To accept payments on your iPhone, you will need an internet or cellular connection, a compatible mobile card reader, and a corresponding payment app downloaded to your phone.

The best credit card readers for iPhone can process swipe, chip, and contactless payments for a small transaction fee with no monthly minimums or restrictions. The best iPhone payment apps are also easy to use, can deposit funds into your account quickly, and have good user reviews.

Based on our evaluation of over a dozen options, the best credit card readers for iPhones are:

- Square: Best overall (and best free)

- PayPal Zettle: Best for solopreneurs

- Shopify: Best for online businesses accepting in-person payments

- SumUp: Cheapest for low-ticket sales

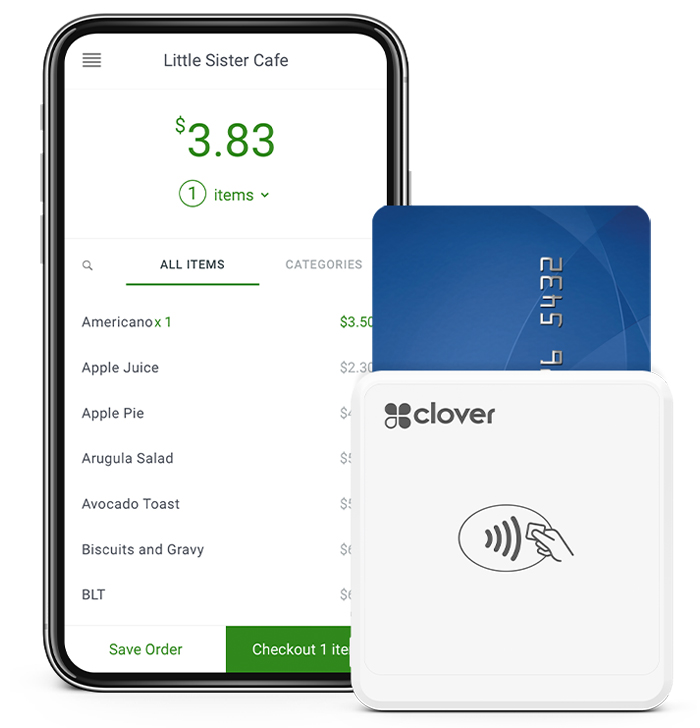

- Clover: Best if you have a preferred payment processor

- Payanywhere: Best for small mobile restaurants

- Payment Depot: Cheapest for high-volume sales U.S. businesses only

Best Credit Card Readers for iPhone Compared

Mobile Card Reader Cost | Payment Method | Monthly Fee | Swipe, Chip, and Contactless Rate | Chargeback Fee | Payment App User Review | |

|---|---|---|---|---|---|---|

| $49; first magstripe reader free | 2-in-1 (tap and dip) | $0 | 2.6% plus 10 cents | Waived up to $250 per month | |

| $79; first reader discounted to $29 | 2-in-1 (tap and dip) | $0 | 2.29% plus 9 cents | $0 to $20 | |

| $49 | 2-in-1 (tap and dip) | $0 to $89 | 2.4% to 2.7% | $15; refundable | |

| $39–$129 | 3-in-1 (tap, dip, and swipe) | $0 | 2.75% | $0 | |

| $49 | 3-in-1 (tap, dip, and swipe) | $0 to $14.95 | 2.6% plus 10 cents* | From $25 | |

| $59.95 | 3-in-1 (tap, dip, and swipe) | $0 | 2.69% | $25 | |

| $49** | 3-in-1 (tap, dip, and swipe) | $79 | Interchange plus 8 cents | $25 | |

*Based on Fiserv rates. Fees will depend on your chosen payment processor.

**Payment Depot is only available to U.S. businesses

Did you know?

Apple Pay is a popular payment method among iPhone users. iPhones are also now equipped with tap-to-pay that can send and accept payments even without a mobile credit card reader. Both payment methods apply contactless rates so merchants should also consider payment processors with cheap contactless fees.

To learn more about the technology behind contactless payments, see our guide to near-field communication (NFC) payments.

Get a Personalized Recommendation

Are you still not sure which iPhone credit card reader is best for you? Take this quiz for our recommendation. It is only three questions and will provide a result without redirecting you to another page.

Are you looking for something different? We have several guides on mobile and in-store payment solutions, including:

- Best Credit Card Payment Apps

- Best Mobile Credit Card Processing

- Best Card Readers for Android

- Best Card Readers

Many of the best iPhone card readers also appear in the above articles.

Square: Best Overall Credit Card Reader for iPhone

Pros

- Easy to use

- Powerful POS system

- Best payment hardware

- Additional plans and tools as your business scales

Cons

- Limited customer support hours

- Must use Square payment processing

- Many complaints in the App Store about held funds

What we like:

Square offers competitive rates with no monthly fees or upfront costs. It provides reliability, security, and a suite of business management tools and scalable hardware, making it the overall best iPhone credit card reader.

Small businesses like food trucks and cafes choose Square for its easy setup and simple payment processing rates. In addition, if you expand and find yourself needing payroll, scheduling, or other software, Square also has these.

Square’s transaction fees are average—not the cheapest, but the powerful free point-of-sale (POS) system and inexpensive card readers make Square a favorite among small merchants.

- Monthly fee: $0

- In-person (including contactless): 2.6% plus 10 cents tap, dip, or swipe

- Keyed-in: 3.5% plus 15 cents

- Online, recurring, and invoicing: 2.9% plus 30 cents

- Chargeback fee: Waived up to $250 per month

- Free POS software

- Next-day funding, same-day with fee

- Card reader: $0 to $49 for chip and tap (one free swipe reader)

- Accepts tap, dip, Apple Pay, Google Pay, and other NFC payments

- Offline payment processing

|  |

$10 (first one is free) Available with lightning or audio jack input. Accepts payments via magstripe (swiped). | $49 Connects via Bluetooth. Accepts payments via EMV (chip) or NFC (Apple Pay, Google Pay). |

Square’s POS app can record both cash and card payments, add tips to each transaction, split sales between different payment methods, and send customer receipts via text or email. Square also works even without an internet connection.

As of this writing, Square ties with SwipeSimple (Payment Depot) for best ratings on the Apple App Store. It has 4.8 out of 5 stars with some 400,000 ratings.

Users Like | Users Don’t Like |

|---|---|

Easy to set up and use | Issues of frozen accounts and funds |

Scalable | Customer support not helpful |

PayPal Zettle: Best for Solopreneurs & PayPal Users

Pros

- Free POS with no minimums

- Low swipe fees

- Very easy to use

- Pays immediately into PayPal

- Accept Venmo payments

Pros

- No offline mode

- Basic POS functionality

- PayPal has a reputation for freezing accounts

- Increasingly negative user reviews: 3.2 out of 5 on App store

What we like:

The PayPal Zettle card reader is simple but powerful and, combined with PayPal’s ability to accept all kinds of payments (from credit cards to bitcoin, Venmo, and even cross-border payments), a top contender for one of the best mobile credit card processors in the market.

PayPal’s reader includes a PIN pad that can process chip, tap, or swipe transactions. Your first PayPal Zettle card reader is discounted to $29.

We like PayPal best for individual users because while it is very easy to use, it has limited POS functionality that larger operations would need. It also doesn’t charge monthly fees for inactivity.

- Monthly fee: $0

- Card-present (including contactless): 2.29% plus 9 cents

- Keyed-in: 3.49% plus 9 cents

- QR code payments: 2.29% plus 9 cents

- Chargeback fee: $20

- Free POS Software

- Next-day funding, same day with fee

- Card reader: $79 (first one, $29)

- One-year limited warranty

- Accepts debit and credit EMV cards, NFC payments, gift cards, and Venmo payments

|  |

$79 (first one $29) Connects via Bluetooth and accepts payments via EMV (chip) and NFC contactless payments (Apple Pay, Android Pay). | $49 Locks the Zettle 2 reader into place for countertop use and charges in-dock. |

Zettle Go is a complete POS app for your mobile device—from ringing up credit card sales to generating sales reports. It has an inventory management system with product images integrated into your main countertop software for seamless selling in-store, curbside, and on the go.

As of this writing, Zettle has 3.0 out of 5 stars on the Apple App Store with more than 700 reviews. One of the most recent complaints is that data from PayPal Here does not carry over. Users also had problems with setup, including being unable to change the app from Spanish to English. Customer support also received complaints. For more responsive help, consider Payment Depot.

Users Like | Users Don’t Like |

|---|---|

Easy to use | Can’t enable manual card entry |

Discount coupons feature | Tipping function on the small card reader screen instead of the app |

Shopify: Best for Online Businesses With Occasional In-person Sales

Pros

- User-friendly mobile app interface

- Customizable mobile checkout

- Strong omnichannel features

- 4.5 out of 5 rating on App store

Cons

- Limited offline features

- Locked into Shopify Payments to use the mobile card reader

- Requires a Shopify Ecommerce subscription

- Payouts take two business days

What we like:

Shopify is a powerhouse name for ecommerce businesses, providing its users with outstanding omnichannel tools so you can reach customers anywhere. It offers a 2-in-1 credit card processor for iPhones and Androids at $49 (similar to Square).

In addition, Shopify lets you sync online and in-person sales, such as curbside and pick-up orders, pop-up shops, and selling at trade fairs. These features make Shopify among our best retail POS systems and bring it to the top of our list of multichannel POS systems.

- Monthly fee: $0 to $89 (plus $39 to $399 for a Shopify ecommerce account)

- In-person transaction (including contactless): 2.4% to 2.7%

- Online transaction: 2.4% plus 30 cents to 2.9% plus 30 cents

- Chargeback fee: Varies

- Funding: 2 business days

- Card reader: $49

- Tap, dip, Apple Pay, Google Pay, and other NFC payments

- One-year limited warranty plus two-year extended warranty with a POS Pro plan

|

Shopify Tap & Chip Card Reader $49 Bluetooth-enabled, EMV-certified mobile card reader that accepts chip and contactless payments for Visa, Mastercard, American Express, Discover, Apple Pay, and Google Pay. |

The Shopify POS app comes free for all Shopify plans including the free Shopify POS Lite. It has a built in inventory and CRM features that works with Shopify’s omnichannel system, allowing for seamless selling to your in-store, curbside, and on-location customers.

The Shopify POS app earned an impressive 4.5 out of 5 stars on the Apple App Store from more than 7,300 reviews as a solid, dependable app with flexible features. However, the most recent feedback, even from those who have given the platform high ratings, is that the latest design and user interface updates are less favorable.

Users Like | Users Don’t Like |

|---|---|

Easy to use interface | Login and user caching issues |

Affordable card reader | Failed contactless payment transactions |

SumUp: Best for In-person Businesses With Low-ticket Sales

Pros

- Pay-as-you-go transaction fees

- Free payment app and virtual terminal

- Easy two-step sign-up process

- PIN pad mobile card readers

Cons

- Account stability issues with holds, freezes, and closures

- Does not support high-risk merchants

- Limited multichannel/sales ecommerce integration

- Poor user reviews: 2.5 out of 5 App Store rating

- Customer support only available during business hours

What we like:

SumUp is a mobile-first payment processor built for small businesses. It does not charge any monthly fees or tie you up in a long-term contract, making it one of the industry’s most affordable merchant services providers. The system is ideal for small in-person businesses with low-volume ticket sales.

Recently, SumUp launched upgraded card readers, which earned it a score of 4.01 out of 5—a significant improvement from our previous evaluation. It also comes with a virtual terminal, basic inventory management features, and reliable app functionality.

- Monthly fee: $0

- In-person transaction (including contactless): 2.75%

- Online transaction (payment gateway): 3.25% plus 15 cents

- Virtual terminal processing: 3.25% plus 15 cents

- Chargeback fee: $0

- Funding: 1 to 2 business days

- Card reader: $39 to $129

- Accepts EMV chip, contactless (NFC), Apple, and Android Pay

- 1-year warranty

|  |

$39 ($49 with dock) Features an LED screen, tip function, Bluetooth connectivity, comes with charging dock, connects with SumUp app. | $129 Standalone card reader and payment processor, touchscreen panel, refund and dynamic tipping tools, invoice processing |

The SumUp App supports a POS function that includes a product catalog, smart tipping, tax setting, refund issuing, and employee management tools. It also allows merchants to process payments, create and manage invoices, and access reports from the dashboard.

Real-life user reviews for SumUp’s iPhone mobile app have considerably improved over the last year, from a low score of 2.6 to a 3.5 out of 5 stars. Still, the actual number of reviews is only about 300, which affected our evaluation of its popularity.

Users Like | Users Don’t Like |

|---|---|

No issues of frozen funds | Occasional app crashes |

Great deal for second card reader | Manual entry of sales items |

Clover: Best for Merchants With a Preferred Payment Processor

Pros

- Highly rated mobile app

- Can be programmed to work with most merchant services and payment processors

- Accepts payments offline

Cons

- Requires paid plan to access inventory tools

- Limited POS features available to the mobile card reader

- Lacks same-day funding option

What we like:

Clover hardware is compatible with most popular payment processors, so you’ll find it offered on multiple payment provider websites. Available POS features depend on the hardware you use so small merchants only pay for what they need according to their business size.

Merchants who prefer to keep their current payment processor or merchant services provider but want to upgrade hardware and POS software will find Clover the best iPhone card reader for this unique feature.

- Monthly fee: $0 to $14.95

- In-person transaction fee (including contactless): 2.6% plus 10 cents

- Keyed-in transaction fee: 3.5% plus 10 cents

- Contract length: Month-to-month

- Chargeback fees: $25

- Card reader: $49

- Accepts traditional magstripe credit cards, EMV chip cards, and NFC contactless payments

|

($49) 3-in-1 Bluetooth-enabled mobile card reader |

Clover’s credit card reader comes with its proprietary POS software, which merchants can use with their preferred payment processing provider. What’s unique about this is that available POS functions are determined by the hardware. Merchants using Clover Go can choose between a free account for simple payment processing and payment tracking while those who require basic inventory management tools can subscribe to the paid plan at $14.95 per month.

Clover Go is both popular and highly rated, earning a score of 4.8 out of 5 from nearly 37,000 user reviews on the Apple App Store.

Users Like | Users Don’t Like |

|---|---|

Quick set up | Difficult to process an exchange |

Ability to review transactions | Sales processing issues after software update |

Payanywhere: Best for Low-volume Restaurants & Food Trucks

Pros

- Low fees on small transactions

- No chargeback fees

- Free same- and next-day funding

- Autopay for subscriptions and recurring payments

Cons

- Possible long-term contracts with hefty early termination fees on custom plans

- Lacks echeck and ACH processing

- Charges an inactivity fee

- Limited customer support hours

What we like:

Payanywhere is an all-in-one payment processing solution with a mobile app and free 3-in-1 mobile card reader when you sign up for a merchant account.

It supports restaurant-specific tools such as splitting checks, opening tabs, and tipping. This is the only provider on this list besides Square that supports these features, making it a great choice for low-volume restaurants and food trucks.

- Monthly fee: $0

- In-person transaction fee (including contactless): 2.69%

- Keyed-in transaction fee: 3.49% plus 19 cents

- Contract length: Month-to-month for pay-as-you-go; minimum three years, with one year auto-renewal, for custom plans

- Inactivity fee (for pay-as-you-go plan): $3.99 per month after 12 months of inactivity

- Chargeback Fees (for pay-as-you-go plan): $25

- Offline payment processing

- Free next-day and same-day funding

- Card reader: $59.95

- Accepts traditional magstripe credit cards, EMV chip cards, and NFC contactless payments

|

$59.95 Bluetooth-enabled card reader. Accepts traditional magstripe credit cards, EMV chip cards, and NFC contactless payments like Apple Pay and Samsung Pay. |

Payanywhere account includes a free mobile POS app, which allows you to process payments from a compatible smartphone or tablet. It comes with inventory and employee management tools and offline payment processing function.

Payanywhere’s mobile app used to be among the most well-rated software in our list, although ratings have recently declined this past year 4.3 to 3.9 out of 5 with more than 700 reviews.

Users Like | Users Don’t Like |

|---|---|

Easy payment processing | Reports of hidden fees |

Zero monthly fees | Poor customer support |

While Payanywhere has restaurant-specific features, it is not a full-fledged POS system for restaurants. If you’re operating anything other than occasional sales or a temporary setup, we recommend considering a restaurant POS system.

Payment Depot: Best for High-volume Sales

Pros

- Interchange-plus pricing

- Highly rated mobile app

- Excellent customer support

- 4.8 out of 5 rating on App Store

Cons

- Charges monthly fees

- Chargeback process is more complex

- US-based merchants only

What we like:

As a traditional merchant account provider, Payment Depot has some of the lowest credit card processing fees available—great for high-volume sales. Although it requires an application and a monthly subscription fee, each account comes with a free SwipeSimple mobile account and account stability.

Having a dedicated merchant account means you’re much less likely to deal with frozen or delayed funds.

- Monthly plans: $79

- Card-present (including contactless): Interchange plus 8 cents

- Card-not-present: Interchange plus 18 cents

- Chargeback fee: $0

- Card reader: Starts at $49

- Accepts tap, dip, Apple Pay, Google Pay, and other NFC payments

- May offer free hardware, depending on custom contract

|

Starts at $49 (Contact Payment Depot) Connects via Bluetooth and accepts payments via magstripe (swipe), EMV (chip), and NFC contactless payments (Apple Pay, Android Pay). |

Payment Depot’s mobile payments are powered by SwipeSimple. The app comes with a product catalog and allows you to not only accept payments, but also add tips, process returns, and even save payment information.

As of this writing, SwipeSimple ties with Square as one of the highest-rated apps, with 4.8 out of 5 stars with 4,900-plus ratings. SwipeSimple is used by many merchant services, and there are complaints about some of them. However, most people said it worked well and was easy to use.

Users Like | Users Don’t Like |

|---|---|

Easy to use and learn | Reports of hidden fees |

Invoicing feature | Lack of CRM feature |

Compare Your Fees

Find out how much you would pay in monthly credit card processing fees with each of our recommended credit card readers for iPhone.

How to Choose the Best iPhone Credit Card Readers

Many popular payment processors offer mobile credit card readers that are both affordable and full-featured. However, businesses vary by size and type so there is no one-size-fits-all mobile payment device. Reliability, functionality, cost-effectiveness, and security are the key features to look for when choosing the best credit card readers for iPhones.

As a merchant, you need an iPhone credit card processor that:

Customers become wary of failed transactions so you need to make sure that your iPhone credit card reader is:

- Compatible with your version of iPhone operating system

- Known for its reliable connection and minimum-to-no instance of failed transactions

- Built with a long battery life for extended use while on-the-go

Nowadays, payment convenience is one of the biggest factors that customers look at when trying to decide where to shop so the best iPhone credit card reader should:

- Support the latest options in payment processing like EMV (chip) and NFC (contactless) payments

- Come with a mobile POS app built with a wide range of payment tools such as generating QR and payment links, processing digital wallet payments, and sending digital receipts

The wide variety of iPhone credit card readers in the market can make choosing the right mobile payment device an intimidating task, so before purchasing one for your business, consider:

- Focusing on options that provide the current payment requirements of your business to avoid spending your budget on features your business does not need

- The security features provided by the payment processor behind the mobile credit card reader to help minimize fraudulent transactions

- The overall cost of accepting credit card payments with the payment processor should be reasonable and most affordable while also providing you with all payment the tools you need to maximize sales.

Mobile Payment Alternatives

If you’re looking for more mobile payment solutions, check out our recommendations below:

| |||

|---|---|---|---|

Best for: Accepting peer-to-peer payments | Best for: Processing QR code payments | Best for: Using payment links for selling anywhere | Best for: iOS users that need a digital wallet app |

Monthly Cost: $0 | Monthly Cost: $0 | Monthly Cost: $0 | Monthly Cost: $0 |

Transaction Fee: $0 | Transaction Fee: from 1.9% + 10 cents | Transaction Fee: 2.9% + 30 cents | Transaction Fee: $0 |

How We Evaluated the Best Credit Card Readers for iPhone

The best mobile credit card processing services work with both iOS and Android, so we chose those that had the best ratings in the Apple store or were more popular in iOS.

We proceeded to evaluate them according to pricing, types of payments provided, additional features, how quickly you can access your earnings, and how well they compared to the others on the list in our evaluation and the opinion of users. Then, our experts weighed in with their knowledge of the product by testing each card reader and evaluating its performance against industry standards.

Square ranks as the best credit card reader for iPhone. With clear-cut pricing and no contracts, a feature-rich POS system and invoice capabilities, and easy access to your funds, it’s a strong choice for individuals and businesses of all sizes.

Click through the tabs below for our full evaluation criteria:

20% of Overall Score

We gave the most points to payment processors that did not require contracts or monthly fees and did not have cancellation fees or minimum requirements. We also took transaction fees heavily into consideration, particularly in-person payments, including contactless/tap, which is most popular among iPhone users for Apple Pay.

25% of Overall Score

The best iPhone payment credit card readers support all types of in-person transactions. We gave premium points for iPhone credit card readers that support offline payment processing and provide PIN pad for debit/prepaid card transactions. We also awarded points for free mobile payment or point-of-sale mobile app.

20% of Overall Score

For this criteria, we evaluated both the mobile credit card readers and the mobile app for their ease of use. We tested the user interface, setup, and configuration as well as the device’s overall reliability. Additionally, we awarded premium points for real-life reviews of each provider’s mobile app.

20% of Overall Score

This criteria focuses on the payment processor’s merchant account service and features. We awarded points for month-to-month contracts, 24/7 support, quick deposit times, and omnichannel features.

15% of Overall Score

This combined our overall evaluation of price and ease of use with scores from real-world users on trusted third-party review sites.

Frequently Asked Questions (FAQs)

These are some of the questions I frequently encounter about credit card readers for iPhones.

Credit card readers can be connected wirelessly (via Bluetooth) compatible with iPhones. Software applications can also be downloaded for free on your iPhone which will give you access to payment processing tools.

Processing payments with iPhones use in-person or card-present rates for swiped, dipped, and tapped transactions. Providers for small businesses or startups usually charge a flat rate, which can range anywhere from 2.29% + 9 cents (PayPal Zettle) to 2.75% (SumUp), and no monthly fees. For more active businesses, there are providers that charge low interchange rates (like Payment Depot at interchange plus 8 cents) and a monthly subscription fee.

Aside from affordable hardware, zero monthly subscription, and low monthly fees, the best credit card readers for iPhones also offer the most payment methods (tap, dip, and swipe), the widest range of payment types (virtual terminal, invoicing, digital wallets, etc.), easy-to-use payment apps, and reliable connection between the card reader and your iPhone.

Most popular payment processors have a free mobile payment app you can download to your iPhone. You can use this to process credit card payments without a credit card reader by keying in your customer’s credit card information. However, you will need a mobile credit card reader attached to your iPhone if you want to swipe, tap, or dip your customer’s credit card to process payments.

Update: Square recently introduced tap-to-pay for iPhones, which allows you to accept contactless payments without a mobile credit card reader.

If you want to use a magstripe reader to accept payments, you need a credit card swiper compatible with your mobile device. Square offers the first magstripe reader for free to every Square merchant account, additional readers cost $10 each. Other payment processors such as Shopify and SumUp sell 3-in-1 card readers (swipe, dip, and tap) starting at $39.

Bottom Line

COVID-19 changed how we do business, emphasizing the importance of being able to accept payments on your mobile phone or iPad for maximum flexibility. The credit card readers we considered not only provide multiple ways to accept on-the-go payments; many have virtual terminals and online options to help.

Overall, for versatility and price, Square is our top choice. It can be a little more expensive if you have small transactions, but it’s good for the occasional user or the regular business and can grow with you. Download the Square app and sign up for an account today.