Adyen and Stripe are popular international payment processors with ecommerce tools, strong integrations, and in-person card terminals. Stripe, however, has more extensive integration options, better rates for non-credit card payment methods, and a slightly larger international reach. Meanwhile, Adyen offers independent merchant accounts for better stability, interchange-plus pricing for credit cards, and a more unified experience for multichannel sales.

Key Takeaways

- Stripe is ideal for businesses of all sizes, and especially when it comes to international payments, ease of use, and user reviews.

- Adyen is best for medium to large businesses, and has the edge when it comes to affordability and payment security.

- Stripe and Adyen are at par with each other when it comes to payment types accepted and ecommerce use.

When to Use an Alternative: Helcim Helcim has paid for this placement. However, our team of experts approved Helcim as an appropriate alternative and our content remains 100% editorially independent.

High-volume businesses might find Helcim a better option with its zero monthly fees, interchange-plus pricing, automatic volume discounts, all-in-one hardware, and an option to opt for ACH payments or pass-on credit card fees for bigger savings. Visit Helcim to learn more, or see how it compares below.

Adyen vs Stripe Comparison

Both Adyen and Stripe are excellent choices for payment systems and are similar in tools and functionality. Both have global reach, reasonable transaction fees, and great versatility in multichannel sales.

Adyen has the advantage of interchange-plus pricing for credit cards and independent merchant accounts. This means cheaper credit card processing fees and fewer issues of withheld funds. In fact, you can manually select independent payouts or create a schedule. However, its application process takes longer, and it does not offer as many integrations, languages, and payment methods as Stripe.

Stripe only offers interchange-plus pricing to high-volume sellers, but its transaction rates are overall cheaper when accepting non-Visa and non-Mastercard brands. It reaches more countries and integrates with more third-party apps but requires some tech-savvy skills. Unlike Adyen, Stripe puts all its customers into a combined merchant account; this means you can get started immediately, but you’re more likely to encounter frozen fund problems.

Looking for a free POS system? Neither Stripe nor Adyen is a strong choice for in-person sales and microbusinesses. In these cases, we recommend Square, which offers competitive rates and a free POS system that works for hobbyists and small businesses. Read our Square Payments review to learn more.

Most Affordable: Adyen

|  | |

|---|---|---|

Monthly account fee | $0 | $0 |

Monthly minimum | $0 | $120 |

Card-present transaction fees | 2.7% + 5 cents | Interchange + 13 cents for Visa and MC, 3.3% + 23 cents for AmEx, 3%–3.95% + 13 cents for other card brands |

Ecommerce transaction fees | 2.9% + 30 cents | Interchange + 13 cents for Visa and MC, 3.3% + 23 cents for AmEx, 3%–3.95% + 13 cents for other card brands |

Invoicing fee | 0.4%–0.5%, 25 free/month; 0.5%–0.8% recurring bills | None |

ACH fee | 0.8%, $5 cap | 13 cents plus 27 cents markup per transaction |

Digital wallet payments | 2.9 + 30 cents for all touchless payments, additional 10 cents per authorization for tap to pay | Depends on card used for PayPal, Apple Pay, Google Pay, Samsung Pay, 0.8% plus Interchange ++, or 0.8% + 3.95% for Amazon Pay |

Chargeback fee | $15, non-refundable | Undisclosed, non-refundable |

Special rates for nonprofits | Custom, discounted | None |

Interchange-plus fees | For high-volume merchants (Contact Stripe) | For Visa, Mastercard, Maestro, most digital payments, occasionally Discover and Diners Club, and JCB |

Card reader and terminal pricing | $59–$349 | Use your own or purchase (pricing not disclosed) |

When comparing Adyen vs Stripe fees, Adyen is overall the cheaper option, despite the higher fixed-rate pricing on some of its payment methods. That’s because, for credit card payments, you pay only the interchange rate charged by the banks with a small processing fee added on, which is 13 cents. This rate varies by issuing bank and type of card but is generally well below Stripe’s flat rates.

The platform is also cheaper when it comes to ACH debit transactions, charging only 40 cents (13 cents as acquirer fee, 27 cents as markup) per transaction, whereas Stripe charges 0.8% with a $5 cap. Adyen does not charge extra for invoices (but Stripe’s invoicing program is more robust). Despite Adyen’s affordability, it has a monthly minimum transaction volume of $120, making it unsuitable for micro and small businesses that may not consistently reach this minimum.

Unfortunately, Adyen no longer advertises its hardware pricing. The two are evenly matched when comparing individual card readers. Adyen, however, has a wider variety—and thus, likely a broader price range.

When Stripe Is Cheaper

At Adyen’s current fixed rates, Stripe is always cheaper for card-present transactions. Looking past the credit cards where Adyen provides interchange-plus pricing, Stripe is the cheaper option for transactions over $180. Finally, Adyen has a minimum monthly invoice requirement of $120; Stripe has no lower limit for the fees it collects in a month. If you are a smaller business that accepts a wider range of credit card brands, Stripe is the better option.

Best for Payment Types: Tied

|  | |

|---|---|---|

Payment methods (non-credit card) | Varies by country | Varies by country |

Credit cards supported | 9 | 8 |

Payment types | Credit card, debit card, contactless payments, ACH debit and credit, checks, cash | Credit card, debit card, contactless payments, ACH, checks, cash, PayPal |

Buy Now Pay Later | Affirm, Afterpay/Clearpay, Klarna, credit card installments | Affirm, Afterpay/Clearpay, Klarna, PayPal, Zip, credit card installments |

Cash-based vouchers | OXXO, Boleto Bancário | OXXO, Boleto Bancário |

Multicurrency payments | ✓ | ✓ |

Cryptocurrency payments | ✓ | ✕ |

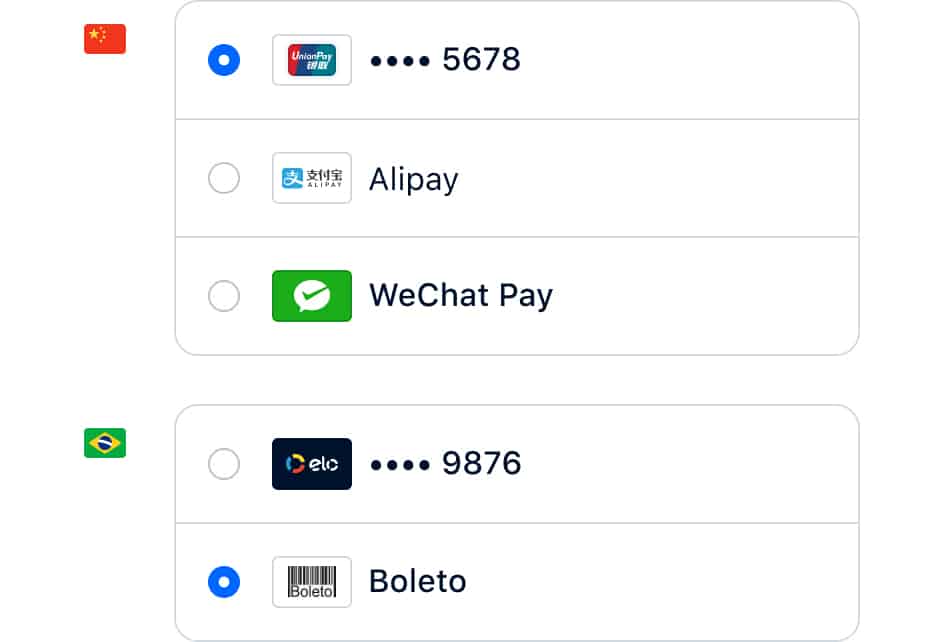

It’s difficult to pick a winner for payment types because Adyen’s depends on what region you are in. Europe has far more options than the US, for example, while Stripe does not make a distinction. Each processes something the other does not. Stripe, for example, can process checks, while Adyen handles Samsung Pay.

The one standout is that Adyen will process PayPal, whereas Stripe does not, charging a simple 12–13 cents markup per transaction on top of PayPal rates. However, PayPal lets you create a free account and add it to any checkout, so this is more a matter of convenience.

Best User Reviews: Stripe

|  | |

|---|---|---|

Capterra | 4.7 out of 5 (2,000+) | 4.8 out of 5 (10+) |

G2 | 4.3 out of 5 (270+) | 3.3 out of 5 (20+) |

GetApp | 4.7 out of 5 (2,900+) | 4.8 out of 5 (10+) |

Software Advice | 4.7 out of 5 (2,900+) | None |

TrustRadius | 8.4 out of 10 (310) | 9 out of 10 (20+) |

Users Like | Easy to use Wide integrations Safe and secure | Convenient international payment processing Fraud protection tools Responsive customer support |

Users Don’t Like | Payment for fraud management tool (Stripe Radar) Transaction fee adds up and can be costly Slow chat support | Complex integration Outdated user interface No free trial |

Despite Adyen edging out Stripe with slightly higher scores on Capterra, G2, and TrustRadius, it’s crucial to consider the volume of reviews each platform has garnered. Stripe, with its significantly larger user base, has amassed over 2,000 reviews on Capterra and 2,900 reviews on GetApp, compared to Adyen’s 10 or fewer reviews on these platforms.

The sheer number of reviews for Stripe not only attests to its widespread usage but also provides a broader spectrum of opinions and experiences. It’s often challenging to maintain a high average rating with a larger user base, making Stripe’s consistently positive ratings across multiple review sites even more impressive.

Adyen is not accredited with the Better Business Bureau and has five complaints closed in the last three years. On the other hand, Stripe is BBB-accredited with the highest rating (A+) and has had 960 complaints closed in the last three years.

While Adyen may have secured slightly higher average scores on certain review platforms, the larger volume of reviews for Stripe suggests a strong and positive user sentiment across a diverse user base.

Why Does Adyen Have Fewer Reviews?

One possible reason for Adyen’s fewer reviews could be its target market. Adyen tends to focus on larger enterprises and global businesses, potentially resulting in a smaller user community compared to Stripe, which caters to businesses of all sizes.

Best for International Payment Processing: Stripe

|  | |

|---|---|---|

Currencies | 135+ | 130 |

Merchant countries | 46 | 37 |

Languages | 34+ | 30+ |

Cross-border fees | 1.5% | Free if customer’s currency is supported by the payment method |

Currency conversion fee | 1% | 1.2%–3% |

Taking price out of the equation, Stripe is the best for international payment processing. It’s available to merchants in more countries around the world (46 vs Adyen’s 37) and offers a wider variety of international payment methods, such as iDEAL (Netherlands) and GrabPay (Southeast Asia). Plus, it can process ACH credit and ACH-style transfers for other countries. Its currency conversion fees are less expensive as well.

When comparing Stripe vs Adyen for cross-border fees, it’s difficult to pick a winner. Stripe has a simple, set fee of 1.5%. Adyen does not list a cross-border fee but may instead leave that to the individual credit card company as part of its interchange fee.

Stripe works with merchants in 46 countries, but can process payments for nearly 200. (Source: Stripe)

When to Use Adyen

Adyen processes three major players in the payment game that Stripe does not: PayPal, Samsung Pay, and Maestro. PayPal is the best-known and trusted payment method for online payments internationally. Samsung Pay is a touchless payment system like Apple Pay, popular for mobile payments in Asia, the US, the UK, and elsewhere. Maestro is a leading credit card service for South America.

Another thing unique about Adyen is its local access to multiple countries. Adyen is a direct processor—which means it’s both an acquiring bank (that accepts and transfers funds on behalf of the merchant) and a merchant services provider. Its local acquiring license in multiple countries ensures that merchants are less at risk of being declined a payment request, which costs not only hefty fines but also incurs the danger of having a merchant account suspended.

Best for Ecommerce: Tied

|  | |

|---|---|---|

Payment features | Split tender, discounts, tips, digital receipts, refunds | Split tender, discounts, tips, digital receipts, refunds |

One-click payment | ✓ | ✓ |

Present in local currency | ✓ | Choice (Dynamic Currency Conversion) |

Buy Now Pay Later | Affirm, Afterpay/Clearpay, Klarna, credit card installments | Affirm, Afterpay/Clearpay, Klarna, PayPal, Zip, credit card installments |

Invoicing | Simple, recurring | Third-party integration |

Virtual terminal | Stripe Terminal (with fee) | Mail Order/Telephone Order (MOTO) feature |

Multichannel (eBay, Amazon) | Third-party integrations | eBay |

Social selling (Facebook, Instagram) | Third-party integrations | API |

Integrations | 680+ integrations, including online stores, sales funnels, crowdfunding, email marketing, and more | 100+ in ecommerce, POS, mobile, unified commerce, CRM |

When comparing Adyen vs Stripe for ecommerce, it comes down to the details and what you want from your system. Both have similar features, such as integration with other systems, card terminals for in-person checkouts, and a virtual terminal option. They can also retain customer account information and update card information, making both good for subscriptions and one-time sales.

They also do well for international sales. Stripe offers more languages than Adyen, which does have 30—a good number for the areas it covers. Both even let you present costs in the local currency.

When to Use Stripe for Ecommerce

Stripe is an extremely versatile system, although it’s most powerful for those with programming skills or access to a developer. Here are some of its solutions to help you decide if it’s right for you.

- Stripe Payment Link makes it easy to create a full-featured payment page and share it with customers via any platform, from email to social media.

- Stripe Terminal lets you create a simple, attractive, and full-feature checkout to post on websites. Its third-party integrations make it possible to use Stripe for payment processing on other platforms, like Etsy.

- Stripe Invoicing makes it easy to bill customers.

- Stripe Connect allows you to accept payments and immediately split them among your users. For example, Lyft uses it to collect payments and get its drivers their share immediately.

Stripe Connect makes it easy to gather payments and send commissions or wages to individuals. (Source: Stripe)

When to Use Adyen for Ecommerce

eBay uses Adyen as its payment processor of choice, making it easy for businesses selling on this platform. However, you can use an API for other platforms or check its partner apps for what you need, as Adyen specializes in unifying all your payment platforms. So, while Stripe also works across channels, you may find it easier to have a fully cohesive, omnichannel system with Adyen.

Adyen’s location-based checkouts make it easy to sell anywhere. (Source: Adyen)

Best for Payment Security: Adyen

|  | |

|---|---|---|

Included | Included | |

Fraud prevention | Chargeback protection, advanced machine-learning fraud protection, customizable risk levels, 3D Secure | Chargeback protection, risk assessment, 3D Secure authentication, optimize risk levels |

Transaction security | PCI DSS Level 1, AES-256 encryption, SSAE18 SOC 1 and 2 reports, PSDS2 and SCA Compliant | Tokenization, PCI DSS Level 1, ISEA3402/SOC 1 |

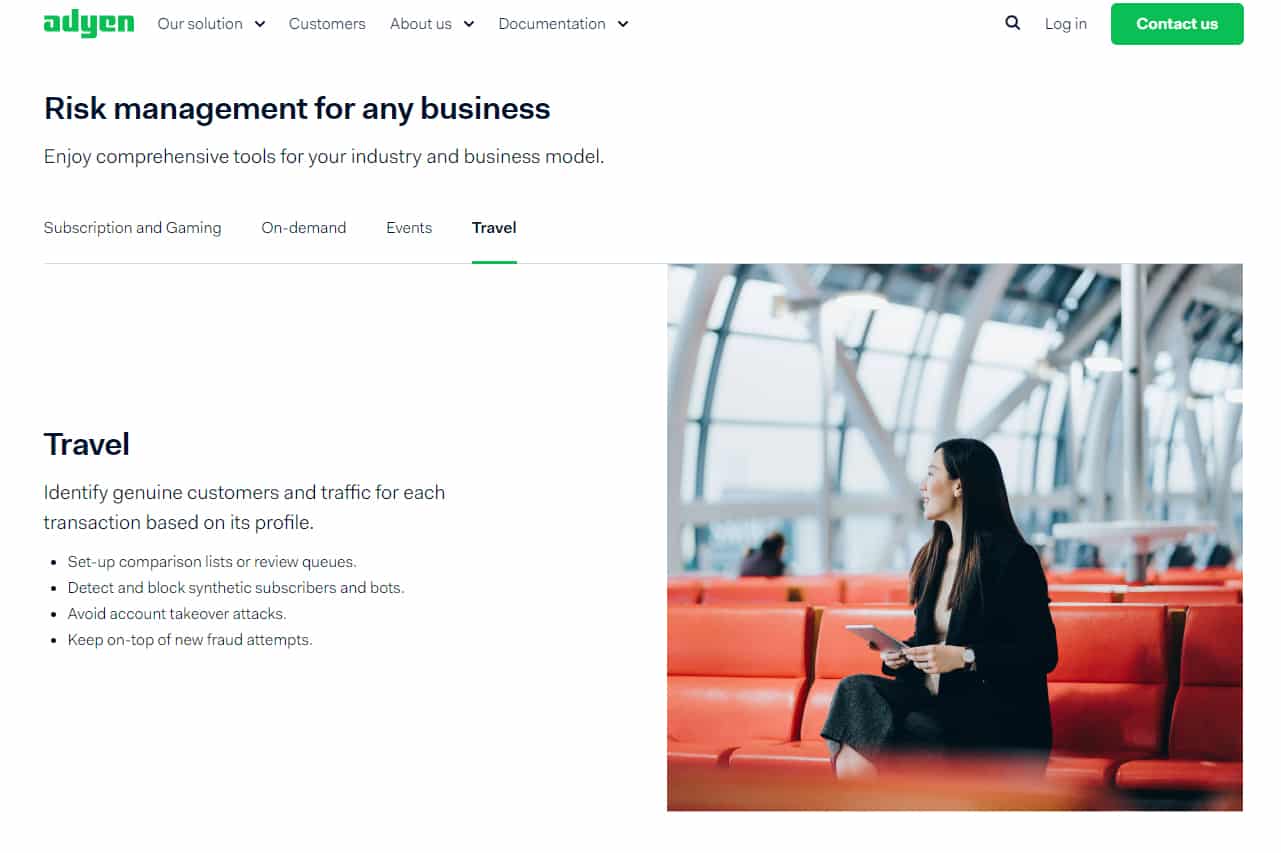

Both Adyen and Stripe offer excellent transaction security, fraud protection, and risk assessment, but Adyen comes out ahead in the number of tools it offers as part of its plans. It also offers risk assessment tools, which can detect and block synthetic subscribers, stop card testing attacks, identify fraudulent domains, and more. Its risk management dashboard lets you monitor fraud and optimize risk procedures. You can create risk rules and block lists.

Adyen offers tools that improve transaction security for many different industries. (Source: Adyen)

When it comes to Adyen vs Stripe in terms of payment security, both offer 3D Secure, which adds a layer of protection to online interactions. It’s required for transactions in the European Union. Both also boast compliance with multiple security programs.

When to Use Stripe

Stripe Radar is fraud protection powered by data from the Stripe network, aided by machine learning to track and adapt to the latest fraud trends. It also offers a version for teams that includes block and allow lists and manual review flows. These cost 5–7 cents per transaction but may be worth it for bigger businesses with a large number of customers or those that do very high ticket sales and prefer additional security.

Best for Ease of Use: Stripe

|  | |

|---|---|---|

Onboarding help | Automated, certified developers (fee) | Account onboarding; training in-person |

Online help articles | ✓ | ✓ |

Customize checkout | ✓ | ✓ |

Video tutorials | ✓ | No |

Customer support | 24/7 | Business hours, ticket |

Frozen accounts complaints | Low | Very low |

Reserves account | ✓ | ✓ |

User ease of use score (2022–2023)* | 4.5 out of 5 | 4.4 out of 5 |

*We looked to third-party user review sites like Capterra, taking into account only the scores in the ease of use category.

When comparing Stripe vs Adyen for ease of use, Stripe comes out ahead. Getting an account only takes minutes, and setting up your tools is easy. There are plenty of resources to assist you, including illustrated help articles, video tutorials, and 24/7 customer and developer support.

Additionally, if you need help with developing an app or integration, it can recommend Stripe-certified developers. Users agree it’s easy to use, and it has an average of 4.5 out of 5 stars on third-party sites.

Is Adyen Hard to Use?

No, Adyen is nonetheless an easy platform, with an ease of use score of 4.4 out of 5, averaged over multiple review sites. It assists you with account onboarding, which is a more involved process since you are qualifying for your own merchant account. The individual merchant account makes it easier to access funds, which is why it has fewer complaints about frozen accounts. (Stripe’s complaints are reasonably low for the size of its customer base.)

Methodology—How We Evaluated Adyen vs Stripe

We considered dozens of processors, narrowing our selection down to the most small business-friendly merchant services providers. We evaluated each across 22 data points divided into the categories of Pricing and Contract, Payment Types, Features, and Expert Score. From our evaluation, we selected the 10 top-scoring payment processors to feature in this guide.

The result is our list of the best merchant services. However, we adjust the criteria for specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for. For this in-depth analysis, we looked closely at how Stripe vs Adyen and how they performed.

Click through the tabs below for our overall online payment processor evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. We also prioritized those that don’t charge hefty monthly fees, cancellation fees, or chargeback fees.

Stripe scored higher in this category with 3.94 out of 5 vs Adyen’s 3.81 out of 5. While it has better transaction rates, Adyen lost points for its $120 monthly minimum. Also, Adyen’s chargeback rate limit of 0.5% is significantly lower than the standard 1% of most payment processors.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and echeck payments, and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Stripe and Adyen are on equal footing in this category, with both scoring 3.75 out of 5. The two providers are known for the wide range of payment types they offer.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same-day or next-day funding earned bonus points. Finally, we considered those offering business management tools, like dispute and chargeback management, reporting, or customer management.

Stripe again took the lead with 3.25 out of 5, while Adyen lagged with 2.19. Adyen’s customer service is limited to business hours, and there are not a lot of free small business tools available.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use―including account stability―popularity, and reputation among business owners and sites like the Better Business Bureau (BBB). Finally, we considered how well each system works with other popular small business software, such as accounting, POS, and ecommerce solutions.

Stripe has a clear lead, scoring 4.69 out of 5, while Adyen earned 3.44—Stripe’s overall pricing and features are more small business-friendly compared to that of Adyen.

Frequently Asked Questions (FAQs)

Click through the sections below for the most common questions around Stripe vs Adyen.

The answer depends on your business profile. Stripe is the better choice for small businesses because it offers flat-rate (predictable) pricing and easy setup. Adyen is a far better option for large businesses with multiple locations that will benefit from a dedicated merchant account.

The main difference between Adyen and Stripe is their target users. Adyen is a direct processor with clients that are mostly resellers and large businesses looking for a dedicated merchant account. Stripe is more small business-friendly and provides aggregate merchant accounts ideal for small businesses.

In some aspects, yes. Both Adyen and Stripe are developer-friendly, with a wide range of customization options. Both also support multicurrency and provide some of the best payment security and fraud detection features in the market.

Bottom Line

When comparing Stripe vs Adyen, it comes down to details of price and use. Both are excellent payment processors with comprehensive tools for online sales plus terminals for in-person checkout. Stripe, however, has a broader global reach and integrations but requires you to be more tech-savvy. Its non-credit card rates are also cheaper. Adyen, meanwhile, has cheaper credit card rates, independent merchant accounts, and more analytics. Regardless of which solution you choose, you’ll get an affordable and easy-to-use payment processor.