There are two main types of cash registers: electronic cash registers (ECRs) and point-of-sale (POS) systems. ECRs provide the most basic functions—tallying sales, completing customer payments, printing receipts, and storing cash. However, the global market for traditional cash registers has declined, and many major ECR providers have stopped manufacturing cash registers. Most modern businesses get their cash register hardware from a POS software provider. This evaluation of the best cash register for small businesses includes both register types.

The best POS cash registers are:

- Square: Best touch-screen cash register for small businesses

- Toast: Best free cash register for restaurants

- Clover: Best for hardware and software flexibility

- Lightspeed: Best for high-volume and multi-location retailers

The best ECRs are:

- SAM4S ER-180U: Best portable cash register for mobile and low-volume sales

- SAM4S SAP-630R: Best electronic register for grocery and convenience stores

- SAM4S ER-925: Best electronic register for low- to mid-volume retailers

Accept payments anywhere customers are: In-person, Online, Remote, Buy Now Pay Later |

|

Best Small Business Cash Registers Compared

Hardware Cost | Monthly Software Fees | Integrated Card Reader | Built-in Receipt Printer | Built-in Cash Drawer | |

|---|---|---|---|---|---|

| $799-$1,899 | $0-165+ | ✓ | Some models | Some models |

| $0-$1,339.20 | $0-$69+ | ✓ | Optional add-on | Optional add-on |

| $279-$1,799 | $13-$330 | ✓ | ✓ | ✓ |

| Quote-based | $89-$399 | ✓ | ✓ | ✓ |

| $164-$350 | None | ✕ | ✓ | ✓ |

| $1,499-$5,000+ | None | Optional add-on | ✓ | ✓ |

| $499-$679 | None | Optional add-on | ✓ | ✓ |

Looking for something for a specific business type? Check out our rankings of the best point-of-sale solutions for retailers, restaurants, and small businesses.

Square: Best Touch-screen Cash Register for Small Businesses

Pros

- Free, user-friendly, cloud-based software

- Affordable hardware with monthly financing options

- Built-in payment processing

Cons

- Must purchase cash drawer separately

- Locked into Square Payments processing; cannot shop for lower rates

- Full hardware kits can get expensive

Overview

Who should use it:

Small businesses of any type (retail, restaurant, or service-based) that want a complete suite of sales, payment, inventory, and business management tools for free—with affordable upgrade options.

Why we like it:

Square is a cloud-based, POS-driven register with several low-cost hardware options. An all-in-one point-of-sale solution that combines a credit card processing service, software, and cash register, Square is our top choice for the best small business POS systems. Unlike ECRs, Square lets you process sales and run your entire business from your smartphone or tablet. Or, you can use one or more handheld POS devices or countertop registers to meet in-store selling needs.

Unlike the other picks on our list, with Square’s POS register, you can’t rate-shop merchant account providers. However, Square’s payment processing offers transparent and simple flat-rate fees. Square also requires no startup or monthly account fees for a baseline subscription. If you want to keep an existing processor or shop for rates, consider any of the ECRs on this list. If you want an iPad-based register with more payment integrations, check out Lightspeed.

Monthly software fees:

- Basic Square: $0-$29+ (custom pricing available)

- Square for Retail: $0-$89 per location (custom pricing available)

- Square for Restaurants: $0-$165+ per location

- Square Appointments: $0-$69 per location

Hardware:

- Portable terminal: $299

- Countertop register: $799

- Hardware kit: $579-$1,899

Processing fees:

- Card present: 2.6% + 10 cents

- Keyed-in: 3.5% + 15 cents

- Online: 2.9% + 30 cents

- Invoices: 3.3% + 30 cents

Square’s hardware includes everything from mobile card readers to handheld POS devices and countertop cash register kits with accessories. (Source: Square)

- Touch-screen cash register

- Versatile and easily expandable hardware

- Built-in credit card processing

- Track unlimited items and variations

- Track unlimited employees

- Specialized options for retail and restaurant businesses

- Easy and affordable to add gift cards, online ordering, employee timekeeping, marketing, loyalty, and more

Toast: Best Free Cash Register for Restaurants

Pros

- Mobile POS and self-service kiosk hardware

- Ingredient-level inventory tracking

- Loads of hardware peripherals for kitchen displays, digital menus, self-service kiosks, drive-thrus, and handheld terminals

Cons

- Locked into Toast Payments processing

- Printers and cash drawers are not built in; you must purchase them separately

- Requires a two-year contract

Overview

Who should use it:

Restaurants of all types and sizes will do well with Toast; in fact, it is our top-recommended restaurant POS system.

Why we like it:

Two things set Toast apart from the others on this list: It is designed specifically for restaurants, and it operates on Toast-designed POS hardware for terminals, self-service kiosks, kitchen displays, and handheld order and payment devices. It also offers a no-upfront-cost hardware option. You’ll pay higher payment processing fees if you opt for Pay-as-You-Go hardware; but if you are a new, small, independent restaurant, you’d be paying higher processing fees no matter what system you use.

Toast has a couple of downsides, though. It is the only system on this list that requires a lengthy contract (two years). Like Square, Toast also locks you into its built-in payment processor, Toast Payments. Though, Toast has a history of matching or beating competitors’ processing rates; contact the provider directly to see what rates you can negotiate. If you need something more short-term, consider Square.

Software:

- Starter Kit (for up to 2 POS stations in one restaurant location): From $0

- Point of Sale: From $69

- Build Your Own: Custom quote

Hardware:

- Pay upfront: From $799.20 + $69 per month to $1,339.20 + $99 per month

- Processing fee: 2.49% + 15 cents

- Pay-as-You-Go: $0 per month

- Processing fee: 3.09% + 15 cents

Toast’s hardware options range from handheld devices to guest self-service kits. You can opt for the Pay-as-You-Go option to pay no fixed monthly fees. (Source: Toast)

- Touch-screen operation

- Restaurant-supporting order screens

- Manages complex modifiers

- $0 upfront option for register hardware

- Built-in credit card processing

- Google online ordering integration

- Track unlimited items with modifiers

- Unlimited employee log-ins

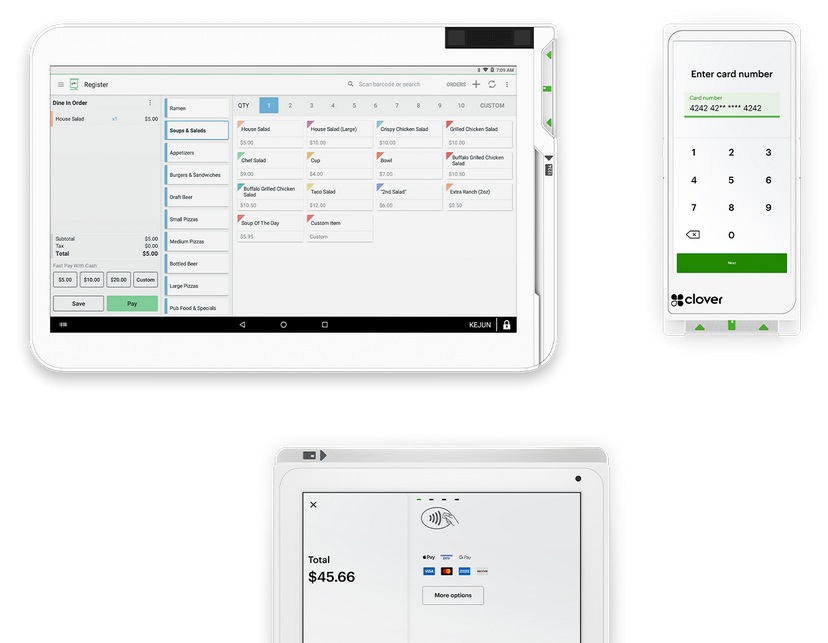

Clover: Best for Hardware and Software Flexibility

Pros

- Lots of proprietary hardware options

- Flexible payment processing

- Offline card payments

Cons

- No vendor management tools

- Must use Clover hardware

- Hardware tied to the merchant account

Overview

Who should use it:

Retailers, small or large restaurants, and service businesses that want a variety of hardware and payment processing options.

Why we like it:

Clover is a flexible and feature-rich POS system that is suitable for retail shops, restaurants of any size, and service or appointment-based businesses. It is similar to Square in this way, except that Clover is also flexible with payment processing; its default payment processor is Fiserv but also allows you to choose a different one if you prefer. Clover also bundles its software offerings with its hardware subscriptions.

Clover does have a few downsides. Unlike Square, there is no long-term free plan, and you’ll need to upgrade for features like returns and exchanges, advanced reports, and item-level inventory management. Clover also has no built-in vendor management tools.

Monthly software fees:

- Retail: $13-$230 per month for 36 months; or $279-$2,448 upfront + $104.90 per month

- Restaurant: $105-$330 per month for 36 months; or $799-$4,147 upfront + $59.95-$129.85 per month

Hardware: $279-$1,799

- Clover Compact (handheld terminal): $$279 or $13 per month

- Mini (small countertop POS): $799 or $45 per month

- Station Solo (all-in-one countertop POS): $1,699 or $160 per month

- Station Duo (dual-screen countertop POS): $1,799 or $170 per month

Processing fees:

- Card present: 2.5% + 10 cents to 2.6% + 10 cents

- Keyed-in: 3.5% + 10 cents

Clover offers a multitude of hardware choices of different types and sizes, bundled with its software subscriptions. (Source: Clover)

- Choice of payment processor

- Proprietary mobile and countertop hardware

- POS systems for retail, restaurants, and service businesses

- Virtual terminal with invoicing

- Free customer-facing loyalty app

Lightspeed: Best Register for High-volume & Multi-location Retailers

Pros

- Robust features with advanced inventory and reporting tools

- Connect multiple registers and locations

- Cloud-based system with real-time data sync

Cons

- Hardware pricing is not transparent

- Monthly software fees can get pricey

Overview

Who should use it:

Multi-location businesses needing networked or cloud-based systems; businesses that need intensive inventory management and purchase ordering tools.

Why we like it:

Lightspeed, like Square, is a POS-driven cash register with a comprehensive set of store management tools. Users can track inventory in real time and manage purchasing, staff, and business tasks across multiple locations. Like Square, Lightspeed also connects in-store and online sales. As a POS-based register system, Lightspeed lets you set up several registers in one or many locations and connect all data within one centralized, cloud-based software system.

If you like Lightspeed’s touch-screen register but hate monthly fees, check out Square (which offers free register software). Restaurants should check out Toast’s Pay-as-You-Go plan. If you want to go electronic, the SAM4S SAP-630R is your best bet.

Monthly software fees:

- Lightspeed Retail

- Basic: $109 (annual pricing: $89)

- Core: $179 (annual pricing: $149)

- Plus: $339 (annual pricing: $289)

- Lightspeed Restaurant

- Essential: $189

- Premium: $399

Hardware: Call for a quote

Processing fees:

- Card present: 2.6% + 10 cents

- Keyed-in: 2.9% + 30 cents

Lightspeed’s POS includes built-in purchase ordering tools. (Source: Lightspeed)

- Multiple options for payment processing

- Operates on iPads or desktop computers

- Specialized software for retailers and restaurants

- Top-of-the-line inventory tracking and reporting

SAM4S ER-180U: Best Portable Cash Register for Mobile Businesses

Pros

- Lightweight, portable register; great for pop-up retailers

- Built-in receipt printer and digital price display support streamline sales functions

- Basic tools are uncomplicated for small retailers

Cons

- Does not support an integrated card reader

- Only supports 10 employee logins and 500 product listings

Overview

Who should use it:

With only 10 supported cashier profiles, the ER-180U is best for small operations with a small staff. At a light 12 pounds, this register is portable, so it can support crafters and hobbyists who frequent craft fairs. This compact register is streamlined to support the smallest retailers. The 180U does not contain any ports to connect an integrated card reader, so this register works best for cash-only transactions.

Why we like it:

The ER-180U is SAM4S’s entry-level economy register. Several legacy cash register manufacturers (Casio, Sanyo) have stopped making ECRs. So, SAM4S has quickly become a global frontrunner in the electronic register category, with its products being sold in more than 70 countries. Users can feel confident that customer support and replacement parts will be available for many years to come. This is why we recommend this brand and do not recommend you purchase a used register from a brand that no longer offers customer support.

If you need detailed, real-time inventory tracking, you’ll need a POS-driven register like Square or Lightspeed. If you need ingredient-level inventory tracking for a food service business, Toast is your best bet. Though, if you don’t mind spending a little more for advanced tools, both Toast and Lightspeed’s restaurant inventory modules are even more robust.

The Sam4S 180U can be purchased from multiple retailers for between $164 and about $350. This is a one-time payment with no ongoing monthly fees, making this system one of the cheapest register options on the market.

You will need to secure a separate credit card processor to accept card payments. You’ll also need to purchase a separate card reader to run card payments, as the 180U does not have a built-in card reader. This allows you the flexibility to choose whatever merchant services provider you like, but using a non-integrated card reader can increase your transaction times.

The 180u is a compact register with programmable raised buttons, a digital display, simple reporting tools, and a built-in printer with customizable receipts. (Source: SAM4S)

- 10 employee logins

- 500 supported price look-up (PLU) codes

- Four programmable tax rates

- Customizable receipts

SAM4S SAP-630R: Best Electronic Register for Grocery & Convenience Stores

Pros

- Built-in touch-screen speeds checkout process

- Tracks 100,000 PLUs

- Connects to cloud-based SAM4POS for remote reporting on mobile app

Cons

- SAM4POS app costs extra

- Cannot track inventory expiration dates

- Expensive

Overview

Who should use it:

Grocers and convenience stores will find the SAP-630 useful, as it has an integrated Android touch-screen that lets you manage 100,000 inventory items. You can also tether an optional handheld Android tablet via the SAM4POS app, which is great for businesses that need to process sales on the floor or count inventory frequently. You can purchase this register with either a retail (SAP-630R) or a hospitality (SAP-630F) configuration.

Why we like it:

SAM4S’s SAP-630 combines a 9.7” Android touchscreen with a built-in keypad, cash drawer, and receipt printer to create a hybrid cash register that acts like a POS.

The SAP-630 is the most expensive register on this list and must be purchased from an authorized SAM4S retailer. But for the price, you get six months of technical support and assistance with programming and setup. This register is also a true POS/ECR hybrid, so some services (like loyalty and rewards programs) require monthly fees. But for the basic sales and inventory tracking functions, you’ll only pay the upfront cost. Setting up this register requires some functions—like a custom screensaver—to be configured by the dealer you purchased from.

The SAM4S SAP-630’s combination configuration is a fascinating option for small businesses, but it requires an authorized dealer to configure it. If you prefer simple self-installation with options for built-in processing, check out Square or Lightspeed.

Prices vary by vendor and configuration but typically range from $1,499 to over $5,000. This is a one-time price. There are no monthly software fees unless you choose to enroll in the cloud reporting app.

The SAP-630 register does have an integrated card reader on the side, though you can opt to attach a peripheral reader as well for credit card processing. This option gives you the benefit of shopping for the lowest available processing rates, but this also increases your setup and transaction times.

The SAM4S SAP-630F is the hospitality/food-service version of the same cash register. The SAP-630 includes a built-in three-inch thermal receipt printer and a digital customer-facing display. (Source: SAM4S)

- Touch-screen and keypad operation

- EBT processing

- Tobacco rebate and loyalty integration

- Tracks 100,000 UPC numbers

- Additional ports to connect: barcode scanner, scale, external card reader, external pole display, and Dallas key port

- Wi-Fi connectivity available for tablets, printers, and scales

- Cloud accessible reports

- Scheduled report emails to keep tabs on operations

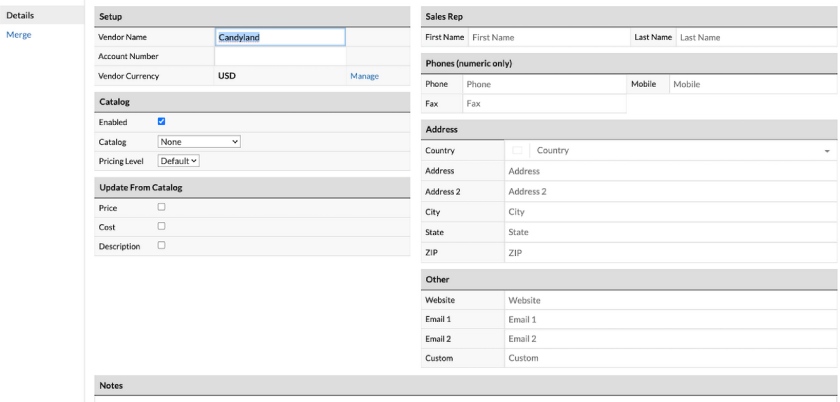

SAM4S ER-925: Best ECR for Low- to Mid-volume Retailers

Pros

- Integrated cash drawer and receipt printer

- Can choose between integrated or external card reader

- Does not need internet access to operate

- Several options for customizable peripherals including additional printers

Cons

- No customer data entry

- Need to find a payment processor

- Upfront cost can be high, depending on your chosen peripherals

Overview

Who should use it:

The SAM4S ER-925 is a sturdy electronic cash register built for retail businesses. It is popular with gift shops, ceramics studios, candy shops, and other mid-volume retailers.

Why we like it:

Price-wise, the SAM4S ER-925 is a big step up from the much more affordable 180U, but it offers a lot more features, including customizable peripheral hardware.

You can attach a barcode scanner, scale, and external pole display. Also, you can choose from an integrated card reader or an external reader. To speed service up, you can add an optional Dallas Key reader, allowing cashiers to quickly log into the register by attaching a magnetic fob.

However, if you want to automatically collect customer emails for your marketing efforts, the ER-925 is not a great fit. Both Lightspeed and Square offer much more robust customer management tools (and Square’s are priced based on your actual use). Both also offer built-in payment processing, which speeds up your setup process.

From $499-$679 (price varies by vendor and add-ons). For payment processing, you will need to get a separate merchant services account. Rates will vary.

The SAM4S ER-925 comes with a built-in cash drawer and receipt printer, plus add-on option for an integrated card reader. The optional Dallas key port lets associates log into the register using a magnetic key fob. (Source: Amazon)

- Up to 15 employee logins

- Tracks up to 2,000 PLUs

- 100 mix-and-match discount options

- 6-line pre- and post-receipt messages

- Additional ports to connect: barcode scanner, scale, external card reader, external pole display, and Dallas Key port

How to Choose a Cash Register

Choosing the right small business cash register is a huge decision. You and your staff will use this system every day; a register that lacks functions or is overly complex will quickly cause headaches. Here are a few questions to ask when choosing a cash register:

Step 1: Specify Your Cash Register Needs

First, consider your business needs. How many cash and how many credit card payments do you expect to handle? Do you plan to sell online, and if so, do you want your online store to communicate with your cash register so you never sell an item that’s out of stock?

A small business with minimal transactions may only need a basic cash register, while a larger business may require a more advanced system with additional features like barcode scanners and inventory tracking.

Step 2: Determine Your Budget

Next, consider your budget. Cash registers can range in price from a few hundred dollars to over a thousand, depending on the features and capabilities.

Step 3: Test User-friendliness

Another important factor to consider is how user-friendly the register is. Your register should be easy to use, with an interface that is easy to navigate during business rushes.

When you shop online, it is tempting to purchase the cheapest cash register available. However, these cheap cash registers are typically older electronic models that are no longer manufactured. You’ll need to rely on your ability to interpret a written user’s manual with no in-person assistance or active customer service. For some people, this setup won’t be a problem. But then you’ll also have to train your staff to use the register (and trust that they are ringing in sales correctly).

Most businesses nowadays need a user-friendly system that comes with configuration assistance. A touch-screen POS-driven cash register is familiar to younger workers who are comfortable operating smartphones.

Features to Look for in a Cash Register

For modern businesses that expect to grow beyond a very small size, a point-of-sale system is almost always a better option than an electronic cash register. Even the most basic and affordable (or free) POS systems contain features that you might find only in advanced ECRs.

Learn more about the differences between POS systems vs cash registers.

The features you need to look for include:

Inventory Management

Keeping track of your store’s item stock is a bread-and-butter function that every business needs to fulfill. This is especially important if your store has multiple locations or if you are aiming to go into multichannel selling. All cloud-based POS systems can track inventory quantities and update information in real time, whereas only some ECRs can perform this at a basic level—for example, a cash register with an electronic journal will be able to do a rudimentary form of inventory tracking.

Tax Calculations & Reporting

Calculating and adding up sales taxes, as well as producing reports, are vital for making sure all transactions are correct and all legal requirements are fulfilled. While many ECRs can calculate tax rates, not many can produce advanced reports for performance, sales, and stock counts. Among the ECRs on this list, only the SAM4S ER-925 generates reports at this level. However, this level of reporting is standard fare for most POS systems on the market.

Sales or Service Mobility

The traditional store layout involves having a stationary cash wrap near the entrance or exit. However, many establishments such as restaurants or larger stores would benefit from increased mobility during customer checkout. This usually comes in the form of checkout capability on mobile devices such as smartphones and tablets, which can be brought to customers anywhere within the store. While greater mobility isn’t necessarily a dealbreaker in physical store locations, it helps increase customer convenience and satisfaction.

Hardware Options & Support

Electronic cash registers may offer a few options for peripheral hardware such as barcode scanners, scales, or external card readers. However, these are limited in both scope and utility compared to the hardware options available for modern POS systems: scanners and tap-to-pay readers that can attach to mobile devices, more portable or integrated card readers, and entire hardware kits or individual devices you can choose from to create your own custom setup.

Purpose-made POS systems such as Toast are also built to survive their niche (in this case, restaurants) with industry-grade hardware that can withstand heat, impact, spills, and other hazards present in a crowded store or restaurant environment.

As for hardware and software support, you’d also be better off with modern POS systems. Many POS providers offer 24/7 support included in your monthly subscription, available by phone, email, or online chat. On the other hand, it may be difficult to get quick support for electronic cash registers because many models are obsolete and being discontinued.

Methodology: How We Evaluated Cash Registers

We compared each system based on its price, ease of use, and retail and restaurant features. Also, we considered the availability of popular peripheral hardware, like barcode scanners, kitchen printers, label printers, and card readers. If there is one piece of equipment that a small business needs to operate seamlessly, it’s the one that handles the money. So, available support and warranties were a big consideration here, as registers can be tricky to program on your own.

Frequently Asked Questions (FAQs)

These are some of the most common questions about the best cash registers for small businesses.

Given the limited features of electronic cash registers, these devices will be most useful only for very small businesses that are limited to cash transactions. For accepting other payment methods and using features like in-depth reporting and multilocation or multichannel selling, modern POS systems are the better choice.

If you accept a large volume of cash, the best register will include lockable cash drawers and possibly even dual cash drawers so two cashiers can use the same register. If you accept card payments, you’ll need a register with an integrated or attached card reader. You’ll also want a register that tracks transactions by cashier so you can easily identify errors or suspicious transactions.

A cash register costs anywhere from around $164 to over $5,000 as a one-time payment. Modern POS systems will run you up to about $1,300 for high-end hardware, plus up to around $90 in monthly software fees.

Depending on your business type, you can use a smartphone, iPad, or other touch-screen tablet as a cash register. All you need to do to turn one of these devices into a register is download a POS or payment app and attach a cash drawer or bank account to receive cash and digital payments.

For solopreneurs, mobile businesses, and service businesses that accept card payments, a smartphone, card reader, and attached bank account are all you need. Brick-and-mortar stores that want to securely accept cash will want a stationary tablet with an attached cash drawer.

Bottom Line

With more customers relying on digital payments and fewer companies manufacturing cash registers, it can be challenging to find the best cash register for your small business. If you are willing to expand your search to include POS-driven registers, you’ll have more options. For its affordable price, ease of use, and popularity with small businesses of all types, we named Square the best small business cash register.

While this POS-driven register requires users to purchase a cash drawer separately, it also gives small business owners access to Square’s full suite of business tools. If you’re unsure about diving into a POS-driven cash register, you can try Square for free on hardware you already own.