Processing payroll in Kansas is less complicated than in some other states, like California. Kansas has only one state-specific payroll form and doesn’t have local taxes. Its payroll laws mostly follow federal guidelines and should be a straightforward process.

Key Takeaways:

- Kansas follows the federal minimum wage of $7.25 per hour

- Kansas has three tax brackets (3.1%, 5.25%, and 5.7%) and no local taxes

- Kansas’ overtime regulations differ from the federal one—consult the wage and hour division to find out which to follow

Step-by-Step Guide to Running Payroll in Kansas

Running payroll in Kansas requires your full attention to make sure you don’t miss any steps. Making even innocent mistakes can be costly. Here are your basic steps for running payroll in Kansas.

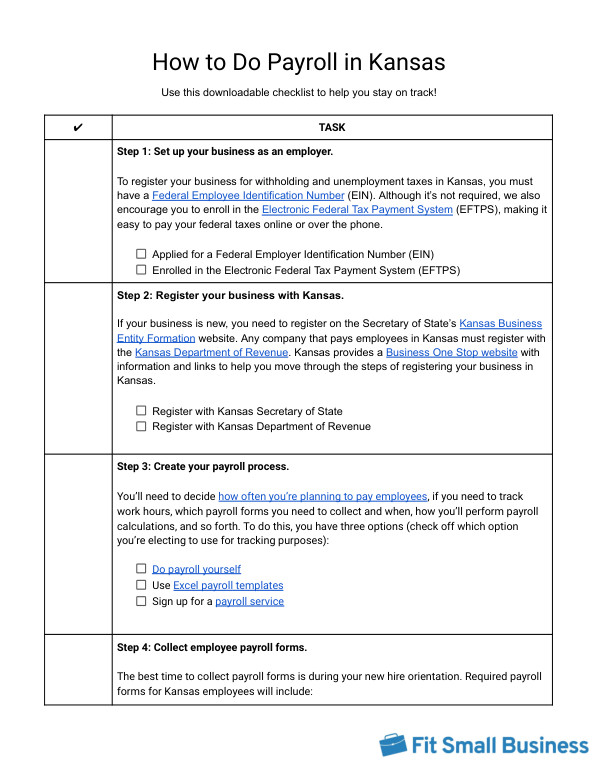

To make sure you don’t miss a step, use our Kansas payroll checklist:

Step 1: Set up your business as an employer. If your company is new, you may not have a Federal Employer Identification Number (FEIN). This is a simple process that can be completed online via the Electronic Federal Tax Payment System (EFTPS). Your FEIN is required to pay federal taxes.

Step 2: Register your business with Kansas. If your business is new, you need to register on the Secretary of State’s Kansas Business Entity Formation website. Any company that pays employees in Kansas must register with the Kansas Department of Revenue. Kansas provides a Business One Stop website with information and links to help you move through the steps of registering your business in Kansas.

Step 3: Create your payroll process. You’ll need to make key decisions, like how often you plan to pay your employees and what form of payment you intend to use. You’ll also need to designate when you’ll collect payroll forms and how payroll taxes will be managed. Overall, you can opt to process payroll by hand, making most of this manual and not recommended; set up an Excel payroll template, which will help ensure your calculations are accurate; or sign up for a payroll service to help you handle your Kansas payroll.

Step 4: Collect employee payroll forms. When your company hires new employees, there are certain forms you must collect. Every employee must complete I-9 verification no later than their third day on the job. New employees must also have a completed W-4 on file. Kansas also requires employees to complete Kansas Form K-4.

Step 5: Collect, review, and approve time sheets. Processing payroll often begins several days before your payroll deadline. Starting a few days early gives you the opportunity to spot and address any issues with employees’ time sheets. You can use paper time sheets or time and attendance software (there are free options); either way, you’ll need to review the time sheets for accuracy.

Step 6: Calculate employee gross pay and taxes. You’ll need to make numerous payroll calculations, from total hours worked and gross pay to total income taxes and benefits deductions. Tax calculations tend to be the most complex for employers. Kansas has three tax brackets and no local taxes.

Step 7: Pay employee wages and benefits. The vast majority of companies and employees use direct deposit, but cash and paper checks are also options. Make sure that you are paying your employees at least the Kansas minimum wage, which is the same as the federal minimum wage, $7.25 per hour. You can pay your federal and Kansas state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 8: Document and store your payroll records. As with any business record, you want to make sure you have a copy for at least several years. Kansas law requires companies to keep the following information for at least three years:

- Each employee’s name and job title

- Each employee’s rate of pay, pay frequency, and time records

- Employee payroll records

Step 9: File payroll taxes with the federal and state government. All Kansas state taxes need to be paid to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the Kansas Department of Revenue website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday by the following Friday

Please note that reporting schedules and depositing employment taxes are different.

Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 10: Complete year-end payroll reports. Every year, you will need to complete payroll reports, including all W-2 forms and 1099 forms. These forms need to be in the hands of employees and contractors no later than Jan. 31 of the following year.

Kansas Payroll Laws, Taxes & Regulations

Kansas mostly mirrors federal regulations. With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% of employee earnings and 1.45% for Medicare. You’ll withhold this amount from employee paychecks and a matching amount from your business bank account. In addition, you’ll likely be responsible for unemployment taxes and workers’ compensation insurance.

To make sure that your company adheres to all laws and regulations, it’s a good idea to speak with an employment law expert in your area. To ensure you maintain compliance with payroll regulations, review the specifics of doing payroll in Kansas below.

Kansas Taxes

Beyond federal taxes, Kansas levies state taxes on businesses and employees. Making your job easier, Kansas does not levy local taxes on businesses.

All businesses in Kansas must pay State Unemployment Tax Act (SUTA) taxes. The current wage base is $14,000 and rates range from 0.16% to 6%. New employers not in the construction industry have a standard rate of 2.70%. The construction industry’s new business rate is 6%.

Did you know?

Businesses that pay SUTA in full and on time can claim a tax credit of up to 5.4% on your Federal Unemployment Tax Act (FUTA) taxes. FUTA is typically 6% of the first $7,000 of each employee’s earnings.

Kansas businesses must carry workers’ compensation insurance if they pay out $20,000 in payroll per year. It covers your company in the event that any employees become injured or sick on the job (or as a result of the job). However, if your business is in the agricultural industry, you do not need to carry it. If your company is required to carry workers’ compensation insurance, you need to ensure all employees are covered, including family members and part-time, full-time, and temporary employees.

Kansas charges income taxes, so you’ll need to withhold the correct amount of funds to remit to the state government. Note that Kansas has only three tax brackets: 3.1%, 5.25%, and 5.7%. You’ll need to follow the Kansas Tax Withholding Guide if you’ll be manually calculating deduction amounts.

Kansas Minimum Wage

Kansas has a straightforward minimum wage that mirrors the federal minimum wage of $7.25 per hour. Businesses must pay tipped employees at least $2.13 per hour, provided that their tips get them to the hourly minimum wage. If it doesn’t, you’ll need to pay the difference.

Calculating Overtime

Kansas overtime law generally follows the Fair Labor Standards Act (FLSA) requirements of 1.5 times the employee’s regular hourly wage for hours worked over 40 in a workweek. However, note that the Kansas law doesn’t require overtime pay until a worker hits 46 hours in a single workweek. So, do you pay overtime after 40 hours or 46 hours? It depends.

Courts in Kansas look at the annual revenue of a business and its level of interstate commerce activity to determine whether the business needs to follow the FLSA or Kansas overtime rules. Generally speaking, the less revenue your business receives outside of Kansas, the more likely you’ll follow Kansas law only.

We strongly encourage you to call the wage and hour division at 913.551.5721 to inquire about which overtime law you need to follow.

Paying Employees

Kansas law requires that employers pay employees at least once per calendar month and make payments on a regular basis. Kansas also provides several options for paying your employees:

Pay Stub Laws

There is no Kansas law that requires an employer to provide employees with a pay stub. However, if an employee requests one, the employer must provide an itemized statement of deductions for each pay period.

Kansas Paycheck Deductions

In Kansas, only certain deductions can be made from an employee’s paycheck. The only deductions allowed include:

- Those required by state or federal law

- Deductions for medical care

- Employee authorized deduction for a lawful purpose

- Retirement plan contributions

The law also specifies that certain deductions cannot be made. These include:

- Cash shortages

- Damage or loss of employer’s property

- Uniforms

- Tools

- Other items necessary for employment

Terminated Employee’s Final Paychecks

Kansas provides for paying employees after the employment relationship ends. In every instance, you must pay the employee their final pay on the next regularly scheduled payday, regardless of whether they left voluntarily.

Kansas HR Laws That Affect Payroll

For the most part, Kansas HR laws are straightforward. However, paying close attention to nuances will help make sure your company remains compliant.

Kansas New Hire Reporting

All employers must complete form K-CNS 436 to report new hires within 20 days of their first day of work. This is used to enforce child support orders and must include the employee’s name, address, and Social Security number.

Meals and Breaks

Kansas does not require employers to provide a meal break to employees. So the federal guidelines apply, requiring breaks of less than 20 minutes (if given) be paid; meal breaks of 30 minutes or more may be unpaid.

Kansas Child Labor Laws

Generally, children must be at least 14 to work in Kansas, although exceptions include paper routes, farm work, and acting. Both federal and Kansas child labor laws restrict children under 16 from working more than three hours on a school day and 18 hours in a school week. Children under 16 can also work up to eight hours on a non-school day and 40 hours in a non-school week. Work hours must be between 7 a.m. and 10 p.m., except Fridays, Saturdays, or any other day that is not followed by a school day.

Time Off and Leave Requirements

Generally, Kansas has no state-specific leave requirements and follows federal law.

Payroll Forms

Payroll forms can vary from state to state, and some have their own W-4, like Kansas. Fortunately, that’s the only one.

- K-4: Employee withholding form

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

Kansas Payroll Tax Resources

- Kansas Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- Setting up a new business can present unique challenges. Kansas Business One Stop provides a setup wizard to help you.

- For extensive information on how to get workers’ compensation coverage, Kansas’s Department of Labor offers guidance.

Running Payroll in Kansas Frequently Asked Questions (FAQs)

Technically, no. However, Kansas and Missouri have provisions in each state’s tax code that allows for credits paid to other states. So employees will have to jump through a few hoops, but they won’t face double taxation.

If you make a mistake on an employee’s paycheck, whether you’ve paid them incorrectly or failed to accurately withhold taxes, you’ll need to fix it immediately. Once you notice the mistake, contact the state agency for help in making a correction and discuss this with the employee so they’re in the loop about what’s happening.

You’ll need to offer the benefits required by the state where your employee performs their work. So if you have a remote worker in California, for example, you’ll need to adhere to California employment laws.

Bottom Line

Kansas makes payroll simple and efficient by adhering to federal guidelines, with only one state-specific form required and no local taxes. Learning how to do Kansas payroll is straightforward, but doing it by hand or memory could lead to costly mistakes. Follow this guide, use our checklist, and consider a payroll software like QuickBooks Payroll to help you ensure accuracy every step of the way.