Payline Data is a merchant services provider with in-person, online, and mobile payment solutions for businesses. Features include a point-of-sale (POS) system, automated clearing house (ACH) payments, invoicing, and hundreds of integration options for ecommerce stores. It has an upfront, transparent pricing model that charges users a monthly subscription, without cancellation and early termination fees, making it ideal for businesses providing high-ticket sales and services.

Although Payline Data didn’t make our list of the best merchant services for small businesses, it received an overall score of 3.42 out of 5 and is one of our top picks for the leading virtual terminals. It offers a free one-month trial, and you can get same-day approval when you apply online.

Pros

- Transparent pricing

- Supports high-risk merchants and nonprofits

- Same-day account approval

Cons

- In-person and online payment processing are separate plans

- Extra fee for virtual terminal

- Monthly fees; $25 monthly minimum

- Limited business management tools

When to Use Payline Data:

- Medical offices: For HIPAA-compliant payment processing

- High-risk merchants

- Restaurants and catering businesses: For its virtual terminal and ACH processing

- Nonprofits and educational institutions: For discounted nonprofit rates

When to Use an Alternative:

- If you want a free merchant account

- If you want to accept international payments

- If you only process payments occasionally, consider Square, which has no monthly fees or minimum requirements

Payline Data has notable features that make it a good fit for many small and large businesses. Aside from accepting almost all payment types, it offers Health Insurance Portability and Accountability Act of 1996 (HIPAA)-compliant payment processing, making it an excellent choice for small businesses in healthcare. Nonprofits and educational institutions can also enjoy discounted rates and free monthly fees for the first two months. Additionally, Payline Data is one of the few merchant account providers that supports high-risk merchants.

Small businesses would find Payline Data’s same-day approval and dedicated account management convenient.

However, business owners that do not want to pay monthly fees should opt for providers offering free merchant accounts, especially since Payline Data charges separate monthly fees for in-person and online payment processing. Sellers with seasonal low-volume transactions should also consider a different solution because Payline Data has a $25 monthly minimum. Lastly, it is not available for merchants outside of the US; small businesses selling internationally should consider other providers such as PaymentCloud, Helcim, or PayPal.

Payline Data Deciding Factors

Supported Business Types | Flexible Retail, restaurants, nonprofits, healthcare |

Standout Features: |

|

Monthly Fees |

|

Setup and Installation Fees | $0 |

Contract Length | Month-to-month |

Payment Processing Options | Integrates with most shopping carts and POS systems |

Payment Processing Fees | In-person: Interchange + 0.4% + 10 cents Online: Interchange + 0.75% + 20 cents Nonprofit & Educational: Starts at interchange + 0.1% High-risk: Starts at interchange + 1% Medical: Starts at interchange + 0.2% + 10 cents |

Deposit Speed | 1–2 business days |

Customer Support |

|

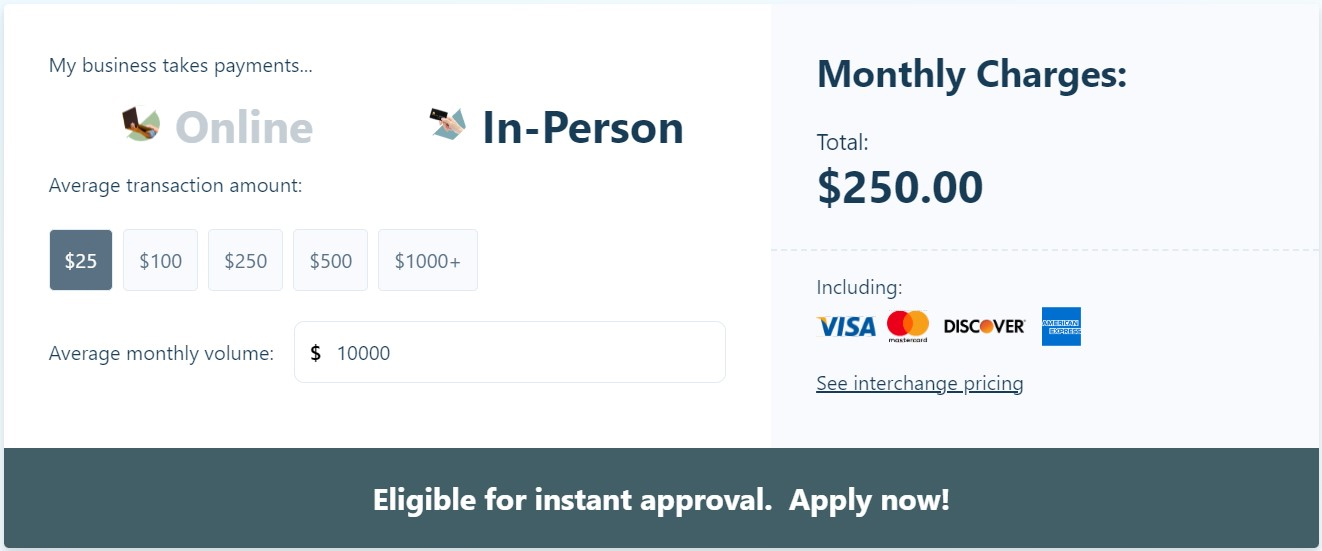

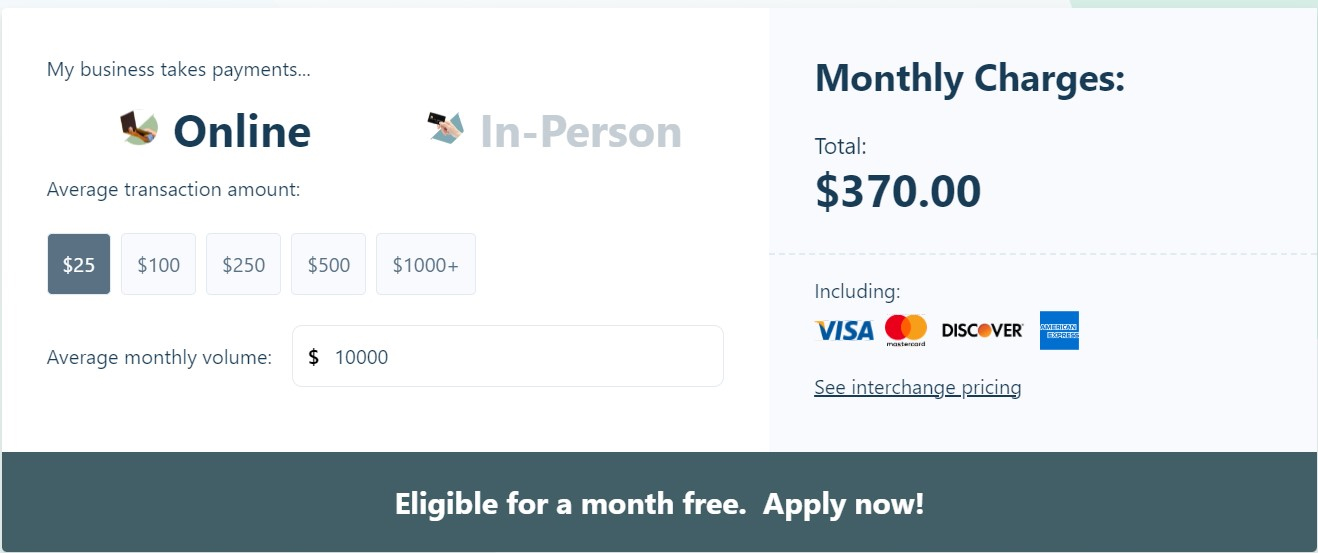

Payline Data Payments Calculator

Payline Data Payments Calculator

Enter your current in-store and/or online sales volumes and average order values for an estimate on the monthly fees you would pay using Payline Data.

Payline Data Alternatives

Best for | High-volume businesses that need billing or recurring payments | New and small businesses that need a free POS solution | Individuals who need a reliable solution for occasional payments | Established businesses that want interchange-plus pricing with no monthly fee |

Monthly Fee | Starts at $99 | Starts at $0 | Starts at $0 | $0 |

Card-present Transaction Fee | Interchange + 8 cents | 2.6% + 10 cents | 2.29% + 9 cents | Interchange + 0.1% + 5 cents to 0.3% + 8 cents |

Keyed Transaction Fee | Interchange + 18 cents | 3.5% + 15 cents | 3.5% + 49 cents | Interchange + 0.2% + 10 cents to 0.5% + 25 cents |

Ecommerce Transaction Fee | Interchange + 18 cents | 2.9% + 30 cents | Starts at 2.59% + 49 cents | Interchange + 0.2% + 10 cents to 0.5% + 25 cents |

Looking for the lowest rates? Leading merchant service providers offer custom payment processing rates based on your business size, type, and average order value. To find the most affordable option for you and compare multiple processing rates, read our guide on the cheapest credit card processing companies.

Payline Data’s month-to-month contract and no cancellation fee earned it good scores for this category. However, its monthly fee, undisclosed chargeback fee, and volume discount that is only available by request prevented it from getting higher scores.

Payline pricing comes in two payment processing options—in-person and online—with monthly and payment processing fees for each. Its pricing plans make it more suitable for businesses selling either exclusively in person or online.

If your revenue is divided heavily between sales from your website and storefront (multichannel sales), you may have to pay separate monthly fees or negotiate a custom monthly fee through one of Payline Data’s sales representatives.

Payline Data uses a subscription interchange-plus pricing model. Merchant account holders pay a monthly fee in exchange for low processing rates, inclusive of incidental fees. Add-ons such as PCI fees, payment gateway (setup and use) fees, and QuickBooks integration are already included in the monthly plan. Note that this provider also charges a monthly virtual terminal fee, which most businesses need—other processors, like Square, offer this for free.

In-person | Online | |

|---|---|---|

Monthly Fee | $10 | $20 |

Transaction Fee | 0.4% + 10 cents | 0.75% + 20 cents |

Virtual Terminal | $10 | $10 |

Cancellation Fee | 0 | 0 |

Deposit Speed | 1–2 business days | 1–2 business days |

Payline Data also offers payment processing for medical, nonprofit, and educational institutions and high-risk merchants. We were quoted the following rates:

- Medical: Interchange plus 0.2% + 10 cents, with free subscription for the first month

- Nonprofit: Starts at interchange plus 0.1% + 10 cents, with free subscription for the first two months

- High-risk: Interchange plus 1%, with free subscription for the first two months

If you need any of these services, it’s important to ask all your questions around transaction rates and incidental charges when you get on a call with a Payline Data representative.

There is a fee calculator on Payline Data’s website that can give you an idea of how much you can expect for payment processing costs. This not only includes the markup fee you pay to Payline Data but also covers an estimate of the interchange price that goes to the acquiring bank and card networks. There’s no long-term contract, and new subscribers will also be offered the first month free.

A quick computation dividing the total monthly cost (“Monthly Charges” on Payline Data’s calculator) by the average number of transactions you process in a month―computed as average monthly volume divided by average transaction amount―will show you how much you spend for processing each time you accept a payment. Use this figure to compare against alternative providers.

Payline Data does not advertise hardware pricing but does support in-person payment processing, including mobile, countertop, and smart terminals. It also integrates with several POS systems like Clover and Vend. In some cases, Payline Data offers free hardware in your contract but note that this will most likely require you to sign up for a long-term contract. Contact Payline Data’s sales team for more information.

Mobile & Countertop Hardware

*Verifone, DejaVoo, and FD wireless terminals are also available.

POS Hardware

Generally, Payline Data offers a month-to-month contract to its merchant account holders. This means you can cancel your account at any time and not have to worry about early termination fees or cancellation fees. On top of that, Payline Data’s transparent pricing gives you a pretty good idea of the fees you can expect to pay every month, with most of your incidental fees already covered in its subscription pricing model.

However, you will need to contact a representative to get the finer details of its terms and condition of service. As with most merchants, a customized plan will mean paying only for services you need to run your business, but certain conditions on the contract may change significantly, such as:

- Accepting ACH payments

- Higher monthly fees for businesses with heavily blended sales channels

- Free (or leasing) hardware in exchange for a long-term contract with early termination fees

- Additional monthly fees and set up fees when using certain payment gateways

- Higher monthly fees and transaction rates for high-risk merchants

- Terms and conditions, including incidental fees, of chargeback management dependent on Payline Data’s partner integration

- Separate fees for fraud protection tools

For instance, Payline Data partners with CardPointe, NMI, Transax, and Authorize.net for its payment gateway and virtual terminal solutions. These third-party integrations vary in their basic plan fees and features, so you may be charged an additional fee if you require functionalities included in its more advanced plans.

The wide availability of payment types you can accept with Payline Data earned it perfect scores for all sub-criteria except for ecommerce integrations and the virtual terminal, which require additional fees.

This solution comes with both pricing plans at no extra cost. Payline Data offers a mobile card reader and payment app you can use anywhere with any Android- and iOS-compatible mobile device. It offers tokenization and encryption tools for processing swipe, chip, tap, and NFC payments.

Additional features allow you to upload and manage your products in sync with your POS system; manage recurring billing; auto-calculate taxes and gratuity; process surcharges, voids, and refunds; and send electronic receipts. The mobile payment app also lets you view reports and manage cash transactions.

Payline Mobile has a simple interface that lets you see sales reports, connect card readers, and accept card and cash payments. (Source: Payline Mobile listing in App Store)

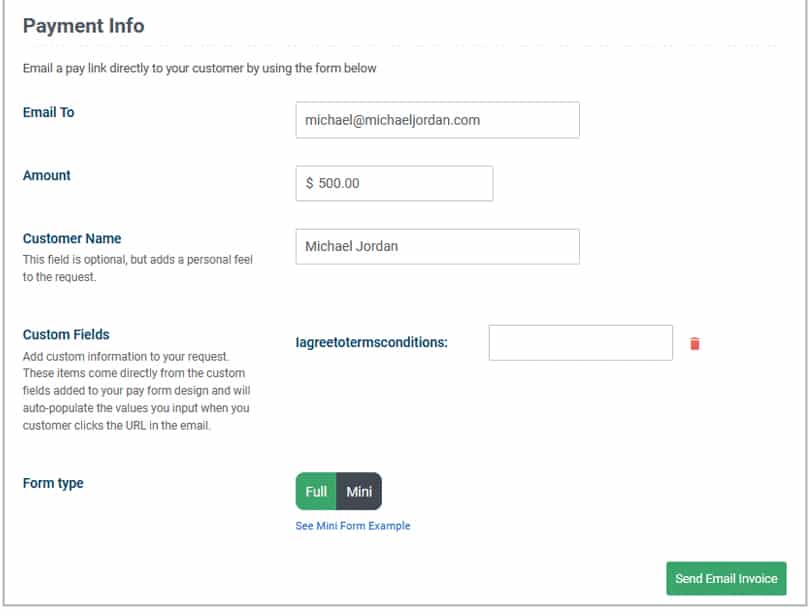

Manage one-time and recurring billing with Payline Data’s payment management platform. It allows you to send emails to collect payments, set up billing plans, view reports, and more. The dashboard features design and templating tools, customization options, and a customer database you can use to set up profiles for recurring billing functions.

Design a collection form and attach the payment link directly to your collection email. (Source: Payline Data)

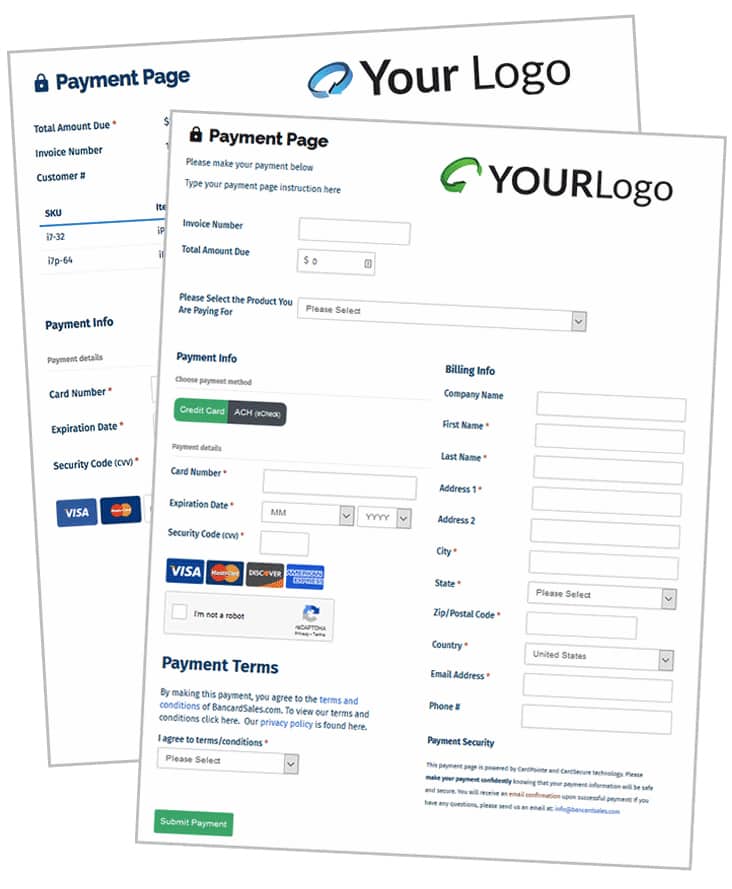

Payline Data offers different tools for accepting online payments. The Payline gateway lets you process debit, credit, and other electronic payments online securely through hosted payment pages, while the virtual terminal allows you to accept payments from phone orders through manual input (keyed in or using card readers). Additionally, it integrates with popular third-party virtual terminal and gateway providers, such as CardPointe, NMI, Transax, and Authorize.net.

For those wanting a more customized payment processing experience for their customers, Payline Data gives you access to its application programming interface (API) at no extra cost. This also makes it easy for businesses that require omnichannel payment features for synchronizing sales made in-store and online. Payline Data’s onboarding team also helps set up this functionality if you need them.

Payline Data’s onboarding team will help you set up, customize, and embed a payment link on your website to start accepting payments. (Source: Payline Data)

Payline Data offers many features that are appealing to different types of small businesses. Its HIPAA-compliant payment processing and medical software integrations, for example, make it suitable for businesses in the healthcare industry.

Approval and setup is quick and easy, and customer support is available 24/7, earning Payline Data a perfect score for this sub-criteria. It only received average scores for integrations and other tools because despite its wide range of software integrations and hardware options, these may come with additional fees.

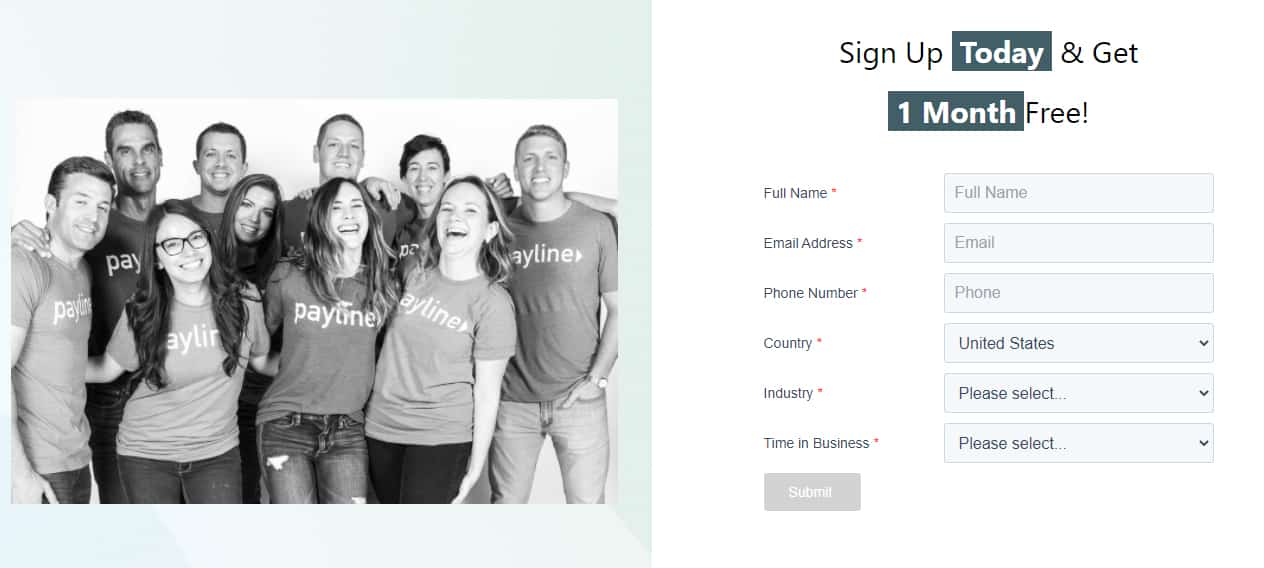

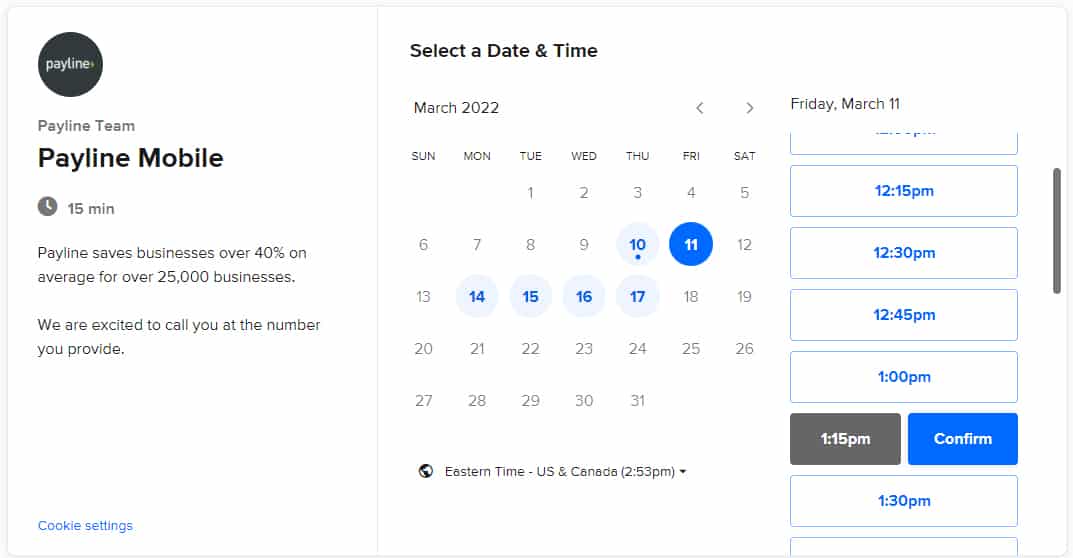

Signing up with Payline Data starts with sending an inquiry from its website. You’ll need to fill out the online form with your contact information. The next window will take you to an online calendar where you can set up an appointment for a call with a Payline Data sales representative.

Included in Payline Data’s initial service is a statement analysis where an account manager will provide you a detailed comparison of your current payment processing fees against Payline Data’s pricing. Instant approval is also available for low-risk merchant account applicants signing up for the in-person plan.

Keep payments secure with card verification value (CVV) and address verification and a fraud protection tool that screens transactions for suspicious activity. You’ll need to reach out to Payline Data’s account manager to check for any additional cost for this service. As for chargeback protection, Payline Data uses Verifi’s Cardholder Dispute Resolution Network to provide up-to-date dispute data and comprehensive coverage.

Payline Medical is a Health Insurance Portability and Accountability Act of 1996 (HIPAA)-compliant payment processing product created exclusively for healthcare businesses and offered at a special medical rate. It offers specialized tools for businesses in the medical profession, such as seamless integration with accounting and some EHR/EMR software and EMV/Chip and mobile payment services.

Nonprofit businesses and educational institutions qualify for a reduced rate, starting at interchange + 0.10%, and a hosted payments page. Payline gateway and other third-party payment gateway partners provide advanced security features for ensuring safe and secure collection of donations and student payments. This provider also offers a secure form to gather donor and student information without requiring adding an extra step to your online process. Nonprofits and educational institutions get to enjoy the first two months without any monthly fees.

Payline Data supports high-risk merchants operating in industries like travel, tobacco, and CBD. It works with more than 20 bank partners to provide you with the most opportunity to get approved for a merchant account.

Also, among Payline Data’s list of partner payment gateway solutions is Network Merchants Inc. (NMI). High-risk merchants will benefit from its load balancing feature and ability to manage multiple merchant accounts through one gateway to avoid being unnecessarily flagged for potentially fraudulent transactions. It can also route transactions to specific accounts automatically.

Another partner payment gateway is Authorize.net, which tops our list of the best payment gateway because of its popularity, numerous integrations, easy setup, and user-friendly features.

High-risk merchant accounts also don’t need to pay any monthly fees for the first two months.

Check out our list of recommended high-risk merchant account providers.

Payline Data offers hundreds of shopping cart and accounting software integrations for you to customize a solution that works best with your needs. Payline’s secure gateway payment processor integrates with over 200 online shopping carts, so you can easily accept payments online without impacting the customer experience. The QuickBooks integration allows you to check out real-time financial information and automate accounting tasks.

Not all payment processors offer a payment app like Payline Data, with POS features such as inventory, CRM, and reporting tools. However, if you want to run a small but growing business, you may find these functionalities somewhat limited. You will need to integrate with popular POS systems like Clover, Vend, and Shopify.

Deposit speed for your payment proceeds takes one to two business days. Payline Data commits to having your funds sent to you the next day, making it a competitive option for businesses that require fast access to funds.

Payline Data offers 24/7 customer support via email or phone. You can also review the frequently asked questions (FAQs) section to troubleshoot on your own and check the gateway service status page if you’re having trouble processing payments. Payline Data also has a YouTube channel and blog where you can search for and discover helpful resources and information about merchant services.

Payline Data earned above average scores for ease of use and popularity—there are hundreds of shopping carts and accounting software integrations, and it has a payment app with POS features. Its pricing is competitive, with monthly fees that are low compared to other providers that use interchange-plus pricing. However, its pricing scheme with separate monthly fees for in-person and online payment processing makes it a less reasonable option for merchants that need both.

Overall, Payline Data is a good option for a merchant service provider, but there are other providers that perform better for each scored category. Where Payline Data could improve is by offering a plan with a single monthly fee for processing both in-person and online payments. This option will make it a more attractive option for small businesses looking for a merchant service provider.

What Users Say in Payline Data Reviews

There are very few Payline Data complaints, although there aren’t many reviews available online at all. Most users have given Payline Data a five-star rating and value its excellent customer service and fair processing fees.

- Capterra: Four reviewers from Capterra give Payline Data 5 out of 5 stars.

- G2: Payline Data earns a rating of 4.7 out of 5 stars, based on seven user reviews.

- TrustRadius: There is only one review, but it detailed a lot of the pros and cons and gave Payline Data 10 out of 10 stars.

There have been no new reviews since our last update, and the most recent was from 2021. From these few Payline Data reviews, below are trends we noticed:

| Users Like | Users Don’t Like |

|---|---|

| Professional customer service | Cannot process international payments |

| Easy to use | Limited integrations |

| Fair pricing | Occasional software glitches |

Methodology: How We Evaluated Payline Data

We test each merchant account service provider ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria for specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

20% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts and extra points if those discounts are transparent or automated.

Payline Data received average scores for pricing and contract. It earned points for month-to-month contracts and having no cancellation fee, but its monthly fee and lack of free hardware pulled it down.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

The wide payment type options that Payline Data offers earned it perfect scores except for two sub-criteria where it charges extra fees–ecommerce integrations and virtual terminal.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

Payline Data received an average score for its features, except for customer support. The availability of a dedicated account manager and 24/7 customer service earned it perfect marks here.

25% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

We gave Payline Data above-average scores for this category. It is easy to use and popular, but when it comes to pricing and integrations, you may find better options with other providers.

Bottom Line

Payline Data is a subscription-based merchant services provider offering payment processing with transparent pricing for both small and large businesses. It offers in-person and online transaction features, including POS, mobile readers, and virtual terminal, along with fraud protection and chargeback prevention. It also has exclusive solutions for nonprofit, medical, and high-risk businesses.