Oracle’s NetSuite and Intuit’s QuickBooks Online are two popular accounting solutions. Tailored to midsized and larger businesses with multiple locations, NetSuite has customer relationship management (CRM) tools and many other integrated solutions. However, it comes at a price: the base licensing fee starts at $999 monthly, and the user fee is $99 monthly. For 25 users, that works out to $3,474 per month—as compared to $200 per month for QuickBooks Advanced, which also allows 25 seats. Because of NetSuite’s complex offerings and high price tag, it isn’t a great fit for small businesses.

- NetSuite: Better for midsize and large businesses, especially international businesses and those looking for an enterprise resource planning (ERP) tool

- QuickBooks Online: Optimal for most small and midsize businesses (SMBs) seeking access to assisted bookkeeping

When To Use

Which Accounting Software is Right for you?

NetSuite vs QuickBooks Online: Pricing (QuickBooks Online Wins)

NetSuite | QuickBooks Online | |

|---|---|---|

Monthly Pricing | Starts at $999 per month (per third-party sites) |

|

Number of Users | Varies | 1 to 25 |

Billable Clients | 10,000 | 10,000 to 100,000 |

QuickBooks Online offers five monthly subscription plans that range from $20 for one user and basic features to $200 for up to 25 users and more complex features. Its pricing is laid out with the functions available for each level, and to learn more about the differences, check out our QuickBooks Online plans comparison.

Meanwhile, NetSuite’s pricing must be obtained with a customized quote based on the size of your business, annual revenue, and the various modules that will be used. NetSuite is much more expensive than QuickBooks Online but is targeted toward larger companies seeking a complete ERP system vs only accounting software. According to Better Buys, NetSuite has a base price of $999 per month plus $99 per month, per user. This is much more expensive than QuickBooks Online, which we selected as the winner in this category.

NetSuite vs QuickBooks Online: Features (NetSuite Wins)

NetSuite | QuickBooks Online | |

|---|---|---|

Platform | Web browser | Web browser |

Track & Categorize Spending by Class and Location | ✓ | ✓ |

Double-entry Bookkeeping | ✓ | ✓ |

Track Unpaid Bills | ✓ | ✓ |

Track Time & Mileage | ✓ | ✓ |

Track Fixed Asset Purchases | ✓ | ✓ |

Send Estimates | ✓ | ✓ |

Collaboration Tools | ✓ | ✕ |

Global Accounting & Consolidation | ✓ | ✕ |

Consolidated Financial Statements | ✓ | ✕ |

Audit & Compliance Reporting | ✓ | ✕ |

View Customer History | ✓ | ✕ |

Access to Key Performance Indicators (KPIs) | ✓ | ✕ |

Multiple Entities | ✓ | ✕ |

Connect Bank Accounts | ✓ | ✓ |

Job Costing | ✓ | ✓ |

Customization Options | ✓ | ✓ |

Generate W-2s for Employees | ✓ | With QuickBooks Payroll |

Both NetSuite and QuickBooks excel in the realm of bookkeeping, but what distinguishes NetSuite as the winner in this category is its additional functionality, such as ERP, consolidations, and integrations. It lets you manage your A/R and A/P, integrates with your financial institutions, and allows for multiple users. It also provides strong business management features, such as global accounting and consolidation, audit and compliance reporting, and consolidated financial statements.

What’s more, the platform offers an extensive catalog of reports, including parent and subsidiary reports that can be viewed in the home currency or the currency where the subsidiary is located. Additionally, it has built-in technology that gives you access to more than 75 KPIs that are customizable to each employee’s dashboard, such as sales, open balances, and receivable turnover for a collections specialist.

NetSuite’s inventory management offerings are more complex than QuickBooks Online’s, making it ideal for manufacturing and product businesses. While both platforms allow you to track fixed asset purchases, NetSuite has a dedicated module that tracks the asset value, depreciation expense, and useful life of an item.

That is a great feature because with QuickBooks Online, you need to calculate depreciation expenses outside of the software and record them as a journal entry manually. However, QuickBooks Online has many useful tools for project accounting, like the ability to classify transactions by location and class, and time and expense tracking.

NetSuite vs QuickBooks Online: Ease of Use (Tie)

NetSuite | QuickBooks Online | |

|---|---|---|

Overall Ease of Use | Moderate | Easy |

Online Help Section | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✓ |

NetSuite and QuickBooks Online have extensive dashboards that provide a lot of information and reports, such as A/R Aging and Cash Flow, and both allow you to set privileges to determine what information users have access to. However, NetSuite is more advanced and can be a bit intimidating to new users. NetSuite’s ability to track KPIs and view trends over a specified period makes it a more attractive option than QuickBooks Online, which only offers this with its Advanced plan. It is for this reason that we determined a tie for this category.

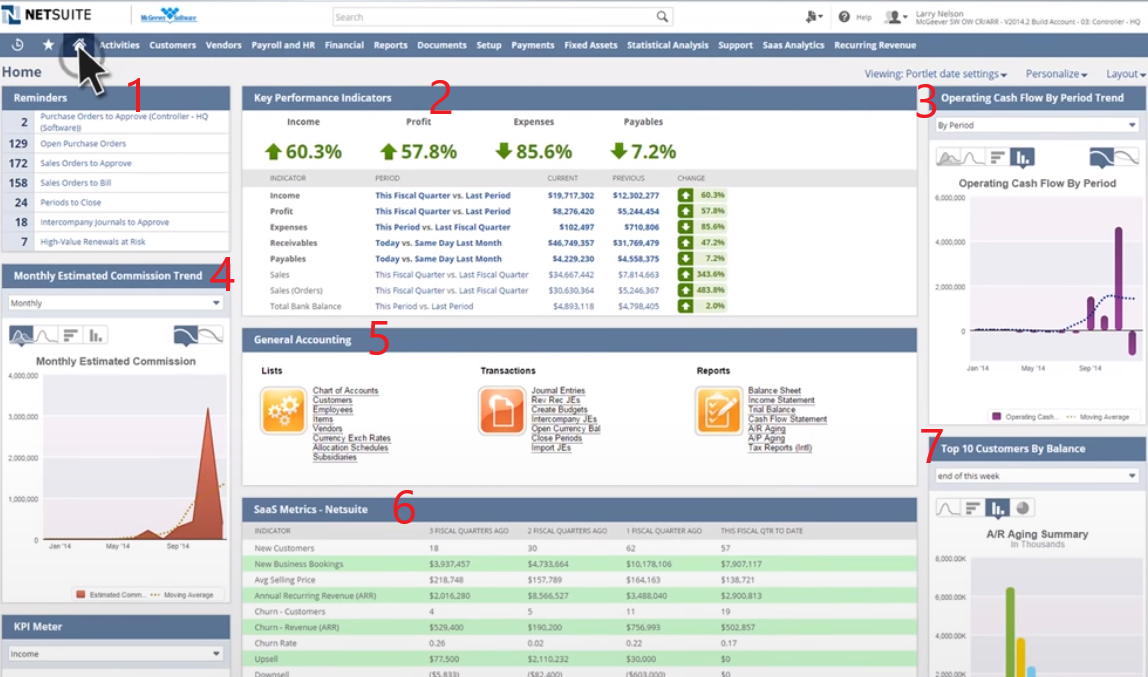

View of NetSuite Dashboard (Source: NetSuite)

- Reminders: This list shows action items that require attention, such as open purchase orders (POs) or periods to close.

- KPIs: This section looks at your income, profit, expenses, A/Rs, A/Ps, sales, sales orders, and your bank balance over a specific period of time and shows the percent change for each, allowing you to monitor the financial health of your business.

- Operating Cash Flow By Period Trend: This information is revealed in graph form, allowing you to customize it over a specified period of time.

- Monthly Estimated Commission Trend: Also shown in graph form, this report shows how commissions change from month to month.

- General Accounting: Separated into Transactions, Lists, and Reports, this section has clickable links that will take you to different sections of the program such as the chart of accounts and journal entries.

- SaaS Metrics: This is a summary of various aspects of your business over a period of time, including the number of new customers, new business bookings, average selling price, and churn rate.

- Top 10 Customers by Balance: This section shows the A/R Aging Summary, in order of your top 10 customers.

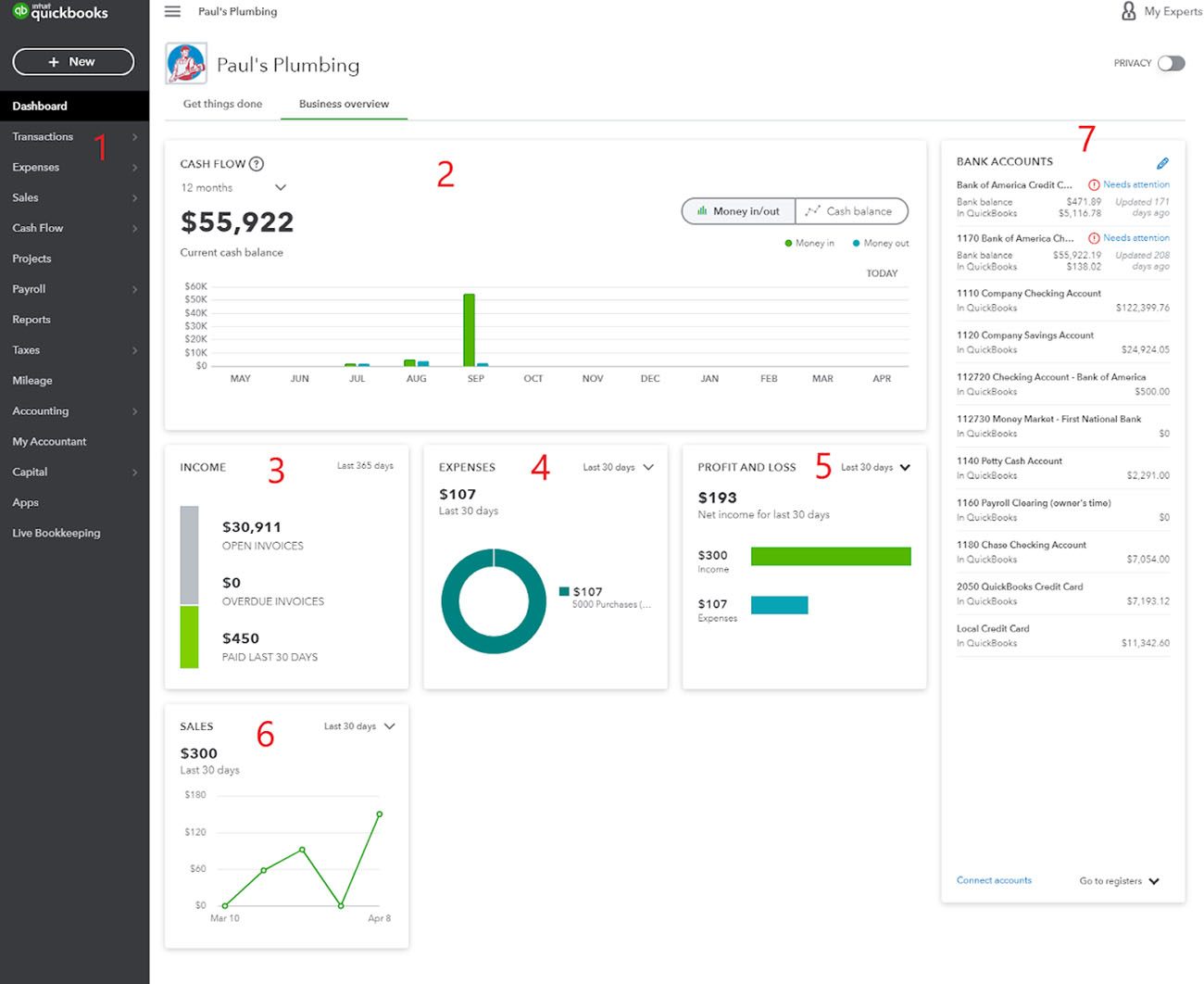

The QuickBooks Online Dashboard is similar to NetSuite’s in that it provides access to quite a bit of information on the initial home screen. You’ll notice that the layout for each differs, and QuickBooks Online isn’t as cluttered. It gives you access to your account balances, income and expense reports, and graphs that illustrate the financial health of your business. Payroll and Live Bookkeeping are optional services that are available for an additional fee.

View of QuickBooks Online Dashboard

- Left Navigation Bar: Each of these tabs will take you to a different function, such as invoicing customers, generating reports, and tracking projects.

- Cash Flow: This report shows your income, cost of goods sold (COGS), and expenses, and is customizable by time period.

- Income: This section shows all items related to your income, such as past-due invoices, and you can also view your A/R report here.

- Expenses: Your expenses, broken down by category, can be viewed here.

- Profit and Loss: You can generate a customizable profit and loss (P&L) statement in this section.

- Sales: Presented in graph form, you can view your sales over a specific time period, such as the fiscal year-to-date (YTD).

- Bank Accounts: View a summary of your bank balances here. Both your bank and QuickBooks balances can be accessed once you connect your online bank and credit card accounts.

NetSuite vs QuickBooks Online: Assisted Bookkeeping (QuickBooks Online Wins)

NetSuite | QuickBooks Live | |

|---|---|---|

Monthly Cost | N/A | Starts at $200 |

Service Frequency | N/A | Monthly |

Monthly Reports | N/A | ✓ |

Day-to-day Bookkeeping | N/A | ✕ |

QuickBooks users looking for bookkeeping support will find it with QuickBooks Live, which matches you with a dedicated virtual bookkeeper. While the service excludes some of the day-to-day bookkeeping tasks—such as A/R, A/P, invoicing customers, and inventory management—it reviews your bank feeds, generates monthly financial reports, and includes video calls that allow you to ask questions and analyze report data. One of the most attractive features of this service is its 100% Accurate Books Guarantee.

Meanwhile, NetSuite users will likely have to rely on outside bookkeeping firms for assistance, which is why we chose QuickBooks Online as the winner in this category. One such firm is Cogneesol, which provides end-to-end accounting services on the NetSuite accounting software. These include A/R, A/P, tax preparation, and extensive reporting. Cogneesol also supports other modules, such as purchasing and vendor management, fixed asset management, and inventory control. Because each business’ needs vary depending on the modules used, a customized quote is provided upon request.

NetSuite vs QuickBooks Online: Integrations (Tie)

NetSuite | QuickBooks Online | |

|---|---|---|

Built-in Integrations | ✓ | ✓ |

Number of Integrations | Unknown | 750+ |

Because NetSuite is integrated from end to end, it reduces the need to connect ERP, CRM, and ecommerce applications. It even offers additional solutions by teaming up with third-party integration providers to create SuiteCloud Connect, a series of packaged solutions for integrating with leading enterprise applications and systems like Salesforce SAP, Oracle, and Google Apps. NetSuite also offers training courses and consulting services for users requiring assistance and support with integration projects.

QuickBooks Online, on the other hand, has integrations with over 750 business apps. It also has a few built-in integrations, which can be accessed from within the platform. Our guide to the best QuickBooks Online integrations for small businesses provides insight into our recommendations.

Here are some third-party integrations for QuickBooks Online:

- Customer management: Insightly, Method:CRM, WORKetc, and Aero Workflow

- Inventory management: Shopify, erplain, TradeGecko, and SOS Inventory

- Budgeting/forecasting: Budgeto, Fathom, Qvinci, and Cash Flow Frog

- Payroll: Gusto, Square Payroll, Wagepoint, and RUN Powered by ADP

- Ecommerce: Freedom Merchants, Stripe by Connex, and PayTraQer

- Sync data: ReceiptBank, Plooto, Hubdoc, and AutoEntry

NetSuite vs QuickBooks Online: Mobile App (QuickBooks Online Wins)

NetSuite | QuickBooks Online | |

|---|---|---|

Mobile App | ✓ | ✓ |

Operating Systems | iOS and Android | iOS and Android |

GPS Mileage Tracking | ✕ | ✓ |

Scan Receipts | ✕ | ✓ |

Receive Payments | ✕ | ✓ |

Invoice Customers | ✕ | ✓ |

Report Expenses | ✓ | ✓ |

Call Logging | ✓ | ✕ |

Time Tracking | ✓ | With QuickBooks Time integration |

While both offer powerful mobile apps, NetSuite excels in this category with its more extensive user interface (UI) that features KPIs and strong report customization options. It also has easy expense reporting, call logging, and time tracking. Available for both iOS and Android, it’s designed with key workflows and support push notifications for time-sensitive actions. It even provides instant access to saved searches and the ability to customize reports by adding fields, grouping levels, and customizing formulas.

QuickBooks Online also offers a robust mobile app for both iOS and Android users, with the ability to record expenses, invoice customers, enter transitions, and send reports. It even turns your phone into a receipt scanner, which will record the billable expense in your books and attach your receipt to the invoice for reimbursement. If you’re an Android user, you can send an invoice via WhatsApp—and when a customer views or pays it, you’ll receive an instant notification.

NetSuite vs QuickBooks Online: Customer Support (Tie)

NetSuite | QuickBooks Online | |

|---|---|---|

Community Support | ✓ | ✓ |

Email Support | ✓ | ✓ |

Live Chat Support | ✓ | ✓ |

Phone Support | ✓ | ✓ |

Searchable Knowledgebase | ✓ | ✓ |

In addition to their extensive knowledgebases, NetSuite and QuickBooks offer live support options for their customers in the form of phone and chat. Both also have extensive help resources that include free access to community forums, video tutorials, and webinars. However, while NetSuite’s customer support is offered 24/7, QuickBooks’ phone support is limited to regular business hours.

All NetSuite subscriptions include Basic Support, with Premium and Advanced Support available to meet additional support requirements. Each provides specific service levels and capabilities, from online case submissions to performance monitoring. Another option for QuickBooks users is to find a QuickBooks ProAdvisor or consider signing up for QuickBooks Live, which provides online bookkeeping support for an additional fee.

Frequently Asked Questions (FAQs)

NetSuite is a cloud-based enterprise resource planning (ERP) software that offers comprehensive financial management, CRM, ecommerce, and other business solutions for businesses of all sizes.

The best QuickBooks plan for your business depends on its size and the features you need. Check out our comparison of QuickBooks Online plans to identify the best fit for your business.

NetSuite’s pricing depends on factors like the number of users, the modules you need, and your specific requirements. It’s best to contact NetSuite for a customized quote.

No, they are completely different products. While QuickBooks Online is cloud-based, QuickBooks Desktop is installed locally. For more information about the differences between the two, check out our QuickBooks Online vs QuickBooks Desktop comparison.

Bottom Line

QuickBooks Online is best suited for small businesses in a variety of industries, and its software is both easy to use and scalable. While NetSuite has most of its integrations built into different modules, such as inventory management and bill payment, QuickBooks Online relies on its integrations with hundreds of third-party apps to achieve many of the same functions.

Because of its high price point, NetSuite isn’t well-suited for a small business. However, if your company is growing internationally and you anticipate needing an ERP platform to manage everything, it could be an excellent solution that sets you up for success.