A virtual terminal lets merchants manually key in customer credit card information when they receive payment requests via phone, email, instant message, or mail. It can be accessed from any browser and requires no special equipment.

The best virtual terminals can securely accept multiple payment methods, let you send invoices, and create recurring payments, making them good for billing.

The top payment processors with the best virtual terminals for 2024 are:

- Square: Best overall

- Helcim: Cheapest for growing businesses

- PayPal: Best for freelancers, occasional sellers, and cross-border sales

- Chase Payment Solutions: Best for free same-day funding

- Shopify Payments: Best for ecommerce

- Payline Data: Best for medical businesses, educational services, and nonprofits

- Payment Depot: Best for no percentage markup U.S. businesses only

- PaymentCloud: Best for high-risk businesses

Best Virtual Terminals Compared

Monthly Subscription | Virtual Terminal Fee (Monthly) | Keyed-in Transaction Fee | |||

|---|---|---|---|---|---|

$0 | $0 | 3.5% + 15 cents | 2.6% + 10 cents | $0 | |

$0 | $0 | Interchange + 0.15% + 15 cents to 0.5% + 25 cents | Interchange + 0.15% + 6 cents to 0.4% + 8 cents | $0 | |

$0–$30 | $30 | 2.39% + 49 cents to 3.09% + 49 cents | 2.99% + 49 cents | +1.5% | |

$0 | Undisclosed | 3.5% + 10 cents | 2.6% + 10 cents | $0 | |

| $5–$399 | $0 | 2.4% + 30 cents to 2.9% + 30 cents | 2.4%–2.7% | +1.5% |

$10–$20 | $10 (one-time payment) | Interchange + 0.75% + 20 cents | Interchange + 0.4% +10 cents | N/A | |

| $79 | $0 | Interchange + 18 cents | Interchange + 8 cents | N/A |

$10–$45 | $15–$45 | 2.7%–4.3% | 2.7%–4.3% | Not disclosed | |

Square Payments: Best Overall Virtual Terminal for Small Business

Pros

- Free to use, no monthly fees

- Free POS and invoicing features included

- Easy chargeback dispute procedures

Cons

- Locked into Square Payments

- Can only process B2B with integration

- Limited support for high-risk merchants

Square Payments Deciding Factors

- Built-in payment processing

- Free POS and Invoicing

- Next-day access to funds (Same-day with fee)

- Waived chargeback fees

- Add-on services like appointments or payroll

- CBD program for businesses selling CBD products

What We Like

Square Payments is the built-in payment processor for Square POS that’s great for small businesses, from startups to shops with a physical location and an online store—even restaurants and salons. The virtual terminal also comes free with every Square POS account that supports almost all payment methods (B2B payments processing requires third-party integration).

The downside to Square’s extensive feature set, especially for those businesses that do high-volume sales, is the transaction fee, which is the highest on our list. If you have consistent sales of over $5,000 per month, do a price comparison against Payline Data, Payment Depot, or Helcim, which offer interchange-plus pricing.

As you consider costs, however, keep in mind all the tools Square provides that you may otherwise have to pay for. As your business grows and you’re processing over $250,000 annually, you can apply for lower, custom rates through Square. Here are the standard fees:

- Monthly subscription fee: $0

- Virtual terminal monthly fee: $0

- Keyed-in (virtual terminal) transaction fees: 3.5% + 15 cents

- In-person (swipe, dip, tap) transaction fees: 2.6% + 10 cents

- Invoice transaction fees: 3.3% + 30 cents

- Ecommerce transaction fees: 2.9% + 10 cents

- ACH/bank transfer fees: 1% with $1 minimum

Credit/debit cards | Recurring billing |

ACH | B2B payments (integration) |

Invoicing | International payments |

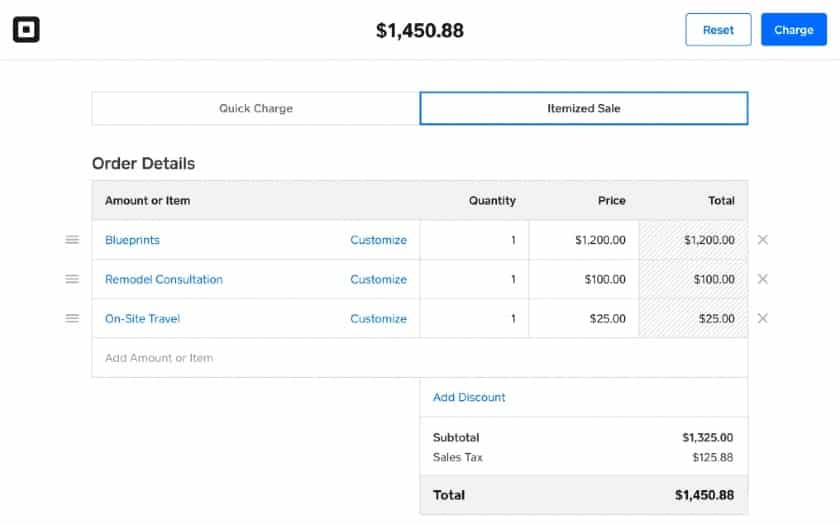

The virtual terminal includes inventory, recurring payments, and receipts. (Source: Square)

- Feature-rich payment tools: Square topped our scores for feature set, checking off our full list of tools for handling one-time and recurring bills, managing customers and invoices, and taking payments. It’s easy to use on both web and mobile, although the limited customer support hours and limited ability to accept Level 2 and 3 payments brought down its overall score.

- Native POS integration: Square’s free POS software integrates with the virtual terminal, so you can itemize sales, calculate taxes, input discounts, and save customer information. Most of the other virtual terminals on our list are more basic, requiring you to manually input the items and prices unless you tie them to a POS system.

- Free virtual terminal: Like most Square products, the virtual terminal is free, easy to set up, and user-friendly. Your inventory gets automatically updated, and changes in your online store are also reflected in the virtual terminal. If you integrate with QuickBooks or other accounting software, the information from the virtual terminal is tied in as well.

Square also offers some of the best solutions for POS software, merchant services, salon and spa software, and mobile payment processing.

Helcim: Cheapest Option for Growing Businesses

Pros

- Strong fraud protection

- Automated discounted interchange plus pricing

- No long-term contracts or monthly fees

Cons

- Lacks option for same-day funding

- Does not support high-risk merchants

- No inventory feature in virtual terminal

Helcim Deciding Factors

- Free virtual terminal

- Free POS

- Excellent rates

- ACH transactions

- Tokenized card information

- Lengthy merchant account approval process

What We Like

You will find other providers on our list that offer interchange-plus pricing, but Helcim stands out for its automated volume discounts and zero monthly fees. You do not need to apply for better rates as your transaction volume increases, making it an ideal choice for growing businesses. The virtual terminal handles phone sales, invoices, and recurring payments.

Helcim’s free monthly plan and automated volume discounts set it apart from the other payment processors on our list. Card-not-present transaction rates, including virtual terminals, range from Interchange plus 0.15% + 15 cents per transaction (if your sales average more than $1,000,000 a month) to 0.5% + 25 cents (for average sales of $50,000 and below a month).

This is considerably cheaper than Payline Data’s 0.75% + 20 cents, but more expensive than Payment Depot’s interchange + 18 cents (although note that you have to pay $79 in monthly fees). Helcim also charges an additional 0.10% + 10 cents when accepting American Express cards. Domestic ACH transactions cost 0.5% + 25 cents.

Monthly Sales Volume | Card-Present Rate Interchange plus | Keyed and Online Rate Interchange plus |

|---|---|---|

$0–$50,000 | 0.4% + 8 cents | 0.50% + 25 cents |

$50,001–$100,000 | 0.35% + 7 cents | 0.45% + 20 cents |

$100,001–$500,000 | 0.25% + 7 cents | 0.35% + 20 cents |

$500,001–$1,000,000 | 0.20% + 6 cents | 0.25% + 15 cents |

$1,000,001+ | 0.15% + 6 cents | 0.15% + 15 cents |

Credit/debit cards | Recurring billing |

ACH/echecks | B2B payments |

Invoicing | International payments (for merchants in Canada) |

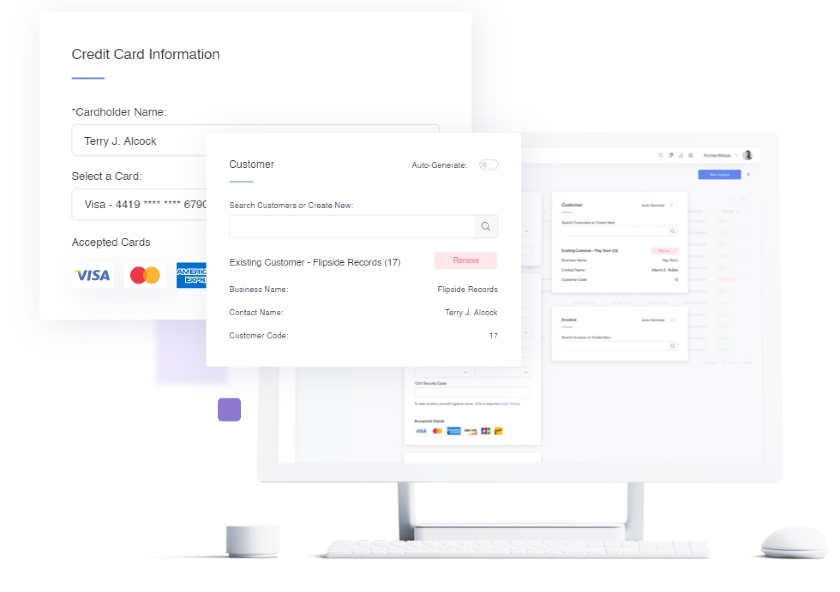

Helcim lets you key in a card payment, or you can select the customer’s card stored in your Helcim card vault. (Source: Helcim)

- Stored-card payments: Helcim offers a simple virtual terminal that lets you put in credit card information. You can also store it to look up later. All the services on our list share this feature, but many of those we evaluated did not.

- Recurring payment processing: In addition to one-time sales, you can easily send invoices or set up recurring payments to automatically bill customers at a schedule of your choosing. Helcim’s virtual terminal can also be set up to accept multiple currencies.

- Highly-compatible virtual terminal platform: The virtual terminal also works on any device, making it a great tool for taking payments on the sales floor and at the register.

- Mobile app with the virtual terminal: You also get a mobile app and a free POS system that can work on your existing smartphone, iPad, or tablet. It accepts ACH payments—something you don’t find with some payment processors on our list, like PayPal.

You can find Helcim on our list of best merchant services and leading retail payment processors.

PayPal: Best Virtual Terminal for Occasional Sellers and Cross-border Payments

Pros

- Trusted name in online payments

- Seamless integration options

- Discounted virtual terminal fee for nonprofits

Cons

- Virtual terminal has a monthly fee

- Lacks Level 2/3 data processing for B2B

- Complex pricing structure

PayPal Deciding Factors

- Instant fund access through your PayPal Account

- Peer-to-peer payments

- Low flat-rate in-person transaction fee w/ PayPal Zettle

- Integrates with hundreds of POS and third-party payment systems

- Easy-to-use platform

What We Like

PayPal is by far the most recognized payment processor in the world, with easy integrations that let you put a payment button just about anywhere. Its virtual terminal can process most types of payment methods, including cross-border transactions; however, it charges $30 per month to use the platform. The system is popular for solopreneurs, occasional sellers, and hobbyists who have low sales volume and would not mind the flat-rate payment processing fees.

PayPal takes a big hit for not processing ACH payments and imposing additional fees for invoicing and recurring billing tools and chargeback protection. It charges $30 per month for use of the virtual terminal, which pales in comparison to Square as it offers similar tools (POS, payment processing) for free.

However, Square’s transaction rates are slightly higher, with PayPal offering 3.09% + 49 cents per transaction for standard virtual terminal rates. It also offers a discounted transaction fee of 2.39% + 49 cents for nonprofits.

- Monthly fee: $0–$30

- Standard card-present fee: 2.99% + 49 cents

- Virtual Terminal fee: $30 per month plus

- Standard: 3.09% + 49 cents

- Charity: 2.39% + 49 cents

- Payment Gateway (Payflow): $0–$25/month

- Recurring Billing: $10 per month

- Invoicing: 3.49% + 49 cents

- Chargeback Fee: $20

- Chargeback Protection: 0.4%–0.6% per transaction

Credit/debit cards | Recurring billing |

Echecks | B2B payments |

Invoicing | International payments |

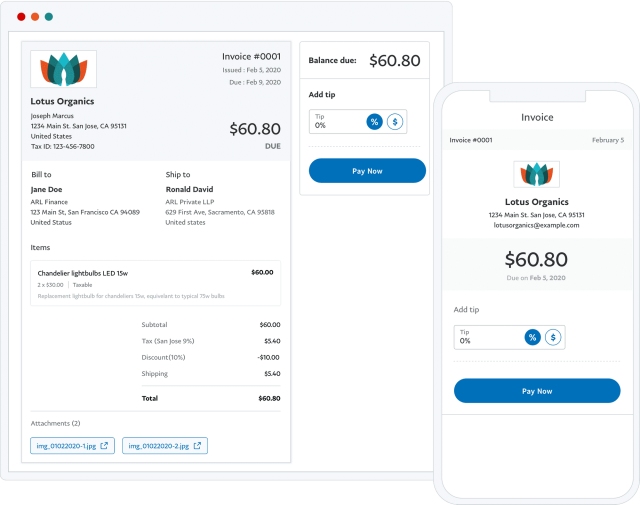

You can use PayPal’s virtual terminal to send invoices on desktop or mobile. (Source: PayPal)

- Free POS integrations: PayPal’s virtual terminal is a simple tool, but the system itself gives you access to a lot of free tools, such as the free POS software, Zettle, and its mobile app.

- Third-party integrations: The virtual terminal does not integrate with PayPal’s POS solution, limiting its ability for inventory tracking or itemizing sales. That said, you still have access to these tools through PayPal and a multitude of other third-party apps.

- International payment processing: One of PayPal’s strengths is its international reach—200 currencies, with international exchange. It also comes with an application that lets your customers make installment payments rather than paying in full. Combine all these with international payment processing, and you have a system that can take payments in any currency and through any venue.

PayPal is undeniably a trusted name in the payments industry and makes our lists for mobile credit card processing and merchant services.

Chase Payment Solutions: Best for Free Same-day Funding

Pros

- Same-day and next-day funds possible

- Rates negotiable in some cases

- Direct processor—can use other payment gateways

- May accept international currencies

Cons

- Some services (Chase QuickAccept) limited to the US

- Some plans require long-term contracts

Chase Payment Solutions Deciding Factors

- Backed by trusted payment processor

- Offers advanced analytics tools

- Processes echecks

- Split payments, refunds, account histories

- Choose between Chase’ native virtual terminals, Orbital and Authorize.net.

- Also works with non-Chase business bank account holders

What We Like

As a merchant services provider, Chase Payment Solutions stands out for its free same-day funding option with a Chase business banking account. Both merchant account and bank account are free, though you need to maintain a $2,000 bank balance (otherwise, you pay $15 for the month). Chase comes with a proprietary virtual terminal platform, Orbital, that can process a wide range of payment methods, including level 2 and 3 data processing for B2B. It even works with some high-risk businesses (while Helcim does not).

You don’t need to have a Chase Business Checking account to sign up for a merchant account with Chase.

Those who do, however, have access to free same-day funding. Otherwise, merchant accounts are free to use, but the use of virtual terminals may cost extra (not disclosed).

The transaction rates vary by platform, but for virtual terminals, they are 3.5% + 10 cents per keyed-in transaction, which is slightly less than Square’s keyed-in rate. Like PaymentCloud (and possibly Payline Data), there may be room to negotiate for better rates. Some influencing factors are sales volume and whether or not you process B2B sales, which are more secure and usually have lower rates.

- Monthly fee: $0

- Virtual terminal fee: Not disclosed

- Online fee: 2.9% + 25 cents

- In-person fee: 2.6% + 10 cents

- Keyed-in fee: 3.5% + 10 cents

- ACH processing:

- Real-time deposits: 1% (capped at $25), non-reversible

- Same-day deposits: 1% (capped at $25), reversible

- Standard deposits (1–2 business days): $2.50 for the first 10 transactions, 15 cents for additional, reversible

- Chargeback fee: $25–$100

Credit/debit cards | Recurring billing |

ACH/echecks | B2B payments (proprietary or third-party integration) |

Invoicing | International payments |

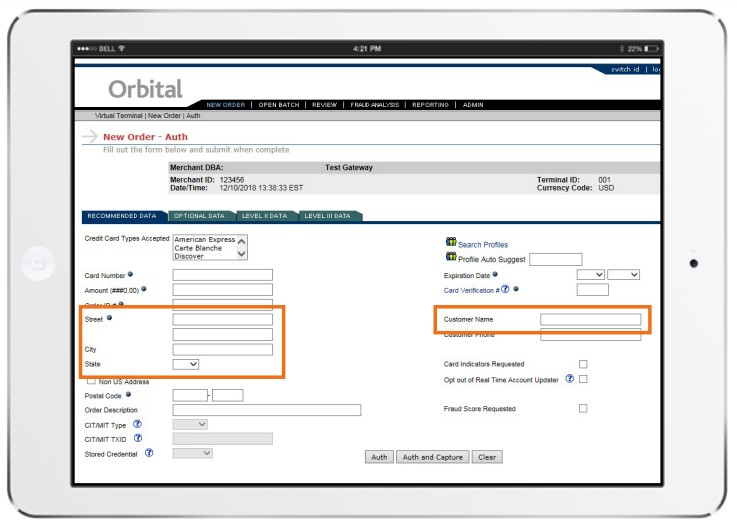

Chase’s Orbital Virtual Terminal lets you save customer data including card information to use again. (Source: Chase)

- Multiple virtual terminal options: Chase lets you have a choice of virtual terminals. If you prefer to use Authorize.net with Chase, you can start accepting payments over the phone. However, Chase has its own—Orbital Virtual Terminal.

- Native virtual terminal with shipping management: Orbital lets you process purchases and refunds and allows splitting of shipments, something we did not find in other virtual terminals, but which makes it well-suited for sales that might need a deposit.

- B2B payment processing: Unlike many virtual terminals on our list, Chase supports Level 2 and Level 3 card processing, which can get you better rates if you qualify. You may also be able to process international currencies and electronic checks like PayPal. All you need to do is discuss this when setting up your account. Learn more about B2B payment processing.

- Free same-day funding: With a Chase bank account, you can get your funds the same or next day. Square charges extra for this, while PayPal will send money immediately but only to your PayPal account.

Chase is among our top picks for retail payment processing and best free merchant accounts.

Shopify Payments: Best Virtual Terminal for Ecommerce

Pros

- Free virtual terminal

- Fully integrates with Shopify platform

- Easy sign up

Cons

- Lacks same-day funding option

- B2B payments require higher subscription plan

- Charges commission fee for third-party payment processing

Shopify Payments Deciding Factors

- Multiple payment methods available for virtual terminal

- Itemized invoicing with customization tools

- Native shipping and delivery management tools

- Refundable chargeback fee

- $0 per transaction markup

- Integrates with Stripe

What We Like

Shopify is the top name for ecommerce merchants and multichannel sales. Its native payment processing feature, Shopify Payments, comes with a free virtual terminal that allows you to complete transactions on your customer’s behalf. And while the virtual terminal is limited to credit card payment options, Shopify does have a manual payment platform for customers who prefer paying via bank transfers, money orders, store credits, or cash—without extra cost.

Every Shopify ecommerce account comes with Shopify Payments, and transaction fees vary depending on your subscription plan. Unlike Square, this provider supports working with other payment processors/payment gateways, although Shopify does charge commission fees. Pricing starts at $5 for those who prefer to sell on social media (without a website), but you will need a plan upgrade if you intend to process multicurrency and B2B transactions.

- Monthly fees:

- Starter: $5 (sell only through social media messaging)

- Basic: $39 billed monthly

- Shopify: $105 billed monthly

- Advanced: $399 billed monthly

- Transaction fees:

- In-person: 2.4% to 2.7%

- Online/ Keyed-in: 2.4% + 30 cents to 2.9% + 30 cents

- Shopify commission fee: 0%–2%(when using a third-party payment processor)

- Cross-border fees: + 1.5%

- Chargeback fee: $15 refundable

Note that the Shopify Starter plan includes a 5% transaction fee on top of credit card processing fees and doesn’t include a Shopify POS.

Credit/debit cards | Recurring billing |

ACH | B2B payments (High subscription plan) |

Invoicing | International payments |

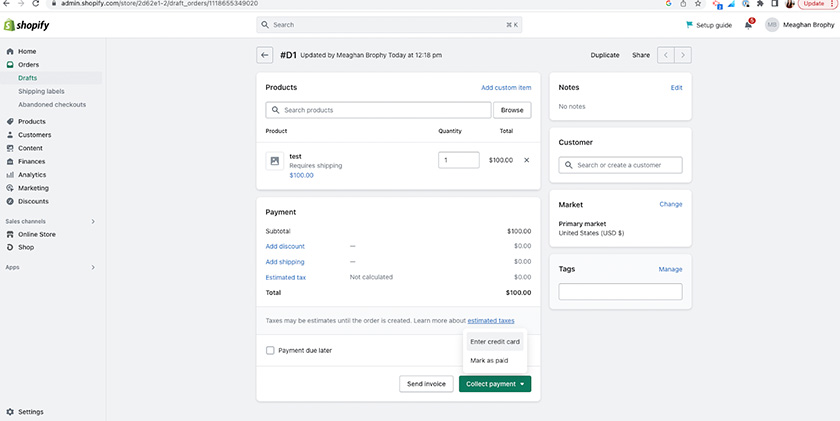

Shopify’s virtual terminal can accept credit card payment options and can be customized to include itemized products.

- Purchase orders payment processing: Draft orders are used to create and send customer invoices. Shopify’s invoicing feature can be set up as one-time payments or recurring (for subscriptions) and list itemized costs for shipping, taxes, discounts, and more on top of the product cost. You can also add a secure payment link in case customers decide to pay for the items themselves.

- Manual payment methods: Shopify supports manual payment methods for non-credit card payments such as cash, bank transfers, gift cards, store credits, and more. Merchants can send payment instructions to customers with the invoice, which can be manually approved from the Shopify Admin once the merchant confirms the payment is received.

- Multicurrency payment processing: Shopify supports multicurrency payments so merchants can receive their sales based on their primary business currency regardless of where the customer is located. Merchants subscribed to a higher Shopify plan can manually set the exchange rate. It charges a 1.5% currency conversion fee on top of the regular transaction fees.

- Social media payment processing: For merchants who prefer to sell on social media, Shopify allows you to design and share your product page on multiple social media platforms like Facebook, Twitter, and Instagram. You can also share your product page (and receive payment instructions) through instant messaging apps.

- B2B payments: B2B payment processing is available on the Shopify Plus plan. Merchants can create draft orders and send invoices with payment links and payment instructions (for payment methods other than credit cards), or accept payments via virtual terminal.

Shopify tops our list of the best ecommerce platforms and is featured in our guide to retail point-of-sale (POS) systems.

Payline Data: Best Virtual Terminal for Medical, Nonprofit & Educational Services

Pros

- Includes mobile app, in-person payment processing

- No chargeback fees

- First month is free

Cons

- Required $25 minimum transaction

- One-time $10 fee for virtual terminal

- Pricing structure can be confusing

Payline Data Deciding Factors

- Health Insurance Portability and Accountability Act (HIPAA)-compliant tools

- Verifi Cardholder Dispute tools

- Special rates for certain industries

- Recurring payments, invoicing

- Charges a one-time fee for use of virtual terminal

What We Like

Payline Data stands out for its compatible features for nonprofit, medical, and educational institutions, while also offering interchange-plus pricing, which makes it a better deal than most for high-volume businesses. Merchants get access to its virtual terminal application with a one-time $10 fee—it works as well as most and can handle invoices and recurring payments.

Payline has a monthly fee (with a one-month free trial) and, in return, offers low interchange-plus pricing. The fees run $20 for online transactions and $10 for in-person transactions. The virtual terminal has a one-time fee of $10, after which it costs nothing.

For online and virtual terminal sales, it charges interchange + 0.75% + 20 cents. Compare this to Payment Depot, which has only an 8 cents to 18 cents transaction fee but a higher monthly membership.

Payline stands out from the rest, however, in its special pricing for medical facilities, nonprofit organizations, and educational institutions.

- Transaction fee for medical: Interchange + 0.2% + 10 cents

- Transaction fee for nonprofit, educational: Interchange + 0.1% + 10 cents

The Payline Data website says it provides payment processing for high-risk businesses adding a 0.1% per transaction fee; however, according to a Payline rep, it actually refers high-risk merchants to PaymentCloud, which is on this list.

Credit/debit cards | Recurring billing |

ACH/echecks | B2B payments |

Invoicing | International payments |

The Payline virtual terminal can be accessed on the web or mobile.

(Source: Payline Data)

- HIPAA compliance: Payline Data services a wide range of businesses but has a particular focus on the medical industry, with HIPAA-compliant tools, ACH transfer, and special pricing. It also has special considerations for nonprofit and educational services

- Multiple virtual terminal options: Payline Data offers a credit card virtual terminal through CardPointe, NMI, Transax, and Authorize.net. All provide tokenization and PCI compliance. Some offer customer management and allow for subscriptions, recurring payments, and electronic invoicing.

- Nonprofit payments processing: As a HIPAA-compliant payment processor, Payline is equipped to protect patient data, something we did not see in other virtual terminal software. Nonprofits and educational services can benefit from the ACH transfer capability.

- Fraud and chargeback protection: Payline Data also comes with strong fraud and chargeback protection (through Verifi). In addition to data to help you discover fraudulent transactions, it alerts you to chargebacks faster and gives you 72 hours to resolve the dispute before it becomes a chargeback.

Payment Depot: Best for No Percentage Markup

Pros

- Surcharging management tools via CardX

- All-in-one subscription

- Integrates with POS and ecommerce

- Has a free mobile app

Cons

- US-based merchants only

- Charges monthly fee

- No option for same-day funding

Payment Depot Deciding Factors

- Choice of virtual terminals through Authorize.net, SwipeSimple, NMI, and more

- Interchange-plus pricing

- Sales staff helps you find the best terminals and POS systems for your business

- Multiple integrations

- Free equipment reprogramming

What We Like

For established, small businesses, a payment processor like Payment Depot with interchange-plus pricing can save you hundreds to thousands of dollars each month, even with its monthly fee.

This is because Payment Depot offers wholesale interchange-plus rates and no percentage markups. Payment Depot makes our list for its wide range of payment processing tools, including a choice of free third-party virtual terminals.

The best thing about Payment Depot’s price is that there is no percentage markup. You only pay a flat fee of 8 cents to 18 cents per transaction, plus the interchange price that every processor charges. No other virtual terminal on our list does this. (Some, like Square, Chase, and PayPal, fold the interchange charge into their rates.)

These are the highest monthly fees of any option on this list, but plans include a free virtual terminal and may also include equipment.

- Monthly fee: $79

- Monthly fee to access virtual terminal: $0

- Transaction fees:

- Card-not-present- fees: Interchange + 18 cents

- Card-present-fees: Interchange + 8 cents

- Chargeback fee: $25

If you are looking for free credit card payment processing, you can access CardX by Stax—powered by the same merchant services provider that supports Payment Depot’s payment processing software. Visit CardX

Credit/debit cards | Recurring billing |

ACH/echecks | B2B payments |

Invoicing | International payments |

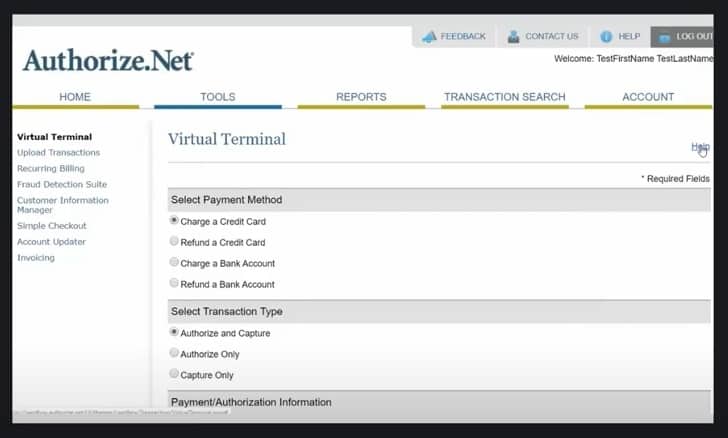

Payment Depot offers several virtual terminals, depending on the plan you purchase. Shown here: Authorize.net.

(Source: Authorize.net demo)

- Highly compatible with most virtual terminals: Unlike most of the products on this list, Payment Depot does not have its own virtual terminal, but gives you a choice of several such as Authorize.net, SwipeSimple, PayTrace, and NMI.

- B2B payments processing: While we prefer Chase Merchant Services for B2B sales, Payment Depot also offers credit card processing with Level 2 and 3 rates through PayTrace.

- Business management integrations: Payment Depot itself integrates with QuickBooks, POS systems, and other software. It also provides merchants with POS equipment reprogramming for free.

- Responsive customer support: We give Payment Depot kudos for customer support. I sent a question via the contact form and got a call minutes later. The support person was friendly and helpful, and did not try to hard-sell me anything. Other FSB reviewers have had similar experiences, and the user reviews also call out the great service.

We’ve also liked Payment Depot for general merchant services and restaurant payment processing. It also made our list of the cheapest credit card processing companies.

PaymentCloud: Best Virtual Terminal for High-risk Businesses

Pros

- Specializes in high-risk businesses

- Flexible pricing structure

- Connects to inventory, CRM

- Strong fraud prevention tools

Cons

- Charges a gateway fee

- Minimum two-year contract

PaymentCloud Deciding Factors

- Supports multiple virtual terminal options

- Integrates with popular POS

- Supports invoices and recurring sales

- Flexible pricing structure

- Gateway agnostic

- Custom fraud protection

- Waived early termination fees

What We Like

While it can serve traditional merchants, PaymentCloud specializes in working with high-risk businesses such as Mail Order Telephone Order (MOTO) that can highly benefit from a virtual terminal solution. It has relationships with over 10 banks that can handle high-risk customers and transaction rates are naturally steeper. But what’s unique with PaymentCloud is that it can adapt its fee structure (interchange-plus, flat rate, tiered) based on the merchant’s preference.

PaymentCloud is the only virtual terminal provider on our list that does not have any publicly disclosed pricing. However, this does not come as a surprise—most high-risk merchant account providers do not disclose pricing because rates are customized to each business.

A quick call with a PaymentCloud representative, however, gave us an overview of typical rates:

- Monthly fee: $10–$45

- Virtual terminal: $15–$45 per month

- Medium-risk transaction fee: 2.3%–3.4%

- High-risk transaction fee: 2.7%–4.3%

- Payment gateway fee: $15 per month (average)

- Chargeback fee: $25

- Early termination fee: Waived

It negotiates with its partner banks to get you the best rates it can, and even adjusts its fee structure to match your needs; plus, it does not charge application, setup, or annual fees.

Aside from credit cards, PaymentCloud also accepts electronic check payments and credit and debit cards (like PayPal and Chase). Some of the virtual terminals on our list, like Square and Helcim, process ACH transfers instead.

Credit/debit cards | Recurring billing |

ACH/echecks | B2B payments |

Invoicing | International payments |

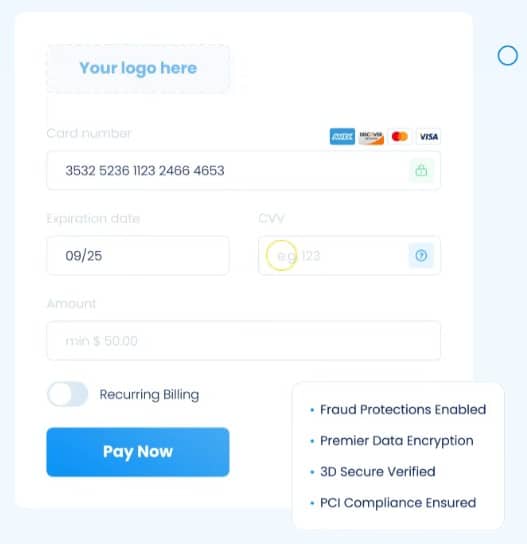

PaymentCloud includes recurring billing and invoicing. (Source: PaymentCloud)

- Advanced payment security tools: Advanced security is one key feature of PaymentCloud’s virtual terminals. It provides PCI compliance, fraud protection, data encryption, and multiple security verifications such as Visa 3D Secure, Mastercard SecureCode, JCB International J/Secure, and American Express SafeKey.

- Simple invoicing features: PaymentCloud can process credit card information but does not let you ring up itemized sales. You can use it to send and accept invoice payments, set up recurring transactions, and send digital receipts.

- CRM integrations: The platform is also specifically designed to connect with CRM software like Salesforce, unlike most providers in our roundup.

- Requires application and approval process: Note that the signup process can take longer than other virtual terminals, such as Square or PayPal, which are sign-up-and-go, but that’s because of the nature of being a high-risk business. However, you can be assured that PaymentCloud will assist you through the application process to make sure you have all the documents needed to get approved by one of its partner banks.

PaymentCloud is our top choice for high-risk merchant account providers.

How I Evaluated Virtual Terminals

To find the best virtual terminals for small businesses, I began by looking for additional payment processors with outstanding virtual terminal solutions to include in our evaluation.

I then tested each system and compared the available virtual terminal features. I looked at invoicing, recurring billing, and cross border payment processing. Additionally, I considered payment methods such as credit cards, ACH, and echecks.

My evaluation also took pricing, merchant account features, integrations, and ease of use into account to come up with a list that offers the best value for the price while being easy for most managers and employees to work day by day.

Based on my evaluation, Square has the best virtual terminal credit card processing for small merchants with simple, competitive pricing and excellent sales and inventory features. Its fees are higher than interchange-plus companies like Helcim, but it offers free tools that can grow with your business.

Click through the tabs below for our full evaluation criteria:

30% of Overall Score

We awarded premium points for providers that offer low transaction fees. In addition, we also considered additional charges for accessing the terminal, chargeback fees, and merchant accounts. Helcim and Square lead this category with 4.5 out of 5.

25% of Overall Score

These cover payment types, recurring billing, inventory and customer management, and B2Bs. Helcim received a perfect score for this category, while Square, PayPal, Chase, and Clover come in second.

25% of Overall Score

We looked for fast deposit speed, dispute management, and in-person payments. We also considered when customer service was available. Chase did well in this category, only missing points for supporting high-risk businesses.

20% of Overall Score

This score takes into account usability as a whole, from affordability to stability of the software, account freezes, processing limits, and whether it integrates with other applications. We also considered input from real-world users. All of the providers did well here, but Square received a perfect score.

How to Choose Virtual Terminals in 4 Steps

Like most payment methods, it’s important to find virtual terminals that complement your business model and give you the most value for your money. The best virtual terminal credit card processing provider should be able to process different payment methods and transaction types.

Some key virtual payment features to consider include:

- Payment methods: Credit and debit cards, ACH, e-checks, wire transfers, gift cards, digital wallet payments, Buy Now, Pay Later (BNPL)

- Payment types: Invoicing, stored card, recurring billing, payment links, Level 2 and 3 data processing, multicurrency

- Payment security: PCI security, tokenization and encryption, fraud protection tools

Make a list of potential merchant services/ payment services providers that offer the payment tools you identified above.

Payment processors structure their payment processing fees based on merchant sales volume, so knowing your business’s monthly or annual average will help narrow down your choices for virtual terminal providers. You can use these figures to estimate the cost of doing business with each option.

Virtual terminal processing rates are often higher because it usually applies the keyed-in rate, which is 3.5% plus 10 cents–15 cents per transaction. You will also need to consider any monthly fees, such as for account maintenance and (sometimes) for accessing the virtual terminal platform. To help you get started, use the calculator below for an estimate of your monthly merchant payment processing fees with our recommended providers.

Guide: This calculator assumes that you are using a virtual terminal on your laptop/desktop computer with a card reader to accept payments. Please indicate below your estimated monthly sales volume for card-present transactions (payments using a card reader) and card-not-present transactions (payments accepted online and over the phone).

Looking for other ways to remotely accept payments? Check out our list of best payment gateways and leading mobile point-of-sale applications.

Once you find your chosen virtual terminal, it’s time to apply for a merchant account to access this service. The ease or complexity of this process depends on the service provider and the merchant account type it offers. Note that most of the providers in our list are ideal for small businesses and do not require an application process—you just need to sign up for a merchant account.

- Learn more about merchant accounts, or

- Download our complete guide to signing up for a merchant account.

Frequently Asked Questions (FAQs)

Here are some questions I often encounter about virtual terminals.

A virtual credit card terminal offers several payment processing conveniences. It does not require specialized hardware and is accessible through a web-based platform (computer or mobile device). Additionally, it is secure and PCI-compliant. A virtual terminal can accept all types of payment methods, including invoicing, and can integrate with shopping cards, websites, and CRMs.

If you often accept payments online, over the phone, or via email, and prefer not to invest in additional hardware, then a virtual terminal may be your best option.

Virtual terminal transaction fees are higher than in-person transactions, though—it’s usually 3.5% plus 10 cents–15 cents per transaction. Also, some processors will charge a monthly fee for virtual terminal software (different from the monthly account maintenance fee). However, the best merchant accounts offer virtual terminals for free, so you just pay a processing fee.

Yes, all built-in virtual terminals in our list observe PCI compliance for accepting online payments as well as payments over the phone. Credit card information is encrypted as soon as it is encoded on the virtual terminal and the system ensures that none of the keyed-in data is saved.

Here is how payments are completed through a virtual terminal:

1) Customer calls over the phone, sends an email, or contacts through instant messaging; 2) Merchant accesses customer’s invoice from the dashboard to set up payment; 3) Merchant keys in customer’s payment information for the invoice; 4) The payment processor encrypts the payment details and gets real-time approval to complete the transaction; 5) The merchant sends a digital receipt to the customer to confirm the payment.

Some virtual terminals are equipped with multicurrency and/or currency conversion. If your provider accepts international payments online, it’s likely that it can also accept the same on the virtual terminal. Note, however, that some impose additional fees on top of the cross-border fee passed on by the card network.

Bottom Line

Virtual credit card terminals are a great addition to any business, allowing you to take orders over the phone or by email. Most payment processors offer these for free or with a small monthly fee. The best handle multiple payment types, including cryptocurrency and ACH transfers, and have some form of fraud or chargeback protection that goes beyond PCI compliance.

For small businesses, we find Square offers the overall best virtual terminal in the industry. It provides reasonable rates, has a free POS system, and is super easy to use. Its wide range of products also makes it a solid choice for growing businesses. Best yet—it’s free! You only pay a by-transaction rate. Sign up for Square today.