OnPay has a suite of easy-to-use HR, payroll, and benefits solutions optimal for small and midsize businesses (SMBs). Priced at $40 plus $6 per employee monthly, it offers an affordable all-in-one plan and caters to religious organizations, nonprofits, and several industries, like restaurants, agriculture, dental, and healthcare.

For this OnPay review, I used our rubric for the best payroll software where it earned an overall rating of 4.44 out of 5 rating. While it has strong HR and payroll features to help manage your workforce, it didn’t get a higher score because it lacks multiple plan options and has limited third-party software integrations and user reviews on popular review websites.

OnPay Overview

Pros

- Runs unlimited payroll, remits tax payments, and files tax forms at no extra cost

- Offers an affordably priced plan

- Files Form 943 for agricultural companies

- Free account migration services for new clients

Cons

- Assesses risk before determining eligibility for either two- or four-day direct deposits

- Doesn’t offer multiple plan tiers that cater to varying needs

- Doesn’t have live phone support on weekends

- Lacks time tracking tools (available via partner apps)

Deciding Factors

Supported Business Types | Startups, nonprofits, and SMBs in various vertical industries, such as accounting, healthcare, farming, agriculture, and restaurant industries. |

|---|---|

Free Trial | One month for new clients |

Pricing | $40 plus $6 per worker monthly |

Standout Features |

|

Ease of Use | OnPay is generally easy to learn and use, but having basic knowledge of how to run payroll will help you navigate pay processes more easily |

Customer Support |

|

OnPay’s feature-rich payroll platform makes it a good option for a wide range of businesses looking for efficient HR, pay processing, and compliance tools. It also appears in several of our buyer’s guides.

- Best Cheap Payroll Services

- Best Restaurant Payroll Software

- Best Payroll Software for Accountants

- Best Payroll Software for Contractors

- Best Church Payroll Services

- Best Payroll Services for Nonprofits

OnPay Is Best For

- Small companies needing to switch from complex software: Many businesses that use OnPay have fewer than 50 employees and swear by it because it’s easy to use and handles important payroll-related tasks, such as paying workers and tax agencies. It’s more affordable than some of the big-name and popular payroll providers. It is even one of our leading Gusto competitors, providing access to all its tools for a monthly fee of $40 plus $6 per employee (Gusto and others require upgrades for full tool access).

- Small agricultural companies: OnPay processes separate tax filing reports for farm and non-farm workers. Additionally, if you have employees on an H-2A visa, it can process payroll and taxes for them. Not all providers have this functionality, which is why OnPay is an excellent option for farms and agricultural companies that need Form 943 filings.

- SMBs requiring HR support: Rated as one of our best human resources payroll software, OnPay offers small business owners access to various HR tools—such as employee offer letters, self-onboarding, PTO management, in-app messaging, and compliance auditing. It also provides benefits administration and will connect you with several top-notch benefits providers so that your employees can sign up for retirement, health insurance, life, disability, FSA, HSA, and commuter benefits.

OnPay Is Not Ideal For

- International payroll operations: OnPay does not support large businesses needing payroll for foreign employees or even those assigned to US territories. Check out our guide to the top international payroll services to find providers better suited for this need.

- Companies looking for a budget-friendly contractor-only payroll plan: While OnPay’s pricing plan includes contractor payouts, it isn’t as affordable as QuickBooks Payroll’s contractor payment package. Its $15 monthly fee covers 20 workers and if you have more than that, QuickBooks Payroll will only charge $2 per additional contractor. To learn more, read our QuickBooks Payroll review.

- Businesses that need 24/7 live customer support: If you need on-demand phone support to get quick answers to payroll, benefits, and HR-related questions, especially during weekends and holidays, OnPay may not be the right provider for you. Its customer support team is available only on weekdays. Some providers, like Justworks, offer 24/7 support. Check out its features in our Justworks review article or look through our roundup of the top payroll services picks for more options.

If you’re in the market for a service to help process employee payments efficiently, check out our guide on finding the right payroll service for your business.

Top OnPay Alternatives

Best For | Starter Monthly Fees | Separate Monthly Contractor Plan | Separate Monthly Contractor Plan | |

|---|---|---|---|---|

Payroll for niche businesses (agricultural, nonprofit, etc.) | $49 per month + $6 per person per month | |||

| Small business payroll with solid HR support | $49 per month + $6 per person per month | $35 base fee plus $6 per worker | |

| Low-cost contractor payments and QuickBooks accounting users | $45 base fee plus $5 per employee | plus $2 for each additional contractor | |

PEO* services and benefits management | $59 per employee for PEO services $50 base fee plus $8 per employee for standalone payroll | |||

*PEO stands for Professional Employer Organization, a co-employer service that helps you manage day-to-day HR payroll tasks. Justworks also offers EOR or Employer of Record services, which function as a co-employer solution for hiring and paying international workers. | ||||

Need more HR functionalities to help manage employees better? Read our guide to the best HR software for small businesses to find a service or software that’s right for your business.

OnPay’s transparent and straightforward pricing scheme helped it earn an almost perfect mark for this criterion. You get one OnPay payroll pricing plan that costs $40 plus $6 per employee monthly, and you will only be charged for the actual number of workers paid in a month. System setup and data migration of prior wages and employee information come at no extra cost for new users. Plus, your first month with OnPay is free.

However, you need to pay for the following services:

- Non-sufficient funds (NSF) returns: Call for a quote; charges apply in case you don’t have sufficient funds to cover a pay run

- Direct mail delivery of W-2 and 1099 forms: $9.99 per W-2/1099 if you want OnPay to print and mail the forms to employees (free, if you print and distribute the forms yourself)

- Employee benefits plan premiums: Premium payments vary depending on the benefits plans selected

What prevented OnPay from getting a perfect mark in this area is its lack of a pay-on-demand option and only covering the penalty for mistakes that it makes. Other than that, you can use OnPay to run payroll on computers and mobile devices. It can also pay both employees and contractors; handle state, federal, and local taxes; and prepare year-end tax reports and online delivery.

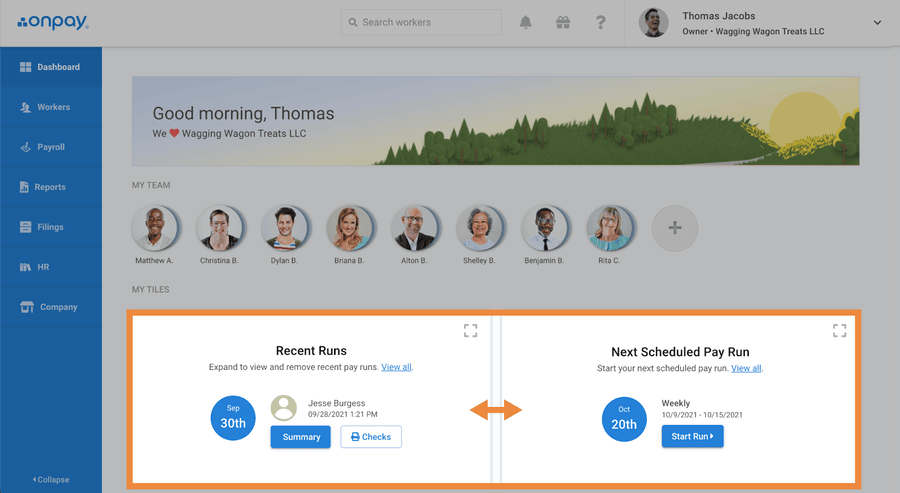

To run payroll, you can log in to OnPay via computers and through the internet browser of any tablet and smartphone. (Source: OnPay)

You can run payroll, including off-cycle and bonus payouts, as many times as you need and want at no extra cost. OnPay can handle multistate payroll, multiple payout schedules, tip calculations, and different pay rates for individual employees. It withholds all your employees’ state and federal unemployment insurance payments and deducts garnishments.

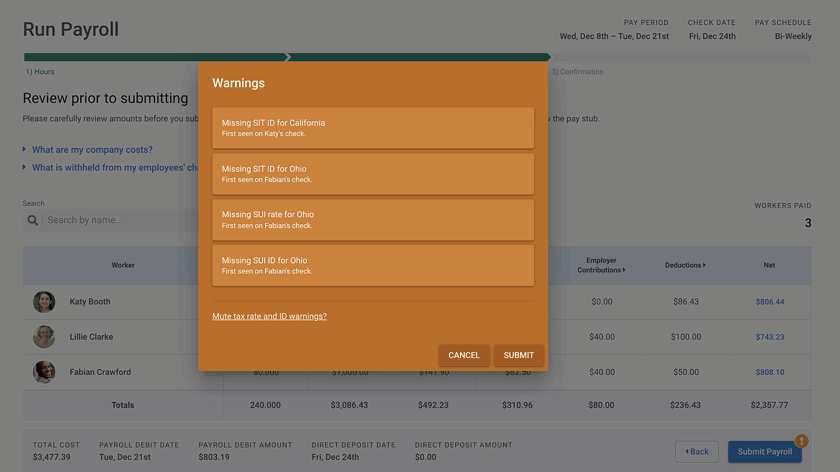

Processing payroll with OnPay takes just a few clicks. It can spot pay run errors and even provide a summarized view of your payroll with expandable data columns if you want to see breakdowns of salaries, taxes, and deductions.

OnPay has smart alerts that notify you of pay errors, missing tax information, and inconsistencies with an employee’s payroll. (Source: OnPay)

OnPay automatically calculates, withholds, pays, and files payroll taxes. It also has a penalty-free guarantee that covers tax filing mistakes by its representatives. Aside from quarterly and annual tax reports, it provides the following special payroll services:

- Restaurants: Helps with minimum wage tip makeup and prepares Form 8846

- Farms and agriculture: Processes tax filings for agricultural workers (Form 943) and non-farm employees, including payment and processing of taxes for workers on H-2A visas

- Nonprofit organizations: Handles and files federal unemployment taxes (FUTA) and tax exemptions for 501(c)(3) organizations

- Clergy and churches: Excludes any parsonage allowances from calculations and FUTA, Social Security, and Medicare taxes (FICA)

OnPay allows you to pay employees and contractors via debit cards and direct deposits. If you prefer paycheck payments, OnPay lets you print checks yourself.

Direct deposits: Turnaround times for direct deposits are two and four days, depending on OnPay’s risk assessment. It will also determine whether you are approved for wire-only or reverse wire-only transactions.

- Wire only: OnPay may require companies with very large payroll amounts to wire the direct deposit and tax funds so that it can process payroll.

- Reverse wire only: It may require some companies to authorize it to make a reverse wire or drawdown request from your bank account so that it can process payroll.

If your approved direct deposit transaction doesn’t fit your payroll needs, you can contact OnPay to discuss other options. You can also request the company reevaluate your approval status, but you have to wait six months.

- Debit cards: For debit card payments, payroll funds are added directly to your workers’ pay cards. This is great for employees who don’t have bank accounts. Plus, OnPay won’t charge extra fees for payroll deposits into debit cards.

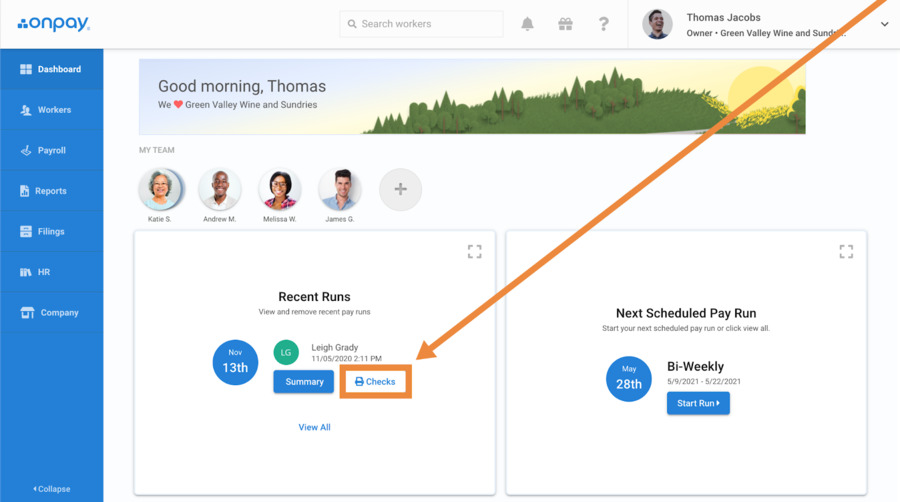

- Paychecks: OnPay has check printing capabilities that allow you to generate the employee paychecks you need. You can even reprint checks from previous pay runs.

You can print employee paychecks directly from the OnPay dashboard. (Source: OnPay)

OnPay offers mobile apps for Android and iOS devices but the features aren’t as complete as the desktop version. Employees can only access their pay stubs and forms, request PTO, change bank details, and update their personal information. However, it doesn’t allow your payroll administrator to run payroll and your managers to approve PTO transactions.

OnPay offers essential tools for managing employees, including a self-service portal and online onboarding. It also helps file state new hire reporting and offers health insurance, as well as benefits. The only thing I found lacking was free access to expert advisers on HR and payroll compliance issues.

However, I still found its HR functionalities helpful, as it can automate new hire onboarding processes while keeping you compliant with the latest labor regulations. It has customizable offer letters, built-in document templates, and a library of HR guides. Incoming employees can also onboard themselves via a self-service portal to complete their profile and e-sign HR documents.

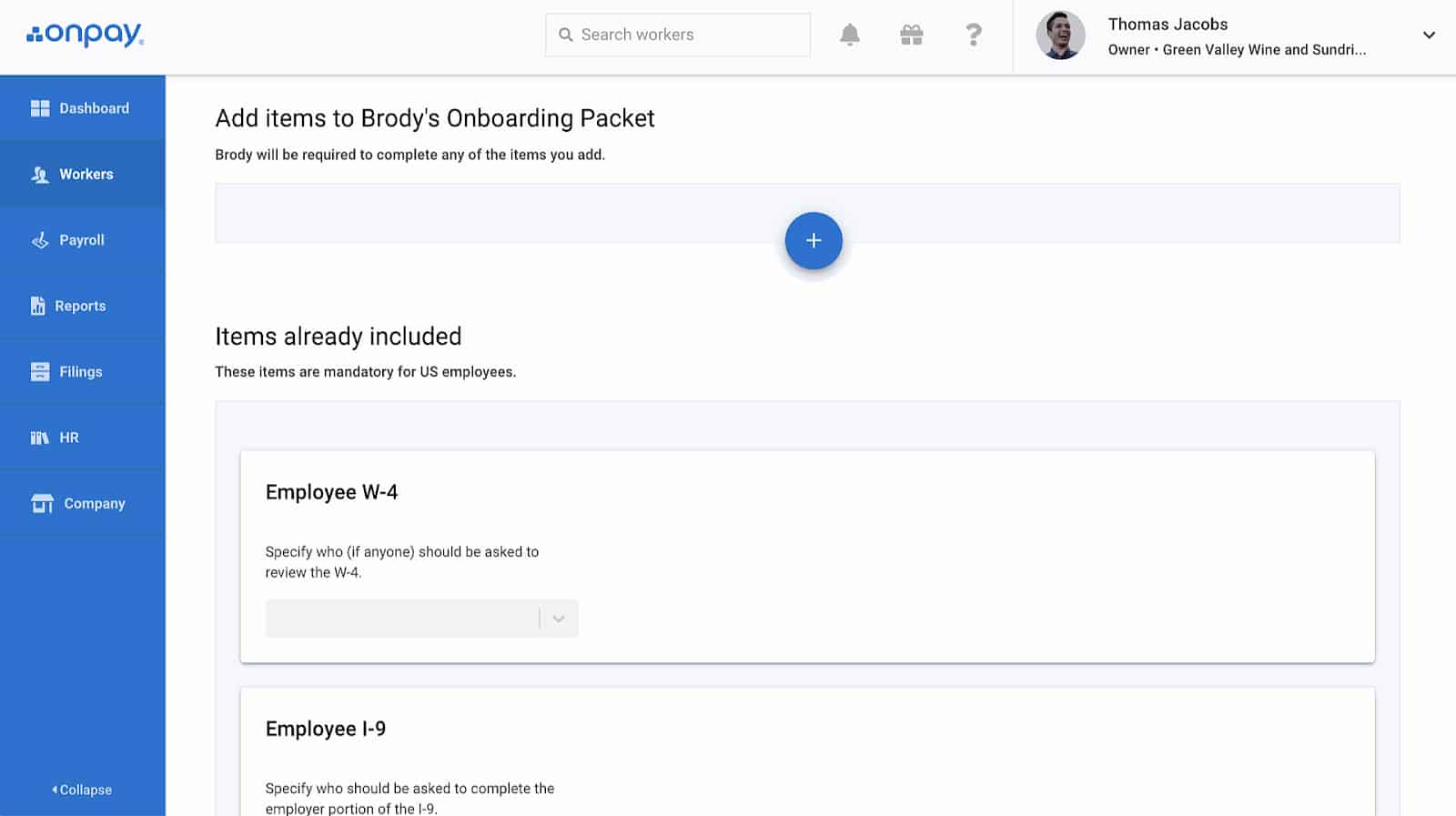

OnPay lets you create and customize onboarding packets that include tasks, checklists, and documents that new hires have to complete. (Source: OnPay)

It even allows you to create, delegate, and track onboarding tasks to specific individuals—such as setting up the employee’s computer, planning the orientation training, and assigning an onboarding buddy to your new hire. You also don’t have to worry about state new hire reporting because OnPay will do this for you.

If you need I-9 and W-4 forms for your new hires, OnPay has electronic versions of the two forms in its system. Both are automatically included in the mandatory onboarding documents in OnPay.

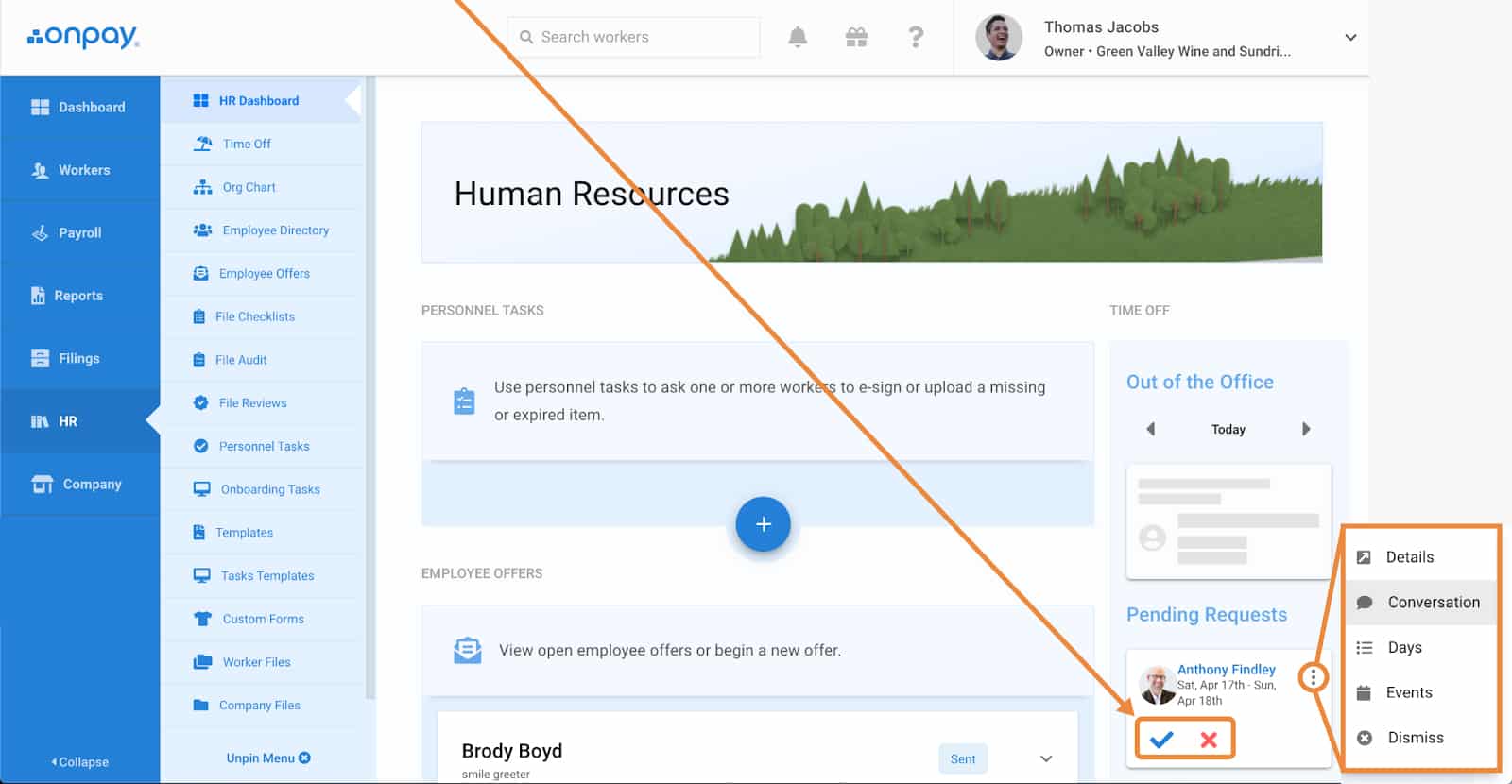

Aside from online PTO requests and approvals, OnPay has three accrual tiers, allowing employees to earn PTO credits depending on several factors, like location and seniority. Creating custom time off policies in the system is also very easy—and once you’ve assigned these to employees, the system will automatically calculate the accruals and add them to each staff’s PTO balances.

OnPay has a “Time Off” sidebar on the right side of its dashboard where managers can see, approve, or disapprove PTO requests. (Source: OnPay)

OnPay partners with several benefits providers, allowing your employees to sign up for a wide range of benefits—from medical and dental to retirement and workers’ compensation plans across all 50 states. It has established partnerships with the following:

- Aetna

- America’s Best 401(k)

- Anthem

- Blue Cross Blue Shield

- Guardian

- Guideline

- Humana

- UnitedHealthcare

- Vestwell

It even has in-house licensed brokers who can help you identify the best options when you need other benefits, like vision, disability, and life insurance. All premiums are also automatically deducted each time you run payroll.

With OnPay’s fully integrated solutions, information from its benefits module flows seamlessly into its pay processing tool. As such, you won’t have to worry about manually inputting deductions for payroll. Its system even automatically updates your employment data and sends this to the applicable insurance carriers (including staff data for workers’ comp).

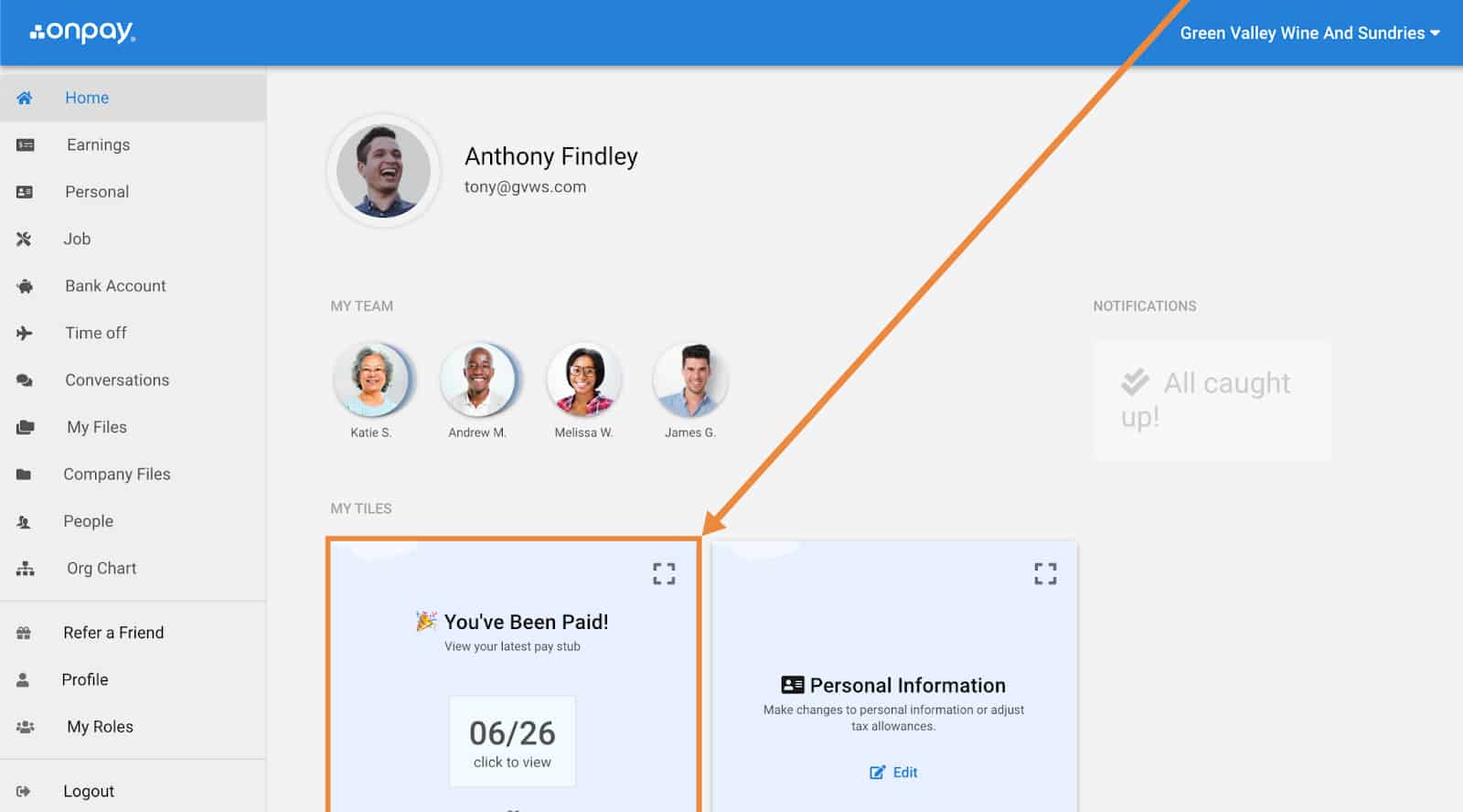

Allow employees to access their pay stubs and documents through OnPay’s self-service portal—even after they resign. Employees can also download tax forms, update their personal information, and adjust their voluntary payroll deductions, such as 401(k) plans.

Employees can easily access their pay stubs and personal information through the “My Tiles” section of their OnPay dashboard. (Source: OnPay)

OnPay’s reporting tools not only provide basic payroll report templates, but they also allow you to customize these reports for better insights into employee and payroll concerns. As such, OnPay received a perfect score in this criterion.

With OnPay, payroll reports can be viewed in real time, downloaded as a PDF or spreadsheet, and exported to your existing accounting software. It has a report designer for creating custom reports, although you can also use one of its pre-built reports.

OnPay’s report designer allows you to add/remove over 50 data points, drag and drop columns, and set up filters. (Source: OnPay)

I gave OnPay a high score in this criterion given its setup assistance, library of help articles, and support options, which include chat, email, and live phone assistance. The platform is relatively easy to use and navigate through, and the learning curve isn’t steep.

- System setup and data migration support

- User-friendly with an intuitive dashboard

- FAQ with how-to articles

- Online library of HR guides and document templates

- Self-service portal

While it’s generally simple to use, setting up its system for the first time can take more than a day. However, what’s great about OnPay is that it provides free setup assistance and can even help migrate your employee data into its system. You can also customize some parts of the main dashboard, such as rearranging section tiles so you can access and view the functions you want, such as tasks, alerts, and your team data.

You can customize OnPay’s main dashboard by moving section tiles and toggling on/off features you don’t want to see.

(Source: OnPay)

You get weekday assistance from payroll experts through phone, email, and chat from 9 a.m. to 8 p.m. Eastern time. If you need HR support, OnPay’s partnership with Mineral provides access to HR professionals who can give expert advice on how to handle compliance and employee issues. Talking to a live rep costs extra ($20), but if you only need to browse through Mineral’s library of HR guides and document templates, the service is free.

OnPay integrates with several accounting, time tracking, and HR solutions. Here are its partner systems:

- 401(k): Guideline and Vestwell

- Accounting: QuickBooks Online and Xero

- Time tracking: Deputy, When I Work, and QuickBooks Time

- HR and compliance: PosterElite and Mineral

The one thing that kept OnPay from getting a perfect score for popularity is its low number of user reviews on popular websites like G2 and Capterra.

| Users Like | Users Don’t Like |

|---|---|

| Easy to use and implement | Occasional software integration glitches |

| Affordable payroll plan | Limited PTO customization options |

| Responsive customer service; reps are generally helpful and knowledgeable | Some reports are difficult to find |

Many reviewers who left positive OnPay reviews online like that it is easy to use and navigate, even for new users. Others highlighted its affordability, good customer support, and efficient onboarding tools. Some, however, wished for more robust PTO tracking features and better integrations with partner apps, such as QuickBooks Payroll.

At the time of publication, OnPay payroll reviews earned the following scores on popular review sites:

- G2: 4.8 out of 5 based on over 320 reviews

- Capterra: 4.8 out of 5 based on more than 430 reviews

For this criterion, OnPay benefited from its affordability and user-friendliness. Its strong suite of payroll tools will help small businesses conveniently and quickly pay employees. Because it doesn’t have limits to payroll runs, you can set up different pay schedules for different types of employees or process payroll on a different day due to a holiday. However, its HR tools aren’t as robust as other providers like Gusto, Paycor, or Rippling, which hurt its score.

Methodology: How I Evaluated OnPay

For this OnPay review article, I used the rubric for our best payroll software where I looked at the payroll functionalities on offer and whether those are sufficient to meet the pay processing requirements of SMBs. I also considered pricing, ease of use, software integrations, customer support, and feedback from actual users.

Click through the tabs below for the full evaluation criteria.

20% of Overall Score

I checked if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Those priced at $50 or less per employee monthly were also given extra points.

20% of Overall Score

I gave priority to those that offer multiple pay options, two-day direct deposits, tax payments and filings, year-end reporting (W-2s and 1099s), and a penalty-free tax guarantee.

20% of Overall Score

Payroll service and software should be simple to set up, customizable, and have a user-friendly interface. I also checked if the provider offers live support and integration options with online tools that most SMBs use, such as accounting, time tracking, and scheduling software.

15% of Overall Score

Online onboarding, which means giving employees the option to fill out forms like W-4s electronically, is the top criterion, followed by state new hire reporting and the availability of a self-service portal where employees can view pay stubs and access forms. Extra points were also given to providers that offer expert HR support, time tracking, and health benefits that cover all US states.

15% of Overall Score

In this criterion, I checked whether the software’s ease of use, pricing, and the width and depth of its payroll and HR tools are ideal for SMBs.

5% of Overall Score

I considered user reviews from popular review sites, such as G2 and Capterra; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.