Sales compensation plans provide a detailed framework or guideline for how businesses will pay salespeople. A well-planned compensation scheme motivates sales reps to hit peak performance. Follow our step-by-step guide on how to develop a sales compensation plan for your small business, from determining baselines and establishing goals and quotas to its full implementation.

Step 1: Choose a Sales Compensation Plan

There are various approaches you can take as you develop a sales compensation plan in terms of methodology. Every organization will be different depending on sales culture, industry norms in terms of what typical compensation rates or methods are in that vertical, and the maturity of the business. The chart below shows different methods you can use, along with the pros and cons of each:

Description: Annual, monthly, semimonthly, or biweekly amount of income will be paid to a rep regardless of production.

Pros:

- It is a consistent expense—your business knows exactly what to pay.

- It is a consistent income for new sales reps trying to build a book of business.

- It shows reps you value them regardless of their performance.

Cons:

- It is challenging to keep reps motivated without rewards for exceeding expectations.

- It is caps a sales rep’s ability to increase earnings based on performance.

Description: The reps income is based on a set percentage of sales or revenue generated by the sales rep during a set time period.

Pros:

- It is a limited risk to the business as it is strictly performance-based.

- It is a good earning potential for your highest-performing sales reps.

Cons:

- It can be difficult to recruit sales reps because of the risk.

- It makes sales reps feel undervalued and only important for revenue.

Description: It combines the base or set income amount plus the percentage of revenue generated by the sales rep.

Pros:

- It is balanced—both values sales reps and rewards them for performance.

- It allows for an adjusted method that slowly transitions reps into more performance-based compensation.

Cons:

- Low performers may stay longer because of the guaranteed income, regardless of performance.

Description: It combines set income and cash rewards for hitting milestones such as a stretch goal, closing a certain size deal, or exceeding a goal by a certain amount.

Pros:

- It can be used on an individual or team basis.

- It offers balance for guaranteed income and goal-based performance.

Cons:

- It may be difficult to understand for sales reps if the parameters are not clear, specific, and fully measurable.

- It could result in a binary performance system that gives sales reps no credit for any level of performance. For instance, if a rep had a productive quarter but fell just short of a bonus threshold, they wouldn’t receive anything for the production they had

Description: It combines set income, a percentage of the revenue generated by the sales rep, and cash rewards for hitting milestones.

Pros:

- It offers balance for guaranteed, performance-based, and milestone-based income.

Cons:

- It may be difficult to understand for sales reps if the measurable parameters are not clear and specific.

- It can become challenging for management to track.

While we put this as the first step, you can also choose to wait until after steps two and three when you understand the financial implications more. Moreover, if you are a fairly new business without consistent financial information, you will likely want to do all of your estimates before selecting a method.

Whether you plan on using one of the performance-based methods or a salary, check out our guide on sales performance management to get the most out of your team. You’ll get insights on what performance management looks like for different organizations and tips to better motivate your sales employees.

Step 2: Determine Your Break-even Point

Next, you have to determine the amount of revenue you need to cover your business’s base expenses. This is foundational to setting overall sales revenue goals and individual quotas for the best compensation plans, which we will do in the next steps.

Since salaries are a fixed expense, those will be easy to include in your analysis. If you want to experiment with commissions or bonuses, however, those will be variable expenses based on the revenue generated and milestones met.

Break-Even Sales Compensation Calculator

The below examples outline two break-even analyses, one for all fixed expenses and one incorporating variable expenses.

Supplies and equipment: $6,000

Marketing and advertising expenses: $3,000

Office space: $15,000

Legal expenses: $2,500

Tax preparation/accounting expenses: $1,000

Productivity software: $2,000

Insurance: $5,000

Total break-even point = $229,900

Supplies and equipment: $6,000

Marketing and advertising expenses: $3,000

Office space: $15,000

Legal expenses: $2,500

Tax preparation/accounting expenses: $1,000

Productivity software: $2,000

Insurance: $5,000

Prevariable expenses break-even point = $131,700

Sales commission (20%) = $131,700 * 20% = $26,340

Additional employer payroll tax = $2,107

Total break-even point = $160,147

Step 3: Establish Your Sales Goal

Once you know your break-even point, it’s time to set a sales goal or total revenue goal. Your overall sales goal is the break-even point + desired profitability. For instance, using the example from the previous section, if you want the business to make $100,000 in profit beyond expenses, add $100,000 to the $229,900 (if salary only) or $160,147 (if salary + commission).

Alternatively, you can also base your goal on a profit margin percentage, such as wanting to make a 40% profit. In this case, multiply the break-even point by the percentage like in the examples below:

Salary Only

- Sales goal = Break-even point + Desired profitability

- Sales goal = $229,900 x 1.40

- Sales goal = $321,860

Salary + Commission:

- Sales goal = Break-even point + Desired profitability

- Sales goal = $160,147 x 1.40

- Sales goal = $224,205

Step 4: Assign Sales Quotas

If strictly production-based, setting sales quotas is as simple as taking your sales goal and dividing it by the number of sales reps. For instance, if you took the sales goal of $321,860 and divided it by three sales reps, you would then set individual sales quotas for each rep at $107,286 in revenue. We advise, however, that you take the experience and individual skill sets of each rep into consideration when setting quotas.

During a sales compensation planning process, you may find it easier to do deal-based quotas where you set a minimum number of new clients or customers each rep needs to bring in. Lastly, if you know your sales pipeline conversion rates, you can do activity-based quotas where you set a minimum number of calls placed, emails sent, appointments set, or leads generated for a time period such as weekly, monthly, or quarterly.

For example, let’s say you know that you need four new deals per month to hit your revenue goals. Based on conversion metrics, it typically takes 200 cold calls to new leads for every deal closed. Therefore, you would set your minimum monthly quota at 800 cold calls per month to hit your four-deal sales goal.

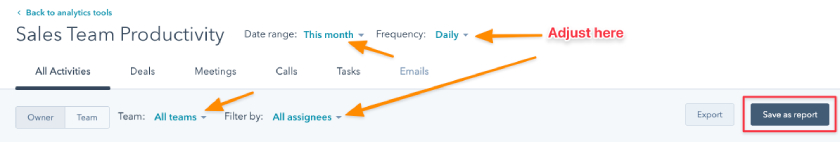

HubSpot lets you track sales team activities and save data as a report. (Source: HubSpot)

Step 5: Set Compensation Rates

The objective of setting compensation rates is to determine salaries, commission rates, and/or sales bonus structures to incorporate into your sales compensation plan. This particular step also has some flexibility in terms of completion date. For instance, certain industries—such as real estate or insurance—have industry standards regarding standard commission rates. In this case, you will have established this in step one. Here are other ways to set compensation rates:

You can also establish compensation rates during your break-even analysis. During this step, you can play around with the numbers to see how they affect your break-even point and determine whether the sales quotas set can provide fair compensation to your sales reps while also being realistically attainable.

You may find during your financial analysis that you might hit a certain revenue point where you will be able to earn good profit while keeping your reps happy with the compensation they receive. In this case, you may decide to add a bonus to your compensation sales plans that gives X number of dollars to a rep (or the whole team) if they surpass that revenue point.

One way to set your rates is by combining realistic expectations with a solid income level to attract more sales rep candidates. For example, let’s say that you know you want to use a salary + commission model due to the balance it offers. You feel that a $80,000 total salary is fair for the type of sales work this job will entail. This figure is a realistic expectation that your sales reps can enjoy, especially your top performers in the team.

You believe, based on historical figures, that the average rep can produce $300,000 per year in revenue and that $30,000 is a respectable base salary to offer. Therefore, you would set your commission rates at 16.6% (50,000/300,000). Any sales rep who produces above-average numbers will receive above-average commission compensation.

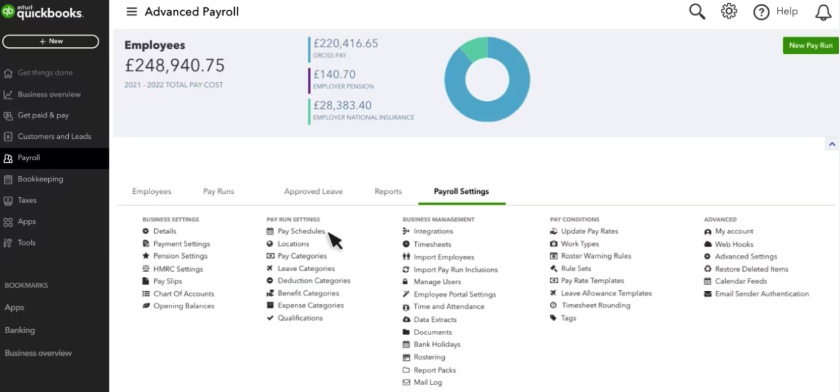

Step 6: Develop a Payout Schedule

After setting base salaries, commission rates, and bonus structures, you are ready to determine a payout schedule as a part of the compensation planning process. This is more so for administrative purposes and managing reps’ expectations on when they will be paid. Decide when you want to pay the commission or bonuses—one of the most crucial aspects of implementing sales commission plan best practices.

Below are a few ways to consider for your payout schedule:

- When the deal is closed: Commission or bonus is paid at the next payroll period after the finalization of a new deal or when the client or customer is onboarded. While this approach is great for sales reps, it’s risky for your business if clients default on payments.

- When the customer pays: Commission or bonus is paid at the next payroll period after the customer or client makes their first or ongoing payments.

- At the end of a time period: Commission or bonus is paid at the next payroll period after the month, quarter, or year is complete and/or the threshold has been reached (for bonuses). This approach is more favorable to the business but could frustrate sales reps if they have to wait to receive their compensation.

QuickBooks Online Payroll (Source: QuickBooks)

Step 7: Announce Your Sales Compensation Plan

As part of sales management, you need to document and be able to explain your plan for recruitment, liability, and motivation purposes. We recommend outlining the plan in the employment contract of new hires and employee handbooks for on-demand reference. When implementing a new structure, plan to have both group and individual meetings with reps to explain the new system, answer any questions they have, and respond to their concerns.

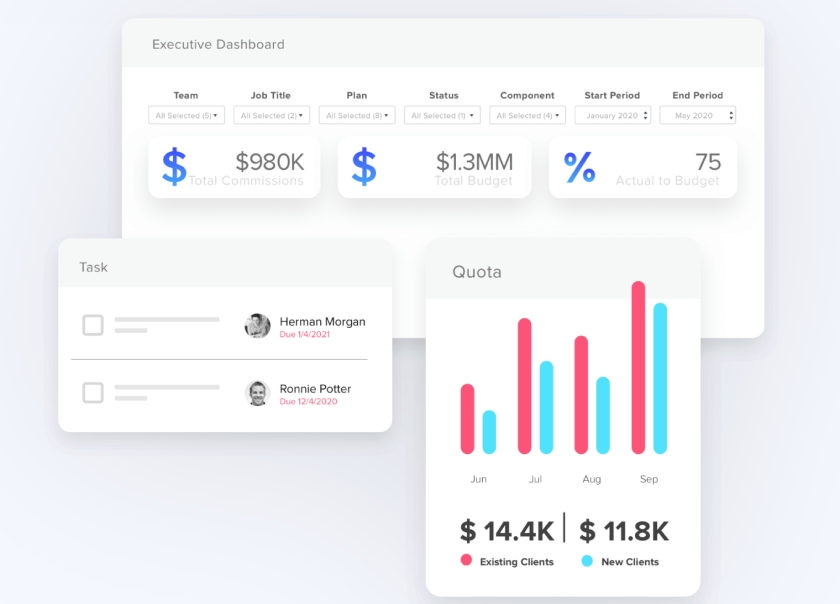

Performio enables sales reps to see their commissions. (Source: Performio)

Step 8: Implement & Evaluate Your Plan

One of the most important aspects of how to develop the best sales compensation plan for your business is following through with paying the appropriate salaries and/or performance-based compensation. Envisioning, developing, and executing motivational techniques are all part of sales leadership and should be addressed in your plan. Here’s how:

As you run your business and manage your sales team, continuously evaluate whether the salary structure you created is appealing to your reps, fair to your business, and makes sense financially. If something is off, you may need to rethink the structure of your plan and go through these steps again to find something that works better.

For instance, let’s say you’re managing a compensation sales plan and find that sales reps keep leaving because they don’t feel motivated enough. You find out that the cause of the lack of motivation is that the commission rates are not high enough to make it worthwhile for reps to give their full effort. This would be a good scenario to reconsider the structure and make changes like increasing commission rates and shifting to a bonus structure.

The best compensation plans don’t have a fixed structure. But if a redesign of your plan is necessary, carefully consider how the system should be changed—since changes to someone’s income or compensation structure are sensitive and could result in cultural, turnover, or legal liability issues.

For instance, let’s say you decide to move from a salary + commission sales compensation plan structure to a salary + bonus one. That significant change will need to be handled with care, including giving plenty of notice of the change, constructing bonuses in a way that reps would make as much or more money based on current metrics, and potentially easing into the transition by providing cash compensation early to account for any potential income gap.

Examples of Sales Compensation Plans

An effective sales incentive compensation plan is tailored to each team member. The important factors sales leaders must consider include the specific roles, experience levels, sales cycle duration, and types of leads or deals sales members work on. Check out these sales comp plan examples that can help you create and execute your plan.

1. Sales compensation plan for sales development reps (SDR)

- Method: Low base salary + commission or bonuses on generated leads

- Description: This sample sales compensation plan entices sales development reps to concentrate on qualifying prospects and generating leads instead of closing sales.

- Computation: The SDR receives a base salary plus a commission or bonus for every qualified prospect or meeting set. For instance, a bonus of $30 for every sales qualified prospect is passed on to your sales team.

2. Commission-based sales compensation plan

- Method: Base salary + commission on closed deals

- Description: This sales compensation plan offers more stable income and is applicable for sales team members tasked with closing deals directly with customers.

- Computation: This is a steady salary plus commission, like 8% of the total sales value for every deal won.

3. Sales compensation plan for managers

- Method: Base salary + performance-based bonus or commission on the team’s total closed deals

- Description: This sales compensation plan is intended to motivate sales management roles, including team leaders and regional sales managers.

- Computation: The sales manager receives performance-based bonuses in addition to their fixed salary, depending on team performance metrics, for instance, an 8% bonus on the team’s total sales or specific bonuses for attaining team targets.

4. Sales compensation plan for upper sales management

- Method: High base salary + performance-based bonus, profit sharing, or stock options

- Description: This compensation plan is recommended for senior sales leaders, demonstrating their roles’ importance in attaining overall company goals.

- Computation: Upper management sales roles involve managing the entire sales department with a significant base salary plus bonuses linked to company-wide sales performance. A good example is 10% of the total sales revenue under the department head’s leadership.

There are different tools that can help you create the best sales compensation plans for your sales team members. For instance, you can use a sales compensation plan template to save you time and effort when creating one from scratch.

Sales Compensation Plan Statistics

Business executives and sales managers must stay updated on the latest trends in creating a sales compensation plan. This can help them redesign their sales compensation plans to align with industry standards and motivate sales reps to close more sales.

Now that you’ve learned how to develop a sales compensation plan, it’s time to check out these stats below. This will help you determine how other businesses are developing their compensation sales plan and some of the biggest challenges in this arena:

About 44% of sales reps want a salary and commission plus bonus plan, while 10% desire a straight commission

Sales reps have varying desires when it comes to getting compensated for their efforts, with sales and commission plus a bonus plan as a very enticing offer. Startups and small businesses with restricted budgets can benefit from a commission basis because it is strictly performance-based with limited risks.

25% of salespeople don’t understand their sales comp plans

Sales managers and business owners should ensure that their sales reps fully understand how they will be incentivized for their efforts. After finalizing your sales compensation plans, set up a meeting with your sales reps and answer any questions or conduct a survey to gauge their understanding of the compensation plan.

The on-target earnings (OTE) of the average sales rep in the US is about $71,294

OTE is a sales compensation model that is represented as an entire year’s earnings, which can also be calculated monthly or quarterly. If your business has a competitive OTE as a part of your compensation plan, then your sales agents will be more eager to attain their sales quotas.

Sales managers and reps have an average compensation of about $75,000

Business executives and sales executives must ensure that their sales compensation plans are aligned with industry standards. Benchmarking your sales compensation plan will attract more sales talents and improve employee loyalty and retention.

56% of companies deal with sales commission errors

Being aware of commission errors can help sales executives and team leaders strategize to calculate this incentive better and identify where the mistakes arise. Using sales compensation software can help sales teams reduce or even eliminate commission errors.

71% of companies committing errors use spreadsheets or other legacy tools for calculations

It’s about time for sales teams to adopt sales compensation systems like Performio to avoid committing errors. While spreadsheets and legacy tools are free or low-cost, errors using them can result in more losses for sales teams and businesses.

Frequently Asked Questions

A sales compensation plan can benefit your small business because you incentivize your reps to stay focused on what they need to do for more successful deals. This allows them to get proper compensation for their hard work and makes them more motivated to sell at their best.

A good compensation plan considers your sales goals and business requirements. It also involves a well-thought-out sales compensation formula considering your fixed and variable expenses. There must also be a way to track the effectiveness of your plan so you can make the necessary adjustments.

An excellent example of a sales compensation plan includes a combination of salary, commission, and bonus. This income set comes from the revenue percentage generated by the sales agent and cash rewards for attaining milestones.

Bottom Line

Learn from the best sales compensation plan examples above so you can learn how to develop a sales compensation plan of your own. This way, you can get maximum production out of your sales reps and keep them satisfied in their roles to ultimately grow your business. Design and implement a sales incentive compensation plan following effective management practices, proper sales rep recruitment, and the right tech investment for proper execution.