SurePayroll by Paychex and Patriot Payroll are both great options for small businesses looking for affordable pay processing tools. The two providers offer full-service payroll with tax payment and filing services and a do-it-yourself (DIY) package where you handle tax filings yourself. However, SurePayroll by Paychex’s full-service plan is slightly cheaper than Patriot Payroll’s and includes access to employee benefits plans. It can also handle household payroll—a functionality that Patriot doesn’t have.

On the other hand, if you have an in-house HR staff and prefer to file taxes yourself, Patriot Payroll’s basic DIY plan is less expensive than SurePayroll by Paychex’s and is optimal for budget-constrained startups and mom-and-pop businesses with only a handful of employees. It also has a time tracking add-on that integrates seamlessly with its payroll tool, making it easy to capture actual employee work hours for payment.

Here’s when we particularly recommend SurePayroll by Paychex vs Patriot Payroll.

- SurePayroll by Paychex: Best for small business owners and household employers looking for payroll with health benefits plans

- Patriot Payroll: Best for small companies needing integrated payroll and time tracking tools

There are instances where neither SurePayroll nor Patriot Payroll is the best option. If you’re looking for HR payroll software with 24/7 customer support, we recommend:

- Justworks: Best for companies that need low-cost professional employer organization (PEO) services to outsource HR and payroll administration

SurePayroll by Paychex vs Patriot Payroll Compared

When to Choose Each

| PROS | CONS |

|---|---|

| User-friendly software | Local tax filing in Ohio/Pennsylvania and multistate filings cost extra |

| Special payroll plan for managing household payroll | Integrates with only time clock and accounting software; third-party integrations are paid add-ons |

| Access to standard benefits like health insurance, 401(k), and workers’ comp plans | Lacks self-onboarding tools |

| Offers pre-employment screenings such as background checks, drug tests, and skills assessments | |

We recommend SurePayroll by Paychex for small businesses looking for a reasonably priced full-service payroll package and benefits plans they can offer to their workforce. While it doesn’t have a wide range of HR solutions, it provides access to pre-employment screening services for new hires and skills and personal development inventories to help you identify your employees’ strengths and growth areas.

If you’re a household employer, the provider can help you process payments for your household staff. SurePayroll by Paychex, which tops our list of the best nanny payroll services, can file 1040-ES for you and prepare signature-ready Schedule H forms that you can attach to 1040 filings (Patriot Payroll doesn’t support Schedule H filings, as of this writing).

| PROS | CONS |

|---|---|

| Easy to use platform | Free direct deposits (including a two-day option) are for qualified clients only |

| Free payroll setup, expert support, and direct deposits | Standard direct deposit timeline is four days |

| ”Net to Gross Payroll” tool automatically calculates gross-up amounts of employee bonuses | Multistate filings cost extra |

| Has time tracking, accounting, and a basic HR solution for managing employee information and documents | Time tracking, accounting, and basic HR tools are paid add-ons |

| Limited access to employee benefits | |

Similar to SurePayroll by Paychex, this provider can handle multiple pay rates and payments for both employees and contractors. What sets Patriot Payroll apart from its competitor include its free payroll setup assistance and “Net to Gross Payroll” tool. This feature lets you add net bonus amounts to pay runs without manually doing the gross-up calculations yourself—Patriot’s system will automatically gross the bonus amounts up for taxes.

Patriot Payroll is also a more affordable option for mom-and-pop businesses that prefer to handle tax payments and filings for a very small number of employees. The monthly base fee of its basic package is $3 cheaper than SurePayroll by Paychex’s “No Tax Filing” option.

In addition, Patriot has accounting software that seamlessly integrates with its payroll solution. This makes managing general ledgers and tracking payroll expenses easier for accountants. A time tracking add-on is also available, including an HR module that lets you maintain paperless personnel files.

Alternatives to SurePayroll by Paychex vs Patriot Payroll

There are times when neither Patriot nor SurePayroll by Paychex is the optimal choice for managing payroll and employees. In general, the best alternatives to SurePayroll by Paychex and Patriot Payroll are payroll software that come with a wider range of HR tools, such as Gusto and Rippling.

Best For | Starter Monthly Pricing | Our Review | |

|---|---|---|---|

Small businesses looking for full-service payroll with solid HR support | $49 per month + $6 per person per month | ||

Tech-heavy companies that want HR, payroll, and IT solutions | $8 per employee plus a $35 base fee* | ||

Solopreneurs and businesses needing dedicated payroll support | $5 per employee plus a $39 base fee | ||

*Pricing is based on a quote we received

If you want more information about which options to look for when choosing a payroll service, check our guide on finding the right payroll solution for your business.

Best for Value: Tie

Comparing SurePayroll by Paychex vs Patriot Payroll for affordability is a bit difficult. Both have transparent pricing and offer reasonably priced plans with packages for those wanting to automate the entire payroll process and those preferring to handle tax filings themselves.

Number of Plans | Two, with a separate plan for nanny payroll | Two |

Base Fees ($/Month) | Full-Service plan: $39 No Tax Filing plan: $20 | Full-Service plan: $37 Basic plan: $17 |

Per-employee Fees ($/Month) | Full-Service: $7 per worker No Tax Filing: $4 per worker | Full-Service: $4 per worker No Tax Filing: $4 per worker |

Special Plan ($/Month) | Nanny payroll: $59 for one household worker Plus $10 for each additional employee | N/A |

Multiple State Filing | $9.99 monthly (for Full-Service plan only) | $12 per additional state monthly (for Full-Service plan only) |

Local Tax Filing | $9.99 monthly for Ohio and Pennsylvania (for Full-Service plan only) | Included in Full-Service plan; no additional fees |

Time Tracking | Stratustime integrated time clock: $5 + $3 per employee Time clock integration: $9.99 | Patriot time and attendance tool: Starts at $6 + $2 per worker |

Add-ons ($/Month) | Accounting integration: $4.99 | Patriot HR software: Starts at $6 + $2 per worker Patriot Accounting: Starts at $20 |

Benefits Fees ($/Month) | Call for quote | Free 401(k) and workers’ comp integration (premium fees may apply) |

Either one can provide better value for money depending on your business location and pay processing requirements. Here are a few instances where SurePayroll by Paychex or Patriot Payroll may be a more suitable option for you.

Subscribing to SurePayroll by Paychex’s full-service plan makes more sense if you have a multi-location business. While its Full Service costs a bit more than Patriot’s, SurePayroll will only charge $9.99 monthly for multistate filings. With Patriot, you will be charged $12 monthly for each additional state. This can get pricey, especially if you have plans to grow your business in other states.

SurePayroll by Paychex is also great for household employers. In addition to accurately paying household staff via direct deposits, it helps you compliantly handle nanny tax regulations and form filings.

Patriot Payroll’s full-service option is slightly less expensive than its competitor. Plus, it’s a good option for small businesses that want payroll tax filing support at all levels. With SurePayroll by Paychex, you have to pay extra for OH/PA local tax filings.

If you’re looking for a payroll plan with DIY tax filings, then Patriot’s basic option is cheaper than SurePayroll by Paychex’s “No Tax Filing” option. You only have to shell out $37 monthly to process payroll and calculate taxes for five employees (SurePayroll by Paychex will charge you $40 per month).

Best for Pay Processing: SurePayroll by Paychex

Employee and Contractor Payroll | ✓ | ✓ |

Nanny and Agriculture Payroll | ✓ | ✓ (but doesn’t support all tax reports/filings for nannies and agriculture workers) |

Unlimited and Automatic Pay Runs | ✓ | ✓ |

Multiple Pay Rates and Schedules | ✓ | ✓ |

Payroll Calculations and Tax Deductions | ✓ | ✓ |

Payroll Tax Filings and Year-end Reporting | Included in the Full-Service plan, but local tax filings in OH/PA cost extra | Included in the Full-Service plan |

Payment Options | Direct deposit, checks (manual printing only) | Direct deposit, checks (manual printing only) |

Direct Deposit Timelines | Two days | Four days; Two days for qualified companies |

Wage Garnishment Deductions | ✓ | ✓ |

Online Paystubs via Self-service Portal | ✓ | ✓ |

Downloaded Mobile App | ✓ | No app; but you can access the software via the web browsers of smartphones and tablets |

While both providers’ online tools can handle the pay processing requirements of businesses in various industries (such as restaurant, retail, and manufacturing), SurePayroll by Paychex offers better tax support for nanny and agriculture payroll. It provides the necessary tax forms (such as Form 943 and Schedule H) and even files the appropriate taxes for you. Note that Patriot Payroll doesn’t offer Schedule H and Form 943 filings as of this writing.

You also get two-day direct deposits with SurePayroll by Paychex. Patriot’s standard timeline is four days—it only offers a two-day option to qualified companies. Plus, if you prefer to download a mobile app to process payroll while on the go, SurePayroll by Paychex has one for iOS and Android devices.

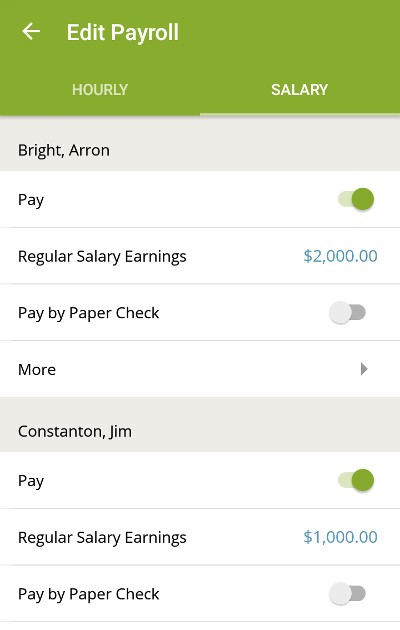

SurePayroll by Paychex’s mobile app for employers allows you to edit and approve pay runs. (Source: Google’s Play store)

When to Use Patriot Payroll

If your business is located in Ohio or Pennsylvania, consider Patriot Payroll as you don’t have to pay extra for local tax filings in those states (this costs an additional $9.99 per month with SurePayroll by Paychex). Patriot is also a good choice for small businesses that don’t require fast direct deposits—although, you can contact the provider to request consideration for its two-day option.

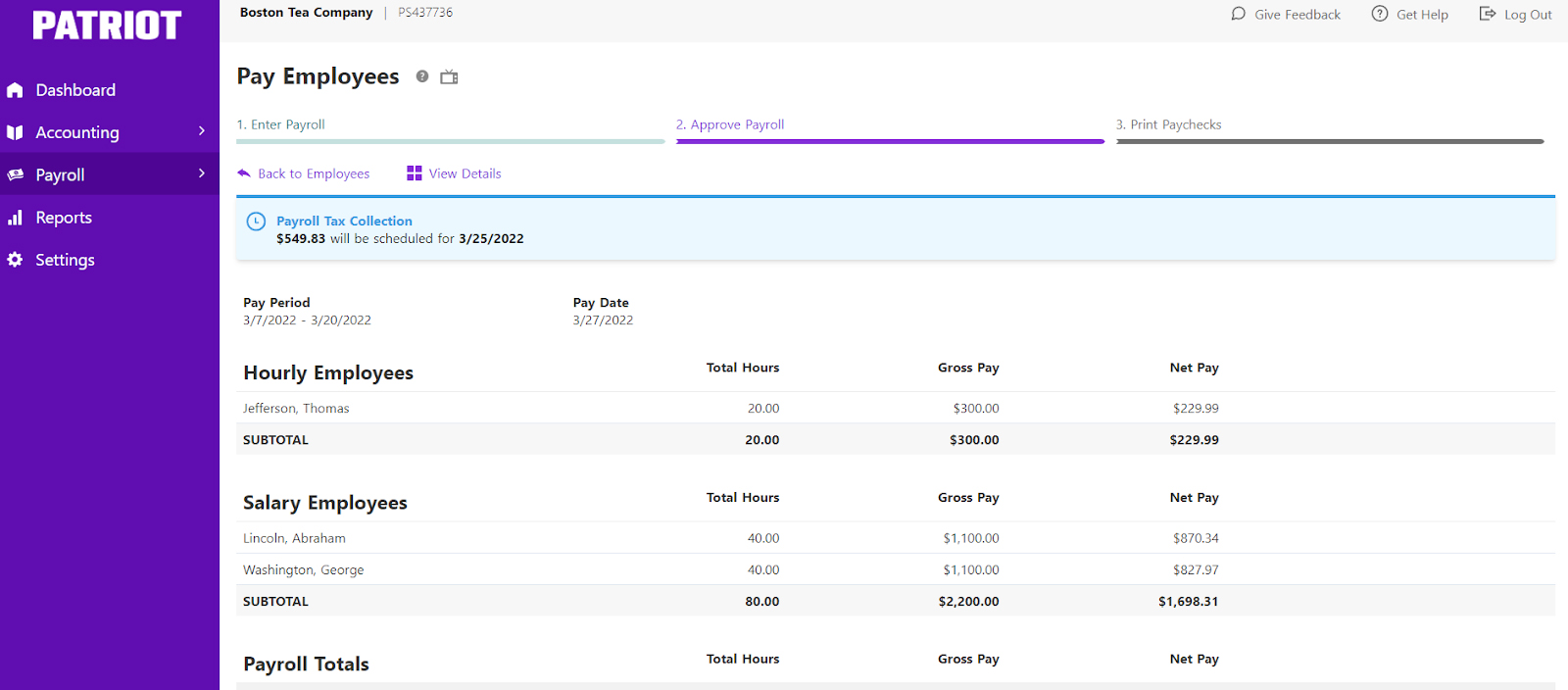

With Patriot Payroll, you can pay employees and print paychecks in three steps. (Source: Patriot Payroll)

It also makes processing bonus payments easy as you don’t need to manually compute the applicable taxes for bonuses—its “Net to Gross Payroll” tool handles this automatically. Patriot Payroll even supports repeating money types, allowing you to create as many options as you need like car, cell phone, and housing allowances.

Best for HR Features: SurePayroll by Paychex

New Hire Reporting | ✓ | ✓ |

PTO Accruals | ✓ | ✓ |

Employee Data Management | Very limited | ✓ (cost extra) |

Time Tracking | Via third-party integration (costs extra) | Via time tracking add-on |

Benefits Options | Health insurance, 401(k), and workers’ comp (via third-party partners) | 401(k) and workers’ comp (via third-party partners) |

Health Insurance in All States | ✓ | ✕ |

HR Adviser | ✓ | ✕ |

Employee Self-onboarding | ✕ | ✕ |

Other HR Tools* |

|

|

*Some of these tools and services may cost extra

When comparing SurePayroll by Paychex vs Patriot Payroll for HR functionalities, the former offers a wider range of basic HR tools, including a better selection of standard benefits options. As a Paychex company, SurePayroll by Paychex works through Paychex (and other partner providers) to offer benefits like health, dental, and vision plans. It also has a Sure401k plan designed for small businesses and integrates with third-party partners for pay-as-you-go workers’ compensation.

If you have new hires, it generates and files the applicable report for state agencies. And while it lacks recruiting tools, SurePayroll by Paychex has pre-employment screening services that allow you to request background checks, drug tests, and skills assessments for qualified candidates.

When to Use Patriot Payroll

If you get Patriot Payroll’s time tracking solution, your staff can securely clock in/out via the self-service portal. This tool also allows seamless transfers of employee attendance data from the time tracking module into its payroll software for pay processing. Plus, you don’t have to worry about potential third-party integration issues because the add-on is developed by Patriot.

Managing employee data is also easier with Patriot’s HR software add-on. Aside from document management features, this solution lets you track position changes, designate people manager roles, and assign direct reports.

Best for Ease of Use & Customer Support: SurePayroll by Paychex

Learning Curve | Relatively easy | Relatively easy |

Ease of Use | Good | Good |

Setup Wizard | ✓ | ✓ (also offers free payroll setup) |

FAQs and How-to Guides | ✓ | ✓ (online FAQs are easier to navigate through) |

Third-party Software Integrations |

| Very limited (QuickBooks Time and QuickBooks Accounting only) |

Customer Support Types | Phone and chat | Phone, chat, and email |

Support Hours | Mondays to Fridays, from 8 a.m.–7 p.m. Central time Saturdays, from 9 a.m.–1 p.m. CT | Mondays to Fridays, from 9 a.m.–7 p.m. Eastern time |

If you need extended customer service hours, SurePayroll by Paychex’s support team is available on weekdays 8 a.m. to 7 p.m. Central time, and Saturdays from 9 a.m. to 1 p.m. CT. And unlike Patriot Payroll, it integrates with a wider selection of third-party accounting and time tracking software.

When to Consider Patriot Payroll

While both have online platforms that are relatively easy to learn and use, Patriot offers better payroll setup support. You can use either its online wizard to guide you through the process or have Patriot set up your account for you. Best of all, this service is free for new clients.

Patriot also offers more ways for you to contact its support team (via chat, email, and phone), although it lacks the Saturday customer service hours that SurePayroll by Paychex provides. However, if you’re the type who enjoys browsing through a provider’s online FAQs to learn more about its services and online tools, I recommend Patriot as its how-to guides are easier to navigate through.

Best for User Popularity: Patriot Payroll

User Feedback | Mostly positive | Mostly positive |

Average User Ratings* | 4.25 out of 5 | 4.8 out of 5 |

Average Number of Reviews* | Close to 350 | More than 1,800 |

*Data from third-party review sites (such as G2 and Capterra)

To compare Patriot Payroll vs SurePayroll by Paychex on user popularity, we looked at each providers’ average overall ratings and the number of reviews on third-party review sites like G2 and Capterra. As of this writing, Patriot Payroll received a higher average rating than SurePayroll by Paychex (4.8 out of 5 vs 4.25 out of 5). The number of average reviews that Patriot Payroll has is also higher than its competitor (1,800+ vs about 350).

What Users Think: SurePayroll by Paychex vs Patriot Payroll

Bottom Line

Deciding whether to get SurePayroll by Paychex vs Patriot Payroll for your small business mainly depends on your pay processing needs. If you want payroll and time tracking tools that integrate well, consider Patriot Payroll as it has a time tracking add-on that seamlessly connects with its payroll module. Its plans are also affordably priced and can handle multiple pay rates and schedules, repeating money types, and automatic pay runs.

If you’re looking for household payroll or require a pay processing solution with employee benefits and pre-employment screening services, then SurePayroll by Paychex is the better option. It provides access to health insurance in addition to workers’ comp and 401(k) plans. Customer support is also available on weekdays and Saturdays, and its integration options include more accounting and time tracking tools than Patriot’s.