Buying a vacation rental property is an incredible way to invest in real estate, offset homeownership expenses, and enjoy your favorite vacation spot as a second home. These properties can generate high rents, but they are often seasonal and have additional operating and maintenance costs. Learning how to buy vacation rental property will require in-depth knowledge of local markets, financial calculations of income and expenses, and an understanding of the real estate buying process.

1. Decide if Buying a Vacation Property Is Right for You

One of the most important parts of investing in real estate is knowing how to carefully evaluate each potential property and deal to determine if it’s right for your business. While buying a vacation rental property can be incredibly profitable and enjoyable, there are some drawbacks to keep in mind. As you consider the process of how to buy a vacation rental property, here are the main benefits and disadvantages:

| PROS | CONS |

|---|---|

| A vacation property can provide an additional source of income | Whether the property is rented or not, you'll be responsible for utilities, maintenance, taxes, and property management fees |

| Rental income can help to offset property and vacation expenses | You might have to pay a property manager to oversee daily operations |

| You will be able to take advantage of tax write-offs | Vacation rental properties are typically hit harder during economic downturns because people often pass on or lessen their vacation trips to save money |

| The property's value could skyrocket | Since vacation rental properties are seasonal, and off-peak seasons generate lower per-night rent, cash flow can be inconsistent |

| You are free to use your vacation rental property whenever you want | Finding renters can be challenging, especially for a new vacation rental property owner |

| Build your equity and wealth | Some cities and HOAs impose strict restrictions and regulations on short-term vacation rentals that you must adhere to |

As you weigh the pros and cons, don’t forget to consider the methods you’ll use to advertise your property and find tenants. For example, if you plan to list your property on Vrbo (Vacation Rental By Owner) or Airbnb, make sure you thoroughly research the requirements for those properties. Buying a Vrbo property means that you must comply with the strict maintenance policies, so make sure you have that information on hand before you make a decision.

2. Research Vacation Spots & Narrow Down Potential Locations

In order to buy a vacation rental property that consistently generates maximum profit, you must find the right location and type of property. You can easily conduct an online search on real estate listing sites like Zillow and Realtor.com to learn more about the properties and rentals in different areas. However, you might already know where you want to buy a vacation home—near the coast, on a lakefront, in the mountains, or near other popular travel destinations.

Vacation rental with infinity pool (Source: MYMOVE)

Before rushing to make an offer on a property you like, make sure you evaluate factors like the rental market conditions, employment rate, weather, and proximity to specific amenities. Check the location demand to know if owning a vacation rental property in that area is a good investment. Then, once you’ve narrowed your search to one or two potential locations, it’s time to dig deeper into the market and demand. Examine the vacation trends and property types influencing a specific area. You can ask yourself the following questions:

- Would tourists like to take a break in this area?

- What types of attractions are nearby?

- How does the location’s popularity peak and fluctuate throughout the year?

- Is there sufficient and consistent demand for a vacation rental in the area?

While you must consider the financial aspects of a potential vacation rental property, you cannot overlook the fact that the property must be in a pleasant, accessible, and desirable location to attract visitors. In addition, consider the type of vacation rental property or second property you would like for yourself—bungalows, cabins, chalets, condos, homes, townhouses, or villas.

3. Calculate Monthly Expenses

With a location in mind to buy a vacation rental, an extremely important step is calculating the profitability of the property. Ensure that you can afford the vacation rental property, and always examine the costs of nearby vacation rentals and compare them to your monthly financing and operational costs.

It will be easier to calculate your rental property income if you can get the occupancy rates for similar vacation rentals in that area. As you learn how to buy vacation rental property, remember that areas with high tourism tend to have higher property values but also higher rental income potential.

Here are the basic expenses vacation rental purchasers should consider:

- Property taxes: These are commonly tax deductible. Consult your certified public accountant (CPA) to maximize vacation rental tax benefits. Property tax information is available online, usually on the property listing or through the assessor’s online database.

- Rental income taxes: These are due at the end of the year, but only if you rent the property for more than 14 days. If you are required to pay taxes, your rental income will be taxed at your ordinary tax rate.

- Occupancy taxes: A hotel or lodging tax varies by state and typically ranges from 1% to 15% per night. These taxes are usually charged to vacation rental guests, and if landlords rent their property through Airbnb, the company may collect the taxes from guests if their city has agreed to do so.

- Property insurance: Vacation rental insurance covers the risks associated with renting your property to others. It covers the structure, contents, and liability while covering income loss. Annual vacation rental insurance costs between $1,500 and $2,500. Property insurance depends on the need and location of your property—it could be against hurricanes, mudslides, or floods.

- Homeowner association (HOA) fees: You will be responsible for paying HOA fees if you purchase a condo or a home in a planned community with common areas. These fees are usually paid monthly but can also be paid quarterly. HOA fees cover grounds maintenance, landscaping, pool maintenance, trash removal, gate security guard, electricity, and other utilities for common areas. If you rent the property, the fees can be tax-deductible.

- Utilities: Utility fees cover costs for heating, cooling, internet, electricity, and gas. Before purchasing a vacation rental property, you should get an idea of these costs from the seller and local utility companies. The prices will vary according to how you and your guests use the property.

- Management fees: If the vacation rental property is far from the owner’s primary residence, they may hire a property manager. Fees vary depending on the management company’s services. The average cost is 12% to 50% or more of the monthly rental income. They are higher than the average long-term rental fee of 4% to 10% because rental income is sporadic or seasonal. The property management company has more work to do with frequent tenant turnover, resulting in higher expenses.

- Financing costs: To finance your vacation rental property, you must include your monthly mortgage principal, interest, and private mortgage insurance (PMI) payments. You are not required to pay PMI if the property has 20% equity. Calculate the financing costs, which include the appraisal, loan origination fees, and closing costs.

- Licensing fees: Depending on the size of the property and the number of bedrooms, some municipalities require short-term rentals to have a vacation rental license, which typically costs $1,200 the first year and $600 each subsequent year.

Before calculating the federal deductions, ensure that you meet Internal Revenue Service’s (IRS) basic requirements for rental properties. You must rent your property for at least 14 days a year. This assessment of the 14-day rule for vacation rentals will determine whether your vacation rental property can be classified as a business. If you rent for less than 14 days, the IRS considers your rental property a second home, and some tax deductions will be invalid.

Also, keep track of the time you use your vacation rental for personal purposes. If you use your rental property for more than 14 days or 10% of the total time, you can only deduct a portion of your property expenses. Depending on the ratio of personal days to rented days, the IRS considers vacation homes to be either a business or an investment.

4. Estimate Monthly Income

With an estimation of your monthly expenses, you can accurately calculate your potential monthly income. This will often make it clear whether learning how to own a vacation rental property is a wise business decision or not. To calculate your potential monthly income, you’ll need the following items to input into the equation:

- Nightly rental rate

- Occupancy rate

- Number of days

- Monthly operating expenses

- Mortgage, taxes, and insurance fees

Potential Monthly Income = [(Nightly Rental Rate) x (Occupancy Rate) x (# of days)] – [(Monthly Operating Expenses) + (Mortgage, Taxes & Insurance)]

Example: If your vacation rental has monthly operating expenses of $1,000, mortgage, taxes, and insurance are $2,500, and the nightly rental rate is $340, with an occupancy rate of 60%, here’s how you can calculate your potential monthly profit:

Potential Monthly Income = [($340) x (60%) x (30 days)] – [($1,000) + ($2,500)] = $2,620

In this example, the vacation rental property’s cash flow is positive for 30 days, and even if rented for only 18 days a month, it would yield a $172 potential income.

Use our potential monthly income calculator below to calculate your estimated monthly income for your vacation rental property.

However, note that vacation rental property revenue is frequently influenced by season. In the summer, a house near the water will be more appealing, while during the winter, a home near a ski resort will thrive. You need to know what to anticipate during the busiest times of the year and during the off-season to ensure the property brings in the income you desire.

5. Consider Additional Factors About Your Vacation Property

A property is a solid asset with the potential to increase your wealth over time. In addition to calculating the potential monthly income of your property, you should also consider the long-term benefits of buying vacation rental property when finding investment properties for sale.

Consider the following factors to guarantee that your vacation rental properties are a good long-term investment:

- Capital growth: Always be on the lookout for expanding areas in terms of population, the economy, and local infrastructure.

- Invest in locations you know: Familiarize yourself with potential vacation rental property investment locations. Learn everything about the area, from demographics to businesses to attractions.

- Return on investment (ROI): It’s important to buy where you won’t go into debt or get a negative cash flow. Keep tabs on rental yield trends when deciding on an investment rental property.

- Vacancy rates: Focus on a tight rental market for vacancy rates. Examine the most recent vacancy rate data for your preferred neighborhood; investing in areas with low vacancy rates reduces your chances of having an empty property between renters.

- Future developments: Learn about the future developments and plans in your preferred location. You can look for information on infrastructure project proposals on government and council websites. It’s also a good idea to keep an eye out for residential developments near amenities like schools, hospitals, and malls.

- Renters’ needs and wants: Choose a type of property that appeals to the people currently renting in your preferred area. It will also benefit you if a property has desirable features for the target market, such as proximity to public transportation, shopping hubs, and hot spots.

6. Get Financing & Close on the Property Purchase

If you find that your potential investment will be profitable after all of your research about how to buy beach rental property, you’re ready to move into financing your purchase. There are several options for financing a rental property, so make sure you consult a mortgage professional to figure out your best course of action.

Here are a few financing options when buying a vacation rental:

- Traditional vacation rental financing: This is the most common method of financing real estate investments. To begin, you will apply for funding for your vacation rental property through a credit union or bank. If your application is approved, you will make an initial or down payment and repay the rest of the loan in monthly installments for 15 or 20 years.

- Conforming loan: This is a popular choice for vacation rentals because the qualification criteria are less stringent than those for a primary residence. A credit score of over 680 and a 20% down payment are required.

- Multifamily loan: This is used for vacation properties with two to four units or apartment complexes with five or more units. Multifamily loans have interest rates as low as 2.625% with terms of up to 35 years. Portfolio loans, conventional mortgages, government-backed loans, and short-term multifamily loans all fall under this category.

- Short-term loan: A short-term loan is an excellent option for investors who need cash to buy a vacation home before securing long-term financing. This category includes both bridge loans and hard money loans.

Once financing is secure, the rest of the property purchase will be similar to that of a single-family or multifamily investment property. The seller and buyer will negotiate the price, the bank will clear the loan, and both parties will sign documentation to transfer ownership to the new homeowner and close the transaction.

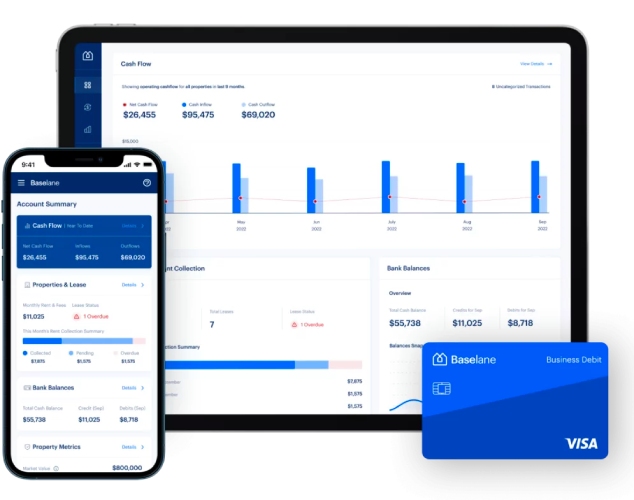

Baselane banking dashboard (Source: Baselane)

No matter which financing option works best for your purchase, consider using Baselane to manage your income and expenses, and even automate rent collection. Baselane is a bank solution made specifically for rental property owners, and creating an account is completely free. Learn more about how Baselane can make you a better property owner.

For more information on financing options, read our articles Investment Property Financing & Requirements and 5 Best Investment Property Loan Providers.

7. Purchase Operational Services & Software to Manage the Property

After finalizing the purchase of your vacation rental home, you have two management options: hire a property manager or manage the property yourself using property management software.

Hiring a property manager is an excellent choice as they plan and execute activities and understand what goes into routine, seasonal, and preventative maintenance. They keep property rentals in good condition by advertising and filling vacancies, negotiating and enforcing leases, and maintaining and securing premises. They also set rental rates by surveying local rental rates and calculating overhead costs, depreciation, taxes, and profit targets.

On the other hand, purchasing property management software is a great option for property owners. It simplifies online rent payments and provides robust features like online marketing, digital lease signing, online rent payment, tenant screening, and maintenance tracking.

Here are the best short-term rental management software providers that provide the best features at an affordable price:

Software | ||||

|---|---|---|---|---|

Best For | Integrating rental property information and guests from multiple platforms | Direct booking and integrations with third-party sites | Connecting directly to QuickBooks for property and financial management | Detailed analytics and accounting tools |

Key Features |

|

|

|

|

Starting Price | $34 per month | $13 per month | $40 per month | $9 per unit |

Learn More |

Pro tip: No matter which type of property management you use, make sure you streamline the process with tools of your own. Use our rental property maintenance checklist to ensure owners take care of their regular preventative maintenance tasks before they become emergencies and require expensive repairs.

8. Advertise Your Property Online

Another extremely important step in learning how to buy vacation rental property is promoting your property to vacationers. Start marketing your rental home on websites like Vrbo, Airbnb, and Booking.com. Since these are the top vacation rental listing sites, advertising your property on these platforms will help you generate the maximum exposure, improving your occupancy rate and potential income.

Consider the differences between each listing site for vacation rentals:

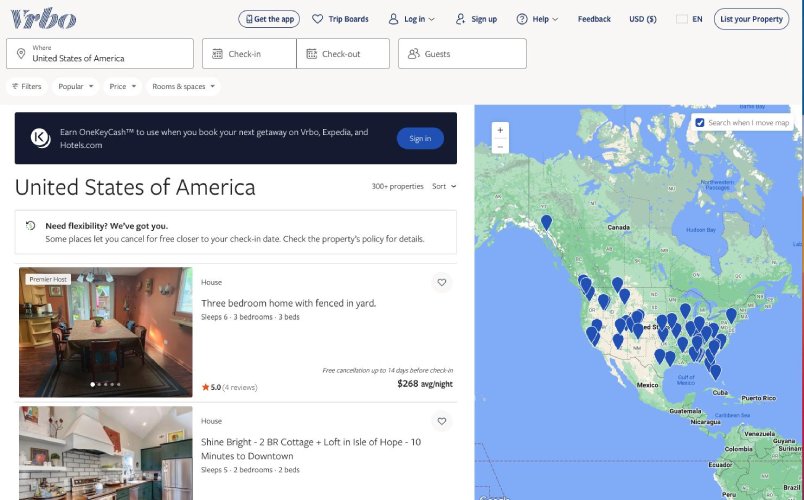

Vacation Rental by Owner (Vrbo) is a website designed for vacation property owners and travelers. You can either manage your property yourself or hire a property manager to list on Vrbo. When you’re considering how to buy a Vrbo property, keep in mind that it has a $499 annual subscription and booking fees. However, the subscription includes Vrbo’s reservation manager and calendar, which aids the owners in keeping track of the guests and their stay duration.

Vrbo vacation rental property listings (Source: Vrbo)

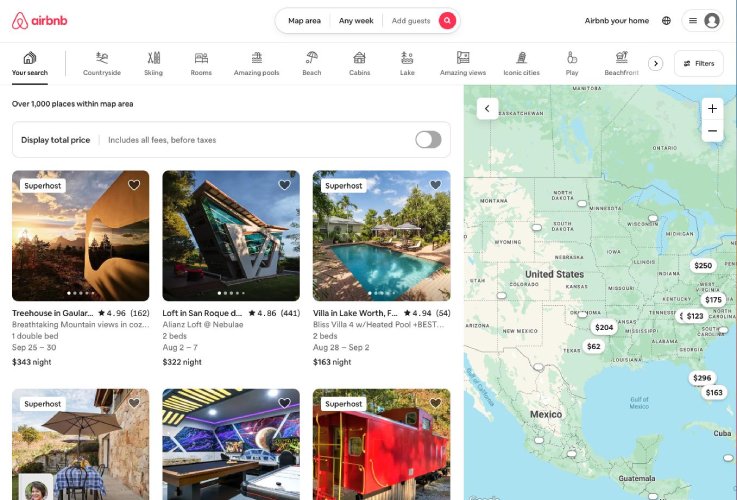

Airbnb is a well-known vacation rental listing site that lets you list and rent your vacation property to tourists looking for accommodation. You can also create a property listing with a description of the property’s amenities, the number of bedrooms and bathrooms, and photos of the property, which helps to get the most exposure on your property listing.

Airbnb charges a service fee every time a booking is completed on the site. There are two fee structures for stays: a split-fee and a host-only fee. The split-fee structure requires the hosts to pay a 3% fee, and guest service fees are under 14.2% of the booking subtotal. On the other hand, with a host-only fee structure, the entire fee is deducted from the host payout, typically 14% to 16%.

Airbnb vacation rental property listings in the United States (Source: Airbnb)

One of the most widely used websites for travelers is Booking.com. It draws millions of visitors daily, has more than 28 million listings worldwide, and provides 24/7 access in 43-plus languages on its site.

Booking.com will help you feel confident with welcoming guests by allowing property owners to set house rules to which guests must agree before staying. Aside from this, it enables landlords to request damage deposits for extra security and report guest misconduct if something goes wrong. It protects against liability claims from guests and neighbors for up to $1,000,000 for every reservation.

Available vacation rental properties near Disneyland (Source: Booking.com)

9. Rent to Qualified Vacationers

Renter screening is essential in finding and choosing suitable renters for your property. This will help avoid renters who will damage your property or scammers who are not willing to pay for their stay. Follow these tips to make the best choice:

- Follow the Federal Fair Housing Act and each state’s Fair Housing laws

- Check and review the vacationer’s basic profile information, such as phone number, email address, “about me” section, age, vocation, and maturity

- Check for the social media account of the renter to confirm that they have a real identity

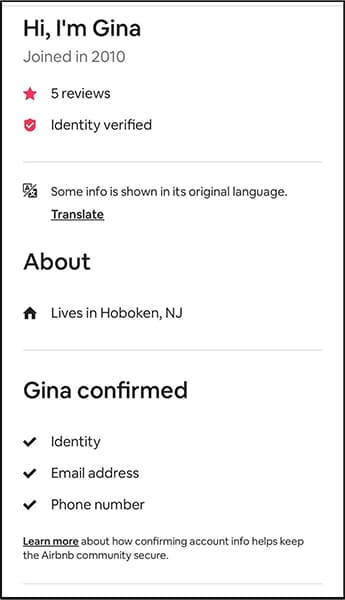

- Choose a renter with an “ID-verified” badge

- Read the vacationer’s reviews

Airbnb renter profile

Bottom Line

When considering how to buy vacation rental property, make sure you carefully evaluate individual properties, their potential income, and your expenses. Buying a vacation rental property can be both risky and rewarding. Use these steps as a guide to help you make the right choices and generate profits on your investments.

Frequently Asked Questions (FAQs)

Buying a vacation rental property can be an incredibly profitable investment, but make sure you do your due diligence before diving in. Don’t forget to consider the pros and cons of vacation rentals, calculate your expenses and income, choose the right financing, and advertise your property online. If you don’t do plenty of research, you may end up with a vacation or beach rental property that costs you more money than it generates.

According to the National Association of Realtors (NAR), an estimate of the average annual revenue for short-term rentals is $39,200. The amount of profit you can generate from buying a vacation rental property depends on many different factors, like location, property size, amenities, and rental demand. Plus, vacation rentals are prone to seasonal fluctuations, so make sure you also consider the appeal of properties in different areas throughout the year.

Yes, Vrbo and Airbnb can be valid investments if they are approached strategically. Make sure to thoroughly understand the rules and fees of each platform in addition to researching the associated costs and potential income of any rental property you purchase. However, both platforms have a large user base, which can help extend your marketing reach.