SurePayroll by Paychex is an affordable payroll service most often used for small business and nanny payroll. It offers unlimited pay runs, direct deposits, new hire and year-end reporting, automatic tax payments and filings, and even a do-it-yourself (DIY) payroll option where you handle tax filings.

SurePayroll by Paychex also provides access to employee benefits, HR forms, compliance posters, and an HR adviser. For $29.99 monthly plus $5 per employee, businesses with up to 10 employees can get its full-service plan that automates the entire payroll process, including payroll tax deposits and filings. In our evaluation of the best cheap payroll services, SurePayroll by Paychex got a 4.06 rating out of 5.

SurePayroll by Paychex Overview

Pros

- Affordable

- Flexible payroll run with a DIY option

- Offers tax calculation and penalty tax filing guarantees

- Has PTO and sick leave tracking

Cons

- Local tax and multistate filings require add-on monthly fees

- Integrates with only time clock and accounting software; third-party integrations cost extra

- Doesn’t pay international employees

SurePayroll by Paychex Deciding Factors

Ease of Use | Relatively easy to use, but you need basic knowledge of how to run payroll, especially if you plan to get its Basic tier, wherein you handle tax flings yourself |

Pricing |

|

Standout Features | Unlimited and automatic payroll runs with new hire reporting services and access to HR support tools (such as how-to guides, business forms, and labor law posters |

Customer Service |

|

What We Recommend SurePayroll by Paychex For

With over 20 years of payroll and tax experience, SurePayroll by Paychex has been helping small businesses run payroll and comply with tax laws and regulations at an affordable price. It offers automatic and unlimited pay runs, flexible payroll options, a mobile app, and access to employee benefits. In addition to providing online software that’s easy to set up, learn, and use, this provider offers flexible tools that can handle the wage processing needs of various small businesses, including restaurants and household employers.

In short, SurePayroll by Paychex is best for:

- Household employers: SurePayroll by Paychex, our best overall nanny payroll service for household employers, is affordably priced and has efficient tools to help you pay your nannies and other household staff. It also prepares Schedule H that all household employers must submit with their 1040 annual filing—something you won’t get with other payroll services.

- Sole proprietors: Handling self-employed payroll can be confusing and stressful for sole proprietors. With this provider, you can choose between its self-service and full-service options, and it’s easy to switch from one to the other when needed. Some single-employee businesses may even opt to initially handle tax filing to save money, making SurePayroll by Paychex’s DIY payroll plan a good option.

- Small companies with employees in multiple states: Although it costs extra to run payroll in more than one state, SurePayroll by Paychex can handle it affordably. This is great for small business owners with employees distributed throughout the US, as it allows them to maintain payroll compliance in multiple states without having to sign up for more complex (and costly) online payroll services they don’t need.

- Restaurants: SurePayroll by Paychex can help restaurant business owners efficiently manage the intricacies of handling their staff’s multiple pay schedules and tip payouts. Rated as one of our leading restaurant payroll software, SurePayroll by Paychex provides restaurant-specific reporting that includes FICA Tip Credit and Tip Sign-Off reports.

- Accountants: SurePayroll by Paychex has an accountant partner program that comes with basic payroll and HR tools, plus white-labeling options with wholesale pricing. It ranks in our top payroll software for accountants guide.

When SurePayroll by Paychex Would Not Be a Good Fit

- Growing companies: Businesses planning to quickly scale to 1,000-plus employees may not find SurePayroll by Paychex a fit for their requirements—its reporting and payroll features are designed for businesses with a simple structure, and its HR features may not be as robust as you need. The range of SurePayroll by Paychex pricing plans isn’t really suitable for businesses of different sizes. Check out our guide to HR payroll software for more options.

- International payroll operations: SurePayroll by Paychex does not support payroll for international employees or even those assigned in US territories. Check out our guide on top international payroll providers, as they are better suited for this.

SurePayroll by Paychex Alternatives Compared

Best for | Paid Plans Start at | Tax Filing Included in the Plan | Learn More | |

|---|---|---|---|---|

Small businesses, sole proprietors, household employers | $39/month + $7/employee per month | ✓ | ||

Small businesses looking for full-service payroll with basic HR tools | $49 per month + $6 per person per month | ✓ | ||

QuickBooks accounting small business users | $50/month + $6/employee per month | ✓ | ||

Fast-growing businesses | $39/month base fee + $5/employee per month | ✓ (included in the basic plan) | ||

SurePayroll by Paychex got a perfect score for its pricing because its pricing plans are ideal even for solopreneurs or very small businesses. Its No Tax Filing plan costs $20 monthly plus $4 per employee and requires you to handle tax filings yourself. Meanwhile, its Full Service plan costs $39 monthly plus $7 per employee and handles tax filing for you.

Both plans come with unlimited pay runs, automatic payrolls, direct deposits, online pay stubs, two-day direct deposits, and new hire state reporting. You can even purchase add-on solutions (like accounting and time clock software integrations) to customize your plan.

Features | No Tax Filing Plan | Full Service Plan |

|---|---|---|

Monthly Pricing | $20 | $39 |

Per Employee Fees | $4 | $7 |

Unlimited and Automatic Pay Runs | ✓ | ✓ |

Multiple Pay Rates and Bonuses | ✓ | ✓ |

Payroll Tax Calculations | ✓ | ✓ |

Payroll Tax Payments and Filing Services | N/A | ✓ |

Year-end Tax Reporting (W-2/1099-NEC Forms) | N/A | ✓ |

Free Two-day Direct Deposits | ✓ | ✓ |

Online Pay Stubs | ✓ | ✓ |

New Hire Reporting | ✓ | ✓ |

“HR Adviser” Access* | ✓ | ✓ |

*Subscribers can access HR forms, compliance posters, and online how-to guides.

If your business is located in Ohio or Pennsylvania, note that SurePayroll by Paychex charges extra for local tax filings. You also have to pay add-on fees for multiple state filings, year-end tax reports, and integrations with time clock and accounting software.

Add-ons

- Multiple state filing: $9.99 monthly

- Ohio or Pennsylvania local tax filing: $9.99 monthly

- Time clock integration: $9.99 monthly

- stratustime integrated time clock: $5 plus $3 per employee monthly

- Accounting integration: $4.99 monthly

- Year-end fees to generate W-2/1099 forms: Custom-priced

SurePayroll by Paychex is a user-friendly software that small businesses can use to process payroll quickly and accurately, and you are free to choose whether you will handle the tax filing yourself or not. While it has a step-by-step setup wizard that’s easy to follow, its representatives can also help new users through the process for free. Despite this, it only received a 3.63 rating out of 5 because it doesn’t offer multiple payment and pay-on-demand options.

Let’s take a look at some of SurePayroll by Paychex’s essential features to help you determine if it fits your requirements.

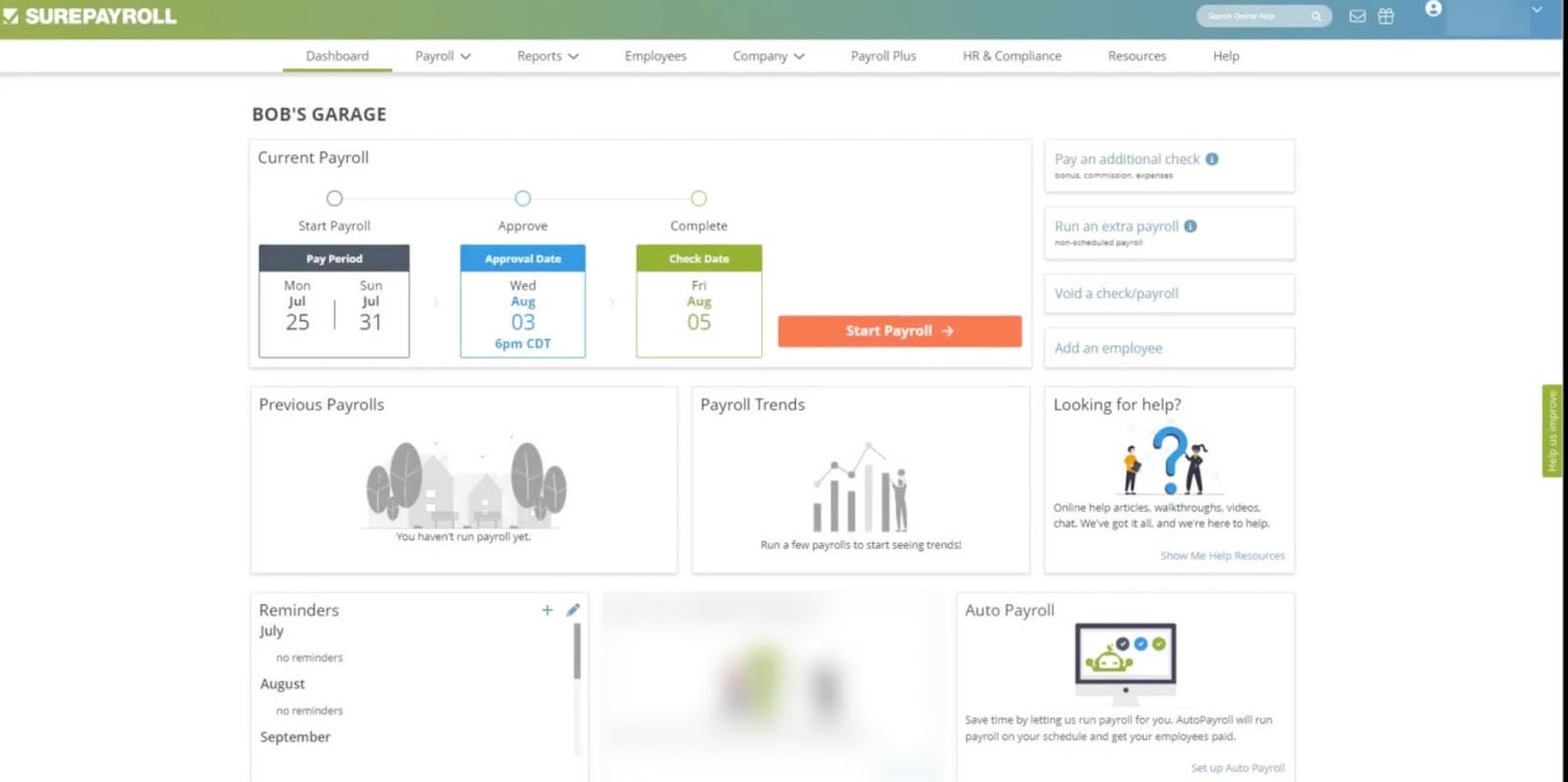

A snapshot of SurePayroll by Paychex dashboard (Source: SurePayroll by Paychex)

Aside from unlimited pay runs, you can set up multiple pay rates, bonuses, and pay schedules. Employees and contractors can be paid either through paper checks or via two-day direct deposits. It also offers flexible payroll options, such as automatic pay runs and next-day or same-day expedited payroll—and you can run all these functions on SurePayroll by Paychex’s mobile apps for iOS and Android devices.

With SurePayroll by Paychex’s mobile apps, you can manage and run payroll from anywhere—provided an internet connection is available.

You can even cancel a payroll run in case you have to correct an error—provided you spotted the mistake shortly after completing the pay run and clicked the “Cancel Payroll” button within SurePayroll by Paychex’s cancellation time period. You can run payroll the next or the same business day if you follow SurePayroll by Paychex’s processing timelines:

- Next-day payroll: Schedule and run payroll by 3 p.m. Central time of the prior business day

- Same-day payroll: Schedule and run payroll by 10:30 a.m. Central time of the same business day

Note that new clients are not eligible for SurePayroll by Paychex’s flexible payroll options; you must have run at least six payrolls with the provider. Additionally, you shouldn’t have had any non-sufficient funding issues within the last six months.

SurePayroll by Paychex calculates, withholds, and pays payroll taxes accurately and on time. If you subscribe to its Full-Service plan, it promises to pay any penalty as a result of mistakes made by its representatives. It can also help you with the following:

- File and pay federal and state unemployment insurance on time

- File year-end reports (940, 941, W-2, W-3, 1099, and 1096)

- File 1040-ES and Schedule-H for nanny taxes

If you live in Ohio and Pennsylvania, however, you have to pay $9.99 per month to have your local taxes paid. Additionally, multistate tax filings incur additional fees of $9.99 monthly.

SurePayroll by Paychex’s two plans are backed by separate tax guarantees to ensure accurate tax computations and compliance with payroll tax regulations.

For those on the Basic plan: You are covered by a “Tax Calculation” guarantee, wherein it will pay all penalties and fines for tax computation errors made by SurePayroll by Paychex—provided you gave accurate and timely tax information. If you receive a tax filing notice from the IRS and other agencies, SurePayroll by Paychex will work with the agency to resolve the issue on your behalf.

For those on the Core plan: SurePayroll by Paychex has a “No Penalty Tax Filing” guarantee in which the provider will cover all tax penalties and fines for tax computation and filing errors made by its representatives—provided you give accurate and timely tax information. It will also help you resolve tax filing errors by directly coordinating with the IRS and other tax agencies on your behalf for any tax notices you may receive.

SurePayroll by Paychex got a 4.63 rating out of 5 because it does not offer robust HR tools to help hire, onboard, and manage employees—but it does provide HR resources that include access to business forms and compliance posters. In addition, SurePayroll by Paychex has basic tools to help you securely store and manage employee information for your pay runs. It also handles new hire state reporting for you.

In case you have incoming new employees, SurePayroll by Paychex offers pre-employment screening services like background checks, drug screenings, behavioral assessments, and skills testing. You can even use its “personal development inventories” solution to help produce objective employee assessments for your staff and identify their strengths and growth opportunities.

SurePayroll by Paychex guides you through the process of adding new employees and contractors into its system. (Source: SurePayroll by Paychex)

Employee Benefits

Through partnerships with licensed insurance agencies like Paychex Insurance Agency, The Hartford, Travelers, and Liberty Mutual, SurePayroll by Paychex connects you to benefits options you can offer to employees. These benefits include pay-as-you-go workers’ compensation insurance, 401(k) retirement plans, and health insurance.

Third-party Software Integration

Unlike similar payroll providers that have robust third-party software partners, SurePayroll by Paychex integrates with only two types of systems:

- Accounting: AccountEdge, Less Accounting, Kashoo, QuickBooks, Sage 50, Xero, and Zoho Books

- Time clocks: Buddy Punch, Homebase, SpringAhead, stratustime, TimeForge, and TimeTrex

SurePayroll by Paychex got a perfect score for its reporting features because of its robust reporting capabilities. It gives users access to basic payroll reports, allowing businesses an overview of their financial operations. It also has job costing and labor distribution features that show a detailed analysis of expenses and resource allocation, which is crucial for effective budgeting, forecasting, and project management. Users can also create custom reports, allowing owners to tailor each analysis based on their needs.

- User-friendly with an intuitive dashboard

- Email payroll reminders

- Knowledgeable support staff

- Supports multiple payroll options

- Mobile application to run payroll anywhere

- Self-service portal

SurePayroll by Paychex is very easy to set up and use, provided that all of your business and employee information is available. You can navigate through its dashboard with ease since its interface is not overwhelming and the learning curve isn’t steep. In case you need assistance, SurePayroll by Paychex’s customer service is available from Monday to Friday, 7 a.m. to 8 p.m. Central time, and on Saturdays from 9 a.m. to 1 p.m. Central time. SurePayroll by Paychex only got a 3.25 rating out of 5 because its interface lacks customizability, and its integration with other third-party software is limited.

This criterion evaluates the range and comprehensiveness of SurePayroll by Paychex’s HR and payroll features, its affordability, and the ease of navigation on its platform. It received a 3.5 out of 5 rating in this criterion, indicating that while it offers a solid array of features and maintains a reasonable price point, there are limitations in its payroll and HR features. For example, it has no multiple pay options or a pay-on-demand feature—causing it to lose some points.

| Users Like | Users Don’t Like |

|---|---|

| Software is user-friendly | Logging into the system requires text verifications |

| Payroll processing is easy | Some features are difficult to understand |

| Affordable for most small businesses | Inconsistent support quality |

Many of the SurePayroll by Paychex reviews on third-party sites like G2 and Capterra are positive. Users appreciate its affordability, efficient payroll tools, and easy-to-use interface. Some reviewers also mentioned that the software works seamlessly once it is set up.

On the other hand, a few users dislike waiting for SMS verifications before they can log in to the system. Some even mentioned that while it has reasonably-priced payroll plans, the monthly costs can get expensive if you have add-on solutions (like accounting software integration).

In terms of customer support, many complained about having to wait long before they could contact its support team. The quality of support also seems to depend on the customer rep that users were able to contact—some of the reviewers said that the reps who handled their cases were helpful, while others were unhappy with the service they received, even citing difficulties getting SurePayroll by Paychex to help with addressing tax issues and filing errors.

While SurePayroll by Paychex received a lot of high ratings and positive reviews, the number of reviews it has is fewer compared to the other popular software—most of which average to more than a thousand reviews. Because of this, SurePayroll by Paychex cannot get a perfect score in this criterion. At the time of publication, SurePayroll by Paychex reviews on popular sites earned the following scores:

- Capterra: 4.2 out 5 based on 285-plus reviews

- G2: 4.4 out of 5 based on 520-plus reviews

Bottom Line

SurePayroll by Paychex is a user-friendly and affordable payroll software that’s ideal for small businesses, household employers, and even restaurants. It has a self-service payroll plan if you prefer to handle tax filings yourself and a full-service payroll that includes automated payroll tax payments and filings. You do have to pay extra for certain features like multi-state payroll and time and attendance integrations. Overall, it performs all of the basic functions you need to pay employees and even provides same-day expedited pay runs should you require it.

Sign up with SurePayroll by Paychex today.