Insurance customer relationship management (CRM) products help insurance agencies manage sales deals, track commissions, oversee insured accounts, and procure policies. The best insurance CRM software will have features for commission tracking, agency team management, reporting, and policy document storage that are both low-cost and easy to use.

Based on our evaluation, these are the eight best CRM software for insurance agents:

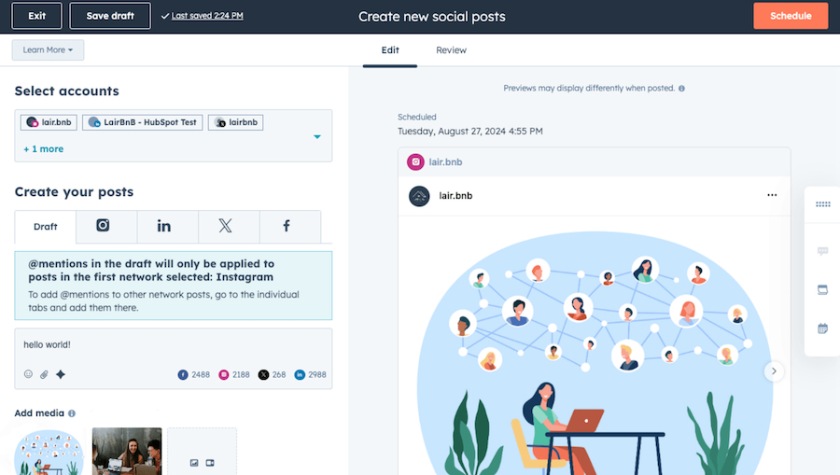

- HubSpot CRM: Best overall for insurance agency marketing

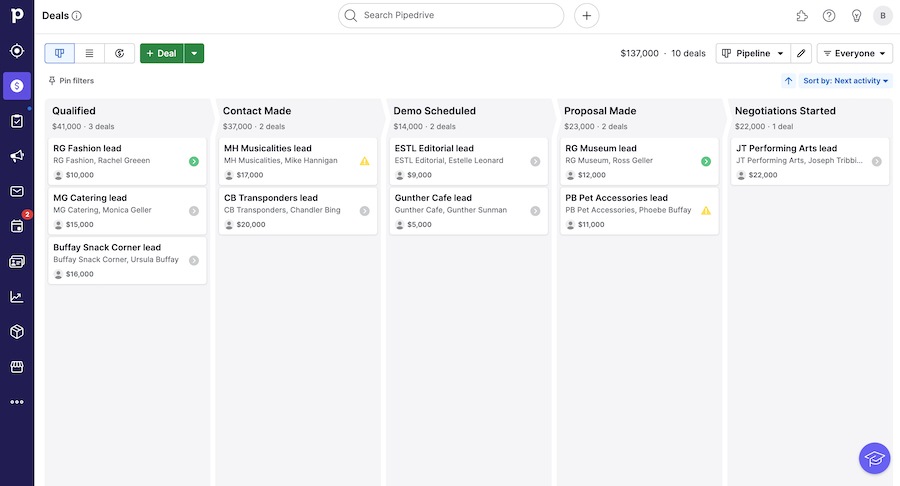

- Pipedrive: Best for insurance deal management

- Zoho CRM: Best customizable CRM for insurance agents

- Bitrix24: Best for multi-policy sales tracking

- Insureio: Best specialty CRM for life insurance agents

- Zendesk Sell: Best for insurance client prospecting

- Freshsales: Best for insurance account management

- Salesforce: Best for insurance commission and claims tracking

Best Insurance CRM Software Options Compared

Provider | Free Plan | Free Trial | Our Rating out of 5 | |

|---|---|---|---|---|

| ✓ 2 users | N/A | $15 | 4.54 |

| ✕ | 14 days | $14 | 4.51 |

| ✓ 3 users | 15 days | $14 | 4.43 |

✓ Unlimited users | 15 days | $49 for five users | 4.17 | |

| ✕ | 30 days | 4.06 | |

| ✕ | 14 days | $19 | 4.04 |

| ✓ 3 users | 21 days | $9 | 4.02 |

| ✕ | 30 days | 3.98 | |

HubSpot CRM: Best for Insurance Agency Marketing

Why I Like It

- Comes with blog, video, email campaign, social media, and ads management to promote an insurance brand and generate leads

- Has a solid free plan with quote generation, document management, and appointment scheduling tools

- Highly intuitive interface with easy-to-operate features

Where It Falls Behind

- Sales team management features locked in with the Enterprise plan

- Getting signatures on quotes requires a Professional plan

- Only one sales pipeline is allowed in the free plan

My Expert Opinion

HubSpot is a great solution for agency marketers to put their brands on the map. Users can deliver multi-range campaigns that engage a wide range of insured audiences through email marketing tools, ad management features, and social media integrations. Additionally, the blog and video library hosting allows agencies to promote themselves as thought leaders by leveraging content on insurance and risk management subjects.

HubSpot Customer Platform Plans* | Free | Starter Customer Platform | Professional Customer Platform | Enterprise Customer Platform |

|---|---|---|---|---|

Annual Pricing | $0 for two users | $15 per user | $1,170 for 5 users $45 per additional user | $4,300 for 7 users $75 per additional user |

Monthly Pricing | $0 for two users | $20 per user | $1,300 for 5 users $50 per additional user | N/A |

Sales, Marketing, Service, Content, Operations, and Commerce Hubs | ✓ | ✓ | ✓ | ✓ |

✓ | ✓ | ✓ | ✓ | |

Marketing Automation | ✕ | ✓ | ✓ | ✓ |

Contact Scoring and Default Forecasting | ✕ | ✕ | ✓ | ✓ |

Team Management | ✕ | ✕ | ✕ | ✓ |

*Customer Platform includes sales, marketing, customer service, content, operations, and commerce software bundled in one plan. Individual modules can be purchased for lower prices. | ||||

- Marketing automation: Besides generating sales and supporting insureds with the platform, agencies can market their brand via email marketing campaigns, online ads, and social media posts on a large scale. They can create and post blog articles and manage an on-demand video library to promote thought leadership in insurance and risk management.

- All-in-one CRM: The HubSpot Customer Platform is a sales, marketing, service, content, operations, and commerce management system. It offers all modules necessary to create and retain clients, including contact, deal, quote, email campaign, and blog management.

- Lead generation and management: HubSpot CRM enables insurance agents to seamlessly capture leads from emails, social media, website inquiries, and phone calls. It also helps you automatically distribute leads to agents and prioritize leads based on specific financial characteristics or sources.

HubSpot CRM’s AI-powered social post generator for publishing social media campaigns. (Source: HubSpot)

Pipedrive: Best for Insurance Deal Management

Why I Like It

- Robust deal management features to oversee large insurance sales opportunities

- Excellent proposal management features to generate, send, and track insurance quotes to leads

- Offers advanced artificial intelligence (AI) across all plans

Where It Falls Behind

- Doesn’t offer a free plan, only a 14-day free trial

- Sales team management tools are locked in with the Professional plan

- Not a specialty CRM insurance software; users cannot procure premium quotes from the system

My Expert Opinion

Pipedrive is the ultimate CRM for insurance agents when it comes to closing large-scale policies. Its easy-to-use yet robust deal management tools allow agencies to efficiently get quotes out to leads and ensure no sales task slips through the cracks. We especially like the deal-rotting tools that will indicate if an opportunity is getting cold—promoting a producer to go in for a follow-up.

Plans | Essential | Advanced | Professional | Power | Enterprise |

|---|---|---|---|---|---|

Annual Pricing (per User) | $14 | $39 | $49 | $64 | $99 |

Monthly Pricing (per User) | $24 | $49 | $69 | $79 | $129 |

Lead, Calendar & Pipeline Management | ✓ | ✓ | ✓ | ✓ | ✓ |

Smart-app Recommendations & Marketplace Search | ✓ | ✓ | ✓ | ✓ | ✓ |

Meeting Scheduler & Automations | ✕ | ✓ | ✓ | ✓ | ✓ |

Team Management & AI Email Creation | ✕ | ✕ | ✓ | ✓ | ✓ |

Project Management | ✕ | ✕ | ✕ | ✓ | ✓ |

Security Alerts & Rules | ✕ | ✕ | ✕ | ✕ | ✓ |

- Lead and deal management: Pipedrive is primarily a sales CRM system that comes with excellent lead and deal management features. That said, insurance agencies can give their producers a leg up in the sales process with its robust deal tracking. These features come with custom pipelines to monitor opportunities, deal activity, potential premium value of deals, and whether a deal is on pace to become cold and needs action.

- SmartDocs: Pipedrive offers an advanced CRM feature known as SmartDocs to streamline the processes of generating quotes and delivering documents to insureds. It’ll auto-pull contact data from a record into a custom quote template to create, send, track, and obtain signatures.

- AI and automations: Pipedrive’s AI-powered Sales Assistant provides insurance agents with suggestions and next-best actions to close a deal faster. Its automation tools also enable you to streamline tasks and assign policies to the right insurance reps to ensure that they meet service level agreements (SLAs).

Pipedrive’s Kanban-style deal management pipeline (Source: Pipedrive trial account)

Zoho CRM: Best Customizable CRM for Insurance Agents

Why I Like It

- Free and affordable plans available

- Highly customizable CRM for tailoring data fields, processes, automations, and modules to meet insurance agency needs

- Includes a built-in account management module to oversee insured clients

Where It Falls Behind

- Poor product usability ratings due to robust and advanced features

- Doesn’t include free access to the Zoho Marketplace for third-party integrations

- Quote generation tools require a Professional plan

My Expert Opinion

Zoho is another solid general-use CRM that can appear industry-specific with the right amount of tailoring, thanks to its custom CRM modules or apps. You can edit these tools to meet insurance data needs, such as the current premium amount, claims history, policy period, lines of coverage, and so on. Once the module is created, you can configure your automatons and run your insurance operation.

Plans | Free | Standard | Professional | Enterprise | Ultimate |

|---|---|---|---|---|---|

Annual Pricing (per User) | $0 3 users | $14 | $23 | $40 | $52 |

Monthly Pricing (per User) | $0 3 users | $20 | $35 | $50 | $65 |

Lead, Account, Contact & Deal Management | ✓ | ✓ | ✓ | ✓ | ✓ |

Workflows | ✓ | ✓ | ✓ | ✓ | ✓ |

Meeting Scheduler, Forecasting & Lead Scoring | ✕ | ✓ | ✓ | ✓ | ✓ |

Sales Gamification & Customer Case Management | ✕ | ✕ | ✓ | ✓ | ✓ |

Zia AI Tool & Territory-based Forecasting | ✕ | ✕ | ✕ | ✓ | ✓ |

Automated Lead Scoring | ✕ | ✕ | ✕ | ✕ | ✓ |

- Customizations: Although Zoho is a general CRM system, users can customize many components, such as data fields, pipelines, and automations, to meet the needs of an insurance agency. Plus, you can create entire modules to meet any informational requirements. This lets you tailor your CRM for agency areas like policy management, client meetings, or renewals.

- Account management: Zoho CRM offers a freemium option with lead and contact management, document storage, workflow automation, and deal tracking. Agencies can also access the standard account management module, which is prebuilt and ready to go to organize insured contact data, track activity, send communications, and monitor renewal dates.

- Assignment rules: Zoho CRM can help insurance agencies maintain high customer satisfaction by quickly resolving claim requests. Assignment rules ensure customers’ claim requests are directed to the right person for proper approval.

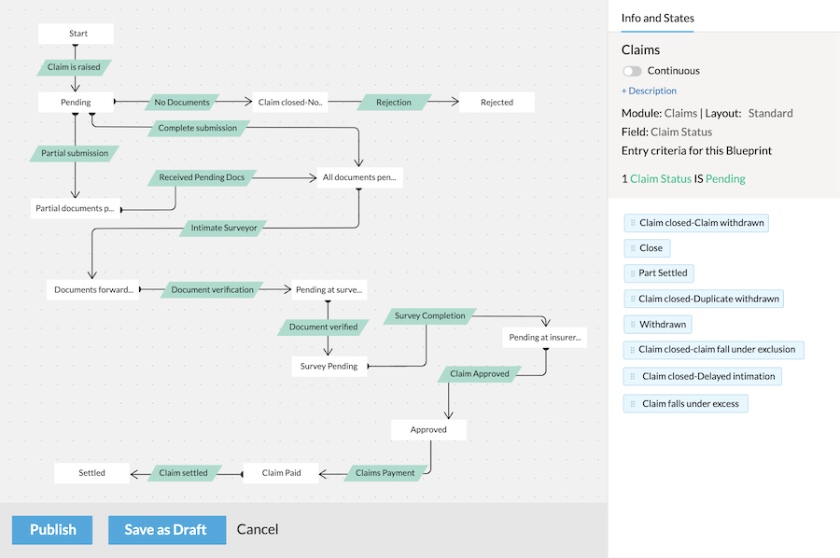

Zoho CRM’s sample automated process for insurance claims (Source: Zoho CRM)

Bitrix24: Best CRM for Insurance Agents Tracking Multiple Policies

Why I Like It

- Solid free plan with project management, deal tracking, and client profiles for activity planning and tracking for specific insureds

- Offers many business modules for managing functions like sales, marketing, projects, service, and human resources

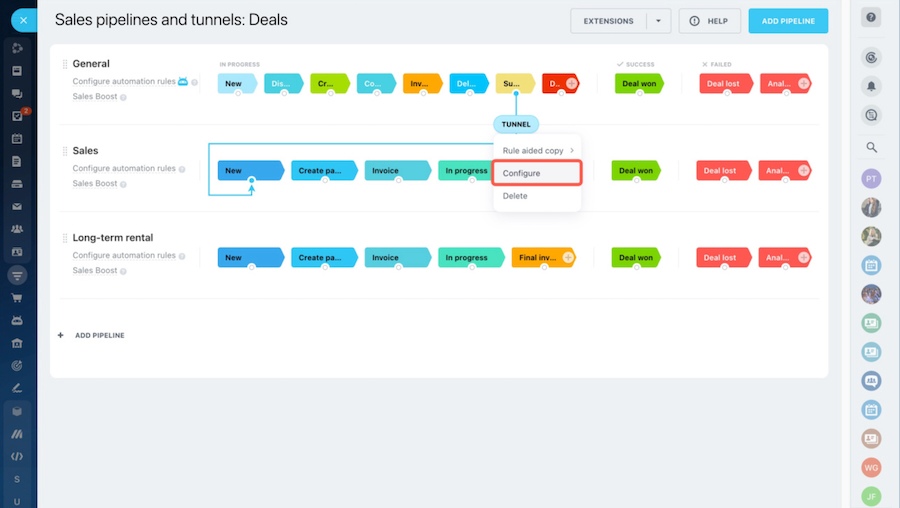

- Unique sales tunnel features for moving leads from one pipeline to another automatically; useful when tracking sales for different coverages

Where It Falls Behind

- Tough system to operate; a high learning curve is required to navigate the CRM

- Relatively expensive paid plans, ranging from $49 to $399 per organization, monthly

- Email and telephone capabilities aren’t available for free

My Expert Opinion

Bitrix24 has some of the widest range of CRM capabilities on this list, standing out for its solid freemium plan that includes project management, unlimited contact records, and the built-in e-signature tool for agents to obtain client signatures. We also like the sales tunnel capabilities that allow insurance brokers to manage complex sales deals involving different teams, coverages, and, ultimately, different processes.

Plans | Free | Basic | Standard | Professional | Enterprise |

|---|---|---|---|---|---|

Annual Pricing | $0 Unlimited users | $49 5 users | $99 50 users | $199 100 users | Starts at $399 250 users |

Monthly Pricing | $0 Unlimited users | $61 5 users | $124 50 users | $249 100 users | Starts at $499 250 users |

Contacts, Deals & e-Signatures | ✓ | ✓ | ✓ | ✓ | ✓ |

Multiple Sales Pipelines, Documents Storage & Task Assignment | ✕ | ✓ | ✓ | ✓ | ✓ |

Unlimited Leads & Quotes | ✕ | ✕ | ✓ | ✓ | ✓ |

File Sharing & Smart Process Automations | ✕ | ✕ | ✕ | ✓ | ✓ |

High-performance Enterprise Cluster | ✕ | ✕ | ✕ | ✕ | ✓ |

- Multiple sales pipelines: Bitrix24 has multiple pipelines that can be used for each insurance product and a unique sales funnel tool to connect pipelines. The sales funnel feature moves or adds records automatically based on triggers for, say, if a business wants quotes for both commercial coverage and employee benefits.

- Client profile management: Bitrix24, while expensive on the paid plans, has a great free-forever plan for unlimited users. It includes useful tools like project management, unlimited stored contact records, pipeline tracking, and Bitrix24. Sign to get signatures from the CRM. There’s also free client profile management to plan and track activity associated with an insured.

- Contact center: Bitrix24’s omnichannel contact center helps facilitate seamless and centralized communication between agents and insureds. It allows you to connect with clients via email, chat, social media messaging apps, and phone from a single page.

Bitrix24 sales pipelines with sales tunnel configuration option (Source: Bitrix24)

Insureio: Best Specialty CRM for Life Insurance Agents

Why I Like It

- Specialty CRM built for life, disability, and annuity insurance sales

- Offers features for managing agency operations like agent recruitment tools and brand management

- End-to-end capabilities for generating leads, obtaining and sending quotes, binding and delivering policies, and managing accounts

Where It Falls Behind

- No free plan, just a 30-day free trial

- Automated lead assignment features are gated with the Agency Management Plan

- Mass email features require a Marketing plan

My Expert Opinion

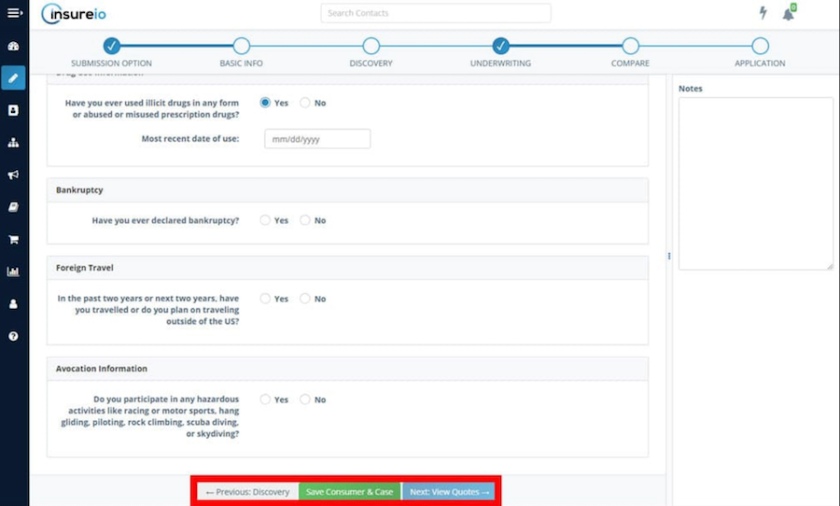

Insureio is the best industry-specific CRM for life insurance, thanks to its integration with over 30 carrier portals. With this, users can directly get quotes and bind coverage from the CRM. This is in addition to the sales and marketing tools, case management features, agency management module, and supplemental financial planning and underwriting features.

Insureio Plans | Basic | Marketing | Agency Management | Marketing & Agency Management |

|---|---|---|---|---|

Monthly Pricing (per User) | $25 | $50 | $50 | $75 |

Lead, Client & Case Management | ✓ | ✓ | ✓ | ✓ |

e-Application Fulfillment & Unlimited Quoting | ✓ | ✓ | ✓ | ✓ |

Mass Emailing & Personalized e-Marketing Website | ✕ | ✓ | ✕ | ✓ |

Lead Routing & Agent Recruiting | ✕ | ✕ | ✓ | ✓ |

- Life insurance sales module: Insureio is a specialty-built insurance CRM for agents and brokers that generate new business and deliver policies. Because it can integrate with over 30 life insurance carrier portals, it is meant to be an end-to-end solution for getting quotes, managing policies, underwriting, health screening, and supporting renewals for life insurance coverage.

- Full agency management: Insureio offers operations management tools that help agencies run smoothly. These include recruiting tools and email templates, brand management features, and company hierarchy tracking to help employees understand the organizational structure. There are also options to manage an entire insurance-based website from the CRM.

- Marketing: Insureio’s Marketing plan comes with a life quoting and lead capture widget, pre-built and customizable e-marketing templates, and mass email-sending capabilities. You can also build a branded insurance-specific website and social media marketing tools.

Insureio’s quoting process showing the underwriting stage (Source: Insureio)

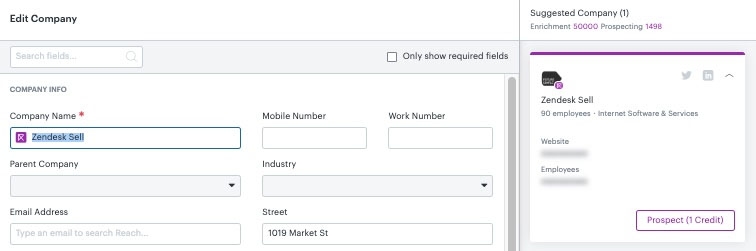

Zendesk Sell: Best for Prospecting Potential Clients

Why I Like It

- Solid prospecting tool with a built-in database to obtain lead data

- Multi-channel outreach options via phone, text, email, or AI chatbot

- Wide reporting capabilities like generating forecasts, tracking premium goals, and getting email campaign insights

Where It Falls Behind

- No free plan, just a 14-day free trial

- Relatively expensive bulk email tools, starting at $55 per user, monthly with the Sell Growth plan

- Lacks proposal management feature to create quotes for insureds

My Expert Opinion

Zendesk Sell is a particularly good option for optimizing early sales funnel stages. Producers and sales reps can leverage the prospecting tools to get lead data on those deemed a good client fit for the agency. This database pairs well with the multi-channel communication tools via email, phone, and text to begin cold outreach and fill up the sales pipeline with new opportunities.

Zendesk Sell Plans | Sell Team | Sell Growth | Sell Professional | Sell Enterprise |

|---|---|---|---|---|

Annual Pricing (per User) | $19 | $55 | $119 | $169 |

Monthly Pricing (per User) | $25 | $69 | $149 | $219 |

Sales Pipelines | 2 | 10 | 20 | Unlimited |

Sales Engagement Credits | 0 | 1,000 enrichment 25 prospecting | 3,500 enrichment 150 prospecting | 10,000 enrichment 300 prospecting |

Task & Appointment Setting | ✓ | ✓ | ✓ | ✓ |

Subscription Management | ✓ | ✓ | ✓ | ✓ |

Product & Price Books | ✕ | ✓ | ✓ | ✓ |

Lead Scoring & Task Automation | ✕ | ✕ | ✓ | ✓ |

Direct Dial Phone Number Data & Company Technology Stack Intelligence | ✕ | ✕ | ✕ | ✓ |

- Prospecting tools: In this list, Zendesk Sell is unique because it’s the only insurance CRM for agents with a built-in database for prospecting. Sales producers can input a company name or search filter and obtain the lead name, phone number, and email contact data. Similarly, you can enrich contact profiles and ensure lead data stays up-to-date so you can reach out before each renewal period.

- Multi-channel outreach: Since most agencies sell the same coverages, insurance tends to be a volume game. With Zendesk Sell, producers and account managers can optimize communication and ensure they engage insureds on all channels, including email, text, phone, and AI chatbots.

- Mobile app geolocation: The mobile Sell app provides agents with directions to clients or leads. Its mobile geo-verification feature lets agency leaders or managers confirm reps’ location at client sites.

Zendesk Sell prospect data enrichment (Source: Zendesk)

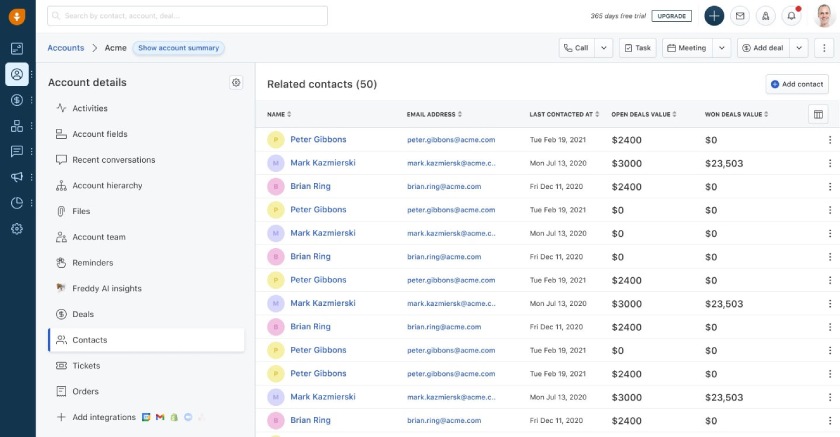

Freshsales: Best for Insured Account Management

Why I Like It

- Offers a dedicated account management module to oversee insured clients and their policy documents

- Includes a free built-in telephone to engage leads and support insureds

- Solid features for premium quota tracking and managing agency teams

Where It Falls Behind

- Relatively expensive auto-profile enrichment, starting at $59 per user, monthly with the Enterprise plan

- Email tools not available for free

- Users can’t automate lead, deal, or account assignments until the Pro plan

My Expert Opinion

Freshsales supports account managers who must service their insureds after closing the deal. We like how the account management module, built-in phone system, and appointment scheduling tools are all included for free for agencies on a tight budget. It’s also important to highlight its robust account management tools, letting you track hierarchies, store contacts, manage files, and create deals from account records.

Freshsales Plans | Free | Growth | Pro | Enterprise |

|---|---|---|---|---|

Annual Pricing (per Month) | $0 3 users | $9 per user | $39 per user | $59 per user |

Monthly Pricing (per Month) | $0 3 users | $11 per user | $47 per user | $71 per user |

Contact, Deal & Account Management | ✓ | ✓ | ✓ | ✓ |

Built-in Phone, Chat Widget & Email Templates | ✓ | ✓ | ✓ | ✓ |

Workflows, Product Catalog & Rotten Deal Indicator | ✕ | ✓ | ✓ | ✓ |

Quota & Team Management | ✕ | ✕ | ✓ | ✓ |

Ad-hoc Deal Teams & Forecasting Insights | ✕ | ✕ | ✕ | ✓ |

- Account management: Freshsales is particularly useful for account managers wanting to organize insured documents, track account activity, and support clients to help retain the business. The Free plan has a dedicated account management module for agencies to handle renewals. There’s even a built-in telephone to receive, place, and track calls from the CRM.

- Quota management: In insurance sales, sales quotas are extremely common to keep producers accountable for new premiums generated. Whether it’s for individuals or specific sales teams, agency principals can use Freshsales to set goals, track progress, and get insights from an AI tool to see which deals can get committed to a report.

- Cross-channel communication: With Freshsales, insurance reps can easily track client communication across all channels, including phone, chat, and messaging apps. You can also build chat campaigns for lead nurturing.

Freshworks account management system (Source: Freshworks)

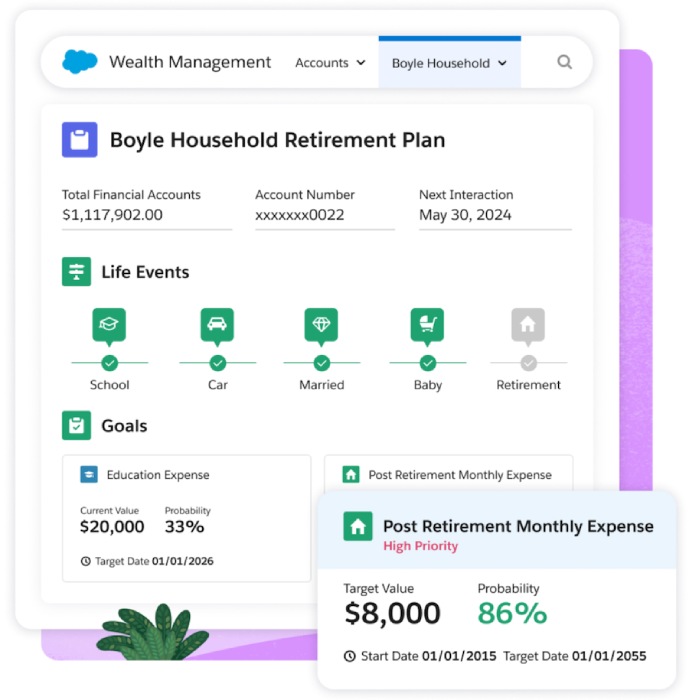

Salesforce: Best for Insurance Commission & Claims Tracking

Why I Like It

- Includes unique opportunity splitting tools that divide commissions when multiple reps are involved

- Wide range of industry-specific CRM integrations, including many insurance tools, like policy management and claims to track

- All-in-one solution for sales, marketing, and service management

Where It Falls Behind

- Relatively expensive plans starting at $300 per user monthly

- Analytics and AI insights require an additional fee ($250 per user monthly)

- Steep learning curve is needed to get comfortable with the interface and advanced sales tools

My Expert Opinion

Built on the Salesforce CRM, Salesforce Financial Services Cloud is the best CRM for connecting all your insurance procurement, quoting, and policy management tools. Between the system customization and a wide range of integration options, the platform is one of the top specialty CRM software for insurance agencies to bring in new business and service current clientele.

Salesforce Financial Services Cloud Plans | Sales | Service | Sales & Service | Einstein 1 |

|---|---|---|---|---|

Annual Pricing (per User Monthly) | Starts at $300 | Starts at $300 | Starts at $325 | Starts at $700 |

Salesforce Sales Cloud | ✓ | ✕ | ✓ | ✓ |

Salesforce Service Cloud | ✕ | ✓ | ✓ | ✓ |

Industry-specific Data Models & Insurance Producer Consoles | ✓ | ✓ | ✓ | ✓ |

Financial Goals, Actionable Segmentation & Branch Management | ✓ | ✕ | ✓ | ✓ |

Insurance Policy & Transaction Dispute Management | ✕ | ✓ | ✓ | ✓ |

Performance Management, Scheduler & Enablement | ✕ | ✕ | ✕ | ✓ |

- Commission tracking: As part of its robust set of sales features, Salesforce comes with commission tracking tools to help monitor new premiums by rep and to allocate performance-based compensation. Additionally, the system allows you to split opportunities when multiple agents are responsible for a sales deal to split commission accordingly.

- Client and financial account management: Salesforce is equipped with a central hub from where you can manage all client profiles, including their financial accounts, insurance policies, and investment portfolios. You can also monitor their relationships and key life events related to financial products they have purchased.

- Einstein Analytics: Use Salesforce’s built-in dashboards and reports to get insights into your insurance business, track rep performance, see recommended next-best actions, and make business decisions based on real-time data. Tailor your marketing efforts with personalized campaigns to improve your client engagement and conversion rates.

Salesforce Financial Services Cloud financial goals and planning features (Source: Salesforce)

Methodology: How I Evaluated the Best Insurance CRM Software

To determine the best CRM for insurance agents, I evaluated the relevant features for an insurance agency to manage sales, marketing, and operations. For instance, commission tracking lets an agency principal properly allocate sales producer earnings on premiums generated. I also looked at other critical CRM software attributes, including price, product ease of use, customer support, and general feats like integrations and system customization.

The tabs below offer insight into my evaluation process of the best CRM software for insurance:

25% of Overall Score

20% of Overall Score

Pricing considered the overall affordability of each CRM system. This accounted for freemium plan options, low-cost subscriptions, and billing flexibility by allowing users to subscribe monthly or save with an annual plan. I also examined the cost of features specifically useful for insurance agencies and whether they were available on the free or lower-tiered plans.

20% of Overall Score

20% of Overall Score

15% of Overall Score

Frequently Asked Questions (FAQs)

An insurance CRM is a software with tools for agencies to grow their business. It will include features like deal tracking, document management for policy files, and communication tools that let you engage leads via phone or email. Some of the more advanced insurance CRMs will even have commission tracking on premium sales, account management tools to support and renew insureds, and team management to oversee multiple policies or geographic territories.

The main benefit of using an insurance CRM is work centralization. Instead of navigating multiple tabs and doing double data entry in various apps, it lets you handle lead and client communications, document management, quote generation, sales reporting, and activity monitoring all in one system. Additionally, an insurance CRM is a lower-cost solution, as you can access your features from one subscription rather than multiple.

The best insurance CRM will depend on your feature needs and budget. If, for example, you need robust deal management and proposal generation tools to send insurance quotes to leads, we’d recommend Pipedrive. However, if you mainly want to market your agency, we’d recommend HubSpot CRM because of its comprehensive marketing and content management tools. Alternatively, specialty tools like Insureio are solid if you primarily sell life insurance policies.

Bottom Line

Insurance CRMs help agencies grow their book of business. These platforms will include tools for generating leads, delivering new policies, and managing current insureds. While we rated HubSpot CRM as the best overall insurance CRM system for marketing, other products could be a better fit, depending on needs. For example, Zoho CRM is highly customizable in creating modules specific to an agency, while Salesforce is best for tracking commissions and policy claims.