Adyen is a merchant services provider, acquirer, payments processor, and payment gateway service based in Europe. It offers international and local payment methods for 37 countries worldwide for online and in-person sales. While there are no monthly fees, Adyen imposes a $120 minimum transaction fee. Rates are a mix of interchange-plus pricing for major credit cards and flat rate for other types.

We gave Adyen an overall score of 3.19 out of 5 in our evaluation of best merchant services providers (it didn’t make our list of recommended providers). Adyen is more of a developer-friendly platform, except it provides a dedicated merchant account, so it’s best for tech-savvy, midsize businesses that won’t mind a monthly sales requirement.

Adyen at a Glance

Pros

- No monthly, setup, or cancellation fees

- Dynamic currency conversion

- Strong multichannel features

Cons

- Monthly minimum sales requirement

- Limited invoicing

- Not-so-user-friendly setup

When To Use Adyen:

- For international payments: Adyen supports cross-border payments

- For savings on automated clearing house (ACH) and credit card sales: Interchange rates for major credit cards; low rates with 0 cap on ACH.

- As an alternative to Stripe: Adyen is often compared to Stripe

When To Use an Alternative

- Small startups: Consider providers that offer free merchant accounts.

- Simple setup: Opt for simple plug-and-play payment gateways.

- Built-in point of sale (POS): Consider all-in-one solutions like Square or Shopify

Adyen Deciding Factors | |

|---|---|

Supported Business Types | Flexible Retail, professional services, and ecommerce |

Standout Features |

|

Monthly Software Fees | Competitive $0 (but requires a $120 minimum monthly invoice) |

Setup and Installation Fees | $0 |

Contract Length | Month-to-month |

POS Options | Integrates with most POS; supports custom-made POS |

Payment Processing Fees | Very competitive

|

Customer Support |

|

Best for | Brick-and-mortar small and startup businesses with low-volume sales | Small tech-savvy businesses that need flexibility | Individuals who need a reliable solution for occasional payments |

Monthly fee | $0 | $0 | Starts at $0 |

Card present | 2.6% + 10 cents | 2.7% + 5 cents | 2.7% |

Card not present | 3.5% + 15 cents | 3.4% + 30 cent | 3.5% + fixed fee |

Ecommerce transaction fee | 2.9% + 30 cents | 2.9% + 30 cents | Starts at 3.4% + 30 cents |

Are you looking for the lowest rates? The payment processing rates you will pay can vary based on your business’ size, type, and average order value. To find the most affordable option and compare multiple processing rates, read our guide on the cheapest credit card processing.

Adyen is a direct processor that also offers payment processing tools directly to merchants. Overall, it is a very competitive payments processing service—with strong credit card processing and ACH payments, plus multichannel payment management features. Adyen did not make our list of best international merchant accounts, but this provider does support dynamic currency conversion and local payment methods for more than 30 countries.

While it is often compared to Stripe because of its developer-friendly features, Adyen comes out as slightly more affordable in terms of transaction fees, and more secure with its wider range of fraud prevention tools. It also provides a dedicated merchant account, which protects merchants from unnecessary withholding of funds. Learn more about merchant accounts.

Meanwhile, these same features, plus the application process, lack of a mobile payment app, and minimum monthly sales requirement, which ultimately cancels out the zero monthly fees, all point to midsize and large businesses. Small merchants and startups on a budget will be better off with payment processors that offer easy signup, free merchant accounts, simple payment setup, and built-in POS software.

It’s always good to see direct processors like Adyen offer pay-as-you-go terms, interchange rates, and zero monthly fees to SMEs. However, it lost partial points for non-automated volume discounts and chargeback fees (like most payment processors). You can use your own hardware although assistance is limited if you do so. You can also opt to purchase from Adyen’s list directly. Larger businesses may get a payment plan along with custom rates.

Adyen Payment Processing

Adyen’s payment processing fees pricing can be somewhat confusing but competitive overall. What’s unique, though, is that it does not distinguish between online and in-person payments. Instead, rates vary based on card brand. Even fees for digital payment methods vary according to the card network.

The following is a summary of Adyen Payments rates and fees for North America and Global:

Adyen Processing Fee | Online/Ecommerce | In-person/POS | |

|---|---|---|---|

Visa | 12 to 13 cents* | Interchange ++ | Interchange ++ |

Mastercard | 12 to 13 cents* | Interchange ++ | Interchange ++ |

American Express | 12 to 13 cents* | North America: 3.3% + 10 cents Global: 3.95% | North America: 3.3% + 10 cents Global: 3.95% |

Discover | 12 to 13 cents* | 3.95% | 3.95% |

JCB | 12 to 13 cents* | 3.75% | 3.75% |

Diners Club | 12 to 13 cents* | 3.95% | 3.95% |

PayPal | 12 to 13 cents* | PayPal Rate | PayPal Rate |

Amazon Pay | 12 to 13 cents* | 0.8% plus Interchange ++, or 0.8% + 3.95% | 0.8% plus Interchange ++, or 0.8% + 3.95% |

Apple Pay | 12 to 13 cents* | Card Network Rate | Card Network Rate |

Samsung Pay | 12 to 13 cents* | Card Network Rate | Card Network Rate |

Google Pay | 12 to 13 cents* | Card Network Rate | N/A |

*Note that Adyen’s standard processing fee converts from the euro to US dollars at around 12 cents to 13 cents based on the latest currency conversion rates.

This is the same as interchange-plus pricing where:

- Interchange: Paid to card issuing bank

- First “+”: Scheme fee that goes to card networks (Visa/Mastercard)

- Second “+”: Acquirer fee that goes to the merchant’s bank (in this case Adyen; fee starts at 0.6%)

In this case, Adyen is both the acquiring bank and payment processor. So, in simple terms:

- Adyen (as an acquirer) charges an acquirer fee that starts at 0.6%, and

- Adyen (as a merchant services provider/payment processor) charges a markup of 12 cents to 13 cents

Adyen charges a 12-cent to 13-cent processing fee plus a varying payment method fee (for all transactions including ACH). Payment method fee is based on card scheme—where major credit card brands are charged an interchange-plus rate plus Adyen’s acquirer fee (from 0.6%) while other card types are charged a flat rate (some like Discover can have interchange ++ rates in certain conditions). Online payment methods like Apple Pay, Google Pay and Amazon Pay also carry fees based on the card used.

Other payment methods supported by Adyen are:

- ACH direct debit: 13 cents plus 27 cents markup per transaction

- PayPal Online and PayPal POS: 13 cents per transaction plus PayPal rates

- Debit card payments:

- Maestro: 13 cents per transaction plus Interchange ++

- PaySafe card: 13 cents per transaction plus 10% to 12% depending on merchant type

- Buy-now-pay-later (BNPL) platforms:

- Affirm: Affirm rates plus 13 cents per transaction

- Afterpay: 4.99% plus 30 cents plus 13 cents per transaction

- Klarna: 4.29% plus 30 cents plus 13 cents per transaction

- Zip: 4.99% plus 30 cents plus 13 cents per transaction

- PayPal Credit: PayPal rates plus 13 cents per transaction

Adyen also supports gift cards and local payment methods. Rates will also vary based on country. Visit Adyen for a complete list of its transaction fees.

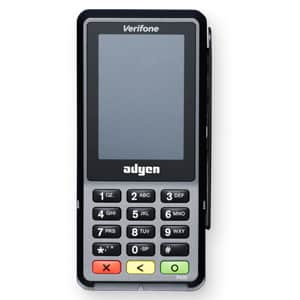

Adyen Hardware

Merchants can use their own hardware and integrate it with Adyen’s payment system. However, there does not seem to be much support apart from software installation. Meanwhile, Adyen also provides a series of payment terminals. It offers everything from iOS and Android-compatible mobile card readers to countertops and self-service kiosks. However, Adyen pricing for these is not disclosed on its website so you will need to contact its sales team to confirm prices.

| Best for: Mobile payments

|

| Best for: Standalone POS

|

| Best for: Standalone POS

|

| Best for: At the counter sales

|

| Best for: Mobile in-store and at the counter sales

|

| Best for: At the counter sales with CRM tools

|

| Best for: NFC payments and Self-checkout

|

You can also visit Adyen for a complete list of its POS payment terminals.

Hardware-free Mobile Payments

Are you looking to accept payments without investing in additional hardware? Thanks to the latest advancement in payment technology, mobile payment apps and digital wallets are now capable of processing payments even if you don’t have a mobile card reader.

While Adyen does not have a native mobile POS app, it integrates with digital wallets that can scan and recognize quick response (QR) codes through a smartphone camera so that customers can access payment links to complete their in-store purchases. Adyen also supports tap-to-pay on iPhone—an upcoming contactless payment method that can function without a mobile card reader or the presence of a physical credit card and works by using near-field communication (NFC) on your payment terminal and the customer’s iPhone.

Contract & Terms of Service (TOS)

Adyen Payments does not lock you into a long-term contract or impose closure fees. However, it does require you to have a monthly minimum invoice of $120, which means this is the least possible amount that you will pay Adyen every month. It also sets a chargeback rate limit of 0.5% which is significantly lower than the standard 1%. This means Adyen allows fewer incidents of chargebacks before imposing fees, suspensions, or even terminating your merchant account.

Other things to consider in Adyen’s terms of service are:

- You are required to inform Adyen Payments two months in advance of your intention to cancel the service.

- Adyen will impose a nonrefundable chargeback fee for each disputed transaction. No chargeback protection scheme is mentioned in the terms of service, so ensure that you ask about this from Adyen’s sales representatives.

- Hardware purchased from Adyen Payments only carries a four-month limited warranty.

- Adyen reserves the right to raise its payment processing fees three months after providing notice to its merchants.

- Adyen Payments require merchants to set up a reserve account to cover fees and other liabilities arising from normal business operations while using Adyen’s merchant services. Adyen determines the amount of deposit to be maintained on the reserve and may be increased at any time.

- Deposits to your reserve account will only be released six months after the termination of the contract.

Setup & Application

The most important note to point out when applying for a merchant account with Adyen is that it requires you to set up a test account on its platform and then set up integrations before getting approved. This means having to work with code to have your system already connected to Adyen without being entirely sure if you will be provided with a merchant account. Small businesses, particularly startups without any access to such technical skills will find this challenging and likely discouraging.

That said, Adyen details the application process as follows:

- Step 1: Contact Adyen’s sales team.

- Step 2: Create a free test account.

- Step 3: Build your integration.

- Step 4: Apply for a live account.

- Step 5: Sign the contract and get details for your live account.

- Step 6: Configure settings for your live account.

The integrations required are to test the compatibility of your current setup with Adyen’s tools for making test payments, inviting team members, and adding platforms.

Required documents when applying for a merchant account:

- Company registration document

- Merchant bank statement (optional)

- Proof of identity

To accept payment online, you will also need to provide Adyen with:

- URLs to either your live website or a test deployment

- Details of your terms and conditions

- Details of your subscription and free trials

- Details of your refund and privacy policy

- Customer checkbox agreeing to your terms and conditions, refunds, and cancellation policy

- Delivery and contact information

- Checkout and payment process information

Adyen supports highly customizable online payment options and has recently added in-person payment tools for both mobile and countertop setups. However, it lacks a native mobile payment app, invoicing, recurring, and business-to-business (B2B) payment processing tools, so merchants that need this feature will have to put in additional effort with third-party integrations or custom design that requires coding.

Adyen provides merchants with a range of online payment integration options that allow you to process card-not-present transactions through Adyen’s application programming interface (API):

- Pay by Link: Adyen-hosted checkout pages can be customized through a set of tools provided on the Adyen Payments platform and embedded on emails, webpages, and social media sites.

- Drop-in: For developers looking to create a full checkout to add to your website. This form contains fields that collect payment details and submits this information securely to Adyen’s secure payment gateway.

- Component: For developers looking for a more flexible checkout option that can be added to a website, on a mobile app, or as a link to collect a per-payment method basis transaction.

Adyen supports standalone, terminal API, and third-party payment terminal integrations. This flexibility provides merchants with the option to choose based on their required level of mobility, customization, and additional hardware and software requirements. Those who select a payment terminal that requires a SIM card to process transactions will be provided with one by Adyen in conjunction with the hardware that will remotely activate once the contract starts. However, note that the use of a SIM card will tie merchants into a one-year contract.

Adyen works with a range of popular digital wallets, such as Apple Pay, Google Pay, Samsung Pay, and Amazon Pay. It even supports Alipay and WeChat Pay in the US for those who prefer these platforms. Not only do these wallets provide merchants with the ability to accept remote payments with the latest advancements in payment technology but they can now be used for in-person payments as well.

Since our last update, Adyen has made Pay by Link available for in-person payments. Merchants only need to create a QR code from their payment terminal, which customers can scan onto their smartphones to initiate payment. This generates a payment link that redirects customers to an online payment checkout to settle their in-store purchases in real time using their preferred digital wallet.

Earlier, we mentioned how Adyen is an acquiring bank (the financial institution powering a merchant’s payment processor that accepts and transfers funds on behalf of the merchant). Adyen also carries local acquiring licenses in multiple countries, which makes it a local bank for these areas. But, at the same time, merchants only need one platform to monitor their transactions coming from any of Adyen’s cross-border locations.

This is an advantage for merchants accepting online, international payments because there is a lesser risk for a customer’s bank to decline a payment request from a local acquirer as opposed to if the payment request comes from an international acquiring bank. What’s more, with a local acquirer, you also get lower fees and faster settlement of funds.

Adyen now integrates with PayPal online (PayPal Business) and PayPal POS (PayPal Zettle) which means any Adyen merchant can add PayPal as an additional payment method from your dashboard seamlessly. As a mobile-first solution, this integration will provide your customers with a simple scan-pay-and-go checkout for faster transactions. It also means larger payment methods, such as PayPal’s Pay Later/ PayPal Credit, and use of international currency as well as cryptocurrency through PayPal’s conversion tools.

You can also accept ACH payments through Adyen. All you need to do is add ACH debit from your Adyen dashboard and include a payment authorization form on your checkout page whenever customers opt to choose this payment method. Customers can then fill it out and send it back electronically to your official merchant email address. Note that Adyen will not be able to process any ACH payment request without the payment authorization form. Download our payment authorization form template for ACH and credit cards.

Adyen supports a number of BNPL platforms including Square’s recently acquired AfterPay and PayPal’s Pay Later app. This allows merchants to offer customers an installment payment option while still getting the proceeds of their sale upfront. However, expect transaction fees to be significantly higher than traditional credit card transactions because of the higher risk.

Adyen’s business management tools are primarily available through third-party paid integrations, its free software is a mobile app for back-end payment management (not for taking payments) and any possible free payment upgrades (except for payment links) come with heavy developer-friendly customizations. Deposit speed is up to two business days, and customer support is business hours only unless it’s an emergency.

Adyen provides dynamic currency conversion, where merchants can sell products and services based on the customer’s currency but receive the sales proceeds in the merchant’s currency. Note that the conversion rate and the DCC fee, which will be specified in the merchant agreement, ranges from 1.2% to 6% (default at 3%) and is charged against the customer. This service is also designed to ask customers to confirm their acceptance of the fees from the POS terminal.

Note that the proceeds of the cardholder DCC fee are shared between the merchant and Adyen according to the merchant agreement.

Adyen also comes with its very own omnichannel features dubbed as “Unified Commerce Solution.” With this functionality, merchants can give their customers the ability to:

- Let shoppers place ecommerce orders in-store and arrange for delivery where stocks are not readily available

- Pay for their payments online while at the counter through payment links

- Return items in your store, regardless of if the product was bought online

- Purchase online and pay in-store upon pick up

Merchants that set up recurring payments processing will be able to store customer credit card information and account updater tools (most likely for an additional fee). This service provides merchants with the ability to request and receive updated payment details automatically through Adyen’s secure system, either in real time or during batch submission. Merchant agrees that any updates to payment details, such as the expiration date of a card, may be used by Adyen to improve or provide payment services on its platform. Adyen Payments impose a fee for using its Account Updater Services, which should be detailed in your merchant application.

Adyen allows merchants to configure payment terminals to process payments even when offline. However, note that you will be required to set a transaction limit allowable for offline payments. You can choose to process transactions within the limit offline by default or attempt to process payments online first, before allowing to accept payments without an internet connection.

You can set up risk rules for multiple risk profiles through Adyen’s RevenueProtect risk management tool, but available profiles will depend on the service option you sign up for. RevenueProtect Basic lets you set up one company-wide profile, while RevenueProtect Premium is ideal if you have multiple merchant accounts which require different acceptable risk levels. A risk profile is already set by default, which you can configure manually and assign company-wide. You can create additional risk profiles with Adyen’s set of tools.

What’s good about Adyen is that it supports payouts in different currencies and does not charge currency conversion if the currency of your sales proceeds and the currency of your business bank account are both supported by the payment method. However, Adyen payouts take up to two business days, depending on the currencies and bank involved. There is no indication of same-day and next-business day funding available, even with a fee.

Adyen provides numerous payment integration options, including options for local payment methods available based on your customer’s location. There are 77 local online payment options and 27 local in-person payment integration options available for Adyen merchants globally.

Through its flexible API tools, Adyen can also support a wide range of platform and marketplace integrations. That said, it’s important to note that most users find Adyen not so easy to set up because of these requirements.

Merchants are provided customer support via email, web, and telephone during business hours, and are available in English, German, and Dutch. Emergency support is also available 24 hours a day. The website also provides a knowledge base for troubleshooting and a complete guide for its suite of developer tools for setting up payment processing integrations and business management functionalities.

However, note that Adyen’s knowledge base consists of guides for both its subprocessor and direct merchant clients. You will need to get used to this to sort through and find the right answers to your questions.

While Adyen offers some of the best features for just about any type of payment, our evaluation focuses on the overall compatibility of a provider for smaller businesses.

I like how Adyen can offer interchange-plus pricing without the monthly fee, and it is less expensive to use compared to Stripe even with the imposed minimum $120 invoice per month. Meanwhile, we prioritize simple transparent pricing in our evaluation so small businesses can monitor their cost of operations easily, which Adyen (somewhat like PayPal) does not deliver.

Small businesses may also find it difficult to set up an Adyen merchant account. On top of a required application and approval process, merchants are expected to configure their system with Adyen from a test account that requires a great deal of coding and configuration. Aside from payment links and ecommerce integration, setting up popular payment methods, such as invoicing, recurring payments, and mobile POS apps all require a software developer to set up.

Taking all of these into consideration, it’s clear that Adyen is a better fit for a more established, midsize business with the resources to take advantage of this provider’s customization tools to maximize its savings. I would recommend smaller businesses with payment solutions that are easy to set up, with ready integrations, affordable payment processing, and features that match its needs.

What Users Say in Adyen Reviews

Almost a year from our last update, there are still very limited Adyen reviews online. The total number of user ratings increased by around 12 for both G2 and Capterra, but the new scores have gone down from 3.6 to 3.3 and from 5 to 4.8, respectively.

The latest feedback says that users are happy with Adyen for its range of features although it can be quite expensive for smaller merchants. Meanwhile, it’s also interesting to note that some merchants accepting international payments find Adyen somewhat lacking in customizations. Some agree that integration and paperwork affect the migration process from one merchant service to another considerably:

- G2: 3.3 out of 5 stars based on around 25 reviews.

- Capterra: 4.8 out of 5 stars based on around 15 reviews.

Most Adyen Payments users have this to say about the provider:

| Users Like | Users Don’t Like |

|---|---|

| Very customizable and easy to use once set up | Hardware and software issues |

| Makes it easy to accept international payments | Hard to contact after-sales customer support |

| Helpful onboarding support | Expensive for small merchants |

Methodology—How We Evaluated Adyen

We test each merchant account service provider ourselves to ensure an extensive review of the products. We compare pricing methods, identifying providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. We then further evaluate according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use―including account stability―popularity, and reputation among business owners and sites, such as the Better Business Bureau (BBB). Finally, we considered how well each system works with other popular small business software, such as accounting, POS, and ecommerce solutions.

Adyen Review Frequently Asked Questions (FAQs)

Adyen does not charge a monthly fee, nor does it impose setup or cancellation fees. However, merchants will have to agree to a minimum invoice of $120 per month, which means this is the least possible amount that you will pay Adyen.

While both Adyen and PayPal offer international payments processing and easy currency conversion features, they cater to very different merchant types. PayPal is more ideal for occasional or seasonal solopreneurs while Adyen is a better fit for midsized companies.

As with PayPal, Adyen is often compared to Stripe. Both providers offer international payment processing and strong customization features through software developer coding—you can design Adyen and Stripe to do sophisticated functions with them. However, Stripe is not a traditional merchant services provider. It aggregates merchants in one single account, so there is no application required and setting up is much faster. However, this makes Stripe more likely to withhold funds or even suspend accounts compared to Adyen.

Adyen offers some of the most sophisticated fraud prevention and detection features that rival―and even exceed―Stripe’s fraud prevention tools. As an acquirer bank with licenses in several countries, Adyen can provide the highest rate of payment approval for businesses that accept international payments and helps protect merchants from the risk of chargebacks.

Bottom Line

All Adyen reviews you find online will agree that Adyen is a strong alternative to Stripe―and Adyen pricing is more affordable to small merchants at a certain point. However, the requirement to set up all of its integrations before approval can be too complicated for the average merchant. As such, unless they have the technical resource to set up integrations, it’s difficult to recommend Adyen for small businesses, especially new ones. Instead, consider merchant provider alternatives like Stripe and PayPal, which may be much easier to set up for beginners.