To determine which payroll training options are best for you, it’s important that you first evaluate what you need to learn. As a business owner, if you run payroll for employees, you can spend little to no money learning with online resources. If you have a payroll clerk who needs to level up their skills, an advanced payroll program might be more appropriate. There are also plenty of online course platforms that offer a low-cost payroll curriculum created by payroll experts.

Read on for how to get the best training for payroll for your business:

1. Search for Free Online Payroll Content

We recommend starting your payroll training by searching for free resources online. There are tons of free articles and online content that can help you start your journey toward getting the best payroll training for your small business. For instance, Fit Small Business provides robust articles on how to do payroll, payroll security, payroll laws and regulations, payroll tax rates, payroll software integrations, and so on. Together, these will help you establish a firm payroll foundation before diving into more complex topics.

If you want to learn how to do payroll with some of the most common small business software, check out the articles below for a step-by-step tutorial:

- How to Do Payroll With Gusto

- How to Run ADP Payroll

- How to Do Payroll With OnPay

- How To Run QuickBooks Payroll

- How to Do Payroll With Patriot

- How to Run Payroll With Rippling

2. Sign Up for a Payroll Certification Program

A payroll certification program can cost anywhere from $100 up to thousands of dollars per program, but it can solidify your understanding of concepts like federal labor laws and state regulations, ensuring you’re up-to-date on industry rules.

Here are the most reputable providers of payroll certification programs that you can take:

Udemy is a massive open online course (MOOC) that caters to millions of students worldwide. It has over 210,000 online courses with over a dozen basic to advanced payroll-related programs, such as payroll accounting, effective bookkeeping and payroll, and payroll management. Aside from instructional videos, many of the courses will give you access to downloadable resources (PDF and Excel formats), full lifetime access, and a certificate of completion. There’s also a 30-day money-back guarantee if you are not satisfied.

If you’re a payroll beginner, we recommend the Effective Bookkeeping and Payroll course. This is aimed toward entry-level bookkeepers who want to learn how to create an effective and reliable bookkeeping system with payroll management. As of this writing, this course has a 4.6 out of 5 rating on the platform and can be purchased for $129.99. Note that pricing can change (it can go to as low as $18.99), depending on the discount promotions offered.

The following courses are also great options for those who are new to payroll:

- Understanding Payroll for Beginners: $44.99, with a 4.3 out of 5 rating

- Covers minimum wage requirements, overtime pay calculations, payroll taxes, and the difference between employees and independent contractors

- Business Basics No. 1: Payroll Fundamentals: $79.99, with a 4.6 out of 5 rating

- Covers the basics for running payroll—from calculating earnings to determining which taxes to apply and knowing the difference between mandatory and voluntary payroll deductions

For experienced bookkeepers wanting to add payroll to their list of service options, we suggest taking Udemy’s Payroll Accounting course. It has a 4.3 out of 5 rating and costs $79.99 at the time of this publication, but pricing also fluctuates depending on the discount promo on offer. This course covers payroll legislation, generation of payroll registers and earning reports, calculation of payroll tax withholding (like federal income tax (FIT), Social Security, and Medicare), payroll journal entries, and payroll tax forms like Forms 941, 940, W-2, or W-4.

Since Our Last Update:

The American Payroll Association (APA) has merged with the Global Payroll Management Institute (GPMI) and is now known as PayrollOrg (PAYO).

PayrollOrg (formerly the APA and GPMI) provides education, training, and resources for payroll professionals. It offers educational opportunities like webinars, interactive virtual sessions, online training, in-person seminars and events, and custom in-house training programs. Its courses and webinars cover a wide range of payroll topics, from basic payroll calculations to federal and state rules and regulations.

PayrollOrg offers membership for $298 per year, plus a $35 enrollment fee for new members. Its members receive significant discounts on all payroll training, conferences, webinars, web-based programs, online training, and publications.

Aside from training and seminars, PayrollOrg also offers self-guided study programs to prepare you for its certification exams and paid publications you can purchase to use as references in your payroll career. It also has two certification programs: Fundamental Payroll Certification (best for entry-level payroll professionals) and Certified Payroll Professional (best for practicing payroll professionals not less than three years). The FPC and CPP exams are offered twice each calendar year in the US and Canada, but internationally, it is available year-round.

If your company is using QuickBooks Online, consider adding QuickBooks Payroll to your plan. By including it in your existing subscription, you will have access to the same system you use to manage your business’ books. To know more about its features, check out our QuickBooks Payroll review.

You can also sign up for QuickBooks training (live classes and self-paced training), attend webinars, and be part of a community to get answers to QuickBooks questions and tips from experts. These resources provide training for QuickBooks Online and QuickBooks Payroll. The QuickBooks Certification program allows your payroll employee to master the basics up to the more advanced tools that will make them a reliable QuickBooks resource.

Although provider-specific, ADP’s certification and training provide instruction on utilizing its software, creating manual checks, using payroll reports, entering pay data, and reviewing payroll results for accuracy. This provides a good foundation for payroll training.

More than learning how to do payroll using ADP, its Professional Certification Program aims to validate your knowledge and proficiency using ADP solutions, including confirming your level of payroll competency and skill. You can become certified in ADP’s payroll, time and attendance, and/or human resource solutions. The exams range from $295 to $595. Many of the best payroll services don’t offer certification for their products, so ADP’s program is a good opportunity to boost your credentials.

If your midsize to large business is in the market for new payroll software, consider ADP Workforce Now. It’s an online platform that combines payroll, benefits, time and attendance, and human resources under one umbrella. Call today for a free quote.

3. Improve Your Excel Skills

When it comes to doing payroll, your math aptitude also counts since you’ll need to translate hours worked into dollars, calculate payroll taxes on gross pay, and so on. To do payroll efficiently, being adept with Microsoft Excel provides you with good leverage whenever you do calculations. You can utilize formulas, such as SUM and SUMIF, to add different amounts quickly; it’s akin to using a calculator.

You can also set up a payroll template with multiple tabs and use a VLookup function to link them together for more advanced calculations. Pivot tables, charts, and conditional formatting are also good analytical tools. You can find many online videos, webinars, and articles that teach you these skills for free.

For a free tutorial and Excel payroll template, check out our guide on how to do payroll in Excel.

4. Watch YouTube Videos

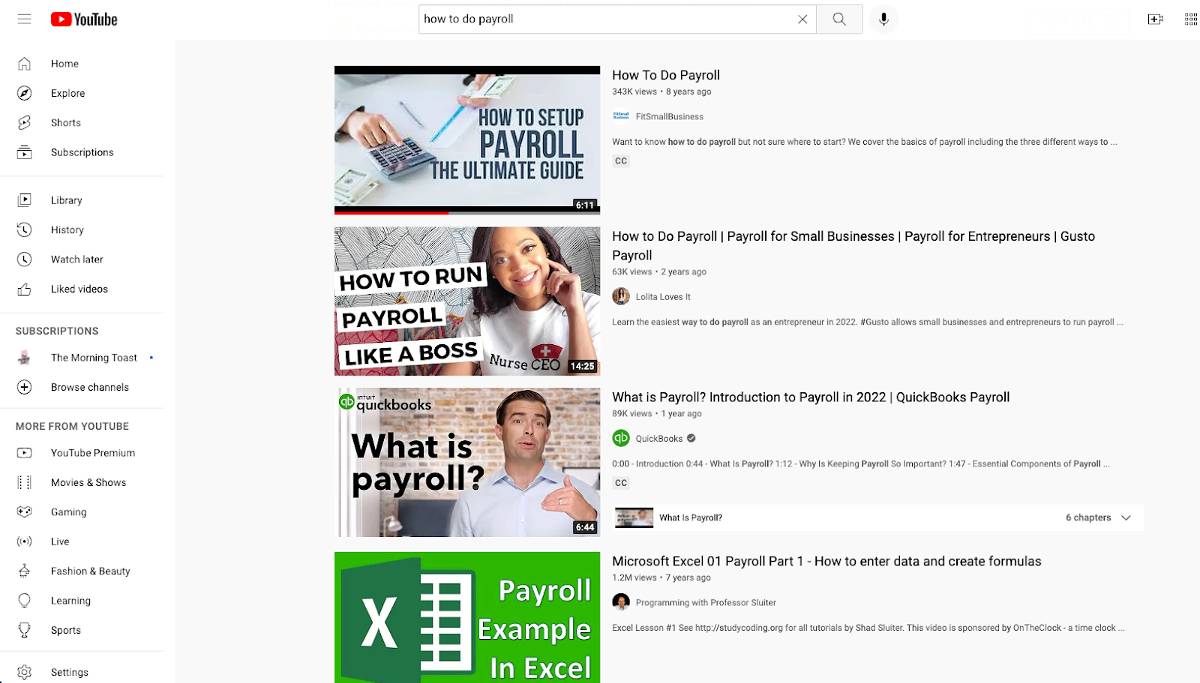

If videos are your preference, you can skip Google altogether and go directly to the YouTube website. This ensures that all of the information you receive is in video format. You can see when the video was initially published, along with the number of views it has. Check the sources and confirm they are reputable and up to date.

One factor we consider when deciding which videos are worth watching, aside from who the publisher is, is the number of views. Typically, although not always, informative videos that have a large number of views are more reputable. You can always look at the comments below the video for instant insight into what other viewers think about the video content.

YouTube dashboard with “How to do Payroll” search key phrase (Source: YouTube)

Also, once you select a video to watch, you can click on the publisher’s logo, and YouTube will take you to the publisher’s main page. You’ll be able to see how many users are subscribed to the channel, links to other videos the publisher uploaded, and, if available, a link to the publisher’s website. You can also set the filter based on upload date, view count, and ratings.

Fit Small Business has more than 33,000 subscribers and provides YouTube content for small businesses, including articles and tutorials on how to do payroll. Check out our payroll video library.

5. Familiarize Yourself With Payroll & Labor Laws

When you think of payroll, it’s easy to visualize paychecks and tax calculations, but it encompasses much more than that. Even once you learn how to calculate an employee’s check properly, you’ll still be responsible for complying with labor laws set by the DOL and state agencies. For instance, the Federal Labor Standards Act (FLSA) regulates the minimum amount you can pay employees, how to pay overtime, and the number of hours that minors are allowed to work.

For more details regarding labor laws, both federal and on a state-by-state basis, check out our state payroll guides. We break down everything you need to know, specific to each state.

6. Encourage Payroll Mentors & Employee Shadowing

As a small business owner, it’s important that you encourage your newer payroll team members to seek help and guidance from more-established staff. This is a great way for them to get accustomed with your process and also learn payroll best practices from the top down. Payroll managers are some of the best resources for figuring out what you need to do to be promoted within the company. Aside from their extensive experience, they know what your strengths and weaknesses are as well as the needs of the company.

If your employees are working in a department other than payroll but are interested in building a payroll career, allow them to shadow the payroll team to gain insight. As a business owner, this can be helpful as it can help you gain more resources for your payroll department, which can help when you’re short-staffed or need more help immediately.

Bottom Line

Depending on your goals, the best payroll training for your business might be as simple as watching free YouTube videos on payroll processing or as challenging as enrolling personnel in an advanced payroll certification course. It’s important to weigh your options and choose a path that aligns with your goals.