Human resources (HR) compliance is a critical part of business operations as it ensures adherence to employment laws. Constant changes to regulations can make this challenging to manage, but HR compliance solutions can simplify processes. The best HR compliance software helps you monitor regulatory updates, detect potential risks, create and store compliance-related documents, and handle complex laws through its HR advisory services.

In this guide, we reviewed 14 HR compliance management software for small to midsize businesses (SMBs) and narrowed the list down to our top six options.

- SixFifty: Best overall HR compliance software

- Justworks: Best PEO solution for outsourced HR compliance services

- Bambee: Best HR compliance service for new businesses

- Mineral: Best for HR advisory services

- TriNet HR Plus: Best for HR and payroll audits

- Rippling: Best for compliance automation

Best HR Compliance Software Compared

All the HR compliance solutions we reviewed track changes to various regulations and laws related to managing employees. Notifications are sent to you via email alerts or through the system if there are compliance risks or updates to employment laws. These human resource compliance software also have reporting and document management capabilities, including online tools for creating HR policies and/or employee handbooks.

Our Score (Out of 5) | Starter Monthly Pricing | Standalone HR Compliance Solution | HR Advisory Services | |

|---|---|---|---|---|

| 4.18 | ✓ | Included in all plans | |

| 4.13 | $59 per employee | Included in all plans | |

| 4.09 | $99 | ✓ | Included in all plans |

| 3.99 | Call for a quote | ✓ | Depends on the product selected |

| 3.58 | $20 per employee | Included in all plans | |

3.51 | $8 per employee + $35 base | Requires getting the core Rippling platform | Paid add-on | |

SixFifty: Best Overall Human Resource Compliance Software

Pros

- Offers customizable HR documents, agreements, and compliance-related forms

- Extensive library of policies, regulations, and laws (as well as checklists, agreements, and document templates)

- Supports unlimited users

- Offers pay-per-document and subscription-based options

Cons

- Limited integrations

- Subscription option requires an annual contract; fees are based on the employee count and number of states where your business is located

- Technical/software support via email and live chat only

- No HR tools for managing employees

Overview

Who should use it:

SixFifty’s wide range of ready-to-customize HR and legal document templates make it a good option for small to midsized businesses (SMBs) and HR teams that need help managing compliance-related documents. Its automated updates and compliance alerts save you time from manually tracking regulatory updates. It even has a team of HR and legal professionals you can contact if you have questions about employment laws, regulations, and policies.

Why we like it:

SixFifty may not be an HR software for managing employees but its legal document creation platform helps simplify and automate compliance. The system uses your responses to the question and answer (Q&A) section of its online document builder to generate the essential documents you need to hire, manage, and terminate employees. Updates to federal, state, and local laws (including US and European privacy regulations) relevant to your business are also sent to you via email and in-app alerts. Plus, its version history feature tracks all changes, allowing you to conduct document audits with ease.

While it offers a pay-per-document option and has an artificial intelligence (AI) tool that highlights regulatory changes and adds legal updates to affected documents, you need a paid subscription to get monthly email notices summarizing all legal updates. SixFifty also doesn’t have the features that Rippling and TriNet offer to help you manage HR processes, such as tracking employee attendance and paying workers.

Plans*

- Business docs: Starts at $180 per month

- Includes access to customizable business documents, such as non-disclosure forms and agreements

- Employment docs: Starts at $250 per month

- Includes access to customizable employment documents, such as offer letters, independent contractor agreements, separation notices, and job descriptions

- Privacy docs: Starts at $650 per month

- Includes access to customizable US and Europe privacy documents

*All plans come with priority customer support, unlimited users and document revisions, automated legal updates, advisory services, and access to a dedicated customer success manager. Note that these require annual contracts (all fees are paid in a lump sum and upfront). Pricing may also change depending on the number of employees you have and your business locations.

Pay-per-document option

- One-time fees range from $0 (free) to $480, depending on the document

- Ideal for those who only need to create or update a specific document at a time

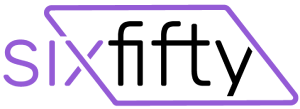

SixFifty’s online document builder has a guided Q&A process to help you create compliant documents. (Source: SixFifty)

- Document builder with a Q&A feature: This guides you through the process of creating the document and ensures that relevant federal, state, and local laws are covered in the draft policy or handbook.

- Smart AI: Aside from flagging regulatory changes, it provides suggested revisions to affected documents, and allows you to merge the changes with one click. This makes it easy to update company policies or your employee handbook (none of the HR compliance solutions in this guide have this feature).

- Legal team expertise: Updates to document templates are written and reviewed by SixFifty’s in-house legal team.

- Handbook addendum tool: Its “State Addenda” feature lets you add new state information to your existing handbook as an addendum. You can also generate an updated version of the employee handbook created using SixFifty—perfect for businesses expanding to multiple states.

- Online knowledge base: Its library of policies, regulations, and legal documents lets you research federal, state, and local laws for your HR forms, agreements, and privacy notices. It also contains checklists and templates you can use.

- Overtime exemption analyzer: The ”Exempt Nonexempt Analyzer” guides you through the overtime exemption criteria and provides a summary of the analysis, helping reduce the risk of mistakenly classifying exempt vs nonexempt employees.

Justworks: Best PEO for Outsourced HR Compliance Services

Pros

- Affordable professional employer organization (PEO) services

- Offers compliance reporting, regulatory updates, and HR advisory services

- Provides access to enterprise-level benefits from major insurance companies plus 401(k)

- Has a standalone US payroll solution, a global contractor payment plan, and an employer of record (EOR) service for hiring and paying international employees

Cons

- Time tracking, EOR, and global contractor payments are paid add-ons

- Some benefits options (such as medical, dental, and vision) are offered only in the highest PEO tier

- Lacks AI tools that automatically update compliance documents

Overview

Who should use it:

Justworks’s PEO solution is ideal for SMBs that don’t have in-house HR teams to handle HR operations. It helps manage your day-to-day HR administrative tasks—from new hire onboarding to pay processing and benefits administration. This provides you with more time to grow your business instead of handling HR admin tasks. Best of all, ensuring HR compliance is an integral part of its services, including helping you understand HR-related laws (if you’re unfamiliar with them) and keeping you up-to-date with ever-changing regulations.

Why we like it:

Apart from PEO services, Justworks offers a user-friendly HR platform to help you track employee attendance, benefits plans, and payroll processes. While its library of legal documents isn’t as extensive as SixFifty’s, its compliance resources include access to state-required training (such as an online sexual harassment prevention program) and state guides for time off, overtime, and rest/meal break rules. Justworks also handles compliance reporting, preparing the necessary payroll, tax, and benefits-related forms for submission to applicable agencies.

Plans

- PEO Basic: $59 per employee monthly

- PEO Plus: $109 per employee monthly

- Payroll: $50 base fee + $8 per employee monthly

- Standalone US payroll module with basic timecards, onboarding, tips processing, and time off management features

Add ons

- Justworks Time Tracking: $8 per employee monthly

- Includes overtime tracking, geofencing, and clock-in/out features

- Paid add-on to the PEO plans and standalone payroll package

- International Contractor Payments: $39 per worker monthly

- Includes contractor payments in over 30 countries

- Available as a paid add-on to the PEO plans

- Employer of Record: $599 per employee monthly

- Includes global hiring and payroll tools in over 100 countries

- Available as a standalone solution and a paid add-on to the PEO plans

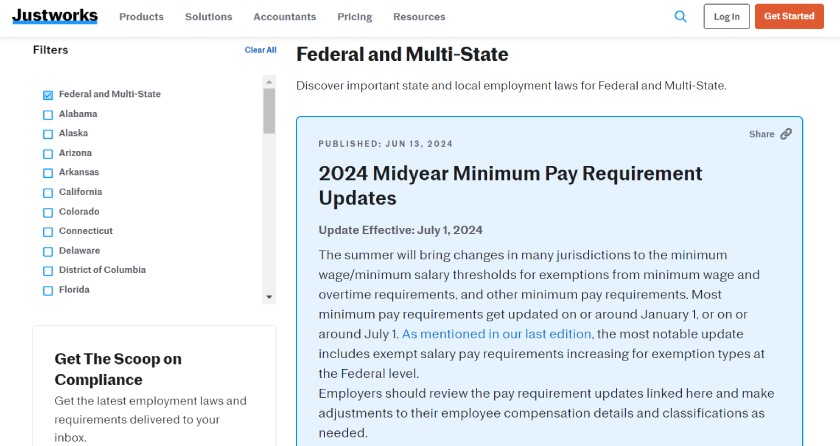

With Justworks, you can access compliance resources via the help center and its employment law updates webpage, The Scoop. (Source: Justworks)

- Overtime and incentive computations: Its built-in tools help you compliantly calculate state-specific overtime rates and pay overtime on applicable incentive payments Federal law requires employers to pay overtime to non-exempt employees when they earn incentive pay and overtime in the same pay period. The regular rate for that period needs to be recalculated and the additional overtime on the incentive pay must be paid out. .

- Customizable leave policies: Justworks supports multiple leave types (e.g., vacation and sick leave) but lets you create custom time off policies, which the system will use to calculate accruals for eligible employees.

- Time off policy alerts: The system sends proactive alerts that describe how edits to a time off policy will affect the current leave balances of employees, which other vendors in this shortlist lack.

- Compliance resources and support available through:

- Help center: Includes access to labor law posters, state-by-state employer compliance starter guides, and other compliance topics.

- The Scoop: Includes monthly federal, state, and local updates through this employment law updates webpage.

- Justworks HR consulting: If you need guidance from HR professionals on HR best practices or handling employee-related issues.

- Mineral: Justworks’s partnership with this provider—which also made this list and is our best provider for HR Advisory Services—grants you access to salary comparison tools, an HR compliance database, and online solutions for creating job descriptions and an employee handbook.

Bambee: Best HR Compliance Service for New Businesses

Pros

- Affordable starter plan for new business owners who have yet to hire employees

- Automated workflows for HR documents requiring electronic signatures

- Dedicated HR manager (for businesses with employees)

- ”HR Autopilot” feature tracks compliance, regulatory updates, and mandatory training programs

Cons

- Guided payroll service is a paid add-on (call for a quote)

- No HR tools for tracking employee attendance, planning work shifts, monitoring time off accruals, and hiring workers

- Charges setup fees for higher plans

- Starter tier only comes with email and chat support

Overview

Who should use it:

Bambee, which topped our list of best HR outsourcing services, is great for new business owners or those starting a company. Its starter tier is designed to help you create the policies, job descriptions, and HR procedures you need to onboard and hire employees compliantly.

Why we like it:

With Bambee, you get a dedicated HR manager who provides full remote support and guidance in navigating HR processes, payroll compliances, labor laws, and employee issues. Bambee can also assist you in conducting background checks for new employees, managing government claims (such as unemployment and disability), and handling sensitive situations like terminating employees. Apart from helping ensure compliance and prevent lawsuits or penalties, these services allow you to spend more time building your business and less time managing day-to-day HR tasks.

In addition, it offers an online platform for creating HR policies, storing and accessing documents, sharing feedback with team members, and tracking employee certifications. Bambee even offers a guided payroll service for paying workers. However, its HR and payroll tools aren’t as advanced as TriNet or Rippling, which have recruiting and compensation planning features.

- No employees yet: $99 per month

- Includes two custom HR policies, two job descriptions, four core HR policies, chat and email support, and access to Bambee HR

- 1-4 employees: $299 per month + a $500 one-time setup fee

- Includes features of No employees yet plan + HR support for up to four employees, access to a dedicated HR manager, and support via chat, email, and phone

- 5-19 employees: $399 per month + a $500 one-time setup fee

- Includes features of 1-4 employees plan + four custom HR policies, four job descriptions, and HR support for up to 19 employees

- 20-49 employees: $499 per month + a $1,500 one-time setup fee

- Includes features of 5-19 employees plan + eight custom HR policies, five job descriptions, and HR support for up to 49 employees

- 50-70 employees: $1,299 per month + a $2,000 one-time setup fee

- Includes features of 20-49 employees plan + 12 custom HR policies and HR support for up to 70 employees

- 71+ employees: Call for a quote

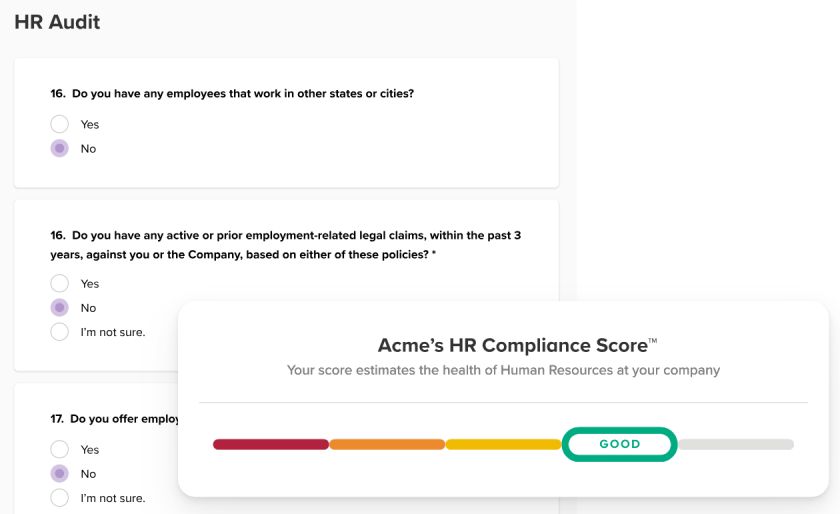

Bambee can run HR audits to evaluate your organization’s compliance level and identify HR gaps. (Source: Bambee)

- Dedicated HR manager: Businesses with employees get unlimited expert advice from a dedicated Bambee HR manager via phone, email, and chat during business hours. Your dedicated Bambee HR manager will help:

- Create, implement, and manage company and HR policies

- Handle government agency claims, such as unemployment, disability, wage and hour, and Equal Employment Opportunity Commission (EEOC) claims

- Develop and maintain a system for managing all your internal corrective actions and employee issues

- Navigate high-risk HR and staff termination situations and guide you throughout the process

- Track regulatory changes and ensure you’re current with state and federal regulations

- Monitor employee attendance to mandatory training programs like workplace safety and sexual harassment prevention sessions

- conduct audits to identify potential compliance risks

- Online document storage: Set up staff folders for employees to access files, see general company memos, and view documents (such as policies and an employee handbook). It also comes with an electronic signature tool for signing HR forms.

- Real-time chat: Employees can share workplace concerns, give feedback, and ask HR-related questions via a chat tool.

Mineral: Best for HR Advisory Services

Pros

- Mineral experts have, on average, 18 years of HR experience

- Sends regulatory change alerts via email and adds recommended compliance update tasks to your Mineral “To-Do list”

- Offers over 200 training programs that cover various compliance, employee upskilling, and business topics (including free employee management webinars)

Cons

- Pricing isn’t transparent

- Some users complain of difficulties navigating through its many features

- Lacks HR tools for managing basic HR tasks like onboarding, time tracking, and pay processing

Overview

Who should use it:

If you don’t have an in-house HR expert or team, Mineral’s HR and legal professionals can provide advice on various HR and compliance topics, such as hiring, employee termination, talent development, workplace safety, and benefits management. Many HR and payroll software providers, like Justworks, even partner with Mineral to provide HR advisory services to their clients.

Why we like it:

Like many on our list, it assigns a dedicated HR expert but Mineral’s over 15 years of expertise in providing HR advisory support makes it one of the most reliable HR compliance service providers in the market. Its team of HR and legal experts can offer advice on HR compliance laws and help you understand how these laws impact your business. Plus, its online document builder not only lets you compliantly build employee handbooks, job descriptions, and benefits compliance guides but also alerts you of regulatory changes that apply to your business.

However, similar to SixFifty and Bambee, Mineral doesn’t have an HR software for managing day-to-day HR processes. We recommend Justworks, Rippling, or TriNet if you require HR payroll tools.

Mineral doesn’t publish its pricing online. You have to call its sales team to discuss your requirements and request a quote.

Mineral has a library of HR and employee management webinars you can access for free. (Source: Mineral)

- Compliance tracking: Its Mineral Intelligence tool continuously tracks over 3,000 federal and state legislations, sends real-time alerts, and provides a list of to-dos to help keep you compliant.

- HR advisory services and legislation review: Mineral’s team of HR and legal experts review 15,000 pieces of legislation annually, offer advisory services, and can help you conduct HR audits, create policies and HR documents, train employees, and compare salaries.

- AI and document storage: With Mineral Platform, you get secure document storage and a document builder (for creating handbooks, job descriptions, and benefits guides) with AI functionalities that automatically notify you of regulatory changes and suggest updates.

- Anonymous feedback: Two-way masked communication tool for collecting anonymous feedback and staff reports about HR-related issues.

- Case management: This allows you to track issues raised by employees and share completion progress.

- Online knowledge base: Access over 3,000 HR and compliance resources, templates, guides, and videos.

TriNet HR Plus: Best for HR and Payroll Audits

Pros

- Offers two audit packages if you require one-time compliance reviews

- Access to HR, payroll, or tax experts (or all, depending on plan selected) who can help manage your HR/payroll needs

- Offers various HR products, such as tax credit services and a PEO solution

Cons

- All TriNet HR Plus plans have a 25-employee minimum

- Requires purchasing an audit service or a subscription to TriNet HR Platform (TriNet’s HR software)

- Pricey for small businesses

Overview

Who should use it:

TriNet HR Plus is ideal for midsize to large companies planning to or are already using the provider’s HR software, TriNet HR Platform. It lets you outsource HR administrative tasks, but if you only need HR audit support, TriNet HR Plus offers one-time services to review your entire HR operations or assess your compliance with payroll and tax regulations.

Why we like it:

Similar to Bambee, TriNet helps identify gaps in your HR processes. But TriNet also takes it a step further by offering specific audit services. Its payroll tax specialists can evaluate your payroll tax documents, spot process gaps to ensure the correct amount is withheld if there are adjustments to Social Security and Medicare taxes or Federal Insurance Contributions Act (FICA) taxes, and guide you in navigating identified concerns. However, if you want to audit HR operations, its HR experts can conduct a full audit and create a roadmap to help you address HR issues.

The only drawback is that TriNet HR Plus can get pricey because it isn’t a standalone HR compliance solution. You have to sign up for its audit services or subscribe to any of the TriNet HR Platform plans. If you only want HR compliance documents, SixFifty is a good option. For HR advisory services, consider either Mineral or Bambee.

Plans

- Payroll Tax Compliance Manager: Starts at $20 per employee monthly

- Includes access to a team of payroll tax specialists to help you navigate payroll taxes.

- Payroll Manager: Starts at $30 per employee monthly

- Includes access to dedicated payroll professionals who can help you manage payroll, including taxes and workers’ compensation reporting

- HR Manager: Starts at $50 per employee monthly

- Includes access to a dedicated team of experts who can help you manage HR tasks, such as onboarding/offboarding, payroll, benefits, and unemployment claims administration

One-time HR audit services

- Payroll Tax Compliance Audit: $1,000 per audit

- HR Operations Audit: $2,500 per audit

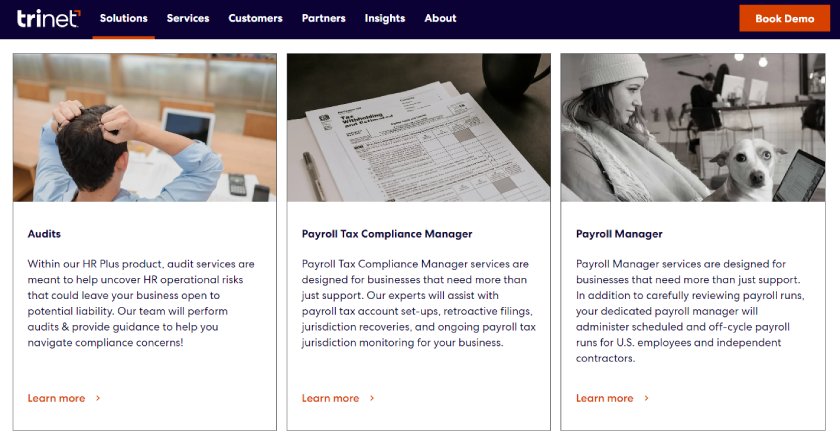

With TriNet HR Plus, you can outsource HR audits and payroll compliance. (Source: TriNet)

- Registration account setup: TriNet HR Plus can help set up federal, state & local tax jurisdiction registration accounts with required government agencies. It also monitors workforce changes requiring new jurisdiction payroll tax accounts.

- Regulatory and policy reviews: In addition to monitoring regulatory changes, it conducts quarterly and annual reviews of your internal policy to ensure compliance. It also helps in creating custom HR policies and procedures.

- Feature-rich platform: Access to a wide range of HR features via TriNet HR Platform, which is one of our recommended HR software for small businesses.

Rippling: Best for Compliance Automation

Pros

- Modular platform; you can choose the solutions you need

- Customizable workflows help streamline HR processes and compliance

- Integrates with over 500 third-party software

- Wide range of solutions for managing HR, payroll, expense claims, business apps, and company-assigned computers

Cons

- Pricing isn’t all transparent; can get pricey depending on the modules selected

- Requires purchasing its core Rippling platform

- No phone support (but you can request a call via online chat)

Overview

Who should use it:

Rippling unifies HR, payroll, IT, and expense management solutions in a single platform, enabling you to streamline processes. With its customizable workflows, businesses looking for an all-in-one system can automate compliance across various HR functions. Plus, to help you remain compliant, it tracks changes to federal and local regulations and even conducts a full review of its compliance tools each year.

Why we like it:

Rippling is one of our top HR information systems and one of the best payroll services because it has a feature-rich platform for managing employees. It makes finding a payroll solution that can handle both US and global salary payouts easy given its local payroll, international contractor payments, and EOR services. Rippling’s PEO solution is also more flexible than Justworks and TriNet’s as it lets you easily turn the service off and transition to using its HR system.

Rippling even lets you build policies that cover different modules. For example, you can create a time-in policy that prevents workers from clocking in if they don’t complete workplace safety training or certification programs. Plus, like the others on our list of best HR compliance software, Rippling offers regulatory updates and HR advisory services. However, contacting its team of HR professionals costs extra. If you don’t want to pay add-on fees, consider SixFifty or Bambee.

With Rippling, you have to call the provider to request a quote. While its monthly fees start at $8 per employee, you have to get its core Rippling platform before getting any of its modules.

We were quoted a monthly fee of $35 plus $8 per employee for the Rippling platform with payroll, time tracking, and employee onboarding/offboarding features. You can add Rippling’s IT tools to manage business apps and computer devices for $8 per employee, per module monthly. Benefits administration services are also available, but fees vary depending on the insurance broker.

Here are some of its add-on solutions and services:

- Global payroll: $20 per employee or contractor monthly*

- EOR: $599 per employee monthly*

- PEO: Call for a quote

- HR help desk: Call for a quote

- ACA & COBRA administration: Call for a quote

- Expense management: Call for a quote

- Headcount planning: Call for a quote

- Learning management: Call for a quote

- Applicant tracking: Call for a quote

*Pricing is based on a quote we received

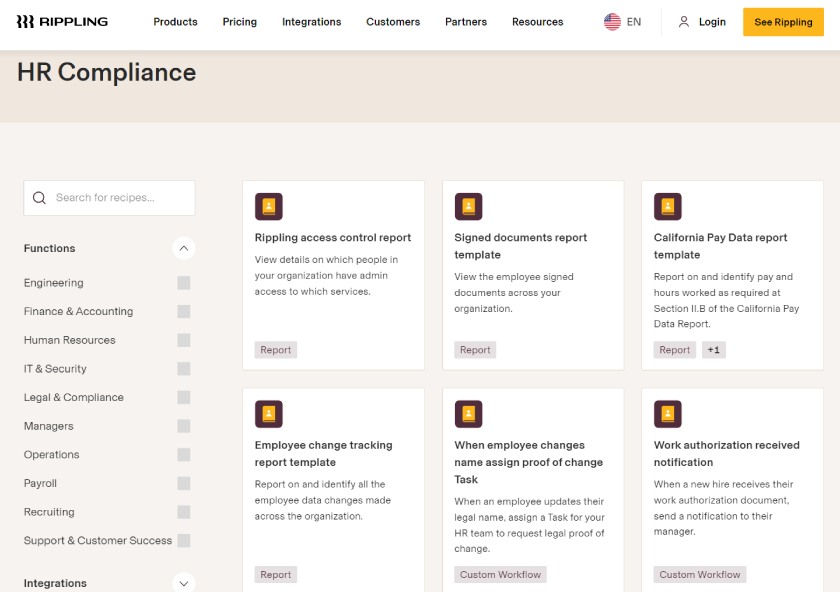

Aside from reports, Rippling has ready-to-use workflow templates to automate compliance and HR processes. (Source: Rippling)

- Tax account registration: Sets up state and local tax accounts automatically and keeps track of any changes in rates.

- Labor posters: Distributes digital workplace posters in states where you have employees.

- Regulatory alerts: Its online compliance dashboard sends real-time alerts, flags potential risks, and recommends action items. Rippling’s employee handbook builder also gets automatic updates if there are revisions to laws in states where you have workers.

- HR advisory services: One-on-one sessions with HR professionals if you need help navigating sensitive employee issues or have questions about managing employees. Rippling’s partnership with Mineral allows you access to a wide range of HR resources (such as compliance guides)

Rippling Unity, Rippling’s base platform that all subscribers must purchase, is now called Rippling Platform.

How to Choose the Best HR Compliance Management Software

There are many factors to consider before choosing an HR compliance solution for your business. To help you find the right one for your organization, follow these steps.

Start by conducting an assessment of your company’s HR compliance needs, including industry-specific regulations. A manufacturing firm will have to follow more workplace safety-related laws than an advertising or accounting company. It also helps if you identify the challenges you face in adhering to or staying on track with employment regulations and laws. This allows you to list the key features you want, such as regulatory tracking and compliance reporting.

Then, take a look at the size of your workforce and business location. These factors can impact software costs as some HR compliance companies may charge monthly fees based on your employee headcount and the complexity of handling compliances specific to certain locations. For example, managing compliance in California is more complicated than in Mississippi because it has more worker protection policies you need to follow.

There are many HR compliance solutions available in the market. You can choose from the following options:

- A standalone software for managing HR and payroll compliance.

- An HR system with compliance features, such as automated compliance alerts, access to HR advisory services, an online employee handbook builder, and compliant reporting of taxes, benefits, and staff information

- One-time HR compliance services to help you create HR policies, update your staff handbook, or conduct an HR compliance audit to identify HR gaps and ensure that your business complies with all relevant labor laws

Identifying which one is best depends on your requirements and budget. If you don’t want to manage multiple systems, search for an HR software with robust compliance features. If you already have an HR software but it has limited compliance tools, look for an HR compliance system that integrates with your existing software for easy data transfers and compliance tracking. Or, consider partnering with HR compliance experts from time to time, especially if you need expert advice in managing complex laws or compliance issues.

At this point, you should have a good idea of which HR compliance solution to get. It’s now time to research providers and compare the features and pricing plans they offer. Don’t forget to check each provider’s customer support options and if free software trials or demos are offered. These can help you assess the system’s general ease of use and intuitiveness.

Methodology: How We Evaluated the Top HR Compliance Solutions

We looked for providers that offer HR advisory services, standalone HR compliance software, or HR systems with strong compliance features. We compared each provider based on their pricing, ease of use, features, and reporting capabilities. We also considered the availability and quality of customer support, including the integration options with other business tools and systems.

Click through the tabs below for a more detailed breakdown of our evaluation criteria.

20% of Overall Score

We checked to see if the provider offers a free trial, transparent pricing, and has zero plan restrictions, such as no annual contract requirements or won’t require purchasing a core HR platform. Providers that offer the best value for their services also get higher points.

25% of Overall Score

The range of compliance functionalities offered by each provider is important to determine how well they can meet a company’s specific needs. This includes regulatory tracking, policy/handbook management, and compliance updates.

20% of Overall Score

Access to advisory services, compliance materials (like labor law posters), and HR audit solutions are essential for efficient compliance management. We evaluated how robust and useful these tools are and gave high scores to providers that have them.

15% of Overall Score

For this criterion, we assessed the comprehensiveness of the reporting features provided by each provider. This includes whether there are standard reports, pre-built templates, and customization options. We also gave extra points to providers whose reports can be downloaded in different formats.

20% of Overall Score

We looked for features that make the software easy to learn and use. Extra points were given to providers with software integration options, live phone or chat support, and a knowledge base that helps users better understand software features.

Best HR Compliance Software Frequently Asked Questions (FAQs)

An HR compliance system streamlines the complex task of managing various employment laws and regulations. It helps you to stay compliant with relevant laws that impact your business, reducing the risk of legal issues from unfair HR practices or deviations from established worker-related policies across federal, state, and local levels.

Managing HR compliance involves keeping track of updates to labor, payroll, and tax regulations. This allows you to adjust HR policies and processes to ensure adherence to ever-changing rules. Conducting regular HR compliance audits also helps you identify potential risks and make the necessary changes to address or reduce these risks.

Pricing can vary, depending on the features and services offered. However, monthly fees for human resource compliance software can range from $20 to more than $100 per employee.

Bottom Line

With the threat of non-compliance and the penalties and fines that go with it, monitoring the labor laws that apply to your business can save you time and money later. In 2023 alone, the Wage and Hour department recovered more than $20 million in back pay for minimum wage violations alone. Compliance software can significantly reduce the chances of this for your business.

We found SixFifty as the top HR compliance solution for small businesses. In addition to its library of policies and jurisdiction-specific regulations, it automates the creation of essential documents to help you compliantly hire, manage, and separate employees. Its AI-powered alerts and updates also help you stay on top of regulatory changes. Sign up for a SixFifty plan today.