Knowing how to do a comparative market analysis (CMA) report is a must-have knowledge, enabling agents to keep up with the constantly changing real estate world. This report estimates the current worth of a home using sales and property data from similar homes (commonly known as “comps”). CMAs are created by agents to report property values, market trends, and investment opportunities. Learning how to do a CMA report is essential, as the output is handed over to home sellers, buyers, and investors.

Download our free CMA worksheet to centralize and organize your data as I go through how to create a comprehensive, well-organized CMA.

Step 1: Understand How & When to Use a Real Estate CMA

A comparative market analysis report generally gives sellers a listing price estimate. As a seller’s agent, you must be able to explain what a CMA is and what it consists of to potential sellers in a prelisting package or during a listing presentation. You will provide a CMA report to the sellers during your first initial meeting or after being hired as a listing agent to assist them in determining the listing price for their home.

While CMAs are most commonly utilized for sellers, a CMA in real estate can also be created for:

- For sale by owner (FSBO) homesellers: Incorporating a CMA into a listing presentation for FSBO homeowners helps demonstrate how they can make more money by working with a real estate agent rather than dealing with the process alone.

- Homebuyers: Gathering data on the pricing of comparable homes in the neighborhood can assist potential buyers in determining whether a home is a good buy and submitting a solid offer.

- Landlords: Real estate investors benefit from knowing the value of their rental homes when marketing properties for sale or deciding on rental pricing.

- Commercial properties: Real estate CMAs are frequently associated with residential homes, but understanding the value of comparable properties is equally essential to commercial buyers and sellers.

- Investors: CMAs enable investors to identify investment opportunities, mitigate risk, and manage portfolios for their real estate assets.

Even if you are a local real estate market expert, most of your clients are not. When learning how to do a comparable market analysis, remember you are not doing it for yourself. It is designed to assist your clients in understanding the market and making the best decisions regarding their property. A comparative market analysis can be utilized to nurture and convert potential leads to obtain more listings.

Step 2: Determine Your Resources

Since a comparative market analysis is intended to deliver value to potential clients, an off-the-cuff home estimate is insufficient for this report. You’ll need to collect and compile data that makes sense to your clients and provides them with clear evidence regarding your evaluation of their homes.

Here are several of the best options you can utilize:

- Local multiple listing service (MLS): It is the most reliable source of property information available to agents, providing the most accurate and up-to-date data and exclusive listings.

- Zillow or Realtor.com: Allows you to see the homes currently on the market or have sold recently and fill any gaps of information missing from the local MLS listings, such as FSBO sales.

- Google Street View: This lets you learn more about the neighborhood before visiting in person.

- HouseCanary: It automates more accurate home valuations and value forecasts, especially for investors.

- Cloud CMA: Enables you to create interactive comparative market analysis presentations.

Pro Tip: As a real estate agent, you have the ability to access the multiple listing service (MLS), which includes programs to easily create a CMA. The MLS is considered to be the first and best option for finding accurate information on comparable sales.

Example of property listing’s description (Source: Zillow)

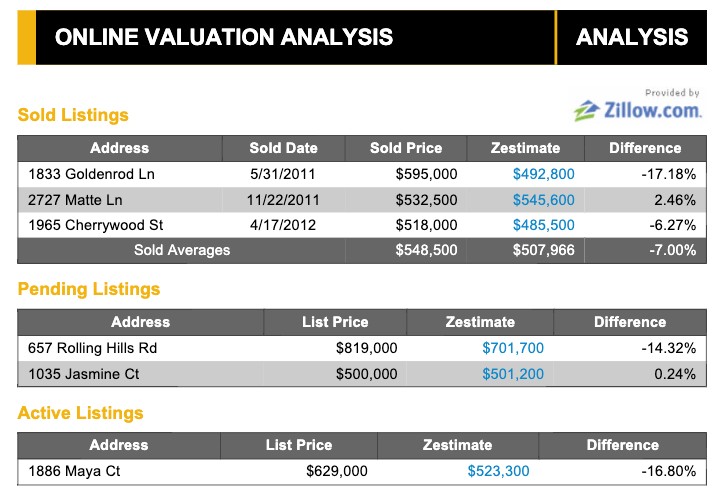

Zillow is well-known for offering “Zestimates,” which are general estimations of a home’s value based on Zillow’s property and market data. However, these estimates have an average error rate of 2.4% for on-market homes and 7.49% for off-market homes. Your CMA is a great tool to discuss these discrepancies with your client, including why your estimate is more accurate.

Step 3: Gather Data on the Subject Property

While the local MLS or real estate listing websites can provide historical information on the subject property, it’s crucial to get the most updated information by visiting the property in person and interacting with the current homeowners. Keep track of any information you uncover about the property, like the number of bedrooms and bathrooms, square footage, age and type of property, and amenities.

In addition, seek any hidden issues or features that will affect the sale price and inquire with the existing homeowners about the dates of previous renovations, average utility bills, homeowners’ association (HOA) fees, and taxes. Include this information in the CMA report, as this will assist you in answering homebuyer questions during open houses or showings.

Other factors to consider when touring a property include the following:

Factors | What to Look for |

|---|---|

Property Condition |

|

Curb Appeal |

|

Upgrades and Features |

|

Location |

|

Neighborhood and Community |

|

Amenities |

|

Seller’s Why |

|

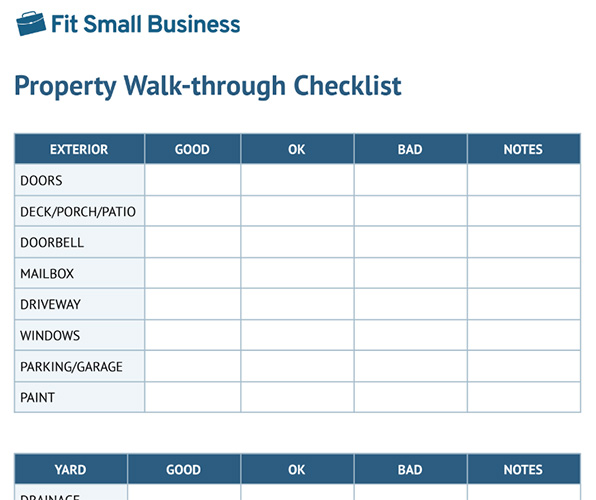

Pro Tip: Create a checklist for property walk-throughs. This will ensure that you obtain all the crucial details during your visit and don’t miss anything. Download the list below and incorporate it into your real estate listing presentation checklist.

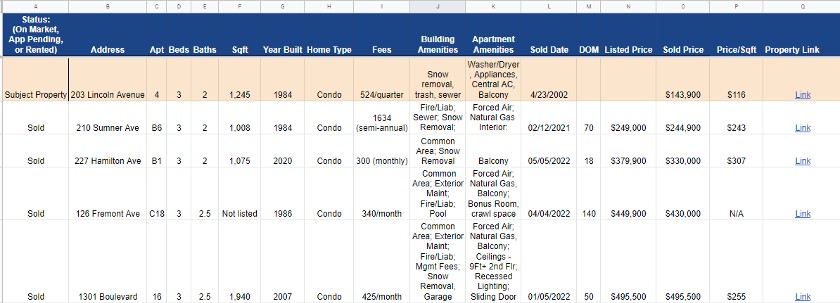

Step 4: Start Compiling Data on Comparable Properties

Once you’ve gathered all the essential details and data about the subject property, you’ll need to find comparable properties to compare, analyze, and construct your real estate CMA. There is no standardized comparative market analysis report; however, basic factors are included in these reports that give an accurate picture of the property’s market value.

Although comparable properties will not be identical, finding as many similarities as possible is beneficial to ensure the accuracy of your report. By identifying properties with similar characteristics, you can be sure your CMA report is based on properties that are truly comparable to the subject property.

Search for properties that are comparable in the following ways:

- Information about the subject property:

- The subject property’s address

- Age of the property

- Include unique identifiers of the property, such as bedrooms, bathrooms, square footage, and price

- Details of comparable properties:

- Five to seven comparable listings sold in the last 90 days and within a three to five-mile radius

- Include unique identifiers for each comparable property

- Sales price of each property

- Adjustments made to comparables:

- Make adjustments to account for the differences between the subject property and comparable properties unique identifiers

- Calculate the price per square foot (divide sales price by square footage)

- Market trends or conditions affecting values:

- Consider the type of sale: traditional, foreclosure, short-sale

- Market conditions (buyers market vs sellers market)

- Economic indicators (such as interest rates)

- Housing supply vs demand

- Local development projects

- Supporting data:

- Charts

- Graphs

- Visuals

The CMA report should be created to empower your clients with the information needed to make informed decisions about the sale of their property or the purchase of a new property.

Step 5: Calculate an Estimated Price

The next step is calculating the price per square foot for each of the five to seven comparable properties. To estimate the cost of your subject property, apply simple calculations to get the average price per square foot for each comparable property.

For example, click through each tab below to see how to conduct a price analysis on a 3,000-square-foot ranch with five comparable homes.

This is a relatively accurate estimate of your client’s home sale price, but remember that there are unique elements that go into each CMA. Many factors will influence the home’s worth, which is especially relevant if there are few comparable homes nearby or if the house is in a new development with no recent sales data.

For an easy way to learn a home’s estimated value, use our property value calculator:

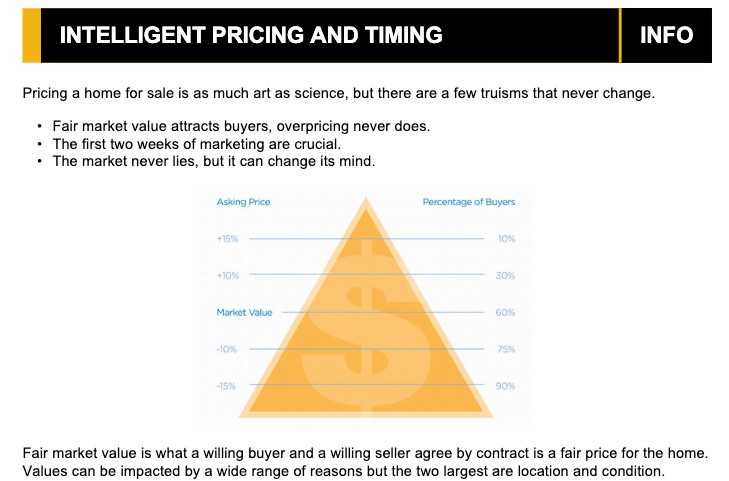

Step 6: Prepare Your Report & Present Findings With Your Recommendations

After collecting, analyzing, and organizing your data, it’s time to combine it by producing a CMA package that includes your recommendations and insights. Make sure to include the following:

- The recommended listing price

- Details of any market conditions affecting the value

- Strategy recommendation to position the property competitively, factoring in the seller’s “why”

- Make recommendations as to any updates or improvements you believe could add value to the home and make it more attractive to potential buyers

- Include any marketing and negotiation strategies you have derived from your research

Once this is complete, set up a meeting with new leads as soon as possible. There are a few different delivery methods, but setting up a meeting for a listing presentation is one of the most effective strategies to convert leads into clients and develop long-term relationships.

Here are some effective ways to deliver your newly created CMA:

- In-person presentation: This delivery method allows you to interact with your clients face-to-face, clarify any questions they may have immediately, and discuss your recommendations.

- Video conferencing: If the prospect is not able to meet with you in person, another great way to maintain a personal connection is to meet your prospects on a video call like Zoom or Google Meet.

- Video explanation: If clients are not able to meet, but can view digital means of delivery, consider making a recorded video outlining your findings and recommendations.

- Printed report: If your client is out-of-state or unable to receive information electronically, consider dropping off a printed copy or mailing it.

- Combination approach: You can combine these methods based on what is best for your client.

Even if the CMA is for existing clients who want to work with you, the presentation is still critical to provide them with the resources they need to sell their houses. It assures that you and the homesellers enter the real estate transaction on the same page, with open communication and established expectations.

Tools for Creating a CMA

Instead of delivering potential clients a plain, dull spreadsheet with property facts that may or may not make sense to them, create a comp report with descriptions and key takeaways.

There are multiple ways to create and customize your comparative market study, including:

- Putting together a digital presentation on PowerPoint or Keynote

- Printing or sending a PDF

- Using Cloud CMA to create an interactive CMA presentation

- Purchasing a CMA template online

- Designing or customizing a template from Canva

Since you are displaying a large amount of information to clients, the best rule is to keep it simple. More information isn’t necessarily better. If the report confuses you, it will likely confuse the seller. Make your real estate CMA understandable by emphasizing critical information, including descriptions, and using a scannable format.

Manually creating a real estate CMA might take hours. However, there are numerous tools available that can help simplify and speed up the process. Most local MLS systems support CMAs but are typically generic and difficult to customize. Several platforms can help you design a CMA report for your clients that is tailored to your brand and style.

To begin streamlining the process, consider the following CMA real estate tools:

Providers | ||||

|---|---|---|---|---|

Best For | Professionally designed printed market analysis reports | Real estate agents and brokers wanting in-depth reports and analytics | Real estate professionals seeking advanced, proprietary analytics | Agents with no design experience looking for a simple graphic design tool |

Key Features |

|

|

|

|

Starting Monthly Price | $49 | $45 | $10 | Free |

Learn More |

Real Estate CMA Examples

Finding the proper format and information will be more time-consuming the first time you create a comparative market analysis. As you obtain more real estate listings and deliver more presentations, you’ll see patterns or common inquiries from homeowners. Your CMA report should evolve to incorporate answers and explanations to typical questions, improving your presentation and client interaction.

Here are four CMA real estate comparable templates and examples to get you started on your analysis:

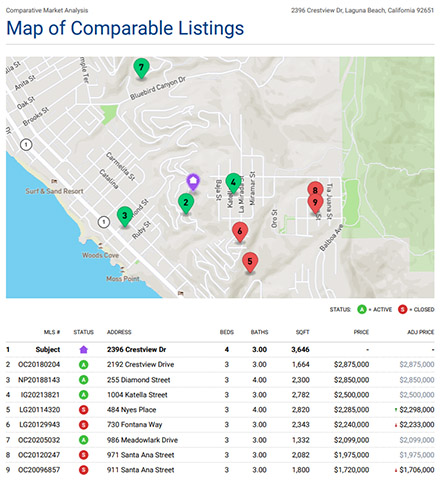

This comp report sample has a simple format and design, yet it contains an array of information and easy-to-understand charts and statistics. The comparable properties are shown on a map and in several easy-to-read charts to make the information as straightforward as possible. It also consists of a QR code, allowing sellers to download the physical report to their electronic devices instantly. This is an excellent solution if you cannot decide whether to provide a printed or digital version of your CMA.

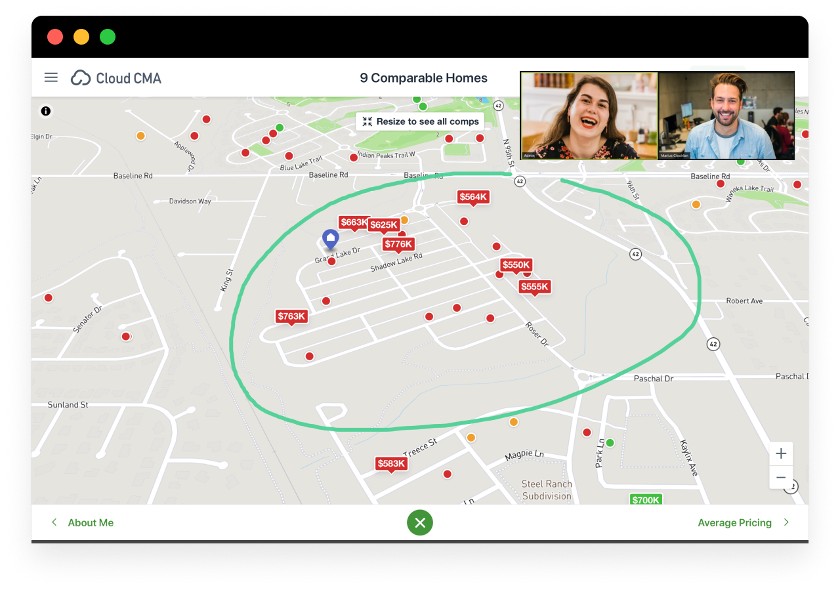

This CMA is an example report from Cloud CMA, and it is incredibly user-friendly and easy to understand due to its graphics, well-organized charts, and concise headings. This analysis may be printed quickly, but Cloud CMA can generate interactive reports you can walk through with your clients online.

This is your ideal strategy if you want to make your comparative market analysis and presentation more engaging and memorable.

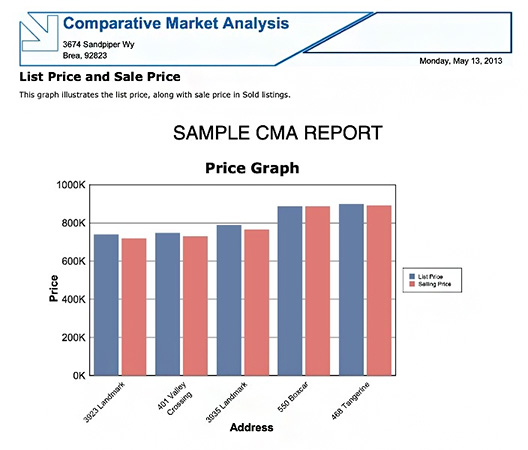

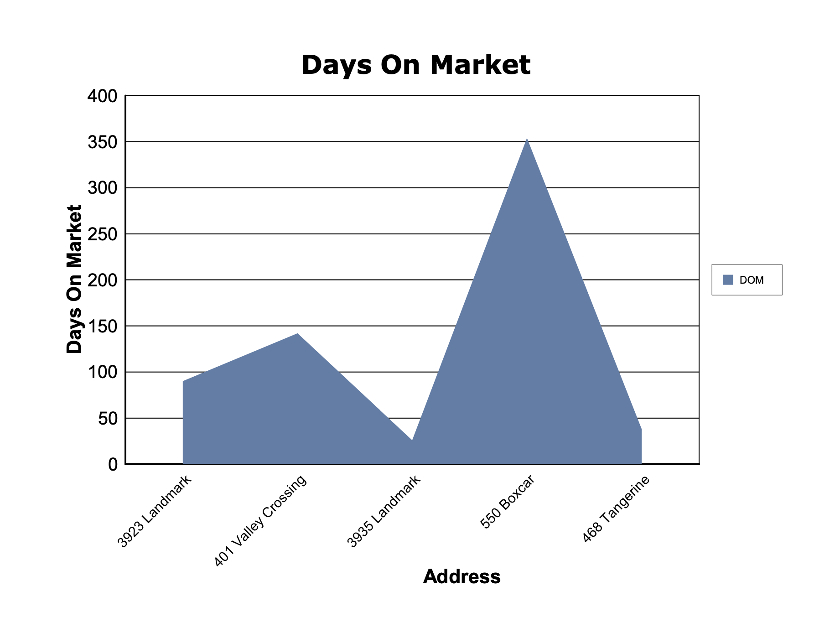

Using graphs is one of the best methods to make your CMA easier for non-real estate professionals to understand. This CMA example includes standard charts with property statistics and comparisons. It also has unique graphs to visually convey essential details, such as list price vs selling price or days on the market.

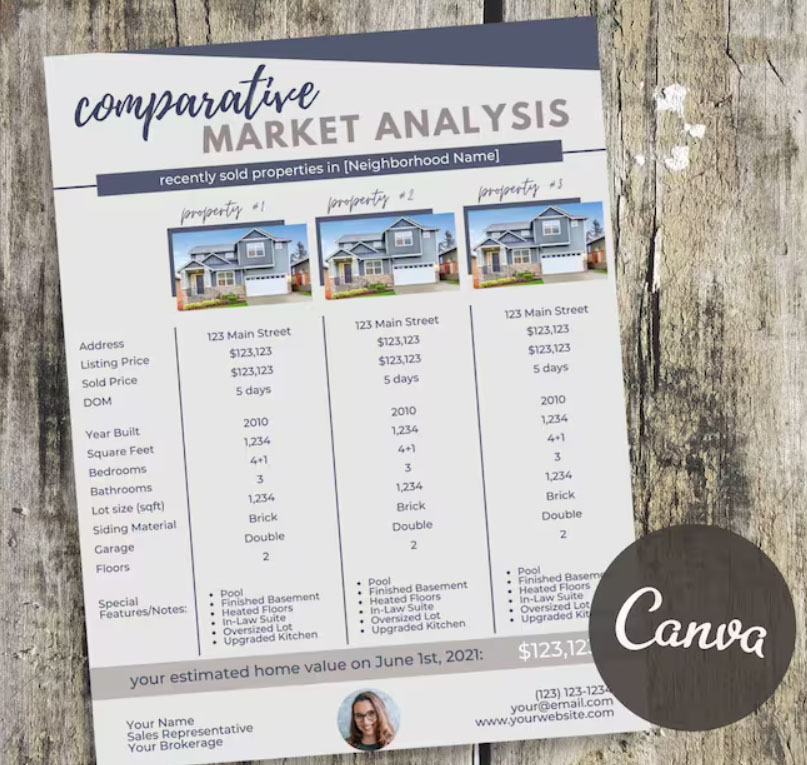

CMA flyers are a visually appealing way to present your CMA to potential clients. You can purchase templates from shops like Esty or create your own with programs like Canva to create eye-catching graphics with information that is simple and easy to understand.

By condensing key information, these flyers provide a snapshot of the property’s market value, comparable properties, and market trends. It’s sure to grab their attention and spark their interest, guiding them towards smart decision-making.

Sample CMA Flyer created on Canva (Source: Etsy)

You don’t have to be a graphic designer to create a visually appealing and intuitive comparative market analysis report. Canva is a visual design tool that offers thousands of templates for documents, presentations, infographics, flyers, and branding elements, such as colors, fonts, and images. You can also save customized templates for each marketing item, making it simple to maintain consistency in your branding.

Frequently Asked Questions (FAQs)

A suitable number of comps for sold and currently listed houses is five to seven. Remember that it is vital to include comps that only align or coincide with your subject property in your CMA report. For example, if one of the comps is a foreclosure, but the subject property is a traditional sale, the foreclosed property was likely negatively adjusted and, therefore, not a good representation of value for this home.

“Location, location, location.” Do you remember hearing that in your real estate prelicensing courses? The most crucial property characteristic to evaluate is the location, which determines its value, shows how far it is from major establishments, and influences the property taxes for the home. Finding comparable homes in similar areas is essential when looking for comps to use in your CMA. I recommend no more than a three-mile radius when possible.

A licensed real estate professional typically prepares the comparative market analysis. The CMA is created for clients as a part of listing a home for sale or estimating value for a buyer who wants to place an offer on a property. This service is usually free of charge for potential clients and used as a tool to help the client make informed decisions.

A CMA and an appraisal are similar in that they are both ways real estate professionals find value. However, there are key differences between the two, including who conducts them, why they are being performed, how they are performed, and the cost involved.

Let’s look at the key differences:

Type | Who | Why | How | When | Cost |

|---|---|---|---|---|---|

CMA | Real Estate Agent | To determine listing price for a seller or a purchase price for a buyer | Involves researching recently sold comps in the area | Informal process for the client's benefit | Free |

Appraisal | Licensed Appraiser | To assess the property’s fair market value | Requires a physical inspection along with a detailed analysis of comps, trends, and property conditions | Formal process providing a comprehensive report used for legal and financial purposes | Fee varies; typically $300–$800 |

Lenders rely on appraisals to ensure a home’s value will justify the loan amount. A more in-depth report will include findings from the inspection, detailed CMA results, market analysis, valuation method used, and the final appraised value. While a CMA is included in the final report, this CMA provides more details than an agent CMA. It includes specific numerical amounts that are added and subtracted from the value based on features present or missing from the comparable home.

Bottom Line

A comparative market analysis (CMA) is an instrument that assists real estate professionals in demonstrating the worth of a possible listing to homesellers. It is accomplished by employing the necessary tools, locating comparable properties, obtaining data, and combining it into a visually appealing and simple-to-understand CMA report. Knowing how to do a comp report is essential to becoming successful in real estate, especially since listing and real estate market data can be used to convert listing leads and generate new ones, with the correct marketing methods.