PayPal Zettle is PayPal’s free mobile point-of-sale (POS) app that replaced PayPal Here (discontinued since September 30, 2023). It provides a complete POS system for tablets or mobile devices with built-in PayPal payment processing.

In our evaluation of the best POS systems, PayPal Zettle earned an overall score of 3.24 out of 5, and did not make our list of the top 10. Regardless, it is a decent choice for small business owners, particularly artists, hobbyists, and solopreneurs, looking for free POS software.

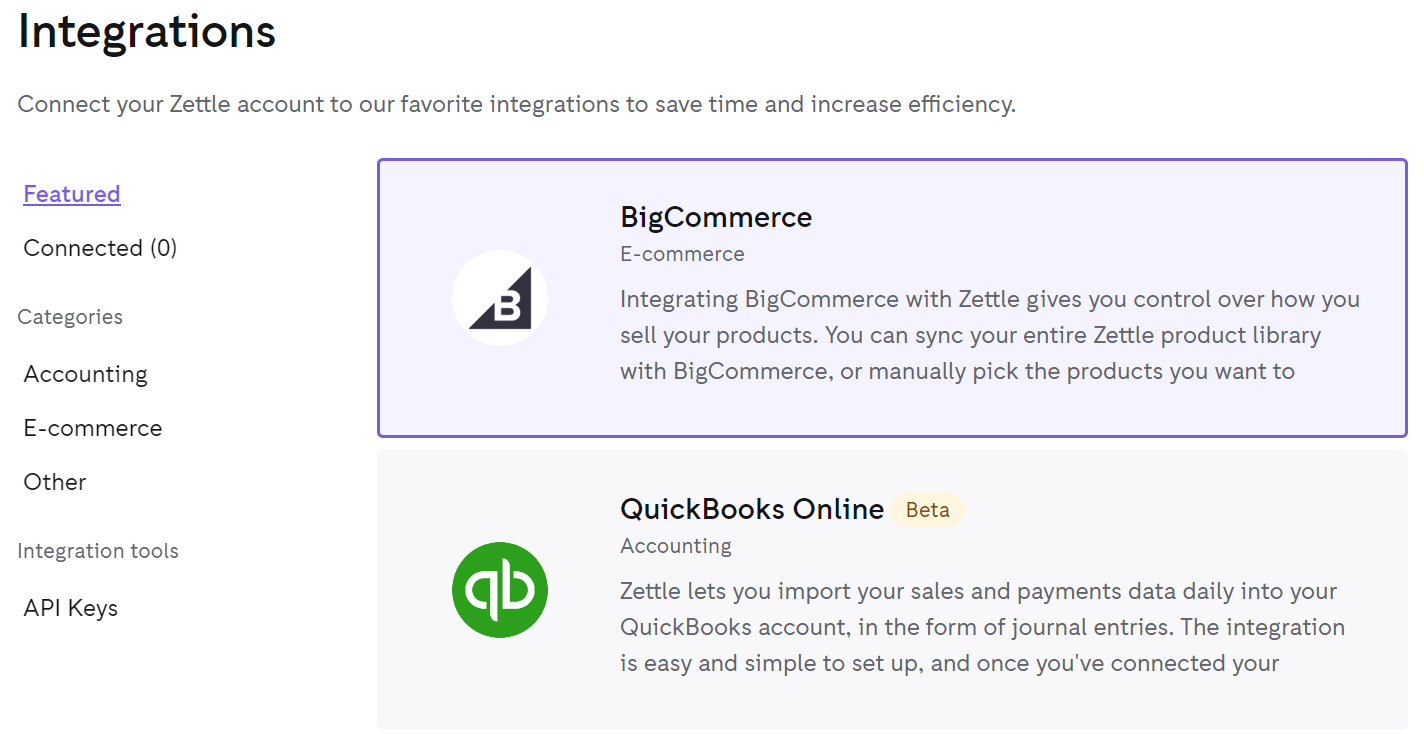

While it has low in-person processing rates compared to other POS systems and a user-friendly app, the system provides only standard register features, basic business management tools, and very limited integrations. It also does not yet integrate with PayPal’s online store.

We’ve tested dozens of POS systems, and after reviewing Zettle, we find it a strong mobile payments competitor to Square, the industry leader. It’s simple enough for the solopreneur and, with PayPal’s affordable processing rates, a good option for the hobbyist. Click through the images below to see what Zettle does best:

Key PayPal Zettle Features

On the other hand, while PayPal easily integrates into some of the best POS systems, you need to consider alternative solutions if you have a growing business:

- Unlike Square, PayPal Zettle does not have any paid plans or add-ons, so you may quickly need a more robust POS solution.

- Zettle has some inventory functions, like low stock alerts and variants; however, it lacks kitting and vendor management.

- PayPal has an online store, a virtual terminal, and integrations, but they do not work through Zettle.

- Zettle has some features that might work in a restaurant, like printing order numbers on receipts, but it’s not the best option. It does have a food and drink solution, but it costs extra and is not yet available in the US.

PayPal Zettle Fee Calculator

Zettle got high marks for its free software plan, low payment processing rates, affordable hardware, and lack of setup or installation fees. It got minor deductions for lacking payment processing flexibility; third-party processors are currently not compatible with the POS.

The POS software is completely free—no trials or premium plans. It has extremely reasonable rates of 2.29% + 9 cents for card-present transactions, and 3.49% + 9 cents for keyed-in transactions. Most mobile POS systems charge higher rates, for example, 2.5% or higher for card-present transactions.

Chargeback fees are $20, which is fairly standard.

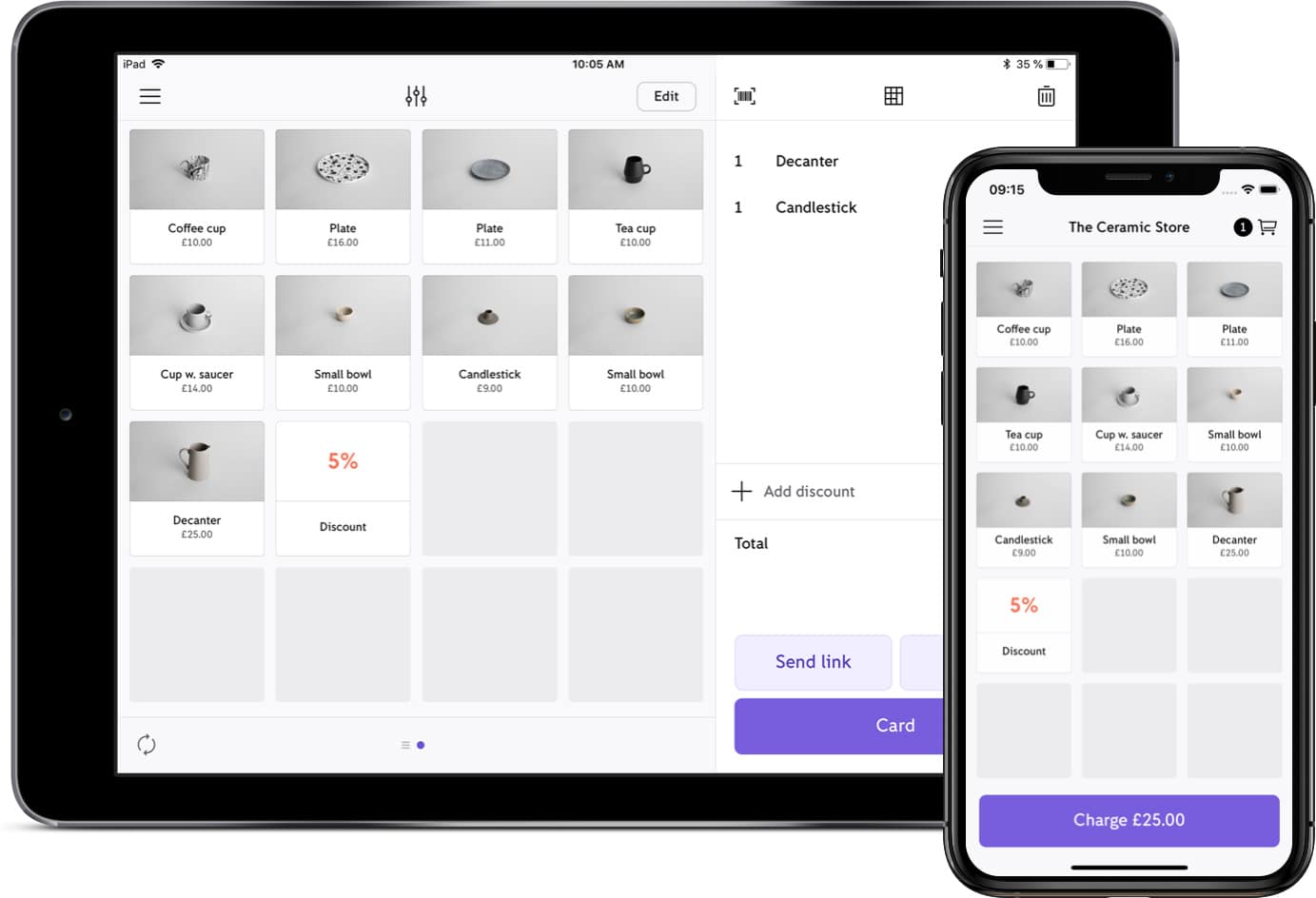

Zettle’s hardware allows for good sales mobility, and its intuitive register has a lot going for it, like generating order tickets, letting customers include tips, issuing refunds, and printing receipts. Overall, Zettle’s simplicity is an asset to small businesses.

However, while Zettle allows online ordering, this ironically does not work with PayPal online (though it is compatible with WooCommerce and other website builders). It does not have any dedicated order management and loyalty management features. You get basic customer directory and other CRM tools.

And, while PayPal Zettle integrates with Shopify for multichannel sales, users will be required to use PayPal as a payment processor. This means that Shopify will also charge a commission fee for each transaction, making it more expensive to accept payments.

Here are a few things you can do with a PayPal Zettle register:

- Payment types: You can accept credit cards, gift cards, PayPal, and Venmo. The card reader is EMV-certified, which is now required by law in the US. (For manual card entry, you need a PayPal Business account.) PayPal can host various cryptocurrencies; when making transactions, customers can convert these to fiat currencies before sending the payment through. You can also record cash transactions.

- QR codes: A feature that’s growing in popularity with POS software is generating a QR code that your customer can scan in order to pay. You need to activate this feature on Zettle to use it.

- Sell by units: You can set your prices in the inventory section to sell by units such as ounces, cases, etc. Keep in mind that there’s no kitting capability.

- Partial refunds: Zettle recently added partial refunds, allowing you to refund the cost of one or more items on a receipt rather than the entire transaction. Note that this function is only available in the mobile app.

- Multiple logins: You can set up logins for your employees to track sales. You can also handle multiple accounts on one device, switching between them as needed. This is one way to get around the fact that Zettle, unlike Square, does not have multi-location functions.

Zettle lets you accept payments by QR code. (Source: Zettle)

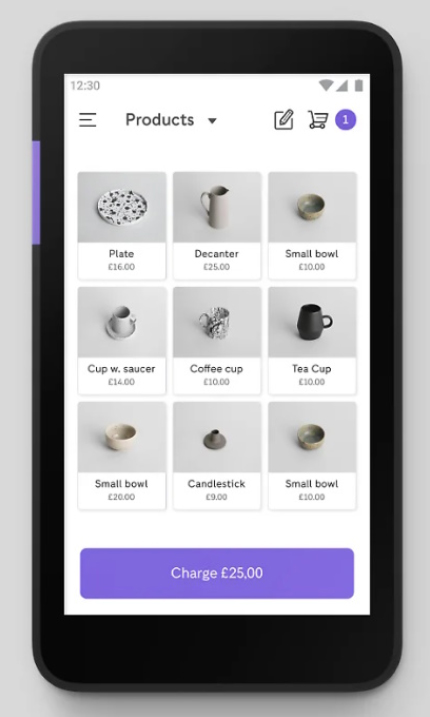

PayPal’s Zettle mobile app, called Zettle Go, requires iOS 12.1 or higher or Android 5.0 or higher. It has a complete register and backend system, from ringing up credit card sales to analyzing sales reports. User complaints include the card reader not connecting, changes due to the acquisition by PayPal, and problems with a recent upgrade making it hard to log in. However, the majority of reviews say it’s easy to use.

Zettle’s smartphone POS app does nearly everything the web app can. (Source: Google Play Store)

As of this writing, the apps have these scores:

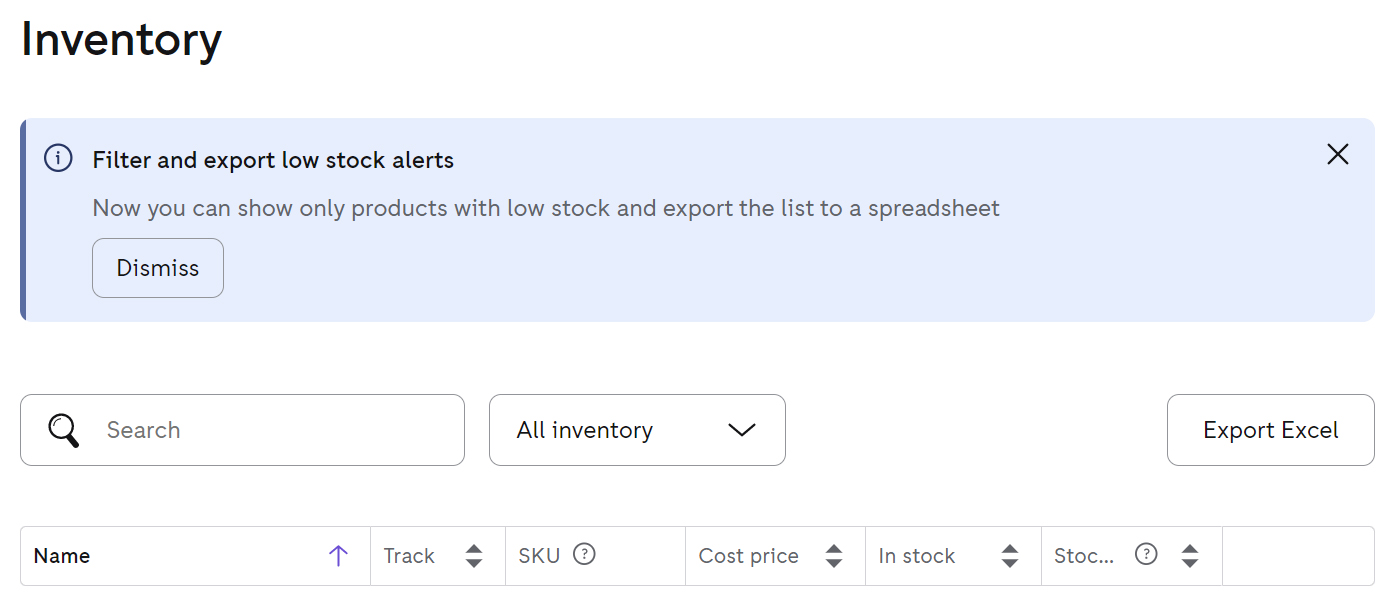

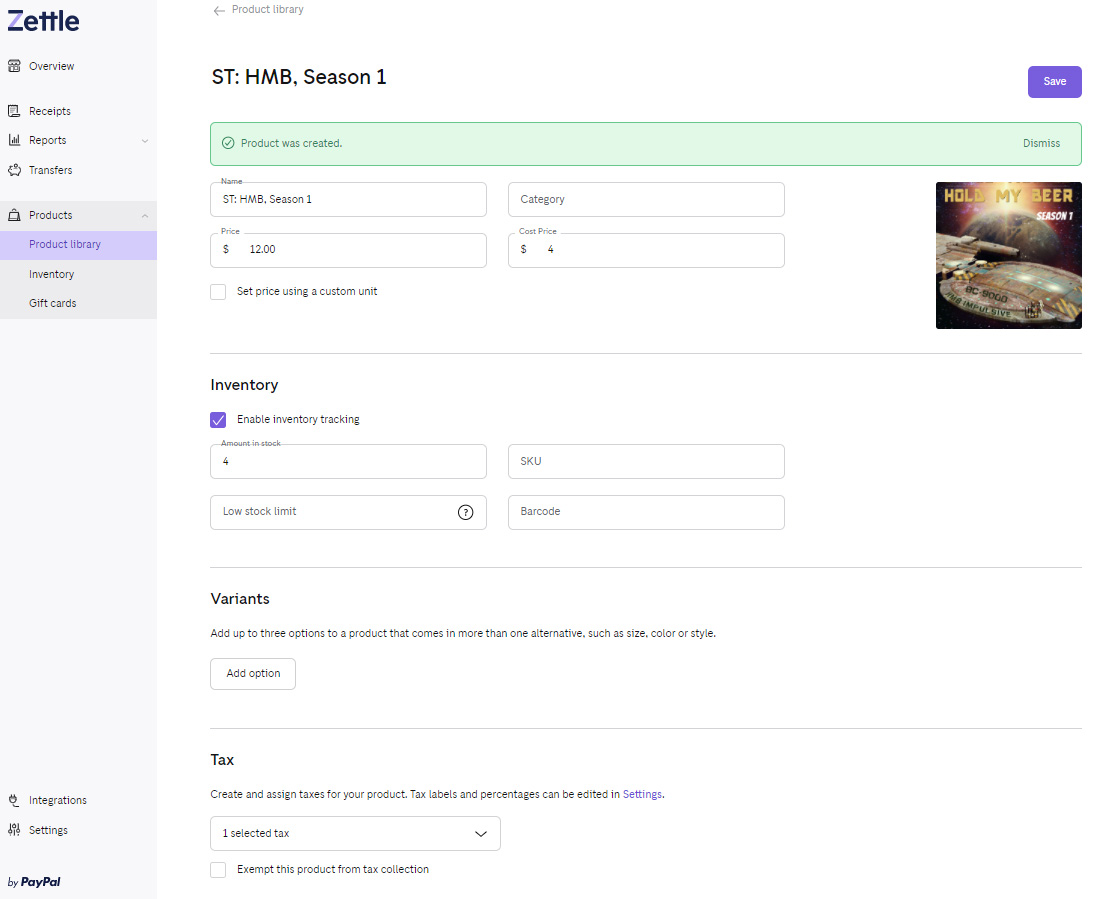

PayPal Zettle did not score very highly for this criterion. It has a serviceable inventory management system and on-hand counting (if you use the barcode scanner), along with basic reporting and employee management tools. However, several points were deducted due to missing features for purchase order and vendor management, multilocation management, and marketing.

Zettle’s inventory software is very simple but has several features that can make it a powerful tool. However, it does not handle vendors, create kits, or build menu items.

- Bulk actions: You can load, assign categories, and delete items in bulk.

- Low-stock alerts: Zettle tracks items and issues low-stock alerts. These show up in the shopping cart when you are selling a low-stock item.

- Variants: You can add up to three options. These are pre-defined as Color, Size, Style, Material, and Finish. Once you set the variant, you create different values and assign a price to each.

- Gift cards: You can manage gift cards that are premade, emailed, or physically created by you. These are tracked in inventory.

The inventory section is basic but includes variants and stock counts. (Source: Zettle app)

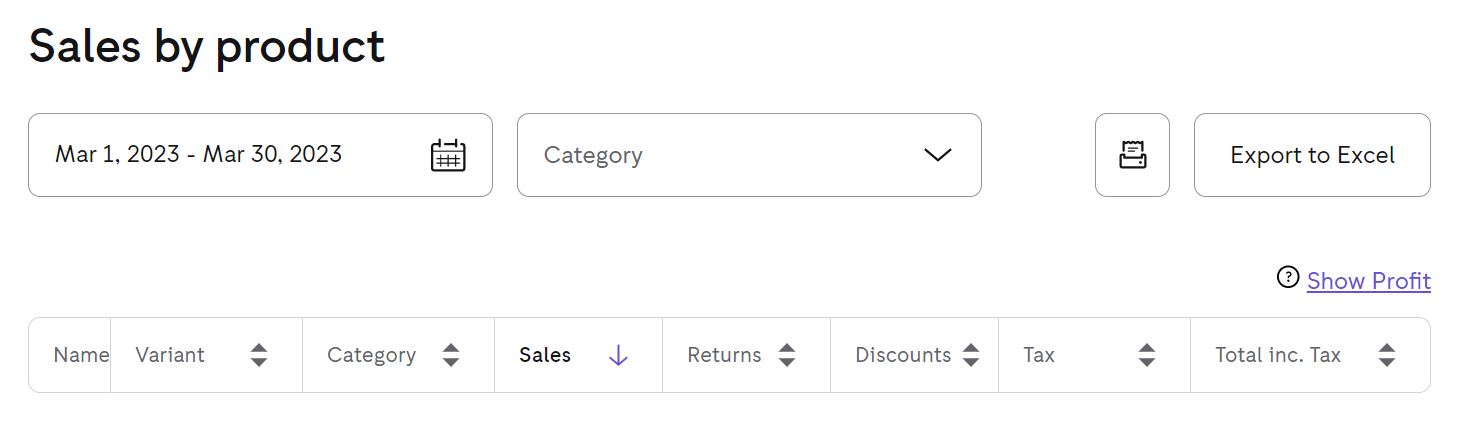

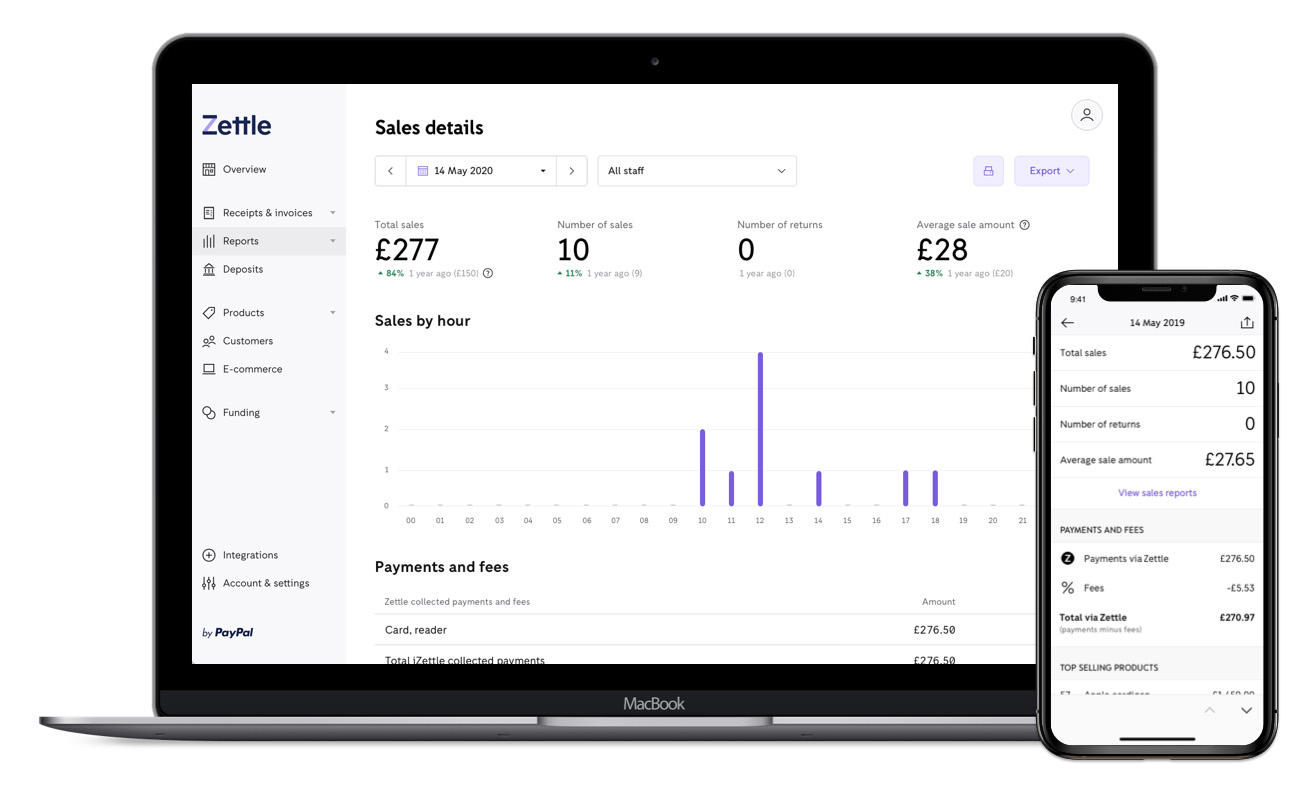

Zettle only offers basic sales reports, including an overview of a particular period, sales by product or category, staff performance, payments made, fees paid, and refunds granted. You can export your reports or data in PDF or Excel format.

Zettle’s reports are mobile-optimized so they can be read on smartphones, too. (Source: Zettle)

Unlike most popular POS systems, PayPal Zettle does not have a wide range of tools for employee management. You can use your PayPal Zettle settings to create sub-accounts and assign each to your staff with individual usernames and passwords. This gives them access to limited functions such as payment processing and sales tracking.

With this feature, you can add more checkout terminals within your store or link multiple store locations. Note that creating sub-accounts for multiple users is important as PayPal is known for freezing accounts when it detects unusual activity such as multiple access. This is specifically mentioned in the Terms of Service.

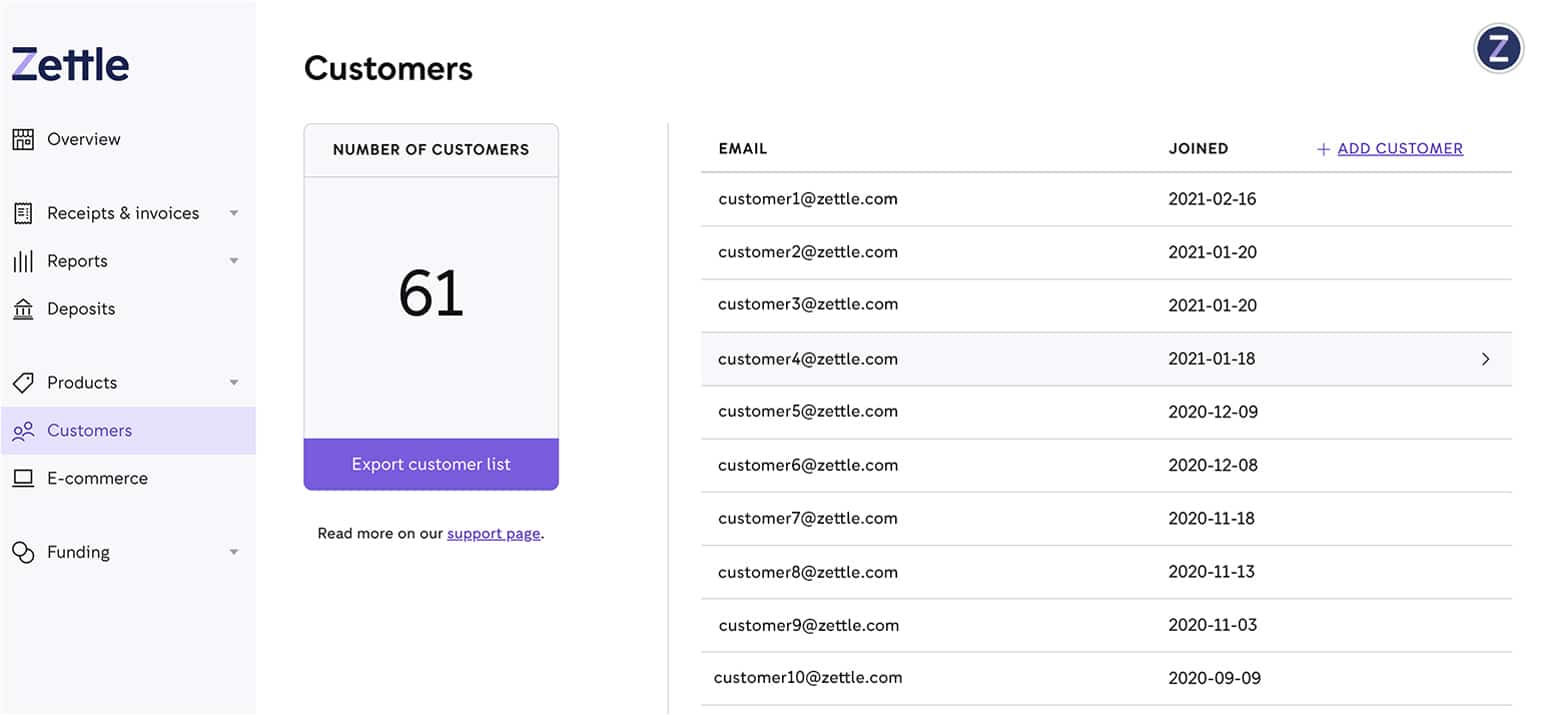

Like Square, PayPal Zettle lets you sign up customers at the point of checkout; however, Zettle’s tools are quite limited compared to other POS software providers. You can store customer email addresses and export them in bulk to upload to an email marketing software. PayPal Zettle currently does not have any available marketing software integration, nor does it include a built-in or dedicated loyalty program.

Collect email addresses at checkout with PayPal Zettle. (Source: PayPal)

Zettle is EMV-approved and complies with the strict Payment Card Industry Data Security Standard (PCI DSS) for handling card data. Zettle uses advanced machine learning systems to monitor every transaction being processed, 24 hours a day, to flag suspicious activity.

You can open a dispute within 180 days of a payment date. When a customer files a dispute, PayPal gives you a chance to address the issue, and if it can be resolved, then there are no charges. You have 20 days to work with the customer to fix any problems, after which, the dispute will automatically close unless it has been escalated. If either you or the buyer escalates the dispute to a claim, PayPal will make a decision regarding the outcome—usually within 14 days, but sometimes exceeding 30 days. If the issue cannot be resolved and the customer is refunded their money, PayPal charges you a $20 chargeback fee. There is no fee for bank reversals.

Zettle scored fairly low for ease of use. It earned points for being available on a variety of devices, being easy to install, and having a good knowledge base available. Like most of PayPal’s products, Zettle is easy to use and popular.

PayPal Zettle has a dedicated help center that lists step-by-step guides and instructions for using the system. (Source: Zettle)

However, the POS system lost points for its lack of integrations and somewhat limited customer support accessibility. Support is available by chat, phone, and email; but only the last of these is available 24/7. The strongest factor that cost Zettle points in this category is the lack of an offline mode for payment processing. This may cause problems if users are away from data or Wi-Fi.

PayPal is still supporting Here and transitioning to Zettle in the US, so there’s not as much information about it as about PayPal Here. We did have some issues finding definitive answers to questions when using the search in the help section, but the articles themselves were clear, albeit unillustrated.

For now, POS integrations are limited for PayPal Zettle users in the US. (Source: PayPal)

In our evaluation, Zettle achieved only a middling score of 3 out of 5. High points include its easy-to-use features and competitive fees compared to other POS systems. As a payment processor, PayPal has always scored high in our evaluation due to its value for money, software reliability, and ease of use; we saw those same qualities in Zettle, not to mention a more simplified set of payment processing fees.

However, Zettle suffered due to the lack of key POS features; while its relatively basic tools may be sufficient for small solo businesses and hobbyists, larger or fast-growing companies may struggle to find everything they need. There are no add-on options and very limited integrations to supplement these tools. The point-of-sale software has also received below-average user reviews.

What Users Say in PayPal Zettle Reviews

We were only able to find Zettle user reviews from a few websites. On Trustpilot, Zettle has over 3,000 reviews and a score of 2.6 out of 5. User reviews on Capterra totaled over 2,000 and give Zettle a better overall score of 4.6 out of 5.

The most common positive feedback from merchants mention flexibility and security when receiving payments via Zettle. The most frequently cited complaint is that users often find that their Paypal accounts have been frozen for unknown or unclear reasons.

| What Users Like | What Users Don’t Like |

|---|---|

| High flexibility and security when receiving payments | PayPal accounts being frozen (a common complaint) |

| Easy POS setup and usage | Weak connections and slow loading times |

| Competitive processing fees | Lack of customer support |

| Fast payment transfers | Large difference in processing fees between card-present and keyed-in transactions |

Methodology: How We Evaluated PayPal Zettle

We test each POS system ourselves to provide you with an extensive review of the product. We start by comparing the system’s core set of features against what is expected of a functional POS software, such as easy transaction and order management and flexible payment processing. We then evaluate its affordability and value for money, making sure that the system is easy to use, offers good value, and is able to grow with your business.

We use these criteria to examine the best overall POS systems. However, when looking at specific use cases such as for retailers, complex inventory management, or mobile POS, we adjust the criteria to match the needs of those business types, which is why every POS has multiple scores across our site depending on the use case you are looking for.

Click through the tabs below for our overall POS evaluation criteria:

30% of Overall Score

We reviewed the pricing structure for hardware, software, and payment processing. Points are awarded to systems with a starter plan and monthly fees less than $75 (extra points for free plans). Transparent payment processing fees, including negotiable or volume discount rates, are also given high marks, while points are docked for caps on the number of users, products, transactions, or sales you can process without upgrading plans. PayPal Zettle unsurprisingly earned above-average marks here, given its free plan and transparent and competitive payment processing fees.

15% of Overall Score

We look for customizable hotkeys and easy product lookup; transaction management (including voids and returns); mobility to process sales curbside or on the sales floor; and flexible payment tools like contactless, gift card, store credit, layaway, and order-ahead options. Finally, we considered whether the system can process custom, work, or service orders such as repairs. PayPal Zettle struggled in this section, missing out on online ordering and loyalty program tools, while also scoring low for order management features.

15% of Overall Score

Our main focus is on inventory management—low-stock alerts, matrix inventory, and purchase orders, plus easy stock counts and shipment receiving. We also consider marketing tools, employee management features, omnichannel management for creating an online store, and reporting capabilities. PayPal Zettle did not do well in this category, lacking advanced inventory management tools and having limited employee and multilocation management functions.

20% of Overall Score

We look for easy installation, detailed training materials, and 24/7 customer support. We also consider whether the system is a hybrid installation or otherwise offers an offline mode so you can still operate if the internet goes down.

We also favor software that can run on various hardware so retailers can choose their preferred devices. Finally, we took our own experience using the software into account, examining how features performed in practice. PayPal Zettle did not fare too well in this category, missing points for 24/7 customer support availability, but mostly for its lack of an offline payment processing mode.

20% of Overall Score

In this section, we evaluated PayPal Zettle by its full feature set (including any standout tools), the value it offers for the price, popularity, user reviews, whether or not the system experiences a lot of downtimes, and the overall experience of navigating the system’s interface. Zettle earned average marks here, missing out on a few points due to negative feedback from users, including slow loading times and accounts being frozen.

PayPal Zettle Frequently Asked Questions (FAQs)

PayPal merchants with a business account who want to sell in person will find PayPal Zettle an ideal choice. We recommend PayPal Zettle for small retailers with infrequent sales, such as hobbyists and those who participate in trade fairs and sell at farmers’ markets. Note, however, that users in these environments will need to ensure they have a stable internet connection, as Zettle cannot process card payments while offline.

Consider an alternative if you want to start growing your business with larger inventory management capabilities and regular monthly sales. Businesses that need robust vendor management tools or restaurant-specific features may also want to look elsewhere.

PayPal Here is PayPal’s previous POS product that’s slowly being phased out. New PayPal merchants in the US are offered Zettle, as PayPal’s new POS software.

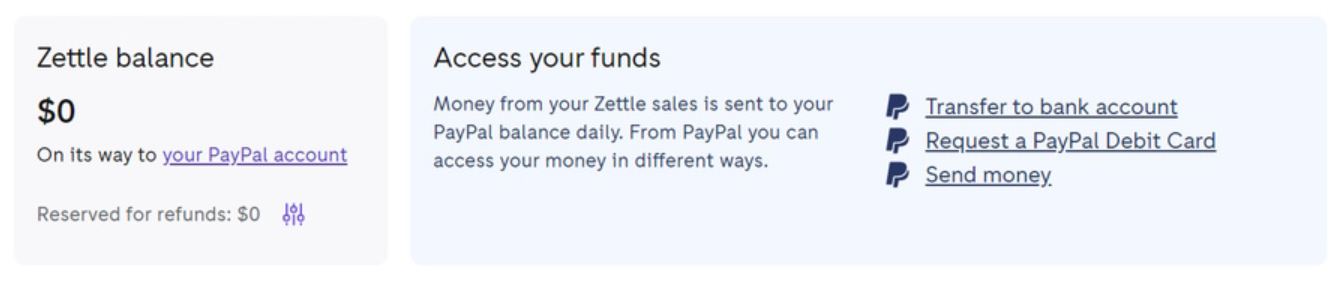

Like any PayPal merchant, users have immediate access to their funds through their PayPal balance. Funds can also be withdrawn to a linked card or bank account within two business days or instantly for a 1.5% fee.

You can pair your Zettle card reader via Bluetooth with an iOS or Android smartphone or tablet. The PayPal Zettle POS app is free to download from the iOS App Store and Google Play.

Some common user complaints mention:

- Freezing of accounts

- Poor customer service

- Significantly higher fees for remote payments vs face-to-face transactions

- Limited customization options

- Difficulties in connecting to the card reader

- Previous iZettle users said services were interrupted, support went down, and readers stopped working after PayPal took over

Bottom Line

PayPal is a remarkably versatile payment processor that works in online stores, social sites like Facebook, multichannel sales like eBay, and more. However, its POS app, Zettle, is somewhat limited. You can use it for basic inventory, ringing up sales, and gift cards. Nonetheless, it is free to use, and with low transaction rates, it’s a good tool for solopreneurs or small businesses.

If you have a PayPal account, go to my.zettle.com and sign up now.