Zoho Books is cloud-based accounting software that streamlines various tasks, such as income and expense tracking, invoicing, project accounting, and inventory management. It offers a free plan for businesses making less than $50,000 in annual revenue and five paid subscriptions that start at $20 monthly per organization.

Users find Zoho Books’ free plan great for startups and very small businesses, and they also like that it has flexible paid options that allow them to upgrade as their business scales. However, some said they wished it was easier to use and that the business form templates were more customizable. Learn if the tool’s right for your business through my detailed Zoho Books review.

Pros

- Competitive free plan

- More affordable than similar software

- Email, phone, and live chat support in all paid tiers

- Best accounting mobile app we’ve reviewed

Cons

- Difficult to find bookkeeping assistance in the US

- Invoices limited to $1,000 per year in the free option

- Advanced features, like project accounting and inventory management, are available only in the higher plans

- Professional plan required to manage and track unpaid bills

Pricing |

|

Discount | ✕ |

Free Trial | 14 days |

Payroll | |

Standout Features |

|

Ease of Use | Excellent—thanks to the ability to add additional seats to any paid plan for just $3 per user, per month Generally easy to use but still has a learning curve, especially for new users |

Customer Support | Phone support, live chat, email support, and self-help resources |

Average User Reviews | Generally positive; praised for its mobile app and customer support |

- Businesses seeking an alternative to QuickBooks: As our top pick for the leading QuickBooks alternatives, Zoho Books offers many of the same features you’ll find in QuickBooks Online—but at a lower price. As an example, Zoho Books offers project accounting and inventory management in its Professional plan at $50 a month compared with QuickBooks Plus at $99 monthly.

- Freelancers and self-employed businesses: You can create and send professional invoices, track time and project expenses to include on invoices, and manage all your clients in one place—making Zoho Books our top-recommended accounting software for freelancers.

- Ecommerce companies looking for integrated management software: Zoho Books integrates with the other Zoho products, like Zoho Inventory and Zoho Commerce, which automates the different aspects of your ecommerce business. It’s in our roundup of the best ecommerce accounting software.

- Businesses wanting accounting software with a powerful mobile app: Its mobile app can do all the basic general accounting features, like sending invoices, entering bills, and recording billable time. This is why it leads our list of the top mobile accounting apps.

- Consultants: Zoho Books is our leading accounting software for consultants because of its workflow automations, document management, and client portal access. It also tracks billable time and expenses—a crucial component of accounting for consultants.

Zoho Books Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Great mobile accounting app | Agents don’t return phone calls or follow up on emails |

| Invoicing and maintaining basic accounts | Slow importing information from banks and connections often break |

| Free version and an option to upgrade | Limited invoice customization |

| Clear user-friendly reporting | Integration with non-Zoho apps is difficult |

Here are some common sentiments from users and my expert opinion:

- Scalable plans: One reviewer commented that Zoho Books’ free tier is great for startups and small businesses. I also like that it has flexible plans, meaning you can easily upgrade for extra features as your business grows.

- Can’t be integrated with other software: Several users commented that while Zoho Books integrates nicely with many other Zoho applications, it’s difficult or impossible to integrate with many third-party apps. I agree that Zoho Books has few third-party integrations, especially when compared with QuickBooks, but Zoho Books does have some great native integrations like Zoho Inventory, Zoho Expense, and Zoho Commerce.

- Poor customer service: As with pretty much any software, there are users dissatisfied with customer service. While I don’t have personal experience with its support team, I’m sure it has a lot to do with the individual service agent you work with—and, usually, mostly the bad experiences get reported.

- Not that easy to use: One reviewer shared that it took them some time to learn and understand how to use the software, which is understandable since it’s a complicated program with plenty of features to master.

- Advanced features are only in higher tiers: You need to get at least the Professional plan to access advanced features, like bill management and inventory tracking—and some consider that a drawback. However, I’d point out that Zoho Books’ higher plans are still considerably more affordable than those in similar premium software, like QuickBooks Online.

As of this writing, here’s how Zoho Books is rated by third-party sites:

Fit Small Business Case Study

To determine how Zoho Books stacks up against similar software, I used the Fit Small Business case study to compare it with Wave, Xero, and QuickBooks—which are my recommended alternatives above.

The chart below sums up the results.

Touch the graph above to interact Click on the graphs above to interact

-

Zoho Books Pro $50 per month

-

QuickBooks Online $99 per month

-

Wave Pro 16 per month

-

Xero Established $80 per month

As shown in the chart, our case study reveals that Zoho Books is similar to QuickBooks Online across many features but lags a bit behind in A/P, sales tax, and usability. Its strongest feature is its mobile app—and Zoho Books is the only software we’ve reviewed to ace that category. Each of these categories is discussed in detail below.

Zoho Books Pricing

Zoho Books offers a free plan for businesses that make less than $50,000 per year in revenue. If needed, you can upgrade to any of the five paid tiers, with monthly prices ranging from $20 to $275 per organization.

I evaluated the Professional plan in our accounting software rubric and awarded it a very good 4.55 out of 5, which is slightly lower than the 4.61 awarded to QuickBooks Online Plus but higher than the 4.23 of Xero Established. The value score is determined by comparing the price of the software to the case study score before consideration of the price.

The table below shows how Zoho Books’ plans compare in terms of pricing, users, and features. If you want to see the complete comparison, you can check out the provider’s pricing page.

Pricing & Features | Free | Standard | Professional | Premium | Elite | Ultimate |

|---|---|---|---|---|---|---|

Monthly Pricing | $0 | $20 | $50 | $70 | $150 | $275 |

Users Included | 1 | 3 | 5 | 10 | 10 | 15 |

Monthly Cost for Additional Users | $3 per user | $3 per user | $3 per user | $3 per user | $3 per user | $3 per user |

Manage Invoices (A/R) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Manage Unpaid Bills (A/P) | ✕ | ✕ | ✓ | ✓ | ✓ | ✓ |

Track Sales Tax | ✕ | ✓ | ✓ | ✓ | ✓ | ✓ |

Track Inventory | ✕ | ✕ | ✓ | ✓ | ✓ | ✓ |

Advanced Inventory Control | ✕ | ✕ | ✕ | ✕ | ✓ | ✓ |

Import Bank Statements | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Connect Bank Feeds | ✕ | ✓ | ✓ | ✓ | ✓ | ✓ |

Project Accounting | ✕ | ✕ | ✓ | ✓ | ✓ | ✓ |

Mileage Tracking | ✓ | ✓ | ✕ | ✓ | ✓ | ✓ |

Manage Budgets | ✕ | ✕ | ✕ | ✓ | ✓ | ✓ |

Forecast Cashflow | ✕ | ✕ | ✕ | ✕ | ✓ | ✓ |

Advanced Analytics | ✕ | ✕ | ✕ | ✕ | ✕ | ✓ |

Zoho Books has all the basic features I expect in an accounting program, which is why it nailed my assessment of the category. I can customize my chart of accounts and use account numbers if I prefer. It’s easy to add and customize the access rights of additional users, including inviting my external accountant to view my books. Custom tags allow me to classify separate transactions by my chosen criteria—like location, division, or product class.

Important for larger companies with multiple users, you can set a closing date that prevents other users from changing prior-period information. This is a crucial year-end step that ensures nothing changes once your books are closed and tax returns are prepared.

Zoho Books has excellent banking features, including the ability to print checks—which seems basic but isn’t generally available in Zoho’s cheaper competitors like Wave and ZipBooks. I can choose between importing bank transactions through a live bank connection or uploading them from a bank statement or CSV file. Once imported, Zoho Books recommends classifications and tries to match them to any existing transactions in my books. I can easily change any recommendations that are incorrect.

Monthly bank reconciliations are a fundamental of good bookkeeping, and Zoho Books provides an easy way for me to reconcile my accounts. It will automatically mark any imported transactions as cleared, which might save me a few minutes. It also allows me to manually enter a statement balance and then manually mark transactions as cleared. This is great if I don’t want to import bank transactions because I enter everything as soon as it happens rather than waiting for it to clear the bank.

The only thing I found missing in Zoho Books is a good undeposited funds feature, which allows customer payments to be grouped into single deposit amounts so that the amount of the deposit in my check register matches the amount on the bank statement. This cost Zoho Books points in my evaluation.

While it provides an undeposited funds account, you have to manually track undeposited cash and checks in that account. QuickBooks does a better job by actually listing individual customer payments sitting in undeposited funds. These payments can be clicked and automatically added to a deposit slip.

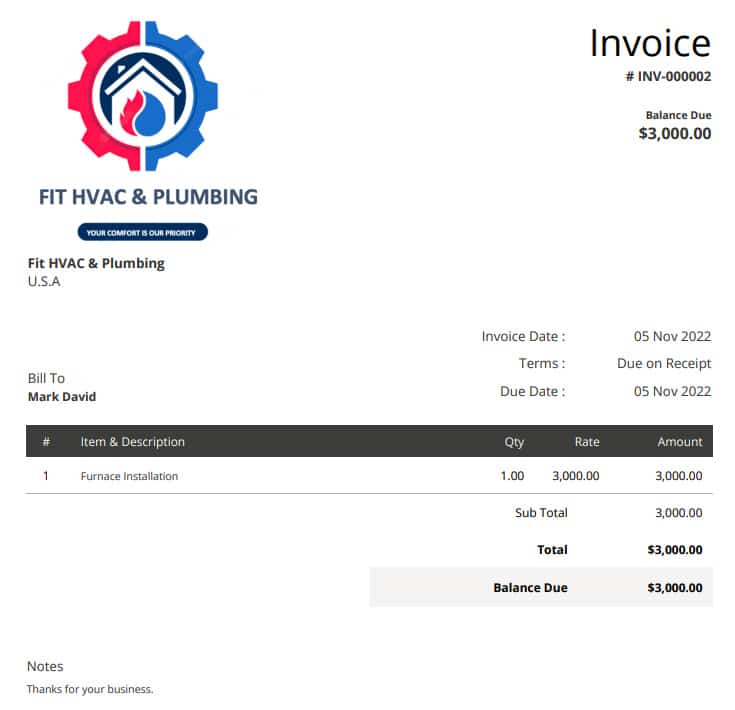

Invoicing is a crucial function for almost every business—and Zoho Books aced my review of the feature. Of course, it handles the basics, like printing or emailing invoices, accepting short payments from customers, and issuing credit payments. However, I was happy to see it also handles the more unusual stuff like refunding credit balances, adding labor and expenses to invoices, and setting up recurring invoices.

Zoho Books gave me plenty of options for customizing my invoice. Not only could I add my logo and change the colors, but I could make more substantial customizations, like deciding which fields should be included on the invoice. I can even create custom fields to be added to my invoice.

Sample customized invoice in Zoho Books

A unique invoicing feature is the ability to send your invoice in different languages and choose the appropriate currency based on the particular location of your business or customer. You can send recurring invoices or schedule them to be sent in advance and add attachments, discounts, shipping charges, and a salesperson field. When your invoice is sent, it reminds customers of unpaid balances, allowing easy payment.

Zoho Books has great general A/P features that let me manage my unpaid bills—it’s easy to create, track, and pay bills. It also handles a few of the more unusual situations, like recording credits issued by your vendors and then applying those credits to your bills before paying them.

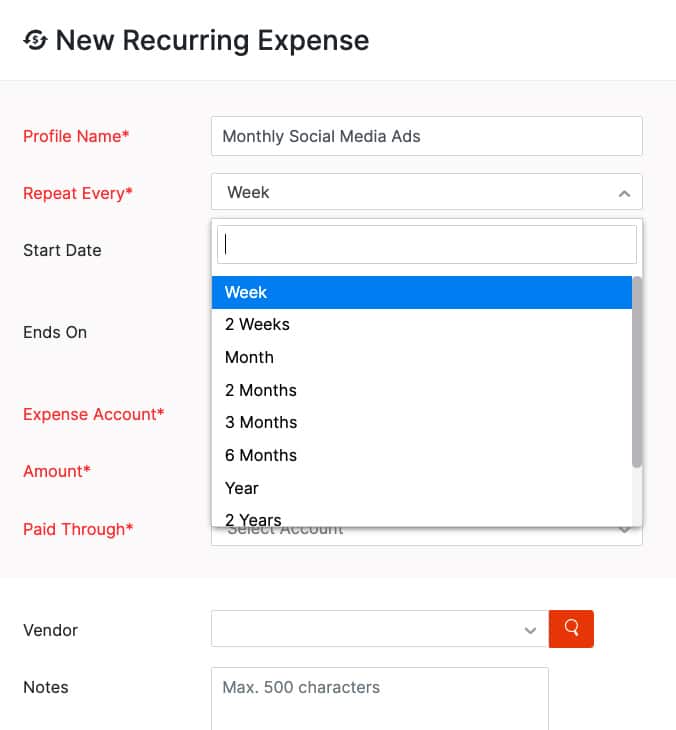

When I have periodic payments to make, such as utility bills and monthly marketing expenses, I can set up recurring payments and add payment reminders so that I can track bills to be paid easily. Recurring expenses can be scheduled to be sent out every week, every two weeks, every month, or at any frequency I desire.

Creating recurring expenses in Zoho Books

One shortfall of Zoho Books is the inability to initiate online payments to my vendors like I can with the QuickBooks Bill Pay feature within QuickBooks Online. Melio and BILL are great third-party apps for making online payments, but neither of these integrates with Zoho Books. Another weakness of the A/P features in Zoho Books is that receipt capture costs an additional $10 per month for 50 scans. QuickBooks and Xero include unlimited receipt scans for free.

Zoho Books has complete inventory tracking features for tracking stock levels. It will track the cost of goods available for sale and divide that cost between the ending inventory and the COGS. I could even sort items based on product details, vendor details, and stock keeping units (SKUs). For retailers that suffer shrinkage, inventory quantities can be manually adjusted, and Zoho Books will automatically deduct the cost of the lost inventory.

Another useful inventory tool is the Price List feature, which provides a convenient way to customize item prices for specific customers (i.e., family and friends and high-volume customers). If inventory accounting is important to you, then Zoho Books is a great choice.

The only inventory feature missing from Zoho Book is the ability to choose between multiple inventory cost-flow assumptions—like LIFO and average cost. The program only allows LIFO, which can present a big problem if you switch to Zoho Books and are currently using average cost on your tax return.

You’ll need to request a change in accounting method from the IRS to change from average cost to FIFO. The lack of choices for inventory costing is pretty typical among small business accounting software, however, including QuickBooks Online.

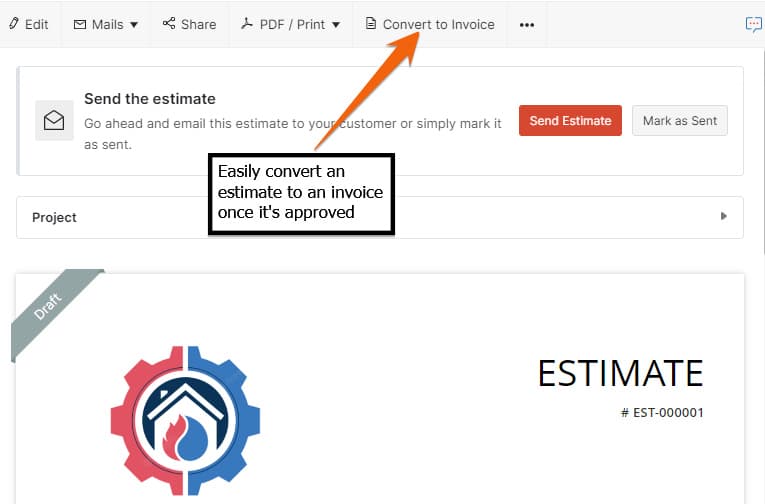

Zoho Books aced project accounting. I can create multiple projects for clients and assign income, expenses, and inventory to each project. I can then view the income and loss per project.

I can also create estimates and assign them to projects. When the estimate is approved by the client and ready to invoice, I can easily convert it to an invoice. Unlike in QuickBooks Online, I can view my actual income and expenses compared to my estimated income and expenses by project.

Estimates can be easily converted to invoices in Zoho Books

Zoho Books provides the level of project accounting I expect from a general bookkeeping system, but if you need a more sophisticated system, explore our list of the best project accounting software.

Zoho Books handles the basics of sales tax accounting. I can manually set up as many sales tax jurisdictions as necessary, then separately track sales tax collections and view the accumulated sales tax liabilities. When it’s time to remit the tax, Zoho Books will automatically record the payment against the liability to the appropriate jurisdiction. For brick-and-mortar businesses that are only doing business locally, these features should suffice.

However, if you are an ecommerce business that must collect sales for a large number of jurisdictions, Zoho Books isn’t great unless you buy an integration. On the other hand, QuickBooks Online works well with multiple jurisdictions because it determines the appropriate jurisdiction based on the customer’s address. Luckily, Zoho Books does integrate with Avalara, which provides excellent ecommerce sales tax features.

Zoho Books has an excellent selection of financial and accounting reports. These include a general business overview, P&L statements, cash flow statements, balance sheets, general ledger, trial balance, and A/P and A/R aging reports. Other handy management reports include transaction lists by customer and vendor and a separation of the income statement by class and location.

Zoho Books has—hands down—the best mobile app among all the small business accounting software I’ve reviewed. Available on iOS and Android devices, it offers all the mobile accounting features I wanted to see, including the ability to send invoices, receive payments, capture expense receipts, record time worked, and view reports. If you need an accounting app that can help you stay on top of your books even when you’re on the road, then Zoho Books is a great choice.

Zoho Books integrates with a huge array of other Zoho products that can be used to manage your business. They have what I view as the most important integrations—including payroll, time tracking, customer payment processing, and sales tax.

However, I can’t find an integration to initiate online payments to your vendors. Two of the most popular vendor payment services are BILL and Melio, but neither offers a Zoho Books integration.

I scored Zoho Books poorly in terms of usability, mostly because of a lack of bookkeeping support in the US. It’s a great accounting program, but you’ll be more or less on your own when you have bookkeeping questions. I evaluated usability in four categories.

It might be hard for you to find a bookkeeper familiar with Zoho Books who can help you when you have questions. While it does have a formal Zoho Books Advisor network, 22 states in the US lack a single advisor—contrast this to the QuickBooks ProAdvisor network, which has hundreds of advisors in each state. I was also unable to find an online bookkeeping service that works with Zoho Books users.

Zoho Books offers good customer service options, including telephone support, live chat, chatbot, and email. However, telephone and live chat support is only available during business hours. Zoho Books also offers a nice user community and self-help information where you might get some of your bookkeeping questions answered.

I was able to import most of the necessary information when setting up my company, like my chart of accounts, account balances, customers, and vendors. However, I had to enter my service items manually. While there is no dedicated onboarding assistance, you can take advantage of its live telephone customer service for any issues you may have.

As an experienced accountant, I found Zoho Books very easy to use, but I think less experienced bookkeepers will like it as well. Ease of use is often about the little things. For instance, when I enter a bill or invoice, I can quickly add a new vendor or customer if needed. This saves a lot of time compared to canceling the bill or invoice, creating the vendor or customer, and then coming back.

Another factor that makes Zoho Books easy to use is viewing a lot of valuable information without printing a report. For example, I can view outstanding invoices, A/R balance by customer, and customer transactions all from within the program without creating a report.

How I Evaluated Zoho Books

I evaluated Zoho Books using an internally developed scoring rubric with 13 major categories. You can read a more detailed description of our methodology by heading over to our case study.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

Yes, it is. If you only need five users and need project accounting and inventory, you can save with Zoho Books Professional ($50 monthly per organization), as opposed to QuickBooks Online ($99 a month).

Zoho Books’ biggest strengths over its competitors are its fully-featured mobile accounting app and integration with the entire line of Zoho apps, which help users manage all aspects of the business.

Depending on your needs, you may prefer QuickBooks Online, Sage 50 Accounting, or Wave. For instance, if you want a free solution, choose Wave. If you want easy access to local bookkeepers, QuickBooks Online might be better. Read our guide on the best small business accounting software for more options.

Bottom Line

Zoho Books is high-quality small business accounting software with features similar to QuickBooks Online for a substantially lower price. However, you might have trouble finding a bookkeeper familiar with Zoho Books who can offer you support when you have bookkeeping questions.