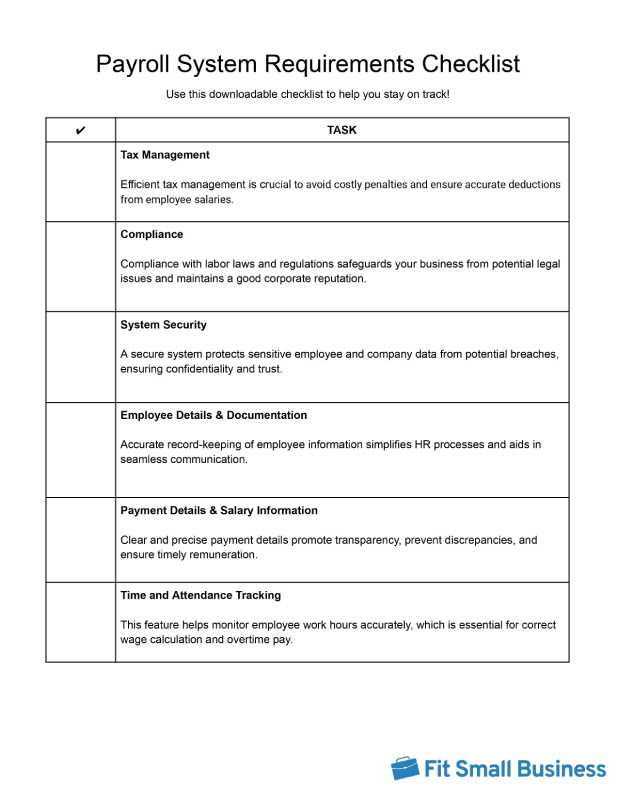

Payroll system requirements are the necessary components and functionalities that a payroll system must possess to effectively manage a company’s payroll operations. For small businesses, a payroll system checklist is an essential tool to streamline your payroll operations. This checklist will help you identify the crucial elements and features your payroll system should possess. Key factors to consider include wage payments, tax obligations, and record-keeping requirements.

Key Takeaways:

- Choose a payroll system that’s compliant with state laws wherever you have workers

- Look for payroll solutions that grow and adapt with you

- You want a payroll system that has robust security given the confidential and financial information you’ll handle

1. Tax Management

Key Features to Look For:

- Automated tax calculations

- Multiple tax rates

- Year-end tax forms

Tax management is the cornerstone of a well-functioning payroll system. A proficient payroll system should handle federal, state, and local taxes like a seasoned pro—calculating, withholding, and paying them on time, every time, with regularly updated payroll tax rates. It should also generate tax forms for employees and manage year-end tax reporting with ease.

You save valuable time and resources that would otherwise be spent navigating the labyrinth of tax regulations. This also ensures you’re not over or underpaying taxes, keeping your company’s finances in check.

Without a system that excels in tax management, you risk falling into the abyss of non-compliance. The consequences are far from trivial—penalties, interest, audits, and a damaged reputation. Not to mention the stress and time spent rectifying these issues. So, if you want to avoid a date with the IRS and keep your business running smoothly, robust tax management is non-negotiable.

2. Compliance

Key Features to Look For:

- Regulatory updates

- Audit trails

- Compliance reporting

Compliance is an essential part of your payroll process, even though it may not always be in the forefront. A stellar payroll system should help you stay compliant with labor laws, tax regulations, and reporting requirements, acting as your very own compliance officer. It should also maintain accurate records for audit purposes, providing peace of mind come audit season.

The upside for you, the small business owner, is twofold. First, it takes the burden of compliance off your shoulders, allowing you to focus on growing your business. Second, it provides assurance that you’re meeting all legal obligations, protecting your business from penalties and legal complications.

What happens without a payroll system that prioritizes compliance? Picture hefty fines, legal issues, and a tarnished reputation. Plus, you’ll be left scrambling to keep up with ever-changing regulations and requirements. In short, without compliance, you’re walking a tightrope without a safety net. So, make sure your payroll system has compliance at its core.

3. System Security

Key Features to Look For:

- Data encryption

- Two-factor authentication

- Regular backups

In an age where data breaches are as common as morning coffee, system security is a necessity. A robust payroll system should be your digital fortress, protecting sensitive employee data from prying eyes. It should have stringent security measures including encryption, multi-factor authentication, and regular security audits.

The advantage to you, the small business owner, is priceless peace of mind. You can rest easy knowing your employees’ information is secure, and your business is protected from potential financial loss and reputational damage associated with data breaches.

But what happens if system security is inadequate or, worse, absent? The consequences can be devastating. A data breach can lead to significant financial loss, legal implications, and irrevocable damage to your company’s reputation. Not to mention the trust deficit it creates with your most valuable asset—your employees.

4. Employee Details & Documentation

Key Features to Look For:

- Customizable fields

- Document storage

- Employee database

The management of employee details and documentation is akin to the engine room of your payroll system. It’s where the magic happens. An efficient payroll system should manage employee details including personal information, job roles, salaries, and tax information. It should also store and manage crucial documents, such as employment contracts, performance reviews, and training records.

This feature offers two key benefits. First, it ensures accurate and efficient payroll processing. With all necessary information at your fingertips, you can avoid errors and delays in salary payments. Second, it simplifies record-keeping, making it easier to retrieve and update employee information when required.

Without this feature, your payroll process may resemble a ship in a storm, tossed by waves of chaos and inefficiency. Errors in employee details can lead to incorrect salary calculations, tax issues, and disgruntled employees. Poor document management can make it difficult to track employee performance, contract renewals, and training requirements.

5. Payment Details & Salary Information

Key Features to Look For:

- Payroll processing

- Wage garnishments

- Overtime tracking and calculation

A competent payroll system should handle various payment types, deductions, bonuses, and overtime with precision. It’s not just about putting money in bank accounts; it’s about ensuring every cent is accounted for, every time.

This feature offers dual benefits. On one side, it ensures accurate salary calculations, eliminating the risk of overpayments or underpayments. On the other, it provides clear, detailed pay stubs, so employees know exactly where their money is going. Plus, these records will help keep you compliant, especially in states that require pay stubs and states where calculating overtime may be more complex.

But what happens if this requirement is overlooked? Picture disgruntled employees questioning their paycheck accuracy, potential legal issues due to incorrect wage payments, and wasted hours rectifying mistakes.

6. Time and Attendance Tracking

Key Features to Look For:

- Real-time tracking

- Shift scheduling

- Absence management

Time and attendance tracking ensures wages are calculated based on actual hours worked, overtime, and time-off. An effective payroll system should integrate an employee attendance tracker seamlessly, keeping an accurate record of every minute worked and every minute taken off.

A payroll system with this feature ensures accurate wage calculations, prevents wage disputes, and helps maintain compliance with labor laws regarding overtime and leave. It also provides valuable data for workforce planning and productivity analysis.

Without it, you’re sailing into a storm of potential wage disputes, compliance issues, and inaccurate payroll processing. You’ll also find it difficult to manage employee schedules and track productivity.

7. Direct Deposit

Key Features to Look For:

- Fast payment processing

- Multiple bank accounts

- Payment scheduling

Direct deposit is more than a convenience; it’s a necessity in the modern payroll landscape. A competent payroll system should offer direct deposit capabilities, ensuring employees receive their wages promptly in their bank accounts.

Direct deposit provides a seamless, fast, and secure method of wage payment, eliminating the need for physical checks. It also offers a cost-effective solution for you by reducing the administrative burden and costs associated with paper checks.

Without direct deposit, you’ll have to deal with the hassle of printing, signing, and distributing checks. Employees may face delays in accessing their wages, leading to dissatisfaction. Not to mention the potential for lost or stolen checks. So, when compiling your payroll system requirements checklist, direct deposit should be a priority.

8. Employee Self-Service

Key Features to Look For:

- Personal information updates

- Pay stub access

- Leave requests

Employee self-service has become the norm in payroll management. A proficient payroll system should empower employees with self-service capabilities, allowing them to view their pay stubs, tax forms, and leave balances at their convenience.

Especially in today’s remote and hybrid work environment, this feature reduces the workload on your HR and payroll team by allowing employees to access and update their personal information. It also enhances transparency and trust, as employees can verify their payroll details independently.

However, without this feature, your HR and payroll team may be inundated with queries from employees about their pay details, tax forms, or leave balances. This can lead to inefficiencies and delays in payroll processing.

9. System Integration

Key Features to Look For:

- HRIS integration

- Accounting software integration

- Time tracking integration

A competent payroll system should play well with others, integrating seamlessly with your existing HR, finance, and time-tracking systems. It streamlines your operations. No more juggling between multiple platforms or worrying about data inconsistencies. Everything you need, in one place, working in harmony. This translates to less time managing systems and more time growing your business.

But what if system integration falls short? You’ll find yourself in a maze of disconnected systems, leading to inefficiencies, errors, and a whole lot of frustration.

10. Robust Reporting

Key Features to Look For:

- Custom reports

- Real-time reporting

- Exportable data

Robust reporting is the compass guiding your payroll journey. An effective payroll system should offer comprehensive reporting capabilities, providing insights into wage costs, overtime, tax liabilities, and more.

Reporting helps you monitor and control labor costs, crucial for the financial health of your small business. It also aids in compliance by ensuring accurate tax reporting and record-keeping.

Without robust reporting, you’re navigating blind. You could miss trends in wage costs, face difficulties in budgeting, or even stumble into compliance issues because of inaccurate records. Robust reporting is a must-have on your payroll system requirements list.

11. Scalability

Key Features to Look For:

- Modular features

- User capacity

- Business growth adaptability

Scalability is a promise that, as your business grows, your payroll system grows with it. A proficient payroll system should offer scalability, accommodating an increase in employees and complexity of operations without missing a beat.

- A scalable system means less worry about outgrowing your current setup. It’s peace of mind, knowing that your payroll system can handle whatever your business throws at it, without having to worry about switching systems as you grow.

- A non-scalable system could lead to inefficiencies and errors as your business grows. You may find yourself dealing with inaccurate reporting and compliance measures, or having to re-evaluate and implement a new payroll system—something that can require months of change management.

12. Time Off & Leave Tracking

Key Features to Look For:

- Leave balance tracking

- Vacation scheduling

- Sick leave management

Time off and leave management is about ensuring accurate wage calculations and maintaining compliance with labor laws, especially in cities and states that now require minimum time off for employees. A reliable payroll system should manage time off and leave with precision, adjusting wages accordingly and keeping track of leave balances.

Having a payroll system with time off and leave recording ensures accurate wage calculations. It also helps maintain compliance with labor laws, preventing potential legal issues.

Without this feature, you risk inaccuracies in wage calculations and potential non-compliance with labor laws. Plus, managing employee leave manually can be a time-consuming task.

13. Benefits Management

Key Features to Look For:

- Benefits enrollment

- Retirement plan management

- Health insurance administration

Benefits are a critical payroll component that directly impacts your employees’ compensation packages. A robust payroll system should handle benefits administration seamlessly, accurately deducting benefits contributions from wages and keeping track of benefits accruals.

The advantage of having this feature is clear. It simplifies benefits administration, reducing potential errors in deductions and accruals. For you, this means less time spent on administrative tasks and more time focusing on strategic business initiatives.

Without this feature, you risk inaccuracies in benefits deductions and accruals, which can lead to employee dissatisfaction and potential compliance issues.

14. Customer Support

Key Features to Look For:

- 24/7 support

- Live chat

- Knowledge base

With payroll, customer support isn’t a luxury; it’s a lifeline. A proficient payroll system should offer exceptional customer support, ready to assist when you encounter issues or have questions.

Good customer support means less time troubleshooting and more time focusing on your core business operations. It’s about peace of mind, knowing that help is just a call or click away.

However, without effective customer support, you may grapple with payroll issues that consume your time and energy. This could lead to delays in payroll processing and potentially costly mistakes.

Evaluating Payroll Systems

Keep your business needs front and center. Each business is unique, and what works for one might not work for another. So, start by identifying your specific needs.

- Are you a small business owner with just a handful of employees looking for a simple, user-friendly interface?

- Or do you manage a larger team and need advanced features like benefits administration and robust reporting?

Reference your payroll system requirements checklist. This includes critical components like system integration, robust reporting, scalability, time off & leave management, benefits, and customer support. Examine each potential system against this quick question checklist.

- Does it integrate well with your existing systems?

- Does it offer detailed reports that provide insights into your wage costs and tax liabilities?

- Can it scale up as your business grows?

- How does it handle time off and leave management?

- What about benefits administration?

- What kind of customer support does it offer?

While it’s essential to find the best payroll service for your needs, it’s equally important to ensure it fits within your budget. But don’t just look at the upfront costs. Consider the long-term value the system offers. A system that’s slightly more expensive but offers features like scalability and robust reporting might save you money in the long run.

Evaluating payroll systems can be a complex task, but with a clear understanding of your needs and a detailed payroll system requirements checklist, you’re well-equipped to find a system that’s just right for your business.

Stages of Business Growth and Payroll System Re-evaluation

In the lifecycle of a business, change is inevitable. As your business evolves, so too should your payroll system. But how do you know when it’s time to re-evaluate your payroll system? Let’s explore this, focusing primarily on legal and compliance aspects.

Stage 1: Startup Phase

In the startup phase, your payroll needs are likely straightforward. However, once you hire your first employee, it’s time to consider a payroll system. At this stage, the system should handle basic payroll calculations and tax withholdings. A user-friendly interface and cost-effectiveness are key considerations to finding the right payroll solution.

Stage 2: Growth Phase

As your business expands and you hire more employees, your payroll system needs to scale up accordingly. Here’s where scalability, as mentioned in our payroll system requirements checklist, comes into play.

You’re probably still a fairly small business so you should be able to stay with your existing payroll provider. If you’ve been doing payroll in-house, this might be the time to start searching for a better solution and review the best payroll software.

Stage 3: Expansion Phase

When your business starts operating across state lines, your payroll system needs to handle multi-state taxation, different minimum wages, and varying benefits requirements. Different states have different laws, so your system should be able to accurately handle these differing laws.

As you expand, your business might have to comply with the Family and Medical Leave Act (FMLA), which applies to companies with 50 or more employees in 20 or more workweeks in the current or preceding calendar year. Your payroll system should track FMLA leave and ensure that employees’ jobs are protected during their leave.

Stage 4: Diversification Phase

If your business diversifies into new sectors or markets, your payroll system should accommodate different pay structures and benefits packages. For instance, if you start a construction division, you might need to handle union dues and prevailing wage rates.

If diversification is on your horizon, flexibility is crucial. Your payroll system should adapt to different pay structures and benefits packages.

In each of these stages, legal and compliance requirements are paramount. Non-compliance can lead to hefty fines and damage to your business reputation. Therefore, regularly re-evaluating your payroll system against the payroll system requirements checklist is crucial.

Frequently Asked Questions (FAQs)

Data security is paramount. Payroll systems house sensitive information, such as social security numbers, banking details, and home addresses. Ensure the payroll system you choose adheres to stringent data security standards. Look for features like encryption, two-factor authentication, and regular security audits.

If your team is spread across the country, your payroll system should be too. Look for a system that handles multi-state payroll and complies with different state’s tax and employment laws. Also consider time-tracking capabilities for remote employees, ensuring accurate payment for hours worked.

Absolutely. Many payroll systems now offer HR functionalities like new hire onboarding, benefits administration, and performance management. These integrated systems can streamline your processes, saving you time and ensuring consistency.

Bottom Line

The right payroll system can be a game-changer, streamlining your processes, ensuring compliance, and freeing up time for you and your HR and payroll teams. From startup to maturity and beyond, we’ve covered the key stages of business growth, highlighting the specific payroll considerations at each stage. With our payroll system requirements checklist in hand, you’re well-equipped to navigate the terrain.