If you need to switch payroll providers, start by evaluating your needs and comparing your current services with those of other providers. You will also need to find a service that fits your budget and can handle a switchover, giving you the ongoing support you need.

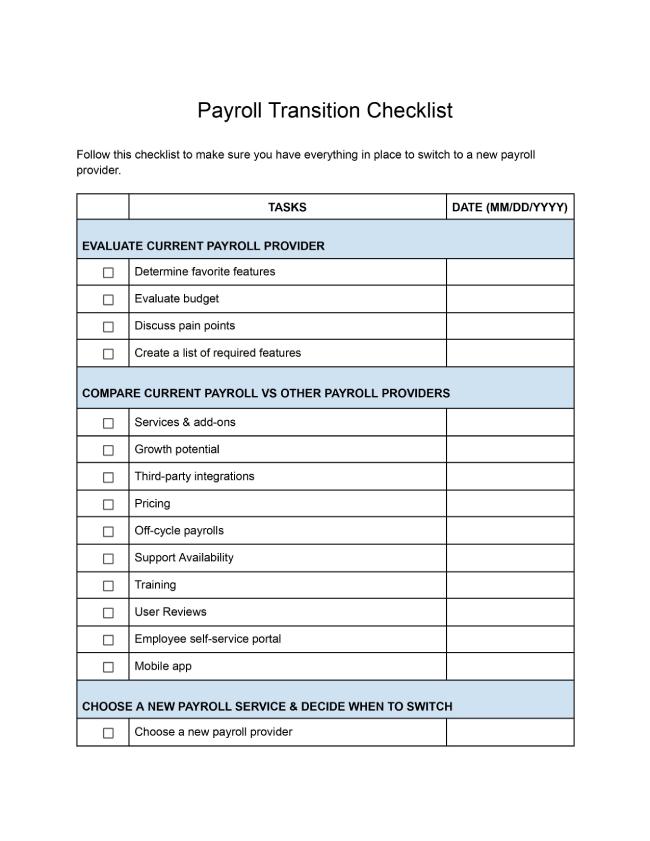

If you’re ready to change payroll companies, it’s simple—just follow our six easy steps below. Also, download our payroll transition checklist to ensure you don’t miss any steps.

Thank you for downloading!

If you haven’t yet decided which payroll provider to switch to, consider Gusto. They offer full-service payroll and HR administration at an affordable rate.

Visit Gusto

Step 1: Evaluate Your Current Payroll Provider

The first thing you’ll want to do is evaluate your current provider. Why are you dissatisfied with it? What do you hope to achieve with a new provider? Some other questions you should ask include:

- What are your favorite features and why?

- What are some of the features you want or need but don’t currently have?

- Does your current provider fall above or below your budget?

- How much are you willing to spend for the right solution?

- What are some of the biggest pain points you’ve experienced?

Once you have answered these questions, you’ll be able to create a list of must-haves. Add any features you’d like your new provider to have and decide which items are deal-breakers. This will aid in the decision-making process and help you choose the right payroll service for your business. Understanding exactly what you need to effectively manage and process payroll is crucial throughout this process.

Step 2: Compare Your Current Provider to Other Payroll Companies

The features and services that different payroll providers offer may vary. While all will offer similar payroll functions, some may provide more support options or additional tax services. Knowing what your business needs most will help you narrow down your list.

Here are some aspects to look into, as well as some questions to go about assessing each.

When considering what payroll provider is best for you, compare the top providers and what they can offer your business.

Pricing | Standout Features | Our Review | |

|---|---|---|---|

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

$40 base + $6 per employee per month |

|

For more options and to learn more about the above payroll providers, visit our best payroll software guide.

When researching payroll providers, go beyond looking at their website or asking a colleague. Consider the plans and pricing, talk to the sales department, and look at review sites like ours, in addition to others like Capterra. Watch demos and be sure to ask which features shown are included with the plan you are interested in. If it offers a free trial, try it out with a sample of your employee base.

Step 3: Choose a New Payroll Service & Decide When to Switch

Once you’ve finished comparing different payroll companies, you’ll need to decide which payroll provider is best for your business. If you’re still having a difficult time picking the right one, then check out our guide to choosing a payroll service.

After finalizing your decision, you’ll want to take time to get all the information transferred and checked, get your employees up to speed, and make sure data is correct and integrations in place before officially moving over. While you may want to jump right in, it’s important to make the transition as smooth as possible for your team and your employees.

When to Switch to a New Payroll Provider

If you can swing it, switching payroll providers at the end of the calendar year—or your company’s fiscal year—is the best option, as it makes for a clean transition for your books.

Switching payroll providers involves transferring a lot of historical and employee information. With the advent of cloud technology, this is much easier, so if you are moving from a cloud-based system to another cloud-based system, you can switch at any time. However, in general, the best time to switch payroll providers is either at the end of the year or the end of the quarter.

By changing at the end of the year, you make it easy for the new payroll provider to track taxes and other government paperwork for the new year. Plan for your first paycheck of the year to come from the new provider, even if it includes work done in December.

The next easiest transition time is the end of the quarter, with the first payroll by the new provider being run at the beginning of the new quarter. Both of these options help avoid confusion and issues with filing and paying taxes. Regardless of when you switch, factor in a sufficient amount of time to get everything in place so that you don’t miss a payroll run.

Step 4: Arrange Setup With Your New Payroll Service

Some payroll services will help you set up the system or do it for you. If they do, ask if or how much they charge. Assigning an employee to serve as the point person keeps the information flow consistent and ensures you don’t have to be involved in every detail yourself.

Access System Through the Cloud or Download

It may be possible to give your new provider the required permissions to access your data through the cloud—this makes transferring payroll from one company to another easier. However, if you need to download, check with them about the format and organization that makes it easiest for uploading into their own software.

Regardless of how you transfer the data, do an internal audit to make sure it transferred without errors or to fix any errors that were already in the old system. Particularly, watch out for duplicate data. To ensure that there’s no duplicate data and instill confidence, you should run at least one mock payroll while on a call with a support representative. We also recommend running your first live payroll with a support representative standing by. If anything goes wrong, they can step in to fix it immediately.

Send Documents & Other Payroll Information

Your new provider will let you know exactly what information is needed to get started. You may be able to authorize your old payroll service to send the information directly to your new one.

These are the most common items needed:

- Federal Tax Info: EIN and other basic business information, like legal business names

- Tax Forms: Past returns, payroll tax deposit dates/amounts, tax account numbers

- Payroll Registration Information: For federal, state, and local tax authorities

- Bank Account Information: A voided check for your payroll or tax account

- Current Employee List and Information: Names, Social Security numbers, addresses, earnings, withholdings, deductions, garnishments, etc.

- Payroll Information: Pay stubs, payroll journal for staff, and any historical information needed to pay taxes if you are not starting at the beginning of the calendar year

- Terminated Employee Information: You need to keep this information by law for a certain number of years, even if your old service gives former employees lifetime access to their files.

- Third-party Authorizations: Any additional authorizations needed for the new provider to pay taxes or make payroll transfers on your behalf, including Form 8655s, state/local authorizations, etc.

Prep Other Software to Sync With New System

Transferring information is not the only task involved in changing payroll providers. Make a complete list of your integrated software and apps. If there are any tasks covered by your new software, you may want to transfer the information and cancel those accounts.

For the rest, work with your new provider for integrations to make sure that when you switch over, you have a smooth flow of information between programs.

Give Clear Instructions Regarding Year-end Tax Filing

Make it clear to your providers who will be supplying the W-2s for the year. If you don’t clarify, they may both file, which means you’ll have to file amended W-2s and may face an audit.

Also, new providers will not issue W-2s for payments not issued in their system if the payroll information wasn’t loaded during a transition. Confusion around year-end filings can cause a huge headache if not managed properly.

Step 5: Notify Employees About New Payroll Service

Even if changing a payroll software is essentially transparent to employees, it’s best to take that extra step and send a new payroll system announcement. If nothing else, they should expect mailings or communications from the new provider. And if your company utilizes PEO services, your employees will have a new employer, something you should let them know in advance.

Depending on the differences, you may want to inform or even train your people on the following:

- New employee interface/mobile app

- Pay card program pros and cons

- New employee accounts

- New benefits sign-ups

This is also a good time for them to review and make any changes in their information, such as withholdings.

Employees should get some form of written notice or email, but also consider announcements via chat, posters, or video conference. Some payroll services offer employee training live or through recordings.

Step 6: Officially Cut Ties With Your Old Payroll Provider

Once you have made all the proper payroll transfers and alerted your employees, you can cut ties with your old provider. Send them a written notice by mail or email.

If you’ve not already done so, be sure to:

- Ask whether you and/or your employees will have lifetime access to their accounts.

- Request copies of records like pay registers, employee documents, tax filings, and receipts.

- Check whether you still have any pending transactions and if they need to be canceled or go through.

- Ensure that you are no longer being charged for the service.

- Ensure you’ve canceled all authorizations your previous provider was given.

Reasons Companies Switch Payroll Providers

Some of the most common reasons companies switch payroll providers include:

- Outdated technology: If the company you are currently using has software that is no longer easy to use or lacks technological updates, you may want to change payroll providers.

- Customer service: When it comes to processing your payroll, it is important to ensure everything runs smoothly. Without access to customer service during the times you need it, your payroll may not be processed correctly.

- Price: Your current payroll service may be continuously charging you more and more to process your payroll. If budget is a concern, you may consider switching payroll companies in order to decrease costs.

- Influx in business: When your business is growing you are likely to need more employees to handle the load. If your current payroll provider can’t keep up with your growth, it may be time to seek a new provider.

- Software errors: Making sure your employees are properly paid is essential. If you find that software errors with your current payroll provider are occurring frequently, it is time to change payroll companies.

- Compliance concerns: It is extremely important that your payroll is legally compliant with all state and federal labor and tax laws. If you suspect your current provider is not fully compliant, it may be time to switch.

Frequently Asked Questions (FAQs)

This is something you should discuss with your new provider before setting a switch date. It will depend on how much work you do, which will speed things up, versus having them handle everything. It may be faster and easier for you to provide the information they need, the size of your company, and tax details.

You’ll need to work with your current payroll provider to get the information you need transferred and deal with any legal or software issues resulting from the transfer. In general, 30 days’ notice is sufficient, although your new provider can give you a more accurate estimate. However, check the details of any existing contracts you have with your current payroll provider. Be sure you are not incurring fees for ending your service early.

It can be uncomfortable telling a provider that you are switching, especially if you’ve had a long-term relationship. However, resist the temptation to tell them you no longer need payroll. Your rep may assume you are closing your business and contact the IRS to close accounts. A better course of action is to be honest about why you’re leaving. No payroll company is perfect, and they depend on customer feedback to know what they need to improve.

Bottom Line

There are many reasons for switching payroll companies, and with cloud technology and batch transfers, it’s easier than ever. However, it’s still an investment of time and effort that deserves thorough consideration to avoid having to switch again, at least in the short term.

Understanding why you want to change your provider and what you expect from the new one will help you select a service that can satisfy your requirements now and in the future. Having a sound plan will make the transition easier and prevent errors that could be costly.

Comparison Articles

For more information on how the suggested providers in this article stack up against each other, read our versus articles listed below.