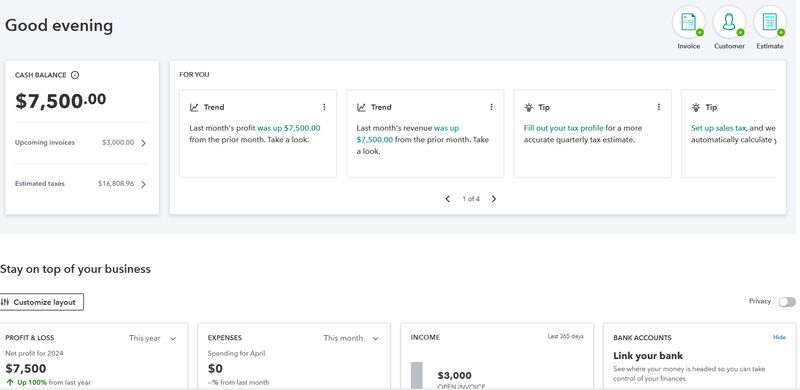

QuickBooks Solopreneur was designed with user-friendliness in mind, catering to those with little or no accounting experience. The software utilizes a straightforward interface with clear navigation and simple workflows. Features like automatic expense categorization and bank transaction downloads can save time and simplify data entry. You can also manage finances on the go with the mobile app for expense tracking, invoicing, and basic financial monitoring.

One of the drawbacks of QuickBooks Solopreneur is that it lacks direct phone support. It primarily offers online support resources like frequently asked questions (FAQs), knowledgebase articles, and video tutorials. You can also access help via live chat or chatbot. If you require extensive customer support or prefer phone consultations, you might want to explore accounting software with more robust customer service options, such as FreshBooks and Zoho Books.

QuickBooks Solopreneur Dashboard

FAQs

QuickBooks Solopreneur builds upon the foundation laid by QuickBooks Self-Employed. They both target one-person businesses, but Solopreneur offers a more streamlined and enhanced experience. This includes a smoother setup process to get you started quickly. You can also expect better organization and management of your business transactions and added productivity tools.

No, because Intuit has discontinued it. However, if you were already subscribed to QuickBooks Self-Employed, Intuit is still supporting existing users, so you can continue using it.

There currently isn’t a direct data migration option available. Therefore, it’s important to consider your needs. If you require historical data for future reference or tax purposes, it might be best to stick with QuickBooks Self-Employed for now. If you’re comfortable starting fresh and prioritizing the more user-friendly features of QuickBooks Solopreneur, you can make the switch.

Unfortunately, QuickBooks doesn’t currently offer a direct upgrade path from QuickBooks Solopreneur to other QuickBooks Online plans. This is because Solopreneur is a separate product with a different structure. However, you can transition to a different QuickBooks Online plan by canceling your QuickBooks Solopreneur subscription and then getting a QuickBooks Online plan. You’ll need to start fresh with your data entry since you’ll be switching products.

Bottom Line

QuickBooks Solopreneur is a solid option for one-person businesses seeking a user-friendly financial management tool. While it may lack advanced features for complex businesses, its core functionalities exist in simplifying expense tracking, invoicing, and tax estimation. If you prioritize ease of use and affordability and don’t need robust accounting features or in-depth customer support, QuickBooks Solopreneur is worth considering.