Legally speaking, employers do not need to offer vacation time to their employees. However, having a strong paid time off (PTO) policy is one of the first steps to attracting and retaining quality talent. Your policy should include various time off categories, including sick leave, vacation, and bereavement leave. While some PTO policies combine vacation and sick time into a single bank of paid days off, keep in mind that many states require a specific amount of time to be allocated directly to sick leave.

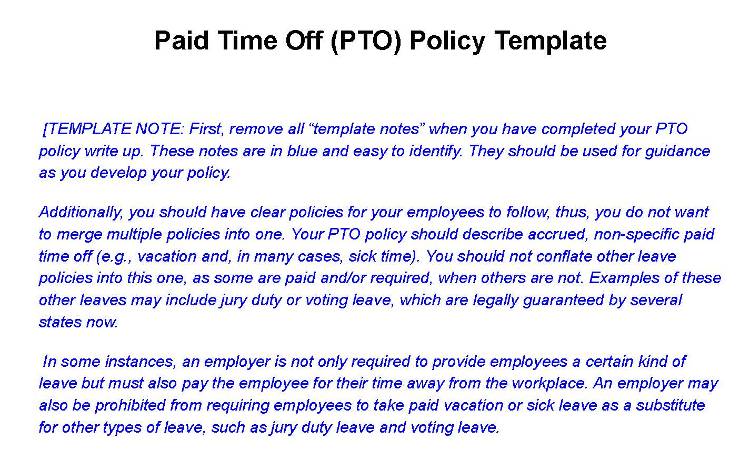

Here are some steps on how to create a PTO policy. We also created a free PTO policy template you can download and customize based on your business’s needs.

Thank you for downloading!

For help with creating policies consider Gusto. Its online software will allow you to hire, onboard, track time, load benefits, upload payroll, and more.

Step 1: Determine the PTO Types to Include in Your Policy

A robust PTO policy can help you attract and retain top talent. Also, sick time, which falls under the umbrella of PTO offerings, may be a requirement in your city or state. Below is a list of PTO types that you may want to consider offering.

Sick time is defined as time taken off of work due to illness. This can be due to an illness suffered by the employee or a need to care for an ill family member.

Traditionally, employers offer around three to five paid sick days per year. However, when creating your sick leave policy, be sure to follow state and federal guidelines, as these may require a specific number of days per year to be allotted for sick leave. States like California and Oregon require companies to offer PTO for employees’ sick time, even if they do not have PTO benefits/policies.

Vacation leave is when an employee schedules time away from the workplace for reasons other than illness. In some cases, emergencies are also covered by vacation PTO, such as a car breakdown or a meeting with a home repair person in the middle of the workday.

While there are no federal regulations regarding the amount of vacation leave a company must provide, the Bureau of Labor Statistics (BLS) found that in the US, the average amount of vacation for private industry businesses was equal to 11 to 20 working days. These amounts typically increase based on the number of years of service with the company.

According to the Harvard Business Review, providing employees longer vacation time can increase employee productivity and improve your bottom line.

Another option for offering time off is to allow your employees unlimited PTO days to use for sick, vacation, or personal leave. With this type of policy, there is no need for accruals. Employees simply take time off when they need it.

However, be sure to still have an unlimited PTO policy in place that sets out guidelines. While there is no cap on the amount of time an employee can take off under this policy, you may want to limit it to full-time exempt employees only and stipulate that their time off still needs to be approved within a certain timeframe.

It is a best practice to switch to an unlimited PTO policy at the beginning of your fiscal year. Typically, this will be on January 1. At the time, hold a meeting to discuss the new plan and be sure to notify your employees that they will no longer accrue PTO. In addition, tell them that there will be no rollover of PTO and no payout upon termination.

Personal leave days (or floating holidays) are additional PTO days that employees can use anytime. As workplaces become more diverse, having personal holidays is how many businesses support employees’ needs that don’t fit neatly into the other PTO buckets.

Many businesses now include three to five paid personal days meant to be used at the employee’s discretion, be it for a religious holiday, children’s school conference, or even their birthday. Most policies don’t require employees to provide a reason for taking a personal day, and it’s a separate box on the PTO request form (or in the tracking system).

Bereavement leave is paid leave available to an employee upon the death of a family member. Typically, this leave is taken to be with family and attend the funeral. Although not required by federal law, most businesses offer an average of one to five paid days for this type of leave.

Be aware that there may be state laws in place that you should consider. For instance, in Oregon, employers with 25 or more employees are required to provide bereavement leave; however, it can be in the form of unpaid leave.

Many employers offer bereavement leave to their employees in increments based on the relation to the employee:

Type of Family Member | Average Number of Paid Leave Days |

|---|---|

Immediate Family Members (parents, grandparents, spouse, children, siblings, etc.) | 3–5 paid days |

Extended Family Members (aunts, uncles, cousins, in-laws, etc.) | 1–3 paid days |

This kind of PTO is typically triggered by a court document requesting your employee to serve jury duty. Although you are required to adhere to these court callings by allowing your employees time away from work, you are not required to pay them.

The developing best practice, however, is that a couple of days of paid jury duty shows that you support your employees’ civic service duties. Regardless of your approach, retaliation laws prohibit employers from threatening or intimidating employees from participating in jury duty. Read our article on jury duty policy for more in-depth information.

Maternity leave refers to the period of time that a new mother takes off from work following the birth of her baby. This is often made up of a combination of PTO benefits that include sick leave, vacation, holiday time, and personal days, as well as short-term disability and unpaid family leave time (FMLA).

On the other hand, paternity leave is a period of time when a father takes time off from work to bond with his new baby. This time is typically less than maternity leave (an average of two weeks).

For companies with 50 or more employees, this type of leave is governed through the FMLA and/or state equivalent leave laws (note that state laws often address employers with fewer than 50 employees, such as Oregon Family Leave Laws). FMLA law sets the maximum allowed leave at 12 weeks (26 weeks for service members), including all paid and unpaid leave.

Step 2: Define Your PTO Eligibility Criteria

Before implementing a PTO policy, define the people who qualify for these benefits. Not all employees you hire will be eligible for PTO; however, that is at your discretion. For example, you could decide whether only full-time employees are entitled to this or part-time employees and 1099 contractors are included.

- Full-time employees: Full-time employees, whether paid by salary or an hourly wage, are typically part of the worker class automatically eligible for PTO.

- Part-time employees: Part-time employees (those paid hourly and working fewer than 35 hours per week) are not generally eligible for PTO. However, if you decide to include this working group in your PTO policy, make sure you clearly spell out how much time they have available per year.

- 1099 contractors: 1099 contractors (those not on your payroll for tax purposes and typically paid by the hour or piece) are not generally eligible for PTO.

By establishing this step, you build the foundation for fairness and consistency in administering PTOs in your company. We recommend that you check with your state and local laws, as some require sick time to be available to different classes of employees.

Step 3: Choose Your Accrual and Allocation Method

Decide how PTO will accrue overtime—is it hourly, weekly, or annually? Also decide how it will be allocated—will it be a lump sum at the beginning of the year or accrued gradually throughout the year? This also determines the rate at which employees earn PTO and how it is distributed throughout the year. By establishing this, you manage employee expectations regarding time off.

Additional things to consider are whether PTO carries over to the next year, who is eligible under the plan, and if you will pay out accrued but unused PTO when an employee leaves.

Accrual Method vs Flat-rate Method

When it comes to PTO, most employers use either an accrual or a flat-rate method to determine how PTO is allotted to their employees. Although either is fine to use, which one you decide on is determined by your preference and work culture.

Waiting Period for New Employees

Some employers require their employees to pass an introductory period—such as 30, 60, or 90 days—before they can take PTO. Some state laws require sick leaves to be made available before this, but no laws require vacation time to be available immediately. Choosing to have a waiting period for vacation, bereavement, or personal holidays is at your discretion.

Rollover vs Use It or Lose It

As you create your PTO policy, you must decide how the remaining PTO will be allocated at the end of the year. There are two options: roll over PTO to the next year or lose any remaining PTO.

- Rollover policy: Employees can roll over a certain amount of unused PTO to the next year. You can decide how many total PTO days roll over to the next year and how long that rolled-over amount is available. For instance, some policies state that you can roll over up to 10 PTO days—however, they must be used by midyear (June 30) or they will be lost.

- Use-it-or-lose-it policy: Employees must use all their PTO time by a certain date, usually within a calendar or fiscal year, or forfeit it. For example, if an employee has five remaining accrued PTO days at the end of the year and does not use them, they will be forever lost and unavailable in the next calendar year. Be sure to check your state and local laws concerning PTO. Some states, such as California, do not allow use-it-or-lose-it PTO policies; however, a cap can be put on accrued PTO that is rolled over.

Payout of Accrued PTO Upon Termination/Layoff

Be sure to include in your policy what happens to accrued but unused PTO once an employee leaves a company. Some states require that any accrued but unused PTO and sick time be paid out to the employee upon termination. In states that do not require payout, if you have a policy in place to pay out unused PTO upon termination, you must adhere to your policy regulations.

PTO Payout Requirements | States Included |

|---|---|

States that don’t require PTO | Alaska, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Kentucky, Mississippi, Missouri, Montana, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania*, South Carolina**, South Dakota***, Texas, Utah, Washington, D.C., West Virginia, Wisconsin, Wyoming *Philadelphia, Pittsburgh, and Allegheny County require paid sick leave **Requires paid parental leave for some govt Employees and public school teachers ***Requires paid family leave for some govt employees |

States with mandatory and statutory PTO mandates | Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Illinois, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, Oregon, Rhode Island, Tennessee, Vermont, Virginia, Washington D.C. |

States that consider earned PTO as wages | Arizona*, California, Colorado, Delaware*, Illinois*, Indiana**, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Montana, Nebraska, North Dakota, Ohio**, Oklahoma*, Oregon, Pennsylvania, Rhode Island***, South Carolina, Texas, West Virginia, Wisconsin, Wyoming *PTO is considered wages if specified in the PTO policy or employer agreement **Considered as deferred compensation in place of wages ***Applicable after one year of employment |

States that don’t consider PTO as wages | Alabama, Alaska, Arkansas, Connecticut, Florida, Georgia, Hawaii, Idaho, Michigan, Mississippi, Missouri, Nevada, New Jersey, South Dakota, Tennessee, Vermont, Virginia, Washington |

States with no use-it-or-lose-it PTO policy | California, Colorado, Montana, Nebraska |

States that require PTOs to be paid out upon separation | California, Colorado, Illinois, Indiana*, Louisiana, Maine, Maryland*, Massachusetts, Montana, Nebraska, New Hampshire*, New Mexico, New York*, North Carolina**, North Dakota, Ohio**, Rhode Island***, West Virginia*, Wisconsin* *Preexisting PTO policy or employment agreement can cancel this **Only applies if there’s no notification of a forfeiture policy ***Only applies after one year of employment |

States with no PTO payout requirements | Alabama, Alaska, Arizona, Arkansas, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Iowa, Kansas, Kentucky, Michigan, Minnesota, Mississippi, Missouri, Nevada, New Jersey, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Vermont, Virginia, Washington, Wyoming |

States with no penalties for not paying unused PTOs | Alabama, Florida, Georgia, Hawaii, Mississippi, South Dakota, Vermont, Virginia, Washington |

States that penalize employers that do not pay unused PTOS | Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, West Virginia, Wisconsin, Wyoming |

Source: Paycom | |

Step 4: Establish a PTO Request and Approval Process

Employees on all levels must follow the same process for requesting PTO. Typically, the process guidelines would include the following:

- How should employees request—is it on a “first come, first serve” basis or by seniority?

- What is your submission method—should it be through email, an online portal, etc.?

- Who is authorized to approve the requests—is it the HR manager or direct supervisor?

Make sure when an employee is brought on board, you communicate the PTO policy to them in the employment agreement (or employee handbook) and during new hire onboarding.

Step 5: Outline PTO Usage Guidelines

This step involves setting the following parameters:

- When PTO can be used—can an employee take a leave every month, twice a month, or unlimited?

- How much notice is required—some require two weeks or a week’s notice. If you are in an industry where you cannot afford to be short-staffed, you should also set a deadline for calling in sick.

- Blackout dates—periods when PTO cannot be used due to operational demands.

- Limitations on consecutive days off—up to how many days can an employee have consecutive day offs (three days, one week, etc.)?

Step 6: Communicate and Provide Documentation

Effective communication is crucial for implementation and ensures that the policy is utilized properly and valued by employees. Have a clear, written policy that employees understand. It is also a good idea to have this policy in your employee handbook and in an online format for easy reference.

PTO Policy Frequently Asked Questions (FAQs)

PTO calculations and how the unused PTOs should be paid depend on the regulations of each state concerning PTOs. If the state has no policy regarding PTO payouts, it is the responsibility of the employer to define it.

Your company could have a policy to have your unused PTO carried over to the next year. However, they are not required to pay for your unused vacation time. If your company has a PTO guideline or operates in one of the states that have laws governing PTO payouts, they need to comply or get penalized for not doing so.

Bottom Line

PTO is an excellent benefit to offer your employees and can help you retain top talent. A top priority when creating a PTO policy is to determine the amount of PTO you want to offer your employees and the different types that will be included in your policy. Be sure to also check your state and local employment laws to remain compliant. Download our PTO policy template to use as a reference for creating your own.