Dharma Merchant Services is a traditional merchant services provider with interchange-plus pricing that specializes in working with independent businesses. Its features include a free virtual terminal, online reporting, mobile processing, online payment links, a customer database, credit card storage, and next-day funding.

In our review of the best merchant services providers, Dharma Merchant Services earned an overall score of 4.00 out of 5 and came out as the best for transparent pricing. Its suite of online and offline payments tools for low-risk business processing also makes it an ideal solution for businesses processing at least $10,000 each month.

Dharma Merchant Services at a Glance

Dharma Merchant Services has an excellent reputation for being honest and transparent—a breath of fresh air in the payment processing industry. The company specializes in working with mom-and-pop businesses and nonprofit organizations. It offers some of the lowest interchange-plus rates available.

However, businesses that process lower than $10,000 monthly will likely find a different merchant account provider a better fit. It is also good to note that Dharma Merchant Services has a stricter application vetting process than most merchant service providers—it will have to confirm your Tax Identification Number (TIN) with the IRS, which usually takes up to two weeks. As such, it’s generally not suitable for high-risk businesses. New merchant account setup takes two to three business days after Dharma receives all the necessary materials.

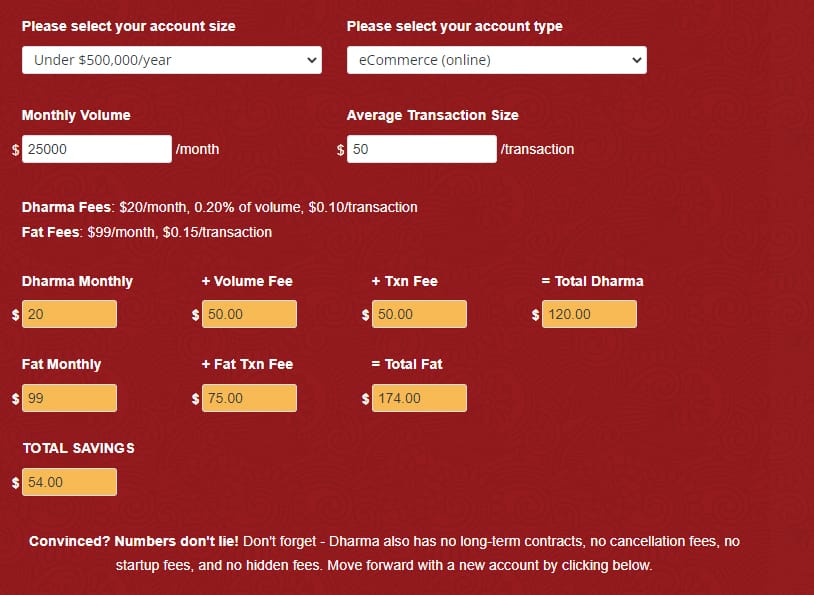

Dharma Merchant Services Calculator

Although Dharma Merchant Services offers among the lowest interchange-plus pricing available, its monthly and other add-on fees brought down its score for pricing and contract. It claims to have no cancellation fee but charges a closure fee of $49, which also lost it a few points. If you’re processing over $100,000 per month, Dharma Merchant Services is still a good option as you can get even lower transaction fees. It also has a lot of hardware options for all kinds of business setups.

Monthly Fee | Transaction Fee (in addition to interchange fees) | Discounted High-volume Rates* ($20/month fee) | Discounted Non-profit Rates ($20/month fee) | |

|---|---|---|---|---|

Virtual | $15/month | 0.2% + 11 cents (0.3% + 11 cents for Amex) | 0.1% + 11 cents | 0.1% + 11 cents (0.2% + 11 cents for Amex) |

Storefront and POS | $15/month | 0.15% + 8 cents (0.25% + 8 cents for Amex) | 0.1% + 8 cents | 0.1% + 8 cents (0.2% + 8 cents for Amex) |

Restaurants, Bars, and Quick Service | $15/month | 0.15% + 8 cents (0.25% + 8 cents for Amex) | 0.1% + 8 cents | N/A |

B2B | $15/month | 0.15% + 8 cents (card present) 0.2% + 11 cents (card not present) | 0.10% + 8 cents (card present) 0.1% + 11 cents (card not present) | N/A |

*To qualify for high-volume discounted rates, merchants must process over $100,000 in credit/debit card sales every month and have over 5,000 transactions per month; restaurants must have an average ticket of $25 or less

You can find a fees calculator on Dharma’s website to help you estimate and compare interchange vs flat fees based on your business needs. (Source: Dharma Merchant Services)

All Dharma Merchant Accounts include the use of its virtual terminal, mobile processing, customer database, credit card storage, address verification service, online reporting, online payment links, and batch processing tools with the MX Merchant payment gateway.

Additional Dharma Merchant Services Fees

While most MX Merchant services are free, the use of some tools come with additional cost:

- Invoicing and recurring billing: $10 per month

- Integrated ACH (check) processing: $25 per month, 40 cents per transaction

- B2B (level 2 and level 3) processing: $20 per month to get reduced interchange rates

- Online ordering: $49 per month

- Account updater: $25 per month to automatically update expiration dates of cards stored on file

- Inventory management: $25 per month

Also, MX Merchant does not support shopping cart integrations and can only perform basic export functions to QuickBooks. This is where Dharma recommends Authorize.net as alternative payment gateways, which will also allow you free use of some of the services listed above, but will cost you an additional $10/month and 5 cents per transaction.

For a detailed comparison between MX Merchant and Authorize.net, visit Dharma Merchant Services.

Other Dharma Merchant Services Fees

- Voice authorization fee: $1.50 for every request made by the customer’s bank to contact them over the phone to verify the charge

- Wireless fee: $20 for merchants using wireless terminals like PAX s90

- Chargeback fee: $25 for every disputed transaction

- Retrieval fee: $5 for every request of additional sales information by your customer’s bank

- PCI non-compliance fee: $39.95/month if you fail to complete the PCI Compliance Survey 90 days after signing up with Dharma

Dharma works with a variety of payment terminals, including hardware that supports direct integration to MX Merchant functionalities. It also offers a mobile card reader that works with its MX Merchant Express mobile app.

However, while most of its payment terminals are competitively priced, you’ll find Dharma’s 3-in-1 card reader to be significantly more expensive than other mobile card readers in the market. Mobile card readers that accept swiped, chip, and tap payments usually range from $59 (Chipper BT) to $109 (Helcim).

| FD-150 Terminal

Price: $295 |

| Ingenico Desk 3500

Price: $295 |

| Verifone Engage V200c Terminal

Price: $295 |

| Ingenico Desk/5000

Price: $369 |

| Dejavoo Z11

Price: $295 |

| Clover POS Hardware

Price: $599 to $1,999 |

Getting approved for a Dharma account typically takes two to three business days after submitting all the documents required. However, Dharma will have to confirm your Tax Identification Number (TIN) with the IRS, which usually takes up to two weeks.

Dharma Merchant Services doesn’t require a long-term or minimum commitment, but it charges a $49 “closure processing fee” if you permanently cancel your account. To avoid that fee, or if you’re a seasonal business, you can close and reactivate your account without paying this or any other applicable fee.

If you require a POS system, you will need to look for providers within the TSYS or First Data (Fiserv) network, such as Clover POS. Depending on which one you chose, you’ll find a copy of Dharma’s terms and conditions (also known as program guides) here:

Dharma got near-perfect scores for every payment type we considered in this review. What cost it a few points are the add-on fees for its ACH check processing and B2B processing. Merchants willing to pay those add-on fees will find maximum payment flexibility with Dharma.

Dharma Merchant Services provides free access to MX Merchant payment gateway so you can process different types of payments online, including mobile card processing. However not all tools are free to use:

Free MX Merchant Gateway Tools | Paid MX Merchant Gateway Tools |

|---|---|

|

|

This means that if your online business relies heavily on accepting invoiced and ACH payments, you might want to consider the overall cost. Alternatively, Dharma integrates with NMI and Authorize.net, which charge a monthly fee of $10 and 5 cents per transaction and may be more cost-effective for businesses with larger sales volume. Both offer free recurring billing and level 2 data processing for B2B businesses, cheaper ACH processing fee, and free shopping cart integration features not available in MX Merchant.

Read our rundown of the leading payment gateways.

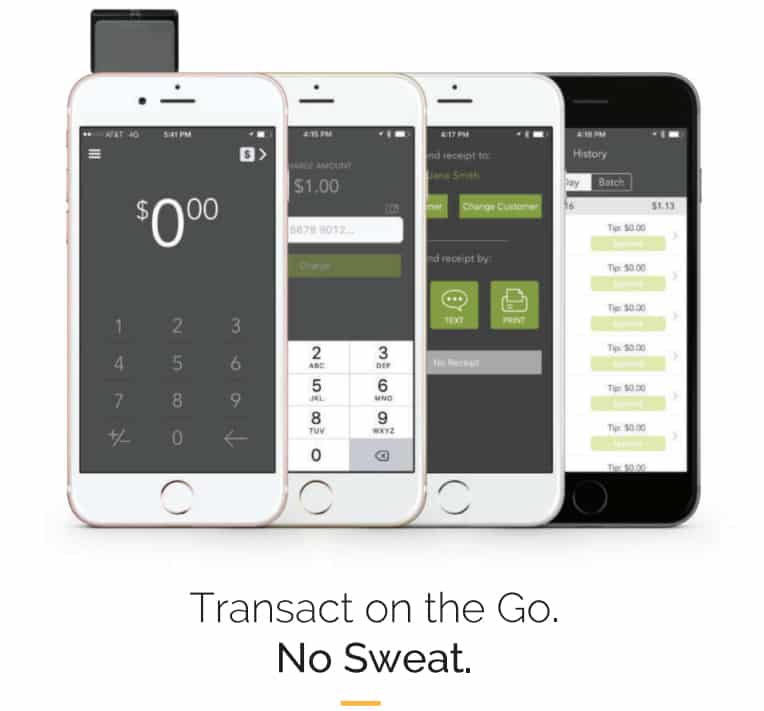

MX Merchant Express is a free mobile payment app for accepting payments on the go. It allows you to accept swiped, chip, and contactless transactions; issue digital receipts; capture digital signatures; and adjust for tips, among other functions. It also seamlessly integrates data from your MX Merchant account so you can charge customers using their stored credit card data and access past transactions.

Compared to other popular mobile payment apps, this one is simple and easy to use, with helpful tools like capturing digital signatures and adding tips. However, you won’t be able to view reports, which most payment apps—like SwipeSimple and Helcim—can now do.

MX Merchant Express works with both mobile iOS or Android devices and is downloadable free from the Apple App and Google Play store. (Source: Dharma Merchant Services)

Learn more about the best credit card payment apps.

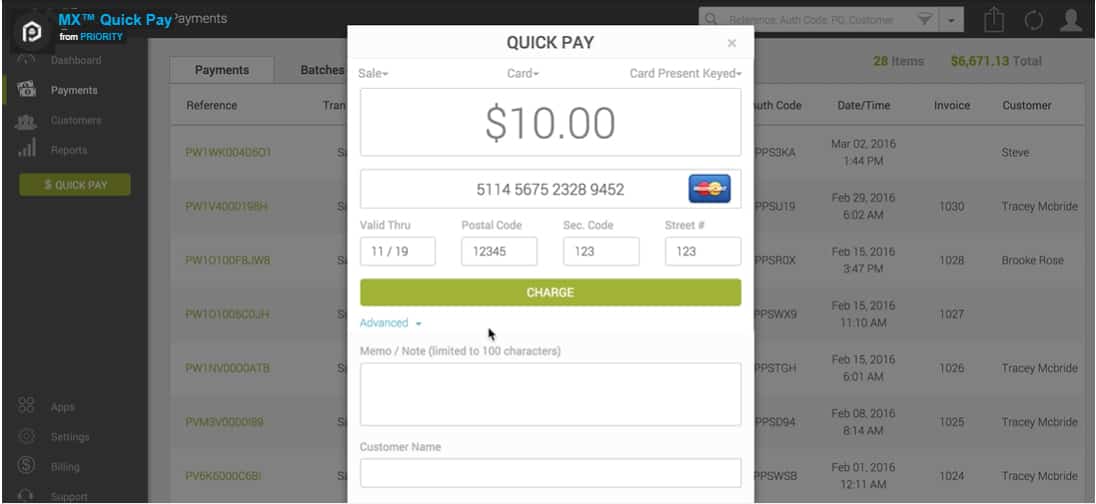

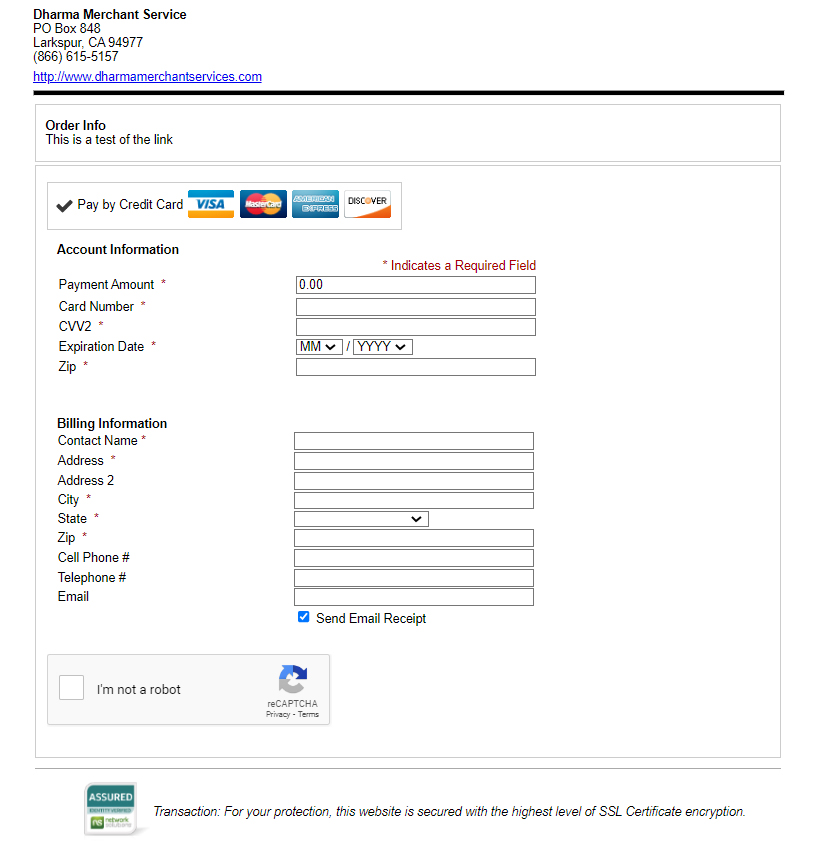

QuickPay is Dharma’s virtual terminal that comes free with its payment gateway and allows you to accept payments from your MX Merchant dashboard. You can opt between adding card details manually or from the stored credit card information. It also provides an option between keyed-in or swipe payments by connecting a magnetic stripe reader directly to your computer, which means you don’t get charged the higher card-not-present transaction rate.

Dharma’s virtual terminal tools and interchange plus pricing are not so different from providers like Helcim; however, you need to pay Dharma a monthly fee of $25 per month for virtual transactions while Helcim is free.

Fill in additional information, such as customer contact details, invoice number, and sales tax, in the advanced section of the QuickPay app. (Source: Dharma Merchant Services)

Find more virtual terminal options from our roundup of best virtual terminals.

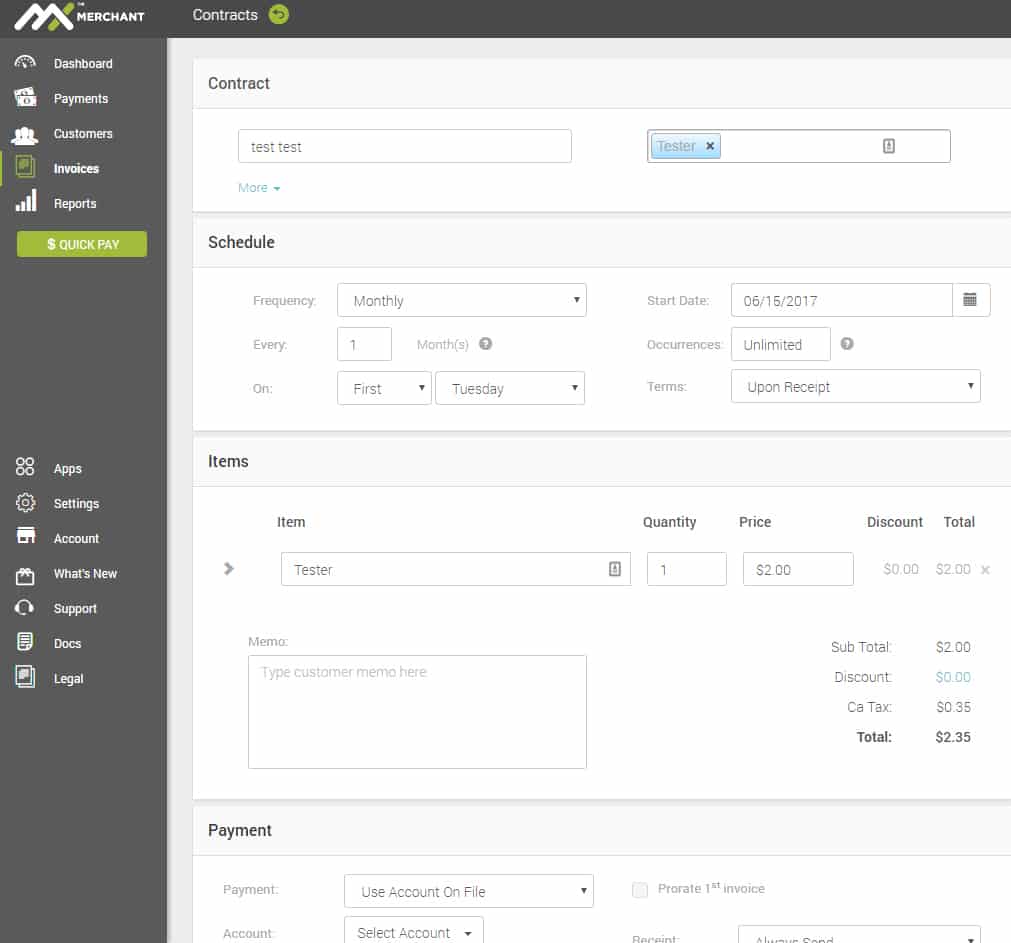

The MX Invoicing app allows you to manage your invoices and recurring payments. You can create templates and customize invoices to add customer memos, allow specific payment terms, easily edit unpaid and canceled invoices, send invoices via email or text, and receive notifications for declines, received payments, and chargebacks.

Dharma offers a strong set of invoice management features that efficiently create and track both one-off and recurring invoices. However, you’ll also find similar functionalities in competitors like Stripe, which you can use without any monthly fees. Dharma’s invoicing app will cost you an additional $10 per month.

Manage your recurring invoices with Dharma’s tools that allow you to set payment frequency and a specific number of occurrences, apply taxes, and adjust for discounts. (Source: Dharma Merchant Services)

If you already have a website, you can easily add “Pay Now” or “Donate Now” buttons to your checkout page. You can create as many payment links as you’d like and manage each of them from the MX Merchant Dashboard. The payment links can be easily inserted into your website with HTML code or shared via URL.

Add a “Pay Now” or “Donate” button on your website using a hosted payment link through MX Merchant. (Source: Dharma Merchant Services)

Dharma offers a B2B app that automates the application of level 2 and level 3 processing rates to your transactions. The MX B2B app automatically populates any missing information required for level 2 or level 3 processing every time you enter a sale on your virtual terminal. This helps to make sure that you always get the lowest rate possible for your transactions. However, this is an extra $20 monthly fee on top of your current processing fees, so it’s best to analyze the cost-worthiness for your business before signing up.

Unfortunately, Dharma does not support international sales, which would have been a useful feature for wholesale B2B sellers that would benefit most from the MX B2B app. The monthly fee is also expensive if you compare it to similar providers like Stripe, which is free to use and supports 135 currencies.

Learn more about our top recommendations for B2B payment solutions.

Aside from Dharma’s MX B2B app, the MX Merchant platform also integrates with ACH.com, allowing you to receive and process ACH payments in the same environment as your credit card processing. The integration allows you to key in a one-time transaction or save ACH payment information for future or recurring billing.

This integration has a $25 monthly fee with a transaction fee of $0.40 per transaction. There’s also a $2 return item fee and a $5 reversal fee. Before you can get the integration up and running, you might also be asked for additional documentation, and the approval could take up to 10 days.

One of Dharma’s biggest strengths is its 24/7 customer support, and it received perfect scores for this. However, it did not do very well in other considerations for this category. Most of its business management tools and solutions come with extra monthly fees, so Dharma was docked points despite the availability of those services. Its deposit speed is also among the slower payouts and without any paid instant deposit option.

Aside from its own payment gateway, Dharma also integrates with Authorize.net and NMI to offer customers more online payment tools. With an Authorize.net gateway, you get access to top ecommerce platforms such as BigCommerce and Shopify, where you can build your own website. It also supports online ordering with MX Merchant’s e|tab app, which works great for restaurants that offer food delivery.

For nonprofits, Dharma integrates with the online fundraising platform 4aGoodCause. Its features include everything small nonprofit organizations need, such as a donation campaign builder, event management, personal or team-based fundraising tools, and advanced customer relationship management functionality.

What Dharma Merchant Services lacks in built-in POS features, it makes up for in integrations. It works with TSYS and First Data (Fiserv) networks and primarily endorses the Clover POS system. However, Dharma also works with other POS systems for retail, restaurant, and niche business types, some of which might require the use of specific payment gateways like Authorize.net.

The following are POS systems that also work with Dharma:

- Aloha

- Ambur

- Breadcrumb

- Digital Dining

- Dinerware

- Groupon

- Lavu POS

- Micros

- NCR Silver

- Revel POS (requires use of the FreedomPay gateway)

- Shopify POS (requires use of the Authorize.net gateway)

- Shopkeep

- Squirrel POS

- Talech POS (requires use of the USAePay gateway)

- Vend POS (online only—requires use of the Authorize.net gateway)

- Vendini (requires use of the Authorize.net gateway

The built-in reporting capabilities in the MX Merchant platform makes it easy to filter and view the data you need. Among the reports it can generate are deposit, customer, payment, and transaction reports. You may customize and filter the data so that you only see what you need in the report you generate.

Some merchants choose to pass on their credit card processing fees to their customers by imposing a surcharge or checkout fee. A feature on the MX Merchant platform, the MX Advantage, allows merchants to turn on surcharging for card-present and card-not-present transactions. Since all MX services are integrated into the MX Merchant platform, surcharging—when turned on—applies to credit card transactions processed in-person, on the virtual terminal, and via invoicing and recurring payments.

Take note that surcharging laws vary by state—it is illegal in some states. Some states require certain conditions, such as a maximum surcharge rate and full disclosure, before you can impose a surcharge. Make sure to check the surcharge laws in your state and read our guide on free credit card processing.

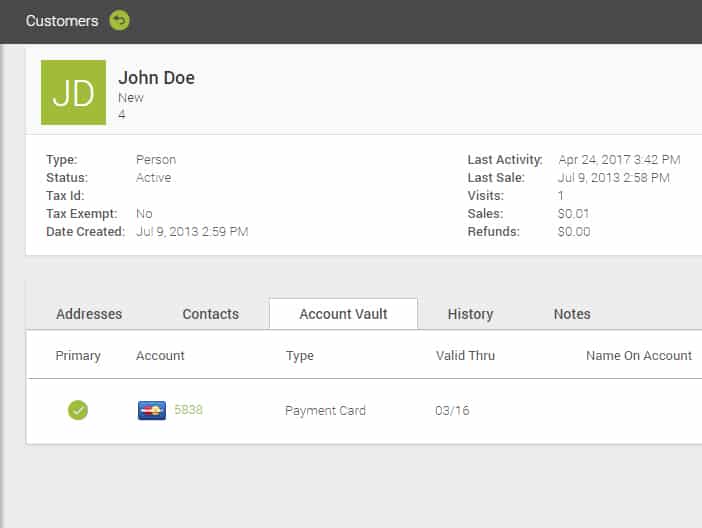

Dharma lets you securely store customer information with its customer data storage feature. Apart from capturing an unlimited number of names and contact details of each customer, Dharma lets you categorize your customer list, save multiple payment details, store historical purchase records, and see the number of visits per customer. You can also create custom fields to save additional information, such as customer preferences and spend profiles.

Not all merchant service providers include a built-in advanced customer relationship management feature for free. Dharma has a clear advantage in this segment, offering huge value, especially for storefront businesses with hardware that compliments this feature. Clover POS, for instance, has a customer-facing display that can allow you to provide customers with the option of choosing their own payment method based on their customer profile.

Dharma lets you easily start a payment from the customer screen to charge a card on file. (Source: Dharma Merchant Services)

The MX Merchant platform also has the MX Account Updater, which automatically updates the expiration dates of cards stored on file. There is a monthly fee of $25 that includes up to 150 updates per month. Any additional updates cost $0.15 per update. The Account Updater only works on Visa, Mastercard, and Discover cards stored on file.

Another optional feature in the MX Merchant platform is the MX Merchant Insights App which gives you access to a database of over 95 billion transactions so you can have actionable insights about your customers and local competitors.

The use of the MX Merchant Insights App has a $10 monthly fee. Among the data you can access with this service are customer demographics (age, gender, income, education levels, and more), and you can even connect your social media accounts to get better insights into the people interested in your business.

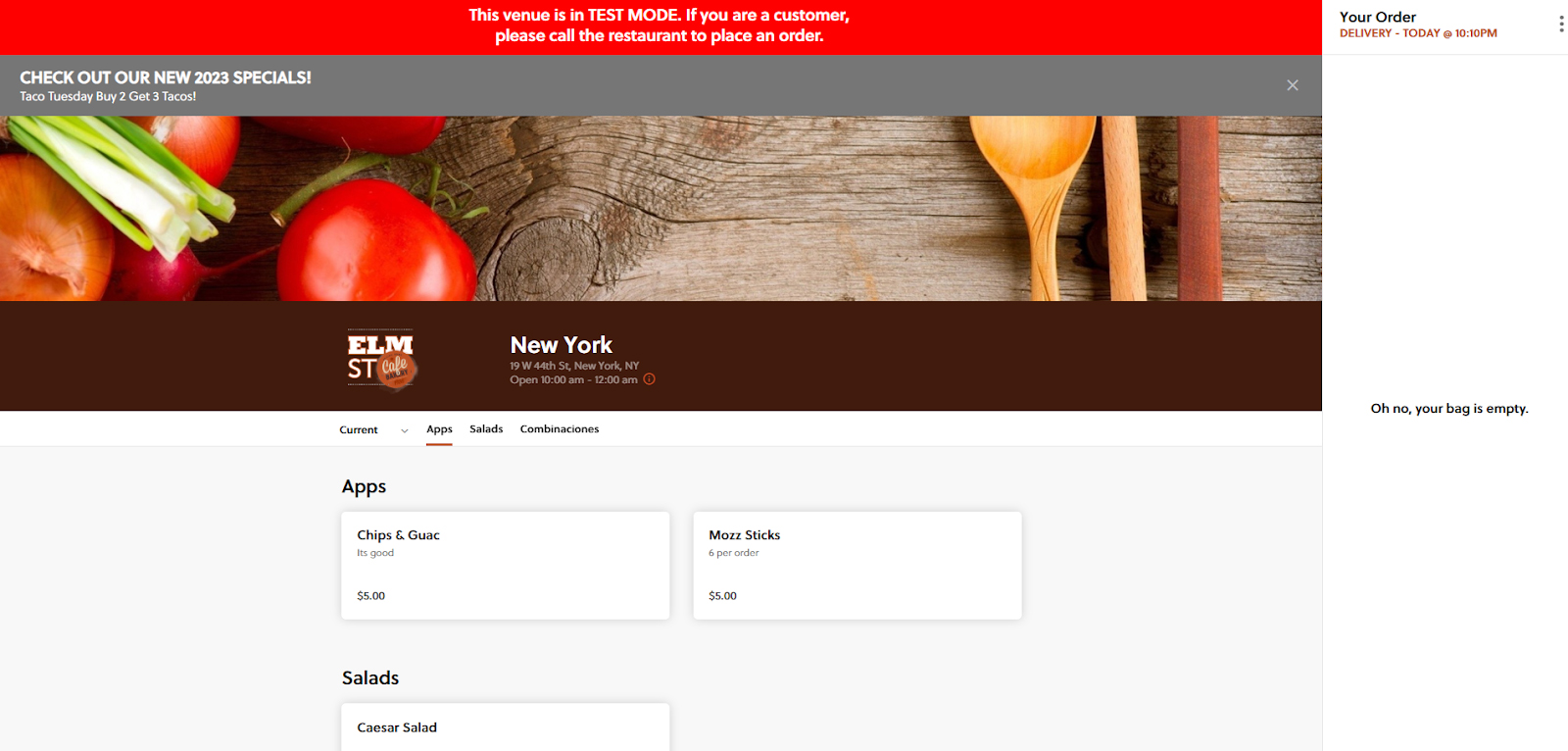

Dharma offers a native app that provides merchants with an online ordering solution. The MX Merchant e|tab is great for restaurants, bars, and retail verticals. The platform gives you a solution for accepting orders for pickup and delivery.

The e|tab comes with a $49 monthly fee, and the same interchange-plus pricing also applies for orders placed on the platform. This makes it potentially cheaper than other similar online ordering services such as Grubhub, ChowNow, and Slice. It also gives you the ability to add a convenience fee to every order.

The MX Merchant e|tab is a full online ordering website that works great for restaurants, bars, and retail verticals. (Source: Dharma Merchant Services)

Dharma Merchant Services has a guaranteed two-business-day funding with daily 7 p.m. network cut-off time. Retail card-present merchants may apply for next-day funding upon account application and are subject to underwriting approval.

The support team at Dharma Merchant Services has earned a reputation for being available and going above and beyond. It offers 24-hour tech support available via phone, live chat, or ticket submission through its website. Their detailed support page has an easy-to-navigate FAQs section for troubleshooting on your own.

Customer reviews show positive experiences with the knowledgeable, patient, and responsive support team. This kind of positive review on customer support is a huge advantage in the payment processing industry.

Dharma Merchant Services received one of the highest scores for this category among other merchant services providers we’ve reviewed. It is easy to use, well-known, and reliable, and offers solid integrations. We docked a few points for pricing and affordability because although we liked the low interchange-plus pricing, its monthly fee, together with the other add-on service fees, can make it an expensive option for smaller businesses.

Smaller businesses looking for lower upfront costs with complete all-in-one solutions may consider Square. If you are after the same interchange-plus pricing without a monthly fee, Helcim is a good option.

For high-volume businesses, especially those that process more than $100,000 per month, Dharma Merchant Services is an affordable and versatile option.

Dharma Merchant Services Reviews From Users

Though there are not many user reviews for Dharma Merchant Services, those we can find are positive. Merchants appreciate the responsive customer support team and transparency around pricing.

- Capterra: Only one user reviewed Dharma Merchant Services on Capterra, giving it 5/5 stars. They like that it’s easy to navigate, even though they don’t use the platform daily.

- Trust Pilot: Dharma earns a 4.3 out of 5 based on more than 110 user reviews.

While Dharma Merchant Services reviews are mostly favorable, many note that it may not be a great fit for merchants processing under $10,000 per month. Plus, Dharma is only available to US-based businesses. Here are some Dharma Merchant Services pros and cons from online user reviews:

| Users Like | Users Don’t Like |

|---|---|

| Easy to use | Software error messages when processing cards |

| Immediate customer receipt printing | Doesn’t support international merchants |

| Accepts payments quickly and easily | No reporting function on the mobile app |

| Commitment to corporate social responsibility | |

Methodology—How We Evaluated Dharma Merchant Services

We test each merchant account service provider ourselves to ensure an extensive review of the products. We compare pricing methods, identifying providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. We then further evaluate according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts and extra points if those discounts are transparent or automated.

This is the weakest category for Dharma Merchant Services, mainly because of its monthly, closure, and chargeback fees.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and echeck payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Dharma Merchant Services scored strongly in this category. It can handle all the payment types we considered, and it only lost minor points for the additional monthly fee for some payment types such as for ACH, echeck, and B2B processing.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

Although Dharma is known for its excellent 24/7 customer service, it lost points in this category for its slower deposit speed and paid business management tools and solutions.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

We scored Dharma Merchant Services well for its ease of use, popularity, available integrations, and overall transparency.

Bottom Line

Dharma Merchant Services is a traditional merchant account provider that offers affordable payment processing rates to high-volume businesses. Restaurants and other food-based businesses also benefit from strong features and integrations tailored to things like tipping, tableside ordering, and more. Other features include discounted B2B payment processing, next-day funding for qualifying transactions, and a helpful support team. Visit its site to estimate the fees for your business and to request a quote from its team.