The annual back-to-school season has always been a significant event for consumers and retailers alike. And in 2024, the landscape of back-to-school shopping is experiencing notable shifts. With economic factors influencing spending habits, consumers are becoming increasingly strategic and budget-conscious in their purchases.

From deal-seeking to the growing importance of sustainability, keep the following 2024 back-to-school shopping statistics in mind as you prepare your business for this season and next year.

Back-to-School Spending

1. Total back-to-school spending is expected to reach $126 billion

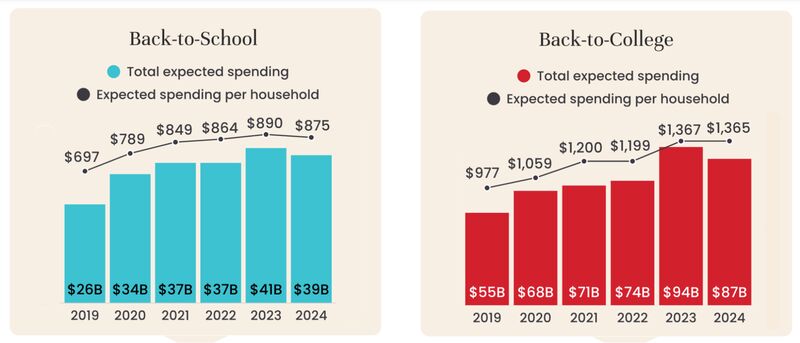

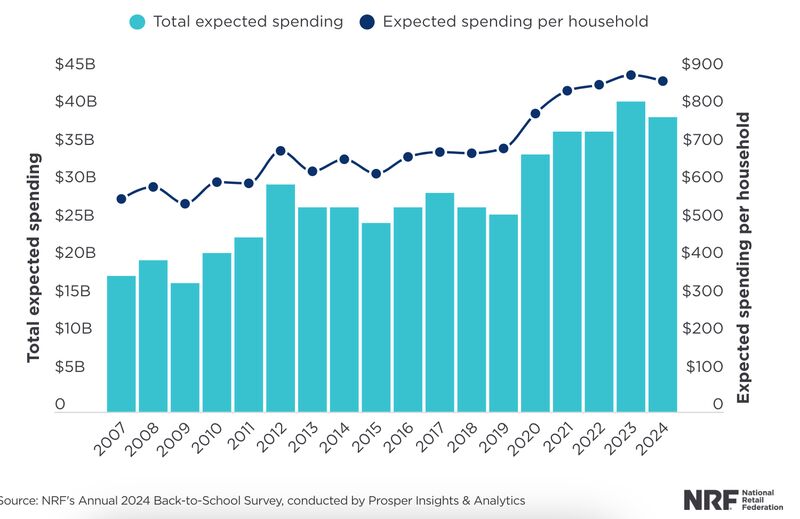

In 2024, total back-to-school spending is forecast to hit about $126 billion—breaking down to $39 billion for households with students in grades K-12 and $87 billion for households with college-aged students. This total spend is actually anticipated to be less than 2023. In 2023, household spend was $41 billion for K-12 and $94 billion for college, a total of $135 billion.

Other estimates say overall back-to-school spending will be about $31.3 billion, versus $31.9 billion in 2023.

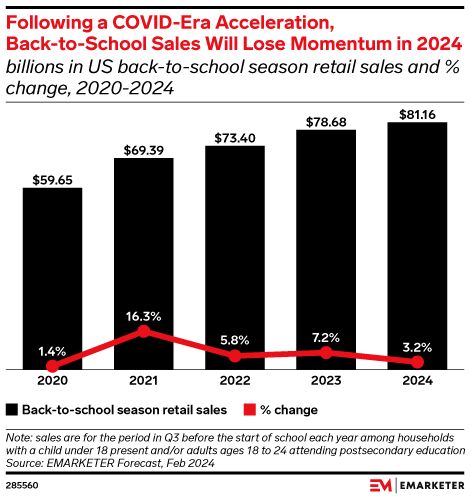

2. Back-to-school sales are expected to decrease by 3.2%

Due to economic challenges and uncertainty, households are spending less on back-to-school shopping in 2024 than they did the year prior. In fact, it’s predicted to see a 3.2% decline.

3. 45% of consumers will purchase something for school

Approximately 45% of US adults surveyed said they will make a back-to-school purchase this year. (source)

4. Families will spend between $875 and $1,365 per household

Depending on the age of the children in the household, each family is expected to spend somewhere between $875 to $1,365 this year. Families with K-12 students will spend around $875, while those with college-aged children will be closer to the $1,365 mark.

Both of these metrics are lower than in 2023, when K-12 households spent about $890 each and college households spent about $1,366 each.

5. Households will spend about $586 per child

Some households have multiple children, while others have only one. In a breakdown of total back-to-school spending by child, each household is expected to spend about $586 per school-aged child in 2024. This is $11 less than in 2023.

6. Low- to mid-income households will spend less while high-income households will spend more

Looking at breakdowns based on household income, low-income families expect to decrease back-to-school spending in 2024 by 4% compared to 2023. Middle-income households are expected to decrease their spending by 9%. High-income households, on the other hand, expect to spend about 5% more in 2024 compared to 2023.

7. Most parents shopping for back to school will pay via debit card

In 2023, it was estimated that 35% of parents used their debit cards to pay for back-to-school purchases. Another 30% used credit cards, 16% used cash, and 1% used buy now, pay later (BNPL) options. About 18% used a combination of multiple payment methods.

According to a different survey, debit and credit cards remain the top payment methods. It found that about 60% of parents will use debit cards to pay in 2024, and 58% will use credit cards. And BNPL is expected to grow, with 20% saying they’ll use this payment option.

Related resources:

- What Is BNPL? Small Business Guide to Buy Now, Pay Later

- Ecommerce Payment Processing: Guide for Small Businesses

- How to Accept Credit Card Payments Online for Free

8. 10% of back-to-school shoppers will take on debt

Though credit cards are a top payment method for back-to-school retail, very few are willing to take on debt. In fact, just 10% say they’ll do so—despite 20% saying they’ll take advantage of BNPL.

9. 42% of shoppers saved money in advance of the shopping season

Because so many are unwilling to take on debt, consumers planned ahead this year. As many as 42% of back-to-school shoppers said they saved money in advance. In fact, more than one-fifth of consumers started putting money aside as early as May.

10. Over half of consumers plan to shop sales for back-to-school deals

The current state of the economy is creating a more budget-conscious shopper. Just over half of consumers (52%) plan to browse sales to snag good deals. About a third of shoppers (32%) also plan to use coupons for savings and 22% will actively seek out free options.

11. More than 80% of parents spend on extracurricular activities

Back-to-school budgets aren’t limited to physical products. In fact, 86% of parents expect to spend money on extracurricular activities for their children. Total spend on extracurricular activities, including enrollment fees and equipment, is forecasted to be about $582 per household.

Key Takeaways:

- Consumers are more budget-conscious and plan to spend more time searching for deals. Brands that want to stand out during the back-to-school season should get creative in how they market and promote products. Focus on savings, promotions, discounts, and pricing.

- Offer flexibility and convenience. Many shoppers are seeking the option with the least amount of friction—especially when it comes to pricing and payment options.

Consumer Trends

12. More than half of back-to-school shoppers start in July

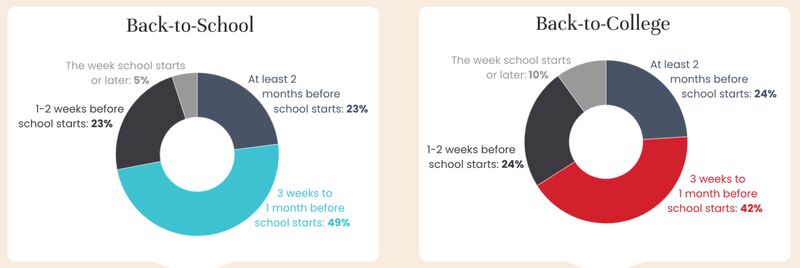

In an NRF survey conducted in early July, more than half (55%) of back-to-school shoppers had already started their shopping. Most—nearly half of K-12 households and 42% of households with college kids—planned to start three weeks to one month prior to school starting—the largest group. Just 23% of K-12 households and 24% of college households started more than two months in advance.

The data from a Deloitte survey indicates similar trends. It found that 66% of shoppers planned to start shopping by the end of July—up from 59% in 2023.

13. Back-to-school shoppers start early to spread out their spending and find deals

Per the NRF survey, most back-to-school shoppers start early so they don’t spend too much money at once. Nearly two-thirds (65%) say they like to spread out their spending in 2024—2% more than the year prior.

At the same time, according to Deloitte, many shoppers start early in July because they’re looking for deals—59% say the best bargains are found early on. And NRF found the same—47% of consumers shop early because they find great prices and promotions at this time.

14. Nearly half of back-to-school shoppers plan around holidays and events

Nearly half (46%) say they plan shopping around holidays like the Fourth of July, retail sales events like Amazon Prime Day, and sales tax holidays to take advantage of deals and promos.

In fact, Amazon Prime Day is a top retail holiday for back-to-school shoppers—as many as 68% plan exclusively around it. Another 32% of consumers plan to shop other online deals in addition to Prime Day, and just over a quarter (26%) plan to shop in-store deals in addition to Prime Day. (source)

According to Deloitte, 48% of consumers plan to shop during 2024 Prime Day—an increase from 39% in 2023.

15. Even if back-to-school shoppers start early, 46% of shopping still happens in August

Many schools send supplies lists for students to share with their parents and help guide their back-to-school shopping. This may or may not align with shopping schedules. In fact, only 13% had received the list in early July, while 42% expected to receive the list by the end of July.

So, even if back-to-school shoppers get an early start, they don’t always finish their shopping early. In fact, 86% still had at least half of their shopping left when surveyed in July. This is because 4% were waiting for better deals, and 45% still didn’t know what they needed to purchase.

So while July sees many shoppers begin their back-to-school purchases, 46% of the spending actually happens in August. This tracks with trends from previous years.

16. 41% of back-to-school shoppers are comparison shopping to find deals and shopping sales

Comparison shopping is emerging as a key strategy for consumers in search of savings. Forty-one percent of K-12 and 38% of college households are comparison shopping online. This marks a slight decrease from 2023 for K-12 households, while the same percentage of college households comparison shopped in 2023.

In line with comparison shopping, 41% of K-12 and 37% of college households look for sales more often. While the same percentage of college households shopped sales in 2023 (37%), there’s a slight decrease for K-12 households in 2024 compared to 2023 (45%).

17. Despite lower spend, only 44% are worried about affordability

While economic uncertainty is top of mind, consumers remain optimistic. There is an 11% decrease of shoppers worried about affordability this year (44%), compared to 2023 (55%).

18. 18% of shoppers will use AI in their shopping

Generative AI is emerging as a technology trend for back-to-school shoppers. This year, about 18% plan to use AI to help in their shopping. Of those shoppers, 76% use it to check out customer reviews, which allow shoppers to sift through product options. Another 62% use it to “economize,” and 35% use it to save time.

Key Takeaways:

- Start early. July seems to be the sweet spot to have your back-to-school offerings ready to go. Deals and promotions are a major driver for early shopping. Create your own competitive deals and align promotions with key shopping events like Amazon Prime Day to attract bargain seekers.

- Despite the early start, back-to-school spending still happens in August. Maintain healthy inventory levels and continue promotions through August—maybe even into September—to cater to shoppers who finish their purchases later in the season.

- Tap into the AI opportunity by integrating AI tools such as chatbots to enhance the customer experience.

Related resources:

- What Is Inventory Planning? 2024 Guide for Retailers

- AI in Ecommerce: Small Business Guide

- Should You Use AI to Write Product Descriptions in 2024?

- Ultimate Guide to Ecommerce Chatbots

Product Categories

19. 36% of K-12 and 31% of college back-to-school shoppers will purchase generic brands

In the name of cost-savings, some shoppers are considering generic or store brands in their purchases. However, this has declined from 2023. In 2024, 36% of K-12 shoppers are considering generic brands, compared to 39% in 2023. Likewise, 31% of college shoppers plan to buy more generic brands in 2024, compared to 33% in 2023.

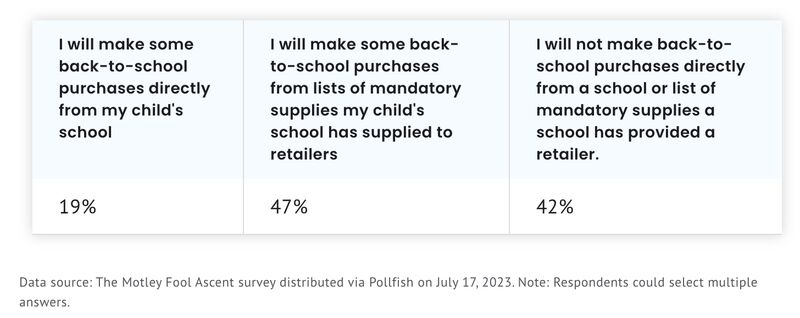

20. 47% of parents do back-to-school shopping based on supplies lists

Many schools share supplies lists online or directly with retailers. In 2023, nearly half (47%) of parents used these lists to guide their shopping with retailers. Another 19% planned to purchase directly from their child’s school. On the contrary, about 42% of parents did not plan to use these lists.

21. 32% plan to only buy what’s on their children’s supplies list—nothing extra

When it comes to school supplies lists, just shy of a third of parents (32%) plan to only purchase what’s named on the list. They don’t plan to purchase anything extra. Another 22% plan to look for freebies to fulfill the list. This is in an effort to cut down on spending.

22. 40% of parents will cut back on supplies if money is tight

Parents are well aware of the current economic situation. In fact, 40% are prepared to cut back on their spending and omit some of the supplies if they find their budgets to be too tight. Another 28% would cut back on back-to-school clothing purchases.

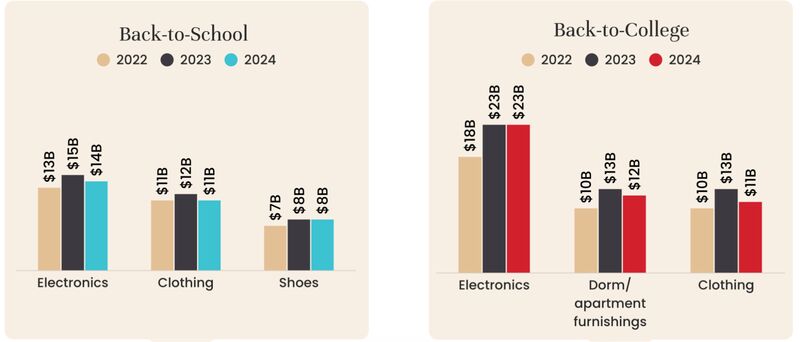

23. Most back-to-school spending is on electronics, followed by clothing

Most back-to-school purchases are in the electronics category. For K-12 shoppers, about $14 billion goes to electronics—about $309 per household—and $23 billion goes to electronics for college shoppers—about $359 per household.

Clothing is another top budget item on the school shopping list. K-12 shoppers expect to spend $11 billion on clothing and accessories in 2024, about $253 per household. College shoppers expect to contribute about the same total spend—$11 billion—or about $171 per household. Shoes are its own line item, with K-12 spend amounting to $7.6 billion, or $170 per household, and college spend amounting to $7.1 billion, or $113 per household.

24. Dorm furnishings will account for $12 billion in spend

When it comes to college back-to-school shopping, the total spend on dorm and apartment furnishings is forecast to hit $12.2 billion—or about $192 per household.

Key Takeaways:

- Consider stocking and promoting generic or store brand options to attract budget-conscious shoppers.

- Parents rely on school supplies lists to guide their shopping. Ensure you have these lists available and prominently display items from these lists to cater to these shoppers. Partnering with schools to provide these lists directly can also drive sales.

- Many parents are looking to omit non-essential items or seek freebies. Consider offering promotions, discounts, or bundled deals to help parents stretch their budgets while still getting necessary supplies.

Related resources:

- Retailer’s Guide to Product Bundling

- 12 Visual Merchandising Strategies to Improve Your Store

Preferences & Shopping Habits

25. 31% of parents talk to their children about back-to-school budgeting

With budgets a top concern in 2024, parents are becoming more open and transparent with their kids about how much they spend on back-to-school. About 31% have talked or plan to talk to their kids about back-to-school shopping budgets. As many as 9% even expect their children to help pay for some of it.

26. More than two-thirds of back-to-school shoppers say sustainability is important.

As consumers grow increasingly aware of the environmental impact of their spending habits, sustainability is emerging as a top priority. In fact, 71% of K-12 parents and 67% of college students say it’s important to find items that are sustainable or environmentally friendly.

See also:

27. 43% of shoppers buy pre-owned products when available

In an effort to reduce costs and environmental impact, more shoppers are turning to second-hand shopping. About 43% plan to buy pre-owned products in 2024—an increase from 40% in 2023.

Parents are becoming less conscious and insecure about purchasing these products. In fact, nearly three-quarters (74%) don’t feel guilty about purchasing pre-owned items for their kids. However, the cost savings are debatable—it’s reported that they only spend 7% less than those who buy brand-new.

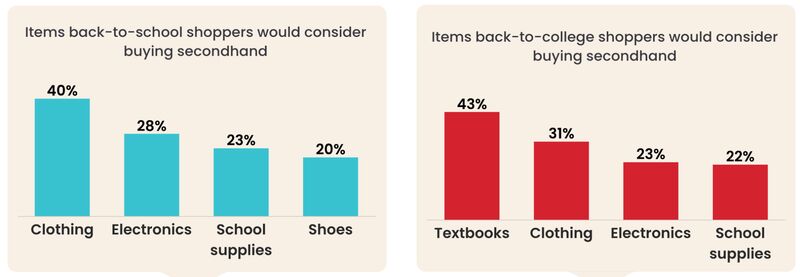

28. Shoppers are most willing to buy clothing or textbooks when it comes to secondhand items

When it comes to secondhand and pre-owned items, K-12 shoppers are most likely to purchase clothing that fits this category (40%). Other top categories include electronics (28%), school supplies (23%), and shoes (20%).

When it comes to college back-to-school shopping, used textbooks top the list (43%). Other top categories also include clothing (31%), electronics (23%), and school supplies (22%).

29. 70% of back-to-school shoppers use multiple channels

Multi-channel shopping is the norm for most back-to-school shoppers. About 70% use multiple channels, an increase from 66% in 2023. Parents plan to shop across 4.7 retail channels, up from 3.9 in 2023. Multi-channel shoppers make up 80% of total back-to-school spending in 2024—up from 73% the year prior.

In fact, 33% of shoppers plan to use social media to buy back-to-school products, compared to 21% in 2023.

30. 70% of shoppers want convenience

Convenience is key for back-to-school shoppers. They want options. Nearly three-quarters (70%) want retailers in easy-to-access locations, convenient delivery options, and an easy returns process.

31. 32% of shoppers are influenced by in-store promotions

While much of back-to-school shopping happens online, retail stores are anything but obsolete. About 32% of consumers say in-store promotions influence their spending. Another 14% say they prefer to do their back-to-school shopping in-store because there are more promotions compared to shopping online.

32. 33% of shoppers will use BOPIS

Buy online, pick up in-store (BOPIS) is another emerging trend for back-to-school shopping. One-third of online shoppers plan to take advantage of this fulfillment method in 2024—an increase from 21% in 2023.

Read also:

- What Is Order Fulfillment? Strategy Guide

- Buy Online, Pick Up In-store (BOPIS) Statistics for 2024

33. Most back-to-school shopping happens online

Most back-to-school shoppers make their purchases online—57% of K-12 shopping and 50% of college shopping. Other top destinations include department stores (50% for K-12 and 35% for college) and discount stores (47% for K-12 and 31% for college).

Another 26% of shopping happens at college bookstores, office supply stores, and clothing stores, respectively. Electronics stores drive 23% of back-to-school shopping.

According to other data, 77% of shoppers plan to shop with mass merchants and 65% with online retailers. This is largely motivated by price and convenience.

Other sources cite discount stores as the most popular type of retailer for 70% of back-to-school shoppers.

34. More than half of people still use retail stores, even if most spending happens online

Though most spending happens online, retail stores play a significant role. More than half (54%) of shoppers use physical stores in their purchasing journey. As many as 46% say in-store shopping or showrooming has the most influence on their back-to-school purchase decisions, even if they do make the purchase online.

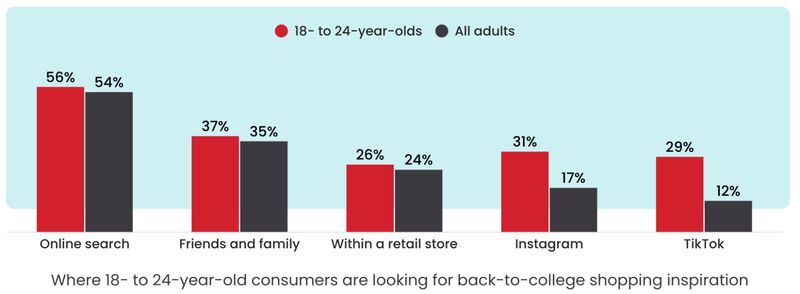

35. Shoppers get most of their inspiration online, too

As far as inspiration for back-to-school purchases, most consumers find that online—especially for the 18- to 24-year-old demographic. Here’s how it breaks down:

- 54% online search

- 35% recommendations from friends and family

- 24% at a retail store

- 17% Instagram

- 12% TikTok

It’s worth noting, though, that 18- to 24-year-olds are way more influenced by social media—31% on Instagram and 29% on TikTok—than general consumer trends.

36. Half of parents will also spend on themselves while shopping for back-to-school items

Back-to-school shopping isn’t just for the kids. Many parents will find space to treat themselves, too. In fact, 50% would also shop for themselves while shopping for their children’s back-to-school needs.

Key Takeaways:

- Budget is top of mind for parents—and they’re even discussing it with their kids. Cater to this heightened awareness of spending limits by offering budget-friendly options and promotions.

- Sustainability is a growing concern. Consider stocking sustainable and secondhand products and highlighting these eco-friendly options in your marketing efforts.

- Multi-channel shopping is prevalent and convenience is crucial, so make sure to have items in easy-to-access locations, provide flexible fulfillment options like BOPIS and free shipping, and offer an easy returns process.

Bottom Line

The 2024 back-to-school shopping season represents a period of adaptation and resilience among consumers. With a strong focus on budget-conscious spending, early shopping, and sustainability, families are navigating their shopping needs with more scrutiny than before.

Retailers have a unique opportunity to cater to these evolving needs by offering strategic promotions, embracing multichannel shopping experiences, and highlighting eco-friendly options. Understanding these back-to-school shopping stats and trends will help retailers make the most of the back-to-school season.