Global payroll providers help businesses compliantly process salary payments for a global workforce but also offer tools to automate basic HR processes.

6 Best International Payroll Services

This article is part of a larger series on Payroll Services.

Global payroll providers help businesses compliantly process salary payments for an international workforce but also offer tools to automate basic HR processes.

The best international payroll services allow you to pay workers located in other countries and comply with local tax and labor laws. Some have separate plans for paying global contractors, while others offer employer of record (EOR) services — allowing them to handle your international employment needs.

In this guide, I evaluated seven popular global payroll providers and narrowed the list down to the six best.

- Papaya Global: Best overall international payroll services

- Remote: Best for country coverage

- Deel: Best for payment flexibility

- Rippling: Best for affordability

- Oyster HR: Best for hiring and payroll support

- Multiplier: Best for onboarding and payroll in Asia

Best international payroll services compared

Expert Score (out of 5) | Country Coverage | ||||

|---|---|---|---|---|---|

4.11 | $25 per employee | $30 per worker | $599 per employee | Over 160 | |

4.07 | $29 per employee | $29 per worker | $699 per employee | Over 190 | |

| 3.97 | $29 per employee | $49 per worker | $599 per employee | Over 150 |

3.72 | Over 140 | ||||

3.65 | $25 per employee | $29 per worker | $699 per employee | Over 180 | |

| 3.55 | Call for a quote | $40 per worker | $400 per employee | Over 150 |

In addition to EOR services, all the global payroll providers I reviewed offer international tax support, online onboarding, local benefits plans, time off tracking, and locally-compliant employment contracts. They also have in-country experts who can guide you through the complexities of managing local laws and regulations.

Papaya Global: Best overall global payroll services

Pros

- Guarantees cross-border payroll payments in as fast as 72 hours

- Agent of Record (AOR) services include contractor misclassification tools.

- Access to a dedicated customer success manager (CSM) who handles your account and answers your queries

Cons

- Lacks local entities and only has partners in countries that it services

- Payroll plans require at least 100 employees.

- Charges a setup fee

Overview

Who should use it:

Papaya Global is great for mid-sized to large businesses that need overseas payroll services with full liability and local compliance. As a licensed payments provider, it can handle payments to employees, contractors, and local tax authorities. It also offers global workforce software that lets you manage worker data, onboarding, global employee benefits, reports, and staff attendance on one platform.

Why I like it:

Papaya Global topped my list of best international payroll services because of its bank-level security payments and wide range of features. Aside from global payroll, it has EOR and AOR services for hiring and paying international employees and contractors, respectively. It offers end-to-end fraud protection, unlimited digital workforce wallets you can fund in 14 currencies, and uses artificial intelligence (AI) tools to validate payments and automate compliance.

While these functionalities contributed to Papaya’s 4.11 out of 5 rating, it lost several points because it lacks local entities in the countries it services. This is a feature that most on my list offer, making it easy to manage, pay, and recruit employees. Papaya makes up for this by providing legal support and access to in-house payroll professionals and its team of country experts, which consists of 40 top-tier certified public accountant (CPA) firms across the globe.

- PayrollPlus

- Grow Global: Starts at $25 per employee monthly for businesses with up to four entities and 101-500 employees

- Scale Global: Starts at $20 per employee monthly for businesses with up to 10 entities and 501-1,000 employees

- Enterprise Global: Starts at $15 per employee monthly for businesses with over 10 entities and more than 1,000 employees

- EOR: Starts at $599 per employee monthly

- Contractor Payments and Management: Starts at $30 per worker monthly

- Payroll, compliance, standardized invoices, and contractor management

- AOR: Starts at $200 per worker monthly

- Contractor management, payroll, compliance, and worker classification

- Workforce OS: Starts at $5 per employee monthly

- For businesses with their own workforce management systems but want Papaya’s technology to pay and onboard global employees

- Payments: Starts at $2.5 per transaction

- Facilitate ad hoc workforce payments (e.g., split payroll payments and statutory payouts to local authorities)

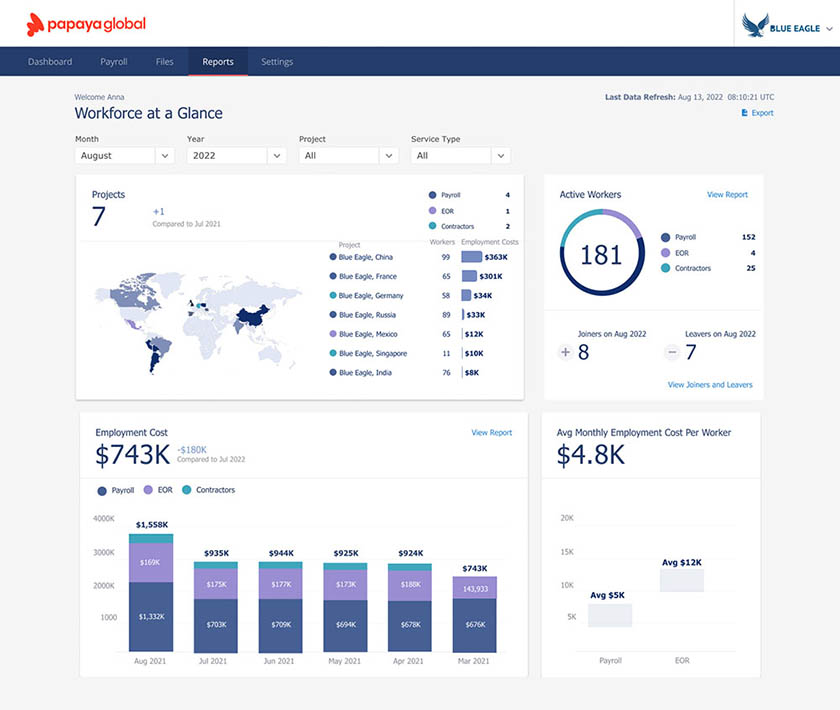

Papaya Global has an intuitive dashboard that shows a comprehensive view of your international workforce, payroll expenses, and more.

(Source: Papaya Global)

- Money-back guarantee: It offers a 60-day money-back guarantee for new clients who may be unsatisfied with Papaya Global’s services.

- Fast cross-border payouts and debit cards: It offers cross-border payments with guaranteed payouts of up to 72 hours. It also offers instant employee payments via the Papaya Payroll debit card — perfect for workers who don’t have bank accounts.

- Workforce wallets: Its unlimited workforce wallets let you make direct deposits for employees and contractors in their local currencies in over 160 countries, including payments to local authorities. You can also view and access workforce payment funds in dedicated wallets that sit safely in segregated Client Money Accounts with global banking institution J.P. Morgan.

- Fraud protection and AI validation tools: You get fraud protection that adheres to global know your customer (KYC) practices and anti-money laundering (AML) standards. It also has AI-based validation tools to check payments and spot errors, which helps ensure payroll compliance.

Remote: Best for country coverage

Pros

- Offers a free HR management platform for managing employee data, contracts, attendance, onboarding, and expense claims

- Has local entities in more than 180 countries that it services

- Discounts for startups, nonprofits, and refugee hiring services

- Has a freelancer hub for solopreneurs to manage global client payments

Cons

- Payroll cutoff deadline is the 11th of each month (except for Bulgaria, Germany, and countries with semimonthly payroll)

- Charges an implementation fee for its global payroll tool if you’re processing employee payments for your business entities

- Collects a refundable deposit (equivalent to one month of the total employment cost)

Overview

Who should use it:

Companies of all sizes can use Remote to pay international contractors and employees. It has the widest country coverage on my list, with EOR and contractor management services reaching over 190 countries.

Why I like it:

Unlike Papaya Global, Remote owns legal entities in countries that it services. It also has iron-clad intellectual property (IP) and invention protection tools to help you track IP transfers while ensuring you retain ownership over your invention rights. Its discounts for startups and Series A businesses Eligible startups get 15% off of Remote's EOR, global payroll, and contractor management services during their first year with the provider. , social purpose organizations Eligible organizations get co-marketing opportunities, including 15% off EOR (for annual plans only) and 15% off contractor management services during their first year with Remote. , and companies that hire refugees Get 15% off EOR services when you hire at leat one qualifying refugee via Remote. make Remote stand out from the rest on our list.

What also sets it apart is its HR platform for managing staff information and documents, onboarding and offboarding workers, submitting expense claims, and tracking employee hours. Similar to Deel, this tool is free to use. In my evaluation, Remote earned a 4.07 out of 5 rating but scored the lowest in pricing. Its global payroll, contractor management, and EOR plans aren’t as affordable as Rippling and Multiplier’s.

- HR Management: Free ($0); includes tools for managing employee information, documents, contracts, time off, attendance, onboarding and offboarding, and expense claims

- Payroll: $29 per employee monthly

- Employer of Record: $699 per employee monthly ($599 per employee monthly if billed annually)

- Contractor Management: $29 per contractor monthly

- Includes payroll and contractor invoices

- Contractor Management Plus: $99 per contractor monthly

- Contractor Management plan features with indemnity coverage

- Contractor of Record: Starts at $325 per contractor monthly

- Direct contractor engagement and payment by Remote + indemnity coverage and AI tools to reduce worker misclassification risks

- Equity: Starts at $999 per year

- Tools to simplify equity grants with tax handling and reporting obligation assistance

- Recruit: Starts at $119 monthly

- Includes smart AI matches, applicant tracking, talent insights, job postings on Remote’s website, and access to Remote’s over 800 million candidate profiles

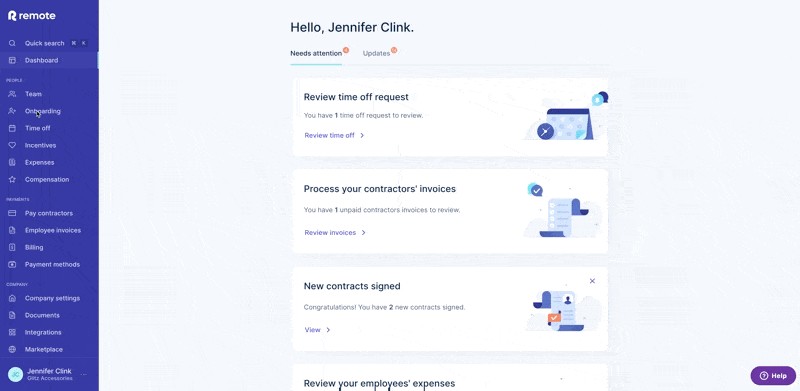

Remote’s main dashboard shows updates and tasks that require your attention.

(Source: Remote)

- Money-back guarantee: New clients get a money-back guarantee of 90 days — longer than Papaya Global’s 60-day offer.

- Smart employee profiles: With Remote’s smart profiles, you can instantly edit important employee details, such as job titles, manager reporting lines, and annual salaries.

- Zero interchange fees: Remote supports over 100 currencies in at least 180 nations and does not charge interchange fees.

- Contractor payment coverage: While Remote’s global payroll and EOR services can handle employee payments in over 190 countries, its contractor plan covers more than 200 countries — the largest coverage on my list of the best international payroll providers.

- Freelancer hub: Solopreneurs can use the Remote Freelancer Hub to manage global clients, organize contracts, track and send client invoices, and receive payments. The others on my list don’t have this feature.

Deel: Best for payment flexibility

Pros

- Offers multiple payment options (bank transfer, crypto, bitcoin, digital payment processors, and contractor card)

- Has a free HR information system (HRIS), Deel HR, to manage staff information and onboarding/offboarding

- Wide range of global HR tools, including IT features to manage devices and apps

Cons

- Background checks, localized benefits, and company device management tools are paid add-ons

- Contractor management pricing is higher than the others on my list

- Doesn’t offer a special plan or discount for hiring refugees

Overview

Who should use it:

If you’re looking for multiple payment options, Deel can pay workers in a variety of ways. It supports direct deposit, bitcoin, and cryptocurrency payments. It even has 15 contractor payment options, which include payouts via digital payment processors and a Deel contractor card.

Why I like it:

Deel can help you expand globally by providing EOR services for hiring and paying international workers, including immigration support and an IT solution to manage the apps and devices of your global distributed team. It also offers worker misclassification tools similar to Papaya Global’s AOR feature. Classifying workers correctly helps avoid potential legal issues and costly fines for violating employment laws.

It earned a score of 3.97 out of 5 in my evaluation because of its global payroll and HR features and user-friendly interface with simple-to-use contract generation tools. Deel even handles payroll for US workers across all states and, similar to Rippling, offers professional employer organization (PEO) services for US companies that need help managing HR administration and workforce management tasks.

- Deel HR: Free ($0); includes tools for managing staff information, documents, onboarding, time-off, org charts, and expense claims

- Global Payroll: Starts at $29 per employee monthly

- Includes payroll solutions for global teams

- Contractor: Starts at $49 per worker monthly

- Includes flexible payment options, locally compliant contracts, time-off tracking, invoicing and expense management, and access to HR support

- EOR: Starts at $599 per employee monthly

- Deel Engage: Starts at $20 per employee monthly

- Includes a Deel plugin for Slack and tools for managing learning courses, performance reviews, career pathways, and surveys

- US Payroll: Starts at $19 per employee monthly

- Includes payroll services in all 50 states, payroll tax filings in all levels (federal, state, and local), year-end tax forms, and new hire state reporting

- US PEO: Starts at $89 per employee monthly

- Deel IT: Starts at $99 per month

- Includes 24/7 IT support and tools to manage computer devices and access to business apps

- Background checks: Call for a quote

- Deel Immigration: Call for quote

- Immigration and visa assistance in over 50 countries plus support from local immigration experts

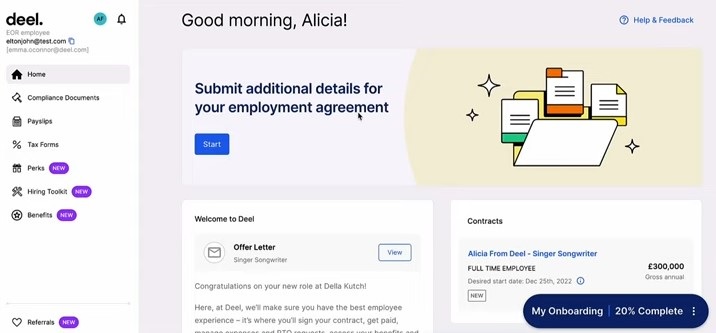

Deel will guide your new employees through the onboarding process — from signing the online offer letter to submitting new hire paperwork, such as bank information. (Source: Deel)

- Flexible payments: It supports payouts via bank transfers, digital payment processors (like Wise and Payoneer), and cryptocurrency (through Binance and Coinbase). Plus, Deel’s contractor card allows your contract workers to receive payments and pay for personal purchases. It has virtual and physical versions, although the physical card doesn’t support ATM withdrawals.

- Free HRIS: With the free Deel HR module, you can securely store and manage employee information and documents. It also includes tools to automate the entire employee lifecycle and keep you compliant with local labor laws.

- IT and immigration support: Its HR services include tools to manage work visa and immigration processes and the issuance of company-assigned devices (like laptops) to your global workforce.

- Deel plugins for Slack: Deel Engage comes with a Slack plugin to help simplify team communications, onboarding, employee referrals, and staff surveys.

Rippling: Best for affordability

Pros

- Integrates with over 600 business apps

- Offers modular HR, payroll, IT, and expense management tools and can create a custom plan to fit your requirements

- Has strong workflow and automation tools

Cons

- Pricing isn’t all transparent

- You can’t buy its payroll solution (and other modules) without purchasing its core workforce management platform first

- Benefits administration, IT tools, and HR advisory services are paid extras

Overview

Who should use it:

For businesses looking for low-cost global payroll tools, Rippling’s international payroll processing module comes with an affordable price tag. It costs only $20 per worker monthlyⓘ to pay global employees and contractors — the cheapest among the providers I reviewed.

Why I like it:

Rippling offers HR and payroll tools, EOR and PEO services, and IT support for businesses of all sizes. Its strength lies in its ease of use, robust automation tools, and capability to work with other applications. Companies with international workers can use Rippling’s feature-rich platform to manage HR, payroll, and IT processes — from tracking employee attendance to monitoring the inventory of laptops assigned to employees across at least 140 countries.

While its wide range of features and modular system that lets you choose the tools you need contributed to its 3.72 out of 5 rating, Rippling can get pricey depending on the functionalities selected. It also lacks Papaya Global’s unlimited workforce wallets with bank-level security, Remote, and Deel’s free HRIS, and Oyster’s easy-to-use application programming interface (API) tools.

For multicountry payroll and hiring, Rippling offers the following services:

- Global payroll*: $20 per employee monthly

- Global contractor payroll*: $20 per worker monthly

- EOR services*: $599 per employee monthly

*Pricing is based on a quote we received

Rippling automatically syncs HR and employee data with its payroll tool, enabling it to easily process employee payments.

(Source: Rippling)

- Integrated solutions with workflow automation tools: Rippling’s modules connect with each other, enabling the easy transfer of employee and pay-related data. Plus, you can create workflows that trigger specific actions across its modules to automate tasks, such as restricting clock-ins for workers who have yet to complete mandatory training courses.

- Fast payroll runs: Rippling claims it can process global payroll in as fast as 90 seconds. It also pays employees and contractors in over 50 currencies.

- Custom reports: It has Excel-like formulas you can add to custom reports, allowing you to generate data showing calculations for tenure and fixed bonus amounts.

- IT tools: Similar to Multiplier and Deel, Rippling’s device management module helps you assign, track, and lock computer devices issued to employees. It also has app management tools that let you remotely manage and disable business software, such as Google Workspace, Slack, and Microsoft 365.

- Third-party software integrations: It can integrate with over 500 apps, so it’s extremely versatile. No other software on my list has this breadth of flexibility.

Oyster HR: Best for hiring and payroll support

Pros

- Provides dedicated support for account and system setup

- Clients who plan to ramp up global recruitment get a hiring success manager to help them recruit employees

- Offers a lump sum payment (or single invoice) to cover all worker payments

Cons

- Charges a refundable deposit

- Oyster Shell plan with misclassification risk tools and indemnity protection costs extra

- Limited third-party software integration options

Overview

Who should use it:

If you require hiring support, you can take advantage of Oyster’s recruiting services. It has hiring success managers who can help you recruit and onboard employees. It can also pay employees in more than 120 currencies.

Why I like it:

With Oyster, you can hire, onboard, pay, and provide benefits to employees in more than 180 countries. It offers invoicing and expense management tools and provides access to locally compliant contracts. Onboarding employees is a breeze with Oyster’s easy-to-use platform. Plus, new clients get system setup and initial onboarding assistance from a CSM.

It earned a 3.65 out of 5 rating in my evaluation because of its EOR and contractor management services, built-in time tracking features, and reasonably priced plans. However, I couldn’t give it a higher score because while it offers hiring and new client support, you can’t contact its customer service team via phone or live chat. What it offers is a chatbot, email or ticket support system, and a knowledge base you can access online.

- Global Payroll: Starts at $25 per employee monthly

- Contractor: Starts at $29 per contractor monthly

- Includes hiring, payroll, onboarding, invoicing, and expense management tools

- Employer of Record: Starts at $699 per employee monthly

- Scale: Call for quote; this is an annual plan that lets you prepurchase and reuse seats for hiring three or more employees

- Includes custom global compliance assistance and access to a dedicated hiring success team

- Benefits packages: Call for a quote

- Salary insights: Call for a quote; includes access to salary bands and ranges across over 130 countries to help you build competitive compensation packages

- Visa sponsorship: Call for a quote

- Oyster Shell: Call for a quote; includes worker misclassification risk assessment tools and indemnity protection of up to $500,000

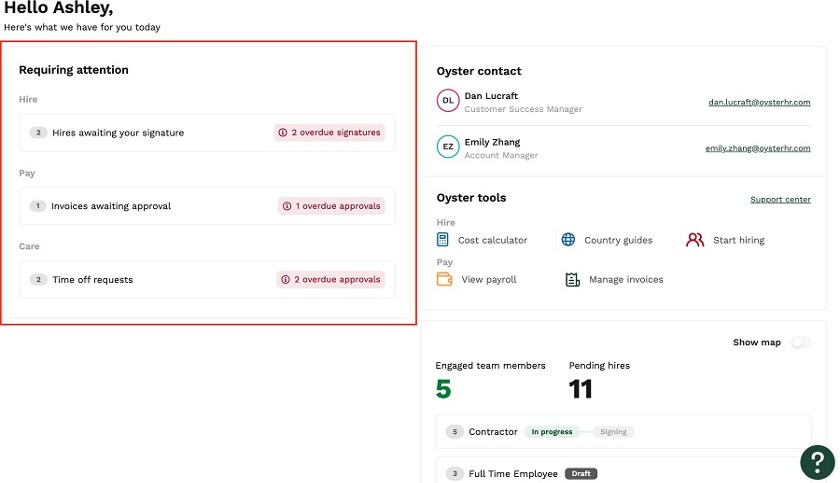

Oyster’s dashboard not only shows the number of employees you have and the online tools you can use, but also flags overdue tasks that require immediate attention.

(Source: Oyster)

- Benefits tool and employment cost calculator: It has an online calculator that shows your total employment cost and a “benefits advisor” tool with a list of statutory and best-in-class benefits plans that local benefits advisors recommend.

- API tools: Oyster’s easy-to-use APIs allow you to integrate its platform with third-party software — no coding knowledge is required.

- Quick lump sump payments: You can settle payments to Oyster with a lump sum option to cover all salaries, and Oyster will divide the amount correctly so each worker is paid accurately and on time.

- Discounts for qualified companies: Similar to Remote, it offers discounts for qualified nonprofit organizations and B Corp businesses. Hiring refugees in countries where Oyster has direct entities is also free (up to 10 refugee hires per company only).

Multiplier: Best for onboarding and payroll in Asia

Pros

- Supports payments in 120 currencies, including cryptocurrency payouts for contractors

- Offers 24/5 assistance from local HR and legal experts

- Hiring solution covers over 150 countries

- Owns legal entities across the Asia Pacific (APAC) region

Cons

- Lacks time tracking features (only monitors leave accruals)

- Has a fixed payroll cut-off date (every 10th of the month)

- Only integrates with BambooHR, Workday, Personio, and HiBob, as of this writing

- Pricing isn’t all transparent

Overview

Who should use it:

Multiplier owns legal entities across Asia, making it a great choice for recruiting, onboarding, and paying employees in APAC. It also offers multilingual and locally-compliant employment contracts that you can generate instantly.

Why I like it:

Out of all the providers on my list of best international payroll software, Multiplier has the least expensive EOR package. For a monthly fee of $400 per employee, you can compliantly hire and pay international employees. The others in this guide have EOR services that cost anywhere from $599 to $699 per employee monthly.

It also has a global team of multilingual payroll professionals who are experts in local labor and tax rules. With Multiplier, you manage employee data, track time off, and even process expense reimbursement claims. While I gave it an overall rating of 3.60 out of 5, it scored the lowest in user reviews and HR features. It doesn’t have as many online reviews as Deel, nor does it have a full-featured HR platform as Rippling’s all-in-one HR system.

- Global Payroll: Call for a quote

- Employer of Record: Starts at $400 per employee monthly

- Contractors: Starts at $40 per worker monthly

- Includes instant contracts with multicurrency and crypto payments

- Immigration: Call for a quote; includes visa assistance in over 140 countries

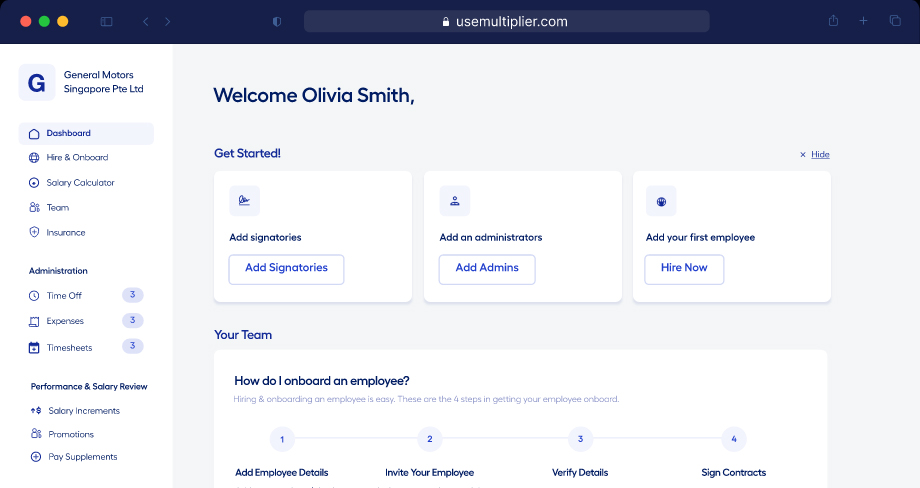

Multiplier’s main dashboard provides easy access to hiring, onboarding, and user management tools. (Source: Multiplier)

- Instant employee contracts: Multiplier claims that it can quickly generate online employment contracts that are multilingual and regionally compliant, provided you give the required new hire information, such as full name, email address, job title, and compensation details.

- Fast onboarding: Multiplier touts an employee onboarding process that can be completed in less than a week.

- Easy issuance of company-assigned computers: Similar to Rippling and Deel’s device management tools, Multiplier’s onboarding tool lets you issue laptops directly from its platform. It’s even part of the onboarding steps, which ensures that you don’t miss assigning computer devices to new employees.

How to choose the best global payroll provider

In choosing the right payroll solution to handle your international pay processing needs, consider the following factors:

- Size of your workforce: Aside from your current headcount, consider your company’s growth plans. Do you plan to add more workers in the near future? Will those be employees or contractors? Knowing the answer to these questions will help you gauge whether a payroll provider can handle your growing global pay processing needs.

- Location and number of countries where your business operates: Check whether the countries where your business is located are covered by the provider’s international payroll services. Don’t forget your growth plans. Look for providers who can handle payroll in countries where you plan to expand business operations.

- Your budget: Once you’ve identified your headcount and location, calculate whether the provider’s monthly fees meet your budget. If you have a large team, consider international payroll companies that offer volume discounts.

- HR and payroll features: Take stock of the functionalities that your business needs. Ask yourself questions — such as which part of the international payroll process do you find most challenging, and can the provider help you with that? Do you require integration options so you can connect the provider’s platform with the software that you use (like accounting systems)?

- Support services: Check whether the global payroll service includes access to compliance experts, in-country payroll professionals, 24/7 assistance, and dedicated support. Also, ask the provider if they offer system setup and data migration assistance. This will help save you time from doing all the initial setup yourself.

Methodology: How I evaluated the best international payroll services

To evaluate the best international payroll software, I collaborated with Irene Casucian, one of our expert research analysts, to review and compare seven popular options. We used a 47-point rubric created by Jessica Dennis, who also selected the products we evaluated based on her hands-on experience with HR software, payroll expertise, and over six years of experience as an HR generalist.

Our options included:

- Papaya Global

- Remote

- Deel

- Rippling

- Oyster HR

- Multiplier

- Gusto

We looked for key features that streamline payroll, benefits administration, onboarding, time tracking, and employee data recordkeeping. In addition to checking online user reviews, we researched the compliance tools, document storage, reporting, third-party software integrations, data privacy, and customer support options offered. If available, we leveraged free trials and demos to assess each software’s functionality and ease of use.

I also added my expert rating to each criterion, where I considered the effectiveness of that area or feature. Then, I narrowed down the list to my top five recommendations.

To view the full evaluation criteria, click through the tabs in the box below.

30% of Overall Score

Here, we considered the country coverage of each vendor’s EOR and payroll packages, including whether they have local entities in those countries. We also checked payroll turnaround times, country-specific benefits options, global compliance and tax reporting, payment methods, and international hiring, payroll, and HR advisory services.

25% of Overall Score

In this criterion, we considered the platform’s data security features, permission controls, mobile app functionality, software integrations, and general ease of use. We also checked for in-app compliance alerts, org charts, time off management, employee onboarding and offboarding, and benefits tracking tools.

25% of Overall Score

In this criterion, we looked for transparent pricing, implementation fees, discount offers, separate contractor plans, and each platform’s “value for money,” which determines whether the number of features in the basic plan is competitive with other vendors in the space. We also considered the affordability of each vendor’s EOR package — wherein those with monthly fees of $599 and below get a higher score.

15% of Overall Score

We looked at the support options available, such as the support hours and whether customer representatives can be reached via phone, email, or chat. We also checked the types of help resources offered, such as how-to guides and a community forum.

5% of Overall Score

Because users have real-world experience with each platform, they played a significant role in narrowing down my list of solutions to compare. For this criterion, we checked the user reviews from third-party software review sites like Capterra, G2, and TrustRadius.

Global payroll services frequently asked questions (FAQs)

A global payroll service helps you pay international workers (either employees or contractors) accurately and on time while keeping you compliant with country tax and labor laws. Its services also involve calculating the applicable wages and deductions, remitting payroll tax payments, generating and filing tax forms, and providing pay slips to employees.

The best global payroll providers include those on my list, such as Papaya Global, Remote, Deel, Oyster HR, Rippling, and Multiplier. While these providers are great options, the right one for your business should meet your pay processing and global compliance needs while helping you stay within your set budget for HR software expenses.

You need to consider the local employment laws of countries where you’re planning on hiring. When it comes to paying distributed teams, it’s important to understand local payment methods, tax regulations, and operational considerations you must comply with. This will prevent you from facing penalties and fines because of worker misclassification (e.g., you hired independent contractors, but if you direct their work, they are considered employees).

If you choose to hire international employees, you can control their work schedules, oversee how the work is completed, and even implement performance management measures. When working with foreign independent contractors to complete specific projects, you are not legally allowed to direct how and when they can do the job. However, the definition of a contractor can vary in different countries, so consult with hiring experts to avoid worker misclassification issues.