An outstanding invoice is an invoice that is yet to be paid. A thorough invoice template, automated reminders, and convenient payment methods can help minimize outstanding invoices.

What Is an Outstanding Invoice & How To Collect & Track Them

This article is part of a larger series on Payments.

An outstanding invoice is a legal sales document sent out to a customer as evidence of goods or services waiting to be paid. It is also referred to as an unpaid invoice. Outstanding invoices contain sales information such as product description, itemized and total cost, discount (if any) and taxes, and credit terms.

They are categorized according to their due date:

- Current invoice: An unpaid invoice still within its due date

- Past due invoice: An unpaid invoice beyond its due date

Outstanding invoices make up the accounts receivable (A/R) in your business’s financial statements and are recognized as income. Learn more about invoices.

How to Collect Outstanding Invoices

Make sure that you have a complete and well-written invoice template. The terms, due date, and modes of acceptable payments should be clearly indicated. Get more invoicing best practices.

Thankfully, most payment processors offer invoice management tools that can send and automatically track digital invoices. Here are tips on how to effectively use invoicing software and other resources for collecting unpaid invoices.

- Automate your payment reminders: Set up payment reminder templates that can automatically be sent to customers with outstanding invoices. If your payment processor allows you to customize the reminder dates, aim to send one a certain number of days before the invoice is due.

- Encourage payments with discounts and late fees: Some businesses find that offering discounts for early payment is an effective strategy. This is particularly helpful for merchants offering longer credit terms. Adding late fees is also a common strategy to encourage customers to settle their invoices. Both can be in the form of percentages (typically 1%–1.5%) or specific dollar values. Make sure to include your discount and late fee policy in the invoice template.

- Provide customers with a convenient means to settle payments: Digital invoices can include an embedded payment link to help customers pay their invoices with ease. If you are adding the payment link to a reminder notice, remember to update the bill with any interest imposed for past-due accounts. Try to offer as many payment method options as possible—such as QR code payment links, mobile/digital wallets, ACH, and card-on-file. Learn what an ACH payment is and how to accept payments online.

- Include a business phone number where customers can call in to settle their invoice: Payment processors also often come with a virtual terminal where merchants can key in payments on the customer’s behalf. You can pull up an outstanding invoice from your records and enter the customer’s information to complete the payment.

- Call customers with a past due invoice: There are many reasons why a customer may not be able to settle their accounts, and a friendly reminder call can help you find out why. The advantage of this strategy is that you can offer a more personalized response that directly resolves a customer’s roadblock to making a payment.

- Send a collection letter to overdue accounts: When all else fails, writing a collection letter is one of the final steps before sending the account to a collection agency. Most businesses send more than one, similar to a reminder notice; however, collection letters are typewritten on your company letterhead and sent via physical mail. Learn how to write effective collection letters.

- Hand over the account to a collection agency: The last resort for attempting to collect an outstanding invoice is with a collection agency. Hiring a debt collector is not unusual, as these are professionals that concentrate on recovering unpaid invoices for any type of business. While they often do not charge anything for their services outright, debt collectors usually take 25% of the total outstanding invoices they successfully recover on your behalf.

Why It’s Important to Manage Outstanding Invoices

The longer outstanding invoices are overdue, the less likely it becomes to collect. Instead of being classified as assets and income, long overdue invoices are eventually reclassified as bad debts and will likely be written off. This results in a negative adjustment to your total income for the period.

To avoid this, it’s important for merchants to have an efficient collection policy in place.

How to Keep Track of Your Outstanding Invoices

Apart from automating the invoicing process, merchants should track how effective their business is at collecting A/R quickly.

The best way to do this is to create an accounts receivable (A/R) aging report, which lets you track outstanding invoices according to the number of days it has been unpaid and overdue. It will also allow you to adjust your collection strategy and manage your cash flow.

Some payment processors that come with accounting tools, such as QuickBooks, include A/R aging in their report generation function.

- Read more about A/R aging reports.

- Have a QuickBooks Online account? Learn how to run an A/R aging report with QBO.

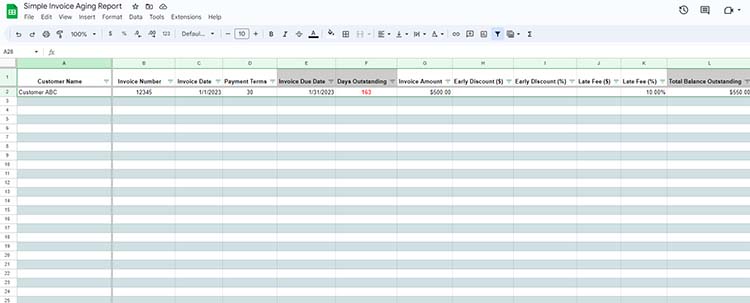

If you keep manual records of your outstanding invoice, download our free outstanding invoice tracking template.

Outstanding Invoice Frequently Asked Questions (FAQs)

An outstanding invoice is a record of sales that a customer has yet to pay. Invoices come with credit terms (usually 30, 60, or 90 days) and late fees for overdue ones.

An outstanding invoice is any unpaid invoice regardless of the due date, while a past due invoice is an invoice that is still outstanding (has not been paid) and is past its due date.

The standard late fee for outstanding invoices is 1%–1.5%, although some businesses prefer to impose a dollar value or a combination of both.

Essentially, you want to come off as helpful. Start by reminding the client of the invoice and the due date, then proceed with letting the client know of the current status and total balance of the invoice (late fees, partial payments). Finally, ask the client if you can assist them in any way to facilitate the payment. Offer additional payment method options if possible.

Bottom Line

Invoicing is a popular sales method for almost any type of small and growing business, but merchants will need to keep track of unpaid invoices in order to be sustainable. Managing outstanding invoices can be easy with the right collection strategy—and thankfully, most popular payment processors offer automation to manage an entire invoicing, tracking, and collection process. If you are a small business merchant that earns from invoiced transactions, choose a merchant account service provider that comes with native invoice management tools.