PayPal and Braintree are two of the most popular online payment processors. PayPal is good for businesses that need a quick and easy way to start accepting payments online, while Braintree is suitable for merchants looking for more robust and customizable payment processing.

PayPal is included among the top providers in our list of the best online payment and credit card processors with an overall score of 3.84 out of 5. Braintree, on the other hand, didn’t make the top five, but earned a decent overall score of 3.60 out of 5.

- PayPal: Best for quick online payment integrations

- Braintree: Best for customized payment integrations

Braintree was acquired by PayPal in 2013. Although Braintree is owned by PayPal and has PayPal in its logo, it is a separate company. However, there are many similarities between the two, especially when it comes to pricing and features.

Braintree vs PayPal Quick Comparison

A major difference between PayPal and Braintree is the type of merchant account they provide. PayPal provides an aggregated merchant account while a Braintree account comes with a dedicated merchant account.

Dedicated Merchant Account vs Aggregated Merchant Account

Businesses need a merchant account to start accepting payments. A dedicated merchant account is an individual account that is unique to the business. On the other hand, an aggregated merchant account is a shared account for multiple businesses under a single account held by a payment facilitator.

A dedicated merchant account is a safer and more stable solution for businesses but usually involves a more stringent application and underwriting process. It is often much easier to open aggregated merchant accounts, although they are prone to account freezes and fund holds.

When to Use an Alternative

Although both PayPal and Braintree offer good online payment processing, businesses that need more convenient all-in-one solutions would benefit from other providers such as Square or Helcim.

|  | |

|---|---|---|

Best for | Low-volume merchants with less than $10,000 monthly transactions | Low-cost payment processing with free POS |

Monthly fee | Starts at $0 | $0 |

Card-present transaction fee | 2.6% + 10 cents | Interchange plus 0.1%–0.3% + 5–8 cents |

Keyed transaction fee | 3.5% + 15 cents | Interchange plus 0.2%–0.5% + 10–25 cents |

Ecommerce transaction fee | 2.9% + 30 cents | Interchange plus 0.2%–0.5% + 10–25 cents |

Looking for the lowest fees? Find other options in our list of the cheapest credit card processing companies.

Braintree vs PayPal Pricing & Contract

|  | |

|---|---|---|

Score | 3.38 out of 5 | 3.69 out of 5 |

Ecommerce Transaction Fees | Starts at 2.99% + 49 cents | 2.59% + 49 cents |

Virtual Terminal Transaction Fees | 3.09% + 49 cents (+ $30 monthly fee) | 2.59% + 49 cents |

In-person Transaction Fees | 2.29% + 9 cents | 2.29% + 9 cents |

ACH/eCheck Transaction Fees | 3.49% + 49 cents (capped at $300) eCheck | 0.75% per transaction capped at $5 per transaction |

Invoice Fees | Starts at 2.59% + 49 cents | Through third-party integration only |

Recurring Billing Fees | 3.49% + 49 cents | 2.59% + 49 cents |

International Transaction Fees | +1.5% (with 4% currency conversion spread) | +1% |

Chargeback fees | $15–$20 | $15 |

Neither PayPal nor Braintree charge any monthly account maintenance fees, and both offer competitive flat transaction rates. With Braintree being owned by PayPal, it’s not surprising that their processing fees are similar for some payment methods. However, unlike PayPal’s more complex pricing structure, Braintree offers a more straightforward schedule of fees that’s easier to understand.

And there are some aspects where Braintree clearly offers lower fees: virtual terminal, recurring billing, ACH payments, and international transactions. For ACH payments and recurring payments, PayPal treats them like any commercial transaction so its commercial transaction rates apply. On the other hand, Braintree charges ACH payment processing fees that are closer to industry standards and charges recurring payments fees based on its virtual terminal processing fees.

Although this evaluation only considered PayPal and Braintree’s capabilities for accepting credit card payments online, they can both handle in-person payments through PayPal Zettle. The fees and features are the same whether you sign up with PayPal or Braintree. Read our PayPal Zettle review.

Our expert take: Braintree is a clear winner when it comes to pricing. When you look at pricing and contract alone, none of PayPal’s services are cheaper than Braintree. The difference in fees is glaring when you look at ACH payments and international payments. If a significant number of your monthly transactions are ACH or international payments, Braintree will give you much lower fees. If your consideration is price alone, it is a more cost-effective option to use Braintree—unless you need to send a lot of invoices because Braintree doesn’t have any native invoicing capability.

Braintree vs PayPal Payment Types

|  | |

|---|---|---|

Score* | 3.88 out of 5 | 3.75 out of 5 |

Ecommerce | Easy one-click integration | Easy integration or with coding |

Invoicing | ✓ | ✕ |

Recurring Billing | ✓ | ✓ |

Virtual Terminal | With additional $30 monthly fee | ✓ |

Payment links | ✓ | Third-party integration |

ACH Processing | ✓ | ✓ |

*These scores did not take into account in-person payment processing capability. | ||

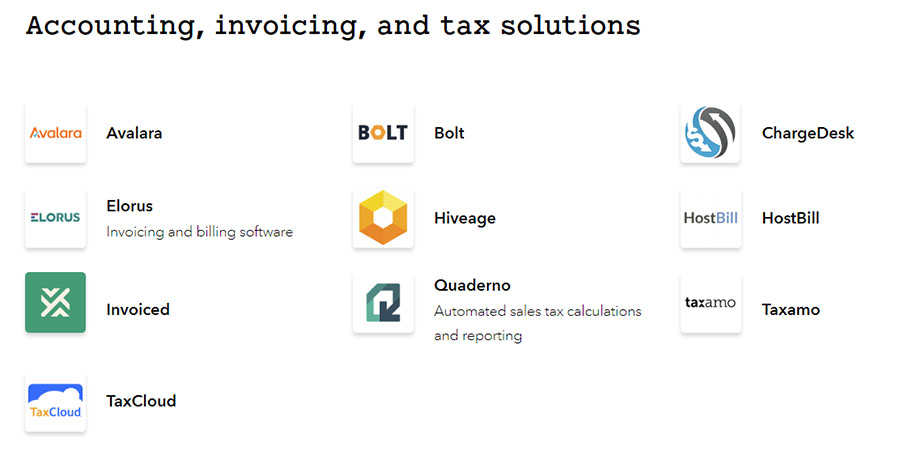

PayPal offers more payment options than Braintree. One of the most glaring differences is Braintree’s lack of native invoicing capabilities. If you use Braintree and need to send invoices, you must do this by using any of Braintree’s invoicing integration. It has several integrations that can provide invoicing help.

Braintree does not have any native invoicing capability but offers invoicing solutions via integration. (Source: Braintree)

Braintree also doesn’t allow payment links unlike PayPal, which provides PayPal.Me links that merchants can send to their customers for easy payment. However, when it comes to virtual terminals, PayPal charges an additional $30 monthly fee for its use while Braintree allows merchants to create transactions right from the Control Panel without any extra fees.

Both PayPal and Braintree accept payments from Venmo, another PayPal company, and their processing fees are the same. However, that is the only other mobile payment wallet that PayPal accepts; Braintree accepts other mobile wallet payments such as Apple Pay and Google Pay.

Our expert take: PayPal offers slightly more than Braintree when it comes to payment types. The lack of native invoicing capabilities is a glaring disadvantage for Braintree. Despite the availability of invoicing integrations, PayPal’s easy and quick invoicing is more suitable for those who do not want to sign up with a third-party provider. If you want to offer more mobile wallet payment options such as Apple Pay or Google Pay to your customers, Braintree is more suitable for your business.

Braintree vs PayPal Features

|  | |

|---|---|---|

Score | 3.63 out of 5 | 3.19 out of 5 |

Deposit Speed | Instant Payout: 1.5% fee Standard: 1–3 business days | 2–3 business days |

Chargeback Protection | 0.40% per transaction | ✓ |

Chargeback Fee | $15–$20 | $15 |

Fraud Prevention | Basic: $0 | $0 |

PCI Compliance | ✓ | ✓ |

Customer Service | live customer and technical support: 24/7; phone support: 6 a.m. to 6 p.m. Pacific time, Monday through Sunday | 24/7 email and phone |

Buy Now, Pay Later | ✓ | ✕ (through PayPal) |

PayPal earned higher scores than Braintree for its features. Just like for pricing and payment types, there is no huge difference between what PayPal and Braintree offers. The most noticeable edge PayPal has over Braintree is the availability of an instant payout option. Braintree does not have this—even as a paid service.

Also, Braintree does not offer any native Buy Now, Pay Later services except for PayPal’s BNPL service. Since PayPal is easy to offer as an additional payment processor alongside any other payment services provider, a merchant may simply add PayPal for its BNPL service without having to sign up with Braintree.

Both Braintree and PayPal offer an abundance of integrations, but PayPal is more widely recognized and offers easier one-click integrations with almost any ecommerce platform. Braintree is more developer-friendly and has a sandbox environment that makes it easy to test any customizations you create.

Aside from integrations, PayPal and Braintree are also on equal footing when it comes to security with their robust fraud protection and chargeback protection tools.

Our expert take: Braintree doesn’t offer anything extra when it comes to features compared to PayPal except for its developer sandbox. However, if you need higher level customizations, Braintree’s developer-friendly platform and easy-to-use application programming interfaces (APIs) provide more flexibility than PayPal. PayPal is the right one for you if you prefer an easy and simple payment solution that allows instant payouts. If you need a more customized solution for your payment processing needs, Braintree is a better choice.

Braintree vs PayPal Expert Score

|  | |

|---|---|---|

Score | 4.38 out of 5 | 3.75 out of 5 |

Pricing | Complex pricing structure | A more budget-friendly option |

Ease of Use | User-friendly | Developer-friendly |

User Reviews | Well-known and trusted platform | Less-than-favorable user reviews |

Integrations | Easy integrations with popular platforms | Easy integrations with popular platforms |

When it comes to PayPal vs Braintree, the right payment processor will depend on your specific business needs and setup. Functionality-wise, they are on equal footing, with PayPal as the better option for merchants that want an easy, fuss-free payment solution and Braintree as the suitable provider for a more customized approach.

If it’s about affordability, Braintree is the budget-friendly option, especially if you process a lot of international transactions or ACH payments. PayPal gets a slight edge when it comes to popularity, especially with Braintree’s less-than-favorable reviews on some websites.

Lastly, if a dedicated merchant account is what you are looking for, Braintree is the right option for your small business.

Methodology—How We Evaluated PayPal and Braintree

We test each online payment processor ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to various payment processing features, scalability, and ease of use.

The result is our list of the best online and credit card processors. However, we adjust the criteria for specific use cases, such as for different business types and merchant categories. This is why every online payment processor has multiple scores across our site, depending on the use case you are looking for. For this in-depth analysis, we looked closely at PayPal vs Braintree and how they performed.

Click through the tabs below for our overall online payment processor evaluation criteria:

20% of Overall Score

We graded based on monthly fees, online rates, chargebacks, and whether or not you could get volume discounts.

30% of Overall Score

Online payments are more than website checkouts. We looked for invoices, recurring billing, and virtual terminals. We also gave points for stored payments and Level 2 and 3 processing for B2B sales.

25% of Overall Score

This score considered sales tools like customer management features, BNPL, fraud prevention, and developer tools for customizations. We also considered deposit speed, giving the most points for same-day processing and customer service.

25% of Overall Score

Here, we scored based on our own experience of ease of use, plus research into account stability. The number and ease of integrations contributed to this score. Finally, we gave some weight to the input of real-world users as recorded in third-party user review sites like Capterra.

Braintree vs PayPal Frequently Asked Questions (FAQs)

The processing fees of PayPal and Braintree are similar for many payment methods, but Braintree offers cheaper rates for international payment processing and ACH payments. Braintree also has lower chargeback and recurring billing fees.

Braintree does not charge any monthly fees, and merchants only need to pay processing fees for every transaction.

Braintree and PayPal are both payment processing platforms owned by PayPal Holdings, Inc., but they serve different purposes. PayPal is a widely used online payment system for individuals and businesses, while Braintree is geared toward businesses with more advanced payment needs requiring customizable solutions.

Braintree and PayPal are two different payment processors, and you can use one without the other. That being said, you may also use them together for your small business.

Bottom Line

In the matter of PayPal vs Braintree, the decision hinges on your business needs and priorities. PayPal is perfect for swift and simple payment integration, ideal for smaller businesses looking for secure, trusted options. On the other hand, Braintree excels for more intricate needs, offering customization, dedicated merchant accounts, and lower fees for international transactions and ACH payments.

For hassle-free integration, PayPal is the pick. But if you seek tailored solutions and customization, Braintree is the way to go. Assess your requirements and prioritize flexibility or ease when deciding between these two powerful payment processors.