ZipBooks, cloud-based accounting software, helps you balance your books effectively, get paid faster, and make informed business decisions through actionable insights. While it may not pack the punch of some higher-priced competitors, it is straightforward and offers excellent value for small service-based businesses.

If your business doesn’t require complex invoicing or bill payments, ZipBooks can be a solid choice. However, it’s not ideal for those that manage inventory or rely on ecommerce integrations. It includes a free plan, and its paid options start at just $15 per month. That said, I recommend Sophisticated at $35 monthly. The lower tiers lack some key features, like the ability to customize your chart of accounts—something most businesses will need sooner or later.

Pros

- Affordable paid plans

- Easy to use

- Able to switch between cash and accrual accounting

- Integrated time tracking

- Assisted bookkeeping options

Cons

- Some basic features missing in Starter and Smarter tiers

- No mobile app

- Unable to track inventory cost

- No integration for electronic bill payments to vendors

Monthly Pricing |

|

|---|---|

Discount | N/A |

Free Trial | 30 days |

Payroll | Via Gusto (read our review of Gusto) |

Standout Features |

|

Scalability | Highly scalable since the highest plan is affordable and comes with unlimited users |

Ease of Use | Is easy to use and has no steep learning curve |

Customer Support | Live support, chatbot, and self-help information |

Average User Reviews | Generally positive, but few high-quality and detailed user reviews |

- Service-based businesses: ZipBooks’ Sophisticated tier has a great built-in time tracking system that allows employees to assign hours worked to customers and projects via custom tags. These billable hours and billable expenses are tracked and can easily be added to customer invoices.

- Business with multiple locations: The platform lets you add custom tags to all transactions. These tags can be used to separate income and expenses by location, product class, project, or any other criteria that meet your needs.

- Businesses seeking bookkeeping services: Assisted bookkeeping services with ZipBooks start at only $125 per month, which is the least expensive option we’ve found among online bookkeeping services. The price even includes your subscription to ZipBooks.

ZipBooks Featured Industry Uses on Fit Small Business

- Best QuickBooks Self-employed Alternatives: Best for assisted bookkeeping that comes with a free plan

- Best Accounting Software for Handyman Businesses: Most affordable bookkeeping software for handyman business

- Best Free Small Business Invoice Generators: Best for occasional invoicing

ZipBooks Alternatives & Comparisons

| Users Like | Users Dislike |

|---|---|

| Simple to use with no software installation | Very limited free plan features |

| No unneeded features to wade through | Bank and payment processor connections sometimes need to be renewed |

| Integrated time tracker | No feature for deferred revenues |

Here are the common user sentiments, along with my expert insights:

- Outstanding user interface: Customers like ZipBooks’ ease of use, clean layout, and user-friendly design. I agree with customers because when I had the chance to explore ZipBooks’ free plan, the interface was clean and neat. The elements are not overwhelming, and the design is not harsh to the eyes.

- Enough for basic users: Reviewers like that it offers only the basic features they need, avoiding unnecessary clutter found in more complex programs. Its simplicity makes it an excellent choice for those who don’t need the advanced tools included in platforms like QuickBooks.

- No confirmation when upgrading: Clicking on a paid feature automatically upgrades your subscription without confirmation, which I found inconvenient. While ZipBooks does mark paid features with a symbol, you need to stay vigilant to avoid accidental upgrades. However, when I was testing the free plan, the automatic upgrades started a free trial period versus actually charging me immediately.

The overall user reviews are generally positive, but the number of total reviews is limited. Here are the average ZipBooks review scores on third-party sites:

- Capterra: 4.5 out of 5 based on over 100 reviews

- G2: 4.7 out of 5 based on around 85 reviews

I used our accounting case study to assess how well ZipBooks meets the needs of small business accounting. Our evaluation focused on 13 critical aspects of small business accounting, along with additional considerations, such as pricing and user reviews. Below are the results of ZipBooks compared with its direct competitors, QuickBooks Online Essentials and Wave Pro.

ZipBooks Case Study Interactive Graph

Touch the graph above to interact Click on the graphs above to interact

-

ZipBooks $35 per month

-

QuickBooks Online Essentials $65 per month

-

Wave Pro $16 per month

ZipBooks holds up well in terms of value, general features, and reporting, but it truly shines in project accounting. What I appreciate is its affordable pricing and impressive feature set. However, compared with QuickBooks Online Essentials, ZipBooks falls short in A/R and A/P but performs similarly in these areas when compared with Wave Pro.

While QuickBooks Online Essentials isn’t the most recommended plan in the QuickBooks lineup, it competes closely with ZipBooks. In this matchup, the deciding factor often comes down to price. ZipBooks wins some battles and loses others, but its price advantage—being almost half the cost of QuickBooks—can make it the more appealing choice. On the other hand, Wave Pro is even cheaper at only $16 a month, making it attractive, though it lacks any meaningful project accounting.

For freelancers, Wave is often the better choice than either ZipBooks Sophisticated or ZipBooks Free. Wave’s free version offers more robust accounting features than ZipBooks’ free tier. However, ZipBooks isn’t a long-term solution for businesses planning to scale. You’re better off starting with QuickBooks Online Essentials and upgrading to Plus or Advanced as your needs grow.

ZipBooks Pricing

In my evaluation, I looked at both pricing and quality to determine ZipBooks’ Value score, which I rated 4.5 out of 5. I believe this reflects the balance between the cost and the quality it offers. With its highest plan priced at just $35 per month, ZipBooks is reasonably affordable.

That said, ZipBooks does lack some advanced features. However, I don’t think this makes it inferior to or less capable than similar software. Instead, it just focuses on essential tools, which is justifiable given its pricing. For users who don’t need extra features, ZipBooks delivers good value.

Pricing & Features | Starter | Smarter | Sophisticated | Accountant |

|---|---|---|---|---|

Monthly Pricing | Free | $15 | $35 | Custom |

Users | 1 | 5 | Unlimited | Unlimited |

Connected Bank Accounts | 1 | Unlimited | Unlimited | Unlimited |

Invoices | Unlimited | Unlimited | Unlimited | Unlimited |

Accept Square & PayPal Payments | ✓ | ✓ | ✓ | ✓ |

Recurring Invoices | ✕ | ✓ | ✓ | ✓ |

Time Tracking | ✕ | ✓ | ✓ | ✓ |

Custom Tags | ✕ | ✕ | ✓ | ✓ |

Customized Chart of Accounts (COA) | ✕ | ✕ | ✓ | ✓ |

Cobranding | ✕ | ✕ | ✕ | ✓ |

Access Client ZipBooks Account | ✕ | ✕ | ✕ | ✓ |

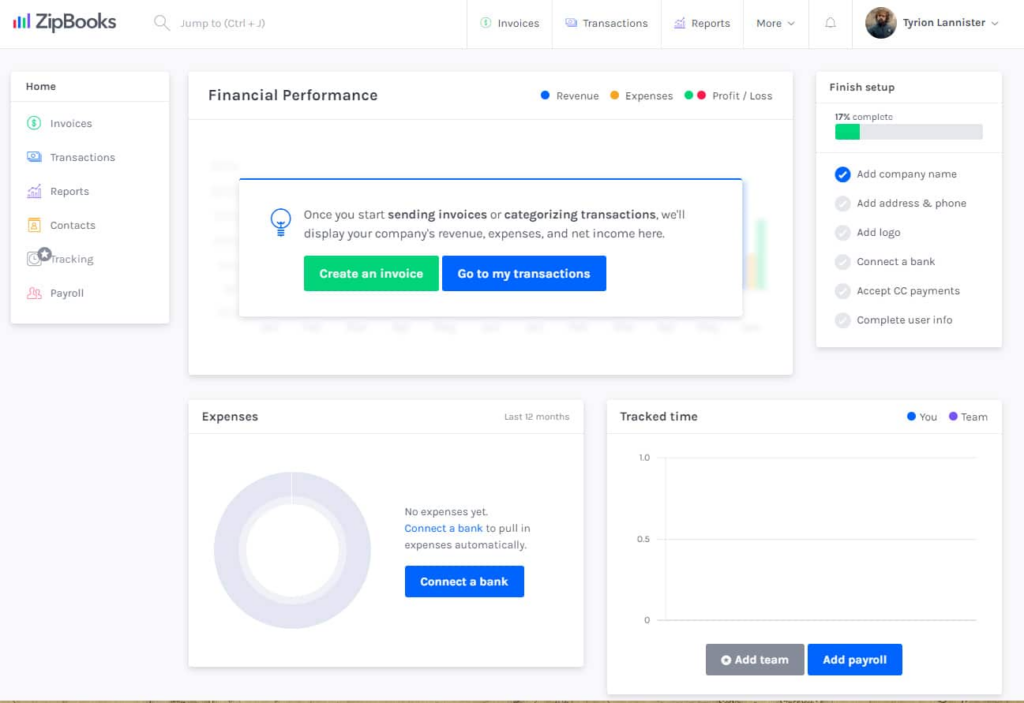

ZipBooks has a fresh, clean design that’s easy to navigate. The dashboard is simple and informative, with a quick-access menu on the left side. If you need to see more options, you can click More on the top right next to the bell icon.

One thing I noticed is the absence of a feature to add new transactions directly from the dashboard, which many other software include. For instance, adding an “Add Transaction” button would make the dashboard even more convenient.

ZipBooks dashboard (Source: ZipBooks Free Account)

Setting up your company in ZipBooks is straightforward. The settings are user-friendly, allowing you to easily update your company name, details, and other information in the Company settings module. In the Accounting Preferences section, you can configure key accounting options like your accounting basis and the closing date for your books.

However, the setup process lacks options for recording a fiscal year-end, specifying an entity type, and importing beginning account balances. The only way to input a beginning balance for an account is by creating journal entries.

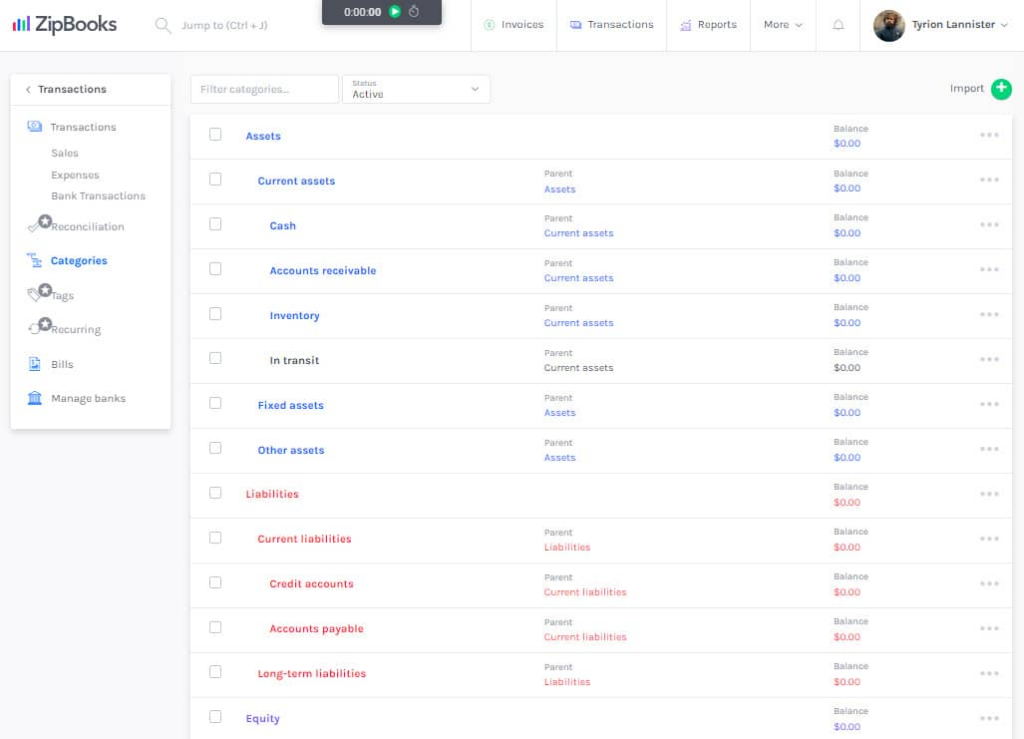

Chart of accounts: assets and liabilities (Source: ZipBooks Free Account)

ZipBooks comes with a default COA ready to use as soon as you purchase the software. If you’re on the Sophisticated plan, you can expand the COA by adding accounts for items like depreciation, amortization, and bad debts. For instance, I noticed the COA doesn’t include an Accumulated Depreciation account, so I created one and assigned Fixed Assets as its parent account.

The equity section of the COA is tailored for sole proprietorships, but it’s flexible enough to modify. You can add accounts—such as Common Stock, Additional Paid-in Capital, and Retained Earnings—to better suit your business structure.

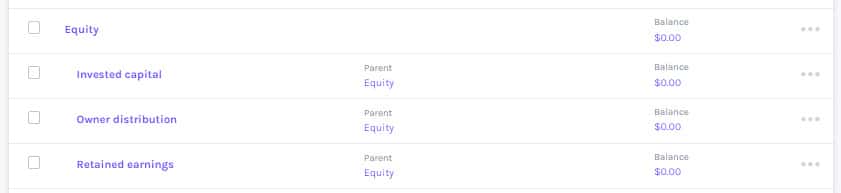

Equity Accounts on ZipBooks

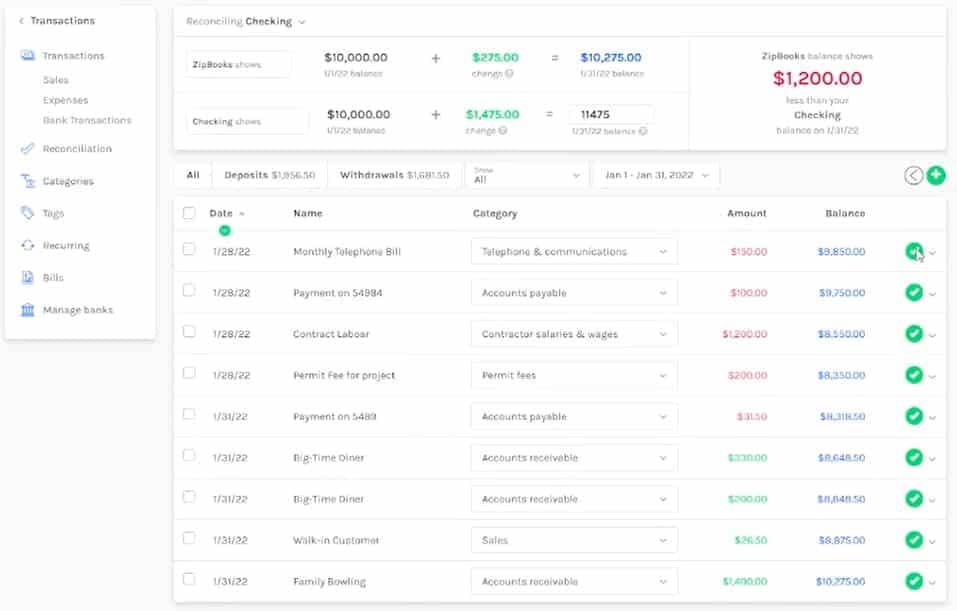

Reconciling your checking account in ZipBooks is straightforward—just ensure you enable “Reconciliation” on the COA first for each account you want to reconcile. ZipBooks approaches bank reconciliation differently than most accounting software. It doesn’t display standard line items like deposits in transit or outstanding checks, which is why I couldn’t award a higher score. Instead, it simply shows the difference between the book and bank balances.

To reconcile, you can uncheck the items listed by ZipBooks or create an adjustment entry for charges appearing in the bank statement that aren’t yet recorded in the books. When your reconciliation is in balance, the difference on the reconciliation screen will change to the number of outstanding transactions—which is the number of transactions left unmarked.

Balancing a checking account (Source: ZipBooks Free Account)

Unfortunately, while you know you’re in balance, you won’t be able to finalize your reconciliation if you have outstanding transactions. This is a pretty big issue if you write a lot of paper checks.

Another downside I’ve found with ZipBooks’ banking features is that it can’t produce a reconciliation report or print checks. If you regularly issue checks for vendor payments, I’d suggest looking into QuickBooks Online, which offers both check printing and comprehensive bank reconciliation features.

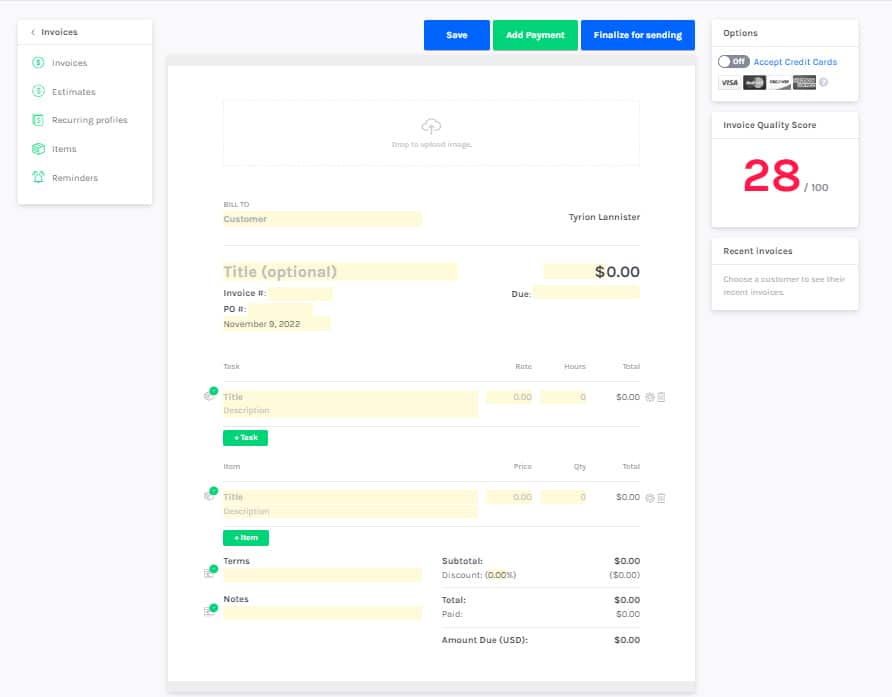

The basic invoicing function in ZipBooks is decent, though not the most impressive I’ve seen. You can upload your logo and select a custom color for the invoice, but the template’s layout isn’t customizable. On the plus side, you can add a personalized message at the bottom of the invoice.

Creating an invoice (Source: ZipBooks Free Account)

What I like about ZipBooks’ invoicing is that it allows users to add unbilled expenses and time to customer invoices, a feature typically found only in higher-priced plans like QuickBooks Online Plus. The Sophisticated plan costs $35 per month, which gives ZipBooks a competitive edge over similarly priced software.

Another useful feature is the ability to accept partial payments on invoices. When a customer makes a partial payment, ZipBooks marks the invoice as “Partial” and displays the amount paid alongside the total invoice amount on the invoice screen.

That said, ZipBooks is missing some key A/R features found in other software. One major drawback is the inability to issue credit memos for refunds—you’ll need to manually add a negative item to the original invoice. Additionally, it doesn’t support issuing receipts for cash sales. You have to issue an invoice first and then mark it as paid, which can be inconvenient.

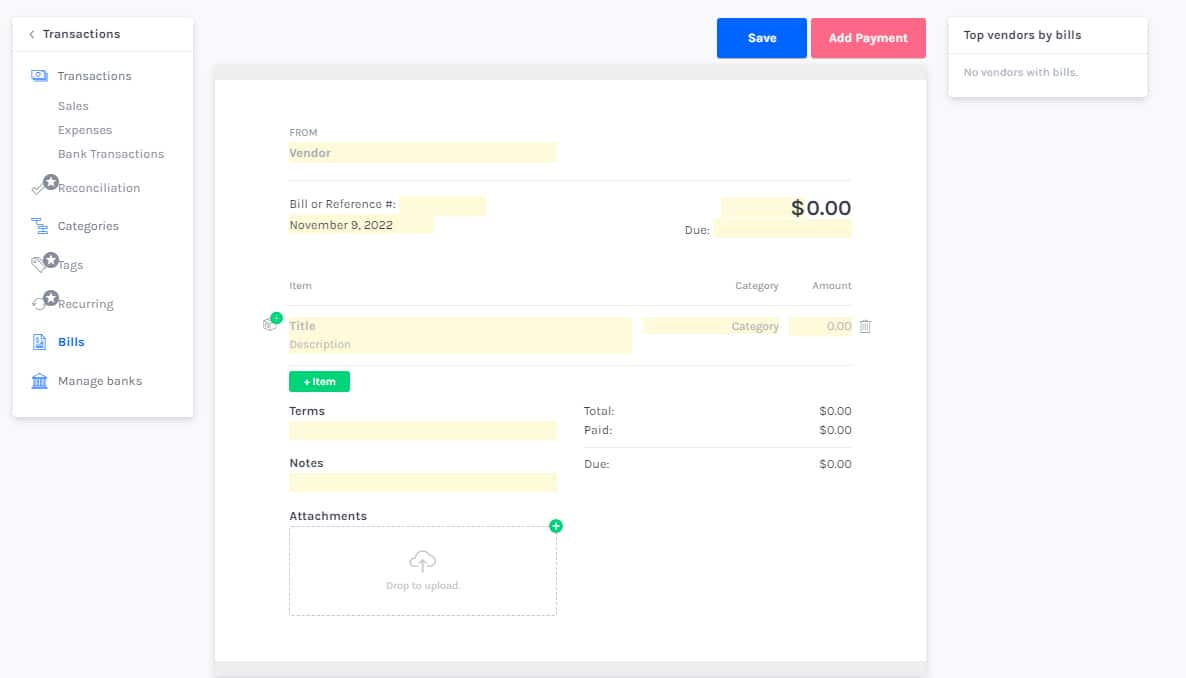

The A/P module is located under the Transactions tab. Creating vendors is simple, and you can even designate a vendor as a 1099 contractor. When creating bills, you can include items and specify which expense account should be debited.

However, I find it a bit inefficient that you can’t tag bills for custom grouping during their creation—being able to tag departments or projects directly while creating a bill would save time. Instead, you’re limited to tagging bills later in the Expense tab.

Creating a bill for inventory purchase (Source: ZipBooks Free Account)

In the image above, I created a bill for purchasing widgets. Ideally, the software should prompt me to enter the quantity of goods purchased. However, ZipBooks only asks for the total cost, making it impossible to track inventory unit costs or calculate COGS accurately. If your business manages inventory, ZipBooks isn’t the best choice—I recommend QuickBooks Online, which offers excellent inventory accounting features.

I’ve also found that ZipBooks lacks some of its competitors’ high-end features. For instance, while you can attach images of receipts to your bills and expenses, it won’t actually read the receipt and create the transaction.

It also lacks a purchase order function, which can be useful, especially for companies dealing with inventory. Finally, one of the newest features added by QuickBooks Online is the ability to initiate electronic bill payments directly from within the software. Perhaps ZipBooks will someday add this feature as well.

Unfortunately, ZipBooks lacks inventory tracking features. It doesn’t allow you to track inventory units ordered and sold, nor does it automatically record COGS or calculate the cost of ending inventory. If inventory management is essential for your business, I recommend using QuickBooks Online for its excellent stock and cost tracking capabilities.

Note: Inventory is touched on in the A/R and A/P video, so there isn’t a dedicated video for it.

I find project accounting in ZipBooks commendable and convenient, especially with its built-in time tracker. I can create projects, assign contractors, and tag income and expenses directly to each project. Billable expenses are easy to convert into invoices when creating invoices.

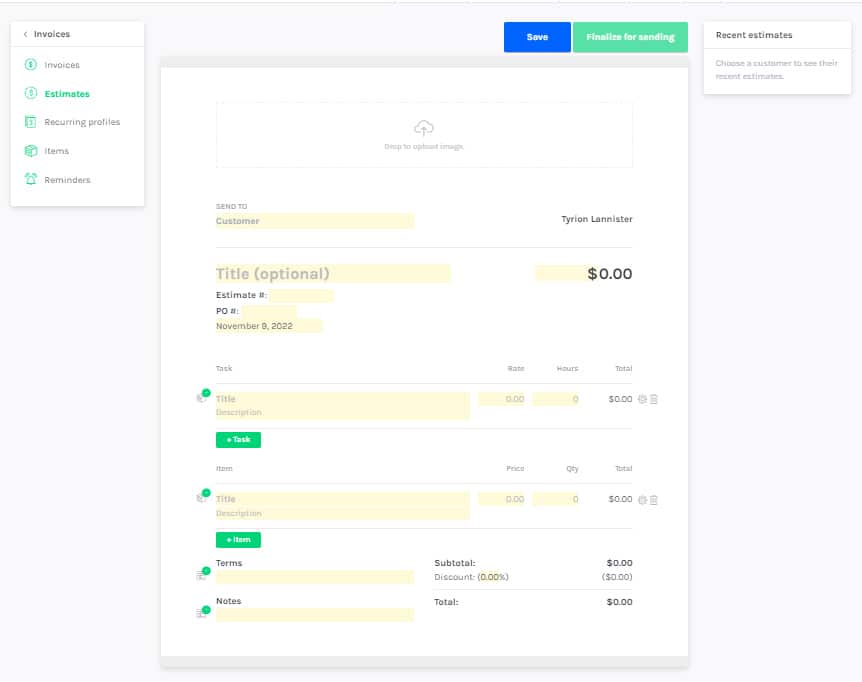

If my clients need estimates, I can create them in the Invoice tab. I appreciate that the estimates form has a similar interface to the invoicing feature, making it simple to use.

Creating an estimate (Source: ZipBooks Free Account)

However, ZipBooks doesn’t allow users to assign estimates to projects because you can only apply project tags to cash flow transactions, not to estimates. Of course, this makes it impossible to easily compare actual project costs with estimates. If you need project accounting features with this capability, I’d recommend Xero (read our Xero review).

I can create a sales tax item to track taxes collected by jurisdiction. However, the program doesn’t allow me to view my sales tax liability without printing a report. It’s also lacking features to help me determine a customer’s sales tax jurisdiction. For comparison, QuickBooks Online will automatically choose the sales tax to apply based on the customer’s address.

Note: Since this topic is covered in the A/R and A/P video, there’s no separate video.

Reporting is one of ZipBooks’ strong points. It can generate the reports that I believe should be available in small business accounting software.

Here’s the summary of the reports.

- Balance Sheet

- P&L Statement

- Statement of Cash Flows

- A/R Aging

- Income/Loss by Month

- Income/Loss by Customer

- Income/Loss by Class

- Income/Loss by Location

- Income/Loss by Project

- Unbilled Charges

- Unbilled Time

- Expenses by Vendor

- General Ledger

- Trial Balance

ZipBooks doesn’t have a mobile app. If you need one, I recommend Zoho Books because it has an outstanding and full-featured mobile app that can send invoices, receive payments, assign expenses, enter bill payments, categorize bank expenses, record time, and view reports.

ZipBooks integrates with Gusto for payroll processing, which allows users to sync hours tracked in ZipBooks with Gusto automatically. This ensures that the hours paid to employees match the hours tracked for accounting. It also integrates with Square and PayPal, making it easy to accept electronic payments from customers.

I do wish ZipBooks could pay bills electronically. An integration with BILL would be a great addition, as that would allow users to send electronic payments directly from unpaid bills in ZipBooks. I’d also like to see an integration with a sales tax manager like Avalara to streamline sales tax tracking, reporting, and return filing. If you deal with many sales tax issues, Xero is the better pick because it integrates with Avalara (read our review of Xero).

In evaluating usability, I considered the four categories below.

In my experience, ZipBooks’ customer service isn’t as accessible as some other accounting software providers. ZipBooks doesn’t offer support over the phone, but you can use the chatbot or chat with a live representative.

The live chat feature is easy to find at the bottom right corner of the screen, and it provides an estimated wait time for a response. While waiting, I can browse the Help Center for possible solutions, which help address minor issues quickly.

ZipBooks offers online bookkeeping assistance, where someone from ZipBooks will take over and organize your organization’s accounting. You must contact ZipBooks directly if you want to know the pricing of their bookkeeping assistance plan.

However, this plan is purely in-house, and there is no Advisor program similar to QuickBooks. Without a nationwide network of independent advisors, it could be hard to find a bookkeeper familiar with ZipBooks to work with you or a tax accountant comfortable with accessing and making the necessary adjustments to your books.

Setting up software can often be a weak point for many inexpensive options, but that’s not the case with ZipBooks. It offers most of the tools I need to transfer data from prior software automatically. Below are the items I typically expect software to import from a spreadsheet or CSV file and how ZipBooks performed.

Chart of Accounts | ✓ |

Vendors | ✓ |

Customers | ✓ |

Service/Inventory Items | ✕ |

Beginning account balance | ✕ |

I find ZipBooks generally easy to use, particularly the Sophisticated plan. However, the Free and Smarter options can be frustrating because you can easily accidentally upgrade to the Sophisticated tier. If you click on a feature exclusive to the Sophisticated tier, your subscription automatically upgrades without asking for confirmation. During my evaluation of the tool, I had to repeatedly navigate back to my subscription settings to downgrade to the Free plan.

Another issue that affects the Ease of Use score is the dashboard. I’d really like the ability to customize it so that I can see exactly what I want as soon as I open the program. Additionally, having a single button on the dashboard to quickly start a new transaction of any kind would make the experience much smoother.

How I Evaluated ZipBooks

I evaluated ZipBooks and other leading small business accounting software using an internal scoring rubric with 13 major categories. You can read a more detailed description of my methodology by visiting our accounting software study page.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

No, ZipBooks has no payroll features, but you can track time on ZipBooks and sync it with Gusto, a payroll provider.

Yes, it uses 256-bit TLS encryption, which is similar to the encryption used by banks and entities handling sensitive information.

Yes, and ZipBooks is good-quality accounting software. It also offers bookkeeping and tax assistance for a separate fee. It competes with QuickBooks in providing accounting software services to service-based businesses.

Bottom Line

ZipBooks provides the essential accounting functions most businesses need, as long as you don’t manage significant inventory. It’s user-friendly, even for DIY accounting. While I recommend the Sophisticated plan for service-based businesses, I’d steer clear of the Free or Smarter plans since they lack fundamental features like the ability to customize your chart of accounts.