OnPay and Gusto are both great choices and highly regarded software by users as they offer excellent payroll and human resources (HR) features with good customer service. However, there are some differences in function that may make one the better choice for your business. OnPay may have the more affordable plan, but Gusto provides multiple payroll plans that can cater to various needs, including a low-cost contractor-only option. Unlike OnPay, Gusto has a wider suite of HR solutions that include hiring, time tracking, and performance review tools.

Here are our recommendations to help you determine whether OnPay or Gusto is right for you:

- OnPay: Best for paying hourly workers, delegating tasks, and special payroll services

- Gusto: Best for small businesses that need advanced payroll and HR solutions

There are instances where neither OnPay nor Gusto is the best option. If you’re looking for HR payroll software with 24/7 customer support, we recommend:

- Justworks: Best for companies that need low-cost professional employer organization (PEO) services to outsource HR and payroll administration

Don’t have an in-house HR team or need expert help managing day-to-day HR and payroll tasks? Consider Justworks |

|

OnPay vs Gusto Compared

| ||

|---|---|---|

4.48 out of 5 | 4.78 out of 5 | |

Starter Monthly Pricing | $6 per employee plus $40 base fee | $6 per employee plus $40 base fee |

Multiple Payroll Plans | ✕ | ✓ |

Payroll Runs | Unlimited | Unlimited and automatic |

Tax Filings and Year-end Tax Reports (W-2/1099) | ✓ | ✓ |

Manual Paychecks, Pay cards, and Direct Deposits | ✓ | ✓ |

Employee Benefits* | Health insurance, 401(k), life and disability, and commuter benefits | Health insurance, 401(k), life and disability, commuter benefits, and college savings plan |

Health Insurance Coverage | 50 states | 37 states |

Time Tracking | Via partner systems (Deputy, When I Work, and QuickBooks Time) | Included in higher tiers |

Onboarding Tools | ✓ | ✓ |

Customer Support | Online help center; chat, email, and phone support | Online help center; chat, email, and phone support; HR advisers; access to a dedicated support team |

*Some benefits plans cost extra or have participation fees.

When to Use OnPay & When to Use Gusto

Still unsure which one is best for you? Take our online quiz.

Alternatives to OnPay and Gusto

Best For | Starter Monthly Pricing | Our Review | |

|---|---|---|---|

Solopreneurs and small companies that need dedicated payroll support | $5 per employee plus a $39 base fee | ||

QuickBooks accounting small business users | $5 per employee plus a $45 base fee | ||

Square POS users, particularly retailers and restaurants | $6 per employee plus a $35 base fee | ||

If you want more information about which options to look for when choosing a payroll service, check our guide on finding the right payroll service for your business.

Best for Value: Gusto

| ||

|---|---|---|

Pricing Score | 4.75 out of 5 | 5 out of 5 |

Monthly Pricing | $6 per employee plus $40 base fee | Simple: $6 per employee plus $40 base fee Plus: $12 per employee plus $80 base fee Premium: Custom priced |

Contractor-only Payroll Plan | No special plan | $6 per contractor plus $35 base fee |

Add-ons | W-2/1099 printing and mailing services: $10 per form* Health and retirement plans: Pay for premiums | Benefits administration using own broker: $6 per eligible employee monthly Health insurance: Pay for premium only 401(k) retirement savings: Pricing varies by provider 529 college savings: $6 per participant monthly (with an $18 monthly minimum) State tax registration: Pricing varies by state International contractor payroll: Custom priced Priority support & HR advisory services for Plus plan only: $8 per employee monthly (this is included for free in the Premium tier) |

*While OnPay can print and mail the tax forms to your workers, W-2/1099s are also available through its self-service portal where employees can print the online forms for free.

When comparing Gusto vs OnPay on pricing, both have similar starter monthly fees ($40 plus $6 per employee). However, Gusto wins overall because it provides better value for money given the wealth of HR features it offers. You get time tracking and performance reviews, including HR advisory services in its higher tiers—all functionalities that OnPay lacks.

Gusto also beats OnPay with its contractor-only payroll plan (OnPay doesn’t have this). Plus, you can add on other services to help you pay international contractors and manage the software access of your new hires.

If you have a limited budget and don’t need Gusto’s advanced HR tools, then OnPay is a great choice. In addition to paying both employees and contractors, it can help you file payroll tax forms, onboard new hires, manage benefits, and offer health plans that are available in all 50 states (Gusto covers only 37 states)—all for a monthly fee of only $40 plus $6 per employee.

Best for Payroll: Tie

| ||

|---|---|---|

Payroll Features Score | 4.50 out of 5 | 4.75 out of 5 |

Full-service Payroll | ✓ | ✓ |

Unlimited and Automatic Pay Runs | Unlimited pay runs only | ✓ |

Multi-state Payroll | ✓ | Available in higher tiers |

Payroll Tax Payment and Filing Services | ✓ | ✓ |

Year-end Tax Reports (W-2/1099s) | ✓ | ✓ |

Direct Deposit Processing Timelines | Two and four days (eligibility based on OnPay’s risk assessment) | Two and four days; next-day option included in higher tiers |

Manual Paychecks | ✓ | ✓ |

Pay Card Option | ✓ | ✓ |

Wage Garnishment Services | ✓ | South Carolina excluded |

Global Payroll Capabilities | ✕ | Pays international contractors only |

In our evaluation, both scored 4.5 out of 5 for pay processing. OnPay and Gusto have a lot of similar functionalities that allow you to pay employees and contractors accurately and on time. However, there are some instances that may make either Gusto or OnPay a better option for your business.

When it comes to straight payroll features, OnPay and Gusto are very close. However, Gusto’s Simple plan, the closest price-wise to OnPay, allows pay runs on autopilot. (OnPay doesn’t have this, which may make it more appropriate for hourly workers.) Gusto, which is our top-recommended payroll service for small businesses, also processes direct deposits more quickly, even offering a next-day option if you subscribe to its higher tiers. In addition, it doesn’t conduct risk assessments to determine standard direct deposit timelines as OnPay does. With Gusto, you are granted access to two- and four-day direct deposits automatically.

Apart from its low-cost payroll plan for contractors, Gusto can pay international contract workers. It can help you complete compliance documents and process cross-border payments in 80 countries (OnPay doesn’t have global contractor payroll services).

Gusto lets you add bonus amounts, hours worked, and paid time off (PTO) details manually when running payroll. (Source: Gusto)

What OnPay offers that Gusto doesn’t is the capability to process salary payments and payroll taxes for agricultural workers, including employees on H-2A visas. It also files Form 943s for you.

For businesses in nonagriculture industries, OnPay also handles payroll for hourly workers, salaried employees, and contractors. While it doesn’t have Gusto’s next-day direct deposits, you get two- and four-day direct deposits as standard processing timelines—provided you don’t mind going through OnPay’s risk assessment to determine eligibility for either of the two options.

With OnPay, you can run payroll in three easy clicks. (Source: OnPay)

Best for HR & Employee Benefits: Gusto

| ||

|---|---|---|

HR Features Score | 4.38 out of 5 | 4.50 out of 5 |

Job Postings and Applicant Tracking | ✕ | ✓ |

Online Onboarding and New Hire Reporting | ✓ | ✓ |

Employee Information Management | ✓ | ✓ |

Time Tracking | Via third-party software integration | Available in higher tiers |

PTO Management | ✓ | Available in higher tiers |

Software Provisioning for Managing Employee Apps | ✕ | Available in higher tiers |

Employee Performance Reviews | ✕ | ✓ |

Standard Benefits Options | Medical, dental, vision, 401(k), life and disability, flexible spending account (FSA), health spending account (HSA), commuter benefits, and workers’ compensation | Medical, dental, vision, 401(k), FSA, HSA, workers’ comp, commuter benefits, Affordable Care Act (ACA), Health Insurance Portability and Accountability Act (HIPAA), Employee Retirement Income Security Act of 1974 (ERISA), and Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) compliances |

Non-standard Benefits Options | Assistance with car, liability, and other business insurance | College savings plan and free Gusto Wallet (financial management app) |

Health Insurance Coverage | 50 states | 37 states |

If you want to track applicants, capture employee attendance, and monitor staff performance, then Gusto is your best bet. Its platform is more feature-rich than OnPay, providing you with an HR solution suite that can handle hiring to retiring processes (OnPay only offers basic HR tools).

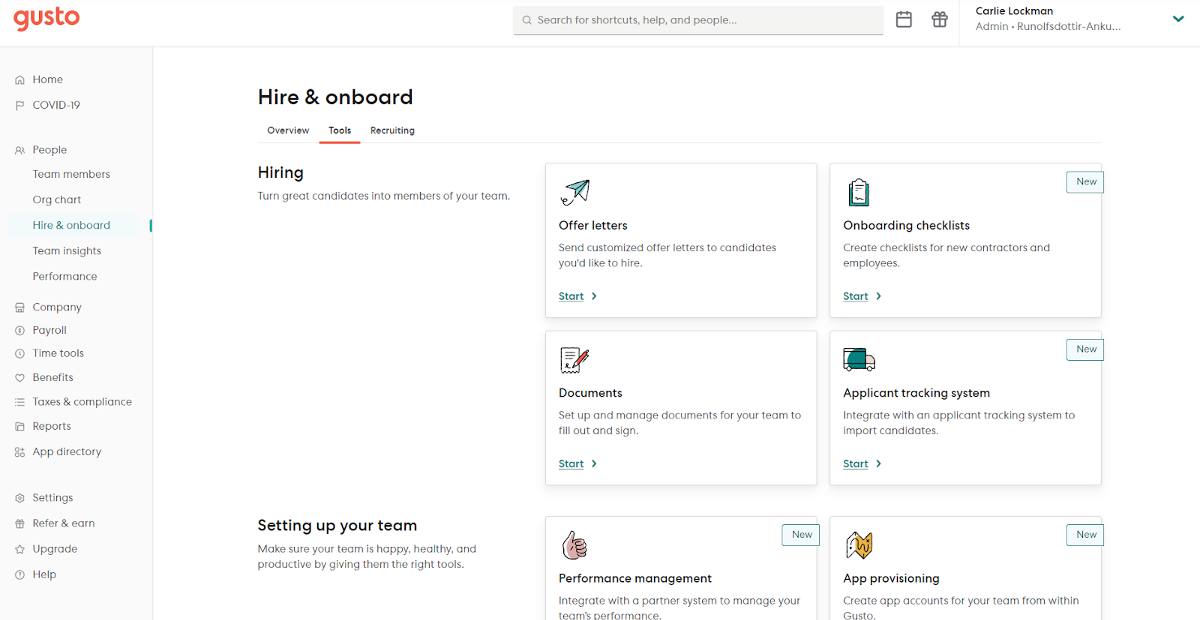

Its new hire onboarding solution also comes with basic and advanced features like customizable onboarding checklists and a software provisioning tool for creating and removing employees’ access to systems that your business uses. Unlike OnPay, it lets you track applicants and post open jobs—provided you get one of Gusto’s higher plans.

Managing employee benefits may be challenging for new business owners, but Gusto makes this task easier to handle with its online benefits administration solution and access to a wide variety of benefits plans. It even provides nonstandard benefits like a college savings plan and an option for employees to access a part of their earned wages between paydays. While its health insurance doesn’t cover all 50 US states like OnPay, we recommend Gusto if your business isn’t located in one of the 13 states that it has yet to expand to, which are Montana, Wyoming, North Dakota, Rhode Island, Vermont, South Dakota, Nebraska, Louisiana, Alabama, Mississippi, West Virginia, Alaska, and Hawaii.

Gusto’s HR tools include online offer letters, PTO management, device and app provisioning, and performance review solutions. (Source: Gusto)

Gusto may have a wider range of HR solutions than OnPay, but many of the HR features it offers are included in its more expensive tiers. You need to get at least the Plus plan ($80 plus $12 per employee monthly), which is pricier than OnPay. Plus, Gusto’s feature-rich platform may be more than you need, especially if you’re only looking for an efficient way to manage employee information, documents, PTO, and new hire reporting.

Using OnPay vs Gusto also makes better sense if you want to provide health plans that are available across the US. Although its nonstandard benefits offerings are limited, it does provide assistance if you need to get car, liability, and business insurance.

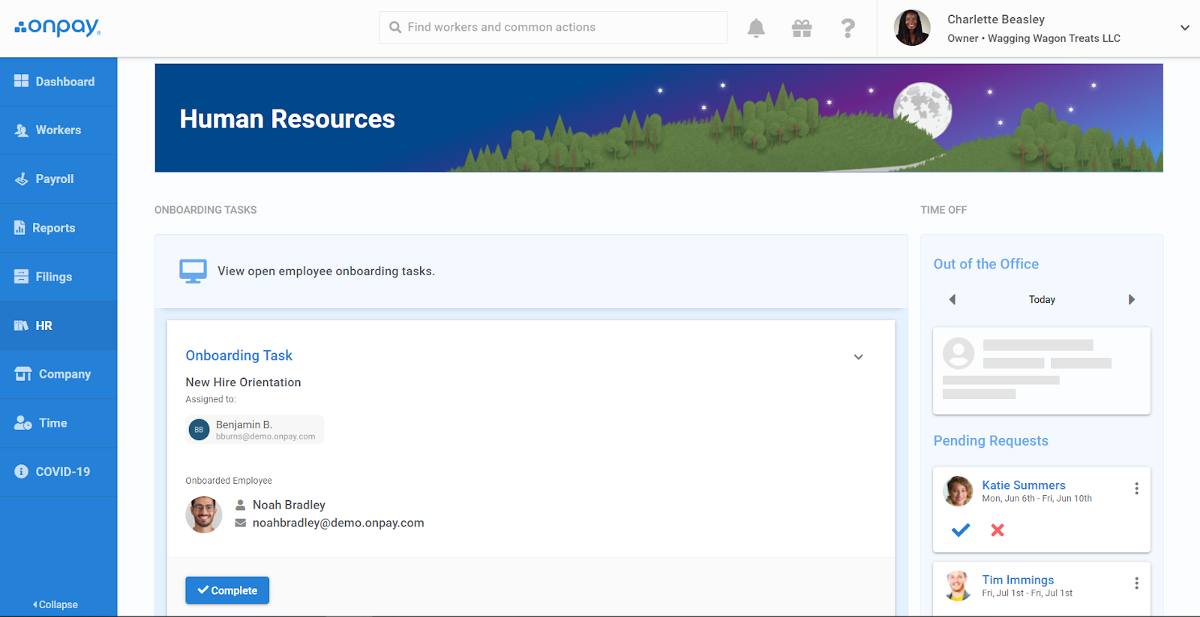

OnPay’s HR module allows you to manage onboarding tasks, employee offers, staff information, and PTO requests. (Source: OnPay)

Best for Reporting: Tie

| ||

|---|---|---|

Reporting Score | 5 out of 5 | 5 out of 5 |

Basic Reports | ✓ | ✓ |

Report Customizations | ✓ | ✓ |

Capability to Create New Payroll Reports in the System | ✓ | ✓ |

In our evaluation of OnPay vs Gusto on reporting features, we found that both offer similar tools. Apart from letting you customize and download reports, you can build new ones directly in their systems.

While both may have similar reporting capabilities, creating custom reports is easier with OnPay because you simply drag and drop the columns that you need. With Gusto, you have to click “select columns” and choose the fields that you want to appear in your report.

Gusto’s reporting tool (Source: Gusto)

OnPay’s reporting tool (Source: OnPay)

Best for Ease of Use & Customer Support: Gusto

| ||

|---|---|---|

Ease of Use Score | 4.38 out of 5 | 4.75 out of 5 |

Learning Curve | Relatively easy | Relatively easy |

Ease of Use | Good | Good |

Customizable Platform | Customizable dashboard | Limited options |

HR Advisory Services | $20 monthly | Available in higher tiers |

How-to Guides | ✓ | ✓ |

Access to a Dedicated Support Team | ✕ | Available in higher tiers |

Third-Party Software Integrations | 9 | 130+ |

Phone, Email, and Chat Support | Unlimited | Unlimited |

Direct HR Advisory Support Line | ✕ | Available in its most premium plan |

Gusto and OnPay have platforms that are easy to learn and use. You can get their software up and running easily with setup wizards. While both have intuitive interfaces, Gusto’s dashboard isn’t as customizable as OnPay, which lets you select how sections, such as tasks and alerts, will appear on screen. Although, it does allow you to choose either to disable or enable specific functions, such as expense reporting and two-step verifications for system administrators.

Gusto’s settings module lets you select system preferences and permissions. (Source: Gusto)

Online how-to guides and helpful frequently asked questions (FAQs)—including unlimited phone, email, and chat support—are also available, although Gusto offers HR advisory services, provided you get its Premium plan (OnPay charges $20 per month for this). This allows you to contact HR professionals if you need expert advice in handling payroll, tax, compliance, and employee issues.

In addition, Gusto’s Premium plan includes access to a direct phone line for contacting a dedicated support team, something OnPay lacks. If you need to integrate with other software, then Gusto is the clear choice as it has more options in a variety of categories, such as accounting, learning management, legal, collaboration, and point-of-sale systems.

For business owners who don’t require robust integrations, OnPay is a good choice. It can even help you connect its platform with apps that most businesses use like Deputy, When I Work, Humanity, Mineral, PosterElite, Xero, QuickBooks Time, and QuickBooks Accounting.

OnPay also offers more options to customize its main dashboard. You can shuffle the sections to fit your preferences, enabling you to see items that are more important to you immediately.

Drag and drop sections to customize OnPay’s main dashboard. (Source: OnPay)

While it doesn’t assign a dedicated service team to its clients like Gusto (only for those on the Premium plan), it provides general HR, payroll, and compliance support. This makes it optimal for businesses with in-house HR professionals who are knowledgeable in managing payroll and handling employee-related issues (such as absenteeism and attendance concerns) since they don’t need constant HR support. However, if you need to talk to an HR expert, OnPay offers advisory services via Mineral for $20 monthly.

Best in Our Expert Review: Gusto

| ||

|---|---|---|

Expert Review Score | 4.38 out of 5 | 5 out of 5 |

Cost is Affordable for Small to Midsize Businesses (SMBs) | ✓ | ✓ |

Width and Depth of HR Features Are Ideal for SMBs | Basic (limited HR features) | Above average |

Width and Depth of Payroll Features Are Ideal for SMBs | ✓ | ✓ |

Software Is Easy to Navigate for SMBs | ✓ | ✓ |

In our expert assessment of Gusto vs OnPay, we found Gusto to be a better payroll software for small business owners given its solid pay processing tools and reasonably priced plans. Its platform is more feature-rich than OnPay as it comes with a wider suite of HR features to help you manage day-to-day HR tasks and the entire employee lifecycle—from hiring to retiring—efficiently.

However, if you only want to pay employees and handle payroll taxes, OnPay has all the essential tools you need, such as unlimited pay runs, tax support, and robust system permissions for delegating payroll and HR tasks. It even offers payroll services for businesses in niche industries, such as farms and agriculture companies, enabling you to handle payments and taxes for agricultural workers and those on H-2A visas with ease. Gusto doesn’t support payroll and tax filings for farm employees.

Best for Popularity Among Users: Gusto

| ||

|---|---|---|

Popularity Score | 3.75 out of 5 | 5 out of 5 |

User Feedback | Mostly positive | Mostly positive |

Average User Ratings* | 4.8 out of 5 | 4.35 out of 5 |

Average Number of Reviews* | 300-plus | 2,100-plus |

*Data from third-party review sites, such as G2 and Capterra.

To compare Gusto vs OnPay on user popularity, we looked at each provider’s average overall ratings and the number of reviews on third-party review sites like G2 and Capterra. For user ratings, OnPay’s average score is slightly higher than Gusto’s (4.8 out of 5 vs 4.35 out of 5 as of this writing). However, Gusto’s average number of reviews online is higher—it has more than 2,000 compared to OnPay’s 300-plus reviews.

In terms of user feedback, many users commented that both have user-friendly platforms with features that are easy to navigate. They also said they appreciate the affordably priced and efficient payroll tools that the providers offer. Although, many seem to prefer Gusto’s feature-rich HR system.

On the flipside, some reviewers wished that Gusto and OnPay offered more customization options. A few others said that OnPay’s integration options are limited, while others noted that Gusto’s support team is slow to respond at times.

How We Evaluated OnPay vs Gusto

We compared OnPay vs Gusto by using a five-star scale designed to assess payroll solutions and services for small businesses. Aside from pricing, we looked at both providers’ features—from pay processing and tax filing services to HR tools and employee benefits options. We also checked other key criteria like ease of use and customer support, including whether users have access to expert professionals who can provide HR and payroll advice.

Click through the tabs below for a detailed breakdown of our evaluation.

20% of Overall Score

We checked to see if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Those priced at $50 or less per employee monthly were also given extra points.

20% of Overall Score

We gave priority to those that offer multiple pay options, two-day direct deposits, tax payments and filings, year-end reporting (W-2s and 1099s), and a penalty-free tax guarantee.

20% of Overall Score

Payroll service and software should be simple to set up, customizable, and have a user-friendly interface. We also looked at whether the provider offers live support and integration options with online tools that most SMBs use.

15% of Overall Score

Online onboarding, which means giving employees the option to fill out forms like W-4s electronically, is the top criterion, followed by state new hire reporting and the availability of a self-service portal where employees can view pay stubs, edit information, and access forms. Extra points were also given to providers who offer expert HR support, benefits options, and health insurance plans that cover all US states.

15% of Overall Score

In this criterion, we assess whether the software’s ease of use, pricing, and the width and depth of its payroll and HR tools are ideal for SMBs.

5% of Overall Score

We considered user reviews, including those of our competitors, based on a 5-star scale; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.

Bottom Line

When comparing OnPay vs Gusto, list your must-have features and those you are willing to pay a little more for, and then weigh them against your budget. Also, consider how you will grow and which payroll software will grow best with you.

OnPay is best for businesses looking for an affordably priced solution to pay hourly workers. Its payroll plan, which is slightly cheaper than Gusto’s, includes efficient payroll tax filing services and basic HR tools. Meanwhile, Gusto is great for small businesses that want full-service payroll and advanced HR solutions. It even offers dedicated HR support and a wider selection of software integrations, but its plans are more expensive. Plus, get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.