Buying an apartment complex provides buyers with the potential to generate reliable monthly income and profit. However, learning how to buy an apartment complex is best for experienced investors because of the time, effort, and money commitment involved. Buying an apartment building includes choosing the type of property to purchase, viewing apartments for sale, and evaluating potential properties. When you’ve found a profitable apartment building and gotten financing, you can purchase and close on your new investment.

If you need financing for your future apartment complex purchase, check out CoreVest. It offers a variety of funding options and competitive rates in an efficient and easy-to-use online platform. Apply online and get prequalified in just a few minutes.

Buying an apartment building can be simplified into the following 10 steps:

1. Decide if Buying an Apartment Complex Is Right for You

As you begin learning how to buy apartment buildings, ensure it’s the right fit for your real estate investing goals. You need to start with a clear understanding of your reasons for owning an apartment building, as well as the risks, benefits, finances, management, and maintenance requirements.

Take this quiz to see if you’re prepared to take on this type of investment:

Are you ready to buy an apartment complex?

Now that you’ve taken the quiz, it’s also necessary to understand the differences between buying a whole complex rather than just a single-family or smaller multi-family property. These differences, as well as pros and cons, will assist you in making a decision on whether an apartment complex is the best financial option for you.

Single-family Properties Versus Apartment Complexes

Compared to purchasing single-family or multi-family properties, buying an apartment building requires more research, more time, and oftentimes more capital and additional expenses. It’s important to weigh the pros and cons before buying an apartment complex.

Pros & Cons of Buying an Apartment Complex

Multi-unit buildings lower risks since vacancies are less impactful, and property maintenance costs can be spread across multiple singular units. However, learning how to buy an apartment complex is inherently more complex (no pun intended) and significantly more expensive than buying a single-family property. Plus, the costs and maintenance requirements are much higher.

| PROS | CONS |

|---|---|

| Recurring income: If the deal is right and the finances are sound, buying an apartment complex can provide a reliable stream of recurring monthly revenue. | Increased management requirements: Buildings with over four units require much more intensive management processes and systems. Hiring a professional property management company or onsite manager is vital, which increases overall costs. Many property managers charge 8% to 12% of gross monthly rents. |

| Diversifying income: Knowing how to own an apartment complex is a great way to mitigate the effects of high vacancy rates. Even if one unit is vacant, you still have plenty of others to cover expenses and generate a positive cash flow. | High tenant turnover: While renters of single-family properties typically stay in their homes for longer periods of time, apartment tenants are generally much more transient. Having a process to consistently end leases and bring in new tenants is vital to minimize vacancies. |

| Lower per-unit maintenance: Economies of scale work in favor of apartment building owners. For example, if you must replace a roof, it serves all the units in the building. If you need to repaint, you can use the same paint for multiple units and overall minimize costs. | Less tenant care: Apartment tenants frequently don’t treat their units with as much care as renters or owners of single-family homes. It’s necessary to have a clear and upfront system for repairs and maintenance beyond normal wear and tear, which are much more common in apartment buildings. |

| Opportunities for additional income sources: Large apartment buildings serve large numbers of people, so adding services and amenities provides additional income streams. For example, tenants may benefit from vending machines, ATMs, coin-operated laundry facilities, or options to rent parking spaces. | Higher maintenance costs: Although the per-unit maintenance costs of apartments are lower than single-family properties, the overall maintenance costs are higher. When major problems arise, like a heating system failure, it will be more urgent because it impacts multiple tenants. Plus, repairs for multi-unit properties are significantly more costly. |

| Revenue-based financing: Financing for apartment buildings is based mainly on the financial performance of the building as opposed to your personal financial situation. Learning how to buy apartment complexes can be more attainable than expected for newer investors. | Exit strategy challenges: After you learn how to buy an apartment building, you also need to have an exit strategy in place. Apartment complexes are less liquid assets than single-family homes because they can take much longer to sell. |

| Valuations based on rent rolls: Since the financing of apartments is tied to the building’s financial performance, apartment building owners can increase the property's value by increasing rent prices. | |

2. Learn About the Types & Classes of Apartments

If you’ve decided that buying an apartment complex is a good option for you, the next step is to learn about the types of apartment buildings and determine which you want to acquire. Apartments come in a variety of forms: converted houses with multiple units, garden apartments with two stories, and properties with a dozen or more units in a single building. There are also multi-story, mid-rise, and high-rise apartments with scores of rental units.

In the U.S., apartments are classified according to a rating scale with letters from A to D. These four types of apartment buildings are:

Like all real estate properties, the classification of a property is relative to its current condition and local market. Finding a complex and learning how to own an apartment building include using the class asset information to identify each building’s benefits and risks.

In general, most first-time apartment complex investors choose class “B” or “C” apartments because they trade at a higher cap rate. Their costs are usually less than class “A” properties, and the risks and management requirements are lower than class “D” properties.

3. Examine Your Personal & Financial Criteria Before Choosing a Type

Most new investors can learn relatively quickly how to research properties and make an objective investment decision. However, it’s just as important to objectively evaluate your own personal and financial goals and abilities when you buy an apartment building.

There are many different criteria you should evaluate for yourself before making such a large investment, starting with the following:

- Number of units: The higher the number of units within the apartment building, the more time, energy, and finances you’ll need to provide. If your reasons for investing are conservative and you’re looking to generate a second source of income or supplement existing funds, you should look for buildings with six units or less.

- Level of ambition: It’s easy to under or overestimate your ambition when you’re simply walking through properties, but that can lead to regret later. Before making an investment decision, clearly decide how ambitious you want this investment to be. Determine how much work and time you’re willing to put into the property immediately after closing and for the next few years of owning it.

- Risk threshold: Every investment carries a certain level of risk, but even a relatively safe investment may be riskier for an investor with an unstable financial situation. Get really clear about how much you are willing to risk, and the answer will impact the type of apartment complexes you can consider.

- Return on investment (ROI): For investors, the ROI of an apartment building is often even more important than the sale price or monthly expenses. A property with high expenses might also generate a high profit, and having a low number of expenses does not guarantee cash flow. You must know how much to charge for rent and be able to calculate the ROI to make a wise decision. The ROI of any property depends on many factors like size, income, expenses, and how much you invest upfront.

4. Locate an Apartment Complex to Buy

When it’s time to seriously look for an apartment building to buy, you need multiple reliable strategies to find and evaluate property data. Other than searching online, consider working with an agent, targeting FSBOs, joining associations, or partnering with an investment company.

The real estate sales and brokerage industry undeniably provides access to the largest body of residential and commercial properties for sale, including apartment buildings. Real estate salespeople have access to one or more local multiple listing services (MLS), listing all the properties for sale by every agency in the area, including multi-family and apartment complexes. The most dedicated real estate agents have rich expertise in the local market, plus skills and resources to find and evaluate data on apartment buildings in your area.

Although many real estate agents in your area likely work only with residential property sales, many others have a commercial real estate license. These agents may even work with a commercial brokerage that specializes in working with investors and business owners. Commercial real estate agents can be valuable sources of finding new investment properties and making connections in the industry.

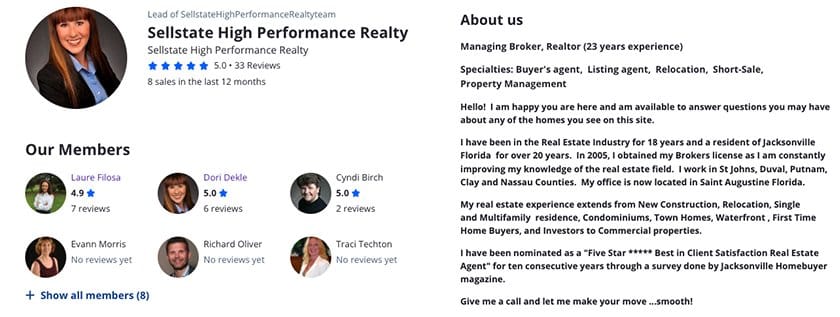

Zillow agent profile example (Source: Zillow)

If you don’t already know of any real estate agents in your area, try using Zillow’s Agent Finder. Many local brokers and agents have a Zillow agent profile, allowing you to evaluate their skills and experience and determine if they are the best fit for your needs. Search for individual agents and teams in your area, view their reviews from past clients, and see what properties they’ve worked with in the past.

A great advantage of for sale by owner (FSBO) properties is that the seller is not paying a real estate commission. It means you may have an opportunity to negotiate 6% or 7% off the asking price. In fact, some FSBOs list higher prices, knowing buyers will deduct commissions from their offer. In addition, FSBO properties often provide more opportunities for favorable terms, like owner financing or less money down upfront.

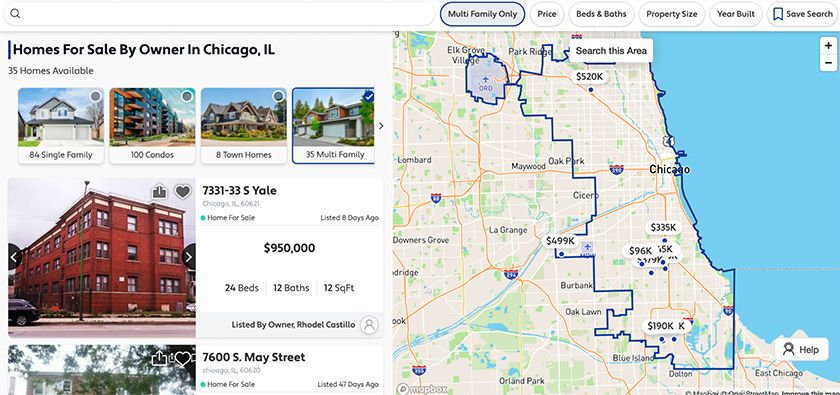

Multi-family property search example (Source: Forsalebyowner.com)

There are many ways to find properties for sale, but using FSBO sites should be a staple in any investor’s acquisition strategy. The best FSBO sites offer property searches, a variety of filtering options, and detailed property information. Start with ForSaleByOwner.com, which allows you to search by ZIP code, property type, price, and property features.

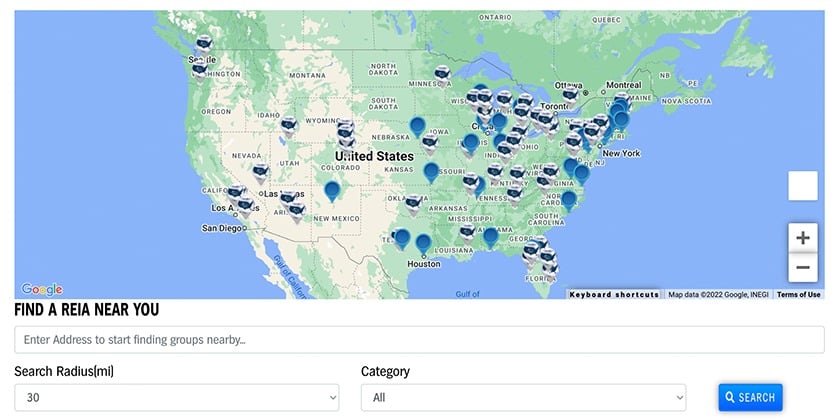

Most first-time apartment complex investors don’t have a team who can research and contact potential investment properties. If you’re searching for apartment buildings on your own, consider joining a local real estate investment club. For example, the Real Estate Investors Association (REIA) offers many local chapters as well as a full resource center with news, videos, and an ROI magazine. Being part of groups or resources like these provides valuable information, updates, and networking with other investors.

REIA chapter search (Source: REIA)

5. Evaluate the Apartment Complex Framework

After you’ve started searching for properties, learn how to gather data on each potential property and evaluate its benefits and drawbacks. Based on your personal and financial situation and the state of your local real estate market, there should be many specific criteria that you consider. Overall, a few of the most important considerations include the building’s location, size, and construction details.

Location or Neighborhood

As with any real estate investment or purchase, it’s important to buy a property in a desirable location. For apartment purchases, in particular, a good location means it is close to local amenities and attractions, provides access to public transportation, has high ratings for local school districts, and is surrounded by growing or thriving businesses. In general, better-located properties provide a stronger base of tenants, better tenants who will take better care of your property, higher rents, and a greater chance of appreciation for the building.

Number & Size of Units

As previously mentioned, anyone who is considering how to buy an apartment complex for the first time should pay particular attention to the number of units in their purchase. Establish a clear understanding of the number of units you can realistically manage within your personal and financial goals. It’s also extremely important to keep the challenges and benefits of different types of properties in mind.

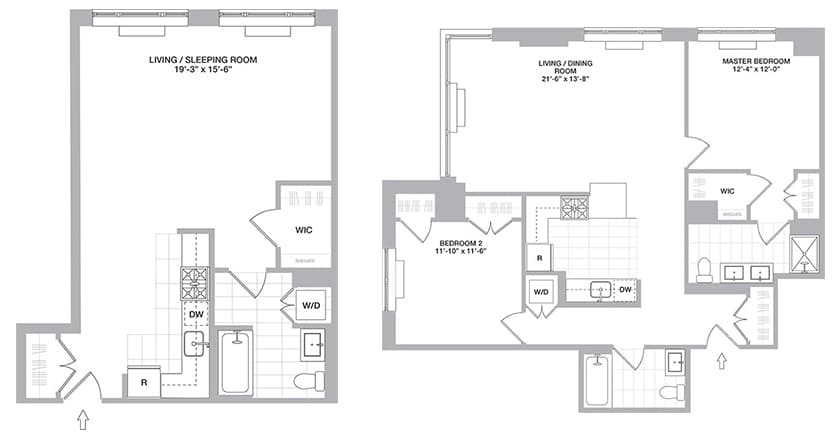

Example floor plans for a studio and one-bedroom unit (Source: The One Jersey City)

For instance, studio or efficiency units can be difficult to rent outside of college campuses and high population areas. One-bedroom units are easier to rent than studios, but your best bet is two-bedroom units. A couple, particularly with a family, or individuals who work from home will want a second bedroom. It opens a larger market of potential renters than a one-bedroom does.

Complex Amenities

Apartment complex amenities examples (Source: Brick Underground)

The existing amenities (or the lack thereof) can drive interest in your property or significantly increase monthly expenses. Amenities can include everything from washers and dryers in the units, a separate laundry area, covered parking or garages, convenience stores, vending machines, swimming pools, spas, and gyms.

The more amenities the property has, the more desirable it can be to potential tenants. This can help you charge higher rent prices, but can also cost thousands more in regular expenses. Be sure to do your research on the costs of each amenity and its financial return.

Construction Details

Unlike amenities, which are easily visible and understandable by investors and tenants, the construction details of an apartment complex can tell you a lot about the property’s potential problems. There are a few building features that go wrong more frequently and tend to cost apartment building owners the most money in repairs and renovations.

A few of the biggest problem areas in apartment buildings are:

- Wood frames: Homes made completely with wood framing are generally more prone to rotting than brick houses, and can increase insurance rates. In addition, these homes are typically covered with siding, which needs regular painting and maintenance.

- Flat roof: Flat roofs are prone to many more problems than sloped or slanted roofs, and typically lead to leaking, overexposure, and deterioration. They can be hard to avoid, but keep in mind that flat roofs are especially important to maintain in order to prevent larger and costlier problems.

- Plumbing: If the plumbing in an apartment complex is 20 to 30 years old, you can guarantee plumbing issues in the future. Old pipes leak and deteriorate over time, and emergency plumbing repair costs can be expensive.

- Shared utilities: Older apartments often have shared systems for heat and electricity. This can be a challenge because the owner or landlord then must pay the utility cost and decide on a system for tenants to cover the cost, whether that means splitting utilities or increasing rent.

- Asbestos and lead paint: It’s common for old buildings, especially those built before 1978, to have asbestos in the insulation, HVAC systems, or exterior siding, as well lead-based paint. Repairing these issues is costly, and causes a major inconvenience if you have tenants living in the space. It’s important to do your research on the appropriate remedies for these problems before making an offer.

If your potential property has one or two of these elements, it doesn’t mean that you should immediately reject it. However, knowing potential problem areas should be an important consideration of the overall property potential.

6. Understand the Full Financial Picture & Profit Potential of the Building

Even if a potential property appears to be an amazing deal, the only way to accurately verify its investment potential is by getting detailed financials for the property for the past one to five years. You can look at several basic numbers as you evaluate an apartment building, including rent rolls, occupancy rate, and cost per unit. These will provide a preliminary look at the profit potential before thoroughly examining the property’s financials.

Basic Numbers

- Rent roll: This is the current amount of rent collected for every unit in the building. Gather the total and multiply the sum by 12 to get the gross annual rent. Use our Gross Rent Multiplier Calculator if you are debating a purchase between several apartment complexes.

- Occupancy and vacancy rates: The occupancy rate tells you how many units in a building are occupied, and conversely, the vacancy rate tells you how many units are vacant in a building. Ask about the property’s occupancy and vacancy rates to compare the figures to the local average. Use our Vacancy Rate Calculator to evaluate your property.

- Cost per unit: To calculate the cost per unit, divide the purchase price by the total number of units in the building. The cost per unit is important in evaluating the purchase property versus those in the area and can be a bargaining chip when negotiating the purchase price.

Complicated Financial Calculations

After you’ve gathered the basic numbers, you’ll have a general understanding of the profitability of an apartment complex. However, to get a more accurate picture of the property’s financial performance, you need to calculate more detailed financials like gross operating income, expenses, and capitalization rate to truly feel comfortable making an informed decision on a property purchase.

If you are working with a real estate agent, they should be able to provide you with these calculations to help guide your decision. If not, we have outlined how to determine the calculations in the tabs below based on a $300,000 six-unit building with each unit renting for $600 per month:

7. Perform Due Diligence

If, after your financial assessments, you’ve decided to move forward with a purchase, you still need to investigate a few more things. Some of these factors should be written into your offer and subject to your approval (e.g., satisfactory review of leases, the profit and loss statement, and property inspections).

Due diligence should include:

- Determining why the owner is selling: The seller’s circumstances are an important consideration for negotiating a deal. For example, a seller who wants to retire and move has vastly different motivations than a seller faced with a property needing major repairs or preforeclosure.

- Viewing current leases: Leases contain rent amounts, terms of the lease, pet policies, security deposits, and who pays for utilities. If you keep the existing tenants after you take ownership, you inherit the existing leases. It’s vital that you know what the tenants expect and have agreed to.

- Tax returns: Request the property accounting records and tax returns, and further investigate any discrepancies. For example, if the seller shows $12,000 in net operating income in their accounting records, but counts $9,500 on the tax return, you’ll need further explanation.

- Conducting inspections: Make sure you have a licensed building inspector perform a thorough inspection of the property. Apartment buildings frequently have shared systems, various condition levels in each unit, and potential issues with common areas and amenities. You’ll want a detailed inspection report of what needs to be repaired in order to make a strong offer and negotiate serious issues.

8. Obtain Financing

Financing for apartments and investment properties is fundamentally different than residential purchases. You will likely use commercial lending as opposed to residential lending because of the size and price point of the building purchase. Financing options include:

- Government-backed apartment loans

- Bank balance sheet apartment loans

- Short-term apartment loans

This strategy is particularly easy with a provider such as Rocket Dollar, which allows you to roll over an existing plan or make direct contributions. With Rocket Dollar, you can take advantage of tax-deferred retirement funds and invest in real estate while staying IRS-compliant. Schedule a free call today to learn more about how Rocket Dollar can help you become an apartment complex owner.

A few other areas to consider when you finance the purchase of an apartment building are:

- Lender-required reserves: Lenders will typically require you to maintain one or two common types of reserves in order to approve financing: interest reserves and cash reserves. These ensure you can meet operating expenses, insurance, taxes, and repairs. In total, requires reserves may total as much as six months of payments.

- Key items considered by lenders: Because net operating income is so important to real estate investing, lenders will look favorably on properties with good market potential, high occupancy rates, and long-term tenants. This is another argument in favor of doing your due diligence upfront by evaluating income, expenses, vacancy rates, and the property’s condition.

- Recourse vs non-recourse loans: A recourse loan means that if you eventually default on payments, the lender can pursue financial remedies beyond foreclosure. In contrast, with a non-recourse loan, the lender can only go after the property. Non-recourse loans are obviously the more preferable choice, but they are more difficult to obtain because they require steeper down payments and typically carry higher interest rates.

9. Make an Offer on the Apartment Complex

Making a good offer on a property involves knowing the current market value for similar properties in the area and the potential for profit. You may find it helpful to perform a rental market analysis, where you compare recently sold properties, properties currently for sale, and expired listings. In addition, you may get an appraisal of the apartment complex.

Appraisals for apartment buildings are different than they are for residential rental properties. There are three methods used together to determine current market value:

- Market value approach: Market value will look at similar properties and their selling prices. For example, if you are considering purchasing a six-unit building with six two-bedroom apartments, the appraiser will look at similar buildings and what they sold for within the prior year. Market value per unit is considered in this approach.

- Replacement cost approach: Replacement cost examines the amount it would cost per square foot to build a similar building. If you are looking at a four-unit building with 4,000 square feet, and construction costs in your area run $100 per square foot, the replacement cost will be valued at $400,000.

- Income approach: The income approach uses the net operating income and local capitalization rates to determine the value of the investment. To accomplish this, take the net operating income and divide it by the cap rate. For example, if the net operating income of the building is $46,000 and the cap rate in your area is 10%, then the value will equal $460,000.

Once you’ve completed your analysis of the property, submit your offer to the seller or have your agent submit it to the seller’s agent. The seller will either accept, reject, or counter your offer. From there, you’ll be able to negotiate any terms and sign a contract to put the purchase in writing and move forward toward closing.

10. Close on the Purchase of the Apartment Complex

For many residential homebuyers, closing on their property only means signing a few documents and getting the keys. For apartment buyers, there are more requirements and complexities. In fact, it’s important to set yourself up for success well before the closing date by choosing an escrow agent or title company with experience in apartment building transactions. This will prevent any mistakes from slowing down or complicating the process.

It’s also important to strategically schedule the closing day. Generally, the most financially advantageous day of the month to close on an apartment is either the last few days or the first few days of the month—after rent is collected. This provides almost a full month of cushion before the next mortgage payment is due.

Finally, when you close on the property, security deposits become your responsibility. Most states require landlords to keep the security deposits in a separate escrow account. However, even without that requirement, that money (plus interest) belongs to the tenants unless it’s required for damage or unpaid rent. Make sure security deposits are turned over at closing and get them into separate escrow accounts for each tenant.

Bottom Line

The general steps of finding and purchasing a complex are similar to a single-family or small multi-family property. However, buying an apartment complex requires a deeper understanding of managing property finances. Follow the 10 steps above to learn how to buy an apartment complex—from deciding if apartment complexes are right for you to calculations to closing on your property.