Like any other organization, churches and ministries need to process their payroll and comply with IRS tax rules. Aside from managing pay processing and tax withholdings and filings at an affordable rate, the best church payroll services offer features like church-specific tax law expertise that make running payroll easier.

In this guide, we evaluated 17 providers to find the best church payroll services and narrowed it down to our top six.

- Gusto: Best overall church payroll software

- SurePayroll by Paychex: Best for small churches wanting budget-friendly plans

- OnPay: Best church payroll service with automated compliance checks

- QuickBooks Payroll: Best payroll software for churches that want fast payments

- Rippling: Best for customizing workflows to automate church payroll and HR processes

- MinistryWorks: Best for ministries requiring a dedicated church payroll specialist

Featured Partner |

|---|

Run Payroll Confidently with QuickBooks Payroll |

|

Top Church Payroll Services Compared

Our Score (out of 5) | Starter Monthly Pricing | Tax Filing Fees | ||

|---|---|---|---|---|

| 4.34 | $6 per employee + $49 base fee | ✕ | |

4.16 | 6 months free |

| ||

| 3.98 | 30-day free trial | $6 per employee + $40 base fee | ✕ |

3.93 | 30-day free trial or 50% off base fees for three months | $6 per employee + $50 base fee | Local tax filing available only in higher tiers | |

3.71 | First month free | ✕ | ||

| 3.69 | ✕ | $23.01 per monthly payroll for one employee | ✕ |

All the church payroll software on our list offer full-service payroll, tax filing services, W-2 and 1099 tax forms at year-end, and unlimited pay runs (except MinistryWorks). Standard reports are also available, including access to pay-as-you-go workers’ compensation plans and time tracking tools—but some of these may require add-on fees or are included in higher tiers.

Quiz: Determine the Ideal Church Payroll Software for You

Unsure which church payroll service to get? This quiz will help you decide.

Gusto: Best Overall Church Payroll Service

Pros

- Has unlimited and automated pay runs; also supports international contractor payments

- Offers global payroll and hiring solutions through its employer of record (EOR) service

- Has online portals for employee self-onboarding

- Integrates with several third-party software (like Aplos, Xero, Clover, and QuickBooks)

- Includes job postings, applicant tracking, and employee performance reviews in its HR tools

Cons

- Lacks a dedicated payroll specialist

- Limits the health benefits coverage to 38 states + Washington, D.C. (as of this writing)

- Includes time tracking, multistate payroll, and advanced HR tools are included only in higher tiers

Overview

Who should use it:

Gusto is the best payroll service for small churches because it offers solid pay processing with tax compliance and HR tools at a reasonable price. It supports church payroll needs by allowing tax exemptions for the church and ministers. Church employees can also access their pay information through a self-service portal. It even integrates well with Aplos, a nonprofit fund accounting software that tracks payroll and tax payments for nonprofits and churches.

Why we like it:

Aside from pay processing solutions, Gusto offers the essential tools for posting job openings, managing applicants, and scheduling interviews. Online offer letter templates are available once you’ve selected a qualified candidate to hire. You can also start the onboarding process, allowing your new employee to complete new hire paperwork and requirements online.

While it provides access to a wide range of employee benefits options, its health insurance is unavailable in 12 states. As of this writing, Gusto's health benefits are unavailable in Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, West Virginia, and Wyoming. This is unlike OnPay, Rippling, QuickBooks Payroll, and SurePayroll by Paychex, which have benefits available in all US states. Further, Gusto doesn’t have a dedicated payroll specialist who can help double-check your pay runs, something MinistryWorks offers.

- Simple: $49 base fee + $6 per employee monthly

- Plus: $80 base fee + $12 per employee monthly

- Premium: Call for a quote.

- Contractor-only payroll package: $35 base fee + $6 per contractor monthly (for organizations that only pay contract workers)

Add-ons

- State payroll tax registration: Pricing varies per state.

- Health insurance and other benefits: Pricing varies by benefit.

- International contractor payments: Call for a quote.

- EOR: $699 per employee monthly

- HR advisory services and priority support for Plus plan only: $8 per employee monthly (this is included for free in the Premium tier)

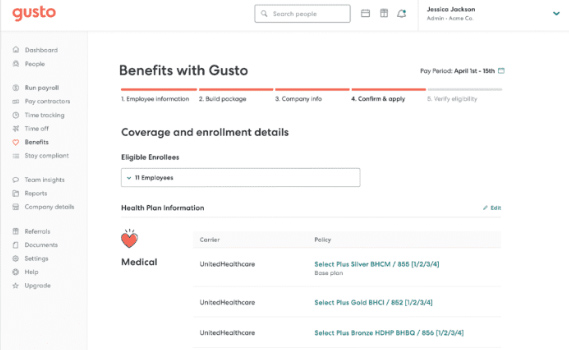

While Gusto can pay employees and process clergy-specific allowances, its benefits module can help track benefits plans and online enrollments. (Source: Gusto)

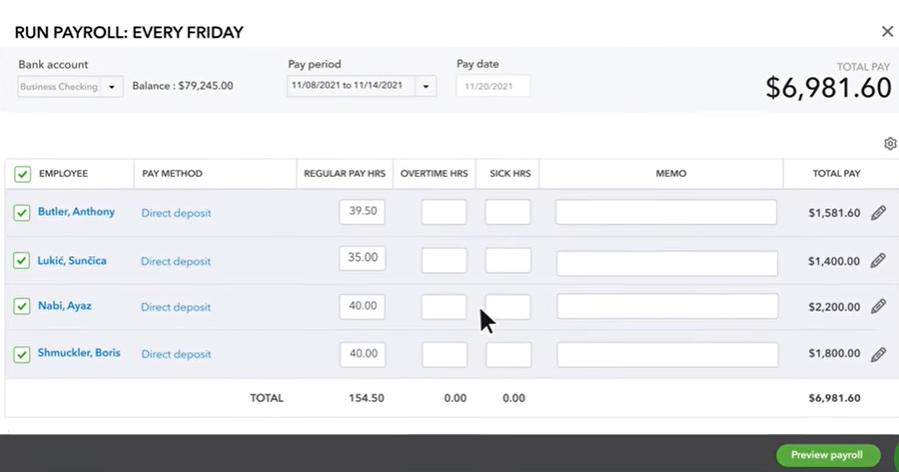

- In addition to unlimited payroll, you can set payroll to run automatically, which is helpful to those who don’t expect changes to payroll.

- Pay church employees via manual checks and direct deposits (with two- and four-day options).

- Set up a church-specific tax exemption directly to capture minister payments that are exempt from certain taxes, like Medicare and Social Security or Federal Insurance Contributions Act (FICA) taxes.

- It supports clergy housing allowance payouts—you can even add the allowance amount as a recurring payment.

- It has HR tools for hiring employees, onboarding new hires, tracking attendance, and managing performance reviews.

- It has a wide range of benefits options, such as health insurance, 401(k) plans, workers’ compensation, a health reimbursement program, and financial management tools through its free Gusto Wallet app.

SurePayroll by Paychex: Best for Small Churches Wanting Budget-friendly Plans

Pros

- Has flexible payroll plans with a do-it-yourself (DIY) tax filing option

- Has unlimited and automatic pay runs

- Is affordably priced

Cons

- Charges add-on fees for multiple state and local tax filings

- Costs extra for software integrations; has limited options (doesn’t connect with church management systems)

Overview

Who should use it:

SurePayroll by Paychex is optimal for small churches looking for budget-friendly and flexible pay processing options. It offers a full-service payroll package (costing $39 plus $7 per employee monthly) with access to employee benefits plans and automatic tax payments and filings. It also has a payroll plan that doesn’t include tax filing services (priced at $20 plus $4 per employee monthly)—ideal for those who prefer to save money by remitting tax payments and submitting tax forms themselves.

Why we like it:

Similar to Gusto and QuickBooks Payroll, you get automatic and unlimited pay runs with SurePayroll by Paychex. Plus, it calculates salaries and deductions for both clergy and non-clergy employees, including contract workers.

However, while it has user-friendly and efficient payroll tools, its church-specific functionalities aren’t as robust as MinistryWorks, which offers church payroll advisers who can offer expert advice. Its platform also doesn’t connect with church management systems as Gusto does, and some of its time tracking and accounting integrations cost extra.

- Full Service: $39 base fee + $7 per employee monthly

- It includes payroll and tax calculations, two-day direct deposits, unlimited and automatic pay runs, new hire reporting, online pay stubs, and tax filing services.

- No Tax Filing: $20 base fee + $4 per employee monthly

- It has all the features of the Full Service plan but without tax filing services.

Add-ons

- Multistate tax filings: $9.99 per month

- Local tax filings: $9.99 per month

- Accounting software integration: $4.99 per month

- Time clock software integration: $9.99 per month

- Stratustime integrated time clock: $5 base fee + $3 per employee monthly

SurePayroll has an auto-payroll feature you can easily set up, which enables its system to automatically process regular pay runs. (Source: SurePayroll)

- It supports church-related allowance payments and helps keep you up-to-date with the Clergy Housing Allowance Clarification Act regulations.

- Its church payroll services ensure that you follow specific tax requirements when processing payments for clergy employees.

- Benefits options include retirement, health insurance, and pay-as-you-go workers’ compensation.

- Preemployment screening services include background checks, online skills testing, behavioral assessments, and personal development inventories to help you identify your workers’ strengths and growth areas. None of the providers on our list of best church payroll services offer a wide range of employee screening tools.

OnPay: Best Church Payroll Service with Automated Compliance Checks

Pros

- Has unlimited payroll

- Offers multiple payment options (like direct deposits, manual checks, and debit cards)

- Allows users to delegate tasks and run payroll however you want through its 6-level system permissions

- Offers free account migration and integration setup to new clients

Cons

- Lacks multiple tiers that cater to varying payroll and HR needs

- Doesn’t have live phone support during weekends (only email)

- Has limited third-party software integrations

- Assesses eligibility to 2- or 4-day direct deposits depending on OnPay’s risk assessment

Overview

Who should use it:

OnPay’s full-service payroll makes it easy for religious organizations to pay both clergy and non-clergy employees. Its payroll tax features automate applicable deductions for employees, but for workers you mark as members of the clergy, OnPay will exempt them from FICA taxes. This functionality, along with its proactive alerts for incomplete onboarding tasks or outdated employee documents, helps ensure that you remain compliant with labor laws and tax regulations.

Why we like it:

New clients transitioning to OnPay won’t have to worry about system setup and data migration because the provider will handle this for them. The service also includes setting up and customizing time tracking and accounting integrations you might need (the others on our list either charge extra for this or only offer it in higher tiers). Plus, its six levels of system permissions allow you to delegate payroll tasks, as well as select the solutions (such as online forms and PTO filings) that your clergy and non-clergy employees have access to.

However, it has limited integration options—it doesn’t even connect with church management software. And, while it provides access to HR advisers through its partnership with Mineral HR, you have to pay extra for it ($20 monthly for contacting an HR expert).

Unlike the other providers on our list of best payroll services for churches, OnPay only offers one plan. For $40 plus $6 per employee monthly, you are granted access to all of its HR, payroll, and employee benefits features.

Add-ons

- Access to live HR experts (via Mineral HR): $20 monthly

- W-2 and 1099 printing and mailing services: $9.99 per form; this service is free if you print the online forms yourself.

OnPay’s payroll tool has expandable columns and summaries, allowing you to take a closer look at itemized wage breakdowns, taxes, and deductions. (Source: OnPay)

- Aside from unlimited pay runs, your clergy and non-clergy staff can get their wages through debit cards, paychecks, and direct deposits.

- Keep essential employee management processes organized and streamlined with OnPay’s automated onboarding workflows, custom paid time off policies, detailed employee profiles, and compliance audits.

- OnPay’s health plans are available in all US states unlike Gusto’s, which is unavailable in 12 states. You can also choose and compare benefit packages from several major providers, such as Aetna, Human, and United Healthcare.

- Its six levels of permissions let you delegate responsibilities and choose who has visibility into payroll and HR, providing you with enough flexibility to run payroll however you want.

QuickBooks Payroll: Best Payroll Software for Churches That Want Fast Payments

Pros

- Has unlimited pay runs

- Offers next- and same-day direct deposits

- Offers seamless integration with QuickBooks Accounting

- Has low-cost contractor payments plan

- Has robust tax penalty protection

Cons

- Includes time tracking, local tax payments and filings, and access to HR advisory services in higher tiers

- Has limited third-party integrations; requires users to use QuickBooks Accounting to access all options

- Doesn’t offer workers’ comp insurance in OH, ND, WA, and WY (as of this writing)

Overview

Who should use it:

Small churches that require fast payment options can take advantage of QuickBooks Payroll’s next- and same-day direct deposits to pay workers. It’s also perfect for those looking for church payroll services that integrate seamlessly with QuickBooks Online. This makes handling church accounting and pay processing easy for ministries.

Why we like it:

All QuickBooks Payroll plans come with full-service payroll, automated taxes and forms, and next-day direct deposits. If you upgrade to higher tiers, you get additional features like time tracking and a tax penalty protection that covers filing errors that you or its representatives make. However, it has limited third-party software integrations (unless you get QuickBooks Accounting) and lacks in-house church payroll and tax experts (which MinistryWorks has).

- Payroll Core: $45 base fee + $6 per employee monthly

- Payroll Premium: $80 base fee + $8 per employee monthly

- Payroll Elite: $125 base fee + $10 per employee monthly

- Contractor payments package: $15 monthly for 20 workers; plus $2 for each additional contractor (for organizations that only pay contract workers)

QuickBooks Payroll’s pay processing solution (Source: QuickBooks Payroll)

- It offers multiple pay types that support clergy-related allowances and church-specific tax exemptions.

- Unlike the other church payroll services on our list, QuickBooks Payroll lets you send direct deposits to your employees’ bank accounts within 24 hours without upgrading to a higher tier. If you decide to get either the Premium or Elite plan, QuickBooks will grant you access to same-day payouts.

- Churches that primarily have contract workers can get bigger savings with QuickBooks’ contractor plan, which only costs $15 monthly for up to 20 workers (plus $2 for each additional contractor).

- All QuickBooks Payroll clients are covered by its basic tax guarantee, which only covers tax filing errors that its representatives make. However, if you get its Payroll Elite plan, QuickBooks will cover tax penalties of up to $25,000—regardless of who makes the mistake. The other providers on our list may have a similar program, but it doesn’t cover client-related tax filing errors.

Rippling: Best for Customizing Workflows to Automate Church Payroll and HR Tasks

Pros

- Has seamless integrations of modular HR, payroll, expense management, and IT solutions (you can choose features that your organization needs)

- Connects with 500-plus business apps

- IT tools help streamline computer and app provisioning and deprovisioning processes

- Offers global payroll and hiring, including professional employer organization (PEO) services for outsourcing HR administration tasks

Cons

- Requires users to purchase its core Rippling platform before adding other modules

- Gets pricey as you add features

- Requires extra fees for HR advisory services

- Lacks live phone support (but you can request a call through its live chat)

Overview

Who should use it:

What makes Rippling a good option for churches is its all-in-one solution that not only simplifies HR and payroll processes but also automates basic IT tasks—from monitoring computer inventory to managing business software and assigning laptops to personnel. It even comes with workflows you can customize, enabling you to further streamline employee management tasks. With these functionalities, you can focus more on running your ministry and spend less time handling day-to-day HR administrative processes.

Why we like it:

Rippling has an intuitive and feature-rich platform with solid payroll, HR, and reporting tools. While it lacks built-in church payroll codes, it can handle tax exemptions for clergy employee payments. However, it doesn’t assign dedicated church payroll specialists to its clients like MinistryWorks does.

Rippling Unity, Rippling’s base platform that all subscribers must purchase, is now called Rippling Platform.

With Rippling, you have to call the provider to request a quote. It works with you to create a custom plan with the features that your business needs.

For an HR payroll platform with time tracking, employee onboarding and offboarding, and software integrations, we were quoted a monthly fee of $35 plus $8 per employee. If you add Rippling’s IT tools to manage business software access and computer devices, each module will cost $8 per employee monthly.

Add-ons*

- Global payroll: $20 per employee or contractor monthly*

- EOR services: $599 per employee monthly*

- It includes global payroll and hiring solutions.

- PEO services: Call for a quote.

- ACA & COBRA administration: Call for a quote.

- Expense management: Call for a quote.

- Learning management: Call for a quote.

- Applicant tracking: Call for a quote.

*Pricing is based on a quote we received.

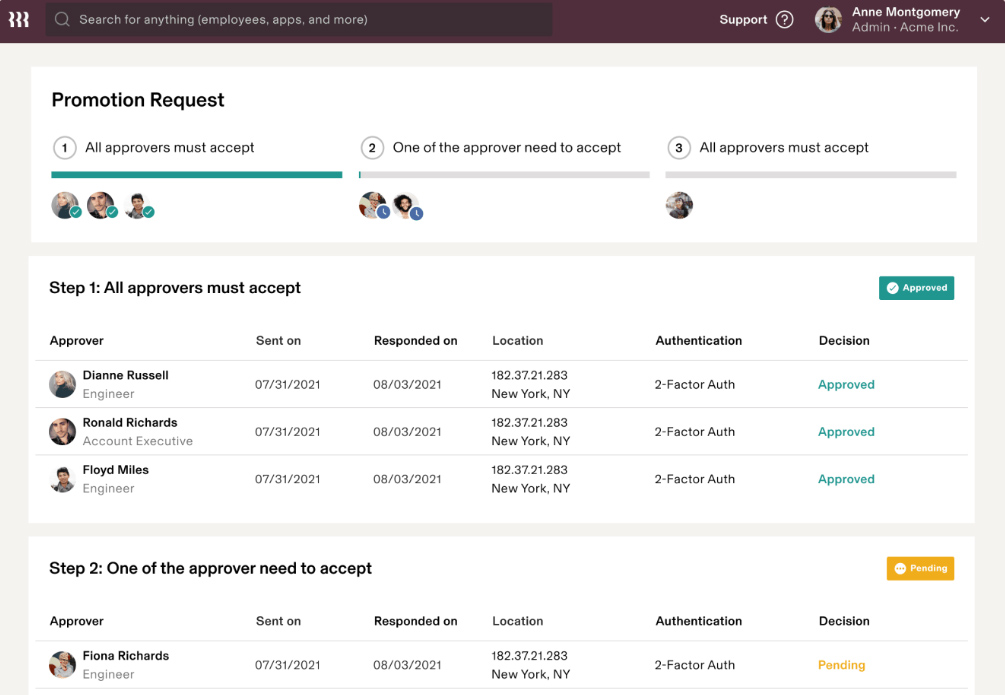

Rippling’s robust automation tools allow you to create simple to complex workflows to manage online approvals and automate HR tasks. (Source: Rippling)

- Rippling touts that it can run payroll within 90 seconds and with just three clicks.

- Apart from automatically calculating wages and the applicable tax deductions for both clergy and non-clergy employees, it files payroll forms for you and can handle global payroll calculations.

- Rippling is the only provider in this guide with a platform that can manage basic to advanced HR payroll processes—from applicant tracking to learning management and compensation planning.

- Aside from its integration with more than 500 software, Rippling’s IT features can help you assign computer units and identify business apps that employees need. It also disables your resigning staff’s access to company-assigned computers and business software on their last working day.

- While OnPay offers six levels of system permissions to control access and delegate tasks, Rippling has robust workforce automation tools to automate and simplify HR, payroll, and IT processes. It even provides ready-to-use workflow templates, but you can easily create your own—no coding knowledge needed.

MinistryWorks: Best for Ministries That Need Dedicated Church Payroll Support

Pros

- Has automated payroll and tax filings

- Files state new hire reports

- Provides access to a dedicated payroll specialist

- Offers a pay-as-you-go workers’ compensation plan

Cons

- Charges per pay run; can get pricey depending on your pay frequency and the number of employees you have

- Has limited benefits options

- Has very few third-party software integrations

- Offers HR solutions as paid add-ons

Overview

Who should use it:

MinistryWorks’ payroll services are designed to handle the pay processing and tax calculation needs of churches. It offers automatic payroll runs, and you can pay employees via manual checks and direct deposits. In addition to Affordable Care Act (ACA) reporting, it manages tax withholdings and deductions and even provides you with a dedicated payroll specialist that can help manage pay runs.

Why we like it:

MinistryWorks is a church payroll software specializing in clergy and ministry tax law. It runs payroll and handles all federal, state, and local tax filings. While it has dedicated payroll support and a generally easy-to-use platform, MinistryWorks has basic HR tools and limited integration options. It also charges fees per pay run, which can make it a bit pricey for religious organizations that pay workers every week. If you want to run payroll as many times as you need without having to pay extra, we recommend any of the other providers included in our guide, all of which offer unlimited pay runs.

- Monthly payroll: $23.01 per pay run for one employee

- Semimonthly payroll: $14.41 per pay run for one employee

- Biweekly payroll: $13.89 per pay run for one employee

- Weekly payroll: $10.82 per pay run for one employee

Pricing for the above plans is from MinistryWorks’ online calculator that shows estimated fees for one employee and for different payroll frequencies. Contact the provider to request a quote.

Add-ons

- Time and attendance: Call for a quote.

- ACA reporting: Call for a quote.

- Pay-as-you-go workers comp: Call for a quote.

- HCM module: Call MinistryWorks for a quote.

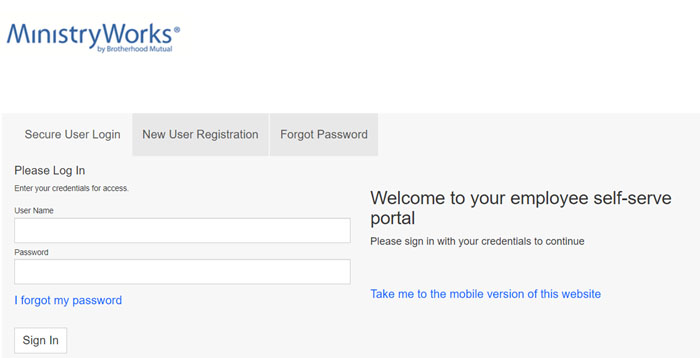

MinistryWorks offers an online portal for employees to view payslips and submit time off requests. (Source: MinistryWorks)

- MinistryWorks handles federal, state, and local payroll tax filings, including year-end tax reporting. You also get tax law compliance counseling and workers’ compensation audit assistance.

- In addition to pay-as-you-go workers’ compensation and clergy housing allowances, MinistryWorks offers health care reporting and employee eligibility status tracking.

- It has basic HR tools for managing employee information, tracking time off, and monitoring attendance.

- MinistryWorks is the only church payroll service in this guide that provides a personal payroll specialist who can help review and check pay runs for all of its clients.

How to Choose the Best Church Payroll Software

In selecting the right church payroll service for your ministry, consider the following factors:

- Cost: Compare the fees charged by different providers and assess whether they offer a good balance between cost and the services offered.

- HR payroll features: Take stock of the features that you need. Consider providers that offer direct deposit payouts, time tracking, and employee self-service portals. For payroll compliance, you should assess whether the provider understands the unique needs and regulations related to churches and ministries. Ensure that the provider has a solid understanding of payroll tax rates and whether it handles tax withholdings, filings, and reporting accurately and in a timely manner.

- Integration with other systems: If you use accounting or church management solutions, check whether the payroll software can integrate smoothly with those systems. Compatibility and seamless data transfer can save time and reduce errors.

- Ease of use: Look for church payroll software that is easy to set up, learn, and use. You should also check the workflow automation options offered as these will help streamline HR and payroll processes.

- Customer support: Prompt assistance and guidance, including access to live support, are essential in case of any issues or questions that may arise. Make sure to look at user reviews and testimonials to gain insights into its reliability, customer service, and overall satisfaction levels.

Methodology: How We Evaluated the Top Church Payroll Services

We compared 17 payroll services for churches, looking for functionalities we believe are most important for ministries. These features include payroll and tax management tools specific to church payroll, plus attributes that make the service easy to use. We also considered providers that offer affordable pricing options, church payroll support, multiple payment options, and basic HR solutions for managing onboarding and employee benefits.

Click through the tabs in the box below to view our full evaluation criteria.

25% of Overall Score

We gave priority to those that offer automatic payroll runs and multiple payment options with at least a two-day direct deposit option. We also looked for tax payment and filing services that cover all levels (federal, state, and local taxes), including year-end tax reporting (W-2s and 1099s).

20% of Overall Score

We looked at the monthly payroll costs, including set-up and year-end fees. Preference was given to providers that have unlimited pay runs and starter payroll plans that cost less than $50 per month for one employee.

20% of Overall Score

We checked if the payroll service and solution are easy to use and have intuitive features. Additional points were given to providers who offer live phone support and can handle most of the client’s pay processing needs. We also considered integration options and user review ratings from popular third-party review sites (like G2 and Capterra).

20% of Overall Score

We gave priority to church payroll services that have expertise in the unique tax treatment of clergy housing allowances and tax exemptions. We also looked into providers that integrate well with existing church management systems and accounting software.

10% of Overall Score

We looked for basic HR tools, such as online onboarding, state new hire reporting, employee benefits options, and a self-service portal that workers can use to see payments made, edit information, and and or print forms.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.

Frequently Asked Questions (FAQs)

Anyone who is an employee of the church and receives a regular salary should be on the church payroll. This includes pastors, administrative staff, and other church employees.

Church employees who have non-clergy roles are required to pay payroll taxes, such as Social Security, Medicare, federal, state, and local taxes. Churches are also required to withhold and pay these taxes on behalf of their employees. Meanwhile, clergy staff members (like priests and ministers) are exempt from Social Security and Medicare taxes.

Church employees typically receive a W2 form at the end of the year, which reports their wages and taxes withheld. However, if an employee is considered an independent contractor, they may receive a 1099 form instead. It is important for churches to properly classify their workers as employees or independent contractors to ensure compliance with tax laws and regulations.

Bottom Line

Churches and ministries have more complicated requirements than general small businesses and need access to clergy tax law and church payroll practice expertise. Depending on your budget, there are different church payroll services to choose from. Apart from affordability, the best church payroll services should have features that help ministries pay clergy and non-clergy employees efficiently and, at the same time, be tax compliant.

We found that Gusto offers all of the features churches would need to facilitate their payroll and tax compliance needs. It’s easy to use and handles tax filings for you, and the price is reasonable when compared to other church payroll services. Sign up for a Gusto plan today.