SumUp is an affordable mobile-first payment processor for small businesses. The payment software is free to use and there are no long-term contracts. Its range of card readers is among the cheapest, particularly the basic 3-in-1 card reader with a PIN pad that costs only $54. SumUp transaction fees start at 2.75% for in-person payments while remote payments start at 2.9% + 15 cents per transaction.

While it did not make our list of best merchant services, SumUp did earn an overall score of 3.59 out of 5 in our evaluation. SumUp is based in Europe, so some key features like ecommerce integration and volume discounts are not yet available for US merchants. Also, next-day funding is only possible with a SumUp business banking account.

SumUp Overview

Pros

- No add-on fees for accepting payments from international credit cards

- Free pay-as-you-go payment app

- No-cost echeck payments for invoice

- Cheapest 3-in-1 mobile card reader

Cons

- Recurring billing or stored payments require custom coding

- Lacks same-day funding option

- Ecommerce payments only with POS plan

- JCB and SamsungPay not supported by basic card reader

Deciding Factors

Supported Business Types | Flexible Retail, restaurants, professional services |

Standout Features |

|

Monthly Software Fees | Competitive

|

Setup and Installation Fees | $0 |

Contract Length | Pay-as-you-go |

Point of Sale Options | Native POS software for a fee |

Payment Processing Fees | Competitive

|

Customer Support |

|

Is SumUp Right for You?

SumUp is somewhat similar to Clover (one of the most popular point-of-sale systems), as the choice of hardware will determine the payment processing features available to you. Note that you have to pay at least $99 per month to get the discounted rates; however, if your business processes a large number of low-ticket sales per month, you can get your money’s worth with SumUp’s 2.75% rate since there’s no fixed fee per transaction.

Overall, SumUp is a small business-friendly mobile payment processor. We highly recommend it for small and seasonal retail businesses that require a mobile solution—such as coffee shops, clothing stores, and businesses participating in farmers’ markets and trade shows.

When to Use SumUp

- Individuals and low-volume businesses: SumUp made our list of top mobile credit card solutions and best credit card payment apps for its simple design and affordable, easy-to-use card processor. This makes it ideal for consultants and home service professionals (HVAC, plumbing, lawn and garden care, pest control, and electricians).

- Seasonal businesses and those catering to tourists: SumUp does not charge additional fees for accepting payments from foreign credit cards, which is ideal for retail businesses that rely on tourism for sales.

When to Use an Alternative

- Businesses requiring booking and scheduling tools: Consider Square Payments with a built-in appointment app.

- Native ecommerce businesses looking for multichannel sales: We recommend merchant services providers like Helcim that support hosted online stores.

- Regulated and age-restricted businesses: Consider our list of top-recommended high-risk merchants that offer transparent pricing and chargeback protection features.

SumUp Alternatives

Best for | Monthly Fee From | |

|---|---|---|

| New and small businesses needing a free POS solution | $0 |

| Individuals requiring a reliable solution for occasional payments | $0 |

| Established businesses wanting low rates | $79 |

Check out our comparison of SumUp vs Square.

SumUp User Reviews

| Users Like | Users Don’t Like |

|---|---|

| User-friendly app | Credit card reader issues |

| Easy setup | Needs more integration |

| Practical | Customer support is slow to respond |

SumUp reviews are somewhat mixed, although—because it is a Europe-based provider—most of the feedback is not from the US. Some features, such as omnichannel tools, are only available to European customers, which may be reflected in the ratings. That said, the overall number of user reviews has increased, while payment software ratings have decreased since our last update.

- Capterra[1]: 4.3 out of 5 stars from around 110 reviews

- Trustpilot[2]: 4.2 out of 5 stars from nearly 20,000 reviews

Users appreciate the fact that SumUp is inexpensive and the pricing is simple. Most cite this as their primary reason for switching to SumUp. Other positive comments mention the system’s mobility and ease of use. SumUp card reader reviews by actual users are also mixed, but not alarming.

SumUp Pricing

SumUp offers a free payment processing plan with card readers as well as POS plans with a different set of proprietary hardware. The POS plans offer a lower card-present transaction fee but the cost for online transactions is much higher compared to other small-business friendly payment processors.

SumUp Payment Processing

SumUp offers a mobile-first free payment processing plan. Depending on the card reader you use, you can either pair the hardware with a SumUp payment app on your mobile device or use a standalone option with a built-in payment app. Transaction fees are competitive as it does not charge flat per-transaction fees (in cents) like Square, PayPal, or Stripe for card-present payments.

When using a payment software account:

- Monthly payment software fee: $0

- Card-present transactions: 2.75% per transaction

- Card-not-present:

- Invoice (pay via SumUp online portal): 2.9% + 15 cents per transaction

- QR codes: 3.25% + 15 cents per transaction

- Payment links: 3.25% + 15 cents per transaction

- Gift card: 3.25% + 15 cents per transaction

- Bank transfer (ACH/e-check for invoice): $0

- Chargeback fee: $10 per transaction from acquirer and passed on to merchant

When using a POS software account:

- Monthly POS software fee: $99–$289

- Monthly ecommerce fee: $19

- Card-present transactions: 2.6% + 10 cents per transaction

- Card-not-present:

- Ecommerce/online ordering: 3.5% + 15 cents per transaction

- Manual entry: 3.5% + 15 cents per transaction

- Bank transfer (ACH/echeck for invoice): $0

- Chargeback fee: $10 per transaction from acquirer and passed on to merchant

SumUp Hardware

SumUp hardware ranges from simple mobile card readers to POS devices with built-in card readers. SumUp offers both mobile device connectable and standalone mobile card readers. Users are required to purchase any one of these SumUp card readers to start processing credit card transactions.

Merchants also have the option to customize SumUp mobile card readers with accessories that can provide varying degrees of functional upgrades.

|  |  |  |

SumUp Plus | SumUp Plus Cradle Bundle | SumUp Solo | SumUp Solo Printer Bundle |

|

|

|

|

$39 | $49 | $129 | $199 |

For larger brick-and-mortar businesses seeking a complete POS hardware solution, SumUp has an all-in-one hardware, software, and payments plan. This will set you back at least $99 per month. The actual cost of the hardware is not disclosed, however, so contact SumUp for a quote.

The SumUp POS hardware comes with built-in card readers. Contact SumUp for pricing (Source: SumUp)

SumUp Payment Types

SumUp is primarily a credit card processor that supports in-person and remote transactions. It can process invoices and even lets you accept e-checks at no extra cost but requires advanced coding setup for automated recurring billing and payments. Payment links via email and SMS are supported for ecommerce merchants but no website integrations are available.

In-person

SumUp’s in-person transactions are available with the help of its mobile credit card readers and POS hardware. The basic card reader can be used with a free SumUp payment app while the more advanced version’s payment software is already built-in.

Merchants can use these to accept digital wallet payments and QR code payments. You can also track cash payments with the built-in cash tracking feature. Depending on the credit card reader, some merchants will also have the ability to provide customers with custom tipping options.

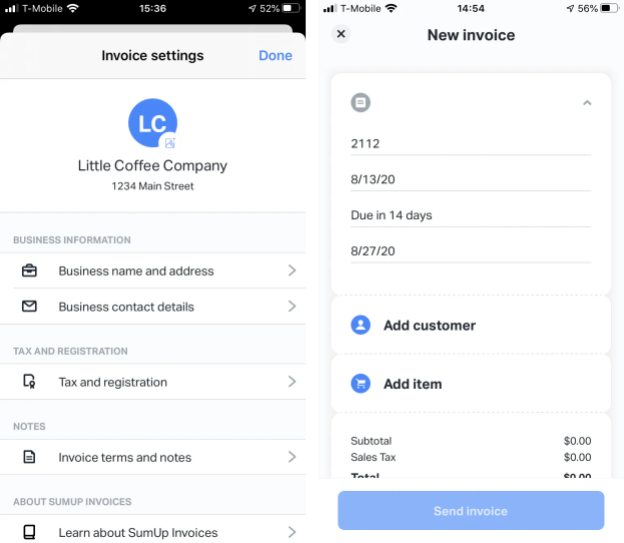

Invoicing

Both SumUp’s mobile app and dashboard give you access to invoicing features, letting you create, send, and track all your invoices in one place. You can also include a payment link in your invoices so customers can easily send you payments in the form of credit card, cash, or echeck. The process is pretty simple and comes with a preview function that you can use before sending it out to your clients.

SumUp’s Invoicing feature can be accessed on the merchant dashboard and on the payment app (Source: SumUp)

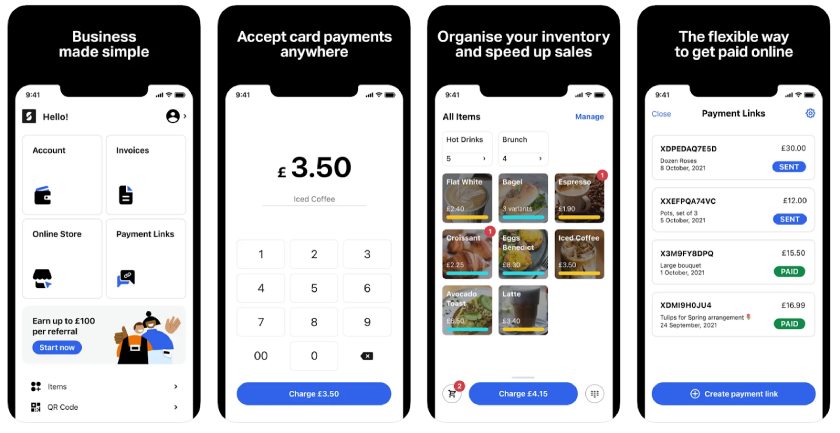

Mobile Payments App

SumUp comes with a free payment app that you can download on your Android or iOS device. It lets you accept swiped, EMV, and contactless card payments from all major credit cards, including Google Pay and Apple Pay, and invoices and gift cards through both mobile and virtual terminals.

Depending on roles and permissions, it gives you and your staff access to tools for accepting payments, processing sales, viewing or managing inventory, creating invoices, and more.

SumUp can add tips, issue refunds, or assign and adjust tax rates for your products and services.

(Source: SumUp App on Apple App Store)

Remote Payments

With SumUp, remote payments include any type of transaction processed through payment links—whether for an invoice or otherwise. Merchants can accept remote payments by sending payment links embedded in a digital invoice or sent via email, SMS, or instant messaging.

SumUp also offers free customization tools for digital gift cards from the SumUp app, which you can then share with your customers through a designated link. You can apply different gift card amounts, as well as discounts, and even create custom designs. Customers can then use these gift cards to complete online purchases.

However, not all businesses are qualified to offer and sell gift cards. You will need to contact customer support if you do not find the option on your app.

Virtual Terminal

The SumUp merchant dashboard comes with a built-in virtual terminal. This lets merchants accept payments by manually entering customer payment details provided via email or over the phone.

Unfortunately, SumUp’s virtual terminal can only process credit card transactions, which means it does not allow you to look up an outstanding invoice and settle the payment on your customer’s behalf. It’s also not available by default. Interested users will have to contact customer support to access this feature.

SumUp Features

The SumUp features are made up of a range of payment types and built-in payment processing tools. Most business tools, however, are only available if you subscribe to a POS plan.

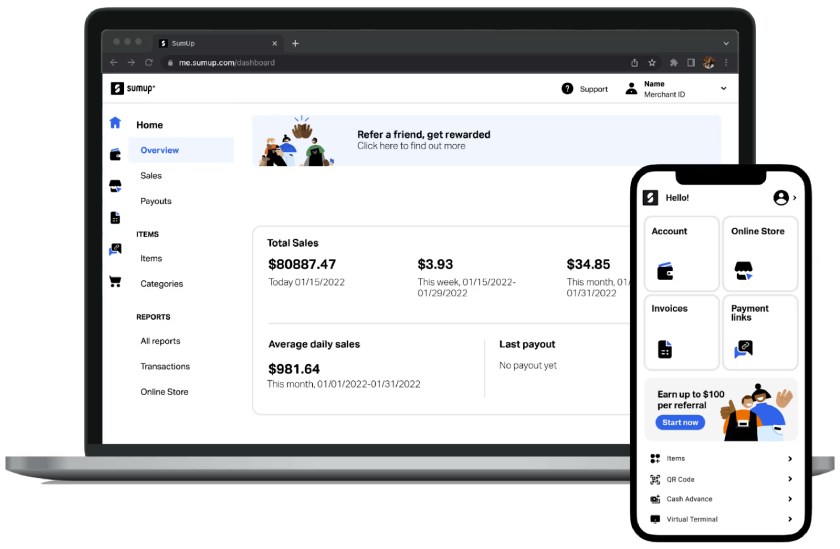

SumUp Dashboard

SumUp’s dashboard is available when you log in to your SumUp account from a desktop. As with the mobile app, it lets you process payments, create and send invoices, and request support. It shows you your total sales revenue, which you can filter according to your preferred time frame or by employee. You can also get a quick analysis of your transaction history along with basic business activity reports.

SumUp merchants can manage their sales, transfer funds, update their profile, purchase more hardware, contact support, and transfer to their bank account through the dashboard. (Source: SumUp)

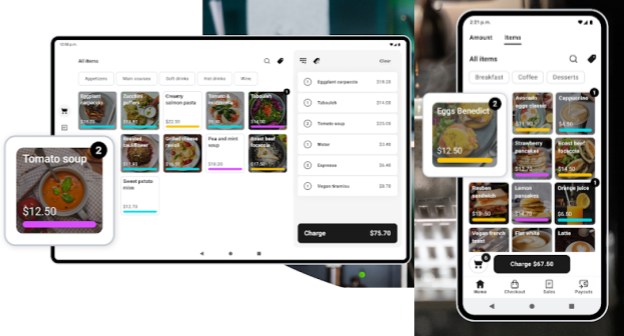

Inventory Management

The Product Catalog can be found in SumUp’s mobile app and provides you with tools to access basic inventory management features. This includes adding products, categories, and variants.

SumUp offers a step-by-step guide to building your catalog, from creating categories to adding items to its knowledge base. You can even accept payments from the product catalog tab. Using this feature also enables the sales tax function, which lets you assign sales tax rates.

Items are listed in alphabetical order, with options to add color labels on each category for visual cues and faster transaction processing. (Source: SumUp)

Employee Management

Adding employee accounts allows you to process multiple transactions simultaneously without giving them access to make changes to sensitive information such as owner profiles and bank details.

The employee management feature lets you create and manage permissions, with each employee profile having a unique login, password, and email connected to the account. Employees can then process payments and view their sales history.

However, permissions for employees are the same and are limited to processing sales, accepting payments, and viewing their sales history.

SumUp POS

SumUp Connect is an all-in-one POS system with complete POS software and hardware, as well as a built-in payment processor. Similar to Square POS, SumUp’s POS software includes tools such as menu and order management, inventory management, customer management and rewards signups, and sales reporting. It also supports important features such as third-party integrations, accounting, and automated marketing campaigns.

Note that signing up for a SumUp POS means having a paid monthly subscription.

SumUp Loyalty

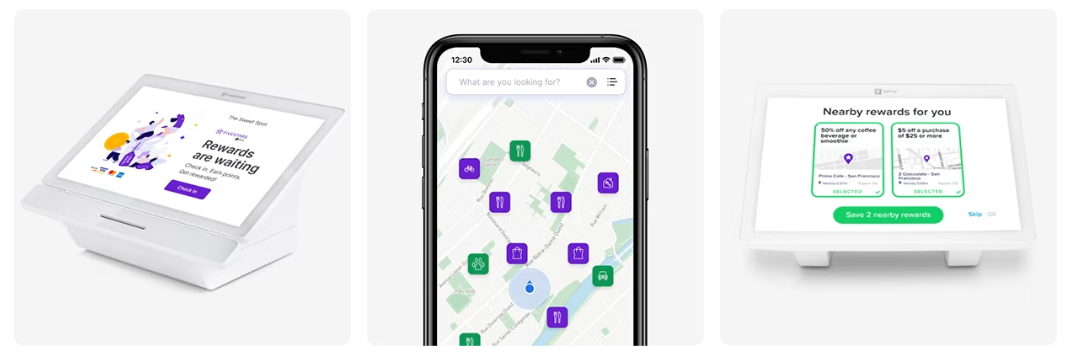

Fivestars is a SumUp add-on product that offers merchants the ability to manage customer data, send out marketing campaigns, and manage customer loyalty. It comes with a touch-screen display that you can set up at the checkout counter not only to promote your business but also to sign up customers with a rewards program at the point of sale. A customer-facing app is also available.

SumUp’s Fivestars loyalty software comes with a customer-facing app that allows users to manage their rewards points and promote their business with in-app mapping. (Source: SumUp)

SumUp Business Banking

The SumUp Business Account is a business banking product. This gives merchants access to banking tools such as ACH debit transfers, wire transfers, check issuance, ATM withdrawals, and mobile check deposits. Opening a bank account is free and comes with a free debit card. There are also no monthly fees, nor does it require a minimum balance.

Merchants who connect a SumUp Business Account with their SumUp merchant account are also guaranteed next-day payouts at no extra cost.

Note that SumUp’s banking services are provided by Piermont Bank, Member Federal Deposit Insurance Corporation (FDIC).

SumUp Ease of Use & Expert Score

As an end-to-end payment solution, SumUp is among the most affordable payment processors on the market. It has no long-term contracts or monthly fees for maintaining a merchant account and its flat-rate transaction fees are competitive. Recent upgrades include the launch of its all-in-one POS system and free business banking solution.

Payouts

SumUp processes payouts daily at no extra cost and tracks the transfer progress from your dashboard. You can also contact customer support if you prefer a different frequency for your payouts. Deposits, however, take at least two business days unless you have a SumUp business banking account that lets you receive funds the next business day.

Tracking payouts starts when you receive an email notification that your funds have been sent to your bank account, which you can then monitor on your dashboard. SumUp will also provide you with daily and monthly payout reports

Third-party Integrations

SumUp’s payment processing software works with other POS systems like Loyverse. For mobile credit card reader users under the free plan, SumUp provides a host of APIs and SDKs for accepting international and recurring payments, adding user interface screens for customers of different business models, and more. Third-party business integrations are only available with the SumUp POS pans.

Customer Support

SumUp’s help center includes a knowledge base and FAQs on its website. A “Support Tab” is also available within the app, allowing you to directly send support requests using a contact template. SumUp customer service team is available via phone at 1-888-250-2164 from Monday to Friday, 9 a.m. to 7 p.m., Eastern time.

Methodology: How We Evaluated SumUp

We test each merchant account service provider ourselves to ensure an extensive review of the product. We start by comparing pricing methods, giving preference to those that offer zero monthly fees, pay-as-you-go terms, and low transaction fees. We then evaluate its range of payment processing features, scalability, and ease of use.

We use these criteria to examine the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts, and extra points if those discounts are transparent or automated.

Helcim performed well in this criteria, only losing points for chargeback fees and hardware pricing.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Helcim earned perfect marks for this section.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

Helcim somewhat struggled in this criteria, earning only partial points for deposit speed and hardware purchasing options.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

Helcim fared well in this category, only missing points for popularity and integrations.

Frequently Asked Questions (FAQs)

These are some of the most common questions we encounter about SumUp.

SumUp is a European mobile-first payment processing platform that offers one of the most affordable mobile credit card readers in the market. It offers zero monthly fees for mobile payment processing and can process most credit card payment methods and send out invoices to bill remote customers.

SumUp provides merchants with a secure mobile credit card reader and a mobile payment app. With these, you can accept credit card payments by swiping, tapping, or using a secure PIN pad to authorize the payment. It uses a payment gateway to send payment links for invoicing and other remote transactions.

You can schedule deposits to your bank account every day. SumUp will take at least two business days to process these transfers. However, next-day funding is available if you sign up for a SumUp business bank account.

Yes, most payment processors like SumUp use data encryption to protect cardholder data and transaction information. With SumUp, your information is encrypted with SSL (Secure Socket Layer) and TLS (Transport Layer Security) and are not stored within the hardware.

Bottom Line

SumUp ticks most of the boxes for startups, and this is evident with most of its positive reviews coming from solopreneurs and small business owners. It offers competitive pricing and a handy, inexpensive card reader with built-in chip and contactless processing. While it does not provide third-party plug-and-play integrations, it comes with API and SDK tools to help users customize their payment process to match their business model. Create a free account today.

1 Capterra

2 Trustpilot