Paylocity offers a suite of integrated cloud-based payroll and human resources (HR) solutions. With a platform designed to automate workforce management, it can streamline HR processes—from hiring and payroll to benefits administration and performance monitoring. It’s ideal for midsize to large businesses looking for an all-in-one and mobile-friendly HR platform.

While pricing isn’t published on its website (you have to contact the provider to request a quote), Paylocity works with you to create a custom package that fits your HR needs. You can start with its payroll solution and then upgrade your plan by adding modules for recruiting qualified candidates, capturing employee data, tracking time and attendance, and more. Implementation support is also available for new users, plus it has a team of experts to help you with your compliance and tax queries.

Pros

- Efficient payroll and time-tracking tools

- Payroll solution includes automated expense reimbursement

- Wide range of HR solutions and integration options

- Global payroll services for 100-plus countries (via Blue Marble)

Cons

- Pricing isn’t transparent (requires you to call for a quote)

- Charges set up fees

- Its full-service HR and payroll platform can be pricey for small businesses

Paylocity Deciding Factors

Supported Business Types | Midsize businesses and large enterprises that want integrated HR tools to handle the entire employee lifecycle |

Free Trial | None, but you can request a free demo |

Pricing | Pricing is not published on its website; you have to contact Paylocity to discuss your HR needs and request a quote |

Standout Features |

|

Ease of Use | Platform generally is easy to use but you need to have basic knowledge of HR processes, such as how to run payroll; there may be a slight learning curve depending on the number of Paylocity modules you get |

Customer Support |

|

If you’re nearing the end of your payroll provider search and are ready to make a decision, check out our step-by-step guide to choosing the right payroll solution to ensure you have all your bases covered.

How Paylocity Compares With Top Alternatives

Best For | Tech-heavy businesses that need HR, payroll, and information technology (IT) tools | Small businesses looking for payroll and solid HR support | Solopreneurs and businesses that want flexible HR payroll solutions | Companies in highly regulated industries |

Starter Monthly Fees | $35 base fee plus $8 per employee* | $40 base fee plus $6 per employee | $39 base fee plus $5 per employee | $16 per employee (includes payroll add-on) |

Average User Rating** | 4.85 out of 5 | 4.35 out of 5 | 4.15 out of 5 | 4.10 out of 5 |

Our Reviews |

*Pricing is based on a quote we received.

**Scores are taken from G2 and Capterra (as of this writing).

Paylocity Pricing

Paylocity’s pricing information isn’t readily available on its website, so you’ll have to contact the provider to request a demo and pricing details. For a business with 25 employees, we were quoted a monthly fee of $200 plus $9 per employee for a package that includes the following:

- Payroll and payroll tax filing services

- Benefits administration

- Recruiting

- Onboarding

- Time management

- Paid-time off (PTO) accrual policy management (up to five policies)

- Performance reviews

- Learning management

- Employee self-service portal with mobile apps (for iOS and Android devices)

- New hire reporting

- Access to an online library of HR templates, job descriptions, state laws, and more

- Wage garnishments

- Reporting tools

There’s also an implementation cost of $700 for new users. While Paylocity can handle quarterly and year-end tax filings for you, it charges a $7 per employee fee for W-2 filings. You can also expect to pay premiums for benefits plans, such as health, 401(k), and workers’ compensation, among others.

Paylocity Features

Since our last update:

We go into more detail on Paylocity’s global payroll, HR compliance, and employee collaboration tools.

Paylocity’s suite of solutions helps users manage day-to-day HR administrative tasks more efficiently, allowing them to focus on other business projects. It has a highly configurable platform that unifies payroll with other human capital management (HCM) applications. Here are some of Paylocity’s important functionalities.

You can simplify and streamline employee pay processing with Paylocity’s payroll solution. It comes with custom general ledgers (GLs), complex calculation reports, and preprocess pay registers for checking and verifying employee payrolls prior to finalizing pay runs. The provider also offers wage garnishment managed services and tax reporting services for filing federal, state, and local payroll taxes.

You even get expense management tools—a feature that similar providers may offer either as a paid add-on or via third-party software integration. Aside from automating the entire process of filing business expense claims, this tool simplifies the reimbursement process as it pulls all approved requests automatically and adds the amount to the employee’s payroll.

Paylocity lets you create, submit, approve, and track expense claims through its online platform and mobile app for iOS and Android devices. (Source: Paylocity)

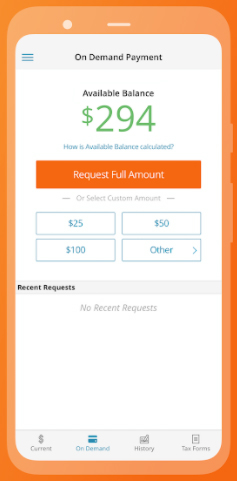

If you want to offer your employees a flexible cash flow option, then you can use Paylocity’s On Demand Payment functionality. This provides your staff early access to a portion of their earned salary during an active pay period. With Paylocity prefunding the transfers, you don’t have to worry about potential cash flow issues.

Real-time net pay calculations that show actual earnings are also available. This helps ensure that your workers don’t request more than their net pay. You don’t even have to approve the transaction manually and track the payroll deductions because Paylocity will handle these processes automatically. Employees can even expect same-day fund transfers, provided the requests are made by noon CT.

Employees can raise On Demand Payment requests through Paylocity’s mobile app.

Manage employee payments in 100-plus countries with Paylocity and Blue Marble’s global payroll services. It grants you access to a dedicated US-based support team and in-country experts who can guide you through the complexities of paying international employees. Support services are also available if you need to set up a local business entity, open an in-country business bank account, hire a global workforce, and manage expat employee requirements.

Paylocity’s employee benefits management solution lets you plan and administer third-party benefits like medical insurance plans, health savings accounts (HSAs), flexible spending accounts (FSAs), health reimbursement arrangements (HRAs), and transportation management accounts (TMAs).

Aside from managing benefits for different employee groups, its platform lets you customize user plan limits, add your company’s enrollment rules, and view plan details online. Your employees can also access their benefits through Paylocity’s mobile app (for iOS and Android devices), manage enrollments, and run reports to see their contribution amounts.

Given that this module connects seamlessly to Paylocity’s payroll solution, employee benefit deductions are automatically captured and included in pay runs. Plus, it lets you send electronic data interface files to insurance carriers in cases of employee coverage changes.

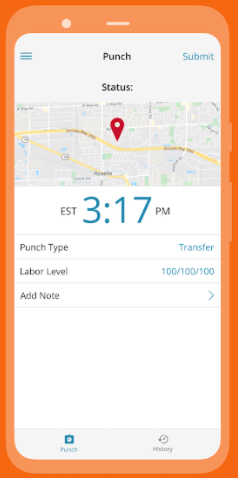

Tracking employee work schedules and time-ins/outs can be quite tedious, but Paylocity’s time and labor management module efficiently automates these two tasks. Apart from creating work schedules, it lets you add shift-related policies, such as shift durations and time between shifts, and manage an audit trail to check tardiness, extended breaks, and absenteeism. You can also assign and monitor attendance points based on the employees’ time-ins/outs.

Similar to popular time and attendance software, Paylocity has a PTO monitoring functionality that enables employees and people managers to request and approve PTO. The provider also offers time clock kiosk tablets for capturing employee time-ins/outs—either through facial recognition, fingerprint scans, or photo captures.

These devices even allow you to screen clocking in employees with prompts that ask about their general health condition (like if they have an elevated temperature at the time of clock-in) and other company or labor policy-related queries (such as whether they have taken the mandated rest breaks).

You can set geographic parameters for employees who clock-in/out through Paylocity’s mobile apps.

Paylocity’s talent management module is designed to help users attract and retain top talent. Its features include recruiting and applicant tracking, new hire onboarding, employee goals and performance management, and compensation management. It also has a learning management solution (LMS) that comes with a course builder and a library of 600-plus premade training programs.

If you want to foster communication and collaboration among employees, Paylocity’s “Community” feature provides you with an online social hub that connects your workers. Announcements and reminders can be posted on its company feed, and you can even create “Ask an Expert” groups that can answer online questions raised by fellow employees.

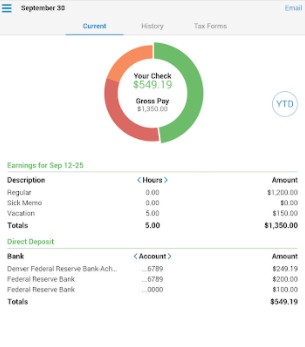

Paylocity’s HR tools enable users to reduce the amount of time needed to manage staff information. With its self-service portal, employees and managers can view pay information, update personal data, collaborate with colleagues, access training sessions, and approve pay rate and schedule changes online.

Paylocity’s employee self-service tools also include access to an employee’s year-to-date (YTD) salary details, pay history, and tax forms.

Paylocity also makes managing compliance easy for HR teams and business owners. With its HR compliance dashboard, you can view and track important compliance items, such as updating I-9 work authorizations and tracking attendance to required courses like sexual harassment prevention training. Updates to tax, payroll, and labor regulations are posted on its “live news feed,” including blog posts about regulatory changes.

Paylocity Ease of Use

- Implementation support

- Employee self-service tools

- More than 300 third-party integrations

- How-to guides and videos

- Live phone and chat support

While Paylocity has a user-friendly interface, some of its features are counterintuitive. You sometimes need to take several steps to complete a simple action. However, you are granted access to dedicated support and expert professionals who can help guide you through the system. You can also contact your dedicated account manager either through phone or chat from Mondays through Fridays, 7 a.m. to 7 p.m. Central time.

If you use third-party software like applicant tracking and time and attendance solutions, Paylocity offers 180- and 360-degree integrations with several systems. This enables vendors to automate the flow of data transfers to and from Paylocity’s system.

In addition, Paylocity has a marketplace of more than 300 third-party partner systems that consist of accounting, recruiting, training, benefits, and other solutions. For reference, here are some of its partner software.

- Accounting systems: Concur, Expensify, QuickBooks, and Xero

- Benefits administration: BenefitPlan Manager, BenXpress, Employee Navigator, and HR Simplified

- Learning management software: CypherWorx, Prosperity, and Wisetail

- Point-of-sale (POS) solutions: Clover and Square POS

- Recruiting systems: ApplicantPro, BreezyHR, CareerPlug, ClearCompany, Greenhouse, iCIMS, Hireology, Lever, and JobScore

- Single sign-on tools: Okta, OneLogin, and PingOne

- Time and attendance solutions: Deputy, Homebase, QuickBooks Time, and When I Work

What Users Think About Paylocity

| Users Like | Users Don’t Like |

|---|---|

| Responsive customer service | The interface isn’t always intuitive; some features are hard to find |

| Efficient for accessing PTO, benefits, payslips, and employee clock-ins/outs online | Occasional system glitches |

| All features work well together | Inconsistent customer support; some reps aren’t knowledgeable |

| Ease of running payroll | Adding advanced HR features can get pricey |

Many of the Paylocity reviews on third-party review sites, such as Capterra and G2, are positive. Users commented that it is generally easy to use for both system administrators and employees. They also appreciate its time tracking and employee self-service solutions, adding that its payroll tools are very efficient.

Meanwhile, other reviewers said that while it has a wide range of HR features, a few of its features aren’t intuitive or are cumbersome to get to. Some wished for more advanced reporting functionalities, including a less expensive option when adding advanced HR tools.

At the time of publication, Paylocity earned the following scores on popular user review sites:

- Capterra: 4.3 out of 5 based on around 730 reviews

- G2: 4.4 out of 5 based on 2,100-plus reviews

Bottom Line

If you have a midsize or large operation and are looking for a cloud-based platform to help you manage all aspects of the employee lifecycle, consider Paylocity. It has a suite of integrated HR and payroll solutions, including wage garnishment managed services and payroll tax filing services. It also has a flexible and customizable system, allowing you to start with basic modules (such as payroll and time tracking) and then add advanced solutions (like performance and compensation management) as your company’s HR needs grow.

Sign up for a free Paylocity demo today.